Outline of Recent SEC Enforcement Actions - the Utah State Bar

Outline of Recent SEC Enforcement Actions - the Utah State Bar

Outline of Recent SEC Enforcement Actions - the Utah State Bar

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

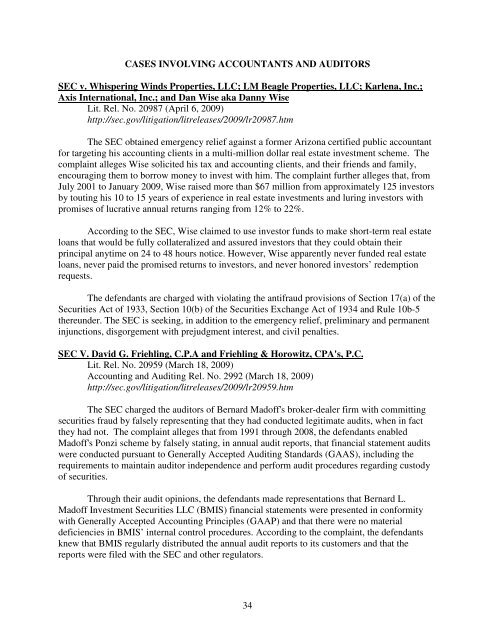

CASES INVOLVING ACCOUNTANTS AND AUDITORS<br />

<strong>SEC</strong> v. Whispering Winds Properties, LLC; LM Beagle Properties, LLC; Karlena, Inc.;<br />

Axis International, Inc.; and Dan Wise aka Danny Wise<br />

Lit. Rel. No. 20987 (April 6, 2009)<br />

http://sec.gov/litigation/litreleases/2009/lr20987.htm<br />

The <strong>SEC</strong> obtained emergency relief against a former Arizona certified public accountant<br />

for targeting his accounting clients in a multi-million dollar real estate investment scheme. The<br />

complaint alleges Wise solicited his tax and accounting clients, and <strong>the</strong>ir friends and family,<br />

encouraging <strong>the</strong>m to borrow money to invest with him. The complaint fur<strong>the</strong>r alleges that, from<br />

July 2001 to January 2009, Wise raised more than $67 million from approximately 125 investors<br />

by touting his 10 to 15 years <strong>of</strong> experience in real estate investments and luring investors with<br />

promises <strong>of</strong> lucrative annual returns ranging from 12% to 22%.<br />

According to <strong>the</strong> <strong>SEC</strong>, Wise claimed to use investor funds to make short-term real estate<br />

loans that would be fully collateralized and assured investors that <strong>the</strong>y could obtain <strong>the</strong>ir<br />

principal anytime on 24 to 48 hours notice. However, Wise apparently never funded real estate<br />

loans, never paid <strong>the</strong> promised returns to investors, and never honored investors’ redemption<br />

requests.<br />

The defendants are charged with violating <strong>the</strong> antifraud provisions <strong>of</strong> Section 17(a) <strong>of</strong> <strong>the</strong><br />

Securities Act <strong>of</strong> 1933, Section 10(b) <strong>of</strong> <strong>the</strong> Securities Exchange Act <strong>of</strong> 1934 and Rule 10b-5<br />

<strong>the</strong>reunder. The <strong>SEC</strong> is seeking, in addition to <strong>the</strong> emergency relief, preliminary and permanent<br />

injunctions, disgorgement with prejudgment interest, and civil penalties.<br />

<strong>SEC</strong> V. David G. Friehling, C.P.A and Friehling & Horowitz, CPA's, P.C.<br />

Lit. Rel. No. 20959 (March 18, 2009)<br />

Accounting and Auditing Rel. No. 2992 (March 18, 2009)<br />

http://sec.gov/litigation/litreleases/2009/lr20959.htm<br />

The <strong>SEC</strong> charged <strong>the</strong> auditors <strong>of</strong> Bernard Mad<strong>of</strong>f's broker-dealer firm with committing<br />

securities fraud by falsely representing that <strong>the</strong>y had conducted legitimate audits, when in fact<br />

<strong>the</strong>y had not. The complaint alleges that from 1991 through 2008, <strong>the</strong> defendants enabled<br />

Mad<strong>of</strong>f's Ponzi scheme by falsely stating, in annual audit reports, that financial statement audits<br />

were conducted pursuant to Generally Accepted Auditing Standards (GAAS), including <strong>the</strong><br />

requirements to maintain auditor independence and perform audit procedures regarding custody<br />

<strong>of</strong> securities.<br />

Through <strong>the</strong>ir audit opinions, <strong>the</strong> defendants made representations that Bernard L.<br />

Mad<strong>of</strong>f Investment Securities LLC (BMIS) financial statements were presented in conformity<br />

with Generally Accepted Accounting Principles (GAAP) and that <strong>the</strong>re were no material<br />

deficiencies in BMIS’ internal control procedures. According to <strong>the</strong> complaint, <strong>the</strong> defendants<br />

knew that BMIS regularly distributed <strong>the</strong> annual audit reports to its customers and that <strong>the</strong><br />

reports were filed with <strong>the</strong> <strong>SEC</strong> and o<strong>the</strong>r regulators.<br />

34