You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

APPROVED 08/18/2022<br />

OPERATING<br />

REVENUES<br />

REVENUE MIX<br />

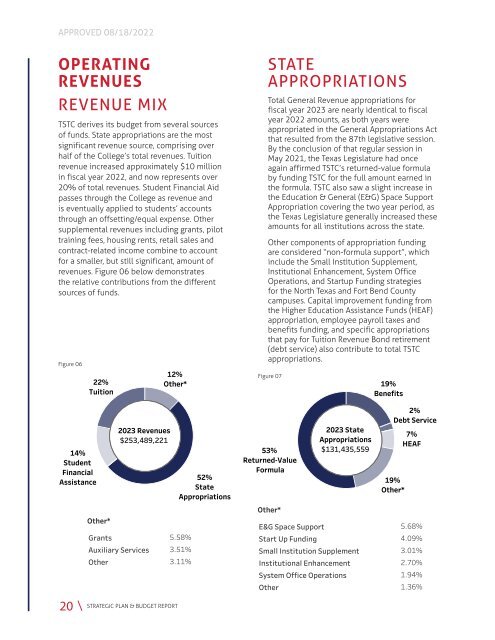

TSTC derives its budget from several sources<br />

of funds. State appropriations are the most<br />

significant revenue source, comprising over<br />

half of the College’s total revenues. Tuition<br />

revenue increased approximately $10 million<br />

in fiscal year 2022, <strong>and</strong> now represents over<br />

20% of total revenues. Student Financial Aid<br />

passes through the College as revenue <strong>and</strong><br />

is eventually applied to students’ accounts<br />

through an offsetting/equal expense. Other<br />

supplemental revenues including grants, pilot<br />

training fees, housing rents, retail sales <strong>and</strong><br />

contract-related income combine to account<br />

for a smaller, but still significant, amount of<br />

revenues. Figure 06 below demonstrates<br />

the relative contributions from the different<br />

sources of funds.<br />

2023 Appropriations<br />

Figure 06<br />

14%<br />

Student<br />

Financial<br />

Assistance<br />

20<br />

22%<br />

Tuition<br />

Other*<br />

Grants<br />

2023 Revenues<br />

$253,489,221<br />

Auxiliary Services<br />

12%<br />

Other*<br />

Other 3.11%<br />

STRATEGIC PLAN & BUDGET REPORT<br />

52%<br />

State<br />

Appropriations<br />

5.58%<br />

3.51%<br />

STATE<br />

APPROPRIATIONS<br />

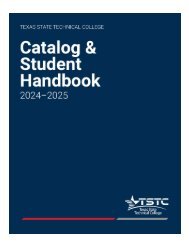

Total General Revenue appropriations for<br />

fiscal year 2023 are nearly identical to fiscal<br />

year 2022 amounts, as both years were<br />

appropriated in the General Appropriations Act<br />

that resulted from the 87th legislative session.<br />

By the conclusion of that regular session in<br />

May 2021, the Texas Legislature had once<br />

again affirmed TSTC’s returned-value formula<br />

by funding TSTC for the full amount earned in<br />

the formula. TSTC also saw a slight increase in<br />

the Education & General (E&G) Space Support<br />

Appropriation covering the two year period, as<br />

the Texas Legislature generally increased these<br />

amounts for all institutions across the state.<br />

Other components of appropriation funding<br />

are considered “non-formula support”, which<br />

include the Small Institution Supplement,<br />

Institutional Enhancement, System Office<br />

Operations, <strong>and</strong> Startup Funding strategies<br />

for the North Texas <strong>and</strong> Fort Bend County<br />

campuses. Capital improvement funding from<br />

the Higher Education Assistance Funds (HEAF)<br />

appropriation, employee payroll taxes <strong>and</strong><br />

benefits funding, <strong>and</strong> specific appropriations<br />

that pay for Tuition Revenue Bond retirement<br />

(debt service) also contribute to total TSTC<br />

appropriations.<br />

Figure 07<br />

53%<br />

Returned-Value<br />

Formula<br />

Other*<br />

E&G Space Support<br />

Start Up Funding<br />

2023 State<br />

Appropriations<br />

$131,435,559<br />

Small Institution Supplement<br />

Institutional Enhancement<br />

System Office Operations<br />

19%<br />

Benefits<br />

2%<br />

Debt Service<br />

19%<br />

Other*<br />

7%<br />

HEAF<br />

5.68%<br />

4.09%<br />

3.01%<br />

2.70%<br />

1.94%<br />

Other 1.36%