Wealden Times | WT258 | November 2023 | Christmas Gift Supplement inside

The lifestyle magazine for Kent & Sussex - Inspirational Interiors, Fabulous Fashion, Delicious Dishes

The lifestyle magazine for Kent & Sussex - Inspirational Interiors, Fabulous Fashion, Delicious Dishes

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Look to the<br />

Finance<br />

Future<br />

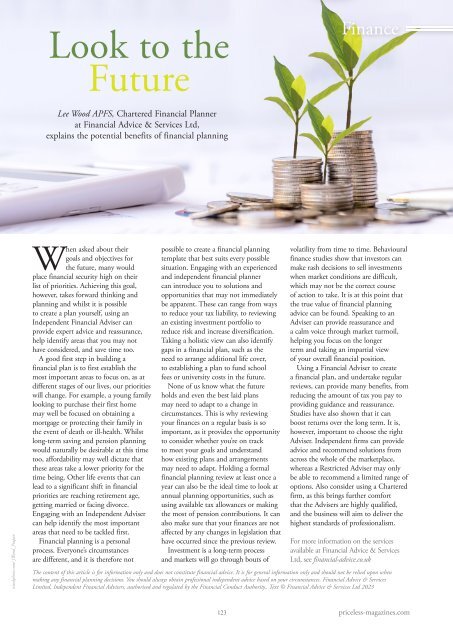

Lee Wood APFS, Chartered Financial Planner<br />

at Financial Advice & Services Ltd,<br />

explains the potential benefits of financial planning<br />

istockphoto.com/ JWand_Prapan<br />

When asked about their<br />

goals and objectives for<br />

the future, many would<br />

place financial security high on their<br />

list of priorities. Achieving this goal,<br />

however, takes forward thinking and<br />

planning and whilst it is possible<br />

to create a plan yourself, using an<br />

Independent Financial Adviser can<br />

provide expert advice and reassurance,<br />

help identify areas that you may not<br />

have considered, and save time too.<br />

A good first step in building a<br />

financial plan is to first establish the<br />

most important areas to focus on, as at<br />

different stages of our lives, our priorities<br />

will change. For example, a young family<br />

looking to purchase their first home<br />

may well be focused on obtaining a<br />

mortgage or protecting their family in<br />

the event of death or ill-health. Whilst<br />

long-term saving and pension planning<br />

would naturally be desirable at this time<br />

too, affordability may well dictate that<br />

these areas take a lower priority for the<br />

time being. Other life events that can<br />

lead to a significant shift in financial<br />

priorities are reaching retirement age,<br />

getting married or facing divorce.<br />

Engaging with an Independent Adviser<br />

can help identify the most important<br />

areas that need to be tackled first.<br />

Financial planning is a personal<br />

process. Everyone’s circumstances<br />

are different, and it is therefore not<br />

possible to create a financial planning<br />

template that best suits every possible<br />

situation. Engaging with an experienced<br />

and independent financial planner<br />

can introduce you to solutions and<br />

opportunities that may not immediately<br />

be apparent. These can range from ways<br />

to reduce your tax liability, to reviewing<br />

an existing investment portfolio to<br />

reduce risk and increase diversification.<br />

Taking a holistic view can also identify<br />

gaps in a financial plan, such as the<br />

need to arrange additional life cover,<br />

to establishing a plan to fund school<br />

fees or university costs in the future.<br />

None of us know what the future<br />

holds and even the best laid plans<br />

may need to adapt to a change in<br />

circumstances. This is why reviewing<br />

your finances on a regular basis is so<br />

important, as it provides the opportunity<br />

to consider whether you’re on track<br />

to meet your goals and understand<br />

how existing plans and arrangements<br />

may need to adapt. Holding a formal<br />

financial planning review at least once a<br />

year can also be the ideal time to look at<br />

annual planning opportunities, such as<br />

using available tax allowances or making<br />

the most of pension contributions. It can<br />

also make sure that your finances are not<br />

affected by any changes in legislation that<br />

have occurred since the previous review.<br />

Investment is a long-term process<br />

and markets will go through bouts of<br />

volatility from time to time. Behavioural<br />

finance studies show that investors can<br />

make rash decisions to sell investments<br />

when market conditions are difficult,<br />

which may not be the correct course<br />

of action to take. It is at this point that<br />

the true value of financial planning<br />

advice can be found. Speaking to an<br />

Adviser can provide reassurance and<br />

a calm voice through market turmoil,<br />

helping you focus on the longer<br />

term and taking an impartial view<br />

of your overall financial position.<br />

Using a Financial Adviser to create<br />

a financial plan, and undertake regular<br />

reviews, can provide many benefits, from<br />

reducing the amount of tax you pay to<br />

providing guidance and reassurance.<br />

Studies have also shown that it can<br />

boost returns over the long term. It is,<br />

however, important to choose the right<br />

Adviser. Independent firms can provide<br />

advice and recommend solutions from<br />

across the whole of the marketplace,<br />

whereas a Restricted Adviser may only<br />

be able to recommend a limited range of<br />

options. Also consider using a Chartered<br />

firm, as this brings further comfort<br />

that the Advisers are highly qualified,<br />

and the business will aim to deliver the<br />

highest standards of professionalism.<br />

For more information on the services<br />

available at Financial Advice & Services<br />

Ltd, see financial-advice.co.uk<br />

The content of this article is for information only and does not constitute financial advice. It is for general information only and should not be relied upon when<br />

making any financial planning decisions. You should always obtain professional independent advice based on your circumstances. Financial Advice & Services<br />

Limited, Independent Financial Advisers, authorised and regulated by the Financial Conduct Authority.. Text © Financial Advice & Services Ltd <strong>2023</strong><br />

123<br />

priceless-magazines.com