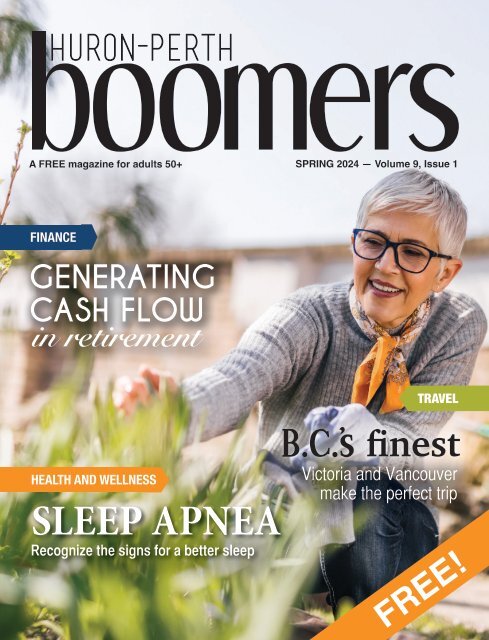

Huron-Perth Boomers Spring 2024

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A FREE magazine for adults 50+<br />

SPRING <strong>2024</strong> — Volume 9, Issue 1<br />

FINANCE<br />

GENERATING<br />

CASH FLOW<br />

in retirement<br />

TRAVEL<br />

HEALTH AND WELLNESS<br />

SLEEP APNEA<br />

Recognize the signs for a better sleep<br />

B.C.’s finest<br />

Victoria and Vancouver<br />

make the perfect trip<br />

FREE!

Formerly: Mackhall Mobility<br />

Home Health Equipment Solutions<br />

Mobility | Accessibility | Home Safety<br />

CPAP/Sleep Therapy | Personal Care<br />

OntarioHomeHealth.ca<br />

1-800-661-1912

FROM THE PUBLISHER<br />

Ah... spring! Although you may be reading this in March, which is<br />

technically when we welcome spring in <strong>Huron</strong>/<strong>Perth</strong>, it often doesn’t<br />

feel like it. Rest assured, those longer, brighter days are ahead of us.<br />

It is often said that spring is a time of renewal, coming out of months of<br />

cold, dark days but I always liken spring to a ‘New, new year’ – when plans<br />

are being made for the year ahead. There are outside projects to prepare<br />

for, which seem to multiply under the snow, summer vacations to plan, new<br />

activities to sign up for (don’t forget that early registration!), and an overall<br />

sense of feeling hopeful, ambitious and somewhat alive again that coincides<br />

with the reappearance of the sun, grass and birds.<br />

I’m thrilled to share that this issue marks the eighth anniversary of <strong>Huron</strong>-<br />

<strong>Perth</strong> <strong>Boomers</strong>, and I couldn’t be prouder that we have made it this far. I’m<br />

always grateful for our advertisers, writers and readers who continue to<br />

participate in each issue, allowing us to publish the only magazine for adults<br />

50+ in <strong>Huron</strong>/<strong>Perth</strong>.<br />

CONTENTS<br />

Sleep apnea • 4<br />

B.C.’s finest • 8<br />

Preserving memories • 14<br />

Cash flow in retirement • 20<br />

Tiger Dunlop • 26<br />

Recipe • 30<br />

In this issue, we have something of interest for everyone! Jill Ellis-Worthington<br />

takes us along with her to the west coast to explore Victoria and Vancouver,<br />

while Ontario Home Health shares some great information about sleep<br />

apnea. Christine Wiedman also shares her expertise about creating cash<br />

flow in retirement, while local writer and history keeper Arlen Wiebe writes<br />

about the importance of recording your life<br />

story or that of your loved ones. We also get to<br />

know Goderich’s favourite son – Tiger Dunlop.<br />

Thank you for reading and happy spring!<br />

Amy Irwin, Publisher<br />

<strong>Huron</strong>-<strong>Perth</strong> <strong>Boomers</strong><br />

SPRING <strong>2024</strong><br />

Publisher<br />

Amy Irwin<br />

amy@huronperthboomers.com<br />

Magazine Design<br />

Becky Grebenjak<br />

Advertising inquiries<br />

Amy Irwin<br />

amy@huronperthboomers.com<br />

<strong>Huron</strong>-<strong>Perth</strong> <strong>Boomers</strong> welcomes<br />

your feedback.<br />

EMAIL<br />

amy@huronperthboomers.com<br />

PHONE 519-524-0101<br />

MAIL<br />

P.O. Box 287, Ripley, ON N0G 2R0<br />

<strong>Huron</strong>-<strong>Perth</strong> <strong>Boomers</strong> is distributed for free in <strong>Huron</strong> and <strong>Perth</strong><br />

counties, and is published each March, June, September, and<br />

December. Distribution of this publication does not constitute<br />

endorsement of information, products or services by <strong>Huron</strong>-<strong>Perth</strong><br />

<strong>Boomers</strong>, its writers or advertisers. Viewpoints of contributors and<br />

advertisers are not necessarily those of the Publisher. <strong>Huron</strong>-<strong>Perth</strong><br />

<strong>Boomers</strong> reserves the right to edit, reject or comment on all material<br />

and advertising contributed. No portion of <strong>Huron</strong>-<strong>Perth</strong> <strong>Boomers</strong> may<br />

be reproduced without the written permission of the Publisher.

HEALTH AND WELLNESS<br />

SLEEP<br />

APNEA<br />

RECOGNIZING THE SIGNS AND TAKING ACTION<br />

BY TRACY GEORGE<br />

4 • HURONPERTHBOOMERS.COM

y Tracy George<br />

HEALTH AND WELLNESS<br />

Sleep apnea is a common, yet often undiagnosed, sleep<br />

disorder that can have serious health implications if left<br />

untreated. It’s crucial to recognize the signs and symptoms<br />

and take appropriate action.<br />

In this article, we’ll discuss how to identify if you have sleep<br />

apnea and what steps to take if you suspect you may be<br />

affected.<br />

What is sleep apnea?<br />

Sleep apnea is a condition characterized by interrupted<br />

breathing during sleep. There are two primary types of<br />

sleep apnea – Obstructive Sleep Apnea (OSA), which is the<br />

most common type. It occurs when the throat muscles relax<br />

excessively, obstructing the airway during sleep. The other<br />

type is Central Sleep Apnea, which is less common and results<br />

from a failure of the brain to send the proper signals to the<br />

muscles responsible for controlling breathing.<br />

SPRING <strong>2024</strong> • 5

HEALTH AND WELLNESS<br />

by Tracy George<br />

Recognize the signs<br />

Identifying the symptoms of sleep apnea is the<br />

first step toward diagnosis and treatment. Here are<br />

common signs to look out for:<br />

Loud and persistent snoring. If you or your<br />

sleep partner snores loudly and frequently, especially<br />

with intermittent pauses in breathing, it may be a<br />

sign of sleep apnea.<br />

Frequent awakening. If you find yourself waking<br />

up gasping for breath or experiencing a choking<br />

sensation during the night, this could be indicative<br />

of sleep apnea.<br />

Excessive daytime fatigue. One of the hallmark<br />

signs of sleep apnea is excessive daytime sleepiness,<br />

even after a full night’s sleep.<br />

Morning headaches. Waking up with frequent<br />

morning headaches, especially if they are severe,<br />

may be related to sleep apnea.<br />

Difficulty concentrating. Poor focus and<br />

difficulty concentrating on tasks can result from sleep<br />

deprivation caused by untreated sleep apnea.<br />

High blood pressure. Sleep apnea is linked to<br />

hypertension and cardiovascular problems, so if<br />

you have high blood pressure, consider it a potential<br />

risk factor.<br />

Suspect sleep apnea?<br />

If you recognize the signs of sleep apnea in yourself<br />

or a loved one, it’s essential to take action promptly.<br />

Here are the steps to follow:<br />

Consult a health care professional. The first<br />

step is to discuss your symptoms with a health care<br />

provider, ideally a sleep specialist or pulmonologist.<br />

You will need to discuss with your family doctor to<br />

get a referral.<br />

Undergo a sleep study. This will monitor your<br />

sleep patterns, breathing, and other essential<br />

parameters to confirm the diagnosis.<br />

6 • HURONPERTHBOOMERS.COM

y Tracy George<br />

HEALTH AND WELLNESS<br />

Explore treatment options. If diagnosed with<br />

sleep apnea, your health care provider will discuss<br />

treatment options. Common approaches include<br />

lifestyle changes, such as weight loss and positional<br />

therapy, and the use of Positive Airway Pressure<br />

(PAP/CPAP) device.<br />

Compliance and follow-up. If prescribed PAP or<br />

other treatments, it’s crucial to use them consistently<br />

and attend follow-up appointments to monitor<br />

progress and make necessary adjustments.<br />

Recognizing the signs of sleep apnea and seeking<br />

treatment is vital for your overall health and wellbeing.<br />

By taking these steps, you can improve your<br />

quality of life, reduce the risks associated with sleep<br />

apnea, and regain restful, uninterrupted sleep.<br />

Tracy George is a Sleep Therapy Manager at Ontario Home<br />

Health. For more information, call 1-800-661-1912, visit<br />

www.OntarioHomeHealth.ca, or visit one of their six locations.<br />

GRANDPARENTS RAISING<br />

GRANDCHILDREN<br />

Peer support group for<br />

grandparent caregivers<br />

education • community • support<br />

Learn more here:<br />

www.rrhc.on.ca/grandparentsraisinggrandchildren<br />

SPRING <strong>2024</strong> • 7

TRAVEL<br />

B.C.’s finest<br />

VANCOUVER AND VICTORIA MAKE THE PERFECT<br />

COMBO FOR A VISIT TO CANADA’S WEST COAST<br />

STORY AND PHOTOS BY JILL ELLIS-WORTHINGTON<br />

Above: Colourful floating homes line the<br />

docks of Victoria’s Fisherman’s Wharf.<br />

Right: Ralph Lembcke and Jill Ellis-<br />

Worthington ready to challenge the<br />

suspension bridge at Lynn Canyon.<br />

8 • HURONPERTHBOOMERS.COM

y Jill Ellis-Worthington<br />

TRAVEL<br />

There are many places around the world where<br />

you can look one way to see the ocean and the<br />

other way to see mountains. Aren’t we lucky that<br />

Canada’s most westerly province is one of them?<br />

Canadians’ interest in travelling inside the country<br />

has been reignited, partially sparked by the pandemic.<br />

We’re finding ways to explore our home that tourists<br />

from all over the world come to see.<br />

Last summer, low-priced Flare Airlines started<br />

flying non-stop from London, Ont., to Vancouver.<br />

Not having a layover in Calgary shortens the trip<br />

considerably, and the cheaper fare is nice because<br />

flights to both Vancouver and Victoria can be pricey.<br />

When you land at Vancouver International Airport,<br />

taxis will be waiting to whisk you to your lodgings,<br />

but Uber and Lyft drivers are plentiful in the nation’s<br />

third-largest city, and it’s good to know the price of<br />

the ride before you start. Once you’re settled at a<br />

hotel or Airbnb, using the Skytrain to get around is<br />

fast, clean and easy. Buying a Compass card at one<br />

of the stations makes getting around even cheaper.<br />

Note, the card costs $6 and then you load it up with<br />

rides as needed, but you can mail it back to get a<br />

refund.<br />

B.C. recently outlawed entire-home Airbnbs,<br />

but you can still use this less expensive option for<br />

accommodations by choosing one that is a separate<br />

suite or room in a home in both Vancouver and<br />

Victoria. We found one with a private suite in a home<br />

just a three-block walk from the Nanaimo Skytrain<br />

station.<br />

In Victoria, where there are many sumptuous<br />

places to stay, Dayna Wilson, who lives just outside<br />

of London, Ont., recommends the Days Inn by<br />

Wyndham on the Harbour as a cheaper alternative.<br />

She says it’s about half the price of “swankier”<br />

places.<br />

“It has a great view, has been updated, is clean and<br />

the staff were great,” Dayna said.<br />

In any large city, taking a hop-on-hop-off tour gives<br />

a wonderful overview and a taste of what’s worth<br />

experiencing fully when you have more time. We<br />

hopped on a Gray Line ‘trolley’ (a retired school<br />

bus) that took us around a loop that included Stanley<br />

Park, Granville Island, Chinatown and Gastown,<br />

along with many other lesser-known stops. The<br />

antiquated sound system made it hard to understand<br />

the drivers at times, but we liked sitting in the openair<br />

portion of the bus.<br />

Granville Island is one of the places you will want to<br />

explore further, so board an aqua bus at one of the<br />

eight stops on False Creek. The ‘island’ was created<br />

after the creek was dredged and became home to<br />

Vancouver’s industrial area. Many buildings have<br />

been repurposed and now house the renowned<br />

SPRING <strong>2024</strong> • 9

TRAVEL<br />

by Jill Ellis-Worthington<br />

Clockwise from left: The steam-powered clock<br />

in Vancouver’s Gastown. History buffs will enjoy<br />

Craigdarroch Castle in Victoria. The colourful, rolling<br />

grounds of Queen Elizabeth Park provide a respite in the<br />

middle of noisy Vancouver. The Fairmont Empress Hotel<br />

is one of Victoria’s iconic sites.<br />

Opposite: On the bow of one of the Prince of Whales’<br />

whale-watching boats, the author and her husband were<br />

happy to see humpbacks and orcas during their excursion.<br />

10 • HURONPERTHBOOMERS.COM

y Jill Ellis-Worthington<br />

TRAVEL<br />

Public Market. Take your appetite because there are<br />

dozens of delicious treats to consume while shopping<br />

in the many quaint shops. The lemon squares and<br />

canelés were particularly tasty. It was fun browsing<br />

in the broom shop and thinking about how Harry<br />

Potter would love it there. In a stall with imported<br />

rugs, I got an amazing bargain on a lovely deep<br />

teal pashmina a few doors down from other shops<br />

charging three or four times as much for the same<br />

thing. There are unique items and good prices if you<br />

hunt a bit. Give your shoes a rest by stopping at the<br />

Granville Island Brewing or the waterside patio at<br />

Tap & Barrel Bridges.<br />

On everyone’s must-go list, Stanley Park sits on 1,000<br />

acres in the west end. While the hop-on-hop-off bus<br />

ride through was good, we really enjoyed going back<br />

and renting bicycles to explore it further. One of the<br />

most convenient places to rent them is at Spokes on<br />

West Georgia Street, just two blocks from one of the<br />

park’s entrances. A shared path circumnavigates;<br />

walkers don’t always stick to their section, so caution<br />

is advised. Electric-assist bikes enabled us to go<br />

around the park twice, as well as explore some of the<br />

hillier interior paths. Riding under the Lions Gate<br />

Bridge and stopping to wade at Third Beach were a<br />

couple of highlights. Stanley Park Brewpub makes<br />

a great stopover for lunch and a libation to fuel the<br />

ride.<br />

For a cheap, active afternoon, we decided to visit<br />

Lynn Canyon, a lovely green oasis. At Canada Place,<br />

we took the Aquabus Ferry to North Van and jumped<br />

on a bus (both covered by our transit passes) to the<br />

neighbourhood adjacent to the canyon. A short walk<br />

took us to the edge of the park. After picking up a map<br />

at the visitors’ centre, we chose the three-kilometre<br />

trail that took us over the Suspension Bridge, past<br />

the Lynn Creek swimming hole, and back around<br />

to the entrance. There are longer and shorter trails;<br />

this seemed a good choice for my knees, but it can<br />

be challenging to hike over the rocky terrain and up<br />

several sets of steep wooden stairs. It wasn’t always<br />

fun, but the stunning beauty of the rainforest made<br />

it more than worthwhile, and all for free. Two other<br />

freebies include Chinatown and Queen Elizabeth<br />

Park. Walk through Chinatown to experience its<br />

architecture and food, and don’t miss the world’s<br />

narrowest commercial building (Sam Kee Building)<br />

or the peaceful Dr. Sun Yat-Sen Classical Chinese<br />

Garden. Queen Elizabeth Park is a serene spot in the<br />

middle of a busy area of town, offering the best view<br />

of Vancouver from a lofty 125 metres above the city.<br />

A walk through the 52-hectare gardens adds to the<br />

enjoyment.<br />

The journey to Victoria starts with a 90-minute ferry<br />

ride to Vancouver Island, during which you may even<br />

see whales. Since neither Vancouver nor Victoria are<br />

close to the ferry terminals on either end, we found<br />

taking a Viator ‘tour’ the cheapest way to do it. A<br />

bus picks you up at historic Pacific Central Station<br />

and takes you onto the ferry. On the other side, it<br />

drives you to downtown Victoria for one lower price<br />

as opposed to paying for the ferry and taxis or ride<br />

shares at each end.<br />

Victoria is a walkable city; we didn’t pay for<br />

transportation during our visit. Much of the action<br />

is centered around the inner harbour. Strolling its<br />

perimeter takes you by the famed Fairmont Empress<br />

SPRING <strong>2024</strong> • 11

TRAVEL<br />

Queen Elizabeth Park offers the best view of<br />

Vancouver from 125 feet above sea level.<br />

Hotel and around to the Legislative Assembly of<br />

British Columbia, with its architectural style most<br />

often described as “free classical,” Romanesque or<br />

Renaissance. Check out the lovely old buildings of<br />

the latter, and the grounds of the former.<br />

Downton Abbey fans will relish a self-guided tour<br />

of Craigdarroch Castle. While not nearly as grand<br />

as the Earl of Grantham’s residence, strolling the<br />

‘castle’ halls and climbing the separate staircases used<br />

by family and servants gives a sense of yesteryear. A<br />

short walk from the castle takes you to the grounds<br />

of Government House, the official residence of<br />

B.C.’s Lieutenant Governor. Walking through the<br />

expansive gardens is free, as opposed to paying to<br />

tour Butchart Gardens.<br />

Founded in 1862, Victoria is one of the nation’s<br />

oldest cities; its architecture exhibits a storied past.<br />

To experience it on the cheap, pick up self-guided<br />

heritage walking tour maps at Victoria’s Visitor Centre<br />

located on the harbour. They cover fun subjects like<br />

Haunted Victoria, Rollicking Boomtown, Law and<br />

Order and Mysterious Chinatown, which was once<br />

the largest in Canada and is well worth exploring.<br />

Hidden alleyways and exotic-looking buildings<br />

beckon visitors.<br />

A walk down pedestrian-friendly Government Street<br />

is good for people watching, appreciating buskers<br />

and window shopping. So many quaint eateries<br />

reside in this tourist-magnet district.<br />

While at the harbour, you’ll see little taxi and harbour<br />

tour boats scuttling along, and you can pick up tickets<br />

at the kiosk on the Empress dock. The captains relate<br />

tales of the harbour’s colourful history and geography.<br />

We jumped off at Fisherman’s Wharf to grab a bite to<br />

eat at one of the many floating restaurants and joined<br />

the crowds checking out the charming floating homes<br />

docked there.<br />

Walking along the waterfront area, you can’t help<br />

but notice all the businesses offering whale watching<br />

tours, and we chose the Prince of Whales. It offers<br />

both zodiac and catamaran tours – we picked the<br />

latter because of its more stable ride and bathrooms.<br />

This excursion was a splurge but well worth the<br />

cost. We sat on the bow, giving us the best view of<br />

the magnificent scenery as we skiffed the waters<br />

12 • HURONPERTHBOOMERS.COM

y Jill Ellis-Worthington<br />

of the Strait of San Juan de Fuca. The crew kept<br />

us informed of where to look for whales. We were<br />

fortunate enough to be in good viewing distance of<br />

a humpback and several orcas, including a baby.<br />

So that you can enjoy the experience fully without<br />

fiddling with your phone, the staff photographer<br />

takes pictures that are shared with all guests on that<br />

trip via a link.<br />

FREE<br />

Hearing<br />

Test *<br />

Love your ears<br />

Professionals<br />

in hearing<br />

& living a full life<br />

Taking a float plane back to Vancouver to catch<br />

our flight to Ontario was a breathtaking once-in-alifetime<br />

experience.<br />

Recommended restaurants<br />

Vancouver<br />

• Fat Mao Noodles (fantastic bowls)<br />

• Chinatown BBQ (best fried rice I’ve ever had)<br />

• Little Bangkok Thai Kitchen (rated best Thai in<br />

Vancouver. Twist: it’s in a mall)<br />

• VJ’s Restaurant (excellent high-end Indian cuisine).<br />

• Sulbing Café Robson (bingsu – amazing Korean<br />

shaved milk dessert)<br />

• Local Public Eatery (great patio, Gastown)<br />

• Blue Fox (delicious breakfasts and mimosas)<br />

Victoria<br />

• Bard and Banker Pub on Government Street<br />

(charming and historic)<br />

• Lido Waterfront Bar (sit and watch the boats)<br />

• Floyd’s Diner (best breakfast and worth the wait)<br />

• Gozen Sushi (best miso)<br />

• Ocean Garden Restaurant (good and in the heart<br />

of Chinatown)<br />

• The Fish Store (best on Fisherman’s Wharf)<br />

• Chocolats Favoris (decadent dipped cones)<br />

A writer, public relations professional, traveller and football<br />

fan, Jill Ellis-Worthington celebrates life every day. You can<br />

follow her blog at writeoncommunicationservices.com.<br />

Being able to hear is central to who you are, and<br />

hearing aids play a crucial role in helping your<br />

brain process sound.<br />

This helps you to engage effortlessly with the<br />

world around you, foster meaningful connections<br />

and most importantly, keep being you!<br />

Why Choose<br />

90-DAY<br />

risk free purchase,<br />

no return fees<br />

FULL-SERVICE<br />

WARRANTY<br />

Get started with a FREE hearing test today!*<br />

Listowel 1195 Wallace Avenue<br />

Wingham 3 Patrick Street<br />

Goderich 394 <strong>Huron</strong> Road, Unit 3<br />

Clinton 89 Albert Street, PO box 751<br />

Exeter 281 Main Street S, Unit 277<br />

Stratford<br />

<strong>Huron</strong> 295 <strong>Huron</strong> Street<br />

Cambria Professional Building 386 Cambria Street<br />

1-888-788-5302<br />

Mention code:<br />

PRICE 350+<br />

match policy ** clinics across<br />

Canada<br />

Book online<br />

HearingLife.ca<br />

Your hearing aid purchase<br />

goes beyond the point of sale<br />

NSP-FHT-HPBM<br />

*A comprehensive hearing assessment is provided to adults ages 19 and older at no cost. The results of<br />

this assessment will be communicated verbally to you. If you request a copy of the Audiological Report, an<br />

administrative fee will apply. Child hearing tests are conducted at select locations for a fee, please contact<br />

us for more information. 90-Day Risk-Free Trial begins at the date of purchase. Information within this offer<br />

may vary or be subject to change. Limit one offer per customer per year. Offer not valid in Quebec. Offer not<br />

applicable for industrial hearing tests. Some conditions apply, see clinic for details. **If you are quoted a lower<br />

price on an identical hearing aid with the same features, options and services, HearingLife Canada Ltd. will<br />

match that price. Conditions Apply. Ask our hearing care professionals for more details.<br />

SPRING <strong>2024</strong> • 13

COMMUNITY<br />

Saving your<br />

Memories<br />

THE “WHY” AND “HOW” OF SAVING YOUR PRECIOUS<br />

RECOLLECTIONS BY ARLEN WIEBE<br />

14 • HURONPERTHBOOMERS.COM

y Arlen Wiebe<br />

People have always been captivated by a<br />

compelling story. Since the birth of language,<br />

people from all cultures have been telling stories that<br />

both instruct and entertain.<br />

Long ago, people gathered around a fire at the end of<br />

a long day to hear myths, legends, fables, epic poems,<br />

proverbs, chants, rhymes, and songs. Storytellers<br />

preserved and passed a community’s stories down<br />

the generations.<br />

A big shift occurred when people created written<br />

language to record spoken words. People weren’t<br />

completely dependent on a community storyteller to<br />

preserve the oral stories anymore. With the printing<br />

press, books could be easily mass produced, and<br />

more people learned to read.<br />

Today, another huge shift has occurred. Instead of a<br />

communal experience around a living fire, families<br />

now congregate facing a glowing electronic screen.<br />

The storytelling task seems to be taken over by<br />

filmmakers and television writers.<br />

Why are stories so powerful?<br />

It’s incredibly fortunate that stories are both<br />

instructive and entertaining. While it might be<br />

possible to commit bits of knowledge to memory<br />

if we try hard enough, stories help us engage with<br />

our history, traditions and values much more easily.<br />

COMMUNITY<br />

Stories help us to create order and make sense of our<br />

lives. They help us appreciate how other people think<br />

and feel. Stories use language in a way that is unlike<br />

our everyday way of speaking and writing. Stories<br />

fashion ordinary words and events into extraordinary<br />

dramas.<br />

Should you record your stories?<br />

Yes! Our personal stories can be extremely valuable to<br />

ourselves and our families. We can preserve important<br />

family stories for our children and grandchildren. We<br />

can gain insight into our struggles and choices and<br />

share our wisdom. We can find direction for the rest<br />

of our lives and heal, especially if our lives have been<br />

shaped by pain or tragedy. We can connect names<br />

and stories to old family photos or add details to the<br />

family tree.<br />

Have you ever thought you’d like to know what your<br />

ancestors’ lives were really like, in their own words?<br />

Consider how your own life will be interesting to<br />

your descendants. Even people that don’t know us<br />

may be interested in our stories. Many people enjoy<br />

reading the personal anecdotes, stories and essays<br />

in the “First Person” section of The Globe and Mail.<br />

Maclean’s magazine publishes “My Arrival: The Lives<br />

of New Canadians” on the last page of each issue.<br />

CBC posts personal stories and experiences in its<br />

online “First Person” columns.<br />

SPRING <strong>2024</strong> • 15

COMMUNITY<br />

by Arlen Wiebe<br />

I’ve started writing about my own childhood<br />

experiences and coming to terms with how they have<br />

affected my adult life.<br />

A Canadian boy in California<br />

I could see my boyhood coming to an end when I<br />

was 12 years old. The curious warmth of springtime<br />

in Winnipeg had come back like a long-lost relative<br />

returning from a freezing and miserable journey.<br />

Light green leaves were budding once more on<br />

ancient elm trees as I walked south along Arlington<br />

Street, turned west onto Wolseley Avenue, and<br />

begrudgingly arrived at my weekday destination,<br />

Laura Secord School.<br />

Like all boys of school age should be, I was in a<br />

terrible hurry for the unbearable monotony of<br />

the daily academic ordeal to be done for the year.<br />

I was exhausted from trying to speak and write<br />

in my teacher’s funny foreign language. Pourquoi<br />

apprenais-je le français when my forebears spoke<br />

Plautdietsch, Nederlands, or Russki yazyk and wrote<br />

in Hochdeutsch? Other kids in my class came from<br />

families that spoke even more exotic languages. Why<br />

were we all being forced to learn a language not one<br />

of our families had ever spoken and likely never<br />

would?<br />

And why this inanely prescribed schedule? All this<br />

writing, reading, presenting, doing, and going here<br />

and there at the same time every day. Had the<br />

adults who ran the school given a maniacal villain<br />

permission to set up a labyrinth of torture? Why were<br />

we tested for our ability to remember the random<br />

order of letters in words or how numbers changed<br />

themselves when they met the funny symbols on the<br />

page?<br />

Once the clock on the classroom wall was finally<br />

persuaded to place a short stingy hand on the<br />

number three and its longer hand on six, I fled the<br />

prison and quickly reversed the route I had slowly<br />

walked that morning.<br />

Once at home, I put on a blue jersey, white pants,<br />

and cap and held my baseball glove in my hand.<br />

I finally felt free of all restraints. My mother had<br />

mercifully signed me up for a team through the R.A.<br />

Steen Community Centre, located on the far end of<br />

the field behind my school. We played our games in a<br />

sunken double baseball diamond circled by a gravel<br />

walking and biking path, near Omand’s Creek.<br />

I tried all the baseball positions in the field but I<br />

most enjoyed pitching. Standing high on an elevated<br />

mound. Controlling the start of each play. Deciding<br />

where to place the baseball to the waiting batters.<br />

I always held the baseball with the fastball grip. I<br />

hadn’t been taught how to throw any other kinds of<br />

pitches. Instead of variety, I tried to throw the same<br />

pitch again and again, laser focused on the shifting<br />

strike zone. Sometimes the ball would thread through<br />

that invisible rectangle between the elbows and knees<br />

of the cocky boy poised at home plate. Other times,<br />

it flew out of control, avoiding that rectangle, and<br />

rolling to the chain link fence behind our catcher.<br />

Most of my pitches flew past the boys at the plate.<br />

On the rare occasion when the batter made contact<br />

with the ball, my teammates organized themselves<br />

around the ball, stopped it, and threw it to first base.<br />

Midway through the baseball season, my mother<br />

got an emotional phone call. My absent father<br />

lay dying in a Regina hospital. She and I dropped<br />

everything and immediately drove 600 kilometres<br />

west across Manitoba and Saskatchewan to visit the<br />

man my mother had once given her heart to and<br />

that we barely knew anymore. When we entered<br />

my father’s hospital room, I saw a sickly, shriveled<br />

man in a hospital gown. He could barely sit up in his<br />

bed to greet us. Who was this person? I stood there<br />

stoically, listening to my parents catching up on years<br />

of missed time together.<br />

My father had three brothers. His brother Jake, from<br />

B.C., came with his wife and two kids to visit in<br />

16 • HURONPERTHBOOMERS.COM

y Arlen Wiebe<br />

COMMUNITY<br />

the hospital. Once his daughter, Shalom, had seen<br />

my father and left the room, she started to sob in<br />

the hallway. I watched her from my dad’s bedside.<br />

Why was she so upset? It wasn’t her father dying, it<br />

was mine. If anyone should be worked up, it should<br />

be me. I looked inside myself to find something<br />

that matched my cousin’s emotion but there was<br />

nothing there.<br />

We returned to Winnipeg and the baseball season<br />

continued. A few weeks later, there was another<br />

difficult phone call. We buried my father beside a<br />

little country church on the Saskatchewan prairie.<br />

Soon after, my mother was very surprised to receive a<br />

large payment from my father’s life insurance policy<br />

that had been kept active. This set the gears in motion<br />

for my mother’s next step. She had always dreamed<br />

of studying to become a pastor and now she had the<br />

money to do it. She wanted to study at a seminary in<br />

California. All that summer, my mother prepared us<br />

to move. I was devastated. I didn’t want to live in a<br />

foreign country without friends or anything familiar.<br />

In late August, my mother and I boarded an airplane<br />

that took us from Winnipeg to Minneapolis, then on<br />

to Los Angeles. We crossed that huge airport to catch<br />

a tiny airplane to take us to Fresno. We moved into<br />

a small apartment on the campus where my mother<br />

would study the Bible and theology.<br />

I would attend school as a light-skinned Canadian<br />

among a sea of black and brown faces. I would<br />

travel to Yosemite National Park, San Francisco, and<br />

Hollywood. I would be forced to adapt to many new<br />

things as I started Grade 7. My Canadian boyhood<br />

had come to an end in California.<br />

Learn how we make clean energy and medical<br />

isotopes at the Bruce Power Visitors’ Centre.<br />

Wonder.<br />

Explore.<br />

Discover.<br />

www.brucepower.com/visit<br />

3394 BRUCE ROAD 20, NORTH OF TIVERTON, WEST OF HIGHWAY 21. T: (519) 361-7777<br />

SPRING <strong>2024</strong> • 17

COMMUNITY<br />

by Arlen Wiebe<br />

to hear you telling your stories with your own voice.<br />

Would you enjoy hearing stories told in the voices of<br />

your ancestors?<br />

Books – A book can be narrative only or it can<br />

feature photos, documents, and other illustrations.<br />

Books can be paperback or hardcover, simple or<br />

elegant.<br />

What all is involved?<br />

Recording your personal stories is a way to connect<br />

generations and preserve memories. Sometimes<br />

called a personal history, it could be a memoir, a<br />

tribute, a life story, a family biography, an oral history,<br />

a legacy letter, or ethical will.<br />

If you work on your own personal history or that of<br />

a loved one, your only cost is your time and expenses.<br />

If you hire a personal historian, the cost will range<br />

in price from a few hundred dollars (audio and/or<br />

transcripts for oral history), to thousand dollars (a life<br />

story with photos), to tens of thousands of dollars<br />

(longer or more complex projects).<br />

What format does personal<br />

history take?<br />

A childhood<br />

photo of<br />

Arlen and<br />

his Mom.<br />

Personal histories can be recorded in many ways.<br />

Here are some areas in which personal historians<br />

may have expertise.<br />

Audio recordings/CDs – Recording your stories<br />

electronically in an audio file or a CD allows your<br />

children, grandchildren, and great-grandchildren<br />

Art books, scrapbooks, handmade books –<br />

These are one-of-a-kind products that can include<br />

written stories, photos, drawings, scraps of fabric,<br />

pressed flowers, jewelry, and any other kind of valued<br />

memento.<br />

Photo books, collages, calendars – These<br />

products are mostly photos or drawings combined<br />

with very few written words. You could create a<br />

beautiful photo book, a poster-sized collage, or a<br />

photo calendar with pictures of family members<br />

included on their birthdays, anniversaries, or other<br />

important dates.<br />

Photo videos – You can use photos, home movies,<br />

slides, videotapes, and other memorabilia to create a<br />

memorable video set to music.<br />

DVDs – You can capture a person’s voice, personality,<br />

gestures, and spirit for posterity on video. This<br />

kind of project can be simple or complex, include<br />

individual or group interviews, and range from short<br />

tribute to TV-style biography.<br />

Ethical wills or legacy letters – An ethical<br />

will or legacy letter is a statement of your personal<br />

values, beliefs, life lessons, and a message you want to<br />

convey to your family, friends, and community.<br />

Legacy planning – Legacy planning helps<br />

you preserve your values and heritage for future<br />

generations. Tasks might include taking care of<br />

historical family documents and photos, creating<br />

an archive, preparing material for an obituary, or<br />

memorial service planning.<br />

18 • HURONPERTHBOOMERS.COM

y Arlen Wiebe<br />

COMMUNITY<br />

Family websites – It’s becoming increasingly<br />

popular for families to create a website to preserve<br />

and share family stories and information. These<br />

sites might include a family tree, genealogy, photos,<br />

letters, stories, videos, and sound files.<br />

Unique products – Some people enjoy being<br />

creative with their precious memories. A special<br />

quilt could be made of valued fabrics or decorations.<br />

Inspiring images and music can lead to a painting,<br />

drawing, mural, collage, memory box or multimedia<br />

presentation. Valued recipes could be collected into<br />

a family cookbook. What else could you imagine?<br />

Tell your story<br />

People now recognize that reminiscence and life<br />

review are important life processes. Working through<br />

our memories to find patterns, meaning, and values<br />

are key to a fully examined life. Many of us think<br />

about interviewing our aging family members but<br />

put it off until later. When we finally find the time, it<br />

may be too late – the loved one could be too frail to<br />

tell their stories, or their memories may have faded.<br />

Worse, they may have already passed away.<br />

If recording your own stories or that of a loved one is<br />

important to you, take the first step today to making<br />

it happen!<br />

Arlen Wiebe is a personal historian, writer, musician, and<br />

teacher living in Owen Sound. He enjoys helping people find<br />

meaning and purpose through writing their life stories, memoirs,<br />

and family history. You can learn more about him at yourlife-stories.ca.<br />

You can contact him by email at arlen.wiebe.<br />

writer@gmail.com or by text/phone at 226-668-3352.<br />

SPRING <strong>2024</strong> • 19

FINANCE<br />

GENERATING<br />

CASH FLOW<br />

in retirement<br />

TOO OFTEN, FINANCIAL ADVICE ONLY<br />

FOCUSES ON SAVING MONEY<br />

BY CHRISTINE WIEDMAN<br />

20 • HURONPERTHBOOMERS.COM

y Christine Wiedman<br />

FINANCE<br />

Throughout your career you were advised to save<br />

for your retirement, so you did. You opened<br />

a Registered Retirement Savings Plan (RRSP) and<br />

later a Tax-Free Savings Account (TFSA). The<br />

government also required you to make contributions<br />

to the Canada Pension Plan (CPP) each paycheque.<br />

You may have contributed to a company pension<br />

plan, and saved money in a non-registered account<br />

like a brokerage account through your bank. You<br />

became a very good saver. Perhaps you had a goal<br />

in mind for how much you needed to save for<br />

retirement, although you likely wondered if that goal<br />

was enough.<br />

Now you have retired, and that’s great! You no<br />

longer have to save and now you can start spending<br />

those hard-earned dollars. Life is good, right? Yet, at<br />

the same time you’ve found freedom, your financial<br />

life becomes much more complicated. You have to<br />

shift from automatically receiving a paycheque to<br />

creating a cashflow management plan to meet your<br />

needs. You have entered a whole new territory of<br />

personal finance.<br />

The cash flow you generate in retirement will likely<br />

not come from one source, such as a paycheque.<br />

Instead, you will be managing multiple sources of<br />

potential cashflow. Some of these sources already<br />

come in the form of a periodic payment, like<br />

government benefits – CPP, Old Age Security (OAS)<br />

and possibly the Guaranteed Income Supplement<br />

(GIS) for low-income Canadians – or a workplacedefined<br />

benefit pension. A big advantage of<br />

government benefits and many company pensions is<br />

that they are indexed to inflation, so you don’t have<br />

to worry about the purchasing power of your money<br />

eroding over time. The remainder of your cash flow<br />

SPRING <strong>2024</strong> • 21

FINANCE<br />

by Christine Wiedman<br />

will come from your assets, including equities and<br />

fixed income securities saved in your registered and<br />

non-registered accounts. But how do you convert<br />

these assets into cashflow?<br />

Meet “Phil and Prya”<br />

Take Phil and Prya (not real people) as an<br />

example. They are both 65 and have just retired.<br />

Phil contributed the maximum amount to CPP<br />

throughout his career, and is therefore entitled to the<br />

maximum benefit of $15,679 per year. He decides<br />

to start taking CPP right away. Prya did not earn as<br />

much as Phil so she is entitled to $7,840 per year. 1<br />

She was employed by the government for part of<br />

her career, and is entitled to government pension of<br />

$12,000 per year. If we assume that neither will have<br />

income exceeding $81,761 (2022) thereby avoiding<br />

OAS claw-backs, and have both lived in Canada<br />

their entire working lives, they will each be entitled to<br />

the maximum OAS of $8,383 per year. This brings<br />

their total pre-tax income to $52,285. All of these<br />

amounts are indexed to inflation and therefore will<br />

increase over time.<br />

Cash flow needs and pre-tax income<br />

Where should Phil and Prya go from here? First,<br />

they need to know how much they will likely spend<br />

each year. A detailed review of their spending in the<br />

past year could help them estimate their cashflow<br />

needs. Let’s assume they will need about $70,000 of<br />

after-tax cashflow in their first year of retirement.<br />

Assuming each pays taxes of about 15 per cent,<br />

this translates to about $82,000 of required pre-tax<br />

income. 2<br />

“Pensionizing” your assets<br />

The good news is that over 60 per cent of their<br />

cashflow needs will come from guaranteed payments<br />

that are indexed to inflation. However, they still need<br />

to generate about $30,000 per year to meet their<br />

retirement spending goals. To do this, they will have<br />

to convert their existing assets into cash flow. Authors<br />

Moshe Milevsky and Alexandra Macqueen coined<br />

the term to “pensionize” your nest egg to describe<br />

the problem, and defined it as converting money<br />

into income you can’t outlive; and creating your own<br />

personal pension, a monthly income that lasts for the<br />

rest of your life. 3<br />

Assets can include savings accounts, Guaranteed<br />

Investment Certificates (GICs), corporate and<br />

government bonds, individual stocks, mutual funds,<br />

and Exchange Traded Funds (ETFs). 4 They may<br />

be accumulated in your TFSA, which is exempt<br />

from tax, in tax-deferred vehicles like your RRSP<br />

or Registered Retirement Income Fund (RRIF), in<br />

workplace-defined contribution plans, or in nonregistered<br />

accounts like a brokerage account.<br />

So how do you convert these assets into a regular<br />

cash flow? Let’s assume that Phil has a workplace<br />

defined contribution pension of $240,000 and<br />

$220,000 accumulated in his RRSP, while Prya has<br />

$120,000 accumulated in her RRSP. They each have<br />

$50,000 in TFSAs. They also have $80,000 invested<br />

in a joint brokerage account and $25,000 in their<br />

joint chequing account.<br />

Risks<br />

There are several risks that come with turning assets<br />

into cash flow in retirement. The first is longevity<br />

risk – this is the risk that you will run out of money<br />

before you die. While the average life expectancy at<br />

age 65 is about 20 years, a glance at the obituary<br />

section of the newspaper confirms that you could<br />

live well into your 90s. 5 Without knowing your life<br />

expectancy, you don’t know how long your money<br />

will need to last. Other challenges include stock<br />

market volatility, especially large market declines<br />

early in your retirement that erode your capital base;<br />

and, inflation, which erodes the purchasing power of<br />

the cash flow you do receive. There is also legacy risk<br />

– the risk that you leave nothing to your beneficiaries<br />

after you die.<br />

22 • HURONPERTHBOOMERS.COM

y Christine Wiedman<br />

FINANCE<br />

Withdrawal rates<br />

So how do you convert a pool of assets into cashflow?<br />

One way is to withdraw a steady amount of cash<br />

each year from your different accounts, something<br />

financial planners refer to as a sustainable withdrawal<br />

rate. You may have heard about the four per cent<br />

rule – you can withdraw four per cent of your<br />

assets annually from your portfolio each year and<br />

still be reasonably certain that you won’t run out of<br />

money during your lifetime. The rule was originally<br />

determined by William Bengen in 1994. 6 He found<br />

that a four per cent withdrawal rate was successful<br />

over any 30-year period dating back to 1926. This<br />

suggests that a retiree could withdraw $40,000 from<br />

a $1 million portfolio and increase that amount every<br />

year by inflation and never run out of money.<br />

Subsequent research has shown that the withdrawal<br />

rate depends on your retirement planning horizon<br />

(higher withdrawal rates for shorter horizons); your<br />

portfolio mix of stocks versus bonds (bonds provide<br />

certainty but stocks provide more upside potential);<br />

and inflation levels (lower withdrawal rates for higher<br />

inflation). For example, researchers found that a<br />

withdrawal rate of four per cent on an inflationadjusted<br />

50/50 portfolio had 100 per cent chance<br />

of success over a 25-year horizon, whereas a five per<br />

cent rate had an 80 per cent chance. 7<br />

Let’s assume that Phil and Prya feel comfortable with<br />

a four per cent withdrawal rate. Phil withdraws four<br />

per cent of his RRSP and his workplace pension, Prya<br />

withdraws the same from her RRSP, and they withdraw<br />

four per cent of their non-registered brokerage account.<br />

They decide to keep the money in their TFSAs as a<br />

financial cushion. This strategy will provide them<br />

with an additional $26,400 of cash flow in their first<br />

year of retirement. Most of this will be fully taxable,<br />

but the tax implications of the withdrawal from their<br />

How many steps will you<br />

take for dementia?<br />

SATURDAY,<br />

MAY 25, <strong>2024</strong><br />

10:00 am<br />

Living safely in the<br />

community depends<br />

on everyone<br />

supporting people<br />

with dementia.<br />

Learn how to stay<br />

SAFE and ACTIVE<br />

with memory loss<br />

www.walkforalzheimers.ca<br />

It’s easy to register and start fundraising or<br />

donate to an individual, team, or event<br />

Show your support for more than 3200 individuals<br />

living with dementia and their care partners<br />

in <strong>Huron</strong> and <strong>Perth</strong> County<br />

CLINTON | EXETER | GODERICH<br />

LISTOWEL | STRATFORD | ST. MARYS | WINGHAM<br />

Take our FREE<br />

online learning course<br />

Learn how you can help people with dementia<br />

live safely in the community and how to<br />

interact with someone who might be lost<br />

Visit: FindingYourWayOntario.ca<br />

SPRING <strong>2024</strong> • 23

FINANCE<br />

by Christine Wiedman<br />

brokerage account will depend on capital gains that<br />

have accumulated in that account. Their total income is<br />

$78,685, a few thousand below their target of $82,000.<br />

Dealing with a shortfall<br />

How should they deal with this shortfall? They need<br />

to either generate more cashflow or spend less. They<br />

might consider working part-time during retirement<br />

or starting a side-hustle to generate some additional<br />

cash flow, at least in the early stages of retirement.<br />

Alternatively, they could withdraw money more<br />

aggressively, say at a withdrawal rate of 4.5 per cent.<br />

While this would introduce the chance of them<br />

running out of money, they may be willing to take<br />

this risk, especially if they expect their expenses to<br />

drop over time when they become less active. If they<br />

own a home, they could later downsize or move to<br />

a less expensive location, thereby freeing up equity.<br />

Alternatively, they may decide to cut down on their<br />

expenses, perhaps dropping to one car, eating out<br />

less, or cutting their travel budget.<br />

Annuities and other insurance products<br />

A different approach to deal with longevity risk is<br />

to purchase an annuity from an insurance company.<br />

For a fixed upfront amount of money, you receive<br />

a fixed monthly amount until you die. A joint<br />

annuity will continue to pay the monthly amount<br />

to your surviving spouse until they die. The amount<br />

you receive depends on prevailing interest rates, so<br />

annuities have only recently been drawing attention<br />

once again as a viable investment option as interest<br />

rates have climbed. The amount the annuity<br />

pays will likely be higher than the four per cent<br />

withdrawal rate. For example, in September 2023,<br />

a $100,000 annuity for a 65-year-old man with a<br />

10-year guarantee would pay approximately $575<br />

per month, or $6,900 per year until their death. 8<br />

Note that a joint annuity paying 60 per cent to the<br />

surviving spouse would pay less.<br />

The longer you live, the greater the advantage of<br />

the annuity. Also, you don’t have to worry about<br />

the volatility of the market because you will always<br />

receive a fixed amount. However, a fixed annuity<br />

does come with costs. First, you immediately lose<br />

liquidity because the $100,000 upfront investment is<br />

no longer yours to invest. Further, while this option<br />

provides you with a stable cash flow over your lifetime,<br />

the amount you receive each month is typically not<br />

adjusted for inflation. There is also no benefit left to<br />

your beneficiaries when you die.<br />

Other alternatives offered by insurance companies<br />

include inflation-adjusted annuities and segregated<br />

funds (also known as seg funds), which are both an<br />

investment and a life insurance product, typically<br />

offering to guarantee 75 per cent to 100 per cent<br />

of your principal, but charging higher fees than<br />

mutual funds.<br />

The plan<br />

In the end, Phil and Prya decide to use $100,000 of<br />

Phil’s RRSP to purchase a joint annuity that provides<br />

$6,500 (or 6.5 per cent) per year. This brings their<br />

total before-tax income to $81,585, very close to their<br />

target of $82,000, providing them with a balance of<br />

security from fixed payments and upside potential<br />

from market investments (chart at right).<br />

Phil and Prya – Pre-tax income estimate<br />

Before finalizing their plan, Phil and Prya decide<br />

to consult their financial planner to review their<br />

investments to ensure they are suitable for their<br />

goals and stage of life; to consider the possibility<br />

of deferring CPP to increase annual benefits; to<br />

discuss the topic of asset location to minimize taxes;<br />

and to consider the impact of future minimum<br />

RRIF withdrawals on their plans. Finally, they plan<br />

to review their spending in more detail to look for<br />

potential savings.<br />

Generating cash flow from your assets represents one<br />

of the biggest financial challenges in retirement. Be<br />

24 • HURONPERTHBOOMERS.COM

y Christine Wiedman<br />

FINANCE<br />

AAII Journal, February.<br />

8 Retrieved from CANNEX on September 19, 2023: https://www.<br />

cannex.com/index.php/services/canada/annuity-products/incomeannuities/<br />

Christine Wiedman, FCPA, PhD, is Professor Emerita, School<br />

of Accounting and Finance at the University of Waterloo, and<br />

a CPA Canada Financial Literacy Program volunteer. Visit<br />

www.cpacanada.ca/en/public-interest/financial-literacy for<br />

information about CPA Canada’s Financial Literacy Program,<br />

www.linkedin.com/in/christine-wiedman-35427752<br />

for more information about Christine.<br />

sure to educate yourself about the issues and options<br />

available and consider consulting with a trusted<br />

accountant or financial planner to develop a detailed<br />

plan that works for your specific situation. You have<br />

worked hard to save money and deserve to peace of<br />

mind in your retirement.<br />

Footnotes<br />

See the Government of Canada website for more details of how much<br />

you can expect to receive from CPP: https://shorturl.at/jvzK3. Note that<br />

CPP entitlements increase each year you defer them after age 65, rising to<br />

a maximum of 42% more at age 70. Conversely, entitlements decrease<br />

7.2% per year before 65, to 36% less at age 60.<br />

2 There are a number of online tax calculators available to estimate your<br />

taxes for a given level of income. For example, see the TurboTax tax<br />

calculator at https://shorturl.at/myMRV.<br />

3 Moshe A. Milevsky and Alexandra C. Macqueen. Pensionize your Nest<br />

Egg: How to use Product Allocation to Create Guaranteed Income for Life.<br />

2010. John Wiley & Sons Canada, Ltd., Mississauga, ON.<br />

4 Assets could also include real estate that could generate income through<br />

rental income or capital gains (or losses) if sold.<br />

5 https://shorturl.at/epqWX<br />

6 Bengen, William P. 1994. “Determining withdrawal rates using<br />

historical data.” Journal of Financial Planning: 14-24.<br />

7 Cooley, Philip L., Carl M. Hubbard and Daniel T. Walz. 1998.<br />

“Retirement savings: Choosing a withdrawal rate that is sustainable.”<br />

Have you had<br />

your Italian today?<br />

Join us for daily deals and<br />

features. Visit online for details<br />

or stop in anytime.<br />

107 Ontario Street<br />

Stratford • 519.271.3333<br />

fellinisstratford.com<br />

fellinisstratford<br />

@FellinisResto<br />

classic ~ Italian ~ cucina<br />

SPRING <strong>2024</strong> • 25

HISTORY<br />

Tiger Dunlop<br />

Background: Dunlop Tomb, Garbraid,<br />

date unknown. Photographer: Reuben<br />

R. Sallows (1855 - 1937). From the<br />

Archival Collection of the <strong>Huron</strong><br />

County Museum.<br />

Inset: William ‘Tiger’ Dunlop. From<br />

the Archival Collection of the <strong>Huron</strong><br />

County Museum.<br />

GODERICH’S MOST FAMOUS SON<br />

BY MAT JOHNSON<br />

Much has been written about Goderich’s<br />

most famous historical figure, William<br />

‘Tiger’ Dunlop. The volume of coverage by local<br />

and national historians has led to a comfortable<br />

familiarity between Goderich residents and the man<br />

whose tomb overlooks the beautiful Lake <strong>Huron</strong> port<br />

town.<br />

Dunlop’s legacy embodies a spirit of restless<br />

adventure, and his exploits around the globe seem<br />

larger than life. History relies on extraordinary<br />

figures like Dunlop to keep the past alive. These<br />

individuals invoke critical thinking and investigative<br />

questioning. This leads to greater understanding of<br />

both their lives and the world in which they lived,<br />

helping us gain a better understanding of our own<br />

past.<br />

Through volumes of available treatises, we can<br />

gain a clear picture of Tiger Dunlop the man. It is,<br />

however, the inscription on the plaque adjacent to<br />

his stone tomb that conjures up questions about the<br />

world in which Dunlop lived.<br />

William Dunlop, born in Scotland, first came to<br />

Canada in 1813 as a surgeon assigned to the 2nd<br />

Battalion of the 89th Regiment during the War<br />

of 1812. Thankfully we can’t experience bloody<br />

combat at Lundy’s Lane, Chippewa, Crysler’s Farm<br />

and numerous small skirmishes in between, but<br />

we can strive to understand the general duties and<br />

responsibilities of a battlefield surgeon. It is through<br />

gaining this understanding that we can add another<br />

critical piece to the puzzle of who was Tiger Dunlop.<br />

For military historians, the time period in which the<br />

War of 1812 took place often falls under the general<br />

umbrella known as the Napoleonic Era. For British<br />

historians, the War of 1812 was a sideshow – many<br />

see it as an insignificant place where the British Army<br />

was engaged while the real fighting was taking place<br />

in Europe against France, which was the real enemy.<br />

Particularly between the years of 1808 and 1815,<br />

the British nation was wholly preoccupied with<br />

the ceaseless conflict in Portugal and Spain. Here,<br />

British armies and their Spanish and Portuguese<br />

allies waged a brutal war of eviction against French<br />

forces commanded by Napoleon’s Marshalls. When<br />

war between the U.S. and Britain commenced in<br />

26 • HURONPERTHBOOMERS.COM

y Mat Johnson<br />

June 1812, it barely served notice in the British<br />

press as the bloody siege of Badajoz (Spain) had<br />

just ended successfully, though in a frenzy of untold<br />

violence. Even today, in masterfully written books<br />

covering this era such as Redcoat by Richard Holmes,<br />

or The Napoleonic Wars: A Global History by Alexander<br />

Mikaberidze, the War of 1812 is seen as an aside,<br />

not a nation-building event.<br />

Conversely, until the current generation of<br />

American historians revisited the conflict through<br />

critical analysis, it seemed that the only War of 1812<br />

information from south of the border was the Star<br />

Spangled Banner and The Battle of New Orleans by 1960s<br />

folk singer Johnny Horton.<br />

Canadians have had a similarly long, confusing<br />

relationship with the War of 1812. Recognized<br />

internationally as a peace-keeping nation, it can be<br />

hard for Canadians to remember that their country’s<br />

sovereignty was saved twice through bloody conflict<br />

– Quebec in 1775-76 and the War of 1812-15.<br />

Traditional folklore sees brave, patriotic Canadians,<br />

many newly arrived from the U.S., rushing to arms in<br />

June 1812, to defend their homes from unwarranted<br />

American aggression. This romanticized view of the<br />

conflict became entrenched in Canadian psyche,<br />

particularly through the decades of the 1970s and<br />

’80s, as Canadians demonstrated their patriotism<br />

by emphasizing how ‘not American’ they were. It is<br />

true that many Canadian citizens became soldiers<br />

whether in the British Army or local militias.<br />

Additionally, recognition must be given to the<br />

Indigenous warriors who were crucial to battlefield<br />

success in several engagements.<br />

However, it was the presence of the British regular<br />

army in Canada, the Redcoats, who provided the<br />

backbone for defence of the colony. British officers<br />

organized the overall defence strategy for the war,<br />

and it was the highly trained, tough regulars whom<br />

the Americans were unable to defeat in order claim<br />

what they thought would be an easy conquest. Not<br />

until the American Army underwent wholesale<br />

changes over the winter of 1813-14, did they have any<br />

forces that were remotely a threat to the professional<br />

British ranks. It is into this context that William<br />

Dunlop arrived in Canada during the summer of<br />

1813 as a new surgeon in the 2nd Battalion of the<br />

89th Regiment of Foot.<br />

HISTORY<br />

Dunlop arrived just in time to tend to wounded<br />

soldiers following the Nov. 11, 1813, Battle of<br />

Crysler’s Farm. This clash near modern-day<br />

Cornwall, Ont., was a classic example of how British<br />

organization, tactics, professionalism, and firepower<br />

soundly defeated an American Army that woefully<br />

lacked these traits. As far as medical professionals<br />

like Dunlop were concerned, regardless of who<br />

won the battle, there were casualties. British and<br />

American soldiers lay about the field requiring<br />

desperate medical attention, and it was the surgeons<br />

attached to the fighting battalions, such as Dunlop,<br />

who would be the difference between life and death<br />

for many of them.<br />

The title ‘surgeon’ brings up different images to<br />

modern readers. Today, a surgeon in a general<br />

hospital, depending on specialty, will have between<br />

10 and 16 years of education and residency training.<br />

Highly skilled and (deservedly) highly paid, surgeons<br />

are one of the cornerstones of modern medicine.<br />

Surgeons save lives and add comfort to the suffering<br />

on a daily basis. Similarly, army surgeons and doctors<br />

receive the same intense schooling with the addition<br />

of rigorous army training, which prepares them for<br />

the challenges they could encounter in a dangerous<br />

combat situation. For Dunlop and his colleagues<br />

during the War of 1812, it was a shockingly different<br />

situation in every aspect. Education was short,<br />

and many surgeons left civilian practices or school<br />

directly to army units and were unprepared for the<br />

rigours of campaigning and combat.<br />

Using the advantage of hindsight, military medicine<br />

during this age seems crude at best. However, the<br />

medicine, techniques and pharmaceuticals used by<br />

the British Army reflected the overall state of medical<br />

understanding and technology at the time. In short,<br />

life in the army was hard, but so was life in the fields<br />

of Lincolnshire, the factories of Manchester, or on<br />

the docks of London. It was an era where death<br />

was dolefully familiar and always close to everyone.<br />

Medical situations that are taken for granted today<br />

such as a broken bone, laceration, or mild illness<br />

often meant terrible suffering and death. In the<br />

early-19th Century, it wasn’t that life was seen as<br />

cheap or expendable, but that it was comparatively<br />

hard to hold on to.<br />

One lifesaving advantage that British soldiers had<br />

SPRING <strong>2024</strong> • 27

HISTORY<br />

by Mat Johnson<br />

over their working-poor civilian brethren was that the<br />

government wanted, and needed, them to be alive. By<br />

the time an infantryman reached a front-line combat<br />

unit, significant resources and money had been<br />

invested in his training, equipage and transportation,<br />

the latter being especially pricey when sending<br />

soldiers to Canada. By 1812, the British Army was<br />

stretched dangerously thin. Almost constant fighting<br />

for nine years, in addition to resource-draining<br />

garrison duty in the far-flung corners of the empire,<br />

left precious few trained, experienced infantrymen<br />

in the ranks. Keeping soldiers alive meant more<br />

veteran, experienced soldiers in the line. And, as was<br />

consistently seen throughout the fighting in Portugal<br />

and Spain, as well as in Canada, it would be the<br />

steady, experienced soldiers who would decide the<br />

fate of nations. Keeping good soldiers alive saved<br />

money and won battles, and that responsibility would<br />

fall heavily on the shoulders of regimental surgeons<br />

like William Dunlop.<br />

During the age of musket, the battlefield wounds<br />

treated by surgeons were horrific to say the least. The<br />

typical infantry musket ball of the age was .68 calibre<br />

(for the British Brown Bess) with a muzzle velocity of<br />

around 1,600 feet per second. What this means is the<br />

weapon hurled a 1.14 oz lead ball at 1,600 feet per<br />

second at enemies who would typically be within 500<br />

feet at the commencement of firing. Modern studies<br />

have shown that muskets of the time had horrific<br />

killing power, though the smoothbore weapons<br />

suffered from woeful inaccuracy. By comparison, the<br />

.303 calibre Lee Enfield rifle used by Canadian forces<br />

during the First World War had a muzzle velocity of<br />

over 2,400 feet per second, and the pointed projectile<br />

itself was less than half the diameter of the rounded<br />

musket ball. Wounds created by these 20th Century<br />

metal-cased bullets, though painful, tended to be<br />

‘cleaner’ than those made by 19th Century firearms.<br />

The slower velocity and larger size of the musket<br />

round meant that instead of passing straight through<br />

a soldier’s extremity, the musket ball ricocheted<br />

off bone and organs becoming an irregular shape,<br />

creating massive exit wounds or getting stuck inside<br />

the body. Additionally, the blunt surface and relatively<br />

slow speed of the ball resulted in bits of equipment<br />

and uniforms being dragged into wounds causing<br />

lethal secondary infections.<br />

On paper, each British infantry battalion of this era<br />

had one surgeon and two assistants. By the book,<br />

before combat began, the head surgeon would<br />

set up a regimental aid station somewhat near the<br />

battlefield. If possible, this would be situated in a<br />

house, church or similar structure, which provided<br />

patients with protection from the elements. Once<br />

fighting commenced, the treating of wounds near the<br />

firing line was handled by the assistant surgeons. The<br />

main task of the assistant surgeons was to bandage,<br />

apply tourniquets and, in some cases, provide basic<br />

medicines. After seeing the assistant surgeon, soldiers<br />

were either ‘patched up’ and returned to the fighting<br />

or instructed to proceed to the regimental aid station<br />

should they be a more serious case. For wounded<br />

soldiers sent to the rear, this was simply the beginning<br />

of their journey.<br />

Transporting wounded soldiers to medical care was<br />

nothing more than an afterthought in many armies<br />

during this era. This reflects many factors. Firstly,<br />

though transporting wounded had been a burden in<br />

the past, the armies of the Napoleonic era had grown<br />

exponentially over their predecessors. More soldiers<br />

fighting meant more casualties, however adjustments<br />

weren’t made to accommodate this deluge of broken<br />

men. Secondly, it reflected the scarcity that armies<br />

on campaign operated. Transportation technology<br />

in the early-19th Century lacked efficiency seen in<br />

more modern military campaigns. This meant that<br />

ammunition and food were prioritized over medicine<br />

and casualty evacuation, as the latter didn’t translate<br />

into immediate battlefield success.<br />

Theoretically, in the British Army during the<br />

Napoleonic Era, it fell to a battalion’s musicians to<br />

act in a casualty evacuation role during combat.<br />

Wounded soldiers were transported from firing line<br />

to hospital in any number of ways. Stretchers, as are<br />

familiar from photos of the First World War, were not<br />

of standard issue in the early-1800s, though crude<br />

stretchers were occasionally made by stringing a<br />

blanket between two sergeant’s pikes or similar items.<br />

A handful of musicians were quickly overwhelmed<br />

by the volume of casualties and fell behind in their<br />

efforts (this doesn’t factor in the high likelihood of<br />

becoming casualties themselves).<br />

Usually, wounded men were left to their own devices<br />

28 • HURONPERTHBOOMERS.COM

y Mat Johnson<br />

HISTORY<br />

to find medical aid, many succumbing to shock<br />

or dying of blood loss in their attempt. In friendly<br />

territory, as the British were for much of the War of<br />

1812 in the northern theatre, a helping hand from<br />

caring civilians was quite common. The soldiers<br />

fortunate enough to find themselves in somewhat<br />

private care of a Canadian household could expect<br />

cleaner and more sanitary conditions than what<br />

would be present in a military hospital, which<br />

resulted in slightly better survival odds.<br />

Not all injuries treated by surgeons in the British<br />

Army during the Napoleonic Era were inflicted<br />

by enemy forces. The British Army had a strict set<br />

of disciplinary rules meant to keep soldiers in line.<br />

Officers of the time, such as Dunlop, were from<br />

the higher echelons of society and often viewed the<br />

soldiers under them as a ragged mob who would only<br />

respond to threats of violent punishment to keep<br />

them between the lines of discipline. Even the great<br />

Duke of Wellington, victor at Waterloo, referred to<br />

his soldiers as “the scum of the Earth.”<br />

The standard form of corporal, or non-lethal,<br />

punishment in the British Army and Navy was the<br />

cat o’ nine tails, or a whip with nine extensions that<br />

when struck across the offending soldiers back caused<br />

deep lacerations. The number of lashes for certain<br />

crimes was somewhat standardized, however it often<br />

depended on the discretion of the commanding<br />

officer how many times the perpetrator suffered<br />

the sting of lashing leather. Offending soldiers were<br />

tied to a stake or sergeant’s pike, typically with the<br />

rest of the battalion drawn up as observers. The<br />

actual whipping was carried out by the battalion’s<br />

musicians, alternating as they became fatigued in<br />

order to keep the lashes at maximum forcefulness.<br />

The role of the battalion’s surgeon was to inspect the<br />

convicted man to make sure he could continue to<br />

receive the treatment. Standing in close proximity<br />

to the accused would have been a sobering<br />

experience as the punishment was draconian at<br />

best. The surgeon could halt the brutal punishment<br />

at any time he felt that the accused was in mortal<br />

danger. Though this sounds like a humanitarian<br />

consideration, in truth it was so the accused wouldn’t<br />

get off easy by dying, and could come back to face<br />

the remaining punishment another day.<br />

There are many documented cases of British soldiers<br />

being condemned to over 1,000 lashes, however only<br />

a portion of the punishment was carried out before<br />

the surgeon put a stop to the suffering. However, once<br />

the accused had healed sufficiently, the punishment<br />

recommenced.<br />

It is important to remember that for Dunlop and<br />

many British personnel sent to Canada, the conflict<br />

with the Americans was, as British historians still see<br />

it, a sideshow. There was a feeling of missing out<br />

on the real war against the French that the British<br />

were currently fighting in the Iberian Peninsula in<br />

Portugal and Spain. Being returned to Europe in<br />

the spring of 1815, Dunlop writes ruefully about the<br />

disappointment of missing the Battle of Waterloo,<br />

which was fought on June 18 of that year.<br />

Once Napoleon was locked up in Saint Helena,<br />

and with the war with the Americans having been<br />

settled by the Treaty of Ghent, the British no longer<br />

had the need for a massive standing army. The<br />

nation had been stretched to the limits financially<br />

following many years of constant fighting, and naval<br />

arms races. Many soldiers were discharged and the<br />

officers, Dunlop included, were put on half-pay, a<br />

purgatory state that left adventurous souls restless.<br />

This restlessness took Dunlop to many locations<br />

before eventually making his way back to the colony<br />

of Canada, the place he had fought to protect.<br />

Today, Dunlop lays at rest surrounded by family<br />

members in a shady park that is easily reached by<br />

hikers just off of the Goderich to Guelph Rail Trail.<br />

Like the preserved battlefields in which he fought, it<br />

is a peaceful place that encourages reflection. We live<br />

in a time where threats to Canadian sovereignty are<br />

almost non-existent, but it wasn’t that way in 1812-<br />

15. Violent combat and the reverberations of musket<br />

fire emphasized the danger faced by early Canadians<br />

whose very survival depended on the thin red line of<br />

British soldiers and the brave army doctors who kept<br />

them alive.<br />