Module 4 - Introduction to Performance Audit_4C

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

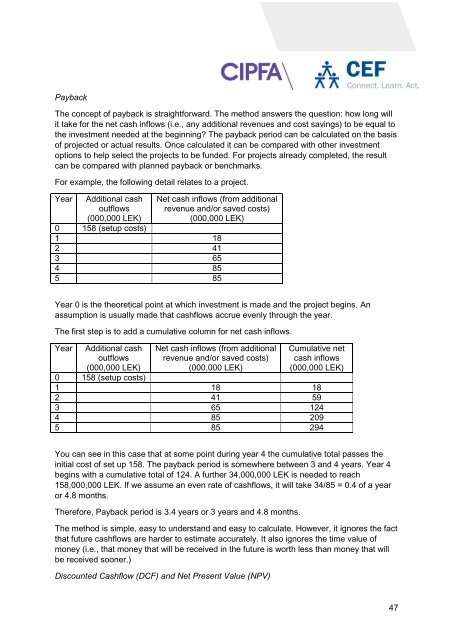

Payback<br />

The concept of payback is straightforward. The method answers the question: how long will<br />

it take for the net cash inflows (i.e., any additional revenues and cost savings) <strong>to</strong> be equal <strong>to</strong><br />

the investment needed at the beginning? The payback period can be calculated on the basis<br />

of projected or actual results. Once calculated it can be compared with other investment<br />

options <strong>to</strong> help select the projects <strong>to</strong> be funded. For projects already completed, the result<br />

can be compared with planned payback or benchmarks.<br />

For example, the following detail relates <strong>to</strong> a project.<br />

Year<br />

Additional cash<br />

outflows<br />

(000,000 LEK)<br />

Net cash inflows (from additional<br />

revenue and/or saved costs)<br />

(000,000 LEK)<br />

0 158 (setup costs)<br />

1 18<br />

2 41<br />

3 65<br />

4 85<br />

5 85<br />

Year 0 is the theoretical point at which investment is made and the project begins. An<br />

assumption is usually made that cashflows accrue evenly through the year.<br />

The first step is <strong>to</strong> add a cumulative column for net cash inflows.<br />

Year<br />

Additional cash<br />

outflows<br />

(000,000 LEK)<br />

Net cash inflows (from additional<br />

revenue and/or saved costs)<br />

(000,000 LEK)<br />

Cumulative net<br />

cash inflows<br />

(000,000 LEK)<br />

0 158 (setup costs)<br />

1 18 18<br />

2 41 59<br />

3 65 124<br />

4 85 209<br />

5 85 294<br />

You can see in this case that at some point during year 4 the cumulative <strong>to</strong>tal passes the<br />

initial cost of set up 158. The payback period is somewhere between 3 and 4 years. Year 4<br />

begins with a cumulative <strong>to</strong>tal of 124. A further 34,000,000 LEK is needed <strong>to</strong> reach<br />

158,000,000 LEK. If we assume an even rate of cashflows, it will take 34/85 = 0.4 of a year<br />

or 4.8 months.<br />

Therefore, Payback period is 3.4 years or 3 years and 4.8 months.<br />

The method is simple, easy <strong>to</strong> understand and easy <strong>to</strong> calculate. However, it ignores the fact<br />

that future cashflows are harder <strong>to</strong> estimate accurately. It also ignores the time value of<br />

money (i.e., that money that will be received in the future is worth less than money that will<br />

be received sooner.)<br />

Discounted Cashflow (DCF) and Net Present Value (NPV)<br />

47