On the move - CA Immo

On the move - CA Immo

On the move - CA Immo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

_ìó<br />

bro=ONKVM<br />

oÉìíÉêë `^fsKsf<br />

_äççãÄÉêÖ `^f=^s<br />

kçK=çÑ=ëÜ~êÉë=EãF UTKOS<br />

cêÉÉ=Ñäç~í VMKMB<br />

j~àçê=<br />

ëÜ~êÉÜçäÇÉê<br />

_^J`^=ENMBF<br />

fpfk ^qMMMMSQNPRO<br />

jÅ~éK=Ebro=ãF NIVNNKM<br />

jÅ~éK=Erpa=ãF OIRRTKQ<br />

bs=Ebro=ãF PIOSUKR<br />

bs=Erpa=ãF QIMURKS<br />

eáÖÜLiçï=ENOjF ORKO=L=ONKO<br />

mÉêÑK=JNj JQKUB<br />

mÉêÑK=JPj JSKVB<br />

mÉêÑK=JNOj OKUB<br />

22/6/07<br />

25.50<br />

25.00<br />

24.50<br />

24.00<br />

23.50<br />

23.00<br />

22.50<br />

22.00<br />

21.50<br />

21.00<br />

20.50<br />

20.00<br />

J A S O N D J F M A M J J A S O N D J F M A M J<br />

<strong>CA</strong> IM.ANLAGEN<br />

^å~äóëí<br />

^äÉñ~åÇÉê=eçÇçëá<br />

qÉäW===HQP=EMF=RM=RMRJUOPRV<br />

c~ñW==HQP=EMF=RM=RMRJUOPUN<br />

Éã~áäW=~äÉñ~åÇÉêK<br />

ÜçÇçëá]Å~JáÄKÅçã<br />

oÉëÉ~êÅÜ=ïÉÄëáíÉW<br />

ÜííéWLLêÉëÉ~êÅÜKÅ~JáÄKÅçã<br />

OO=gìåÉ=OMMT<br />

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

q~êÖÉí=éêáÅÉW=bro=OS <strong>On</strong> <strong>the</strong> <strong>move</strong><br />

`^=fããç=^åä~ÖÉå<br />

oÉ~ä=bëí~íÉ<br />

Source: DATASTREAM<br />

^ìëíêá~<br />

p~äÉë=sáÉåå~W=<br />

HQP=EMF=RM=RMRJUOVTV<br />

p~äÉë=içåÇçåW=<br />

HQQ=EOMTF=VTO=MOMU<br />

p~äÉë=kÉï=vçêâW<br />

HN=EONOF=STO=SNQM<br />

`^=fããç=^åä~ÖÉå<br />

oÉ~ä=bëí~íÉ<br />

^ìëíêá~<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

Initiating Coverage<br />

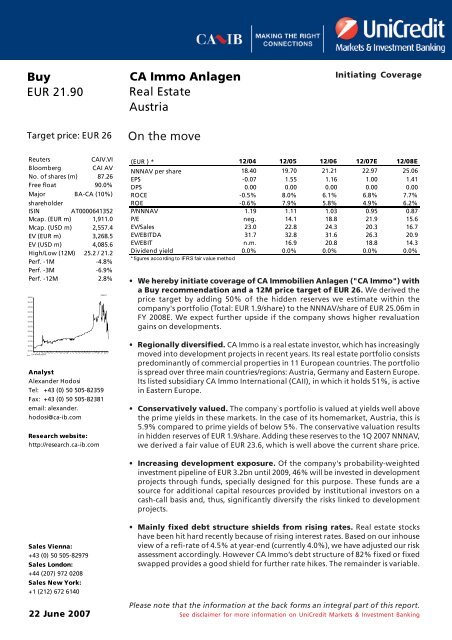

Ebro=F=G NOLMQ NOLMR NOLMS NOLMTb NOLMUb<br />

kkk^s=éÉê=ëÜ~êÉ NUKQM NVKTM ONKON OOKVT ORKMS<br />

bmp JMKMT NKRR NKNS NKMM NKQN<br />

amp MKMM MKMM MKMM MKMM MKMM<br />

ol`b JMKRB UKMB SKNB SKUB TKTB<br />

olb JMKSB TKVB RKUB QKVB SKOB<br />

mLkkk^s NKNV NKNN NKMP MKVR MKUT<br />

mLb åÉÖK NQKN NUKU ONKV NRKS<br />

bsLp~äÉë OPKM OOKU OQKP OMKP NSKT<br />

bsLb_fqa^ PNKT POKU PNKS OSKP OMKV<br />

bsLb_fq åKãK NSKV OMKU NUKU NQKP<br />

aáîáÇÉåÇ=óáÉäÇ<br />

* figures according to IFRS fair value method<br />

MKMB MKMB MKMB MKMB MKMB<br />

• We hereby initiate coverage of <strong>CA</strong> <strong>Immo</strong>bilien Anlagen ("<strong>CA</strong> <strong>Immo</strong>") with<br />

a Buy recommendation and a 12M price target of EUR 26. We derived <strong>the</strong><br />

price target by adding 50% of <strong>the</strong> hidden reserves we estimate within <strong>the</strong><br />

company's portfolio (Total: EUR 1.9/share) to <strong>the</strong> NNNAV/share of EUR 25.06m in<br />

FY 2008E. We expect fur<strong>the</strong>r upside if <strong>the</strong> company shows higher revaluation<br />

gains on developments.<br />

• Regionally diversified. <strong>CA</strong> <strong>Immo</strong> is a real estate investor, which has increasingly<br />

<strong>move</strong>d into development projects in recent years. Its real estate portfolio consists<br />

predominantly of commercial properties in 11 European countries. The portfolio<br />

is spread over three main countries/regions: Austria, Germany and Eastern Europe.<br />

Its listed subsidiary <strong>CA</strong> <strong>Immo</strong> International (<strong>CA</strong>II), in which it holds 51%, is active<br />

in Eastern Europe.<br />

• Conservatively valued. The company`s portfolio is valued at yields well above<br />

<strong>the</strong> prime yields in <strong>the</strong>se markets. In <strong>the</strong> case of its homemarket, Austria, this is<br />

5.9% compared to prime yields of below 5%. The conservative valuation results<br />

in hidden reserves of EUR 1.9/share. Adding <strong>the</strong>se reserves to <strong>the</strong> 1Q 2007 NNNAV,<br />

we derived a fair value of EUR 23.6, which is well above <strong>the</strong> current share price.<br />

• Increasing development exposure. Of <strong>the</strong> company's probability-weighted<br />

investment pipeline of EUR 3.2bn until 2009, 46% will be invested in development<br />

projects through funds, specially designed for this purpose. These funds are a<br />

source for additional capital resources provided by institutional investors on a<br />

cash-call basis and, thus, significantly diversify <strong>the</strong> risks linked to development<br />

projects.<br />

• Mainly fixed debt structure shields from rising rates. Real estate stocks<br />

have been hit hard recently because of rising interest rates. Based on our inhouse<br />

view of a refi-rate of 4.5% at year-end (currently 4.0%), we have adjusted our risk<br />

assessment accordingly. However <strong>CA</strong> <strong>Immo</strong>’s debt structure of 82% fixed or fixed<br />

swapped provides a good shield for fur<strong>the</strong>r rate hikes. The remainder is variable.<br />

Please note that <strong>the</strong> information at <strong>the</strong> back forms an integral part of this report.<br />

See disclaimer for more information on UniCredit Markets & Investment Banking<br />

1

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

Contents<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

Investment case 5<br />

The company 8<br />

Valuation 13<br />

The management 16<br />

The portfolio 17<br />

The strategy 26<br />

Project pipeline 27<br />

Financials 30<br />

3

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

Investment case<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

<strong>On</strong>e of Austria's largest listed real estate companies. <strong>CA</strong> <strong>Immo</strong>, founded in<br />

1987, is active as a real estate investor in its home market, Austria, as well as in<br />

Germany and Eastern Europe. The company's portfolio consists currently of 181<br />

properties in 11 different countries and a lettable space of 1.6m sqm. The portfolio<br />

reached a value of EUR 2.2bn (+ 100% YoY) in 1Q 2007, partly due to <strong>the</strong> acquisition<br />

of a large portfolio in Germany sold by <strong>the</strong> state of Hesse. This acquisition led to<br />

value proportions similar to that of its two o<strong>the</strong>r business regions within its portfolio.<br />

Lots of hidden reserves. The portfolio of <strong>the</strong> company is very conservatively<br />

valued, taking into account an Austrian portfolio valued at a yield of 5.9% and CEE<br />

and SEE portfolios yielded at 6.9% and 8.7%. These yields are in sharp contrast to<br />

<strong>the</strong> prime office yields in <strong>the</strong>se markets, which are in <strong>the</strong> case of Austria around 5%;<br />

<strong>the</strong> latter two are also far below <strong>the</strong>se yields. For example, <strong>the</strong> Polish portfolio was<br />

valued with a 7.2% yield compared to prime market yields of 5.5%. This conservative<br />

valuation implies a lot of hidden reserves, which we estimate at EUR 1.9 per share.<br />

Adding this to <strong>the</strong> announced NNNAV at <strong>the</strong> end of March 2007 of EUR 21.69 it<br />

results in a fair value of EUR 23.59, which is 8% higher than <strong>the</strong> current share price.<br />

Increasing development exposure. Of <strong>the</strong> company's probability-weighted<br />

investment pipeline of EUR 3.2bn until <strong>the</strong> end of 2009, 46% will be invested in<br />

development projects. In addition to <strong>the</strong> established practice of executing<br />

developments in Eastern Europe with local developers, <strong>CA</strong> <strong>Immo</strong> has now developed<br />

funds for this purpose. These funds will develop all <strong>the</strong> projects in <strong>CA</strong> <strong>Immo</strong>'s Eastern<br />

European pipeline ei<strong>the</strong>r standalone or, in some cases, in joint ventures. This will,<br />

on <strong>the</strong> one hand, provide <strong>CA</strong> <strong>Immo</strong> with interesting acquisition possibilities for its<br />

core portfolio while, on <strong>the</strong> o<strong>the</strong>r hand, it could profit through its holdings from<br />

<strong>the</strong> development margins. In addition, <strong>CA</strong> <strong>Immo</strong> constantly monitors its portfolio<br />

for re-development opportunities, which increase <strong>the</strong> value of a property or change<br />

<strong>the</strong> kind of utilisation.<br />

Risk reduction through funds. Through <strong>the</strong> funds <strong>CA</strong> <strong>Immo</strong> has a source for<br />

additional capital provided by institutional investors on a cash-call basis. This<br />

significantly diversifies <strong>the</strong> risk linked to development projects.<br />

Combining stable returns with an Eastern European growth story. <strong>CA</strong> <strong>Immo</strong><br />

offers <strong>the</strong> investor <strong>the</strong> possibility to profit from <strong>the</strong> stable returns coming from its<br />

Austrian and German portfolios while also profiting from <strong>the</strong> growth dynamic and<br />

higher yields in Eastern European real estate markets. These higher yields especially<br />

in SEE and CIS will lead to high revaluation gains in <strong>CA</strong> <strong>Immo</strong>'s rapidly growing<br />

Eastern European real estate portfolio through expected yield compression to Western<br />

European levels. The best example for <strong>the</strong> stable returns is <strong>the</strong> recently acquired<br />

portfolio in Germany, which is predominantly let for a time period of 30 years to<br />

<strong>the</strong> state at a yield of 5.3%.<br />

Rapid investment strategy. After almost doubling its real estate portfolio in FY<br />

2005 and FY 2006, <strong>CA</strong> <strong>Immo</strong> intends to continue this rapid investment strategy in<br />

<strong>the</strong> coming years. This is backed by a sound investment pipeline of projects with a<br />

value of EUR 5.9bn (not probability weighted) until <strong>the</strong> end of 2009. The investments<br />

are planned especially in developments within Eastern Europe in SEE and CIS while<br />

in Germany large portfolio acquisitions are targeted.<br />

5

6<br />

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

Active portfolio management. <strong>CA</strong> <strong>Immo</strong> not only acquires and develops projects<br />

but also strategically sells properties to optimise <strong>the</strong> growth of its NAV. A recent<br />

example of this strategy was <strong>the</strong> selling of an office building in Prague<br />

(Jungmannova), which has been developed in a joint venture since 2001. Having<br />

invested EUR 10m, <strong>CA</strong> <strong>Immo</strong> sold its stake with a gain of 128% at a very favourable<br />

yield of 5.1%.<br />

No management contract with affiliated bank. The company has an in-house<br />

management. Investors have often criticised <strong>the</strong> management structure of Austrian<br />

real estate companies (payment of fees to affiliated banks though a management<br />

contract), which, however, is in compliance with Austria's Companies Act<br />

(Aktiengesetz). In <strong>the</strong> case of <strong>CA</strong> <strong>Immo</strong> <strong>the</strong>re are no management fees payable to<br />

affiliated banks. In contrast, it contributes through <strong>CA</strong>II to <strong>the</strong> management fees<br />

paid by <strong>the</strong> funds.<br />

Targeted loan to value target of 60%. Like its subsidiary <strong>CA</strong>II, <strong>the</strong> company<br />

targets a much more aggressive leverage than most o<strong>the</strong>r Austrian real estate<br />

companies, which usually carry a very high proportion of equity on <strong>the</strong>ir balance<br />

sheet. In contrast to companies such as Meinl European Land, <strong>CA</strong> <strong>Immo</strong> has adopted<br />

<strong>the</strong> policy to wait until this leverage target has been reached before raising capital<br />

again.<br />

Local knowledge. In all markets where <strong>CA</strong> <strong>Immo</strong>'s portfolio exposure reaches a<br />

certain size, it will establish local offices. This strategy provides <strong>the</strong> company with<br />

local knowledge, a factor that is key in <strong>the</strong>se markets.<br />

High transparency. <strong>CA</strong> <strong>Immo</strong> is one of <strong>the</strong> most transparent listed Austrian<br />

companies. <strong>CA</strong> <strong>Immo</strong> provides acquisition prices, yields, market values, etc. for each<br />

of its real estate properties - information that is not necessarily provided in detail<br />

by o<strong>the</strong>r real estate companies.<br />

Experienced management team. Management has a successful track record and<br />

<strong>the</strong> three-member management board has extensive experience in <strong>the</strong> real estate<br />

sector.

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

Risks<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

USD exposure. In its Eastern European portfolio <strong>CA</strong> <strong>Immo</strong> has two buildings each<br />

in Warsaw and Bucharest, which have lease contracts predominantly or completely<br />

based on <strong>the</strong> USD. This exposure made up 13% of its total rental income in 2006. If<br />

<strong>the</strong>re were a devaluation of <strong>the</strong> USD, <strong>CA</strong> <strong>Immo</strong> would be affected at rental level but<br />

also at revaluation level - a constellation that led to a devaluation of EUR 8.6m in<br />

two of <strong>the</strong>se properties in 2006. In terms of rents <strong>CA</strong> <strong>Immo</strong> mitigates exposure<br />

through <strong>the</strong> financing of <strong>the</strong> relevant properties in USD, which leads to an internal<br />

hedge, as <strong>the</strong> cash flows are used to match <strong>the</strong> interest payable. We do not expect<br />

this foreign currency exposure to decrease in <strong>the</strong> mid-term because of <strong>CA</strong> <strong>Immo</strong>'s<br />

pipeline in Russia where rents are usually based in USD.<br />

Interest rates. <strong>CA</strong> <strong>Immo</strong> like any o<strong>the</strong>r real estate company has profited from <strong>the</strong><br />

boom in real estate asset prices in Europe over <strong>the</strong> past few years. Due to its more<br />

aggressive leverage, <strong>CA</strong> <strong>Immo</strong> is more exposed to <strong>the</strong> risk of rising interest rates.<br />

According to our in-house economists, we expect two more small interest hikes of<br />

25bp by <strong>the</strong> ECB (European Central Bank) to 4.5% in <strong>the</strong> refi-rate this year, which is<br />

part of our risk assessment. Any fur<strong>the</strong>r rate hikes would need to be assessed at <strong>the</strong><br />

appropriate time. <strong>CA</strong> <strong>Immo</strong> uses derivatives and fixed rates for reducing this risk.<br />

7

8<br />

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

The company<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

<strong>CA</strong> <strong>Immo</strong> Anlagen AG ("<strong>CA</strong> <strong>Immo</strong>") was founded in 1987 and has been listed on <strong>the</strong><br />

Vienna Stock Exchange since 1988. With a current market cap of EUR 2bn, <strong>CA</strong> <strong>Immo</strong><br />

is <strong>the</strong> fourth-largest listed real estate company in Austria. Its main activities comprise<br />

<strong>the</strong> acquisition, rental and commercial utilisation of primarily office properties in<br />

cities in Austria, Germany and Eastern Europe, with <strong>the</strong> goal to optimise its<br />

investments. <strong>CA</strong> <strong>Immo</strong> is also active in project developments, which are typically<br />

carried out in co-operation with local developers in <strong>the</strong> form of joint ventures or<br />

forward purchases. However, <strong>CA</strong> <strong>Immo</strong> is also increasingly assuming 100% of <strong>the</strong><br />

development risk in projects. This proportion is expected to increase in <strong>the</strong> midterm,<br />

taking into account <strong>the</strong> numerous development projects in <strong>CA</strong> <strong>Immo</strong>'s pipeline.<br />

By <strong>the</strong> end of 1Q 2007, <strong>the</strong> real estate portfolio of <strong>CA</strong> <strong>Immo</strong> consisted of 181 properties<br />

in 11 European countries and 1.1m sqm of lettable space. Seventy-five percent of<br />

<strong>the</strong> space was located predominantly in its home market, Austria, and in Germany.<br />

However, <strong>the</strong> high proportion in Germany was due to a huge portfolio acquisition<br />

in Hesse with an investment volume of EUR 798m. All in all, <strong>CA</strong> <strong>Immo</strong>'s portfolio<br />

had a total value of EUR 2.1bn at <strong>the</strong> end of FY 2006, which was almost double that<br />

of <strong>the</strong> year before (EUR 1.2bn). The total portfolio provided a current yield of 6% at<br />

<strong>the</strong> end of 2006, whereas <strong>the</strong> Eastern European properties contributed a yield of<br />

7.5%.<br />

Portfolio growth by region Number of objects<br />

PIMMM<br />

OIMMM<br />

NIMMM<br />

M<br />

Ebro=ãF<br />

RSU<br />

TNT<br />

NINRT<br />

OINNSG<br />

OIPRN<br />

OMMP OMMQ OMMR OMMS Nn=OMMT<br />

^ìëíêá~ dÉêã~åó b~ëíÉêå=bìêçéÉ `çããáííÉÇ=Ñçê=OMMT<br />

* including <strong>the</strong> Hesse portfolio<br />

OMM<br />

NUM<br />

NSM<br />

NQM<br />

NOM<br />

NMM<br />

UM<br />

SM<br />

QM<br />

OM<br />

M<br />

RT<br />

SO<br />

NQT<br />

NTV<br />

NUN<br />

OMMP OMMQ OMMR OMMS Nn=OMMT<br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

Following <strong>the</strong> IPO in 1988, <strong>CA</strong> <strong>Immo</strong> initiated its activities in its home market,<br />

Austria, particularly in <strong>the</strong> capital city of Vienna, in which it became a specialist in<br />

commercial space. In 1999 <strong>the</strong> company began its expansion into Eastern Europe<br />

with <strong>the</strong> acquisition of an office building in Budapest (Hungary). With this <strong>move</strong>,<br />

<strong>CA</strong> <strong>Immo</strong> became <strong>the</strong> first listed Austrian real estate company to launch activities in<br />

Eastern Europe at that time. Two years later (2001), <strong>the</strong> first development projects<br />

commenced in Eastern Europe in Budapest and Prague (Czech Republic). In 2003,<br />

<strong>the</strong> company made its first investments in SEE with <strong>the</strong> acquisition of office buildings<br />

in Bulgaria (Sofia) and Romania (Bucharest). This was followed by a rapid series of<br />

investment activities, which, at <strong>the</strong>ir peak in 2005, led to a more than doubling of<br />

<strong>CA</strong> <strong>Immo</strong>'s real estate portfolio in Eastern Europe. In <strong>the</strong> Austrian market, <strong>the</strong><br />

company increased its portfolio precipitously in 2005/2006 with <strong>the</strong> acquisition of<br />

<strong>the</strong> BBAG portfolios for EUR 224m.

Historic development (20 years)<br />

Foundation of<br />

<strong>CA</strong> <strong>Immo</strong><br />

Anlagen AG<br />

IPO on <strong>the</strong><br />

Vienna Stock<br />

Exchange<br />

CEE market<br />

entry with first<br />

purchase of an<br />

office building in<br />

Hungary<br />

(Budapest)<br />

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

1) Total committed equity volume (on capital call basis)<br />

2) Total equity volume (target)<br />

3) Two portfolios purchased in two steps<br />

4) Total investment volume<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

Due to <strong>the</strong> high dynamic in <strong>the</strong> Eastern European countries and <strong>the</strong> extensive cash<br />

demand for new projects, <strong>CA</strong> <strong>Immo</strong> decided to float its subsidiary <strong>CA</strong>II, which is<br />

active in <strong>the</strong> Eastern European market. Post-IPO - EUR 287m was raised in additional<br />

equity - <strong>CA</strong> <strong>Immo</strong> continues to hold 51 % of <strong>CA</strong>II, which became a company with a<br />

EUR 626m market cap in its own right. Following <strong>the</strong> IPO, <strong>the</strong> company made its<br />

first investment in <strong>the</strong> CIS in Moscow: <strong>the</strong> Maslov Tower. The development project<br />

for an office building (a 50:50 joint venture with a local developer) has a total<br />

investment volume of EUR 130m. In December 2006, <strong>the</strong> <strong>the</strong>n still small activities in<br />

Germany were greatly expanded by <strong>the</strong> Hesse portfolio acquisition, mentioned<br />

above, adding properties with a value of EUR 798m to <strong>CA</strong> <strong>Immo</strong>'s portfolio.<br />

1987 1988 1999 2003 2004 2005<br />

SEE market entry<br />

with first<br />

investments in<br />

Bulgaria/Sofia and<br />

Romania/Bucharest<br />

9<br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

The successful capital increase by EUR 677m increased <strong>the</strong> number of <strong>the</strong> company's<br />

shares by 50%, or 29.1m shares, to 87.3m, significantly enlarging <strong>the</strong> company's<br />

potential for fur<strong>the</strong>r acquisitions and developments, particularly in Austria and<br />

Germany. The capital increase significantly changed <strong>the</strong> shareholder structure, which<br />

was formerly dominated by retail investors, in favour of institutional investors,<br />

which now makes up 32% of <strong>the</strong> total. By enlarging its stake from 5% to 10%, BA<br />

<strong>CA</strong> became <strong>the</strong> largest shareholder.<br />

Shareholder structure<br />

fåëíáíìíáçå~ä=<br />

fåîÉëíçêë<br />

POB<br />

_^J`^<br />

NMB<br />

líÜÉêë<br />

UB<br />

Acquisition of<br />

BBAG portfolios<br />

(EUR 224 m) 3<br />

Capital<br />

increase of<br />

<strong>CA</strong> <strong>Immo</strong><br />

(EUR 307 m)<br />

Issuance of<br />

<strong>CA</strong> <strong>Immo</strong><br />

bond (EUR<br />

200 m)<br />

CIS market entry<br />

through first<br />

investment in<br />

Russia/Moscow<br />

(EUR 120 m:<br />

50/50 JV) 4<br />

mêáî~íÉ=<br />

ëÜ~êÜçäÇÉêë<br />

RMB<br />

IPO and capital<br />

increase of <strong>CA</strong> II<br />

(EUR 287 m)<br />

2006 2007<br />

Financial<br />

investment of<br />

25% plus 4<br />

shares in UBM<br />

<strong>CA</strong> <strong>Immo</strong> New<br />

Europe<br />

Property Fund<br />

(EUR 400 m) 1<br />

German market<br />

entry through<br />

acquisition of<br />

large Hesse<br />

portfolio in<br />

Germany<br />

(EUR 798 m)<br />

Hotel Fund<br />

(EUR 275 m) 2<br />

Source: <strong>CA</strong> <strong>Immo</strong>, <strong>CA</strong> IB

10<br />

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

Structure of <strong>the</strong> company<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

The company's business consists of three segments, each responsible for one of <strong>the</strong><br />

three investment regions. Within this structure, <strong>CA</strong>II is responsible for <strong>the</strong> company's<br />

activities in Eastern Europe. <strong>CA</strong> <strong>Immo</strong> holds a 100% stake in its Austrian and German<br />

activities. Through <strong>CA</strong> II, <strong>the</strong> parent company also holds stakes in funds formed<br />

specifically for its development activities in Eastern Europe (New Europe Property<br />

Fund, Hotel Fund).<br />

Structure of <strong>CA</strong> <strong>Immo</strong><br />

^ìëíêá~<br />

dÉêã~åó<br />

cêÉÉ=cäç~í<br />

NMMB<br />

`^=fããç<br />

NMMB RNB<br />

`^=fããç<br />

fåíÉêå~íáçå~ä<br />

b~ëíÉêå=bìêçéÉ<br />

E`bbI=pbbI=`fpFG<br />

`^=fããç<br />

kÉï=bìêçéÉ<br />

mêçéÉêíó=cìåÇ<br />

cêÉÉ=cäç~í<br />

eçíÉä=cìåÇ=GG<br />

* CEE stands for Central and Eastern Europe and covers Czech Republic, Hungary, Poland and Slovakia<br />

SEE stands for South Eastern Europe and covers Albania, Bosnia & Herzegovina, Bulgaria, Croatia, Macedonia, Romania, Serbia/Montenegro and Slovenia<br />

CIS stands for Commonwelth of Independent States and includes Belarus, Moldavia, Russia and Ukraine<br />

* * <strong>CA</strong> <strong>Immo</strong> International AG and Raiffeisen Versicherung AG (Uniqa Group) currently hold 50% each. Following <strong>the</strong> full placement of <strong>the</strong> fund,<br />

<strong>CA</strong> <strong>Immo</strong> International AG and Raiffeisen Versicherung AG will both be diluted to a 25.5% interest each<br />

Funds<br />

[=RNB<br />

QVB<br />

[=NOKTRJORKRB<br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

The company is currently participating in two funds through <strong>CA</strong>II. These funds provide<br />

<strong>the</strong> company with potential new properties for its core portfolio, and <strong>the</strong> potential<br />

to participate in <strong>the</strong> development margins and management fees. In addition, <strong>the</strong>se<br />

vehicles provide a risk-sharing opportunity for third-party investors and access to<br />

committed capital through cash calls when required. The cash calls prevent <strong>the</strong><br />

funds from carrying a large cash position on <strong>the</strong>ir balance sheets, and consequently<br />

<strong>the</strong>y are able to increase <strong>the</strong>ir profitability. At company level, <strong>CA</strong> <strong>Immo</strong> participates<br />

in <strong>the</strong> profits of <strong>the</strong> funds through its 51% holding in <strong>CA</strong>II, at a 25.5% participation<br />

in <strong>the</strong> New Europe Property Fund and 12.75% participation in <strong>the</strong> H1 Hotel Fund.<br />

Additional funds are planned across all regions in <strong>the</strong> coming years.

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

Effective share of investments<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

bÑÑÉÅíáîÉ=ëÜ~êÉ=çÑ=áåîÉëíãÉåíë=J=`^=fããç `^=fããç cêÉÉ=Ñäç~í<br />

RNKMMB<br />

ORKRMB<br />

NOKTRB=J=ORKRMB<br />

G=`^=fããç=fåíÉêå~íáçå~ä=^d=~åÇ=o~áÑÑÉáëÉå=sÉêëáÅÜÉêìåÖë=^d=Eråáè~=dêçìéF=ÅìêêÉåíäó=ÜçäÇ=RMB=É~ÅÜK=cçääçïáåÖ=íÜÉ=Ñìää=éä~ÅÉãÉåí=çÑ=íÜÉ=ÑìåÇI=`^=<br />

fããç=fåíÉêå~íáçå~ä=~åÇ=o~áÑÑÉáëÉå=sÉêëáÅÜÉêìåÖë=^d=ïáää=ÄçíÜ=ÄÉ=ÇáäìíÉÇ=íç=~=ORKRB=áåíÉêÉëí=É~ÅÜK<br />

New Europe Property Fund<br />

[=RNB<br />

`^=fããç=<br />

kÉï=bìêçéÉ=mêçéÉêíó=cìåÇ<br />

RNB QVB<br />

`^=fããç=fåíÉêå~íáçå~ä<br />

eçíÉä=ÑìåÇG<br />

11<br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

The target of this fund is to develop new real estate projects in Eastern Europe. <strong>CA</strong>II<br />

will invest approximately EUR 200m of equity over <strong>the</strong> next three years in<br />

development projects. The balance of <strong>the</strong> fund volume was placed amongst<br />

international institutional investors. Altoge<strong>the</strong>r, this provides an equity base of EUR<br />

400m, which can be called up by <strong>the</strong> management of <strong>the</strong> fund and provided by<br />

<strong>CA</strong>II, when needed. In terms of cash calls, <strong>the</strong> company expects EUR 102m in 2007,<br />

EUR 148m in 2008, and EUR 150m in 2009.<br />

In terms of debt finance for <strong>the</strong> projects, <strong>the</strong> fund targets a leverage of 75% in<br />

suitable cases but 60% on average. All considered, this will lead to a total fund<br />

volume of EUR 1bn, which is intended to be invested in projects with an average<br />

investment volume of between EUR 40m and EUR 70m. In terms of region, <strong>the</strong><br />

company targets 20% of <strong>the</strong> investments in CEE countries, and 40% each in SEE and<br />

CIS. The investment period is expected to be 3-4 years, beginning with <strong>the</strong> acquisition<br />

of a plot of land and ending with <strong>the</strong> sale of <strong>the</strong> completed project to potential<br />

investors or to <strong>CA</strong>II.<br />

As indicated, <strong>the</strong> management for <strong>the</strong> fund is provided by <strong>CA</strong>II, through a<br />

management contract, for which it is granted a development fee of 125bp on <strong>the</strong><br />

project value of <strong>the</strong> development and an asset management fee of 85bp for <strong>the</strong> real<br />

estate portfolio of <strong>the</strong> fund under management at market value. In addition, <strong>CA</strong>II<br />

receives a profit participation fee of 20% of <strong>the</strong> amount exceeding an internal rate<br />

of return (IRR) of 15% per year. Should <strong>the</strong> IRR amount to 20%, <strong>CA</strong>II is to receive an<br />

additional profit participation fee of 30% of <strong>the</strong> amount exceeding 20%.

12<br />

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

The fund launched its first project in Belgrade in February of this year, where an<br />

office tower (Savograd) with an investment volume of EUR 45m is under<br />

development. The fund expects a yield on investment costs of between 10-12%,<br />

with <strong>the</strong> completion of <strong>the</strong> project scheduled for <strong>the</strong> beginning of 2008.<br />

The fund has planned ano<strong>the</strong>r investment: a 50:50 joint venture with developer<br />

UBM in Warsaw. The first phase of <strong>the</strong> office project is planned to begin by <strong>the</strong> end<br />

of this year, while completion is slated for 2010 (investment volume of EUR 88m,<br />

yield of 8-10%). The subsequent phases of <strong>the</strong> project, to be carried out within <strong>the</strong><br />

ensuing 12-14 years with a total EUR 250m in investment volume, will consist of a<br />

total lettable area of 200,000 sqm of office, retail and hotel space.<br />

The H1 Hotel Fund<br />

<strong>CA</strong>II and Raiffeisen Versicherung, which is part of <strong>the</strong> Uniqa group, hold a 50%<br />

participation each in <strong>the</strong> Hotel Fund. The fund is intended to develop 3-4-star business<br />

hotels in Eastern European countries, and currently has a committed equity base of<br />

EUR 140m. This equity base is intended to double to EUR 275m through an offering<br />

to institutional investors. The targeted capital structure of <strong>the</strong> fund of 60:40 debt to<br />

equity provides <strong>the</strong> fund with potential investment volume of EUR 700m. To secure<br />

<strong>the</strong> letting of <strong>the</strong> development project following completion, <strong>the</strong> fund co-operates<br />

closely with international hotel chains. The management for <strong>the</strong> fund is provided<br />

by <strong>CA</strong>II, Raiffeisen Versicherung and Deloitte, for which <strong>the</strong>y receive a 0.75% asset<br />

management fee and a success fee, to be shared equally among <strong>the</strong>m. Currently 10<br />

hotel projects are being considered by management.<br />

A framework contract was just recently signed between this fund and Russian<br />

Avtopromimport for 50 hotels throughout Russia. This contract does not include<br />

concrete projects but is a good sign that most of <strong>the</strong> fund's activity will be focused<br />

on <strong>the</strong> Russian market.

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

Valuation<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

We have used <strong>the</strong> P/NAV as a core yardstick for valuing <strong>CA</strong> <strong>Immo</strong>. The NAV multiple<br />

is used for three reasons. First, <strong>CA</strong> <strong>Immo</strong> is - despite an increasing development exposure<br />

- still predominantly a real estate investor, because most of <strong>the</strong> development projects<br />

are executed via joint ventures with local partners. Second, <strong>the</strong> NAV provides a good<br />

reflection of <strong>the</strong> underlying value of a real estate company. And third, <strong>the</strong> net asset<br />

value is <strong>the</strong> least biased by different accounting standards and, thus, enables a good<br />

comparison of <strong>the</strong> various companies. The NAV is derived from valuation reports<br />

prepared by external appraisers; for <strong>CA</strong> <strong>Immo</strong>, <strong>the</strong>se are CB Richard Ellis for <strong>the</strong> Eastern<br />

European portfolio; MRG and CB Richard Ellis for <strong>the</strong> Austrian real estate portfolio;<br />

and Colliers for Germany. For appraising <strong>the</strong> real estate portfolio, <strong>the</strong> company mainly<br />

uses <strong>the</strong> DCF methodology on a yearly basis. The company itself calculates a NNNAV<br />

based on EPRA (European Public Real Estate Association) standards for its financial<br />

statements, which includes revaluation gains on developments, deferred taxes and<br />

value adjustments of financial instruments.<br />

<strong>CA</strong> <strong>Immo</strong> reports its figures according to IFRS, which allows it to report <strong>the</strong> real estate<br />

portfolio ei<strong>the</strong>r at fair value or at cost value. <strong>CA</strong> <strong>Immo</strong> uses <strong>the</strong> fair value for its real<br />

estate portfolio while <strong>the</strong> development projects are valued at cost until completion.<br />

Through this accounting method <strong>the</strong> NAV is <strong>the</strong> same as <strong>the</strong> shareholders' equity<br />

position. However, <strong>the</strong> company has an increasing development exposure, which is,<br />

according to IFRS, only accounted at cost. This leads to value jumps as soon as a<br />

project is completed and revalued by <strong>the</strong> appraisers. To take <strong>the</strong>se developments into<br />

account on a constant basis, we have calculated <strong>the</strong> NNNAV, in which, in contrast to<br />

IFRS, revaluation gains in <strong>the</strong> properties under construction are included. This approach<br />

leads us to additional revaluation gains on developments after minorities of EUR<br />

30.7m in FY 2007 and EUR 73.2m in FY 2008, totalling an NNNAV per share of EUR 23.0<br />

in FY 2007 and EUR 25.1 in FY 2008. These expected revaluation gains on developments<br />

are based on <strong>the</strong> conservative approach of <strong>the</strong> company, which only showed 8% of its<br />

development costs as revaluation gains in FY 2006. This stands in contrast to <strong>the</strong><br />

company's closest peers, <strong>Immo</strong>finanz, which adds 67% of its development costs as<br />

revaluation gains to its NAV calculation in 3Q 2006/07.<br />

NNNAV calculation<br />

Ebro=ãF OMMQ OMMR OMMSm OMMTb OMMUb<br />

pÜ~êÉÜçäÇÉêë=Éèìáíó SPNKO URNKP NIOMUKN NIVPQKV OIMRTKS<br />

kk^s=~ÑíÉê=ÉñÉêÅáëÉ=çÑ=çéíáçåë<br />

s~äìÉ=~ÇàìëíãKÑçê=éêçàÉÅíë=áå=<br />

SPNKO URNKP NIOMUKN NIVPQKV OIMRTKS<br />

ÇÉîÉäçéãK NUKS MKU NNKV RQKT NQVKS<br />

jáåçêáíáÉë<br />

s~äìÉ=~ÇàìëíãÉåí=Ñçê=Ñáå~åÅá~ä=<br />

MKM MKM MKM JOQKN JTSKQ<br />

áåëíêìãÉåíë NKM MKV JRKP JUKR JNNKV<br />

aÉÑÉêêÉÇ=í~ñÉë NNKT NOKQ OUKP TQKP NMSKN<br />

kk^s=~ÑíÉê=~ÇàìëíãÉåíë<br />

s~äìÉ=~ÇàìëíãÉåí=Ñçê=Ñáå~åÅá~ä=<br />

SSOKS USRKQ NIOQPKM OIMPNKQ OIOORKN<br />

áåëíêìãÉåíë JNKM JMKV RKP UKR NNKV<br />

s~äìÉ=~ÇàìëíãÉåí=Ñçê=äá~ÄáäáíáÉë JOKQ JMKP MKM MKM MKM<br />

aÉÑÉêêÉÇ=í~ñÉë JSKM JSKP JNQKQ JPRKQ JRMKR<br />

kkk^s=~ÅÅçêÇáåÖ=íç=bmo^= SRPKO URTKV NIOPPKV OIMMQKR OINUSKQ<br />

kkk^s=éÉê=ëÜ~êÉ=EbroF NUKQ NVKT ONKO OPKM ORKN<br />

B=ÅÜ~åÖÉ MB TB UB UB VB<br />

13<br />

Source: <strong>CA</strong> <strong>Immo</strong>, <strong>CA</strong> IB

14<br />

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

Very conservative valuation<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

The portfolio of <strong>the</strong> company is very conservatively valued, taking into account an<br />

Austrian portfolio valued at a yield of 5.9% and CEE and SEE portfolios yielded at<br />

6.9% and 8.7%, respectively. These yields stand in heavy contrast to <strong>the</strong> prime office<br />

yields in <strong>the</strong>se markets, which are in <strong>the</strong> case of Austria below 5% and in <strong>the</strong> latter<br />

two also far below <strong>the</strong>se yields. For example, <strong>the</strong> Polish portfolio was valued with a<br />

yield of 7.2% compared to prime market yields of 5.5%. This conservative valuation<br />

implies a lot of hidden reserves, which total EUR 1.9 per share. Adding this to <strong>the</strong><br />

announced NNNAV of EUR 21.69 at <strong>the</strong> end of March 2007 results in a fair value of<br />

EUR 23.59, which is 7% higher than <strong>the</strong> current share price. The conservative valuation<br />

is explained by <strong>CA</strong>II's management with <strong>the</strong> need to be prepared for short-term<br />

market price declines. In such cases <strong>the</strong> company would not have to devalue its<br />

property portfolio, which would pull in a kind of safety net into its valuation.<br />

Austria and Germany have <strong>the</strong> lowest yields, but account each for 1/3<br />

portfolio value<br />

NOB<br />

NMB<br />

UB<br />

SB<br />

QB<br />

OB<br />

MB<br />

SKUB<br />

päçî~âá~<br />

SKVB<br />

eìåÖ~êó<br />

UKNB<br />

oçã~åá~<br />

NMKPB<br />

päçîÉåá~<br />

UKVB<br />

_ìäÖ~êá~<br />

TKOB<br />

mçä~åÇ<br />

RKVB<br />

^ìëíêá~<br />

RKPB<br />

dÉêã~åó<br />

Source: <strong>CA</strong> <strong>Immo</strong>, <strong>CA</strong> IB<br />

We initiate coverage in <strong>CA</strong> <strong>Immo</strong> with a Buy recommendation and a price target of<br />

EUR 26. We derived this price target through adding 50% of <strong>the</strong> total hidden reserves<br />

of EUR 1.9/share to <strong>the</strong> NNNAV 2008E/share. Additional upside could come if <strong>the</strong><br />

company were to show higher revaluation gains on developments.

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

Peer group valuation<br />

Peer group comparison P/NAV and P/EPRA NAV<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

In valuing <strong>the</strong> stock, we have compared it with a peer group of Austrian real estate<br />

companies on single NAV and on EPRA NAV, which includes revaluation gains on<br />

developments and deferred taxes. Some of <strong>the</strong>se companies are active solely in<br />

Eastern Europe (<strong>Immo</strong>east, Meinl European Land, subsidiary <strong>CA</strong> II), while some,<br />

such as <strong>CA</strong> <strong>Immo</strong>, have a more diversified real estate portfolio through additional<br />

exposure to Austrian or o<strong>the</strong>r Western European countries (<strong>Immo</strong>finanz).<br />

<strong>On</strong> single NAV <strong>CA</strong> <strong>Immo</strong> is currently traded at a discount of 10% to its peer group's<br />

median 2007E P/NAV, while on EPRA NAV basis <strong>the</strong> company is traded at its peer<br />

group's median P/EPRA NAV 2007E.<br />

The investor in this respect should always keep in mind <strong>the</strong> hidden reserves of EUR<br />

1.9/share, which would significantly enlarge <strong>the</strong> discount to its peer group median.<br />

mêáÅÉ<br />

k^s=<br />

OMMS<br />

k^s=<br />

OMMTb<br />

k^s=<br />

OMMUb<br />

mLk^s=<br />

OMMS<br />

mLk^s=<br />

OMMTb<br />

15<br />

mLk^s=<br />

OMMUb<br />

fããçÉ~ëí NMKMU UKPQ VKSM NMKRS NKON NKMR MKVR<br />

fããçÑáå~åò NMKRR UKSR VKUM NNKOM NKOS NKNM NKMM<br />

`^=fããç=fåíÉêå~íáçå~ä NQKOU NPKQN NQKTS NSKVM NKMS MKVT MKUQ<br />

`^=fããç=^åä~ÖÉå ONKOM OMKTT OOKOQ OPKTO NKMO MKVR MKUV<br />

jÉáåä=bìêçéÉ~å=i~åÇ ONKOR NRKPO NTKOM NUKUQ NKPV NKOQ NKNP<br />

jÉÇá~å NKON NKMR MKVR<br />

mêáÅÉ<br />

bmo^=k^s=<br />

OMMS<br />

bmo^=k^s=<br />

OMMTb<br />

bmo^=k^s=<br />

OMMUb<br />

mLbmo^=k^s=<br />

OMMS<br />

mLk^s=<br />

OMMTb<br />

mLk^s=<br />

OMMUb<br />

fããçÉ~ëí NMKMU VKPR NNKNQ NPKPR NKMU MKVM MKTS<br />

fããçÑáå~åò NMKRR NMKPO NNKRR NPKNO NKMO MKVN MKUM<br />

`^=fããç=fåíÉêå~íáçå~ä NQKOU NPKSR NRKQO NUKPO NKMR MKVP MKTU<br />

`^=fããç=^åä~ÖÉå ONKOM ONKOM OPKMM OQKVM NKMM MKVO MKUR<br />

jÉáåä=bìêçéÉ~å=i~åÇ ONKOR NSKUV NUKTM ONKOM NKOS NKNQ NKMM<br />

jÉÇá~å NKMR MKVO MKUM<br />

Source: <strong>CA</strong> <strong>Immo</strong>, <strong>CA</strong> IB

16<br />

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

The management<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

In contrast to most o<strong>the</strong>r listed Austrian real estate companies, where all management<br />

services are provided by affiliated banks, <strong>CA</strong> <strong>Immo</strong> has an in-house management. This<br />

team of investment managers and real estate professionals is based ei<strong>the</strong>r in <strong>the</strong><br />

Vienna head offices or in <strong>the</strong> local offices in Budapest, Warsaw, Bucharest and Belgrade.<br />

The local offices, which provide <strong>the</strong> country knowledge for <strong>the</strong> company, are<br />

responsible for marketing and for property and facility management. In addition, <strong>CA</strong><br />

<strong>Immo</strong> has stated it intends to open additional offices in Germany, Moscow, Prague,<br />

Sofia and Kiev as soon as a specific level of exposure in <strong>the</strong> property portfolio has<br />

been reached. In contrast to this strategy <strong>CA</strong> <strong>Immo</strong> just recently opened a local office<br />

in Belgrade, where it has currently only one development project (Savograde). In our<br />

view, this action is a good indication of additional activities in this market or adjacent<br />

countries such as Montenegro or Croatia.<br />

In preparation of <strong>the</strong> planned increase in <strong>the</strong> level of exposure in Eastern Europe, <strong>CA</strong><br />

<strong>Immo</strong> increased <strong>the</strong> number of employees in 2005. This resulted in a 70% increase of<br />

staff in <strong>the</strong> Vienna HQ in 2005, while in 2006 additional management and controlling<br />

resources were added.<br />

Bruno Ettenauer, <strong>the</strong> chairman of <strong>the</strong> board of <strong>CA</strong> <strong>Immo</strong> since 2006, has more than<br />

15 years of experience in <strong>the</strong> real estate sector and is a certified and chartered surveyor<br />

for real estate valuation. Ettenauer is responsible for <strong>the</strong> property portfolio in Germany<br />

and Eastern Europe as well as for institutional products.<br />

Wolfhard Fromwald has been a member of <strong>the</strong> board of <strong>CA</strong> <strong>Immo</strong> since 1990. With<br />

17 years of experience in <strong>the</strong> real estate sector, Fromwald is responsible for accounting,<br />

controlling, organisation, investor relations and corporate communication.<br />

Gerhard Engelsberger is responsible for development and technical areas. With<br />

more than 40 years of experience in <strong>the</strong> real estate sector, Engelsberger has been a<br />

member of <strong>the</strong> board of <strong>CA</strong> <strong>Immo</strong> since 1987.<br />

Gregor Drexler joined <strong>CA</strong> <strong>Immo</strong> in 2006 and works as a chief asset manager. He has<br />

more than 10 years of experience in <strong>the</strong> real estate sector and graduated with a<br />

degree in Real Estate Economics from <strong>the</strong> European Business School in Oestrich-Winkel.<br />

Martina Schmidradner works as a chief investment manager. Schmidradner has<br />

more than 13 years of experience in <strong>the</strong> real estate sector and is a certified real estate<br />

agent.<br />

Roland Pomajbik works as <strong>the</strong> head of development. Pomajbik has nearly 20 years<br />

of experience in real estate development and was previously project developer for<br />

Wienerberger <strong>Immo</strong>bilien.<br />

<strong>CA</strong> <strong>Immo</strong> has 105 key employees, 48 of whom are based in <strong>the</strong> head office in Vienna.<br />

In addition, 68 employees work for <strong>CA</strong>II, carrying out various tasks. To fur<strong>the</strong>r expand<br />

internal resources for project monitoring and due diligence, <strong>the</strong> company intends to<br />

recruit additional asset managers.<br />

As mentioned above, <strong>CA</strong> <strong>Immo</strong>'s subsidiary will provide management services for <strong>the</strong><br />

New Europe Property Fund and for <strong>the</strong> H1 Hotel Fund. For this service, two types of<br />

fees are collected, which differ depending on <strong>the</strong> fund. (see pages 11 and 12.)

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

The portfolio<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

<strong>CA</strong> <strong>Immo</strong>'s portfolio consists of 181 properties in 11 European countries, with a<br />

total market value of EUR 2.1bn (end of 1Q 2007). The value of <strong>the</strong> portfolio almost<br />

doubled in 2006 due to a large acquisition in Hesse (Germany), where a real estate<br />

portfolio with a market value of EUR 798m was acquired from local municipalities.<br />

The increase in <strong>the</strong> portfolio value in 2005 was driven by a strategy change in <strong>the</strong><br />

Eastern European activities to one that is more aggressive, which almost doubled<br />

<strong>the</strong> Eastern European real estate portfolio valuewise in 2005.<br />

Portfolio growth by region Number of objects<br />

PIMMM<br />

OIMMM<br />

NIMMM<br />

M<br />

Ebro=ãF<br />

RSU<br />

TNT<br />

NINRT<br />

OINNSG<br />

OIPRN<br />

OMMP OMMQ OMMR OMMS Nn=OMMT<br />

^ìëíêá~ dÉêã~åó b~ëíÉêå=bìêçéÉ `çããáííÉÇ=Ñçê=OMMT<br />

* including <strong>the</strong> Hesse portfolio<br />

OMM<br />

NUM<br />

NSM<br />

NQM<br />

NOM<br />

NMM<br />

UM<br />

SM<br />

QM<br />

OM<br />

M<br />

RT<br />

SO<br />

NQT<br />

NTV<br />

NUN<br />

OMMP OMMQ OMMR OMMS j~êJMT<br />

17<br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

Regionwise, <strong>the</strong> real estate portfolio is almost equally diversified in terms of value<br />

in <strong>CA</strong> <strong>Immo</strong>'s markets: Austria, Germany and Eastern Europe. The investment pipeline<br />

of <strong>the</strong> company suggests <strong>the</strong> relatively smaller proportion of <strong>the</strong> Eastern European<br />

region will draw level with <strong>the</strong> o<strong>the</strong>r regions in <strong>the</strong> mid-term.<br />

Regional diversification of current portfolio*<br />

^ìëíêá~<br />

PTB<br />

dÉêã~åó<br />

PUB<br />

* including <strong>the</strong> Hesse portfolio<br />

b~ëíÉêå=<br />

bìêçéÉ<br />

ORB<br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

Sectorwise, <strong>the</strong> property portfolio is dominated by <strong>the</strong> office sector with 75% in<br />

terms of value, followed by <strong>the</strong> "mixed usage" (offices with hotels and/or retail or<br />

residential) properties with 9% of value. This domination by <strong>the</strong> office sector is a<br />

throwback to <strong>the</strong> beginnings of <strong>the</strong> company when it was just a specialist in office<br />

space. In addition, <strong>the</strong> recent large acquisition in Germany, which consists solely of<br />

office space, increased this domination.

18<br />

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

The office sector dominates <strong>CA</strong> <strong>Immo</strong>’s portfolio(FY 2006)*<br />

lÑÑáÅÉ<br />

TRB<br />

* including <strong>the</strong> Hesse portfolio<br />

oÉëáÇÉåíá~ä<br />

OB<br />

iÉ~ëÉÇ=ä~åÇ<br />

RB<br />

eçíÉä<br />

RB<br />

jáñÉÇ<br />

VB<br />

oÉí~áä<br />

PB<br />

içÖáëíáÅë<br />

NB<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

In terms of rental income <strong>the</strong> company's three investment regions, Austria, Germany<br />

and Eastern Europe, each make up almost a third of <strong>the</strong> total rental income in 1Q<br />

2007.<br />

Even split of rental income in 1Q 2007<br />

`bbLpbbL`fp<br />

PNB<br />

dÉêã~åó<br />

PSB<br />

^ìëíêá~<br />

PPB<br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

The current yield on <strong>the</strong> whole real estate portfolio of <strong>CA</strong> <strong>Immo</strong> is 6% on average,<br />

with great differences depending on <strong>the</strong> region. The yields are led by its SEE<br />

exposure, which contributes current yields of 8.7%, followed by <strong>the</strong> CEE portfolio,<br />

which provides current yields of 6.9%. Taking into account that yields in <strong>the</strong> real<br />

estate sector in Western Europe are between 4% and 5%, it becomes apparent that<br />

a greater degree of yield compression exists in Eastern Europe for <strong>the</strong> <strong>CA</strong> <strong>Immo</strong><br />

portfolio. In Austria, <strong>the</strong> company has current yields of 5.8%, while Germany brings<br />

up <strong>the</strong> rear with 5.2%, although its yield is of <strong>the</strong> stable sort derived from longterm<br />

tenant commitments.

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

SEE offers <strong>the</strong> highest yield in <strong>CA</strong> <strong>Immo</strong>’s portfolio<br />

NMB<br />

VB<br />

UB<br />

TB<br />

SB<br />

RB<br />

QB<br />

PB<br />

OB<br />

NB<br />

MB<br />

RKV=<br />

RKP=<br />

SKV=<br />

UKT=<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

^ìëíêá~ dÉêã~åó `bb pbb<br />

* including <strong>the</strong> Hesse portfolio, including rent from two properites scheduled for completion in 2010<br />

** excluding value added<br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

Market activities<br />

Austria<br />

Austria is <strong>CA</strong> <strong>Immo</strong>'s home market, in which it started its business 20 years ago.<br />

Historically <strong>the</strong> company has been predominantly active in <strong>the</strong> office sector in <strong>the</strong><br />

high-quality segment, but in recent years, <strong>the</strong> proportion of o<strong>the</strong>r sectors has grown.<br />

Two-thirds of <strong>CA</strong> <strong>Immo</strong>'s lettable space (totalling 343,700 sqm) and projects in terms<br />

of market value (totalling EUR 667m) are located in <strong>the</strong> capital, Vienna, while <strong>the</strong><br />

remainder is located in o<strong>the</strong>r large cities of <strong>the</strong> country. In total, 124 buildings<br />

make up <strong>CA</strong> <strong>Immo</strong>'s Austrian real estate portfolio, which provides a current yield of<br />

5.9% (excluding value added) on average (in market values).<br />

Development of <strong>the</strong> portfolio<br />

UMM<br />

SMM<br />

QMM<br />

OMM<br />

M<br />

Ej~êâÉí=î~äìÉ=Ebro=ãFF<br />

PO<br />

PRO<br />

QU<br />

PV<br />

QTT<br />

RN<br />

SP<br />

RVU<br />

NOV<br />

TN<br />

TNN<br />

NOQ<br />

OMMP OMMQ OMMR OMMS<br />

`çêÉ=áåîÉëíãÉåíë aÉîÉäçéãÉåíë kçK=çÑ=çÄàÉÅíë=EêáÖÜí=ëÅ~äÉF<br />

OMM<br />

NUM<br />

NSM<br />

NQM<br />

NOM<br />

NMM<br />

UM<br />

SM<br />

QM<br />

OM<br />

M<br />

19<br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

The properties are let predominantly on open-ended rental contracts (54%) to large<br />

international companies such as Siemens and Ikea, with <strong>the</strong> former alone constituting<br />

24% of <strong>the</strong> rental income in Austria. All rents are adjusted on an annual basis<br />

according to CPI.

20<br />

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

More than half of <strong>CA</strong> <strong>Immo</strong>’s contracts are open end in Austria<br />

SMB<br />

RMB<br />

QMB<br />

PMB<br />

OMB<br />

NMB<br />

MB<br />

RKQB<br />

RKVB<br />

NVKSB<br />

SKQB<br />

OKRB<br />

RKTB<br />

RQKSB<br />

OMMT OMMU OMMV OMNM OMNN OMNOH çéÉå<br />

ÉåÇ<br />

B=çÑ=êÉåí~ä=áåÅçãÉ=Ebñéáêó=Ç~íÉ=çÑ=Åçåíê~ÅíF<br />

Top three tenants in Austria<br />

`çãé~åó fåÇìëíêó pÜ~êÉG<br />

pÜ~êÉ=íçí~ä=<br />

ÖêçìéGG<br />

páÉãÉåë=^d=^ìëíêá~ fqLqÉäÉÅçããìåáâ~íáçå OQB UB<br />

fhb^=báåêáÅÜíìåÖÉå=e~åÇÉäÖÉëK=ãKÄKeK oÉí~áä PB NB<br />

rm`=qÉäÉâ~ÄÉä=táÉå=dãÄe qÉäÉÅçããìåáÅ~íáçå PB NB<br />

* Share of rental income of Austrian rent income<br />

** Share of rental income of total annual Group rental income including Hesse portfolio based on contracted rent<br />

for 2007<br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

In its home market, <strong>CA</strong> <strong>Immo</strong> gained its initial expertise in development projects<br />

before transferring this experience to Eastern Europe. Three projects are currently<br />

under development in Austria, of which a hotel/office development in Vienna<br />

(Rennweg) is <strong>the</strong> largest, with 43,000 sqm of lettable space. The majority of <strong>the</strong><br />

project, with an investment volume of EUR 86m, has already been pre-let to an<br />

operator, Austrian Trend Hotel Verkehrsbüro. Completion of <strong>the</strong> development, which<br />

will provide stable cash flows from <strong>the</strong> hotel operator, is planned for spring 2008.<br />

Ano<strong>the</strong>r project under development is an office building in Vienna with a total<br />

investment volume of EUR 107m. The project, which is planned to be completed in<br />

two phases, has a targeted IRR (Internal Rate of Return) of 12-14%. Completion of<br />

<strong>the</strong> total development is expected by 2010.<br />

<strong>CA</strong> <strong>Immo</strong> is also active in refurbishment projects, an example of which is <strong>the</strong> Donau<br />

Business Centre in Vienna, which is currently a pure office property in a secondary<br />

location. The opening of a metro station, scheduled for 2008, will see a definite<br />

increase in <strong>the</strong> attractiveness of <strong>the</strong> location. The refurbishment of <strong>the</strong> property<br />

provides <strong>the</strong> addition of up to five floors and a change in usage from that of a pure<br />

office building to one that is mixed usage, which also offers hotel space. The hotel<br />

space will be used for a 2-3-star hotel and will provide stable cash flows from <strong>the</strong><br />

operator.

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

Targets: <strong>CA</strong> <strong>Immo</strong> is planning to enlarge its Austrian portfolio through <strong>the</strong> acquisition<br />

of whole portfolios but also single objects. <strong>CA</strong> <strong>Immo</strong> will actively manage portfolio<br />

deals through selective divestments if properties are not compatible with its core<br />

portfolio. In addition, <strong>the</strong> company's development and redevelopment measures<br />

will provide <strong>CA</strong> <strong>Immo</strong> with attractive margins and new space.<br />

The acquisition of <strong>the</strong> BBAG portfolio in 2005 for an investment volume of EUR<br />

125m is an example of this strategy. During <strong>the</strong> due diligence, <strong>CA</strong> <strong>Immo</strong> identified<br />

8% of <strong>the</strong> portfolio as non-core, which was sold once <strong>the</strong> deal closed at an average<br />

profit of 10% above <strong>the</strong> acquisition price. In addition, redevelopment opportunities<br />

were identified and developments were completed.<br />

Germany<br />

The German real estate market is a relatively new market for <strong>CA</strong> <strong>Immo</strong>. Until <strong>the</strong><br />

end of 2006, <strong>CA</strong> <strong>Immo</strong> had only one office building in Düsseldorf. This changed at<br />

<strong>the</strong> end of December 2006 when <strong>CA</strong> <strong>Immo</strong> successfully participated in a tender for a<br />

portfolio of government buildings in <strong>the</strong> state of Hesse. This 447,500 sqm of lettable<br />

space and 659,700 sqm of land area were acquired for EUR 798m and at a yield of<br />

5.24%. The portfolio is let under long-term contracts to state organisations (state of<br />

Hesse: AA+ rating) such as government ministries, courts of law and police stations,<br />

which will provide stable cash flows in <strong>the</strong> coming centuries. In addition, rents are<br />

adjusted as soon as <strong>the</strong> changes in CPI total 7.5%.<br />

About 2/3 of German contracts expire not before 2030<br />

UMB<br />

TMB<br />

SMB<br />

RMB<br />

QMB<br />

PMB<br />

OMB<br />

NMB<br />

MB<br />

RKMB<br />

VKPB<br />

NOKUB<br />

TOKUB<br />

Y=OMNM Y=OMOM Y=OMPM [=OMPM<br />

B=çÑ=êÉåí~ä=áåÅçãÉ=Ebñéáêó=Ç~íÉ=çÑ=Åçåíê~ÅíF<br />

21<br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

Through <strong>the</strong> Hesse acquisition <strong>CA</strong> <strong>Immo</strong> established itself in Germany as a reliable<br />

long-term investor and potential buyer for fur<strong>the</strong>r privatisations of state-owned<br />

real estate portfolios. The acquisition was financed with EUR 550m of debt, resulting<br />

in a loan to value ratio of 69%. The leverage was swapped 100% into a fixed interest<br />

rate of 4.4% p.a. for <strong>the</strong> coming 10 years, which protects <strong>the</strong> company from fur<strong>the</strong>r<br />

interest rate hikes. <strong>On</strong>ly minor administrative costs arise from this acquisition as <strong>the</strong><br />

whole administration is provided by <strong>the</strong> tenant.<br />

Fur<strong>the</strong>rmore, <strong>the</strong> portfolio provides <strong>CA</strong> <strong>Immo</strong> with redevelopment opportunities in<br />

<strong>the</strong> event state austerity measures were to result in <strong>the</strong> cancellation of contracts.<br />

Such cancellation would be possible only if <strong>CA</strong> <strong>Immo</strong> were to agree to it, providing<br />

a bargaining chip for <strong>the</strong> company for any necessary rededication of <strong>the</strong> properties<br />

in such case.

22<br />

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

Eastern Europe<br />

Map of CEE and number of properties<br />

CEE<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

In CEE, <strong>CA</strong> <strong>Immo</strong> focuses its investments - through its subsidiary <strong>CA</strong>II - predominantly<br />

in <strong>the</strong> capital cities on prime or secondary locations and predominantly prime office<br />

space. However, investments also in second- and third-tier cities and o<strong>the</strong>r sectors<br />

are planned for <strong>the</strong> future to increase diversification. The first investment in CEE<br />

following this new strategy was <strong>the</strong> start of a hotel development project in Pilsen<br />

(CZ).The portfolio currently consists of ten office buildings with lettable space of<br />

126,700sqm (excluding parking) and a total market value of EUR 336m. In addition,<br />

<strong>CA</strong> <strong>Immo</strong> has eight development projects in CEE, for which EUR 66.6m have been<br />

capitalized so far.<br />

Poland: Poland is one of <strong>CA</strong> <strong>Immo</strong>'s key markets in Eastern Europe. Its real estate<br />

portfolio, which consists of three office buildings, is located solely in Warsaw. The<br />

market was entered upon <strong>the</strong> acquisition of <strong>the</strong> Wspolna building in 2001. Most of<br />

<strong>the</strong> rents are denominated in USD, but are gradually changed to EUR as soon as a<br />

tenant contract expires.<br />

<strong>CA</strong> <strong>Immo</strong> just recently announced a development project in Warsaw for an office<br />

building in a joint venture with developer UBM. Subsidiary <strong>CA</strong>II has held a 25% +4<br />

shares stake in this company since November 2006. The project is a multi-phase<br />

project of a business park with office, retail and hotel space. In <strong>the</strong> first phase, an<br />

office building is under development up until 2011 with an investment volume of<br />

EUR 88m; it is expected to provide a yield of 8-10% on investment costs. The<br />

investment value of <strong>the</strong> various complete phases is EUR 250m.<br />

Hungary: The Hungarian portfolio consists of five office buildings in prime or<br />

secondary locations in Budapest. Hungary was <strong>the</strong> first Eastern European real estate

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

market <strong>CA</strong> <strong>Immo</strong> entered back in 1999. In <strong>the</strong> case of one office building, 45% of<br />

rents are denominated in HUF (Hungarian forint). In February this year, <strong>CA</strong> <strong>Immo</strong><br />

concluded a forward purchase agreement of an office development project from<br />

<strong>the</strong> developer Hochtief in Budapest for EUR 71m. The completion of <strong>the</strong> project is<br />

expected by spring 2009; it will be <strong>CA</strong> <strong>Immo</strong>'s largest investment yet in Hungary.<br />

Czech Republic: <strong>CA</strong> <strong>Immo</strong> currently has only one development project in <strong>the</strong> Czech<br />

Republic - in Pilsen - for a hotel, with an effective area of 14,300 sqm of lettable<br />

space. The forward purchase will total EUR 30m in costs; it will be run by Marriott<br />

Hotel upon its expected completion in autumn 2007.<br />

In 1Q 2007 <strong>CA</strong> <strong>Immo</strong> sold an office building in Prague (Jungmannova) to its joint<br />

venture partner at a favourable yield of 5.1 %, leading to a profit of 127% compared<br />

to <strong>the</strong> development costs of EUR 10.4m. Just recently <strong>the</strong> ECM Airport Centre in<br />

Prague, a development project, was completed, which provides 6,800 sqm of lettable<br />

office space. In ano<strong>the</strong>r joint venture with Czech ECM, <strong>CA</strong> <strong>Immo</strong> is developing an<br />

office building in Prague (ECM City Deco).<br />

Slovakia: The Bratislava Business Centre was <strong>CA</strong> <strong>Immo</strong>'s second investment in Eastern<br />

Europe back in 2000. It is located in a prime area and let to local companies such as<br />

Slovenska sporitelna. An enlargement of this property with an investment volume<br />

of EUR 27m is currently being executed by <strong>the</strong> New Europe Property Fund.<br />

SEE<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

The entry of <strong>CA</strong> <strong>Immo</strong> into SEE dates back to <strong>the</strong> company's entry into <strong>the</strong> Bucharest<br />

real estate market in 2003. <strong>CA</strong> <strong>Immo</strong> concentrates its efforts on high-quality office<br />

buildings in <strong>the</strong> countries' capitals. <strong>CA</strong> <strong>Immo</strong> plans to increase <strong>the</strong> SEE proportion in<br />

its total portfolio in <strong>the</strong> coming years while increasing its sector diversification<br />

through investments in <strong>the</strong> retail sector and investments in logistics at major traffic<br />

junctions. The portfolio currently consists of five office buildings and one hotel<br />

building with a total lettable space of 69,857 sqm excluding parking and a market<br />

value of EUR 175m. In addition, <strong>CA</strong> <strong>Immo</strong> has signed three development projects in<br />

SEE with an expected investment value of EUR 171m.<br />

Romania: With a portfolio of three office buildings, Romania is <strong>CA</strong> <strong>Immo</strong>'s key<br />

market in SEE. The properties are located in prime areas of Bucharest and are let to<br />

international tenants. In two buildings of <strong>the</strong> portfolio, rents are denominated to a<br />

great extent in USD. Last year, one of <strong>CA</strong> <strong>Immo</strong>'s developments was sold at <strong>the</strong><br />

favourable price of EUR 41m, which was 78% higher than <strong>the</strong> investment costs. Just<br />

recently <strong>CA</strong> <strong>Immo</strong> announced a development project in <strong>the</strong> second-largest Romanian<br />

city, Timisoara. This office project with a lettable space of 20,000 sqm is being<br />

developed in a joint venture with Austrian/Romanian developer Wimpex and has<br />

an investment volume of EUR 47.5m.<br />

Bulgaria: The portfolio consists of two buildings in Sofia, called Mladost 1 & 2,<br />

which are located in a prime area and let to tenants such as Cosmo Bulgaria Mobile<br />

and Johnson Control. In a joint venture with developer Soravia and BA <strong>CA</strong> Real<br />

Invest, <strong>CA</strong> <strong>Immo</strong> just recently started an office and retail development project in<br />

Sofia (Megapark).<br />

21 23

24<br />

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

Slovenia: <strong>CA</strong> <strong>Immo</strong> acquired its only non-office building in its Eastern European<br />

portfolio in 2005. The hotel is located in Ljubljana.<br />

Serbia: <strong>CA</strong> <strong>Immo</strong> entered <strong>the</strong> Serbian real estate market this year with an office<br />

development project (Savograd) in Belgrade. This project is executed through <strong>the</strong><br />

New Europe Property Fund with a total investment volume of EUR 45m. The<br />

completion of this office building is expected by <strong>the</strong> beginning of 2008. The yield is<br />

expected to be 10-12% on investment costs.<br />

CIS<br />

This region was entered following <strong>the</strong> IPO of <strong>CA</strong> <strong>Immo</strong>'s subsidiary <strong>CA</strong>II through an<br />

investment in Moscow, an office development called Maslov Tower. <strong>CA</strong> <strong>Immo</strong> entered<br />

into a 50:50 joint venture with a local developer for <strong>the</strong> execution of <strong>the</strong> project.<br />

The local developer, whose business is run by a German, has been active on <strong>the</strong><br />

Moscow real estate market for more than 10 years. The project has a total investment<br />

volume of EUR 130m and is expected to provide a yield of 14-16% on its investment<br />

costs.<br />

Projects in development and planning in Eastern Europe<br />

`çìåíêó pí~âÉ<br />

fåîÉëíãÉåí=<br />

îçäìãÉ=Ebro=ãF `çãéäÉíáçå bñéÉÅíÉÇ=óáÉäÇëEBF<br />

The tenants in CEE and SEE<br />

cìåÇ=L=cçêï~êÇ=<br />

mìêÅÜ~ëÉ<br />

b`j=`áíó=aÉÅç `òÉÅÜ= RMB RM OMMV SKQ cìåÇ<br />

mçäÉíòâá=_ìëáåÉëë=m~êâ mçä~åÇ RMB UU OMMV UJNM cìåÇ<br />

`~éáí~ä=pèì~êÉ eìåÖ~êó NMMB TM OMMV T cçêï~êÇ<br />

aáéäçã~í=eçíÉä `òÉÅÜ RMB OV OMMT UKOR cçêï~êÇ<br />

__` päçî~âá~ NMMB OT OMMV NM `^=ff<br />

p~îçÖê~Ç pÉêÄá~ RMB QR OMMU NMJNO cìåÇ<br />

qáãáëç~ê~ oçã~åá~ RMB PM OMMV NNJNQ cìåÇ<br />

jÉÖ~é~êâ _ìäÖ~êá~ RMB VS OMMV TKOR cçêï~êÇ<br />

j~ëäçî jçëÅçï RMB NPM OMMV NQJNS `^=ff<br />

qçí~ä RSR<br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

Most of <strong>the</strong> rental contracts in <strong>CA</strong> <strong>Immo</strong>'s Eastern Europe portfolio are long term,<br />

with 66% of <strong>the</strong> contracts running until 2010 and beyond. In terms of tenants, eight<br />

companies made up 34% of <strong>CA</strong> <strong>Immo</strong>'s 2006 rental income. These are ei<strong>the</strong>r<br />

international companies such as PricewaterhouseCoopers, or local telecommunications<br />

companies such as PTK Centertel, or banks such as PBK Property in Poland. A review<br />

of <strong>the</strong> maturity of <strong>the</strong> Eastern European portfolio suggests a favourable mix of midand<br />

long-term contracts, which provide a stable return on <strong>the</strong> portfolio.

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

Favourable mix of short term and long term contracts in CEE and SEE<br />

PMB<br />

ORB<br />

OMB<br />

NRB<br />

NMB<br />

RB<br />

MB<br />

SKQB<br />

NMKQB<br />

NTKTB<br />

OQKTB<br />

OMKRB<br />

OMKPB<br />

OMMT OMMU OMMV OMNM OMNN OMNOÑÑ<br />

R=çÑ=êÉåí~ä=áåÅçãÉ=Ebñéáêó=Ç~íÉ=çÑ=Åçåíê~ÅíF<br />

Top four tenants in CEE and SEE<br />

pÜ~êÉ=íçí~ä=<br />

`çãé~åó fåÇìëíêó `áíó pÜ~êÉG ÖêçìéGG<br />

mqh=`ÉåíÉêíÉä qÉäÉÅçããìåáÅ~íáçåë t~êëÜ~ï NMB PB<br />

açãáå~=s~Å~åÅÉ eçíÉä iàìÄäà~å~ TB OB<br />

m_h=mêçéÉêíó _~åâ t~êë~ï QB NB<br />

bap=j~Öó~êçêëò~Ö fq _ìÇ~éÉëí PB NB<br />

* Share of total rental income Eastern Europe<br />

** Share of rental income of total annual Group rental income including Hesse<br />

portfolio based on contracted rent for 2007<br />

Appreciation of <strong>the</strong> portfolio<br />

25<br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

Source: <strong>CA</strong> <strong>Immo</strong><br />

The real estate portfolio is valued on an annual basis by external appraisers, which<br />

differ according to <strong>the</strong> region. The Eastern European portfolio is valued by CB Richard<br />

Ellis, which also provides quarterly updates separate from <strong>the</strong> yearly ones. CB Richard<br />

Ellis also values <strong>the</strong> majority of <strong>the</strong> Austrian portfolio, while <strong>the</strong> remaining portion<br />

is valued by MRG (Metzger Realitäten Gruppe). The German portfolio is valued by<br />

Colliers. The portfolios are valued according to standards established by <strong>the</strong> Royal<br />

Institution of Chartered Surveyors (RICS) or <strong>the</strong> regulations of <strong>the</strong> Austrians Real<br />

Estate Valuation Act. The former calculates <strong>the</strong> market value based on <strong>the</strong> discounted<br />

cash flow methodology. The discount rate in this respect is determined on <strong>the</strong> basis<br />

of net initial yields seen in transactions of comparable properties on <strong>the</strong>se markets.<br />

In addition, <strong>the</strong> appraisers take into account rent indexing, vacancy periods and <strong>the</strong><br />

expected fair rents for new lease contracts.

26<br />

<strong>CA</strong> <strong>Immo</strong>bilien Anlagen<br />

The strategy<br />

`^=f_=fåíÉêå~íáçå~ä=j~êâÉíë=^d<br />

gìåÉ=OMMT<br />

Increasing development exposure. Of <strong>the</strong> company's investment pipeline of EUR<br />

3.9bn for 2007, 46% will be invested in development projects. In <strong>the</strong> past, <strong>CA</strong> <strong>Immo</strong><br />

predominantly entered into joint ventures with local real estate developers for<br />

development projects. This changed with <strong>the</strong> newly established New Europe Property<br />

Fund and Hotel Fund, which will develop all future projects in <strong>CA</strong> <strong>Immo</strong>'s Eastern<br />

European development pipeline ei<strong>the</strong>r on a 100% basis or via a joint venture with a<br />

local developer. In its home market Austria <strong>CA</strong> <strong>Immo</strong> intends to establish itself as a<br />

major developer.<br />

Risk reduction through funds. The company uses additional capital resources to<br />

reduce <strong>the</strong> higher risk associated with <strong>the</strong> development projects. These resources are<br />

raised through funds in which <strong>CA</strong> <strong>Immo</strong> holds a specific stake and for which it provides<br />

<strong>the</strong> management. The funds will be a future source for <strong>CA</strong> <strong>Immo</strong> in two ways. First, it<br />

will provide <strong>CA</strong> <strong>Immo</strong> with interesting acquisition possibilities for its core portfolio.<br />