Fiscal Year 2010 CBP Annual Financial Report - CBP.gov

Fiscal Year 2010 CBP Annual Financial Report - CBP.gov

Fiscal Year 2010 CBP Annual Financial Report - CBP.gov

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to <strong>Financial</strong> Statements<br />

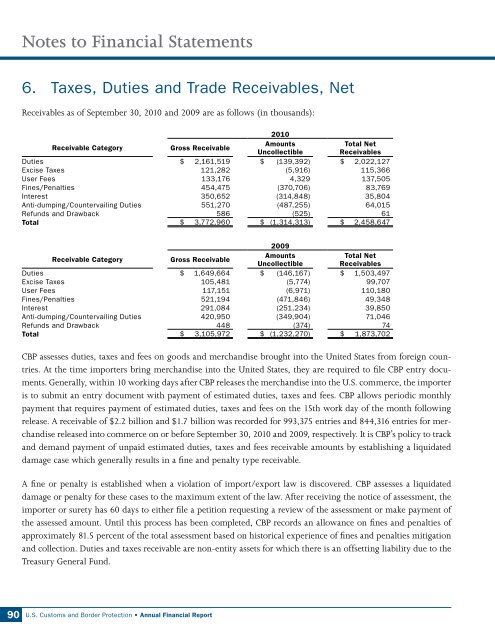

6. Taxes, Duties and Trade Receivables, Net<br />

Receivables as of September 30, <strong>2010</strong> and 2009 are as follows (in thousands):<br />

Receivable Category Gross Receivable<br />

<strong>2010</strong><br />

Amounts<br />

Uncollectible<br />

Total Net<br />

Receivables<br />

Duties $ 2,161,519 $ (139,392) $ 2,022,127<br />

Excise Taxes 121,282 (5,916) 115,366<br />

User Fees 133,176 4,329 137,505<br />

Fines/Penalties 454,475 (370,706) 83,769<br />

Interest 350,652 (314,848) 35,804<br />

Anti-dumping/Countervailing Duties 551,270 (487,255) 64,015<br />

Refunds and Drawback 586 (525) 61<br />

Total $ 3,772,960 $ (1,314,313) $ 2,458,647<br />

Receivable Category Gross Receivable<br />

2009<br />

Amounts<br />

Uncollectible<br />

Total Net<br />

Receivables<br />

Duties $ 1,649,664 $ (146,167) $ 1,503,497<br />

Excise Taxes 105,481 (5,774) 99,707<br />

User Fees 117,151 (6,971) 110,180<br />

Fines/Penalties 521,194 (471,846) 49,348<br />

Interest 291,084 (251,234) 39,850<br />

Anti-dumping/Countervailing Duties 420,950 (349,904) 71,046<br />

Refunds and Drawback 448 (374) 74<br />

Total $ 3,105,972 $ (1,232,270) $ 1,873,702<br />

<strong>CBP</strong> assesses duties, taxes and fees on goods and merchandise brought into the United States from foreign countries.<br />

At the time importers bring merchandise into the United States, they are required to file <strong>CBP</strong> entry documents.<br />

Generally, within 10 working days after <strong>CBP</strong> releases the merchandise into the U.S. commerce, the importer<br />

is to submit an entry document with payment of estimated duties, taxes and fees. <strong>CBP</strong> allows periodic monthly<br />

payment that requires payment of estimated duties, taxes and fees on the 15th work day of the month following<br />

release. A receivable of $2.2 billion and $1.7 billion was recorded for 993,375 entries and 844,316 entries for merchandise<br />

released into commerce on or before September 30, <strong>2010</strong> and 2009, respectively. It is <strong>CBP</strong>’s policy to track<br />

and demand payment of unpaid estimated duties, taxes and fees receivable amounts by establishing a liquidated<br />

damage case which generally results in a fine and penalty type receivable.<br />

A fine or penalty is established when a violation of import/export law is discovered. <strong>CBP</strong> assesses a liquidated<br />

damage or penalty for these cases to the maximum extent of the law. After receiving the notice of assessment, the<br />

importer or surety has 60 days to either file a petition requesting a review of the assessment or make payment of<br />

the assessed amount. Until this process has been completed, <strong>CBP</strong> records an allowance on fines and penalties of<br />

approximately 81.5 percent of the total assessment based on historical experience of fines and penalties mitigation<br />

and collection. Duties and taxes receivable are non-entity assets for which there is an offsetting liability due to the<br />

Treasury General Fund.<br />

90 U.S. Customs and Border Protection • <strong>Annual</strong> <strong>Financial</strong> <strong>Report</strong>