AnnuAL rePOrt 2011 - Winchester College

AnnuAL rePOrt 2011 - Winchester College

AnnuAL rePOrt 2011 - Winchester College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A rePort froM<br />

the ChAIrMAn<br />

of the fInAnCe<br />

CoMMIttee<br />

The finance Committee has<br />

responsibility, delegated from the<br />

governing Body, for the financial<br />

well-being of the <strong>College</strong>. In practice<br />

this means working closely with the<br />

headmaster, the Bursar and their<br />

colleagues to manage the viability of<br />

the <strong>College</strong> in the short term, and also<br />

to control well into the future the flow<br />

of income (principally school fees)<br />

and expenditure (both current<br />

expenses and maintenance and the<br />

capital spend which keeps up and<br />

improves the fabric of the <strong>College</strong>).<br />

Unsurprisingly, this is something of<br />

a balancing act, with the sustainability<br />

of the founder’s vision at its core.<br />

We want to attract bright boys<br />

who can benefit from the <strong>College</strong>’s<br />

approach to education. This means<br />

both providing value to those families<br />

who have a choice of schools, and<br />

assisting through bursaries those<br />

whose financial constraints would put<br />

a <strong>Winchester</strong> education beyond them.<br />

It means attracting and retaining<br />

in the right numbers the talented<br />

teaching and support staff that make<br />

this education possible.<br />

It means providing accommodation<br />

which need not be luxurious, but must<br />

not be an obstacle to effective study.<br />

“ We want to attract bright boys who can benefit from<br />

no report on finances would<br />

the <strong>College</strong>’s approach to education. This means both<br />

be complete without some figures,<br />

providing value to those families who have a choice of<br />

which are encouraging on the one<br />

schools, and assisting those whose financial constraints<br />

hand, but require new and significant<br />

would put a <strong>Winchester</strong> education beyond them,<br />

progress on the other.<br />

through bursaries.”<br />

Current financial performance<br />

ChArLes sInCLAIr (B, 1961-66)<br />

is encouraging in that the surplus<br />

(‘net incoming resources’) in charity<br />

accounts for the year to 31 August<br />

<strong>2011</strong> was £1,574,000, a good<br />

improvement on the prior year<br />

surplus of £947,000.<br />

It means maintaining ancient which both bridge current shortfalls<br />

school fees made up most of our<br />

(and modern) buildings and grounds and help to build the long-term real<br />

income, but did not cover educational<br />

which have provided an inspirational value of the endowment. The Works<br />

expenses. It was investment income,<br />

setting for intellectual and athletic Committee oversees the daily challenge<br />

grants and donations that largely<br />

endeavour for past generations, and of the necessary maintenance and<br />

met this shortfall and created the<br />

which are more than ever needed enhancement of the fabric of the<br />

overall surplus.<br />

for our future.<br />

<strong>College</strong>, yet with limited resources.<br />

The income from the <strong>College</strong>’s<br />

It means finding the resources for The disbursements Committee<br />

property investments and investment<br />

a continuing proud musical tradition, ensures that donations are properly<br />

portfolio does not of itself provide<br />

to which the Quiristers make a unique and efficiently spent in accordance<br />

sufficient income to cover current<br />

contribution, and for a technology base with donors’ wishes, and so enables<br />

shortfall. Yet it remains fundamental<br />

both for pure educational purposes the <strong>College</strong> to report back properly.<br />

that sufficient investment income<br />

and the efficient running of the<br />

As to the finance Committee<br />

should be retained to contribute<br />

<strong>College</strong> as a whole.<br />

itself, robin fox retired as its<br />

to long-term real growth in the<br />

These balances could not be Chairman in June <strong>2011</strong>, after a<br />

investment assets.<br />

managed without a first-class executive most distinguished 15 years as fellow,<br />

Whilst we are not, as a charity,<br />

staff and a combination of Committees and as sub-Warden. his involvement<br />

profit driven, we must manage our<br />

which provide an effective managing in the <strong>College</strong>’s affairs was so extensive<br />

income so as to cover our aspirations<br />

and control network. The Investment that his Chairmanship of the<br />

for both the bursary programme and<br />

Committee, a sub-committee of the finance Committee seemed effortless<br />

our maintenance and project needs.<br />

finance Committee, has oversight and so all the more daunting to<br />

This is where the activities of<br />

of the investment portfolio, and the me as his successor, with less than<br />

the development Committee and<br />

agricultural and residential estates. a year’s experience as a fellow.<br />

the development executive become<br />

The Audit and risk Committee My appointment was made possible<br />

crucial, because, as we stand,<br />

provides an independent view to by the strength and experience of<br />

the <strong>College</strong>’s finances are perhaps<br />

the governing Body on the financial the three continuing Committee<br />

too finely balanced.<br />

reports of the <strong>College</strong>, and of the members: robert sutton, formerly<br />

risks inherent in the <strong>College</strong>’s<br />

senior partner of Macfarlanes;<br />

operations including its finances. robert Woods, a seasoned managing<br />

The development Committee is director from the maritime world;<br />

responsible for sustaining and and Mark Loveday, formerly senior<br />

enhancing the flow of donations partner of Cazenove.<br />

our project load, including<br />

the modernisation of new hall,<br />

the development of two existing<br />

properties for investment or <strong>College</strong><br />

use, and the next round of Commoner<br />

house refurbishments, has brought<br />

into sharp focus the need for deeper<br />

financial capacity. With our current<br />

resources, near-term needs can be<br />

met, and projects financed. In the<br />

medium-term, our bursary<br />

aspirations and campus development<br />

will not be financeable without a<br />

growing donor and donations base.<br />

only that way will we be able to<br />

balance the demand for expendable<br />

income with real growth of our<br />

asset base over time, and the<br />

competing needs of current and<br />

future beneficiaries of the <strong>College</strong>.<br />

Charles sinclair<br />

Chairman of the Finance Committee<br />

32 WINCHESTER COLLEGE AnnUAL rePort <strong>2011</strong><br />

33<br />

5<br />

3<br />

4<br />

2<br />

6<br />

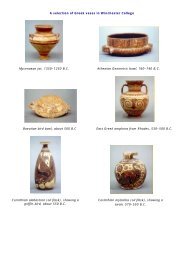

<strong>College</strong> investments<br />

1 Agricultural property 64.1%<br />

2 Commercial property 5.1%<br />

3 Woodlands 2.2%<br />

4 residential property 7.6%<br />

5 fixed interest 1.7%<br />

6 equities 11.1%<br />

7 hedge funds 4.4%<br />

8 Private equity 1.3%<br />

9 Commodities 1.3%<br />

10 Cash 1.2%<br />

A good return<br />

7<br />

8 9 10<br />

64.1 %<br />

To balance current and future needs,<br />

the <strong>College</strong> aims to:<br />

• maintain (at least) the value of the<br />

investments in real terms;<br />

• produce a consistent and sustainable<br />

amount to support current<br />

expenditure; and<br />

• deliver these first two objectives<br />

within acceptable levels of risk.<br />

At 31 August <strong>2011</strong> the total value of<br />

the <strong>College</strong>’s long-term investments was<br />

£63,481,000. The total return for the<br />

year across all these investments was<br />

+20%. They generated investment<br />

income of £1,371,000 and a further<br />

£742,000 was withdrawn from<br />

capital under the <strong>College</strong>’s total return<br />

investment approach.<br />

1