EFAMA KPMG Solvency II Report

EFAMA KPMG Solvency II Report

EFAMA KPMG Solvency II Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4.2.3 Data Licensing<br />

4 WORKING GROUP FINDINGS | 31<br />

Requirements<br />

To allow completion of the proposed Quantitative <strong>Report</strong>ing Templates (QRTs) and<br />

the actuarial analysis required to perform solvency calculations, <strong>Solvency</strong> <strong>II</strong> requires<br />

signifi cantly greater data on the assets held by insurers than has been traditionally<br />

utilised. Much of this data can only be sourced from commercial data vendors and<br />

rating agencies such as Bloomberg, Reuters, Standard and Poor’s and Fitch.<br />

The current structure of data licences and the diversity of data required to support<br />

the three pillars of <strong>Solvency</strong> <strong>II</strong>, means all data cannot be supplied within a single<br />

data licence and therefore insurers and the suppliers of their asset data need to hold<br />

multiple licences with data vendors. Frequently, these licences allow for signifi cantly<br />

more data to be provided than is required to fulfi l <strong>Solvency</strong> <strong>II</strong> requirements.<br />

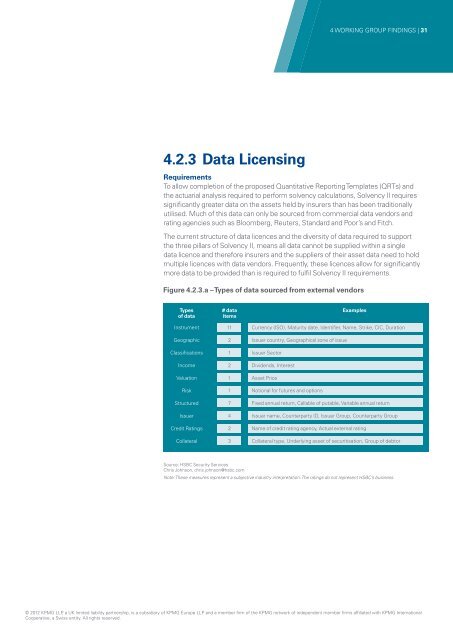

Figure 4.2.3.a – Types of data sourced from external vendors<br />

.<br />

Types<br />

of data<br />

# data<br />

items<br />

Examples<br />

Instrument 11 Currency (ISO), Maturity date, Identifi er, Name, Strike, CIC, Duration<br />

Geographic 2 Issuer country, Geographical zone of issue<br />

Classifi cations 1 Issuer Sector<br />

Income 2 Dividends, Interest<br />

Valuation 1 Asset Price<br />

Risk 1 Notional for futures and options<br />

Structured 7 Fixed annual return, Callable of putable, Variable annual return<br />

Issuer 4 Issuer name, Counterparty ID, Issuer Group, Counterparty Group<br />

Credit Ratings 2 Name of credit rating agency, Actual external rating<br />

Collateral 3 Collateral type, Underlying asset of securitisation, Group of debtor<br />

Source: HSBC Security Services<br />

Chris Johnson, chris.johnson@hsbc.com<br />

Note: These measures represent a subjective industry interpretation. The ratings do not represent HSBC’s business.<br />

© 2012 <strong>KPMG</strong> LLP, a UK limited liability partnership, is a subsidiary of <strong>KPMG</strong> Europe LLP and a member fi rm of the <strong>KPMG</strong> network of independent member fi rms affi liated with <strong>KPMG</strong> International<br />

Cooperative, a Swiss entity. All rights reserved.