Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

higher level of overheads typical of the engineering and<br />

professional services acquired in the year.<br />

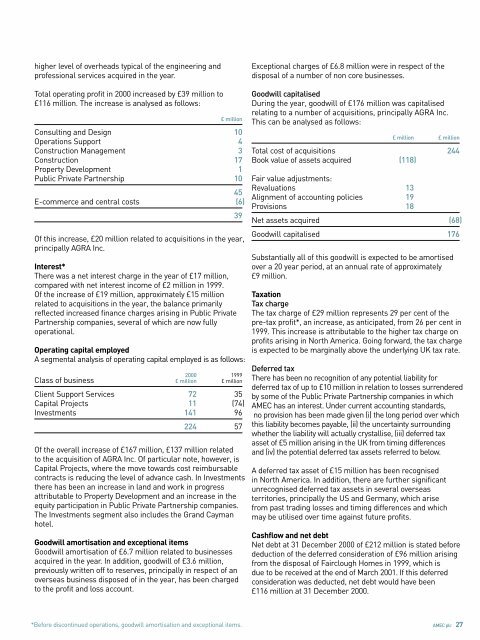

Total operating profit in <strong>2000</strong> increased by £39 million to<br />

£116 million. The increase is analysed as follows:<br />

£ million<br />

Consulting and Design 10<br />

Operations Support 4<br />

Construction Management 3<br />

Construction 17<br />

Property Development 1<br />

Public Private Partnership 10<br />

45<br />

E-commerce and central costs (6)<br />

Of this increase, £20 million related to acquisitions in the year,<br />

principally AGRA Inc.<br />

Interest*<br />

There was a net interest charge in the year of £17 million,<br />

compared with net interest income of £2 million in 1999.<br />

Of the increase of £19 million, approximately £15 million<br />

related to acquisitions in the year, the balance primarily<br />

reflected increased finance charges arising in Public Private<br />

Partnership companies, several of which are now fully<br />

operational.<br />

Operating capital employed<br />

A segmental analysis of operating capital employed is as follows:<br />

Class of business £ million<br />

39<br />

<strong>2000</strong> 1999<br />

£ million<br />

Client Support Services 72 35<br />

Capital Projects 11 (74)<br />

Investments 141 96<br />

224 57<br />

Of the overall increase of £167 million, £137 million related<br />

to the acquisition of AGRA Inc. Of particular note, however, is<br />

Capital Projects, where the move towards cost reimbursable<br />

contracts is reducing the level of advance cash. In Investments<br />

there has been an increase in land and work in progress<br />

attributable to Property Development and an increase in the<br />

equity participation in Public Private Partnership companies.<br />

The Investments segment also includes the Grand Cayman<br />

hotel.<br />

Goodwill amortisation and exceptional items<br />

Goodwill amortisation of £6.7 million related to businesses<br />

acquired in the year. In addition, goodwill of £3.6 million,<br />

previously written off to reserves, principally in respect of an<br />

overseas business disposed of in the year, has been charged<br />

to the profit and loss account.<br />

*Before discontinued operations, goodwill amortisation and exceptional items.<br />

Exceptional charges of £6.8 million were in respect of the<br />

disposal of a number of non core businesses.<br />

Goodwill capitalised<br />

During the year, goodwill of £176 million was capitalised<br />

relating to a number of acquisitions, principally AGRA Inc.<br />

This can be analysed as follows:<br />

£ million £ million<br />

Total cost of acquisitions 244<br />

Book value of assets acquired (118)<br />

Fair value adjustments:<br />

Revaluations 13<br />

Alignment of accounting policies 19<br />

Provisions 18<br />

Net assets acquired (68)<br />

Goodwill capitalised 176<br />

Substantially all of this goodwill is expected to be amortised<br />

over a 20 year period, at an annual rate of approximately<br />

£9 million.<br />

Taxation<br />

Tax charge<br />

The tax charge of £29 million represents 29 per cent of the<br />

pre-tax profit*, an increase, as anticipated, from 26 per cent in<br />

1999. This increase is attributable to the higher tax charge on<br />

profits arising in North America. Going forward, the tax charge<br />

is expected to be marginally above the underlying UK tax rate.<br />

Deferred tax<br />

There has been no recognition of any potential liability for<br />

deferred tax of up to £10 million in relation to losses surrendered<br />

by some of the Public Private Partnership companies in which<br />

<strong>AMEC</strong> has an interest. Under current accounting standards,<br />

no provision has been made given (i) the long period over which<br />

this liability becomes payable, (ii) the uncertainty surrounding<br />

whether the liability will actually crystallise, (iii) deferred tax<br />

asset of £5 million arising in the UK from timing differences<br />

and (iv) the potential deferred tax assets referred to below.<br />

A deferred tax asset of £15 million has been recognised<br />

in North America. In addition, there are further significant<br />

unrecognised deferred tax assets in several overseas<br />

territories, principally the US and Germany, which arise<br />

from past trading losses and timing differences and which<br />

may be utilised over time against future profits.<br />

Cashflow and net debt<br />

Net debt at 31 December <strong>2000</strong> of £212 million is stated before<br />

deduction of the deferred consideration of £96 million arising<br />

from the disposal of Fairclough Homes in 1999, which is<br />

due to be received at the end of March 2001. If this deferred<br />

consideration was deducted, net debt would have been<br />

£116 million at 31 December <strong>2000</strong>.<br />

<strong>AMEC</strong> plc 27