Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3 Total operating profit/(loss) continued<br />

Total operating profit includes the following in respect of acquisitions: cost of sales of £399.8 million, gross profit of £96.0 million and<br />

administrative expenses (before goodwill amortisation) of £76.3 million. Share of turnover and operating profit in joint ventures in respect<br />

of acquisitions amounted to £19.8 million and £0.6 million respectively.<br />

In addition to the above amounts, due diligence fees paid to KPMG Audit Plc of £0.6 million were capitalised as part of the costs<br />

of acquisitions in the year ended 31 December <strong>2000</strong>.<br />

For the year ended 31 December 1999, total operating profit included the following in respect of discontinued operations: cost of sales<br />

of £35.5 million, gross profit of £2.8 million and administrative expenses of £3.0 million.<br />

The results of AGRA Inc. under Canadian GAAP and using AGRA’s accounting policies for the period from 1 August 1999 to 20 April <strong>2000</strong><br />

were as follows: revenue Cdn$1,092.5 million, expenses Cdn$1,083.2 million, restructuring charges Cdn$18.2 million, income tax<br />

creditCdn$4.1 million, minority interests charge Cdn$1.0 million and charge in respect of discontinued operations Cdn$1.0 million.<br />

The statement of total recognised gains and losses for the period includes the loss for the period of Cdn$6.8 million and a charge<br />

in respect of exchange movements of Cdn$6.5 million.<br />

Profit after tax and minority interests for the year ended 31 July 1999 as reported by AGRA inc. was Cdn$22.6 million.<br />

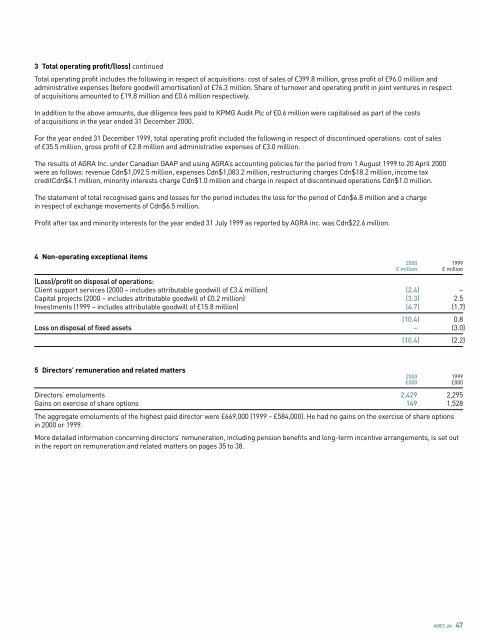

4 Non-operating exceptional items<br />

<strong>2000</strong> 1999<br />

£ million £ million<br />

(Loss)/profit on disposal of operations:<br />

Client support services (<strong>2000</strong> – includes attributable goodwill of £3.4 million) (2.4) –<br />

Capital projects (<strong>2000</strong> – includes attributable goodwill of £0.2 million) (3.3) 2.5<br />

Investments (1999 – includes attributable goodwill of £15.8 million) (4.7) (1.7)<br />

(10.4) 0.8<br />

Loss on disposal of fixed assets – (3.0)<br />

5 Directors’ remuneration and related matters<br />

(10.4) (2.2)<br />

<strong>2000</strong> 1999<br />

£000 £000<br />

Directors’ emoluments 2,429 2,295<br />

Gains on exercise of share options 149 1,528<br />

The aggregate emoluments of the highest paid director were £669,000 (1999 – £584,000). He had no gains on the exercise of share options<br />

in <strong>2000</strong> or 1999.<br />

More detailed information concerning directors’ remuneration, including pension benefits and long-term incentive arrangements, is set out<br />

in the report on remuneration and related matters on pages 35 to 38.<br />

<strong>AMEC</strong> plc 47