Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

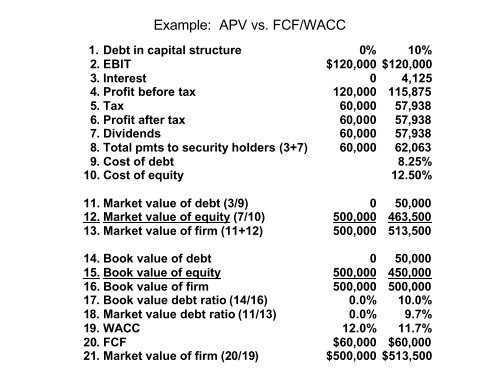

Example: <strong>APV</strong> vs. FCF/WACC<br />

1. Debt in capital structure 0% 10%<br />

2. EBIT $120,000 $120,000<br />

3. Interest 0 4,125<br />

4. Profit before tax 120,000 115,875<br />

5. Tax 60,000 57,938<br />

6. Profit after tax 60,000 57,938<br />

7. Dividends 60,000 57,938<br />

8. Total pmts to security holders (3+7) 60,000 62,063<br />

9. Cost of debt 8.25%<br />

10. Cost of equity<br />

12.50%<br />

11. Market value of debt (3/9) 0 50,000<br />

12. Market value of equity (7/10) 500,000 463,500<br />

13. Market value of firm (11+12) 500,000 513,500<br />

14. Book value of debt 0 50,000<br />

15. Book value of equity 500,000 450,000<br />

16. Book value of firm 500,000 500,000<br />

17. Book value debt ratio (14/16) 0.0% 10.0%<br />

18. Market value debt ratio (11/13) 0.0% 9.7%<br />

19. WACC 12.0% 11.7%<br />

20. FCF $60,000 $60,000<br />

21. Market value of firm (20/19) $500,000 $513,500