Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

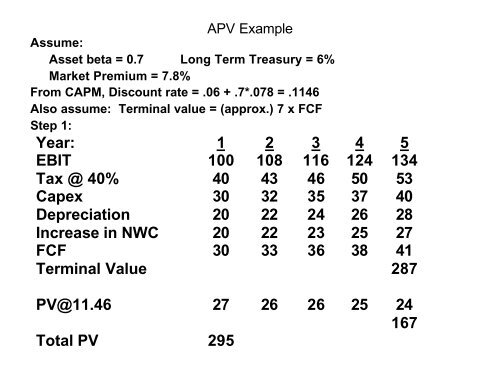

<strong>APV</strong> Example<br />

Assume:<br />

Asset beta = 0.7 Long Term Treasury = 6%<br />

Market Premium = 7.8%<br />

From CAPM, Discount rate = .06 + .7*.078 = .1146<br />

Also assume: Terminal value = (approx.) 7 x FCF<br />

Step 1:<br />

Year: 1 2 3 4 5<br />

EBIT 100 108 116 124 134<br />

Tax @ 40% 40 43 46 50 53<br />

Capex 30 32 35 37 40<br />

Depreciation 20 22 24 26 28<br />

Increase in NWC 20 22 23 25 27<br />

FCF 30 33 36 38 41<br />

Terminal <strong>Value</strong> 287<br />

PV@11.46 27 26 26 25 24<br />

167<br />

Total PV 295