Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

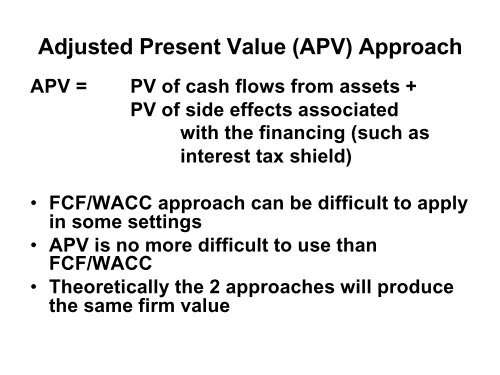

<strong>Adjusted</strong> <strong>Present</strong> <strong>Value</strong> (<strong>APV</strong>) <strong>Approach</strong><br />

<strong>APV</strong> = PV of cash flows from assets +<br />

PV of side effects associated<br />

with the financing (such as<br />

interest tax shield)<br />

• FCF/WACC approach can be difficult to apply<br />

in some settings<br />

• <strong>APV</strong> is no more difficult to use than<br />

FCF/WACC<br />

• Theoretically the 2 approaches will produce<br />

the same firm value

Example: <strong>APV</strong> vs. FCF/WACC<br />

1. Debt in capital structure 0% 10%<br />

2. EBIT $120,000 $120,000<br />

3. Interest 0 4,125<br />

4. Profit before tax 120,000 115,875<br />

5. Tax 60,000 57,938<br />

6. Profit after tax 60,000 57,938<br />

7. Dividends 60,000 57,938<br />

8. Total pmts to security holders (3+7) 60,000 62,063<br />

9. Cost of debt 8.25%<br />

10. Cost of equity<br />

12.50%<br />

11. Market value of debt (3/9) 0 50,000<br />

12. Market value of equity (7/10) 500,000 463,500<br />

13. Market value of firm (11+12) 500,000 513,500<br />

14. Book value of debt 0 50,000<br />

15. Book value of equity 500,000 450,000<br />

16. Book value of firm 500,000 500,000<br />

17. Book value debt ratio (14/16) 0.0% 10.0%<br />

18. Market value debt ratio (11/13) 0.0% 9.7%<br />

19. WACC 12.0% 11.7%<br />

20. FCF $60,000 $60,000<br />

21. Market value of firm (20/19) $500,000 $513,500

<strong>APV</strong> procedure<br />

1. Calculate value of the firm assuming it<br />

is all equity financed (i.e. no interest<br />

expense)<br />

Discount rate uses CAPM and asset<br />

(unlevered) beta<br />

2. Calculate the value of tax shields<br />

(based on the difference in tax<br />

payments vs. the unlevered case in<br />

step 1).

<strong>APV</strong> Example<br />

Assume:<br />

Asset beta = 0.7 Long Term Treasury = 6%<br />

Market Premium = 7.8%<br />

From CAPM, Discount rate = .06 + .7*.078 = .1146<br />

Also assume: Terminal value = (approx.) 7 x FCF<br />

Step 1:<br />

Year: 1 2 3 4 5<br />

EBIT 100 108 116 124 134<br />

Tax @ 40% 40 43 46 50 53<br />

Capex 30 32 35 37 40<br />

Depreciation 20 22 24 26 28<br />

Increase in NWC 20 22 23 25 27<br />

FCF 30 33 36 38 41<br />

Terminal <strong>Value</strong> 287<br />

PV@11.46 27 26 26 25 24<br />

167<br />

Total PV 295

<strong>APV</strong> example (continued)<br />

Step 2: Calculate value of tax shield.<br />

Assume $150 of debt at 8% (pretax) initially outstanding & is<br />

repaid from available cash flow<br />

Year: 1 2 3 4 5<br />

EBIT 100 108 116 124 134<br />

Interest (=outstanding debt*.08) 12 10 8 6 3<br />

Profit before tax 88 98 108 118 131<br />

Tax 35 39 43 47 52<br />

Profit after tax 53 59 65 71 79<br />

Capex 30 32 35 37 40<br />

Depreciation 20 22 24 26 28<br />

Increase in NWC 20 22 23 25 27<br />

Cash flow available to pay down debt 23 27 31 35 40<br />

Ending Debt =<br />

(beginning debt – pay down) 127 101 70 35 0

<strong>APV</strong> Example (step 2 continued)<br />

Compare tax payments with vs. without debt. The<br />

difference equals the tax savings available from<br />

the interest deduction (tax shield).<br />

Discount tax savings at pre-tax rate of return on<br />

debt*<br />

Tax payments with no debt 40 43 46 50 53<br />

Tax payments with debt @ 8% 35 39 43 47 52<br />

Tax savings 5 4 3 3 1<br />

PV of tax savings @ 8% $13<br />

* assumes risk of tax shields being realized = risk of debt

<strong>APV</strong> example: non-interest tax shields<br />

Suppose in addition there is a tax loss carryforward of<br />

$100 million. This means that the first $40 million of<br />

taxes need not be paid.<br />

Year Tax savings Taxable Income<br />

Used<br />

1 35 87.5<br />

2 5 100<br />

PV of tax savings @ 8% $37<br />

<strong>Present</strong> value these savings at 8%, produces a value of 37<br />

for the tax loss carryforward.<br />

Conclusion: Total firm value =<br />

value of all equity firm (295) +<br />

side effects of financing (13 + 37) = 345.

RJR Nabisco buyout

RJR Nabisco buyout