Energy Industry Trends Review

Energy Industry Trends Review

Energy Industry Trends Review

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

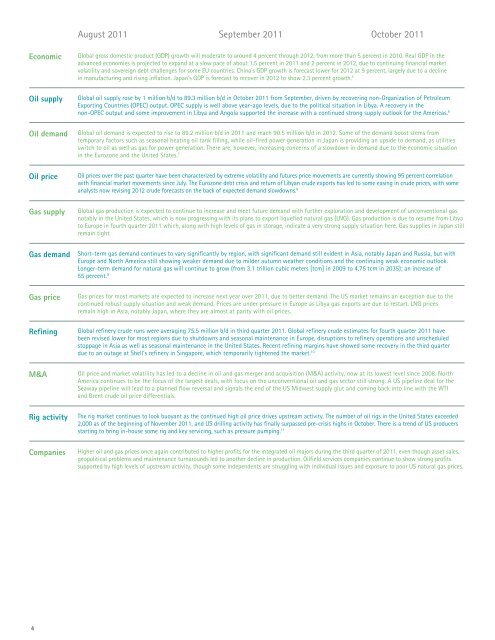

Economic<br />

Oil supply<br />

Oil price<br />

4<br />

August 2011 September 2011 October 2011<br />

Global gross domestic product (GDP) growth will moderate to around 4 percent through 2012, from more than 5 percent in 2010. Real GDP in the<br />

advanced economies is projected to expand at a slow pace of about 1.5 percent in 2011 and 2 percent in 2012, due to continuing financial market<br />

volatility and sovereign debt challenges for some EU countries. China’s GDP growth is forecast lower for 2012 at 9 percent, largely due to a decline<br />

in manufacturing and rising inflation. Japan’s GDP is forecast to recover in 2012 to show 2.3 percent growth. 5<br />

Global oil supply rose by 1 million b/d to 89.3 million b/d in October 2011 from September, driven by recovering non-Organization of Petroleum<br />

Exporting Countries (OPEC) output. OPEC supply is well above year-ago levels, due to the political situation in Libya. A recovery in the<br />

non-OPEC output and some improvement in Libya and Angola supported the increase with a continued strong supply outlook for the Americas. 6<br />

Oil demand Global oil demand is expected to rise to 89.2 million b/d in 2011 and reach 90.5 million b/d in 2012. Some of the demand boost stems from<br />

temporary factors such as seasonal heating oil tank filling, while oil-fired power generation in Japan is providing an upside to demand, as utilities<br />

switch to oil as well as gas for power generation. There are, however, increasing concerns of a slowdown in demand due to the economic situation<br />

in the Eurozone and the United States. 7<br />

Gas supply<br />

Oil prices over the past quarter have been characterized by extreme volatility and futures price movements are currently showing 95 percent correlation<br />

with financial market movements since July. The Eurozone debt crisis and return of Libyan crude exports has led to some easing in crude prices, with some<br />

analysts now revising 2012 crude forecasts on the back of expected demand slowdowns. 8<br />

Global gas production is expected to continue to increase and meet future demand with further exploration and development of unconventional gas<br />

notably in the United States, which is now progressing with its plans to export liquefied natural gas (LNG). Gas production is due to resume from Libya<br />

to Europe in fourth quarter 2011 which, along with high levels of gas in storage, indicate a very strong supply situation here. Gas supplies in Japan still<br />

remain tight.<br />

Gas demand Short-term gas demand continues to vary significantly by region, with significant demand still evident in Asia, notably Japan and Russia, but with<br />

Europe and North America still showing weaker demand due to milder autumn weather conditions and the continuing weak economic outlook.<br />

Longer-term demand for natural gas will continue to grow (from 3.1 trillion cubic meters [tcm] in 2009 to 4.75 tcm in 2035); an increase of<br />

55 percent. 9<br />

Gas price<br />

Refining<br />

M&A<br />

Gas prices for most markets are expected to increase next year over 2011, due to better demand. The US market remains an exception due to the<br />

continued robust supply situation and weak demand. Prices are under pressure in Europe as Libya gas exports are due to restart. LNG prices<br />

remain high in Asia, notably Japan, where they are almost at parity with oil prices.<br />

Global refinery crude runs were averaging 75.5 million b/d in third quarter 2011. Global refinery crude estimates for fourth quarter 2011 have<br />

been revised lower for most regions due to shutdowns and seasonal maintenance in Europe, disruptions to refinery operations and unscheduled<br />

stoppage in Asia as well as seasonal maintenance in the United States. Recent refining margins have showed some recovery in the third quarter<br />

due to an outage at Shell’s refinery in Singapore, which temporarily tightened the market. 10<br />

Oil price and market volatility has led to a decline in oil and gas merger and acquisition (M&A) activity, now at its lowest level since 2008. North<br />

America continues to be the focus of the largest deals, with focus on the unconventional oil and gas sector still strong. A US pipeline deal for the<br />

Seaway pipeline will lead to a planned flow reversal and signals the end of the US Midwest supply glut and coming back into line with the WTI<br />

and Brent crude oil price differentials.<br />

Rig activity The rig market continues to look buoyant as the continued high oil price drives upstream activity. The number of oil rigs in the United States exceeded<br />

2,000 as of the beginning of November 2011, and US drilling activity has finally surpassed pre-crisis highs in October. There is a trend of US producers<br />

starting to bring in-house some rig and key servicing, such as pressure pumping. 11<br />

Companies Higher oil and gas prices once again contributed to higher profits for the integrated oil majors during the third quarter of 2011, even though asset sales,<br />

geopolitical problems and maintenance turnarounds led to another decline in production. Oilfield services companies continue to show strong profits<br />

supported by high levels of upstream activity, though some independents are struggling with individual issues and exposure to poor US natural gas prices.