Filing at a Glance General Information - Delaware Insurance ...

Filing at a Glance General Information - Delaware Insurance ...

Filing at a Glance General Information - Delaware Insurance ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

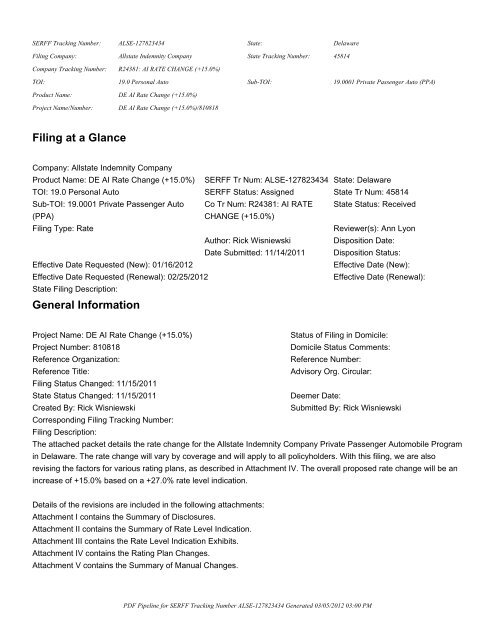

SERFF Tracking Number: ALSE-127823434 St<strong>at</strong>e: <strong>Delaware</strong><br />

<strong>Filing</strong> Company: Allst<strong>at</strong>e Indemnity Company St<strong>at</strong>e Tracking Number: 45814<br />

Company Tracking Number: R24381: AI RATE CHANGE (+15.0%)<br />

TOI: 19.0 Personal Auto Sub-TOI: 19.0001 Priv<strong>at</strong>e Passenger Auto (PPA)<br />

Product Name: DE AI R<strong>at</strong>e Change (+15.0%)<br />

Project Name/Number: DE AI R<strong>at</strong>e Change (+15.0%)/810818<br />

<strong>Filing</strong> <strong>at</strong> a <strong>Glance</strong><br />

Company: Allst<strong>at</strong>e Indemnity Company<br />

Product Name: DE AI R<strong>at</strong>e Change (+15.0%) SERFF Tr Num: ALSE-127823434 St<strong>at</strong>e: <strong>Delaware</strong><br />

TOI: 19.0 Personal Auto SERFF St<strong>at</strong>us: Assigned St<strong>at</strong>e Tr Num: 45814<br />

Sub-TOI: 19.0001 Priv<strong>at</strong>e Passenger Auto<br />

(PPA)<br />

Co Tr Num: R24381: AI RATE<br />

CHANGE (+15.0%)<br />

PDF Pipeline for SERFF Tracking Number ALSE-127823434 Gener<strong>at</strong>ed 03/05/2012 03:00 PM<br />

St<strong>at</strong>e St<strong>at</strong>us: Received<br />

<strong>Filing</strong> Type: R<strong>at</strong>e Reviewer(s): Ann Lyon<br />

Author: Rick Wisniewski Disposition D<strong>at</strong>e:<br />

D<strong>at</strong>e Submitted: 11/14/2011 Disposition St<strong>at</strong>us:<br />

Effective D<strong>at</strong>e Requested (New): 01/16/2012 Effective D<strong>at</strong>e (New):<br />

Effective D<strong>at</strong>e Requested (Renewal): 02/25/2012 Effective D<strong>at</strong>e (Renewal):<br />

St<strong>at</strong>e <strong>Filing</strong> Description:<br />

<strong>General</strong> Inform<strong>at</strong>ion<br />

Project Name: DE AI R<strong>at</strong>e Change (+15.0%) St<strong>at</strong>us of <strong>Filing</strong> in Domicile:<br />

Project Number: 810818 Domicile St<strong>at</strong>us Comments:<br />

Reference Organiz<strong>at</strong>ion: Reference Number:<br />

Reference Title: Advisory Org. Circular:<br />

<strong>Filing</strong> St<strong>at</strong>us Changed: 11/15/2011<br />

St<strong>at</strong>e St<strong>at</strong>us Changed: 11/15/2011 Deemer D<strong>at</strong>e:<br />

Cre<strong>at</strong>ed By: Rick Wisniewski Submitted By: Rick Wisniewski<br />

Corresponding <strong>Filing</strong> Tracking Number:<br />

<strong>Filing</strong> Description:<br />

The <strong>at</strong>tached packet details the r<strong>at</strong>e change for the Allst<strong>at</strong>e Indemnity Company Priv<strong>at</strong>e Passenger Automobile Program<br />

in <strong>Delaware</strong>. The r<strong>at</strong>e change will vary by coverage and will apply to all policyholders. With this filing, we are also<br />

revising the factors for various r<strong>at</strong>ing plans, as described in Attachment IV. The overall proposed r<strong>at</strong>e change will be an<br />

increase of +15.0% based on a +27.0% r<strong>at</strong>e level indic<strong>at</strong>ion.<br />

Details of the revisions are included in the following <strong>at</strong>tachments:<br />

Attachment I contains the Summary of Disclosures.<br />

Attachment II contains the Summary of R<strong>at</strong>e Level Indic<strong>at</strong>ion.<br />

Attachment III contains the R<strong>at</strong>e Level Indic<strong>at</strong>ion Exhibits.<br />

Attachment IV contains the R<strong>at</strong>ing Plan Changes.<br />

Attachment V contains the Summary of Manual Changes.

SERFF Tracking Number: ALSE-127823434 St<strong>at</strong>e: <strong>Delaware</strong><br />

<strong>Filing</strong> Company: Allst<strong>at</strong>e Indemnity Company St<strong>at</strong>e Tracking Number: 45814<br />

Company Tracking Number: R24381: AI RATE CHANGE (+15.0%)<br />

TOI: 19.0 Personal Auto Sub-TOI: 19.0001 Priv<strong>at</strong>e Passenger Auto (PPA)<br />

Product Name: DE AI R<strong>at</strong>e Change (+15.0%)<br />

Project Name/Number: DE AI R<strong>at</strong>e Change (+15.0%)/810818<br />

Company and Contact<br />

<strong>Filing</strong> Contact Inform<strong>at</strong>ion<br />

Rick Wisniewski, Associ<strong>at</strong>e St<strong>at</strong>e <strong>Filing</strong>s<br />

Director<br />

rwisn@allst<strong>at</strong>e.com<br />

2775 Sanders Road 847-402-0723 [Phone] 20723 [Ext]<br />

Suite A2-W 847-402-9757 [FAX]<br />

Northbrook, IL 60062<br />

<strong>Filing</strong> Company Inform<strong>at</strong>ion<br />

Allst<strong>at</strong>e Indemnity Company CoCode: 19240 St<strong>at</strong>e of Domicile: Illinois<br />

2775 Sanders Rd. Group Code: 8 Company Type: Property and<br />

Casualty<br />

Suite A2-W Group Name: Allst<strong>at</strong>e St<strong>at</strong>e ID Number:<br />

Northbrook, IL 60062 FEIN Number: 36-6115679<br />

(847) 402-5000 ext. [Phone]<br />

---------<br />

<strong>Filing</strong> Fees<br />

Fee Required? Yes<br />

Fee Amount: $50.00<br />

Retali<strong>at</strong>ory? No<br />

Fee Explan<strong>at</strong>ion:<br />

Per Company: Yes<br />

COMPANY AMOUNT DATE PROCESSED TRANSACTION #<br />

Allst<strong>at</strong>e Indemnity Company $50.00 11/14/2011 53726505<br />

PDF Pipeline for SERFF Tracking Number ALSE-127823434 Gener<strong>at</strong>ed 03/05/2012 03:00 PM

SERFF Tracking Number: ALSE-127823434 St<strong>at</strong>e: <strong>Delaware</strong><br />

<strong>Filing</strong> Company: Allst<strong>at</strong>e Indemnity Company St<strong>at</strong>e Tracking Number: 45814<br />

Company Tracking Number: R24381: AI RATE CHANGE (+15.0%)<br />

TOI: 19.0 Personal Auto Sub-TOI: 19.0001 Priv<strong>at</strong>e Passenger Auto (PPA)<br />

Product Name: DE AI R<strong>at</strong>e Change (+15.0%)<br />

Project Name/Number: DE AI R<strong>at</strong>e Change (+15.0%)/810818<br />

R<strong>at</strong>e Inform<strong>at</strong>ion<br />

R<strong>at</strong>e d<strong>at</strong>a applies to filing.<br />

<strong>Filing</strong> Method: File & use<br />

R<strong>at</strong>e Change Type: Increase<br />

Overall Percentage of Last R<strong>at</strong>e Revision: -13.100%<br />

Effective D<strong>at</strong>e of Last R<strong>at</strong>e Revision: 07/21/2008<br />

<strong>Filing</strong> Method of Last <strong>Filing</strong>: File & use<br />

Company R<strong>at</strong>e Inform<strong>at</strong>ion<br />

Company Name: Overall %<br />

Allst<strong>at</strong>e Indemnity<br />

Company<br />

Indic<strong>at</strong>ed<br />

Change:<br />

Overall % R<strong>at</strong>e<br />

Impact:<br />

Written<br />

Premium<br />

Change for<br />

this Program:<br />

# of Policy<br />

Holders<br />

Affected for this<br />

Program:<br />

Written<br />

Premium for<br />

this Program:<br />

PDF Pipeline for SERFF Tracking Number ALSE-127823434 Gener<strong>at</strong>ed 03/05/2012 03:00 PM<br />

Maximum %<br />

Change (where<br />

required):<br />

Minimum %<br />

Change (where<br />

required):<br />

27.000% 15.000% $339,581 1,238 $2,263,871 108.500% -40.700%

SERFF Tracking Number: ALSE-127823434 St<strong>at</strong>e: <strong>Delaware</strong><br />

<strong>Filing</strong> Company: Allst<strong>at</strong>e Indemnity Company St<strong>at</strong>e Tracking Number: 45814<br />

Company Tracking Number: R24381: AI RATE CHANGE (+15.0%)<br />

TOI: 19.0 Personal Auto Sub-TOI: 19.0001 Priv<strong>at</strong>e Passenger Auto (PPA)<br />

Product Name: DE AI R<strong>at</strong>e Change (+15.0%)<br />

Project Name/Number: DE AI R<strong>at</strong>e Change (+15.0%)/810818<br />

R<strong>at</strong>e/Rule Schedule<br />

Schedule Item<br />

St<strong>at</strong>us:<br />

Exhibit Name: Rule # or Page<br />

#:<br />

R<strong>at</strong>e Action Previous St<strong>at</strong>e <strong>Filing</strong> Attachments<br />

Number:<br />

Manual Pages Replacement Manual - R24381.pdf<br />

PDF Pipeline for SERFF Tracking Number ALSE-127823434 Gener<strong>at</strong>ed 03/05/2012 03:00 PM

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

PREMIUM CALCULATION<br />

ROUND AFTER EACH CALCULATION TO THE NEAREST PENNY<br />

STEP<br />

# AA BB VA DD HH<br />

1 TERRITORIAL BASE RATE (RP-2A)<br />

2 RATE ADJUSTMENT FACTOR (PENNY ROUND) x 1.731 x 1.854 x 1.936 x 1.259 x 1.249<br />

3 INCREASED LIMIT FACTOR/ADDEND (RP-3A) x x x<br />

4 PIP DEDUCTIBLE FACTOR (RP-3A) x x x<br />

5 DRIVER CLASSIFICATION FACTOR (RP- 4A, 5A, 6A, 7A and 8A) x x x x x<br />

6 HOUSEHOLD COMPOSITION FACTOR (RP-9A) x x x x x<br />

7 MODEL YEAR FACTOR (RP-10A) x x<br />

8 DEDUCTIBLE BY PGS FACTOR (RP-10A) x x<br />

9 EXPERIENCE GROUP RATING FACTOR (EGR PAGES) x x x x x<br />

10 VEHICLE SURCHARGE FACTOR (RP-11A) x x<br />

11 RESIDENT STUDENT DISCOUNT FACTOR (RP-15A) x x x<br />

12 GOOD STUDENT DISCOUNT FACTOR (RP-15A) x x x x x<br />

13 PASSIVE RESTRAINT DISCOUNT FACTOR (RP-15A) x<br />

14 SENIOR ADULT DISCOUNT FACTOR (RP-15A) x x x x<br />

15 ACCIDENT FACTOR (RP-12A) x x x x<br />

16 MINOR VIOLATION FACTOR (RP-13A) x x x x<br />

17 MAJOR VIOLATION FACTOR (RP-14A) x x x x<br />

18 NONVERIFIABLE DRIVING RECORD SURCHARGE (RP-15A) x x x x<br />

19 INEXPERIENCED OPERATOR SURCHARGE FACTOR (RP-15A) x x x<br />

20 CAMPER UNIT ADDITIONAL PREMIUM (RP-22A) + +<br />

21 DEFENSIVE DRIVER DISCOUNT FACTOR (RP-15A) x x x x<br />

22 TIER FACTOR (RP-16A-21A) x x x x x<br />

23 PERFORMANCE DISCOUNT FACTOR (RP-15A) x x x x x<br />

24 HOMEOWNERSHIP DISCOUNT FACTOR (RP-15A) x x x x x<br />

25 MULTIPLE POLICY DISCOUNT FACTOR (RP-16A) x x x x x<br />

26 CERTIFIED RISK SURCHARGE FACTOR (RP-15A) x x<br />

27 ANTILOCK BRAKE DISCOUNT FACTOR (RP-15A) x x x<br />

28 THE GOOD HANDS PEOPLE® DISCOUNT FACTOR (RP-15A) x x x x x<br />

29 THE GOOD PAYER DISCOUNT FACTOR (RP-15A) x x x x x<br />

30 ALLSTATE® EASY PAY PLAN DISCOUNT FACTOR (RP-15A) x x x x x<br />

31 FUTURE EFFECTIVE DATE DISCOUNT FACTOR (RP-15A) x x x x x<br />

32 TOTAL COVERAGE PREMIUM<br />

33 MINIMUM PREMIUM AMOUNT $10 $5 $5 $15 $5<br />

34 LARGER OF 32 OR 33<br />

UM/UIM COVERAGE (SS) NOTES<br />

35 UM/UIM PREMIUM (RP-2A)<br />

36 RATE ADJUSTMENT FACTOR x 1.000 Territory #:<br />

37 INCREASED LIMIT FACTOR (RP-3A) x<br />

38 TOTAL UM/UIM COVERAGE PREMIUM Tier:<br />

RENTAL REIMBURSEMENT (UU) Classific<strong>at</strong>ion:<br />

39 BASE RATE (RP-22A)<br />

40 INCREASED LIMIT FACTOR (RP-22A) x Limits of Liability:<br />

41 TOTAL COVERAGE PREMIUM<br />

Model Year:<br />

42 ROADSIDE HELP RATE (JJ) (RP-22A)<br />

43 SOUND SYSTEMS RATE (ZA) (RP-22A) + PGS:<br />

44 TAPE RATE (ZZ) (RP-22A) +<br />

45<br />

LEASE OR LOAN GAP COVERAGE (LG) (RP-3B, LINE 28) OR<br />

REPAIR OR REPLACEMENT COST COVERAGE (RC) (RP-4B, LINE 28) + DD/HH Deductibles:<br />

46 TOTAL MISCELLANEOUS COVERAGES (LINES 42 TO 45) =<br />

Multi Car Y / N<br />

47 LINES 34 (AA+BB+CC+DD+HH) + 38 + 41 + 46<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-1A

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

INCREASED LIMITS FACTORS / RATES AND LOYALTY BONUS<br />

BODILY INJURY<br />

INCREASED LIMITS<br />

LIMIT FACTOR LIMIT FACTOR<br />

$ 10/20 (BASE) 1.00 $ 15/30 1.00<br />

15/30 (FR) 1.25 15/40 1.91<br />

15/40 1.31 25/50 2.40<br />

25/50 1.63 30/85 3.39<br />

30/85 1.80 25/100 3.48<br />

25/100 1.85 50/100 4.02<br />

50/100 2.05 100/300 6.47<br />

100/100 2.20 300/300 9.86<br />

100/300 2.60 250/500 10.85<br />

200/300 2.78 300/500 11.05<br />

300/300 2.85 500/500 11.82<br />

250/500 3.07 500/1000 12.67<br />

300/500 3.08 1000/1000 14.68<br />

500/500 3.20<br />

500/1000 3.30<br />

1000/1000 3.52<br />

2000/2000 3.91<br />

RULE 17<br />

UNINSURED / UNDERINSURED MOTORISTS<br />

INCREASED LIMITS<br />

PROPERTY DAMAGE PERSONAL INJURY PROTECTION<br />

INCREASED LIMITS<br />

DEDUCTIBLE FACTORS<br />

LIMIT FACTOR<br />

$10,000 (FR) 0.910 INCREASED LIMITS Named Named Insured &<br />

25,000 1.000 Insured Only Members Of Household<br />

50,000 1.065 LIMIT FACTOR DEDUCTIBLE Factor Factor<br />

100,000 1.130 VA04 1.00 $0 1.00 1.00<br />

200,000 1.195 VA02 1.10 $250 0.90 0.85<br />

300,000 1.236 VA03 1.20 $500 0.85 0.80<br />

400,000 1.277 VA05 1.50 $1,000 0.80 0.75<br />

500,000 1.319 $10,000 0.75 0.55<br />

750,000 1.360<br />

1,000,000 1.401<br />

2,000,000 1.545<br />

RULE 3<br />

POLICY FEES<br />

RATING POLICY<br />

GROUP FEE<br />

1 $30<br />

2 $30<br />

3 $30<br />

4 $30<br />

5 $30<br />

6 $30<br />

7 $30<br />

8 $30<br />

RULE 53<br />

LOYALTY BONUS<br />

Percent<br />

Bonus 10%<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-3A

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

DRIVER CLASSIFICATION FACTORS<br />

RULE 11<br />

Classific<strong>at</strong>ion Mileage Use Class Code AA BB VA DD HH<br />

14-16 Male Single Basic All All MB1 2.00 2.18 0.95 1.77 1.32<br />

17 Male Single Basic MB2 1.79 1.80 0.95 1.77 1.32<br />

18 Male Single Basic MB3 1.79 1.58 0.95 1.77 1.32<br />

19 Male Single Basic MB4 1.39 1.34 0.95 1.77 1.32<br />

20 Male Single Basic MB5 1.16 1.20 0.95 1.53 1.32<br />

21 Male Single Basic MB6 1.16 1.10 0.95 1.53 1.32<br />

22 Male Single Basic MB7 1.09 1.10 0.95 1.29 1.04<br />

23 Male Single Basic MB8 1.09 1.10 0.95 1.29 1.04<br />

24 Male Single Basic MB9 1.09 1.10 0.95 1.29 1.04<br />

14-16 Male Single Restricted All All MR1 1.90 2.07 0.95 1.68 1.13<br />

17 Male Single Restricted MR2 1.70 1.71 0.95 1.68 1.13<br />

18 Male Single Restricted MR3 1.70 1.50 0.95 1.68 1.13<br />

19 Male Single Restricted MR4 1.32 1.27 0.95 1.68 1.13<br />

20 Male Single Restricted MR5 1.10 1.14 0.95 1.46 1.13<br />

21 Male Single Restricted MR6 1.10 1.04 0.95 1.46 1.13<br />

22 Male Single Restricted MR7 1.04 1.04 0.95 1.24 0.89<br />

23 Male Single Restricted MR8 1.04 1.04 0.95 1.24 0.89<br />

24 Male Single Restricted MR9 1.04 1.04 0.95 1.24 0.89<br />

25-29 Male Single Short Pleasure MS1SP 1.00 1.04 1.00 1.24 1.21<br />

Work 0-3 MS1SW 0-3 1.00 1.04 1.00 1.24 1.21<br />

Work 3.1-9.9 MS1SW 3.1-9.9 1.00 1.04 1.00 1.24 1.21<br />

Work 10-20 MS1SW 10-20 1.00 1.04 1.00 1.24 1.21<br />

Work 20+ MS1SW 20+ 1.00 1.04 1.00 1.24 1.21<br />

Business MS1SB 1.34 1.21 1.00 1.24 1.21<br />

Long Pleasure MS1LP 1.00 1.04 1.00 1.24 1.21<br />

Work 0-3 MS1LW 0-3 1.00 1.04 1.00 1.24 1.21<br />

Work 3.1-9.9 MS1LW 3.1-9.9 1.00 1.04 1.00 1.24 1.21<br />

Work 10-20 MS1LW 10-20 1.00 1.04 1.00 1.24 1.21<br />

Work 20+ MS1LW 20+ 1.00 1.04 1.00 1.24 1.21<br />

Business MS1LB 1.34 1.21 1.00 1.24 1.21<br />

30-49 Male Single Short Pleasure MS2SP 1.00 1.00 1.00 1.03 1.08<br />

Work 0-3 MS2SW 0-3 1.00 1.00 1.00 1.03 1.08<br />

Work 3.1-9.9 MS2SW 3.1-9.9 1.00 1.00 1.00 1.03 1.08<br />

Work 10-20 MS2SW 10-20 1.00 1.00 1.00 1.03 1.08<br />

Work 20+ MS2SW 20+ 1.00 1.00 1.00 1.03 1.08<br />

Business MS2SB 1.34 1.16 1.00 1.03 1.08<br />

Long Pleasure MS2LP 1.00 1.00 1.00 1.03 1.08<br />

Work 0-3 MS2LW 0-3 1.00 1.00 1.00 1.03 1.08<br />

Work 3.1-9.9 MS2LW 3.1-9.9 1.00 1.00 1.00 1.03 1.08<br />

Work 10-20 MS2LW 10-20 1.00 1.00 1.00 1.03 1.08<br />

Work 20+ MS2LW 20+ 1.00 1.00 1.00 1.03 1.08<br />

Business MS2LB 1.34 1.16 1.00 1.03 1.08<br />

14-16 Male Married All All MM1 1.83 2.07 0.89 1.68 1.16<br />

17 Male Married MM2 1.64 1.71 0.89 1.68 1.16<br />

18 Male Married MM3 1.64 1.50 0.89 1.68 1.16<br />

19 Male Married MM4 1.27 1.27 0.89 1.68 1.16<br />

20 Male Married MM5 1.06 1.14 0.89 1.46 1.16<br />

21 Male Married MM6 1.06 1.02 0.89 1.46 1.16<br />

22 Male Married MM7 1.00 1.02 0.89 1.05 1.12<br />

23 Male Married MM8 1.00 1.02 0.89 1.05 1.12<br />

24 Male Married MM9 1.00 1.02 0.89 1.05 1.12<br />

25-29 Male Married Short Pleasure MM10SP 1.00 0.93 1.00 0.99 1.12<br />

Work 0-3 MM10SW 0-3 1.00 0.93 1.00 0.99 1.12<br />

Work 3.1-9.9 MM10SW 3.1-9.9 1.00 0.93 1.00 0.99 1.12<br />

Work 10-20 MM10SW 10-20 1.00 0.93 1.00 0.99 1.12<br />

Work 20+ MM10SW 20+ 1.00 0.93 1.00 0.99 1.12<br />

Business MM10SB 1.34 1.07 1.00 0.99 1.12<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-4A

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

DRIVER CLASSIFICATION FACTORS<br />

RULE 11<br />

Classific<strong>at</strong>ion Mileage Use Class Code AA BB VA DD HH<br />

Long Pleasure MM10LP 1.00 0.93 1.00 0.99 1.12<br />

Work 0-3 MM10LW 0-3 1.00 0.93 1.00 0.99 1.12<br />

Work 3.1-9.9 MM10LW 3.1-9.9 1.00 0.93 1.00 0.99 1.12<br />

Work 10-20 MM10LW 10-20 1.00 0.93 1.00 0.99 1.12<br />

Work 20+ MM10LW 20+ 1.00 0.93 1.00 0.99 1.12<br />

Business MM10LB 1.34 1.07 1.00 0.99 1.12<br />

30-49 Male Married Short Pleasure MM11SP 1.00 0.93 1.00 0.91 0.90<br />

Work 0-3 MM11SW 0-3 1.00 0.93 1.00 0.91 0.90<br />

Work 3.1-9.9 MM11SW 3.1-9.9 1.00 0.93 1.00 0.91 0.90<br />

Work 10-20 MM11SW 10-20 1.00 0.93 1.00 0.91 0.90<br />

Work 20+ MM11SW 20+ 1.00 0.93 1.00 0.91 0.90<br />

Business MM11SB 1.34 1.08 1.00 0.91 0.90<br />

Long Pleasure MM11LP 1.00 0.93 1.00 0.91 0.90<br />

Work 0-3 MM11LW 0-3 1.00 0.93 1.00 0.91 0.90<br />

Work 3.1-9.9 MM11LW 3.1-9.9 1.00 0.93 1.00 0.91 0.90<br />

Work 10-20 MM11LW 10-20 1.00 0.93 1.00 0.91 0.90<br />

Work 20+ MM11LW 20+ 1.00 0.93 1.00 0.91 0.90<br />

Business MM11LB 1.34 1.08 1.00 0.91 0.90<br />

14-16 Female Single Basic All All FB1 1.84 1.84 1.23 1.43 1.02<br />

17 Female Single Basic FB2 1.43 1.49 1.23 1.43 1.02<br />

18 Female Single Basic FB3 1.43 1.40 1.23 1.43 1.02<br />

19 Female Single Basic FB4 1.39 1.24 1.23 1.43 1.02<br />

20 Female Single Basic FB5 1.16 1.10 1.23 1.22 1.02<br />

21 Female Single Basic FB6 1.16 1.10 1.23 1.22 1.02<br />

22 Female Single Basic FB7 1.09 1.10 1.23 1.19 0.91<br />

23 Female Single Basic FB8 1.09 1.10 1.23 1.19 0.91<br />

24 Female Single Basic FB9 1.09 1.10 1.23 1.19 0.91<br />

14-16 Female Single Restricted All All FR1 1.75 1.75 1.23 1.36 0.87<br />

17 Female Single Restricted FR2 1.36 1.41 1.23 1.36 0.87<br />

18 Female Single Restricted FR3 1.36 1.33 1.23 1.36 0.87<br />

19 Female Single Restricted FR4 1.32 1.17 1.23 1.36 0.87<br />

20 Female Single Restricted FR5 1.10 1.04 1.23 1.16 0.87<br />

21 Female Single Restricted FR6 1.10 1.04 1.23 1.16 0.87<br />

22 Female Single Restricted FR7 1.04 1.04 1.23 1.14 0.78<br />

23 Female Single Restricted FR8 1.04 1.04 1.23 1.14 0.78<br />

24 Female Single Restricted FR9 1.04 1.04 1.23 1.14 0.78<br />

25-29 Female Single Short Pleasure FS1SP 1.00 1.04 1.07 1.14 1.06<br />

Work 0-3 FS1SW 0-3 1.00 1.04 1.07 1.14 1.06<br />

Work 3.1-9.9 FS1SW 3.1-9.9 1.00 1.04 1.07 1.14 1.06<br />

Work 10-20 FS1SW 10-20 1.00 1.04 1.07 1.14 1.06<br />

Work 20+ FS1SW 20+ 1.00 1.04 1.07 1.14 1.06<br />

Business FS1SB 1.34 1.21 1.07 1.14 1.06<br />

Long Pleasure FS1LP 1.00 1.04 1.07 1.14 1.06<br />

Work 0-3 FS1LW 0-3 1.00 1.04 1.07 1.14 1.06<br />

Work 3.1-9.9 FS1LW 3.1-9.9 1.00 1.04 1.07 1.14 1.06<br />

Work 10-20 FS1LW 10-20 1.00 1.04 1.07 1.14 1.06<br />

Work 20+ FS1LW 20+ 1.00 1.04 1.07 1.14 1.06<br />

Business FS1LB 1.34 1.21 1.07 1.14 1.06<br />

30-49 Female Single Short Pleasure FS2SP 1.00 1.00 1.07 1.00 1.00<br />

Work 0-3 FS2SW 0-3 1.00 1.00 1.07 1.00 1.00<br />

Work 3.1-9.9 FS2SW 3.1-9.9 1.00 1.00 1.07 1.00 1.00<br />

Work 10-20 FS2SW 10-20 1.00 1.00 1.07 1.00 1.00<br />

Work 20+ FS2SW 20+ 1.00 1.00 1.07 1.00 1.00<br />

Business FS2SB 1.34 1.16 1.07 1.00 1.00<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-5A

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

DRIVER CLASSIFICATION FACTORS<br />

RULE 11<br />

Classific<strong>at</strong>ion Mileage Use Class Code AA BB VA DD HH<br />

Long Pleasure FS2LP 1.00 1.00 1.07 1.00 1.00<br />

Work 0-3 FS2LW 0-3 1.00 1.00 1.07 1.00 1.00<br />

Work 3.1-9.9 FS2LW 3.1-9.9 1.00 1.00 1.07 1.00 1.00<br />

Work 10-20 FS2LW 10-20 1.00 1.00 1.07 1.00 1.00<br />

Work 20+ FS2LW 20+ 1.00 1.00 1.07 1.00 1.00<br />

Business FS2LB 1.34 1.16 1.07 1.00 1.00<br />

14-16 Female Married All All FM1 1.68 1.75 1.15 1.36 1.10<br />

17 Female Married FM2 1.31 1.41 1.15 1.36 1.10<br />

18 Female Married FM3 1.31 1.33 1.15 1.36 1.10<br />

19 Female Married FM4 1.27 1.17 1.15 1.36 1.10<br />

20 Female Married FM5 1.06 1.01 1.15 1.08 1.10<br />

21 Female Married FM6 1.06 1.01 1.15 1.08 1.10<br />

22 Female Married FM7 0.89 1.01 1.15 1.05 0.99<br />

23 Female Married FM8 0.89 1.01 1.15 1.05 0.99<br />

24 Female Married FM9 0.89 1.01 1.15 1.05 0.99<br />

25-29 Female Married Short Pleasure FM10SP 0.89 1.01 1.07 0.99 0.99<br />

Work 0-3 FM10SW 0-3 0.89 1.01 1.07 0.99 0.99<br />

Work 3.1-9.9 FM10SW 3.1-9.9 0.89 1.01 1.07 0.99 0.99<br />

Work 10-20 FM10SW 10-20 0.89 1.01 1.07 0.99 0.99<br />

Work 20+ FM10SW 20+ 0.89 1.01 1.07 0.99 0.99<br />

Business FM10SB 1.19 1.17 1.07 0.99 0.99<br />

Long Pleasure FM10LP 0.89 1.01 1.07 0.99 0.99<br />

Work 0-3 FM10LW 0-3 0.89 1.01 1.07 0.99 0.99<br />

Work 3.1-9.9 FM10LW 3.1-9.9 0.89 1.01 1.07 0.99 0.99<br />

Work 10-20 FM10LW 10-20 0.89 1.01 1.07 0.99 0.99<br />

Work 20+ FM10LW 20+ 0.89 1.01 1.07 0.99 0.99<br />

Business FM10LB 1.19 1.17 1.07 0.99 0.99<br />

30-49 Female Married Short Pleasure FM11SP 1.00 0.98 1.07 0.96 0.90<br />

Work 0-3 FM11SW 0-3 1.00 0.98 1.07 0.96 0.90<br />

Work 3.1-9.9 FM11SW 3.1-9.9 1.00 0.98 1.07 0.96 0.90<br />

Work 10-20 FM11SW 10-20 1.00 0.98 1.07 0.96 0.90<br />

Work 20+ FM11SW 20+ 1.00 0.98 1.07 0.96 0.90<br />

Business FM11SB 1.34 1.14 1.07 0.96 0.90<br />

Long Pleasure FM11LP 1.00 0.98 1.07 0.96 0.90<br />

Work 0-3 FM11LW 0-3 1.00 0.98 1.07 0.96 0.90<br />

Work 3.1-9.9 FM11LW 3.1-9.9 1.00 0.98 1.07 0.96 0.90<br />

Work 10-20 FM11LW 10-20 1.00 0.98 1.07 0.96 0.90<br />

Work 20+ FM11LW 20+ 1.00 0.98 1.07 0.96 0.90<br />

Business FM11LB 1.34 1.14 1.07 0.96 0.90<br />

50-54 Single Short Pleasure SMA1SP 1.03 0.95 0.86 0.95 0.87<br />

Work 0-3 SMA1SW 0-3 1.03 0.95 0.86 0.95 0.87<br />

Work 3.1-9.9 SMA1SW 3.1-9.9 1.03 0.95 0.86 0.95 0.87<br />

Work 10-20 SMA1SW 10-20 1.03 0.95 0.86 0.95 0.87<br />

Work 20+ SMA1SW 20+ 1.03 0.95 0.86 0.95 0.87<br />

Business SMA1SB 1.38 1.10 0.86 0.95 0.87<br />

Long Pleasure SMA1LP 1.03 0.95 0.86 0.95 0.87<br />

Work 0-3 SMA1LW 0-3 1.03 0.95 0.86 0.95 0.87<br />

Work 3.1-9.9 SMA1LW 3.1-9.9 1.03 0.95 0.86 0.95 0.87<br />

Work 10-20 SMA1LW 10-20 1.03 0.95 0.86 0.95 0.87<br />

Work 20+ SMA1LW 20+ 1.03 0.95 0.86 0.95 0.87<br />

Business SMA1LB 1.38 1.10 0.86 0.95 0.87<br />

55-59 Single Short Pleasure SMA2SP 1.03 0.95 0.85 0.92 0.87<br />

Work 0-3 SMA2SW 0-3 1.03 0.95 0.85 0.92 0.87<br />

Work 3.1-9.9 SMA2SW 3.1-9.9 1.03 0.95 0.85 0.92 0.87<br />

Work 10-20 SMA2SW 10-20 1.03 0.95 0.85 0.92 0.87<br />

Work 20+ SMA2SW 20+ 1.03 0.95 0.85 0.92 0.87<br />

Business SMA2SB 1.38 1.10 0.85 0.92 0.87<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-6A

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

DRIVER CLASSIFICATION FACTORS<br />

RULE 11<br />

Classific<strong>at</strong>ion Mileage Use Class Code AA BB VA DD HH<br />

Long Pleasure SMA2LP 1.03 0.95 0.85 0.92 0.87<br />

Work 0-3 SMA2LW 0-3 1.03 0.95 0.85 0.92 0.87<br />

Work 3.1-9.9 SMA2LW 3.1-9.9 1.03 0.95 0.85 0.92 0.87<br />

Work 10-20 SMA2LW 10-20 1.03 0.95 0.85 0.92 0.87<br />

Work 20+ SMA2LW 20+ 1.03 0.95 0.85 0.92 0.87<br />

Business SMA2LB 1.38 1.10 0.85 0.92 0.87<br />

60-64 Single Short Pleasure SMA3SP 1.03 0.94 0.85 0.91 0.76<br />

Work 0-3 SMA3SW 0-3 1.03 0.94 0.85 0.91 0.76<br />

Work 3.1-9.9 SMA3SW 3.1-9.9 1.03 0.94 0.85 0.91 0.76<br />

Work 10-20 SMA3SW 10-20 1.03 0.94 0.85 0.91 0.76<br />

Work 20+ SMA3SW 20+ 1.03 0.94 0.85 0.91 0.76<br />

Business SMA3SB 1.38 1.10 0.85 0.91 0.76<br />

Long Pleasure SMA3LP 1.03 0.94 0.85 0.91 0.76<br />

Work 0-3 SMA3LW 0-3 1.03 0.94 0.85 0.91 0.76<br />

Work 3.1-9.9 SMA3LW 3.1-9.9 1.03 0.94 0.85 0.91 0.76<br />

Work 10-20 SMA3LW 10-20 1.03 0.94 0.85 0.91 0.76<br />

Work 20+ SMA3LW 20+ 1.03 0.94 0.85 0.91 0.76<br />

Business SMA3LB 1.38 1.10 0.85 0.91 0.76<br />

65-70 Single Short All SMA4S 1.08 1.03 0.83 0.97 0.76<br />

71-75 Single SMA5S 1.18 1.16 0.83 0.98 0.76<br />

76-80 Single SMA6S 1.22 1.29 0.72 1.13 0.76<br />

81-85 Single SMA7S 1.23 1.51 0.72 1.23 0.76<br />

86+ Single SMA8S 1.23 1.57 0.72 1.25 0.76<br />

65-70 Single Long All SMA4L 1.08 1.03 0.83 0.97 0.76<br />

71-75 Single SMA5L 1.18 1.16 0.83 0.98 0.76<br />

76-80 Single SMA6L 1.22 1.29 0.72 1.13 0.76<br />

81-85 Single SMA7L 1.23 1.51 0.72 1.23 0.76<br />

86+ Single SMA8L 1.23 1.57 0.72 1.25 0.76<br />

50-54 Married Short Pleasure MMA1SP 1.03 0.94 0.94 0.91 0.79<br />

Work 0-3 MMA1SW 0-3 1.03 0.94 0.94 0.91 0.79<br />

Work 3.1-9.9 MMA1SW 3.1-9.9 1.03 0.94 0.94 0.91 0.79<br />

Work 10-20 MMA1SW 10-20 1.03 0.94 0.94 0.91 0.79<br />

Work 20+ MMA1SW 20+ 1.03 0.94 0.94 0.91 0.79<br />

Business MMA1SB 1.38 1.09 0.94 0.91 0.79<br />

Long Pleasure MMA1LP 1.03 0.94 0.94 0.91 0.79<br />

Work 0-3 MMA1LW 0-3 1.03 0.94 0.94 0.91 0.79<br />

Work 3.1-9.9 MMA1LW 3.1-9.9 1.03 0.94 0.94 0.91 0.79<br />

Work 10-20 MMA1LW 10-20 1.03 0.94 0.94 0.91 0.79<br />

Work 20+ MMA1LW 20+ 1.03 0.94 0.94 0.91 0.79<br />

Business MMA1LB 1.38 1.09 0.94 0.91 0.79<br />

55-59 Married Short Pleasure MMA2SP 0.96 0.94 0.84 0.88 0.79<br />

Work 0-3 MMA2SW 0-3 0.96 0.94 0.84 0.88 0.79<br />

Work 3.1-9.9 MMA2SW 3.1-9.9 0.96 0.94 0.84 0.88 0.79<br />

Work 10-20 MMA2SW 10-20 0.96 0.94 0.84 0.88 0.79<br />

Work 20+ MMA2SW 20+ 0.96 0.94 0.84 0.88 0.79<br />

Business MMA2SB 1.29 1.09 0.84 0.88 0.79<br />

Long Pleasure MMA2LP 0.96 0.94 0.84 0.88 0.79<br />

Work 0-3 MMA2LW 0-3 0.96 0.94 0.84 0.88 0.79<br />

Work 3.1-9.9 MMA2LW 3.1-9.9 0.96 0.94 0.84 0.88 0.79<br />

Work 10-20 MMA2LW 10-20 0.96 0.94 0.84 0.88 0.79<br />

Work 20+ MMA2LW 20+ 0.96 0.94 0.84 0.88 0.79<br />

Business MMA2LB 1.29 1.09 0.84 0.88 0.79<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-7A

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

DRIVER CLASSIFICATION FACTORS<br />

RULE 11<br />

Classific<strong>at</strong>ion Mileage Use Class Code AA BB VA DD HH<br />

60-64 Married Short Pleasure MMA3SP 0.93 0.88 0.84 0.88 0.77<br />

Work 0-3 MMA3SW 0-3 0.93 0.88 0.84 0.88 0.77<br />

Work 3.1-9.9 MMA3SW 3.1-9.9 0.93 0.88 0.84 0.88 0.77<br />

Work 10-20 MMA3SW 10-20 0.93 0.88 0.84 0.88 0.77<br />

Work 20+ MMA3SW 20+ 0.93 0.88 0.84 0.88 0.77<br />

Business MMA3SB 1.24 1.02 0.84 0.88 0.77<br />

Long Pleasure MMA3LP 0.93 0.88 0.84 0.88 0.77<br />

Work 0-3 MMA3LW 0-3 0.93 0.88 0.84 0.88 0.77<br />

Work 3.1-9.9 MMA3LW 3.1-9.9 0.93 0.88 0.84 0.88 0.77<br />

Work 10-20 MMA3LW 10-20 0.93 0.88 0.84 0.88 0.77<br />

Work 20+ MMA3LW 20+ 0.93 0.88 0.84 0.88 0.77<br />

Business MMA3LB 1.24 1.02 0.84 0.88 0.77<br />

65-70 Married Short All MMA4S 1.08 0.97 0.78 0.89 0.77<br />

71-75 Married MMA5S 1.18 1.09 0.78 0.90 0.68<br />

76-80 Married MMA6S 1.22 1.21 0.68 1.03 0.68<br />

81-85 Married MMA7S 1.22 1.42 0.68 1.12 0.68<br />

86+ Married MMA8S 1.22 1.47 0.68 1.14 0.68<br />

65-70 Married Long All MMA4L 1.08 0.97 0.78 0.89 0.77<br />

71-75 Married MMA5L 1.18 1.09 0.78 0.90 0.68<br />

76-80 Married MMA6L 1.22 1.21 0.68 1.03 0.68<br />

81-85 Married MMA7L 1.22 1.42 0.68 1.12 0.68<br />

86+ Married MMA8L 1.22 1.47 0.68 1.14 0.68<br />

Extra Vehicles All All EXV 1.08 1.02 1.15 1.07 0.97<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-8A

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

HOUSEHOLD COMPOSITION FACTORS<br />

RULE 48<br />

One Oper<strong>at</strong>or on Policy<br />

Number of Youngest Driver Age 14-20 Youngest Driver Age 21-24 Youngest Driver Age 25+<br />

Vehicles AA BB VA DD HH AA BB VA DD HH AA BB VA DD HH<br />

1 1.39 1.60 1.00 1.49 1.53 1.25 1.26 1.00 1.32 1.33 1.00 1.00 1.00 1.00 1.00<br />

2 1.00 1.05 0.64 1.63 1.74 0.82 0.88 0.64 1.20 1.74 0.75 0.79 0.64 0.87 1.04<br />

3 1.00 1.05 0.43 1.11 1.74 0.82 0.88 0.43 0.93 1.74 0.75 0.79 0.43 0.75 1.04<br />

4+ 1.00 1.05 0.43 1.11 1.74 0.82 0.88 0.43 0.93 1.74 0.75 0.79 0.43 0.75 1.04<br />

Two Oper<strong>at</strong>ors on Policy<br />

Number of Youngest Driver Age 14-20 Youngest Driver Age 21-24 Youngest Driver Age 25+<br />

Vehicles AA BB VA DD HH AA BB VA DD HH AA BB VA DD HH<br />

1 1.14 1.37 1.13 1.34 1.48 1.00 1.05 1.13 1.06 1.30 0.86 0.94 1.14 0.91 1.04<br />

2 0.94 1.07 0.82 1.16 1.03 0.82 0.91 0.82 0.98 1.03 0.74 0.80 0.82 0.80 0.90<br />

3 1.00 1.05 0.64 1.11 1.10 0.82 0.88 0.64 0.93 1.10 0.75 0.79 0.64 0.75 1.04<br />

4+ 1.00 1.05 0.43 1.11 1.14 0.82 0.88 0.43 0.93 1.14 0.75 0.79 0.43 0.75 1.04<br />

Three Oper<strong>at</strong>ors on Policy<br />

Number of Youngest Driver Age 14-20 Youngest Driver Age 21-24 Youngest Driver Age 25+<br />

Vehicles AA BB VA DD HH AA BB VA DD HH AA BB VA DD HH<br />

1 1.23 1.46 1.13 1.30 1.48 1.23 1.12 1.13 1.18 1.30 1.19 1.01 1.13 1.01 1.04<br />

2 1.14 1.14 0.91 1.15 1.08 1.00 0.88 0.91 1.01 1.08 0.86 0.86 0.91 0.89 1.04<br />

3 0.93 1.08 0.68 1.09 1.08 0.80 0.91 0.68 1.03 1.08 0.81 0.80 0.68 0.86 1.04<br />

4+ 1.00 1.05 0.64 1.11 1.08 0.82 0.88 0.64 0.93 1.08 0.75 0.79 0.64 0.75 1.04<br />

Four or More Oper<strong>at</strong>ors on Policy<br />

Number of Youngest Driver Age 14-20 Youngest Driver Age 21-24 Youngest Driver Age 25+<br />

Vehicles AA BB VA DD HH AA BB VA DD HH AA BB VA DD HH<br />

1 1.23 1.46 1.13 1.30 1.48 1.23 1.12 1.13 1.18 1.30 1.19 1.01 1.13 1.01 1.04<br />

2 1.23 1.46 0.91 1.30 1.09 1.23 1.12 0.91 1.18 1.09 1.19 1.01 0.91 1.01 1.04<br />

3 1.14 1.14 0.91 1.15 1.09 1.00 0.88 0.91 1.01 1.09 0.86 0.86 0.91 0.89 1.04<br />

4+ 0.93 1.08 0.68 1.09 1.09 0.80 0.91 0.68 1.03 1.09 0.81 0.80 0.68 0.86 1.04<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-9A

COLLISION AND COMPREHENSIVE<br />

MODEL YEAR FACTORS<br />

RULE 21<br />

LEASE OR LOAN GAP COVERAGE (RULE 41)<br />

COLLISION FACTOR = 0.07<br />

COMPREHENSIVE FACTOR = 0.07<br />

MODEL<br />

YEAR FACTOR Note: Both Collision and Comprehensive must be purchased.<br />

2012 3.82<br />

2011 3.57 REPAIR OR REPLACEMENT COST COVERAGE (RULE 42)<br />

2010 3.34<br />

2009 3.12 COLLISION FACTOR = 0.10<br />

2008 2.92<br />

2007 2.78 Note: Both Collision and Comprehensive must be purchased.<br />

2006 2.65<br />

2005 2.52<br />

2004 2.40<br />

2003 2.29<br />

2002 & 2.18<br />

PRIOR<br />

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

PHYSICAL DAMAGE RATING FACTORS<br />

SUBSEQUENT MODEL YEAR ADJUSTMENT:<br />

For model year factors not shown in the table, apply the following<br />

annual increase to the most recent model year factor shown above.<br />

Round to two decimal places after each calcul<strong>at</strong>ions.<br />

Collision = 7%<br />

Comprehensive = 7%<br />

DEDUCTIBLE BY PGS FACTOR DEDUCTIBLE BY PGS FACTOR<br />

RULES 19 AND 20 RULES 19 AND 20<br />

COLLISION COMPREHENSIVE<br />

DEDUCTIBLE DEDUCTIBLE<br />

PGS $200* $250 $500 $1,000 PGS $100 $150 $250 $500 $1,000<br />

M 0.75 0.71 0.54 0.34 M 0.71 0.60 0.48 0.37 0.26<br />

O 0.91 0.87 0.71 0.51 O 0.92 0.80 0.67 0.54 0.41<br />

S 1.03 1.00 0.85 0.64 S 1.34 1.17 1.00 0.83 0.66<br />

T 1.18 1.15 0.99 0.73 T 1.80 1.59 1.37 1.16 0.94<br />

U 1.33 1.29 1.12 0.89 U 2.28 2.06 1.83 1.68 1.37<br />

V 1.49 1.44 1.25 1.01 V 2.77 2.56 2.31 2.01 1.74<br />

W 1.68 1.63 1.43 1.16 W 3.34 3.12 2.80 2.48 2.15<br />

N 1.88 1.84 1.60 1.32 N 4.05 3.79 3.44 3.02 2.62<br />

P 1.88 1.84 1.60 1.32 P 4.05 3.79 3.44 3.02 2.62<br />

Q 2.19 2.14 1.93 1.63 Q 5.29 4.95 4.50 3.94 3.43<br />

R 2.19 2.14 1.93 1.63 R 5.29 4.95 4.50 3.94 3.43<br />

G 2.19 2.14 1.93 1.63 G 5.29 4.95 4.50 3.94 3.43<br />

I 2.64 2.59 2.34 1.98 I 7.14 6.84 6.39 5.71 4.96<br />

K 2.64 2.59 2.34 1.98 K 7.14 6.84 6.39 5.71 4.96<br />

C 3.19 3.13 2.86 2.46 C 9.42 9.03 8.44 7.75 6.77<br />

D 3.70 3.63 3.36 2.89 D 11.68 11.31 10.58 9.85 8.64<br />

E 4.33 4.24 3.92 3.38 E 13.77 13.34 12.48 11.62 10.18<br />

F 4.96 4.85 4.54 3.92 F 16.01 15.51 14.50 13.50 11.84<br />

H 5.61 5.49 5.14 4.44 H 18.64 18.05 16.88 15.72 13.78<br />

J 5.97 5.85 5.47 4.73 J 21.82 21.14 19.77 18.41 16.14<br />

L 6.69 6.55 6.13 5.29 L 23.09 22.36 20.92 19.48 17.07<br />

* These deductibles are available for existing policyholders prior to September 28, 1987 and Allst<strong>at</strong>e <strong>Insurance</strong> Company transfers only.<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-10A

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

ACCIDENT FACTORS<br />

RULE 12<br />

RATED OPERATOR AGE 20 OR LESS:<br />

0-11<br />

Months Since Most Recent Chargeable Accident<br />

12-23 24-35<br />

# of Chargeable<br />

Accidents in Last<br />

3 Years<br />

AA BB VA DD AA BB VA DD AA BB VA DD<br />

0 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00<br />

1 1.39 1.22 1.20 1.20 1.16 1.10 1.20 1.11 1.12 1.03 1.03 1.00<br />

2 1.72 1.38 1.33 1.35 1.72 1.24 1.33 1.24 1.72 1.24 1.12 1.24<br />

3<br />

Each Additional<br />

1.99 1.89 2.18 1.82 1.79 1.52 1.86 1.52 1.79 1.52 1.86 1.52<br />

Accident add 0.28 add 0.28 add 0.29 add 0.26 add 0.28 add 0.28 add 0.29 add 0.26 add 0.28 add 0.28 add 0.29 add 0.26<br />

RATED OPERATOR AGE 21 - 24:<br />

0-11<br />

Months Since Most Recent Chargeable Accident<br />

12-23 24-35<br />

# of Chargeable<br />

Accidents in Last<br />

3 Years<br />

AA BB VA DD AA BB VA DD AA BB VA DD<br />

0 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00<br />

1 1.39 1.22 1.23 1.20 1.16 1.10 1.23 1.11 1.12 1.03 1.06 1.00<br />

2 1.72 1.38 1.37 1.35 1.72 1.24 1.37 1.24 1.72 1.24 1.15 1.24<br />

3<br />

Each Additional<br />

1.99 1.89 2.24 1.82 1.79 1.52 1.92 1.52 1.79 1.52 1.92 1.52<br />

Accident add 0.28 add 0.28 add 0.29 add 0.26 add 0.28 add 0.28 add 0.29 add 0.26 add 0.28 add 0.28 add 0.29 add 0.26<br />

RATED OPERATOR AGE 25 - 49:<br />

0-11<br />

Months Since Most Recent Chargeable Accident<br />

12-23 24-35<br />

# of Chargeable<br />

Accidents in Last<br />

3 Years<br />

AA BB VA DD AA BB VA DD AA BB VA DD<br />

0 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00<br />

1 1.39 1.45 1.23 1.34 1.16 1.31 1.23 1.23 1.12 1.21 1.06 1.10<br />

2 1.72 1.79 1.37 1.69 1.72 1.60 1.37 1.55 1.72 1.60 1.15 1.55<br />

3<br />

Each Additional<br />

1.99 2.82 2.24 2.46 1.79 2.26 1.92 2.05 1.79 2.26 1.92 2.05<br />

Accident add 0.96 add 0.91 add 0.42 add 0.66 add 0.96 add 0.91 add 0.42 add 0.66 add 0.96 add 0.91 add 0.42 add 0.66<br />

RATED OPERATOR AGE 50 OR OLDER:<br />

0-11<br />

Months Since Most Recent Chargeable Accident<br />

12-23 24-35<br />

# of Chargeable<br />

Accidents in Last<br />

3 Years<br />

AA BB VA DD AA BB VA DD AA BB VA DD<br />

0 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00<br />

1 1.75 1.55 1.53 1.55 1.46 1.40 1.53 1.42 1.40 1.30 1.31 1.27<br />

2 2.08 2.16 1.81 1.86 2.08 1.94 1.81 1.70 2.08 1.94 1.51 1.70<br />

3<br />

Each Additional<br />

4.06 2.89 2.98 2.69 3.64 2.31 2.55 2.23 3.64 2.31 2.55 2.23<br />

Accident add 2.01 add 1.33 add 1.24 add 1.07 add 2.01 add 1.33 add 1.24 add 1.07 add 2.01 add 1.33 add 1.24 add 1.07<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-12A

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

MINOR VIOLATION FACTORS<br />

RULE 12<br />

RATED OPERATOR AGE 20 OR LESS:<br />

0-11<br />

Months Since Most Recent Minor Viol<strong>at</strong>ion<br />

12-23 24-35<br />

# of Minor<br />

Viol<strong>at</strong>ions in Last<br />

3 Years<br />

AA BB VA DD AA BB VA DD AA BB VA DD<br />

0 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00<br />

1 1.00 1.00 1.00 1.04 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00<br />

2 1.01 1.07 1.13 1.10 1.00 1.00 1.13 1.10 1.00 1.00 1.13 1.10<br />

3<br />

Each Additional<br />

1.13 1.13 1.16 1.27 1.08 1.07 1.16 1.15 1.08 1.07 1.16 1.12<br />

Minor Viol<strong>at</strong>ion add 0.02 add 0.02 add 0.05 add 0.06 add 0.02 add 0.02 add 0.05 add 0.06 add 0.02 add 0.02 add 0.05 add 0.06<br />

RATED OPERATOR AGE 21 - 24:<br />

0-11<br />

Months Since Most Recent Minor Viol<strong>at</strong>ion<br />

12-23 24-35<br />

# of Minor<br />

Viol<strong>at</strong>ions in Last<br />

3 Years<br />

AA BB VA DD AA BB VA DD AA BB VA DD<br />

0 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00<br />

1 1.15 1.06 1.00 1.15 1.15 1.06 1.00 1.09 1.05 1.06 1.00 1.05<br />

2 1.20 1.29 1.13 1.22 1.19 1.17 1.13 1.22 1.19 1.17 1.13 1.22<br />

3<br />

Each Additional<br />

1.35 1.29 1.16 1.40 1.29 1.19 1.16 1.27 1.29 1.19 1.16 1.24<br />

Minor Viol<strong>at</strong>ion add 0.10 add 0.08 add 0.05 add 0.11 add 0.10 add 0.08 add 0.05 add 0.11 add 0.10 add 0.08 add 0.05 add 0.11<br />

RATED OPERATOR AGE 25 - 49:<br />

0-11<br />

Months Since Most Recent Minor Viol<strong>at</strong>ion<br />

12-23 24-35<br />

# of Minor<br />

Viol<strong>at</strong>ions in Last<br />

3 Years<br />

AA BB VA DD AA BB VA DD AA BB VA DD<br />

0 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00<br />

1 1.15 1.10 1.00 1.19 1.15 1.10 1.00 1.13 1.05 1.10 1.00 1.09<br />

2 1.20 1.32 1.13 1.26 1.19 1.21 1.13 1.26 1.19 1.21 1.13 1.26<br />

3<br />

Each Additional<br />

1.35 1.39 1.16 1.45 1.29 1.32 1.16 1.31 1.29 1.32 1.16 1.28<br />

Minor Viol<strong>at</strong>ion add 0.10 add 0.13 add 0.05 add 0.14 add 0.10 add 0.13 add 0.05 add 0.14 add 0.10 add 0.13 add 0.05 add 0.14<br />

RATED OPERATOR AGE 50 OR OLDER:<br />

0-11<br />

Months Since Most Recent Minor Viol<strong>at</strong>ion<br />

12-23 24-35<br />

# of Minor<br />

Viol<strong>at</strong>ions in Last<br />

3 Years<br />

AA BB VA DD AA BB VA DD AA BB VA DD<br />

0 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00<br />

1 1.24 1.20 1.18 1.20 1.24 1.20 1.18 1.15 1.13 1.20 1.18 1.11<br />

2 1.30 1.42 1.33 1.28 1.29 1.30 1.33 1.28 1.29 1.30 1.33 1.28<br />

3<br />

Each Additional<br />

1.45 1.54 1.37 1.47 1.39 1.46 1.37 1.33 1.39 1.46 1.37 1.30<br />

Minor Viol<strong>at</strong>ion add 0.20 add 0.21 add 0.22 add 0.16 add 0.20 add 0.21 add 0.22 add 0.16 add 0.20 add 0.21 add 0.22 add 0.16<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-13A

RATING FACTOR<br />

RATING PLAN RULE GROUP AA BB VA DD HH<br />

RESIDENT STUDENT DISCOUNT 28<br />

Male Restricted 16-20 (MR1-5) * 0.90 0.88 N/A 0.97 N/A<br />

Female Restricted 16-20 (FR1-5) * 0.90 0.88 N/A 0.97 N/A<br />

Male Restricted 21-24 (MR6-9) * 0.90 0.88 N/A 0.97 N/A<br />

Female Restricted 21-24 (FR6-9) * 0.90 0.88 N/A 0.97 N/A<br />

GOOD STUDENT DISCOUNT 39<br />

Male Basic (16-20) MB1-5, Male Restricted (16-20) MR1-5 * 0.90 0.90 0.90 0.90 0.90<br />

Female Basic (16-20) FB1-5, Female Restricted (16-20) FR1-5 * 0.90 0.90 0.90 0.90 0.90<br />

Male Basic (21-24) MB6-9, Male Restricted (21-24) MR6-9 * 0.90 0.90 0.90 0.90 0.90<br />

Female Basic (21-24) FB6-9, Female Restricted (21-24) FR6-9 * 0.90 0.90 0.90 0.90 0.90<br />

SENIOR ADULT DISCOUNT 30 N/A N/A 0.85 N/A N/A<br />

PASSIVE RESTRAINT DISCOUNT 25<br />

Airbags on both sides * N/A N/A 0.70 N/A N/A<br />

Airbags on driver side only * N/A N/A 0.80 N/A N/A<br />

Autom<strong>at</strong>ic motorized se<strong>at</strong>belts * N/A N/A 0.90 N/A N/A<br />

DEFENSIVE DRIVER DISCOUNT 27 * SEE RULE 27 N/A N/A<br />

CERTIFIED RISK SURCHARGE<br />

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

MISCELLANEOUS DISCOUNT & SURCHARGE RATING FACTORS<br />

Note: This factor is applied once per policy to the vehicle with the<br />

highest combined BI & PD premium.<br />

22 * 1.10 1.10 N/A N/A N/A<br />

ANTILOCK BRAKE DISCOUNT 26 * 0.90 0.90 N/A 0.90 N/A<br />

THE GOOD HANDS PEOPLE® DISCOUNT 45 * 0.90 0.90 0.90 0.90 0.90<br />

NONVERIFIABLE DRIVING RECORD SURCHARGE 14 * 1.10 1.10 1.10 1.10 N/A<br />

INEXPERIENCED OPERATOR SURCHARGE 24<br />

Years of<br />

Age Licensed Driving Experience<br />

14-16 All * 1.00 1.00 N/A 1.00 N/A<br />

17 < 1 Year * 1.38 1.21 N/A 1.27 N/A<br />

17 <strong>at</strong> least 1 Year but < 2 Years * 1.29 1.21 N/A 1.19 N/A<br />

17 <strong>at</strong> least 2 Years but < 3 Years * 1.29 1.10 N/A 1.11 N/A<br />

17 3 or More Years * 1.00 1.00 N/A 1.00 N/A<br />

18 < 1 Year * 1.38 1.21 N/A 1.27 N/A<br />

18 <strong>at</strong> least 1 Year but < 2 Years * 1.29 1.21 N/A 1.19 N/A<br />

18 <strong>at</strong> least 2 Years but < 3 Years * 1.29 1.10 N/A 1.11 N/A<br />

18 3 or More Years * 1.00 1.00 N/A 1.00 N/A<br />

19 < 1 Year * 1.38 1.21 N/A 1.27 N/A<br />

19 <strong>at</strong> least 1 Year but < 2 Years * 1.29 1.21 N/A 1.19 N/A<br />

19 <strong>at</strong> least 2 Years but < 3 Years * 1.29 1.10 N/A 1.11 N/A<br />

19 3 or More Years * 1.00 1.00 N/A 1.00 N/A<br />

20 < 1 Year * 1.38 1.21 N/A 1.27 N/A<br />

20 <strong>at</strong> least 1 Year but < 2 Years * 1.29 1.21 N/A 1.19 N/A<br />

20 <strong>at</strong> least 2 Years but < 3 Years * 1.29 1.10 N/A 1.11 N/A<br />

20 3 or More Years * 1.00 1.00 N/A 1.00 N/A<br />

21+ < 1 Year * 1.38 1.21 N/A 1.27 N/A<br />

21+ <strong>at</strong> least 1 Year but < 2 Years * 1.29 1.21 N/A 1.19 N/A<br />

21+ <strong>at</strong> least 2 Years but < 3 Years * 1.29 1.10 N/A 1.11 N/A<br />

21+ 3 or More Years * 1.00 1.00 N/A 1.00 N/A<br />

FUTURE EFFECTIVE DATE DISCOUNT 58 * 0.95 0.95 0.95 0.95 0.95<br />

GOOD PAYER DISCOUNT 43 * 0.90 0.90 0.90 0.90 0.90<br />

THE ALLSTATE® EASY PAY PLAN DISCOUNT 52 * 0.95 0.95 0.95 0.95 0.95<br />

HOMEOWNERSHIP DISCOUNT 44 1 0.95 0.95 0.95 0.95 0.95<br />

(R<strong>at</strong>ing Group is defined by Tier - please refer to the 2 0.95 0.95 0.95 0.95 0.95<br />

Tier section in the r<strong>at</strong>ing pages) 3 0.95 0.95 0.95 0.95 0.95<br />

4 0.95 0.95 0.95 0.95 0.95<br />

5 0.95 0.95 0.95 0.95 0.95<br />

6 0.95 0.95 0.95 0.95 0.95<br />

7 0.95 0.95 0.95 0.95 0.95<br />

8 0.95 0.95 0.95 0.95 0.95<br />

PERFORMANCE DISCOUNT 49 1 0.98 0.95 1.00 0.97 0.94<br />

(R<strong>at</strong>ing Group is defined by Tier - please refer to the 2 0.98 0.95 1.00 0.97 0.94<br />

Tier section in the r<strong>at</strong>ing pages) 3 0.98 0.95 1.00 0.97 0.94<br />

4 0.98 0.95 1.00 0.97 0.94<br />

5 0.98 0.95 1.00 0.97 0.94<br />

6 0.98 0.95 1.00 0.97 0.94<br />

7 0.98 0.95 1.00 0.97 0.94<br />

8 0.98 0.95 1.00 0.97 0.94<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-15A

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

MISCELLANEOUS DISCOUNT & SURCHARGE RATING FACTORS<br />

RATING FACTOR<br />

RATING PLAN RULE GROUP AA BB VA DD HH<br />

MULTIPLE POLICY DISCOUNT Homeowners 57 1 0.92 0.95 0.80 0.92 0.85<br />

(R<strong>at</strong>ing Group is defined by Tier - please refer to the Mobilehome and Manufactured Home Owners 1 0.92 0.95 0.80 0.92 0.85<br />

Tier section in the r<strong>at</strong>ing pages) Renters 1 0.92 0.95 0.80 0.92 0.85<br />

Condominium Owners 1 0.92 0.95 0.80 0.92 0.85<br />

Homeowners 2 0.92 0.95 0.80 0.92 0.85<br />

Mobilehome and Manufactured Home Owners 2 0.92 0.95 0.80 0.92 0.85<br />

Renters 2 0.92 0.95 0.80 0.92 0.85<br />

Condominium Owners 2 0.92 0.95 0.80 0.92 0.85<br />

Homeowners 3 0.92 0.95 0.80 0.92 0.85<br />

Mobilehome and Manufactured Home Owners 3 0.92 0.95 0.80 0.92 0.85<br />

Renters 3 0.92 0.95 0.80 0.92 0.85<br />

Condominium Owners 3 0.92 0.95 0.80 0.92 0.85<br />

Homeowners 4 0.92 0.95 0.80 0.92 0.85<br />

Mobilehome and Manufactured Home Owners 4 0.92 0.95 0.80 0.92 0.85<br />

Renters 4 0.92 0.95 0.80 0.92 0.85<br />

Condominium Owners 4 0.92 0.95 0.80 0.92 0.85<br />

Homeowners 5 0.92 0.95 0.80 0.92 0.85<br />

Mobilehome and Manufactured Home Owners 5 0.92 0.95 0.80 0.92 0.85<br />

Renters 5 0.92 0.95 0.80 0.92 0.85<br />

Condominium Owners 5 0.92 0.95 0.80 0.92 0.85<br />

Homeowners 6 0.92 0.95 0.80 0.92 0.85<br />

Mobilehome and Manufactured Home Owners 6 0.92 0.95 0.80 0.92 0.85<br />

Renters 6 0.92 0.95 0.80 0.92 0.85<br />

Condominium Owners 6 0.92 0.95 0.80 0.92 0.85<br />

Homeowners 7 0.92 0.95 0.80 0.92 0.85<br />

Mobilehome and Manufactured Home Owners 7 0.92 0.95 0.80 0.92 0.85<br />

Renters 7 0.92 0.95 0.80 0.92 0.85<br />

Condominium Owners 7 0.92 0.95 0.80 0.92 0.85<br />

Homeowners 8 0.92 0.95 0.80 0.92 0.85<br />

Mobilehome and Manufactured Home Owners 8 0.92 0.95 0.80 0.92 0.85<br />

Renters 8 0.92 0.95 0.80 0.92 0.85<br />

Condominium Owners 8 0.92 0.95 0.80 0.92 0.85<br />

TIER 1 51 1 0.68 0.80 0.44 0.77 0.60<br />

2 1 0.68 0.80 0.50 0.77 0.65<br />

3 1 0.74 0.82 0.63 0.78 0.69<br />

4 1 0.71 0.80 0.51 0.82 0.64<br />

5 1 0.71 0.80 0.58 0.82 0.69<br />

6 2 0.77 0.82 0.73 0.84 0.73<br />

7 1 0.68 0.80 0.44 0.77 0.60<br />

8 2 0.68 0.80 0.50 0.77 0.65<br />

9 2 0.74 0.82 0.63 0.78 0.69<br />

10 2 0.71 0.80 0.51 0.82 0.64<br />

11 2 0.71 0.80 0.58 0.82 0.69<br />

12 3 0.77 0.82 0.73 0.84 0.73<br />

13 1 0.68 0.80 0.44 0.77 0.60<br />

14 1 0.68 0.80 0.50 0.77 0.65<br />

15 1 0.74 0.82 0.63 0.78 0.69<br />

16 1 0.71 0.80 0.51 0.82 0.64<br />

17 1 0.71 0.80 0.58 0.82 0.69<br />

18 2 0.77 0.82 0.73 0.84 0.73<br />

19 1 0.68 0.80 0.44 0.77 0.60<br />

20 2 0.68 0.80 0.50 0.77 0.65<br />

21 2 0.74 0.82 0.63 0.78 0.69<br />

22 2 0.71 0.80 0.51 0.82 0.64<br />

23 2 0.71 0.80 0.58 0.82 0.69<br />

24 3 0.77 0.82 0.73 0.84 0.73<br />

25 1 0.71 0.80 0.51 0.82 0.64<br />

26 2 0.71 0.80 0.58 0.82 0.69<br />

27 2 0.77 0.82 0.73 0.84 0.73<br />

28 1 0.71 0.80 0.51 0.82 0.64<br />

29 1 0.71 0.80 0.58 0.82 0.69<br />

30 2 0.77 0.82 0.73 0.84 0.73<br />

31 1 0.69 0.81 0.45 0.77 0.61<br />

32 1 0.69 0.81 0.51 0.77 0.67<br />

33 2 0.75 0.84 0.65 0.79 0.71<br />

34 1 0.72 0.81 0.53 0.83 0.65<br />

35 2 0.72 0.81 0.59 0.83 0.71<br />

36 2 0.78 0.84 0.75 0.85 0.75<br />

37 2 0.69 0.81 0.45 0.77 0.61<br />

38 2 0.69 0.81 0.51 0.77 0.67<br />

39 3 0.75 0.84 0.65 0.79 0.71<br />

40 2 0.72 0.81 0.53 0.83 0.65<br />

41 2 0.72 0.81 0.59 0.83 0.71<br />

42 3 0.78 0.84 0.75 0.85 0.75<br />

43 1 0.69 0.81 0.45 0.77 0.61<br />

44 1 0.69 0.81 0.51 0.77 0.67<br />

45 2 0.75 0.84 0.65 0.79 0.71<br />

46 1 0.72 0.81 0.53 0.83 0.65<br />

47 2 0.72 0.81 0.59 0.83 0.71<br />

48 2 0.78 0.84 0.75 0.85 0.75<br />

49 2 0.69 0.81 0.45 0.77 0.61<br />

50 2 0.69 0.81 0.51 0.77 0.67<br />

51 3 0.75 0.84 0.65 0.79 0.71<br />

52 2 0.72 0.81 0.53 0.83 0.65<br />

53 2 0.72 0.81 0.59 0.83 0.71<br />

54 3 0.78 0.84 0.75 0.85 0.75<br />

55 2 0.72 0.81 0.53 0.83 0.65<br />

56 2 0.72 0.81 0.59 0.83 0.71<br />

57 3 0.78 0.84 0.75 0.85 0.75<br />

58 1 0.72 0.81 0.53 0.83 0.65<br />

59 2 0.72 0.81 0.59 0.83 0.71<br />

60 2 0.78 0.84 0.75 0.85 0.75<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-16A

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

MISCELLANEOUS DISCOUNT & SURCHARGE RATING FACTORS<br />

RATING FACTOR<br />

RATING PLAN RULE GROUP AA BB VA DD HH<br />

61 1 0.71 0.82 0.47 0.79 0.64<br />

62 2 0.71 0.82 0.53 0.79 0.70<br />

63 2 0.77 0.85 0.67 0.81 0.73<br />

64 1 0.74 0.82 0.55 0.85 0.68<br />

65 2 0.74 0.82 0.62 0.85 0.74<br />

66 2 0.80 0.85 0.78 0.87 0.78<br />

67 2 0.71 0.82 0.47 0.79 0.64<br />

68 2 0.71 0.82 0.53 0.79 0.70<br />

69 3 0.77 0.85 0.67 0.81 0.73<br />

70 2 0.74 0.82 0.55 0.85 0.68<br />

71 3 0.74 0.82 0.62 0.85 0.74<br />

72 3 0.80 0.85 0.78 0.87 0.78<br />

73 1 0.71 0.82 0.47 0.79 0.64<br />

74 2 0.71 0.82 0.53 0.79 0.70<br />

75 2 0.77 0.85 0.67 0.81 0.73<br />

76 1 0.74 0.82 0.55 0.85 0.68<br />

77 2 0.74 0.82 0.62 0.85 0.74<br />

78 2 0.80 0.85 0.78 0.87 0.78<br />

79 2 0.71 0.82 0.47 0.79 0.64<br />

80 2 0.71 0.82 0.53 0.79 0.70<br />

81 3 0.77 0.85 0.67 0.81 0.73<br />

82 2 0.74 0.82 0.55 0.85 0.68<br />

83 3 0.74 0.82 0.62 0.85 0.74<br />

84 3 0.80 0.85 0.78 0.87 0.78<br />

85 2 0.74 0.82 0.55 0.85 0.68<br />

86 2 0.74 0.82 0.62 0.85 0.74<br />

87 3 0.80 0.85 0.78 0.87 0.78<br />

88 1 0.74 0.82 0.55 0.85 0.68<br />

89 2 0.74 0.82 0.62 0.85 0.74<br />

90 2 0.80 0.85 0.78 0.87 0.78<br />

91 1 0.72 0.83 0.48 0.80 0.65<br />

92 2 0.72 0.83 0.54 0.80 0.71<br />

93 2 0.78 0.86 0.69 0.82 0.75<br />

94 2 0.75 0.83 0.56 0.86 0.70<br />

95 2 0.75 0.83 0.63 0.86 0.76<br />

96 3 0.81 0.86 0.80 0.88 0.80<br />

97 2 0.72 0.83 0.48 0.80 0.65<br />

98 3 0.72 0.83 0.54 0.80 0.71<br />

99 3 0.78 0.86 0.69 0.82 0.75<br />

100 2 0.75 0.83 0.56 0.86 0.70<br />

101 3 0.75 0.83 0.63 0.86 0.76<br />

102 4 0.81 0.86 0.80 0.88 0.80<br />

103 1 0.72 0.83 0.48 0.80 0.65<br />

104 2 0.72 0.83 0.54 0.80 0.71<br />

105 2 0.78 0.86 0.69 0.82 0.75<br />

106 2 0.75 0.83 0.56 0.86 0.70<br />

107 2 0.75 0.83 0.63 0.86 0.76<br />

108 3 0.81 0.86 0.80 0.88 0.80<br />

109 2 0.72 0.83 0.48 0.80 0.65<br />

110 3 0.72 0.83 0.54 0.80 0.71<br />

111 3 0.78 0.86 0.69 0.82 0.75<br />

112 2 0.75 0.83 0.56 0.86 0.70<br />

113 3 0.75 0.83 0.63 0.86 0.76<br />

114 4 0.81 0.86 0.80 0.88 0.80<br />

115 2 0.75 0.83 0.56 0.86 0.70<br />

116 2 0.75 0.83 0.63 0.86 0.76<br />

117 3 0.81 0.86 0.80 0.88 0.80<br />

118 2 0.75 0.83 0.56 0.86 0.70<br />

119 2 0.75 0.83 0.63 0.86 0.76<br />

120 3 0.81 0.86 0.80 0.88 0.80<br />

121 1 0.73 0.84 0.50 0.82 0.68<br />

122 2 0.73 0.84 0.56 0.82 0.74<br />

123 2 0.80 0.87 0.71 0.84 0.78<br />

124 2 0.76 0.84 0.58 0.88 0.72<br />

125 2 0.76 0.84 0.66 0.88 0.79<br />

126 3 0.83 0.87 0.83 0.90 0.83<br />

127 2 0.73 0.84 0.50 0.82 0.68<br />

128 3 0.73 0.84 0.56 0.82 0.74<br />

129 3 0.80 0.87 0.71 0.84 0.78<br />

130 3 0.76 0.84 0.58 0.88 0.72<br />

131 3 0.76 0.84 0.66 0.88 0.79<br />

132 4 0.83 0.87 0.83 0.90 0.83<br />

133 1 0.73 0.84 0.50 0.82 0.68<br />

134 2 0.73 0.84 0.56 0.82 0.74<br />

135 2 0.80 0.87 0.71 0.84 0.78<br />

136 2 0.76 0.84 0.58 0.88 0.72<br />

137 2 0.76 0.84 0.66 0.88 0.79<br />

138 3 0.83 0.87 0.83 0.90 0.83<br />

139 2 0.73 0.84 0.50 0.82 0.68<br />

140 3 0.73 0.84 0.56 0.82 0.74<br />

141 3 0.80 0.87 0.71 0.84 0.78<br />

142 3 0.76 0.84 0.58 0.88 0.72<br />

143 3 0.76 0.84 0.66 0.88 0.79<br />

144 4 0.83 0.87 0.83 0.90 0.83<br />

145 2 0.76 0.84 0.58 0.88 0.72<br />

146 3 0.76 0.84 0.66 0.88 0.79<br />

147 3 0.83 0.87 0.83 0.90 0.83<br />

148 2 0.76 0.84 0.58 0.88 0.72<br />

149 2 0.76 0.84 0.66 0.88 0.79<br />

150 3 0.83 0.87 0.83 0.90 0.83<br />

151 2 0.75 0.86 0.51 0.83 0.70<br />

152 2 0.75 0.86 0.58 0.83 0.76<br />

153 3 0.82 0.89 0.73 0.85 0.80<br />

154 2 0.78 0.86 0.60 0.89 0.74<br />

155 2 0.78 0.86 0.67 0.89 0.81<br />

156 3 0.85 0.89 0.85 0.91 0.85<br />

157 2 0.75 0.86 0.51 0.83 0.70<br />

158 3 0.75 0.86 0.58 0.83 0.76<br />

159 4 0.82 0.89 0.73 0.85 0.80<br />

160 3 0.78 0.86 0.60 0.89 0.74<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-17A

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

MISCELLANEOUS DISCOUNT & SURCHARGE RATING FACTORS<br />

RATING FACTOR<br />

RATING PLAN RULE GROUP AA BB VA DD HH<br />

161 3 0.78 0.86 0.67 0.89 0.81<br />

162 4 0.85 0.89 0.85 0.91 0.85<br />

163 2 0.75 0.86 0.51 0.83 0.70<br />

164 2 0.75 0.86 0.58 0.83 0.76<br />

165 3 0.82 0.89 0.73 0.85 0.80<br />

166 2 0.78 0.86 0.60 0.89 0.74<br />

167 2 0.78 0.86 0.67 0.89 0.81<br />

168 3 0.85 0.89 0.85 0.91 0.85<br />

169 2 0.75 0.86 0.51 0.83 0.70<br />

170 3 0.75 0.86 0.58 0.83 0.76<br />

171 4 0.82 0.89 0.73 0.85 0.80<br />

172 3 0.78 0.86 0.60 0.89 0.74<br />

173 3 0.78 0.86 0.67 0.89 0.81<br />

174 4 0.85 0.89 0.85 0.91 0.85<br />

175 2 0.78 0.86 0.60 0.89 0.74<br />

176 3 0.78 0.86 0.67 0.89 0.81<br />

177 3 0.85 0.89 0.85 0.91 0.85<br />

178 2 0.78 0.86 0.60 0.89 0.74<br />

179 2 0.78 0.86 0.67 0.89 0.81<br />

180 3 0.85 0.89 0.85 0.91 0.85<br />

181 2 0.76 0.87 0.53 0.85 0.72<br />

182 2 0.76 0.87 0.60 0.85 0.79<br />

183 3 0.83 0.90 0.76 0.86 0.83<br />

184 2 0.79 0.87 0.62 0.91 0.77<br />

185 3 0.79 0.87 0.70 0.91 0.84<br />

186 3 0.86 0.90 0.88 0.93 0.88<br />

187 3 0.76 0.87 0.53 0.85 0.72<br />

188 3 0.76 0.87 0.60 0.85 0.79<br />

189 4 0.83 0.90 0.76 0.86 0.83<br />

190 3 0.79 0.87 0.62 0.91 0.77<br />

191 4 0.79 0.87 0.70 0.91 0.84<br />

192 4 0.86 0.90 0.88 0.93 0.88<br />

193 2 0.76 0.87 0.53 0.85 0.72<br />

194 2 0.76 0.87 0.60 0.85 0.79<br />

195 3 0.83 0.90 0.76 0.86 0.83<br />

196 2 0.79 0.87 0.62 0.91 0.77<br />

197 3 0.79 0.87 0.70 0.91 0.84<br />

198 3 0.86 0.90 0.88 0.93 0.88<br />

199 3 0.76 0.87 0.53 0.85 0.72<br />

200 3 0.76 0.87 0.60 0.85 0.79<br />

201 4 0.83 0.90 0.76 0.86 0.83<br />

202 3 0.79 0.87 0.62 0.91 0.77<br />

203 4 0.79 0.87 0.70 0.91 0.84<br />

204 4 0.86 0.90 0.88 0.93 0.88<br />

205 2 0.79 0.87 0.62 0.91 0.77<br />

206 3 0.79 0.87 0.70 0.91 0.84<br />

207 4 0.86 0.90 0.88 0.93 0.88<br />

208 2 0.79 0.87 0.62 0.91 0.77<br />

209 3 0.79 0.87 0.70 0.91 0.84<br />

210 3 0.86 0.90 0.88 0.93 0.88<br />

211 2 0.78 0.88 0.55 0.87 0.74<br />

212 3 0.78 0.88 0.62 0.87 0.81<br />

213 3 0.84 0.91 0.78 0.88 0.86<br />

214 3 0.81 0.88 0.64 0.93 0.79<br />

215 3 0.81 0.88 0.72 0.93 0.86<br />

216 4 0.88 0.91 0.91 0.95 0.91<br />

217 3 0.78 0.88 0.55 0.87 0.74<br />

218 4 0.78 0.88 0.62 0.87 0.81<br />

219 5 0.84 0.91 0.78 0.88 0.86<br />

220 4 0.81 0.88 0.64 0.93 0.79<br />

221 4 0.81 0.88 0.72 0.93 0.86<br />

222 5 0.88 0.91 0.91 0.95 0.91<br />

223 2 0.78 0.88 0.55 0.87 0.74<br />

224 3 0.78 0.88 0.62 0.87 0.81<br />

225 3 0.84 0.91 0.78 0.88 0.86<br />

226 3 0.81 0.88 0.64 0.93 0.79<br />

227 3 0.81 0.88 0.72 0.93 0.86<br />

228 4 0.88 0.91 0.91 0.95 0.91<br />

229 3 0.78 0.88 0.55 0.87 0.74<br />

230 4 0.78 0.88 0.62 0.87 0.81<br />

231 5 0.84 0.91 0.78 0.88 0.86<br />

232 4 0.81 0.88 0.64 0.93 0.79<br />

233 4 0.81 0.88 0.72 0.93 0.86<br />

234 5 0.88 0.91 0.91 0.95 0.91<br />

235 3 0.81 0.88 0.64 0.93 0.79<br />

236 4 0.81 0.88 0.72 0.93 0.86<br />

237 4 0.88 0.91 0.91 0.95 0.91<br />

238 3 0.81 0.88 0.64 0.93 0.79<br />

239 3 0.81 0.88 0.72 0.93 0.86<br />

240 4 0.88 0.91 0.91 0.95 0.91<br />

241 3 0.79 0.90 0.57 0.87 0.77<br />

242 3 0.79 0.90 0.64 0.87 0.84<br />

243 4 0.86 0.93 0.81 0.89 0.88<br />

244 3 0.83 0.90 0.66 0.94 0.82<br />

245 4 0.83 0.90 0.74 0.94 0.89<br />

246 4 0.90 0.93 0.94 0.96 0.94<br />

247 4 0.79 0.90 0.57 0.87 0.77<br />

248 4 0.79 0.90 0.64 0.87 0.84<br />

249 5 0.86 0.93 0.81 0.89 0.88<br />

250 4 0.83 0.90 0.66 0.94 0.82<br />

251 5 0.83 0.90 0.74 0.94 0.89<br />

252 6 0.90 0.93 0.94 0.96 0.94<br />

253 3 0.79 0.90 0.57 0.87 0.77<br />

254 3 0.79 0.90 0.64 0.87 0.84<br />

255 4 0.86 0.93 0.81 0.89 0.88<br />

256 3 0.83 0.90 0.66 0.94 0.82<br />

257 4 0.83 0.90 0.74 0.94 0.89<br />

258 4 0.90 0.93 0.94 0.96 0.94<br />

259 4 0.79 0.90 0.57 0.87 0.77<br />

260 4 0.79 0.90 0.64 0.87 0.84<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-18A

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

MISCELLANEOUS DISCOUNT & SURCHARGE RATING FACTORS<br />

RATING FACTOR<br />

RATING PLAN RULE GROUP AA BB VA DD HH<br />

261 5 0.86 0.93 0.81 0.89 0.88<br />

262 4 0.83 0.90 0.66 0.94 0.82<br />

263 5 0.83 0.90 0.74 0.94 0.89<br />

264 6 0.90 0.93 0.94 0.96 0.94<br />

265 3 0.83 0.90 0.66 0.94 0.82<br />

266 4 0.83 0.90 0.74 0.94 0.89<br />

267 5 0.90 0.93 0.94 0.96 0.94<br />

268 3 0.83 0.90 0.66 0.94 0.82<br />

269 4 0.83 0.90 0.74 0.94 0.89<br />

270 4 0.90 0.93 0.94 0.96 0.94<br />

271 3 0.81 0.91 0.58 0.89 0.79<br />

272 3 0.81 0.91 0.66 0.89 0.87<br />

273 4 0.88 0.94 0.83 0.91 0.91<br />

274 3 0.85 0.91 0.68 0.96 0.84<br />

275 4 0.85 0.91 0.77 0.96 0.92<br />

276 5 0.92 0.94 0.97 0.98 0.97<br />

277 4 0.81 0.91 0.58 0.89 0.79<br />

278 5 0.81 0.91 0.66 0.89 0.87<br />

279 6 0.88 0.94 0.83 0.91 0.91<br />

280 4 0.85 0.91 0.68 0.96 0.84<br />

281 5 0.85 0.91 0.77 0.96 0.92<br />

282 6 0.92 0.94 0.97 0.98 0.97<br />

283 3 0.81 0.91 0.58 0.89 0.79<br />

284 3 0.81 0.91 0.66 0.89 0.87<br />

285 4 0.88 0.94 0.83 0.91 0.91<br />

286 3 0.85 0.91 0.68 0.96 0.84<br />

287 4 0.85 0.91 0.77 0.96 0.92<br />

288 5 0.92 0.94 0.97 0.98 0.97<br />

289 4 0.81 0.91 0.58 0.89 0.79<br />

290 5 0.81 0.91 0.66 0.89 0.87<br />

291 6 0.88 0.94 0.83 0.91 0.91<br />

292 4 0.85 0.91 0.68 0.96 0.84<br />

293 5 0.85 0.91 0.77 0.96 0.92<br />

294 6 0.92 0.94 0.97 0.98 0.97<br />

295 4 0.85 0.91 0.68 0.96 0.84<br />

296 4 0.85 0.91 0.77 0.96 0.92<br />

297 5 0.92 0.94 0.97 0.98 0.97<br />

298 3 0.85 0.91 0.68 0.96 0.84<br />

299 4 0.85 0.91 0.77 0.96 0.92<br />

300 5 0.92 0.94 0.97 0.98 0.97<br />

301 2 0.83 0.93 0.60 0.91 0.82<br />

302 2 0.83 0.93 0.68 0.91 0.89<br />

303 4 0.90 0.96 0.86 0.93 0.94<br />

304 3 0.86 0.93 0.70 0.98 0.87<br />

305 4 0.86 0.93 0.79 0.98 0.95<br />

306 5 0.94 0.96 1.00 1.00 1.00<br />

307 4 0.83 0.93 0.60 0.91 0.82<br />

308 5 0.83 0.93 0.68 0.91 0.89<br />

309 6 0.90 0.96 0.86 0.93 0.94<br />

310 5 0.86 0.93 0.70 0.98 0.87<br />

311 6 0.86 0.93 0.79 0.98 0.95<br />

312 7 0.94 0.96 1.00 1.00 1.00<br />

313 3 0.83 0.93 0.60 0.91 0.82<br />

314 4 0.83 0.93 0.68 0.91 0.89<br />

315 4 0.90 0.96 0.86 0.93 0.94<br />

316 3 0.86 0.93 0.70 0.98 0.87<br />

317 4 0.86 0.93 0.79 0.98 0.95<br />

318 5 0.94 0.96 1.00 1.00 1.00<br />

319 4 0.83 0.93 0.60 0.91 0.82<br />

320 5 0.83 0.93 0.68 0.91 0.89<br />

321 6 0.90 0.96 0.86 0.93 0.94<br />

322 5 0.86 0.93 0.70 0.98 0.87<br />

323 6 0.86 0.93 0.79 0.98 0.95<br />

324 7 0.94 0.96 1.00 1.00 1.00<br />

325 4 0.86 0.93 0.70 0.98 0.87<br />

326 5 0.86 0.93 0.79 0.98 0.95<br />

327 6 0.94 0.96 1.00 1.00 1.00<br />

328 3 0.86 0.93 0.70 0.98 0.87<br />

329 4 0.86 0.93 0.79 0.98 0.95<br />

330 5 0.94 0.96 1.00 1.00 1.00<br />

331 2 0.85 0.94 0.62 0.93 0.84<br />

332 3 0.85 0.94 0.70 0.93 0.92<br />

333 5 0.92 0.97 0.89 0.95 0.97<br />

334 4 0.88 0.94 0.72 1.00 0.90<br />

335 5 0.88 0.94 0.81 1.00 0.98<br />

336 5 0.96 0.97 1.03 1.02 1.03<br />

337 5 0.85 0.94 0.62 0.93 0.84<br />

338 5 0.85 0.94 0.70 0.93 0.92<br />

339 6 0.92 0.97 0.89 0.95 0.97<br />

340 5 0.88 0.94 0.72 1.00 0.90<br />

341 6 0.88 0.94 0.81 1.00 0.98<br />

342 7 0.96 0.97 1.03 1.02 1.03<br />

343 3 0.85 0.94 0.62 0.93 0.84<br />

344 4 0.85 0.94 0.70 0.93 0.92<br />

345 5 0.92 0.97 0.89 0.95 0.97<br />

346 4 0.88 0.94 0.72 1.00 0.90<br />

347 5 0.88 0.94 0.81 1.00 0.98<br />

348 5 0.96 0.97 1.03 1.02 1.03<br />

349 5 0.85 0.94 0.62 0.93 0.84<br />

350 5 0.85 0.94 0.70 0.93 0.92<br />

351 6 0.92 0.97 0.89 0.95 0.97<br />

352 5 0.88 0.94 0.72 1.00 0.90<br />

353 6 0.88 0.94 0.81 1.00 0.98<br />

354 7 0.96 0.97 1.03 1.02 1.03<br />

355 4 0.88 0.94 0.72 1.00 0.90<br />

356 5 0.88 0.94 0.81 1.00 0.98<br />

357 6 0.96 0.97 1.03 1.02 1.03<br />

358 4 0.88 0.94 0.72 1.00 0.90<br />

359 5 0.88 0.94 0.81 1.00 0.98<br />

360 5 0.96 0.97 1.03 1.02 1.03<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-19A

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

MISCELLANEOUS DISCOUNT & SURCHARGE RATING FACTORS<br />

RATING FACTOR<br />

RATING PLAN RULE GROUP AA BB VA DD HH<br />

361 3 0.87 0.96 0.64 0.95 0.88<br />

362 3 0.87 0.96 0.73 0.95 0.96<br />

363 5 0.94 0.99 0.92 0.97 1.01<br />

364 4 0.90 0.96 0.75 1.02 0.93<br />

365 5 0.90 0.96 0.85 1.02 1.02<br />

366 6 0.98 0.99 1.07 1.04 1.07<br />

367 5 0.87 0.96 0.64 0.95 0.88<br />

368 5 0.87 0.96 0.73 0.95 0.96<br />

369 7 0.94 0.99 0.92 0.97 1.01<br />

370 5 0.90 0.96 0.75 1.02 0.93<br />

371 6 0.90 0.96 0.85 1.02 1.02<br />

372 7 0.98 0.99 1.07 1.04 1.07<br />

373 3 0.87 0.96 0.64 0.95 0.88<br />

374 4 0.87 0.96 0.73 0.95 0.96<br />

375 5 0.94 0.99 0.92 0.97 1.01<br />

376 4 0.90 0.96 0.75 1.02 0.93<br />

377 5 0.90 0.96 0.85 1.02 1.02<br />

378 6 0.98 0.99 1.07 1.04 1.07<br />

379 5 0.87 0.96 0.64 0.95 0.88<br />

380 6 0.87 0.96 0.73 0.95 0.96<br />

381 7 0.94 0.99 0.92 0.97 1.01<br />

382 5 0.90 0.96 0.75 1.02 0.93<br />

383 6 0.90 0.96 0.85 1.02 1.02<br />

384 7 0.98 0.99 1.07 1.04 1.07<br />

385 4 0.90 0.96 0.75 1.02 0.93<br />

386 5 0.90 0.96 0.85 1.02 1.02<br />

387 6 0.98 0.99 1.07 1.04 1.07<br />

388 4 0.90 0.96 0.75 1.02 0.93<br />

389 5 0.90 0.96 0.85 1.02 1.02<br />

390 6 0.98 0.99 1.07 1.04 1.07<br />

391 3 0.88 0.97 0.66 0.97 0.90<br />

392 3 0.88 0.97 0.75 0.97 0.98<br />

393 5 0.96 1.00 0.95 0.99 1.03<br />

394 4 0.92 0.97 0.77 1.04 0.96<br />

395 5 0.92 0.97 0.87 1.04 1.05<br />

396 6 1.00 1.00 1.10 1.06 1.10<br />

397 5 0.88 0.97 0.66 0.97 0.90<br />

398 6 0.88 0.97 0.75 0.97 0.98<br />

399 7 0.96 1.00 0.95 0.99 1.03<br />

400 6 0.92 0.97 0.77 1.04 0.96<br />

401 7 0.92 0.97 0.87 1.04 1.05<br />

402 8 1.00 1.00 1.10 1.06 1.10<br />

403 4 0.88 0.97 0.66 0.97 0.90<br />

404 5 0.88 0.97 0.75 0.97 0.98<br />

405 5 0.96 1.00 0.95 0.99 1.03<br />

406 4 0.92 0.97 0.77 1.04 0.96<br />

407 5 0.92 0.97 0.87 1.04 1.05<br />

408 6 1.00 1.00 1.10 1.06 1.10<br />

409 5 0.88 0.97 0.66 0.97 0.90<br />

410 6 0.88 0.97 0.75 0.97 0.98<br />

411 7 0.96 1.00 0.95 0.99 1.03<br />

412 6 0.92 0.97 0.77 1.04 0.96<br />

413 7 0.92 0.97 0.87 1.04 1.05<br />

414 8 1.00 1.00 1.10 1.06 1.10<br />

415 5 0.92 0.97 0.77 1.04 0.96<br />

416 6 0.92 0.97 0.87 1.04 1.05<br />

417 7 1.00 1.00 1.10 1.06 1.10<br />

418 4 0.92 0.97 0.77 1.04 0.96<br />

419 5 0.92 0.97 0.87 1.04 1.05<br />

420 6 1.00 1.00 1.10 1.06 1.10<br />

421 3 0.90 0.99 0.69 0.98 0.93<br />

422 3 0.90 0.99 0.77 0.98 1.02<br />

423 6 0.98 1.02 0.98 1.00 1.07<br />

424 5 0.94 0.99 0.80 1.06 0.99<br />

425 6 0.94 0.99 0.90 1.06 1.08<br />

426 7 1.02 1.02 1.14 1.08 1.14<br />

427 6 0.90 0.99 0.69 0.98 0.93<br />

428 7 0.90 0.99 0.77 0.98 1.02<br />

429 8 0.98 1.02 0.98 1.00 1.07<br />

430 7 0.94 0.99 0.80 1.06 0.99<br />

431 7 0.94 0.99 0.90 1.06 1.08<br />

432 8 1.02 1.02 1.14 1.08 1.14<br />

433 4 0.90 0.99 0.69 0.98 0.93<br />

434 5 0.90 0.99 0.77 0.98 1.02<br />

435 6 0.98 1.02 0.98 1.00 1.07<br />

436 5 0.94 0.99 0.80 1.06 0.99<br />

437 6 0.94 0.99 0.90 1.06 1.08<br />

438 7 1.02 1.02 1.14 1.08 1.14<br />

439 6 0.90 0.99 0.69 0.98 0.93<br />

440 7 0.90 0.99 0.77 0.98 1.02<br />

441 8 0.98 1.02 0.98 1.00 1.07<br />

442 7 0.94 0.99 0.80 1.06 0.99<br />

443 7 0.94 0.99 0.90 1.06 1.08<br />

444 8 1.02 1.02 1.14 1.08 1.14<br />

445 6 0.94 0.99 0.80 1.06 0.99<br />

446 7 0.94 0.99 0.90 1.06 1.08<br />

447 7 1.02 1.02 1.14 1.08 1.14<br />

448 5 0.94 0.99 0.80 1.06 0.99<br />

449 6 0.94 0.99 0.90 1.06 1.08<br />

450 7 1.02 1.02 1.14 1.08 1.14<br />

451 3 0.92 1.00 0.71 1.00 0.97<br />

452 4 0.92 1.00 0.80 1.00 1.05<br />

453 7 1.00 1.03 1.01 1.02 1.11<br />

454 6 0.96 1.00 0.83 1.08 1.03<br />

455 7 0.96 1.00 0.93 1.08 1.12<br />

456 8 1.04 1.03 1.18 1.10 1.18<br />

457 7 0.92 1.00 0.71 1.00 0.97<br />

458 8 0.92 1.00 0.80 1.00 1.05<br />

459 8 1.00 1.03 1.01 1.02 1.11<br />

460 8 0.96 1.00 0.83 1.08 1.03<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-20A

DELAWARE<br />

VOLUNTARY PRIVATE PASSENGER AUTO<br />

MISCELLANEOUS DISCOUNT & SURCHARGE RATING FACTORS<br />

RATING FACTOR<br />

RATING PLAN RULE GROUP AA BB VA DD HH<br />

461 8 0.96 1.00 0.93 1.08 1.12<br />

462 8 1.04 1.03 1.18 1.10 1.18<br />

463 5 0.92 1.00 0.71 1.00 0.97<br />

464 6 0.92 1.00 0.80 1.00 1.05<br />

465 7 1.00 1.03 1.01 1.02 1.11<br />

466 6 0.96 1.00 0.83 1.08 1.03<br />

467 7 0.96 1.00 0.93 1.08 1.12<br />

468 8 1.04 1.03 1.18 1.10 1.18<br />

469 7 0.92 1.00 0.71 1.00 0.97<br />

470 8 0.92 1.00 0.80 1.00 1.05<br />

471 8 1.00 1.03 1.01 1.02 1.11<br />

472 8 0.96 1.00 0.83 1.08 1.03<br />

473 8 0.96 1.00 0.93 1.08 1.12<br />

474 8 1.04 1.03 1.18 1.10 1.18<br />

475 7 0.96 1.00 0.83 1.08 1.03<br />

476 8 0.96 1.00 0.93 1.08 1.12<br />

477 8 1.04 1.03 1.18 1.10 1.18<br />

478 6 0.96 1.00 0.83 1.08 1.03<br />

479 7 0.96 1.00 0.93 1.08 1.12<br />

480 8 1.04 1.03 1.18 1.10 1.18<br />

December 1, 2011 Allst<strong>at</strong>e Indemnity Company RP-21A

SERFF Tracking Number: ALSE-127823434 St<strong>at</strong>e: <strong>Delaware</strong><br />

<strong>Filing</strong> Company: Allst<strong>at</strong>e Indemnity Company St<strong>at</strong>e Tracking Number: 45814<br />

Company Tracking Number: R24381: AI RATE CHANGE (+15.0%)<br />

TOI: 19.0 Personal Auto Sub-TOI: 19.0001 Priv<strong>at</strong>e Passenger Auto (PPA)<br />

Product Name: DE AI R<strong>at</strong>e Change (+15.0%)<br />

Project Name/Number: DE AI R<strong>at</strong>e Change (+15.0%)/810818<br />

Supporting Document Schedules<br />

S<strong>at</strong>isfied - Item: P&C - St<strong>at</strong>e Specific Requirements<br />

Comments:<br />

Attachment:<br />

R24381 - St<strong>at</strong>e<strong>Filing</strong>Form.pdf<br />

S<strong>at</strong>isfied - Item: Supporting Documents<br />

Comments:<br />

Attachments:<br />

ActIndMemo01-R24381.pdf<br />

Bulletin 23-R24381.pdf<br />

S<strong>at</strong>isfied - Item: R<strong>at</strong>e Impact by Territory / Territory<br />

Definitions<br />

Comments:<br />

Attachments:<br />

R<strong>at</strong>e Impact by Territory.pdf<br />

Allst<strong>at</strong>e Indemnity Auto Territory Definitions.pdf<br />

PDF Pipeline for SERFF Tracking Number ALSE-127823434 Gener<strong>at</strong>ed 03/05/2012 03:00 PM<br />

Item St<strong>at</strong>us: St<strong>at</strong>us<br />

D<strong>at</strong>e:<br />

Item St<strong>at</strong>us: St<strong>at</strong>us<br />

D<strong>at</strong>e:<br />

Item St<strong>at</strong>us: St<strong>at</strong>us<br />

D<strong>at</strong>e:

ALLSTATE INDEMNITY COMPANY<br />

VOLUNTARY PRIVATE PASSENGER AUTOMOBILE<br />

DELAWARE<br />

INDEX OF ATTACHMENTS<br />

Attachment I – Summary of Disclosures<br />

Page 1 Actuarial Standards of Practice<br />

Page 2 M<strong>at</strong>erial Changes in Sources of D<strong>at</strong>a, Assumptions, or Methods<br />

Attachment II – Summary of R<strong>at</strong>e Level Indic<strong>at</strong>ion<br />

Page 1 Formula Calcul<strong>at</strong>ions for R<strong>at</strong>e Level Indic<strong>at</strong>ions<br />

Page 2 Base D<strong>at</strong>a<br />

Pages 3-5 Adjustments to Losses<br />

Pages 6-8 Expense and Profit Provision<br />

Page 9 Adjustments to Premiums<br />

Attachment III – R<strong>at</strong>e Level Indic<strong>at</strong>ion Exhibits<br />

Exhibits 1.1-1.6 Determin<strong>at</strong>ion of St<strong>at</strong>ewide R<strong>at</strong>e Level Indic<strong>at</strong>ion<br />

Exhibits 2.1-2.6 Development of Provision for Loss and LAE<br />

Exhibits 3.1-3.6 Calcul<strong>at</strong>ion of Loss Development Factors – Additive Method<br />

Exhibits 4.1-4.6 Calcul<strong>at</strong>ion of Loss Development Factors – Link R<strong>at</strong>io Method<br />

Exhibit 5 Ultim<strong>at</strong>e Losses & ALAE<br />

Exhibit 6 Unalloc<strong>at</strong>ed Loss Adjustment Expense Provision<br />

Exhibit 7 Calcul<strong>at</strong>ion of Pure Premium Trend Factor<br />

Exhibits 8.1-8.6 Loss Trends – Pure Premium<br />

Exhibits 8.7-8.12 Loss Trends – Frequency<br />

Exhibits 8.13-8.18 Loss Trends – Severity<br />

Exhibit 9 C<strong>at</strong>astrophe <strong>Insurance</strong> Losses - Comprehensive<br />

Exhibit 10 Summary of Expense Provisions<br />

Exhibit 11 Countrywide Expense Experience For Other Acquisition<br />

Exhibit 12 Countrywide Expense Experience For <strong>General</strong> Expenses<br />

Exhibit 13 Factor to Adjust for Subsequent Change in Fixed Expense<br />

Exhibits 14.1-14.2 Investment Income<br />

Exhibits 15.1-15.6 Development of Projected Average Earned Premium<br />

Exhibit 16 Calcul<strong>at</strong>ion of Premium Trend Factor<br />

Exhibits 17.1-17.6 Premium Trends<br />

Attachment IV– Summary of R<strong>at</strong>ing Plan Changes<br />

Pages 1-3 Summary of R<strong>at</strong>ing Plan Changes<br />

Exhibits 1-8 Summary of R<strong>at</strong>ing Plan Changes – Exhibits<br />

Attachment V– Summary of Manual Changes<br />

Page 1 Summary of Manual Changes<br />

Index<br />

Page 1

ATTACHMENT I<br />

Summary of Disclosures

ALLSTATE INDEMNITY COMPANY<br />

VOLUNTARY PRIVATE PASSENGER AUTOMOBILE<br />

DELAWARE<br />

ACTUARIAL STANDARDS OF PRACTICE<br />

This document confirms compliance with the following Actuarial Standards of Practices<br />

th<strong>at</strong> are applicable to the prepar<strong>at</strong>ion of st<strong>at</strong>ewide r<strong>at</strong>e filings performed by casualty<br />

actuaries as st<strong>at</strong>ed in “Applicability Guidelines for Actuarial Standards of Practice”<br />

(American Academy of Actuaries, September 2004). In addition, references to relevant<br />

sections of this filing are included, where applicable.<br />

Actuarial Standard of Practice No. 12, Risk Classific<strong>at</strong>ion (for all Practice Areas)<br />

- Att IV, Pages 1-3: Summary of R<strong>at</strong>ing Plan Changes.<br />

Actuarial Standard of Practice No. 13, Trending Procedures in Property/Casualty<br />

<strong>Insurance</strong> R<strong>at</strong>emaking<br />

- Att II, Page 1: Formula Calcul<strong>at</strong>ions for R<strong>at</strong>e Level Indic<strong>at</strong>ions<br />

- Att II, Pages 4-5: Adjustments to Losses – Loss Trend<br />

- Att II, Page 7: Expenses, Profit Provision– Fixed Expenses – Trend<br />

- Att II, Page 9: Adjustments to Premiums – Premium Trend<br />

Actuarial Standard of Practice No. 23, D<strong>at</strong>a Quality<br />

- Att II, Page 1: Formula Calcul<strong>at</strong>ions for R<strong>at</strong>e Level Indic<strong>at</strong>ions<br />

Actuarial Standard of Practice No. 25, Credibility Procedures Applicable to<br />

Accident and Health, Group Term Life, and Property/Casualty Coverages<br />

- Att II, Page 2: Base D<strong>at</strong>a – Accident Year Weights<br />

- Att II, Pages 4-5: Adjustments to Losses - Loss Trend<br />

Actuarial Standard of Practice No. 29, Expense Provisions in Property/Casualty<br />

<strong>Insurance</strong> R<strong>at</strong>emaking<br />

- Att II, Pages 6-8: Expenses and Profit Provision<br />

Actuarial Standard of Practice No. 30, Tre<strong>at</strong>ment of Profit and Contingency<br />

Provisions and the Cost of Capital in Property/Casualty <strong>Insurance</strong> R<strong>at</strong>emaking<br />

- Att II, Pages 7-8: Expenses and Profit Provision– Variable Expenses –<br />

Underwriting Profit<br />

Actuarial Standard of Practice No. 38, Using Models Outside the Actuary’s Area<br />

of Expertise (Property and Casualty)<br />

- This ASOP is not applicable to this r<strong>at</strong>e filing, as no models outside of the<br />

Actuary’s Area of Expertise were applied<br />

Actuarial Standard of Practice No. 39, Tre<strong>at</strong>ment of C<strong>at</strong>astrophe Losses in<br />

Property/Casualty <strong>Insurance</strong> R<strong>at</strong>emaking<br />

- Att II, Page 5: Adjustments to Losses - C<strong>at</strong>astrophes<br />

Actuarial Standard of Practice No. 41, Actuarial Communic<strong>at</strong>ions<br />

- Applies to this filing in its entirety<br />

Attachment I<br />

Page 1

ALLSTATE INDEMNITY COMPANY<br />

VOLUNTARY PRIVATE PASSENGER AUTOMOBILE<br />

DELAWARE<br />

MATERIAL CHANGES IN SOURCES OF DATA, ASSUMPTIONS, OR<br />

METHODS<br />

Attachment I<br />

Page 2<br />

This document lists all m<strong>at</strong>erial changes in sources of d<strong>at</strong>a, assumptions, or methods from<br />

the last priv<strong>at</strong>e passenger automobile Allst<strong>at</strong>e r<strong>at</strong>e level indic<strong>at</strong>ion filing. These changes<br />

are further described in the subsequent memos in compliance with Actuarial Standard of<br />

Practice No. 41, Actuarial Communic<strong>at</strong>ions.<br />

ULAE Provision<br />