INFORMACJA DODATKOWA DO SPRAWOZDANIA ... - Inter Cars SA

INFORMACJA DODATKOWA DO SPRAWOZDANIA ... - Inter Cars SA

INFORMACJA DODATKOWA DO SPRAWOZDANIA ... - Inter Cars SA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Separate Annual Financial Statements of <strong>Inter</strong> <strong>Cars</strong> S.A. for the period January 1st – December 31st 2010<br />

Notes<br />

(PLN’000)<br />

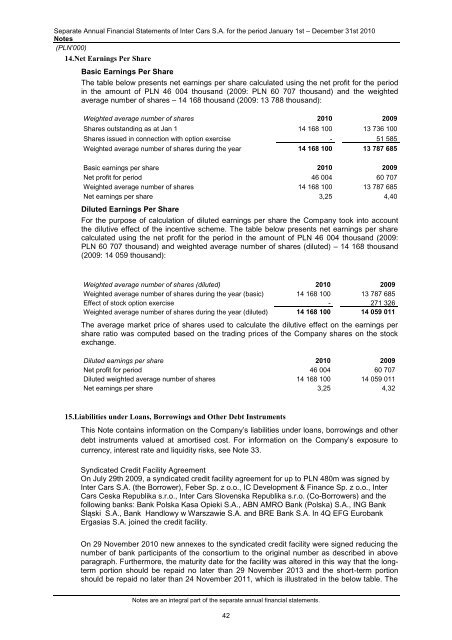

14.Net Earnings Per Share<br />

Basic Earnings Per Share<br />

The table below presents net earnings per share calculated using the net profit for the period<br />

in the amount of PLN 46 004 thousand (2009: PLN 60 707 thousand) and the weighted<br />

average number of shares – 14 168 thousand (2009: 13 788 thousand):<br />

Weighted average number of shares 2010 2009<br />

Shares outstanding as at Jan 1 14 168 100 13 736 100<br />

Shares issued in connection with option exercise - 51 585<br />

Weighted average number of shares during the year 14 168 100 13 787 685<br />

Basic earnings per share 2010 2009<br />

Net profit for period 46 004 60 707<br />

Weighted average number of shares 14 168 100 13 787 685<br />

Net earnings per share 3,25 4,40<br />

Diluted Earnings Per Share<br />

For the purpose of calculation of diluted earnings per share the Company took into account<br />

the dilutive effect of the incentive scheme. The table below presents net earnings per share<br />

calculated using the net profit for the period in the amount of PLN 46 004 thousand (2009:<br />

PLN 60 707 thousand) and weighted average number of shares (diluted) – 14 168 thousand<br />

(2009: 14 059 thousand):<br />

Weighted average number of shares (diluted) 2010 2009<br />

Weighted average number of shares during the year (basic) 14 168 100 13 787 685<br />

Effect of stock option exercise - 271 326<br />

Weighted average number of shares during the year (diluted) 14 168 100 14 059 011<br />

The average market price of shares used to calculate the dilutive effect on the earnings per<br />

share ratio was computed based on the trading prices of the Company shares on the stock<br />

exchange.<br />

Diluted earnings per share 2010 2009<br />

Net profit for period 46 004 60 707<br />

Diluted weighted average number of shares 14 168 100 14 059 011<br />

Net earnings per share 3,25 4,32<br />

15.Liabilities under Loans, Borrowings and Other Debt Instruments<br />

This Note contains information on the Company‟s liabilities under loans, borrowings and other<br />

debt instruments valued at amortised cost. For information on the Company‟s exposure to<br />

currency, interest rate and liquidity risks, see Note 33.<br />

Syndicated Credit Facility Agreement<br />

On July 29th 2009, a syndicated credit facility agreement for up to PLN 480m was signed by<br />

<strong>Inter</strong> <strong>Cars</strong> S.A. (the Borrower), Feber Sp. z o.o., IC Development & Finance Sp. z o.o., <strong>Inter</strong><br />

<strong>Cars</strong> Ceska Republika s.r.o., <strong>Inter</strong> <strong>Cars</strong> Slovenska Republika s.r.o. (Co-Borrowers) and the<br />

following banks: Bank Polska Kasa Opieki S.A., ABN AMRO Bank (Polska) S.A., ING Bank<br />

Śląski S.A., Bank Handlowy w Warszawie S.A. and BRE Bank S.A. In 4Q EFG Eurobank<br />

Ergasias S.A. joined the credit facility.<br />

On 29 November 2010 new annexes to the syndicated credit facility were signed reducing the<br />

number of bank participants of the consortium to the original number as described in above<br />

paragraph. Furthermore, the maturity date for the facility was altered in this way that the longterm<br />

portion should be repaid no later than 29 November 2013 and the short-term portion<br />

should be repaid no later than 24 November 2011, which is illustrated in the below table. The<br />

Notes are an integral part of the separate annual financial statements.<br />

42