Focus - The Dow Chemical Company

Focus - The Dow Chemical Company

Focus - The Dow Chemical Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management’s Discussion and Analysis of Financial Condition and Results of Operations<br />

<strong>Chemical</strong>s<br />

<strong>Chemical</strong>s sales were $3.4 billion in 2002, compared with $3.6 billion<br />

in 2001 and $4.1 billion in 2000. Prices decreased 11 percent<br />

versus 2001, primarily due to decreases in organic intermediates,<br />

solvents and monomers (“OISM”), caustic soda, and<br />

chloromethanes, somewhat offset by higher vinyl chloride<br />

monomer (“VCM”) and ethylene dichloride (“EDC”) prices.<br />

Volume was up 6 percent from 2001, with increases in ethylene<br />

glycol (“EG”), chlorinated organics and VCM. In 2001, prices<br />

declined 5 percent and volumes declined 9 percent versus 2000.<br />

EBIT was a loss of $78 million in 2002, down from income of<br />

$111 million in 2001, principally due to declining prices that were<br />

only partially offset by lower feedstock and energy costs. EBIT was<br />

also impacted by costs related to the start-up of new VCM facilities<br />

in Freeport, Texas, and chlor-alkali facilities in Stade, Germany; and<br />

a $13 million charge for the write-down of assets related to the<br />

shutdown of a chlor-alkali facility in Fort Saskatchewan, Alberta,<br />

Canada. EBIT in 2001 was down from $422 million in 2000, principally<br />

due to declining prices and volumes.<br />

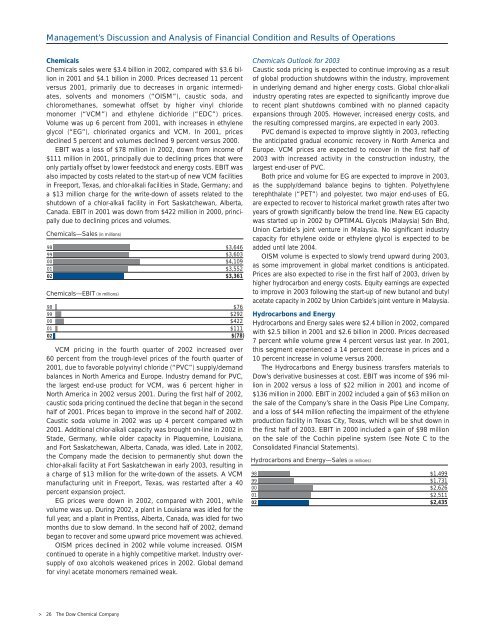

<strong>Chemical</strong>s—Sales (in millions)<br />

98 $3,646<br />

99<br />

$3,603<br />

00<br />

$4,109<br />

01<br />

$3,552<br />

02<br />

$3,361<br />

<strong>Chemical</strong>s—EBIT (in millions)<br />

98 $76<br />

99<br />

$292<br />

00<br />

$422<br />

01<br />

$111<br />

02<br />

$(78)<br />

VCM pricing in the fourth quarter of 2002 increased over<br />

60 percent from the trough-level prices of the fourth quarter of<br />

2001, due to favorable polyvinyl chloride (“PVC”) supply/demand<br />

balances in North America and Europe. Industry demand for PVC,<br />

the largest end-use product for VCM, was 6 percent higher in<br />

North America in 2002 versus 2001. During the first half of 2002,<br />

caustic soda pricing continued the decline that began in the second<br />

half of 2001. Prices began to improve in the second half of 2002.<br />

Caustic soda volume in 2002 was up 4 percent compared with<br />

2001. Additional chlor-alkali capacity was brought on-line in 2002 in<br />

Stade, Germany, while older capacity in Plaquemine, Louisiana,<br />

and Fort Saskatchewan, Alberta, Canada, was idled. Late in 2002,<br />

the <strong>Company</strong> made the decision to permanently shut down the<br />

chlor-alkali facility at Fort Saskatchewan in early 2003, resulting in<br />

a charge of $13 million for the write-down of the assets. A VCM<br />

manufacturing unit in Freeport, Texas, was restarted after a 40<br />

percent expansion project.<br />

EG prices were down in 2002, compared with 2001, while<br />

volume was up. During 2002, a plant in Louisiana was idled for the<br />

full year, and a plant in Prentiss, Alberta, Canada, was idled for two<br />

months due to slow demand. In the second half of 2002, demand<br />

began to recover and some upward price movement was achieved.<br />

OISM prices declined in 2002 while volume increased. OISM<br />

continued to operate in a highly competitive market. Industry oversupply<br />

of oxo alcohols weakened prices in 2002. Global demand<br />

for vinyl acetate monomers remained weak.<br />

> 26 <strong>The</strong> <strong>Dow</strong> <strong>Chemical</strong> <strong>Company</strong><br />

<strong>Chemical</strong>s Outlook for 2003<br />

Caustic soda pricing is expected to continue improving as a result<br />

of global production shutdowns within the industry, improvement<br />

in underlying demand and higher energy costs. Global chlor-alkali<br />

industry operating rates are expected to significantly improve due<br />

to recent plant shutdowns combined with no planned capacity<br />

expansions through 2005. However, increased energy costs, and<br />

the resulting compressed margins, are expected in early 2003.<br />

PVC demand is expected to improve slightly in 2003, reflecting<br />

the anticipated gradual economic recovery in North America and<br />

Europe. VCM prices are expected to recover in the first half of<br />

2003 with increased activity in the construction industry, the<br />

largest end-user of PVC.<br />

Both price and volume for EG are expected to improve in 2003,<br />

as the supply/demand balance begins to tighten. Polyethylene<br />

terephthalate (“PET”) and polyester, two major end-uses of EG,<br />

are expected to recover to historical market growth rates after two<br />

years of growth significantly below the trend line. New EG capacity<br />

was started up in 2002 by OPTIMAL Glycols (Malaysia) Sdn Bhd,<br />

Union Carbide’s joint venture in Malaysia. No significant industry<br />

capacity for ethylene oxide or ethylene glycol is expected to be<br />

added until late 2004.<br />

OISM volume is expected to slowly trend upward during 2003,<br />

as some improvement in global market conditions is anticipated.<br />

Prices are also expected to rise in the first half of 2003, driven by<br />

higher hydrocarbon and energy costs. Equity earnings are expected<br />

to improve in 2003 following the start-up of new butanol and butyl<br />

acetate capacity in 2002 by Union Carbide’s joint venture in Malaysia.<br />

Hydrocarbons and Energy<br />

Hydrocarbons and Energy sales were $2.4 billion in 2002, compared<br />

with $2.5 billion in 2001 and $2.6 billion in 2000. Prices decreased<br />

7 percent while volume grew 4 percent versus last year. In 2001,<br />

this segment experienced a 14 percent decrease in prices and a<br />

10 percent increase in volume versus 2000.<br />

<strong>The</strong> Hydrocarbons and Energy business transfers materials to<br />

<strong>Dow</strong>’s derivative businesses at cost. EBIT was income of $96 million<br />

in 2002 versus a loss of $22 million in 2001 and income of<br />

$136 million in 2000. EBIT in 2002 included a gain of $63 million on<br />

the sale of the <strong>Company</strong>’s share in the Oasis Pipe Line <strong>Company</strong>,<br />

and a loss of $44 million reflecting the impairment of the ethylene<br />

production facility in Texas City, Texas, which will be shut down in<br />

the first half of 2003. EBIT in 2000 included a gain of $98 million<br />

on the sale of the Cochin pipeline system (see Note C to the<br />

Consolidated Financial Statements).<br />

Hydrocarbons and Energy—Sales (in millions)<br />

98 $1,499<br />

99<br />

$1,731<br />

00<br />

$2,626<br />

01<br />

$2,511<br />

02<br />

$2,435