fulfilling vision - Tenaga Nasional Berhad

fulfilling vision - Tenaga Nasional Berhad

fulfilling vision - Tenaga Nasional Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

62<br />

letter to<br />

SHAREHOLDERS (cont’d.)<br />

<strong>Tenaga</strong> <strong>Nasional</strong> <strong>Berhad</strong> 2005 Annual Report<br />

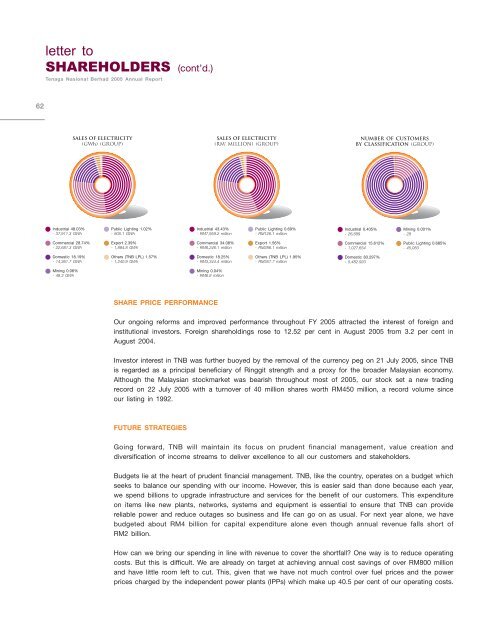

Industrial 48.03%<br />

- 37,911.3 GWh<br />

Commercial 28.74%<br />

- 22,681.3 GWh<br />

Domestic 18.19%<br />

- 14,361.7 GWh<br />

Mining 0.06%<br />

- 48.3 GWh<br />

sales of electricity<br />

(GWh) (Group)<br />

Public Lighting 1.02%<br />

- 805.1 GWh<br />

Export 2.39%<br />

- 1,884.8 GWh<br />

Others (TNB LPL) 1.57%<br />

- 1,240.9 GWh<br />

SHARE PRICE PERFORMANCE<br />

Our ongoing reforms and improved performance throughout FY 2005 attracted the interest of foreign and<br />

institutional investors. Foreign shareholdings rose to 12.52 per cent in August 2005 from 3.2 per cent in<br />

August 2004.<br />

Investor interest in TNB was further buoyed by the removal of the currency peg on 21 July 2005, since TNB<br />

is regarded as a principal beneficiary of Ringgit strength and a proxy for the broader Malaysian economy.<br />

Although the Malaysian stockmarket was bearish throughout most of 2005, our stock set a new trading<br />

record on 22 July 2005 with a turnover of 40 million shares worth RM450 million, a record volume since<br />

our listing in 1992.<br />

FUTURE STRATEGIES<br />

sales of electricity<br />

(RM' Million) (Group)<br />

Industrial 43.43%<br />

- RM7,959.2 million<br />

Commercial 34.08%<br />

- RM6,246.1 million<br />

Domestic 18.25%<br />

- RM3,344.4 million<br />

Mining 0.04%<br />

- RM6.8 million<br />

Public Lighting 0.69%<br />

- RM126.1 million<br />

Export 1.56%<br />

- RM286.1 million<br />

Others (TNB LPL) 1.95%<br />

- RM357.7 million<br />

number of customers<br />

by classification (group)<br />

Industrial 0.405%<br />

- 26,689<br />

Commercial 15.612%<br />

- 1,027,654<br />

Domestic 83.297%<br />

- 5,482.920<br />

Mining 0.001%<br />

- 28<br />

Public Lighting 0.685%<br />

- 45,083<br />

Going forward, TNB will maintain its focus on prudent financial management, value creation and<br />

diversification of income streams to deliver excellence to all our customers and stakeholders.<br />

Budgets lie at the heart of prudent financial management. TNB, like the country, operates on a budget which<br />

seeks to balance our spending with our income. However, this is easier said than done because each year,<br />

we spend billions to upgrade infrastructure and services for the benefit of our customers. This expenditure<br />

on items like new plants, networks, systems and equipment is essential to ensure that TNB can provide<br />

reliable power and reduce outages so business and life can go on as usual. For next year alone, we have<br />

budgeted about RM4 billion for capital expenditure alone even though annual revenue falls short of<br />

RM2 billion.<br />

How can we bring our spending in line with revenue to cover the shortfall? One way is to reduce operating<br />

costs. But this is difficult. We are already on target at achieving annual cost savings of over RM800 million<br />

and have little room left to cut. This, given that we have not much control over fuel prices and the power<br />

prices charged by the independent power plants (IPPs) which make up 40.5 per cent of our operating costs.