Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

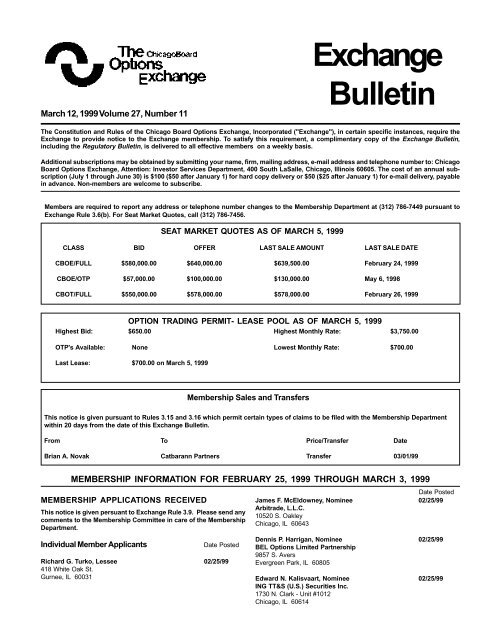

March 12, 1999Volume 27, Number 11<br />

<strong>Exchange</strong><br />

<strong>Bulletin</strong><br />

The Constitution and Rules of the Chicago Board Options <strong>Exchange</strong>, Incorporated ("<strong>Exchange</strong>"), in certain specific instances, require the<br />

<strong>Exchange</strong> to provide notice to the <strong>Exchange</strong> membership. To satisfy this requirement, a <strong>com</strong>plimentary copy of the <strong>Exchange</strong> <strong>Bulletin</strong>,<br />

including the Regulatory <strong>Bulletin</strong>, is delivered to all effective members on a weekly basis.<br />

Additional subscriptions may be obtained by submitting your name, firm, mailing address, e-mail address and telephone number to: Chicago<br />

Board Options <strong>Exchange</strong>, Attention: Investor Services Department, 400 South LaSalle, Chicago, Illinois 60605. The cost of an annual subscription<br />

(July 1 through June 30) is $100 ($50 after January 1) for hard copy delivery or $50 ($25 after January 1) for e-mail delivery, payable<br />

in advance. Non-members are wel<strong>com</strong>e to subscribe.<br />

Members are required to report any address or telephone number changes to the Membership Department at (312) 786-7449 pursuant to<br />

<strong>Exchange</strong> Rule 3.6(b). For Seat Market Quotes, call (312) 786-7456.<br />

SEAT MARKET QUOTES AS OF MARCH 5, 1999<br />

CLASS BID OFFER LAST SALE AMOUNT LAST SALE DATE<br />

<strong>CBOE</strong>/FULL $580,000.00 $640,000.00 $639,500.00 February 24, 1999<br />

<strong>CBOE</strong>/OTP $57,000.00 $100,000.00 $130,000.00 May 6, 1998<br />

CBOT/FULL $550,000.00 $578,000.00 $578,000.00 February 26, 1999<br />

OPTION TRADING PERMIT- LEASE POOL AS OF MARCH 5, 1999<br />

Highest Bid: $650.00 Highest Monthly Rate: $3,750.00<br />

OTP's Available: None Lowest Monthly Rate: $700.00<br />

Last Lease: $700.00 on March 5, 1999<br />

Membership Sales and Transfers<br />

This notice is given pursuant to Rules 3.15 and 3.16 which permit certain types of claims to be filed with the Membership Department<br />

within 20 days from the date of this <strong>Exchange</strong> <strong>Bulletin</strong>.<br />

From To Price/Transfer Date<br />

Brian A. Novak Catbarann Partners Transfer 03/01/99<br />

MEMBERSHIP INFORMATION FOR FEBRUARY 25, 1999 THROUGH MARCH 3, 1999<br />

MEMBERSHIP APPLICATIONS RECEIVED<br />

This notice is given persuant to <strong>Exchange</strong> Rule 3.9. Please send any<br />

<strong>com</strong>ments to the Membership Committee in care of the Membership<br />

Department.<br />

Individual Member Applicants Date Posted<br />

Richard G. Turko, Lessee 02/25/99<br />

418 White Oak St.<br />

Gurnee, IL 60031<br />

Date Posted<br />

James F. McEldowney, Nominee 02/25/99<br />

Arbitrade, L.L.C.<br />

10520 S. Oakley<br />

Chicago, IL 60643<br />

Dennis P. Harrigan, Nominee 02/25/99<br />

BEL Options Limited Partnership<br />

9857 S. Avers<br />

Evergreen Park, IL 60805<br />

Edward N. Kalisvaart, Nominee 02/25/99<br />

ING TT&S (U.S.) Securities Inc.<br />

1730 N. Clark - Unit #1012<br />

Chicago, IL 60614

Page 2 March 12, 1999 Volume 27, Number 11 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong><br />

Andrew W. Smyth, CBT Registered For 03/01/99<br />

JSS Investments, L.L.C.<br />

98 Church Rd.<br />

Winnetka, IL 60093<br />

Christopher Wooldridge, CBT Registered For 03/01/99<br />

JSS Investments, L.L.C.<br />

440 N. Wabash - #4208<br />

Chicago, IL 60611<br />

James D. Rosen, Nominee 03/01/99<br />

Lakota Trading, Inc.<br />

1339 N. Dearborn - #10C<br />

Chicago, IL 60610<br />

Daniel C. Mandernach, Nominee 03/01/99<br />

TFM Investment Group<br />

16225 Bormet Drive<br />

Tinley Park, IL 60477<br />

Mark M. Grywacheski, CBT Registered For 03/01/99<br />

LETCO DPM L.P.<br />

441 E. Erie - #5803<br />

Chicago, IL 60611<br />

Charles F. Imburgia, Nominee 03/01/99<br />

The Arbitrage Group, L.P.<br />

14963 Woodcrest<br />

Lockport, IL 60441<br />

Michael J. Bartholomew, CBT Registered For 03/01/99<br />

Premo Trading, Ltd<br />

6751 N. LaPorte<br />

Chicago, IL 60646<br />

Gregg A. Prskalo, Nominee 03/02/99<br />

Arbitrade, L.L.C.<br />

9271 Arquilla Drive<br />

Mokena, IL 60448<br />

Samuel Rauch, Nominee 03/02/99<br />

Changes, L.L.C.<br />

3159 N. Seminary Ave.<br />

Chicago, IL 60657<br />

Kenneth J. Bellavia, Nominee 03/02/99<br />

BEL Options Limited Partnership<br />

685 Sapling Lane<br />

Deerfield, IL 60015<br />

Steve L. Ettenger, CBT Registered For 03/03/99<br />

Susquehanna Investment Group<br />

1133 N. Dearborn - Apt. 308<br />

Chicago, IL 60610<br />

Eric R. Wojciechowski, CBT Registered For 03/03/99<br />

G-Bar Limited Partnership<br />

254 S. Valparaiso Street - Apt. 1<br />

Valparaiso, IN 60610<br />

Member Organization Applicants Date Posted<br />

Carolina Holding 02/26/99<br />

Donn P. Baca, Nominee<br />

Victor M. Casaz, Nominee<br />

Frederick A. Gahl, Nominee<br />

Terrence W. Herlihy, Nominee<br />

440 S. LaSalle - Ste. 614<br />

Chicago, IL 60605<br />

Terrence W. Herlihy - General Partner<br />

Frederick A. Gahl - General Partner<br />

Date Posted Date Posted<br />

NBN TRADING LLC. 03/01/99<br />

William T. Carrington, CBT Registered For<br />

Paul D. Riggio, Nominee<br />

86 Trinity Place<br />

New York, NY 10006<br />

Kenneth Bantum - Managing Member<br />

CXX L.L.C. - Investing Member<br />

Spear Leeds & Kellogg - Member<br />

ALK, L.L.C. - General Partner<br />

MEMBERSHIP LEASES<br />

This notice is given pursuant to <strong>Exchange</strong> Rules 3.15 and 3.16 which<br />

permit certain types of claims to be filed with the Membership Department<br />

within 20 days from the date of this <strong>Exchange</strong> <strong>Bulletin</strong>.<br />

New Leases Effective Date<br />

Lessor: William F. O’Connor 03/01/99<br />

Lessee: Tradenet, L.L.C.<br />

David C. Coupe, NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: Thomas V. Gariti 03/01/99<br />

Lessee: Blackhawk Financial L.L.C.<br />

Jeremy T. Nau, NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: David B. Carman 03/01/99<br />

Lessee: Sallerson-Troob L.L.C.<br />

Norris P. Wright Jr., NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: First Northern Securities Ltd 03/01/99<br />

Lessee: Jupiter Trading, Ltd.<br />

James T. Ebert, NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: Daniel A. Stucka 03/01/99<br />

Lessee: WST Trading Inc.<br />

Robert T. Bockel, NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: William R. Halloran 03/01/99<br />

Lessee: JIS Options Corp<br />

D. Brooke Gottshall, NOMINEE<br />

Rate: 1 3/4% Term: Monthly<br />

Lessor: Anthony M. Mareno 03/01/99<br />

Lessee: LaRocque Trading Group L.L.C.<br />

Scott J. Samuelsohn, NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: Pyramid Capital, L.L.C. 03/01/99<br />

Lessee: Donald A. Newell, L.L.C.<br />

Donald A. Newell, NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: John A. Downey 03/01/99<br />

Lessee: David B. Alexander<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: Robert M. Trackman 03/01/99<br />

Lessee: GPZ Trading, L.L.C.<br />

Chad R. Gramann, NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: William J. Deevy 03/01/99<br />

Lessee: AKJ Trading Limited Partnership<br />

Walter A. Schafer Jr., NOMINEE<br />

Rate: 1 5/8% Term: Monthly

March 12, 1999 Volume 27, Number 11 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong> Page 3<br />

Lessor: Scott I. Andrews<br />

Effective Date<br />

03/01/99<br />

Lessee: Telluride Trading Company<br />

Scott I. Andrews, NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: First Options Of Chicago, Inc. 03/01/99<br />

Lessee: LaRocque Trading Group L.L.C.<br />

Michael S. Harper, NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: Kenneth R. Silverstein 03/01/99<br />

Lessee: John E. Ebert<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: Paul J. Roesler 03/01/99<br />

Lessee: Cole Roesler Traders L.P<br />

Carl M. Peller, NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: Larkspur Securities, Inc. 03/01/99<br />

Lessee: FCT Equities L.L.C.<br />

William H. Dean, NOMINEE<br />

Rate: 1 3/4% Term: Monthly<br />

Lessor: Theodore E. Darch 03/01/99<br />

Lessee: PKS Trading L.L.C.<br />

Paul K. Suvak, NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: Seats <strong>Exchange</strong> Inc. 03/01/99<br />

Lessee: PEAK6 Capital Management LLC<br />

Ryan S. McNally, NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: First Options Of Chicago, Inc. 03/01/99<br />

Lessee: Strawberry Trading, Inc<br />

Robert B. Galowich, NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: Babbitt & Company Inc 03/01/99<br />

Lessee: Israel A. Englander & Co.,Inc.<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: Catbarann Partners 03/01/99<br />

Lessee: LaRocque Trading Group L.L.C.<br />

Robert P. Baids, NOMINEE<br />

Rate: 1 1/2% Term: Monthly<br />

Lessor: John R. Nixon 03/02/99<br />

Lessee: G-Bar Limited Partnership<br />

James A. Gray, NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: Donaldson Lufkin Jenrette Securities 03/02/99<br />

Corporation/Pershing<br />

Lessee: TFM Investment Group<br />

Michael T. Coghlan, NOMINEE<br />

Rate: 1 5/8% Term: Monthly<br />

Lessor: Wolverine Trading L.P. 03/03/99<br />

Lessee: DBS Partners L.P.<br />

Daniel M. Kerrane, NOMINEE<br />

Rate: 1 5/8% Term: Daily<br />

Terminated Leases Termination Date<br />

Lessor: William F. O’Connor 03/01/99<br />

Lessee: Tradenet, L.P.<br />

David C. Coupe (VIG), NOMINEE<br />

Termination Date<br />

Lessor: Theodore E. Darch 03/01/99<br />

Lessee: Jumbo Trading Corp.<br />

Joseph A. Klein (KLN), NOMINEE<br />

Lessor: William R. Halloran 03/01/99<br />

Lessee: PJH Options Inc.<br />

Daniel J. Walsh (DJW), NOMINEE<br />

Lessor: First Northern Securities Ltd. 03/01/99<br />

Lessee: Cornerstone Partners<br />

Scott N. Goldfarb (WUF), NOMINEE<br />

Lessor: Daniel A. Stucka 03/01/99<br />

Lessee: Cornerstone Partners<br />

Roberto Zagaroli (RZX), NOMINEE<br />

Lessor: David B. Carman 03/01/99<br />

Lessee: Strawberry Trading, Inc<br />

Robert B. Galowich (JUJ), NOMINEE<br />

Lessor: Thomas V. Gariti 03/01/99<br />

Lessee: Atlas Trading L.L.C.<br />

Jeremy T. Nau (NAU), NOMINEE<br />

Lessor: John A. Downey 03/01/99<br />

Lessee: BEL Options Limited Partnership<br />

Dennis P. Harrigan (HGN), NOMINEE<br />

Lessor: Kenneth R. Silverstein 03/01/99<br />

Lessee: Jupiter Trading, Ltd.<br />

James T. Ebert (EBT), NOMINEE<br />

Lessor: PBL Partners L.L.C. 03/01/99<br />

Lessee: Action Trading<br />

James D. Rosen (PGA), NOMINEE<br />

Lessor: First Options Of Chicago, Inc. 03/01/99<br />

Lessee: Gregory Allen Limited Partnership<br />

Amanda R. Gregory (ARA), NOMINEE<br />

Lessor: First Options Of Chicago, Inc. 03/01/99<br />

Lessee: Greg P. Farrall (TEG)<br />

Lessor: Larkspur Securities, Inc. 03/01/99<br />

Lessee: LaRocque Trading Group L.L.C.<br />

Scott J. Samuelsohn (ZSS), NOMINEE<br />

Lessor: Robert M. Trackman 03/01/99<br />

Lessee: WST Trading Inc.<br />

Robert T. Bockel (BXY), NOMINEE<br />

Lessor: Paul J. Roesler 03/01/99<br />

Lessee: Triangle Trading, L.L.C.<br />

Joel A. Blumenau (JXB), NOMINEE<br />

Lessor: Anthony M. Mareno 03/01/99<br />

Lessee: U.S. Clearing Corp.<br />

Philip G. Oakley (OGP), NOMINEE<br />

Lessor: Pyramid Capital, L.L.C. 03/01/99<br />

Lessee: Donald A. Newell (DAN)<br />

Lessor: Babbitt & Company Inc 03/01/99<br />

Lessee: Cole Roesler Traders L.P<br />

Carl M. Peller (CMP), NOMINEE<br />

Lessor: Seats <strong>Exchange</strong> Inc. 03/01/99<br />

Lessee: Mark J. Lee (KML)

Page 4 March 12, 1999 Volume 27, Number 11 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong><br />

Termination Date<br />

Lessor: Brian A. Novak 03/01/99<br />

Lessee: LaRocque Trading Group L.L.C.<br />

Robert P. Baids (MUK), NOMINEE<br />

Lessor: John R. Nixon 03/02/99<br />

Lessee: CMB Trading Group L.L.C.<br />

Larry J. Jackson (ACT), NOMINEE<br />

Lessor: Donaldson Lufkin Jenrette Securities 03/02/99<br />

Corporation/Pershing<br />

Lessee: Barry & Gianone Securities L.L.P.<br />

MEMBERSHIP TERMINATIONS<br />

Individual Members Termination Date<br />

CBT Registered For:<br />

Thomas L. Vear (TLV) 02/25/99<br />

Rock Trading, Inc.<br />

1220 Judson<br />

Evanston, IL 60602<br />

Lessee(s):<br />

Greg P. Farrall (TEG) 03/01/99<br />

440 S. LaSalle - Suite 1586<br />

Chicago, IL 60605<br />

Donald A. Newell (DAN) 03/01/99<br />

440 S. LaSalle - Ste. 1650<br />

Chicago, IL 60605<br />

Mark J. Lee (KML) 03/01/99<br />

230 S. LaSalle - 6th Floor<br />

Chicago, IL 60604<br />

Lessor(s):<br />

Brian A. Novak 03/01/99<br />

440 S. LaSalle - Ste. 700<br />

Chicago, IL 60605<br />

Nominee(s) / Inactive Nominee(s):<br />

Phillip B. Bruckman (PHL) 02/25/99<br />

Joseph Klopfer Investments Inc.<br />

440 S. LaSalle - Ste. #2800<br />

Chicago, IL 60605-<br />

Joseph A. Klein (KLN) 03/01/99<br />

Jumbo Trading Corp.<br />

1872 N. Clybourn - #601<br />

Chicago, IL 60614<br />

Peter J. Heinz Jr. (PJH) 03/01/99<br />

PJH Options Inc.<br />

401 S. LaSalle St., Suite 1401<br />

Chicago, IL 60604<br />

Daniel J. Walsh (DJW) 03/01/99<br />

PJH Options Inc.<br />

401 S. LaSalle - Ste. 1400<br />

Chicago, IL 60605<br />

Scott N. Goldfarb (WUF) 03/01/99<br />

Cornerstone Partners<br />

440 S. LaSalle - Ste. 2500<br />

Chicago, IL 60605<br />

Termination Date<br />

Roberto Zagaroli (RZX) 03/01/99<br />

Cornerstone Partners<br />

440 S. LaSalle - Ste. 2500<br />

Chicago, IL 60605<br />

James D. Rosen (PGA) 03/01/99<br />

Action Trading<br />

401 S. LaSalle St. - Ste. 200<br />

Chicago, IL 60605-<br />

Amanda R. Gregory (ARA) 03/01/99<br />

Gregory Allen Limited Partnership<br />

440 S. LaSalle - #2110<br />

Chicago, IL 60605<br />

Elizabeth M. Donovan (LMD) 03/01/99<br />

Barry & Gianone Securities L.L.P.<br />

400 S. LaSalle-<strong>CBOE</strong> Box 143<br />

Chicago, IL 60605<br />

Stephen F. Klopfer (KLO) 03/02/99<br />

Joseph Klopfer Investments Inc.<br />

440 S. LaSalle-Ste. 2800<br />

Chicago, IL 60605<br />

Larry J. Jackson (ACT) 03/02/99<br />

CMB Trading Group L.L.C.<br />

440 S. LaSalle - Suite # 1735<br />

Chicago, IL 60605-<br />

Member Organizations<br />

Tradenet, L.P. 03/01/99<br />

Attn: Jesse Stamer<br />

401 S. LaSalle - Ste. 1401<br />

Chicago, IL 60605<br />

Jumbo Trading Corp. 03/01/99<br />

Attn: Joseph Klein<br />

440 S. LaSalle - Ste. 1021<br />

Chicago, IL 60605<br />

Atlas Trading L.L.C. 03/01/99<br />

401 S. LaSalle - Ste. 1200<br />

Chicago, IL 60605<br />

Action Trading 03/01/99<br />

Attn: Carter Laney<br />

440 S. LaSalle - Ste 2110<br />

Chicago, IL 60605<br />

EFFECTIVE MEMBERSHIPS<br />

This notice is given pursuant to <strong>Exchange</strong> Rule 3.11.<br />

Individual Members Effective Date<br />

CBT Registered For:<br />

Joel S. Nitz (NTZ) 03/01/99<br />

Cornerstone Partners<br />

440 S. LaSalle - Ste. 2500<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

Scott C. England (SCE) 03/03/99<br />

JSS Investments, L.L.C.<br />

230 S. LaSalle St.<br />

Chicago, IL 60604<br />

Type of Business to be Conducted: Market Maker

March 12, 1999 Volume 27, Number 11 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong> Page 5<br />

Lessee(s):<br />

Effective Date<br />

David B. Alexander (DBA) 03/01/99<br />

440 S. LaSalle, #600<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

John E. Ebert (EBE) 03/01/99<br />

401 S. LaSalle - Ste. 1500<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

Nominee(s) / Inactive Nominee(s):<br />

Daniel G. Brennan (DBZ) 02/25/99<br />

Hull Trading Company, L.L.C.<br />

311 S. Wacker-Ste. 1400<br />

Chicago, IL 60606<br />

Type of Business to be Conducted: Floor Broker Market Maker<br />

Stephen F. Klopfer (KLO) 02/25/99<br />

Joseph Klopfer Investments Inc.<br />

440 S. LaSalle-Ste. 2800<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

Ryan S. McNally (RNO) 03/01/99<br />

PEAK6 Capital Management LLC<br />

401 S. LaSalle - Suite 1500<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

Donald A. Newell (DAN) 03/01/99<br />

Donald A. Newell, L.L.C.<br />

440 S. LaSalle - Ste. 1650<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

D. Brooke Gottshall (GOT) 03/01/99<br />

JIS Options Corp.<br />

440 S. LaSalle - Suite 1600<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

John A. Vinci (VNC) 03/01/99<br />

BOTTA Trading, L.L.C.<br />

440 S. LaSalle St. - Ste. 3100<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

Chad R. Gramann (CEG) 03/01/99<br />

GPZ Trading, L.L.C.<br />

230 S. LaSalle - Suite 688<br />

Chicago, IL 60604<br />

Type of Business to be Conducted: Market Maker<br />

Walter A. Schafer Jr. (AKJ) 03/01/99<br />

AKJ Trading Limited Partnership<br />

440 S. LaSalle - Ste. 1506<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

Michael S. Harper (MOG) 03/01/99<br />

LaRocque Trading Group L.L.C.<br />

440 S. LaSalle - Suite 700<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

Effective Date<br />

William H. Dean (DNR) 03/01/99<br />

FCT Equities L.L.C.<br />

150 S. Wacker Dr. - Ste. 805<br />

Chicago, IL 60606<br />

Type of Business to be Conducted: Market Maker<br />

Paul K. Suvak (SUV) 03/01/99<br />

PKS Trading L.L.C.<br />

440 S. LaSalle - Ste. 1021<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

Phillip B. Bruckman (PHL) 03/02/99<br />

Joseph Klopfer Investments Inc.<br />

440 S. LaSalle - Ste. #2800<br />

Chicago, IL 60605-<br />

Type of Business to be Conducted: Market Maker<br />

Member Organizations<br />

Donald A. Newell, L.L.C. 03/01/99<br />

440 S. LaSalle - Ste. 1650<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

AKJ Trading Limited Partnership 03/01/99<br />

440 S. LaSalle - Ste. 1506<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

Telluride Trading Company 03/01/99<br />

440 S. LaSalle - Ste. 1600<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Floor Broker Market Maker<br />

PKS Trading L.L.C. 03/01/99<br />

440 S. LaSalle - Ste. 1021<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

Tradenet L.L.C. 03/01/99<br />

401 S. LaSalle - Ste. 1600<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Floor Broker Market Maker<br />

JOINT ACCOUNTS<br />

This notice is given pursuant to <strong>Exchange</strong> Rule 8.9.<br />

New Participants Acronym Effective Date<br />

Daniel G. Brennan QHT 02/25/99<br />

Chad R. Gramann QCL 03/01/99<br />

D. Brooke Gottshall QOJ 03/01/99<br />

Richard J. Wright QEW 03/01/99<br />

Richard J. Wright QDP 03/01/99<br />

Michael S. Harper QAM 03/01/99<br />

Michael S. Harper QSC 03/01/99<br />

Christopher G. Larkin QNY 03/01/99<br />

Christopher G. Larkin QEW 03/01/99

Page 6 March 12, 1999 Volume 27, Number 11 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong><br />

Effective Date Effective Date<br />

John A. Vinci QTK 03/01/99<br />

Jeremy T. Nau 03/01/99<br />

From: Nominee For Atlas Trading L.L.C.; Market Maker<br />

Scott C. England<br />

New Accounts<br />

QRH 03/03/99<br />

To: Nominee For Blackhawk Financial L.L.C.;<br />

Market Maker<br />

Donald A. Newell 03/01/99<br />

Mitchell J. Kasper QWX 03/03/99<br />

From:<br />

To:<br />

Lessee from Pyramid Capital L.L.C.; Market Maker<br />

Nominee For Donald A. Newell L.L.C.;<br />

Jerry E. Diegel QWX 03/03/99<br />

Market Maker<br />

Anthony E. Hozian QWX 03/03/99<br />

Robert T. Cummings 03/01/99<br />

From: CBT Exerciser Registered For Tradenet, L.P.;<br />

Terminated Participants Acronym Termination Date<br />

To:<br />

Floor Broker, Market Maker<br />

CBT Exerciser Registered For Tradenet, L.L.C.;<br />

Phillip B. Bruckman QRA 02/25/99<br />

Floor Broker, Market Maker<br />

Roberto T. Zagaroli QZY 03/01/99<br />

Craig R. Barone 03/01/99<br />

From: Nominee For BOTTA Trading, L.L.C.; Market Maker<br />

Terminated Accounts<br />

To: CBT Exerciser Registered For BOTTA Trading,<br />

L.L.C.; Market Maker<br />

Scott N. Goldfarb QEM 03/01/99<br />

Stephen M. Dillinger QEM 03/01/99<br />

Brian J. Dowling QAT 03/01/99<br />

Jeremy T. Nau QAT 03/01/99<br />

Mark J. Lee QJL 03/01/99<br />

William C. Floersch QJL 03/02/99<br />

CHANGES IN MEMBERSHIP STATUS<br />

Individual Member Applicants Effective Date<br />

Joshua S. Singer 03/01/99<br />

From: CBT Exerciser; Market Maker<br />

To: CBT Exerciser Registered For G-Bar Limited<br />

Partnership; Floor Broker, Market Maker<br />

David C. Coupe 03/01/99<br />

From: Nominee For Tradenet, L.P.; Floor Broker,<br />

Market Maker<br />

To: Nominee For Tradenet, L.L.C.; Floor Broker,<br />

Market Maker<br />

Joel A. Blumenau 03/01/99<br />

From: Nominee For Triangle Trading, L.L.C.;<br />

Market Maker<br />

To: CBT Exerciser Registered For Triangle Trading,<br />

L.L.C.; Market Maker<br />

William J. Deevy 03/01/99<br />

From: Owner; Floor Broker, Market Maker<br />

To: Lessor to AKJ Trading Limited Partnership<br />

Christopher G. Larkin 03/01/99<br />

From: CBT Exerciser Registered For Susquehanna<br />

Securities; Market Maker<br />

To: CBT Exerciser Registered For Susquehanna<br />

Investment Group; Floor Broker, Market Maker<br />

Brian J. Dowling 03/01/99<br />

From: CBT Exerciser Registered For Atlas Trading<br />

L.L.C.; Market Maker<br />

To: CBT Exerciser Registered For Blackhawk Financial<br />

L.L.C.; Market Maker<br />

Scott I. Andrews 03/01/99<br />

From: Membership Owner; Floor Broker, Market Maker<br />

To: Nominee For Telluride Trading Company; Floor<br />

Broker, Market Maker/Lessor to Telluride Trading<br />

Company<br />

David J. Savoia 03/03/99<br />

From: Nominee For ING TT&S (U.S.) Securities Inc.;<br />

Market Maker<br />

To: CBT Exerciser Registered For ING TT&S (U.S.)<br />

Securities Inc.; Market Maker<br />

MEMBER ADDRESS CHANGES<br />

Individual Members Effective Date<br />

Thomas A. Ascher 02/25/99<br />

223 W. Jackson, Ste. 1014<br />

Chicago, IL 60606<br />

Michael C. Rothman 02/25/99<br />

311 S. Wacker Dr. - Ste. 4190<br />

Chicago, IL 60606<br />

Donn P. Baca 02/26/99<br />

400 S. LaSalle, <strong>CBOE</strong> Box 301<br />

Chicago, IL 60605<br />

Victor M. Casaz 02/26/99<br />

440 S. LaSalle<br />

Chicago, IL 60605<br />

Frederick A. Gahl 02/26/99<br />

269 East Vine Ave.<br />

Lake Forest, IL 60045<br />

Craig R. Barone 02/26/99<br />

440 S Lasalle, Ste. 3112<br />

Chicago, IL 60605<br />

Daniel C. Mandernach 03/01/99<br />

440 S. LaSalle, Suite 1600<br />

Chicago, IL 60604<br />

Jeffrey J. Kupets 03/01/99<br />

311 S. Wacker, Ste. 4750<br />

Chicago, IL 60606

March 12, 1999 Volume 27, Number 11 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong> Page 7<br />

Effective Date<br />

Jeffrey D. Bower 03/01/99<br />

311 S. Wacker, Ste. 4750<br />

Chicago, IL 60606<br />

Jeffrey J. Oechsel 03/01/99<br />

311 S. Wacker, Ste. 4750<br />

Chicago, IL 60606<br />

Patrick J. Connelly 03/01/99<br />

3300 Lake Shore Drive, Apt. 4-C<br />

Chicago, IL 60657<br />

Christopher Wooldridge 03/02/99<br />

230 S. LaSalle St., Ste 688<br />

Chicago, IL 60604<br />

James D. Rosen 03/02/99<br />

401 S. LaSalle St, Ste. 200<br />

Chicago, IL 60605<br />

Frank X. Becker II 03/02/99<br />

749 12th Street<br />

Wilmette, IL 60091<br />

Charles F. Imburgia 03/02/99<br />

440 S. LaSalle, Suite 3010<br />

Chicago, IL 60605<br />

Antanas Siurna 03/03/99<br />

208 S. LaSalle<br />

Chicago, IL 60604<br />

David J. Savoia 03/03/99<br />

899 S. Plymouth, #303<br />

Chicago, IL 60605<br />

Steve L. Ettenger 03/03/99<br />

141 W. Jackson Blvd., Ste. 2201-A<br />

Chicago, IL 60604<br />

POSITION LIMITS<br />

Effective Date<br />

Paul D. Riggio 03/03/99<br />

440 S. LaSalle - Ste. 2118<br />

Chicago, IL 60605<br />

John E. Tracy 03/03/99<br />

337 W. Evergreen Ave.<br />

Chicago, IL 60610<br />

Christ L. Sirigas 03/03/99<br />

223 W. Jackson Blvd., Ste. 1014<br />

Chicago, IL 60606<br />

Joseph S. Weiss 03/03/99<br />

16401 Gold Club Rd., #8-311<br />

Weston, FL 33326<br />

Gregg A. Prskalo 03/03/99<br />

440 S. LaSalle, Suite 748<br />

Chicago, IL 60605<br />

Stuart B. Young 03/03/99<br />

821 W. George<br />

Chicago, IL 60657<br />

Member Organizations Effective Date<br />

Ink Kiss, Inc. 02/26/99<br />

7226 N. Tripp<br />

Lincolnwood, IL 60646<br />

Bock Trading L.L.C 03/01/99<br />

311 S. Wacker<br />

Ste. 4750<br />

Chicago, IL 60606<br />

For all equity options classes except those listed below, the standard position and exercise limits pursuant to <strong>Exchange</strong> Rule 4.11 and<br />

4.12 will be applicable. For a <strong>com</strong>plete list of all applicable limits, check 2nd floor data information bins or contact the Department of<br />

Market Regulation. If you wish to receive regular updates of the position limit list, please contact Candice Nickrand at (312) 786-7730 of<br />

the Department of Market Regulation.<br />

Class Limit Date<br />

BDZ/TLC/LAC/ZAC 7,500,000 shares 3/20/99<br />

MDT/QBY 7,500,000 shares 3/20/99<br />

PIR 3,150,000 shares 3/20/99<br />

QBY/MDT 7,500,000 shares 3/20/99<br />

QHI/IHY 3,150,000 shares 3/20/99<br />

QRD/YDQ 31,500 contracts 3/20/99<br />

QST/YST 3,150,000 shares 3/20/99<br />

TLC/LAC/ZAC/BDZ 7,500,000 shares 3/20/99<br />

TQT/TUT 3,150,000 shares 3/20/99<br />

AQR/YLJ 3,150,000 shares 4/17/99<br />

FHT/FUT 31,500 contracts 4/17/99<br />

GZQ/GZY 75,000 contracts 4/17/99<br />

TSM/TVM 6,000,000 shares 4/17/99<br />

WQN 7,500,000 shares 4/17/99<br />

YLJ/AQR 3,150,000 shares 4/17/99<br />

YQQ/LQB 2,935,000 shares 4/17/99<br />

CMH/CNZ 3,150,000 shares 5/22/99<br />

DXG/FLC 7,500,000 shares 5/22/99<br />

EFW/SRV 97,500 contracts 5/22/99<br />

FZC/MMR 1,350,000 shares 5/22/99<br />

IWY/HBQ/LHG/ZHG 7,500,000 shares 5/22/99<br />

MGM/MUM 13,500 contracts 5/22/99<br />

MMR/FZC 1,350,000 shares 5/22/99<br />

NIS 2,250,000 shares 5/22/99<br />

NUR/SQN 75,000 contracts 5/22/99<br />

QQZ/HBQ/LHG/ZHG 4,022,500 shares 5/22/99<br />

SQN/NUR 75,000 contracts 5/22/99<br />

CKR/CKW 3,150,000 shares 6/19/99<br />

Class Limit Date<br />

EZI/TGO 3,150,000 shares 6/19/99<br />

QWA/YTZ 97,500 contracts 6/19/99<br />

SKM/SKW 3,150,000 shares 6/19/99<br />

TGO/EZI 3,150,000 shares 6/19/99<br />

YTZ/QWA 97,500 contracts 6/19/99<br />

BSC/BSZ 7,875,000 shares 7/17/99<br />

BYZ/PQS/LPO/ZPO 54,000 contracts 7/17/99<br />

CGO/CYU 2,025,000 shares 7/17/99<br />

CSN/XCN 31,500 contracts 7/17/99<br />

CZA/PZN 73,500 contracts 7/17/99<br />

FNF/FUF 2,250,000 shares 7/17/99<br />

GQP 63,000 contracts 7/17/99<br />

HET/RUC 45,000 contracts 7/17/99<br />

MRX/MXQ 4,725,000 shares 7/17/99<br />

OQU/UOQ 7,762,500 shares 7/17/99<br />

PQS/LPO/ZPO/BYZ 54,000 contracts 7/17/99<br />

QGR 150,000 contracts 7/17/99<br />

QKU/DST 1,350,000 shares 7/17/99<br />

QYK 120,000 contracts 7/17/99<br />

ROK/ROX 60,000 contracts 7/17/99<br />

RQB 63,000 contracts 7/17/99<br />

RUC/HET 45,000 contracts 7/17/99<br />

UOQ/OQU 7,762,500 shares 7/17/99<br />

VQN 45,000 contracts 7/17/99<br />

AEU/CAH 135,000 contracts 8/21/99<br />

CEN 63,000 contracts 8/21/99<br />

GZG/PPE 97,500 contracts 8/21/99<br />

PPE/GZG 97,500 contracts 8/21/99

Page 8 March 12, 1999 Volume 27, Number 11 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong><br />

Class Limit Date Class Limit Date<br />

TQA 63,000 contracts 8/21/99<br />

VSZ/ICO 55,000 contracts 8/21/99<br />

GZZ/SYG/LYK/MDT/ 18,712,500 shares 9/18/99<br />

QBY/ZVY<br />

JBL 150,000 contracts 9/18/99<br />

MDT/SYG/GZZ/LYK 18,712,500 shares 9/18/99<br />

QBY/ZVY<br />

QBO/YBO 22,500 contracts 9/18/99<br />

QBY/SYG/GZZ/LYK/ 18,712,500 shares 9/18/99<br />

MDT/ZVY<br />

SYG/GZZ/LYK/MDT/ 18,712,500 shares 9/18/99<br />

QBY/ZVY<br />

AA 150,000 contracts 10/16/99<br />

KMG/ORX 91,500 contracts 10/16/99<br />

MGG/PVR 45,000 contracts 10/16/99<br />

ORX/KMG 91,500 contracts 10/16/99<br />

PVR/MGG 45,000 contracts 10/16/99<br />

BAC/LNB/ZNB/LBZ/ZZC 8,150,000 shares 1/22/00<br />

CD/VFS/LFZ/VUC/LUL 8,500,000 shares 1/22/00<br />

CNC/UNG/VJS/LLG 7,500,000 shares 1/22/00<br />

CPB/VLL/LLL/ 75,000 contracts 1/22/00<br />

VXL/ULL<br />

CYQ/LYL/CYY/LYZ/ZYZ 7,500,000 shares 1/22/00<br />

CYR/DAZ/DCX/LZY 7,500,000 shares 1/22/00<br />

DCX/DAZ/CYR/LZY 7,500,000 shares 1/22/00<br />

F/VFO/LFO/VFV/LFV 75,000 contracts 1/22/00<br />

GM/LGM/VGN/LGZ 75,000 contracts 1/22/00<br />

LDQ/LQM/ZQM/ 7,500,000 shares 1/22/00<br />

MWM/LYI<br />

LFZ/CD/VUC/LUL 8,500,000 shares 1/22/00<br />

LLG/CNC 7,500,000 shares 1/22/00<br />

LTD/VLD/LLD/ 75,000 contracts 1/22/00<br />

TDU/VUD/LDX<br />

LUV/LOV/ZUV/VUY/ 13,500,000 shares 1/22/00<br />

LVW/VLU/LVO/ZVO<br />

MTC/VM/LCT/LYC 75,000 contracts 1/22/00<br />

MWM/LYI/LDQ/LQM/ZQM 7,500,000 shares 1/22/00<br />

ORQ/LRO/LRZ/ZOR 15,000,000 shares 1/22/00<br />

PEP/VP/LPP/LDV 75,000 contracts 1/22/00<br />

SLM/VRM/LOS/VZL/LYM 7,500,000 shares 1/22/00<br />

POSITION LIMIT CIRCULARS<br />

POSITION LIMIT CIRCULAR PL99-26<br />

DATE: March 1, 1999<br />

TO: Members and Member Organizations<br />

RE: Oryx Energy Company (“ORX”) Merger with Kerr-McGee Corporation (“KMG”)<br />

Effective Date March 1, 1999<br />

The <strong>Exchange</strong> has established that the position and exercise limits following this merger will be any <strong>com</strong>bination of OUX and KMG option contracts on<br />

the same side of the market not to exceed 91,500 contracts through October 16, 1999. Following the October 1999 expiration, the position and exercise<br />

limits will revert to the standard limit of 31,500 contracts of KMG.<br />

For additional information, please contact Candice Nickrand at (312) 786-7730 in the Department of Market Regulation.<br />

POSITION LIMIT CIRCULAR PL99-27<br />

DATE: March 1, 1999<br />

TO: Members and Member Organizations<br />

RE: Primadonna Resorts, Inc. (“PRMA/PQR”) Merger with MGM Grand, Inc. (“MGG”)<br />

Effective Date March 1, 1999<br />

SBC/LFE/ZFE 7,500,000 shares 1/22/00<br />

AIG/LAJ/LVJ/YGA/ 7,500,000 shares 1/20/01<br />

LZJ/ZAF/ZFA<br />

AOL/AOO/AOE/LOL/LMR/ 300,000 contracts 1/20/01<br />

LKF/ZOL/ZAN/ZKF<br />

AX/LVK/ZOU/BPA 150,000 contracts 1/20/01<br />

BAY/LBN/ZBN/BZY/LZW/ 7,500,000 shares 1/20/01<br />

ZZN/NT/LOZ/ZOO<br />

BMY 150,000 contracts 1/20/01<br />

BPA/AX/LVK/ZOU 150,000 contracts 1/20/01<br />

C/CCY/CWY/LRV/LVZ/LXW/<br />

ZRV/ZUZ 10,000,000 shares 1/20/01<br />

CCY/C/CWY/LRV/LVZ/LXW/<br />

ZRV/ZUZ 10,000,000 shares 1/20/01<br />

CWQ/LQW/ZWC 300,000 contracts 1/20/01<br />

DAL/LDZ/ZDA 40,000 contracts 1/20/01<br />

FQU/LVX/ZNU/ONE/LBE/ZBE 7,500,000 shares 1/20/01<br />

GPS/LGS/LYP/ZGS/ 7,500,000 shares 1/20/01<br />

GPZ/LXB/ZVG<br />

KRB/LZK/KRW/ZK/LKW 7,500,000 shares 1/20/01<br />

LYY/YZD/CPQ 14,850,000 shares 1/20/01<br />

MRK/LMK/ZMK 150,000 contracts 1/20/01<br />

NT/LOZ/ZOO/BAY/LBN/ 7,500,000 shares 1/20/01<br />

ZBN/BZY/LZW/ZZN<br />

OIL/LOI/ZOI 60,000 contracts 1/20/01<br />

ONE/LBE/ZBE/FQU/LVX/ZNU 7,500,000 shares 1/20/01<br />

PQO/LLP/ZPQ/POY/ 75,000 contracts 1/20/01<br />

LWQ/ZQW<br />

PVN/LNX/ZLA/PVU/LXC/ZKU 7,500,000 shares 1/20/01<br />

QAQ/LLU/ZLU/QZQ/LXW/ZYL 75,000 contracts 1/20/01<br />

QGC/QGW/LKG/ZCK 150,000 contracts 1/20/01<br />

RCQ/LGJ/ZGJ 63,000 contracts 1/20/01<br />

SCH/LWS/LWZ/VYS/SYH 7,500,000 shares 1/20/01<br />

SLR/LOP/ZSR 120,000 contracts 1/20/01<br />

XRX/LXX/ZXR 150,000 contracts 1/20/01<br />

ZQN/YZN/QZN/YZZ/YQN/ 225,000 contracts 1/20/01<br />

LCM/ZWE/ZCR/ZCM<br />

The <strong>Exchange</strong> has established that the position and exercise limits following this merger will be any <strong>com</strong>bination of PVR and MGG option contracts on<br />

the same side of the market not to exceed 45,000 contracts through October 16, 1999. Following the October 1999 expiration, the position and exercise<br />

limits will revert to the standard limit of 22,500 contracts of MGG.<br />

For additional information, please contact Candice Nickrand at (312) 786-7730 in the Department of Market Regulation.

March 12, 1999 Volume 27, Number 11 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong> Page 9<br />

POSITION LIMIT CIRCULAR PL99-28<br />

DATE: March 5, 1999<br />

TO: Members and Member Organizations<br />

FROM: Department of Market Regulation<br />

RE: Equity Position and Exercise Limits<br />

Please be reminded that the position and exercise limits 1 for the following equity option classes will be decreased to a lower tier limit with the<br />

March 1999 expiration. Effective March 22, 1999, the position and exercise limit for the following equity option classes will be decreased to the<br />

applicable standard limit as noted below:<br />

Underlying Stock Option Symbol Standard Position and Exercise Limit<br />

American Eco Corporation EOQ 22,500 contracts<br />

ASM International N.V. IQB 13,500 contracts<br />

China Tele<strong>com</strong> HK Ltd., ADR CHL 13,500 contracts<br />

Compu<strong>com</strong> Systems, Inc. ICQ 22,500 contracts<br />

FSI International FQH 13,500 contracts<br />

Gencorp GY 13,500 contracts<br />

Glenayre Technologies, Inc. GQM 60,000 contracts<br />

Guilford Pharmaceuticals, Inc. GQF 13,500 contracts<br />

Herbalife International Inc. HQR 13,500 contracts<br />

Hollywood Park Inc. HPK 13,500 contracts<br />

Integrated Silicon Solution, Inc. IXQ 13,500 contracts<br />

International Rectifier Corp. IRF 22,500 contracts<br />

Iona Technologies PLC YWQ 13,500 contracts<br />

Jones Pharma Incorporated JQM 31,500 contracts*<br />

Lattice Semiconductor Corp. LQT 31,500 contracts<br />

Lone Star Steakhouse and Saloon, Inc. LQS 31,500 contracts<br />

Longview Fibre Company LFB 13,500 contracts<br />

Nam Tai Electronics, Inc. QNA 13,500 contracts<br />

Plexus Corporation QUA 13,500 contracts<br />

Proxim, Inc. WQG 13,500 contracts<br />

Reliant Energy Incorporated REI 60,000 contracts<br />

Semitool, Inc. PQD 13,500 contracts<br />

Silicon Valley Group Inc. VQQ 31,500 contracts**<br />

Taubman Centers Inc. TCO 13,500 contracts<br />

Tera Computer Company QIP 13,500 contracts<br />

Unova, Inc. UNA 13,500 contracts<br />

Whirlpool Corp. WHR 22,500 contracts<br />

Wyman-Gordon Company WYG 22,500 contracts<br />

*JQM’s position and exercise limit will be further decreased to 22,500 contracts effective September 18, 1999.<br />

**VQQ’s position and exercise limit will be further decreased to 22,500 contracts effective September 18, 1999.<br />

Copies of the <strong>com</strong>plete list of the applicable limits for all <strong>Exchange</strong> listed options are available in the 2nd floor data information bins or may be<br />

obtained from the Department of Market Regulation. If you wish to receive regular updates of the position limit list via telefax, please contact<br />

Candice Nickrand at (312) 786-7730 in the Department of Market Regulation.<br />

1 Limits were previously reviewed in January 1999 and, at that time, these equity option classes were not eligible to remain at their current tier limit.

Page 10 March 12, 1999 Volume 27, Number 11 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong><br />

POSITION LIMIT CIRCULAR PL99-29<br />

DATE: March 5, 1999<br />

TO: Members and Member Organizations<br />

FROM: Department of Market Regulation<br />

RE: Equity Position and Exercise Limits<br />

Please be reminded that the adjusted position and exercise limits 1 for the following equity option class will expire with the March 1999 expiration.<br />

Effective March 22, 1999, the position and exercise limits for the following equity option class will revert to the applicable standard limit as noted<br />

below:<br />

Underlying Stock Option Symbol Standard Position and Exercise Limit<br />

Ugly Duckling Corp. QRD 22,500 contracts*<br />

*QRD’s position and exercise limit will be further decreased to 13,500 effective September 18, 1999.<br />

Additionally, please be reminded that effective March 22, 1999, the position and exercise limits for the following equity option class will revert to a<br />

new adjusted limit as noted below:<br />

Underlying Stock Option Symbol(s) New Adjusted Position and Exercise Limit<br />

Medtronic, Inc. MDT 18,712,500 Shares of MDT/GZZ/LYK/SYG/ZVY**<br />

**The adjusted option symbol SYG represents Sofamor Danek Group, Inc. (“SDG”) which merged with MSD Merger Corp., a wholly-owned<br />

subsidiary of Medtronic, Inc., effective January 28, 1999. The adjusted option symbol GZZ, LYK, and ZVY represents Arterial Vascular Engineering,<br />

Inc. (“AVEI/GQZ/LAV/ZVU”) which merged with MAV Merger Corp., a wholly-owned subsidiary of Medtronic, Inc., effective January 29, 1999.<br />

Copies of the <strong>com</strong>plete list of the applicable limits for all <strong>Exchange</strong> listed options are available in the 2nd floor data information bins or may be<br />

obtained from the Department of Market Regulation. If you wish to receive regular updates of the position limit list via telefax, please contact<br />

Candice Nickrand at (312) 786-7730 in the Department of Market Regulation.<br />

1 Limits were previously adjusted due to a stock split, merger, stock distribution, stock dividend, etc.<br />

POSITION LIMIT CIRCULAR PL99-30<br />

DATE: March 5, 1999<br />

TO: Members and Member Organizations<br />

FROM: Department of Market Regulation<br />

RE: Equity Position and Exercise Limits<br />

Please be reminded that the position and exercise limits 1 for the following narrow-based index option class will be decreased to a lower tier limit with<br />

the March 1999 expiration. Effective March 22, 1999, the position and exercise limit for the following narrow-based index option class will be<br />

decreased to the applicable standard limit as noted below:<br />

Narrow-Based Index Type Option Symbol Standard Position and Exercise Limit<br />

<strong>CBOE</strong> Gold GOX 12,000 contracts<br />

Copies of the <strong>com</strong>plete list of the applicable limits for all <strong>Exchange</strong> listed options are available in the 2nd floor data information bins or may be<br />

obtained from the Department of Market Regulation. If you wish to receive regular updates of the position limit list via telefax, please contact<br />

Candice Nickrand at (312) 786-7730 in the Department of Market Regulation.<br />

1Limits were previously reviewed in January 1999 and, at that time, the narrow-based index option class was not eligible to remain at its current tier<br />

limit.

March 12, 1999 Volume 27, Number 11 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong> Page 11<br />

RESEARCH CIRCULARS<br />

The following Research Circulars were distributed between February 26, 1999 and March 5, 1999. If you wish to read the entire document, and have<br />

access to a fax machine, please call the <strong>CBOE</strong> FaxLine at 1-800-OPTIONS, choose option “4” and then option “1”. Please have your fax number and<br />

the corresponding FaxLine document number ready. The FaxLine number is listed adjacent to each circular. To receive a list of all available documents,<br />

use the FaxLine number 000. You may also access the Research Circulars on our Web Site at http://www.cboe.<strong>com</strong> Questions regarding any of the<br />

information that is discussed in any Research Circular may be directed to the <strong>CBOE</strong> Investor Services Department at 1-800-OPTIONS.<br />

<strong>CBOE</strong> Research Circular #RS99-119 FaxLine Document #807<br />

February 26, 1999<br />

Shiva Corporation (“SHVA/VQS”): Merger Completed — Cash Settlement<br />

<strong>CBOE</strong> Research Circular #RS99-120 FaxLine Document #808<br />

February 26, 1999<br />

Primadonna Resorts, Inc. (“PRMA/PQR”): COMPLETED Merger with MGM Grand, Inc.<br />

<strong>CBOE</strong> Research Circular #RS99-121 FaxLine Document #809<br />

February 26, 1999<br />

Iridium World Communications Ltd - Class A (“IRIDF/QAK”) Underlying Symbol Change to “IRID”<br />

Effective Date: March 1, 1999<br />

<strong>CBOE</strong> Research Circular #RS99-122 FaxLine Document #810<br />

February 26, 1999<br />

Able Tele<strong>com</strong> Holding Corp. (“ABTEE/QZB”) Underlying Symbol Change to “ABTE”<br />

Effective Date: March 1, 1999<br />

<strong>CBOE</strong> Research Circular #RS99-123 FaxLine Document #811<br />

February 26, 1999<br />

eBay Inc. (“EBAY/QXB”) 3-for-1 Stock Split<br />

Ex-Distribution Date: March 2, 1999<br />

<strong>CBOE</strong> Research Circular #RS99-124 FaxLine Document #812<br />

February 26, 1999<br />

Florida Panthers Holdings, Inc. Class A (“PAW”): Non-Transferable Rights Distribution<br />

<strong>CBOE</strong> Research Circular #RS99-125 FaxLine Document #813<br />

February 26, 1999<br />

Tadiran Ltd. ADS (“TAD”): Merger Completed — Cash Settlement<br />

<strong>CBOE</strong> Research Circular #RS99-126 FaxLine Document #900<br />

March 1, 1999<br />

New Listing: United Pan-Europe Communications NV (“UPCOY/UPO”)<br />

<strong>CBOE</strong> Research Circular #RS99-127 FaxLine Document #814<br />

March 1, 1999<br />

Fingerhut Companies, Inc. (“FHT”): Tender Offer by Bengal Subsidiary Corp.<br />

<strong>CBOE</strong> Research Circular #RS99-128 FaxLine Document #900<br />

March 1, 1999<br />

New Listing: MGM Grand, Inc. (“MGG”)<br />

<strong>CBOE</strong> Research Circular #RS99-129 FaxLine Document #815<br />

March 1, 1999<br />

BJ’s Wholesale Club, Inc. (“BJ”) 2-for-1 Stock Split<br />

Ex-Distribution Date: March 3, 1999<br />

<strong>CBOE</strong> Research Circular #RS99-130 FaxLine Document #816<br />

March 1, 1999<br />

LucasVarity plc ADS (“LVA”): Tender Offer by Morgan Guaranty Trust Company of New York, London Branch on behalf of TRW Automotive<br />

<strong>CBOE</strong> Research Circular #RS99-131 FaxLine Document #817<br />

March 1, 1999<br />

Outback Steakhouse, Inc. (“OSSI/OSQ”) 3-for-2 Stock Split<br />

Ex-Distribution Date: March 3, 1999<br />

<strong>CBOE</strong> Research Circular #RS99-132 FaxLine Document #900<br />

March 1, 1999<br />

New Listing: Go2Net, Inc. (“GNET/GQI”)<br />

<strong>CBOE</strong> Research Circular #RS99-133 FaxLine Document #818<br />

March 2, 1999<br />

Apex PC Solutions, Inc. (“APEX/PXQ”) 3-for-2 Stock Split<br />

Ex-Distribution Date: March 4, 1999

Page 12 March 12, 1999 Volume 27, Number 11 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong><br />

<strong>CBOE</strong> Research Circular #RS99-134 FaxLine Document #900<br />

March 1, 1999<br />

New LEAPS® Listings: DaimlerChrysler AG (DCX) — LLX<br />

UST Inc. (UST) — LDI<br />

<strong>CBOE</strong> Research Circular #RS99-135 FaxLine Document #819<br />

March 2, 1999<br />

Philips Electronics N.V. (“PHG”) Name Change to: Koninklijke Philips Electronics N.V.<br />

Effective Date: March 4, 1999<br />

<strong>CBOE</strong> Research Circular #RS99-136 FaxLine Document #900<br />

March 2, 1999<br />

New LEAPS® Listing: Orbital Sciences Corporation (“ORB”) — LRI & ZRI<br />

Listing Date: March 5, 1999<br />

<strong>CBOE</strong> Research Circular #RS99-137 FaxLine Document #900<br />

March 2, 1999<br />

New LEAPS® (January 2001 Expiration) Listing: Medtronic, Inc. (“MDT”) — ZKD<br />

Listing Date: March 3, 1999<br />

<strong>CBOE</strong> Research Circular #RS99-138 FaxLine Document #820<br />

March 2, 1999<br />

Check Point Software Technologies, Ltd. (“CHKPF/KEQ”) Underlying Symbol Change to “CHKP”<br />

Effective Date: March 3, 1999<br />

<strong>CBOE</strong> Research Circular #RS99-139 FaxLine Document #900<br />

March 2, 1999<br />

New Listings: Adelphia Communications Corporation (“ADLAC/ADU”)<br />

Global Imaging Systems, Inc. (“GISX/GQC”)<br />

Information Advantage, Inc. (“IACO/IAU”)<br />

Image Entertainment, Inc. (“DISK/DIU”)<br />

Province Healthcare Company (“PRHC/PUH”)<br />

ISS Group, Inc. (“ISSX/ISU”)<br />

NetGravity, Inc. (“NETG/NUG”)<br />

<strong>CBOE</strong> Research Circular #RS99-140 FaxLine Document #821<br />

March 3, 1999<br />

Hummingbird Communications, Ltd. (“HUMCF/UQH”) Underlying Symbol Change to “HUMC”<br />

Effective Date: March 4, 1999<br />

<strong>CBOE</strong> Research Circular #RS99-141 FaxLine Document #900<br />

March 4, 1999<br />

New Listing: Shop-At-Home, Inc. (“SATH/SQR”)<br />

<strong>CBOE</strong> Research Circular #RS99-142 FaxLine Document #900<br />

March 4, 1999<br />

New LEAPS® (January 2001 Expiration) Listing: Federated Department Stores, Inc. (“FD”) — ZFD<br />

Listing Date: March 5, 1999<br />

<strong>CBOE</strong> Research Circular #RS99-143 FaxLine Document #822<br />

March 4, 1999<br />

Fruit of the Loom, Inc. (“FTL”) Class A Common Stock Formation of Holding Company/Reorganization and<br />

Name Change to: Fruit of the Loom, Ltd. Class A Ordinary Shares<br />

Anticipated Effective Date: March 5, 1999<br />

<strong>CBOE</strong> Research Circular #RS99-144 FaxLine Document #823<br />

March 4, 1999<br />

CSG Systems International, Inc. (“CSGS/QGA”) 2-for-1 Stock Split<br />

Ex-Distribution Date: March 8, 1999<br />

<strong>CBOE</strong> Research Circular #RS99-145 FaxLine Document #824<br />

March 4, 1999<br />

McDonald’s Corporation (“MCD/LMC/ZMC”) 2-for-1 Stock Split<br />

Ex-Distribution Date: March 8, 1999<br />

<strong>CBOE</strong> Research Circular #RS99-146 FaxLine Document #900<br />

March 4, 1999<br />

New Listing: ValueVision International, Inc. (“VVTV/UVR”)<br />

<strong>CBOE</strong> Research Circular #RS99-147 FaxLine Document #825<br />

March 5, 1999<br />

Iona Technologies, Inc. (“IONAY/YWQ”) Underlying Symbol Change to “IONA”<br />

Effective Date: March 8, 1999

March 12, 1999 Volume RB10, Number 11<br />

Regulatory<br />

Circulars<br />

Regulatory<br />

<strong>Bulletin</strong><br />

The Constitution and Rules of the Chicago Board Options <strong>Exchange</strong>, Incorporated (“<strong>Exchange</strong>”),<br />

in certain specific instances, require the <strong>Exchange</strong> to provide notice to the<br />

membership. The weekly Regulatory <strong>Bulletin</strong> is delivered to all effective members to<br />

satisfy this requirement.<br />

Regulatory Circular RG 99-64<br />

Date: March 12, 1999<br />

To: Members and Member Firms<br />

From: Department of Market Regulation<br />

Re: Exercises on the Day Prior to Expiration for Position Limit Purposes<br />

While the Options Clearing Corp. (OCC) does not accept exercise instructions for<br />

expiring option contracts on the final day of trading prior to expiration, the <strong>Exchange</strong><br />

has determined that a member or customer may irrevocably exercise near-term, inthe-money<br />

option positions on this day to eliminate such positions from their account<br />

for position limit purposes. A position is considered irrevocably exercised at the time<br />

an irrevocable exercise instruction memorandum (memorandum) is prepared and time<br />

stamped. Therefore, any member or customer with an overall position near the applicable<br />

limit the day prior to expiration may prepare and time stamp an irrevocable<br />

memorandum for their near-term, in-the-money options to enable an increase in their<br />

overall position. Irrevocable memoranda must be <strong>com</strong>pleted prior to establishing additional<br />

positions that would otherwise put the account over the position limit. It is<br />

important to note that such irrevocable memoranda must be <strong>com</strong>pleted, even though<br />

a position may be subject to the OCC’s exercise by exception process. Only those<br />

near-term contracts indicated on irrevocable memoranda which are actually exercised<br />

will be eliminated from the account for position limit purposes.<br />

To be applied against a position for position limit purposes, a copy of all irrevocable<br />

memoranda prepared on the day prior to expiration must be submitted to the Department<br />

of Market Regulation no later than the Monday following expiration. A copy<br />

must also be maintained by both entering and clearing members for the appropriate<br />

amount of time in accordance with SEC rules.<br />

Any questions pertaining to this matter should be directed to Pat Cerny at (312) 786-<br />

7722 or Karen Charleston at (312) 786-7724.<br />

(Regulatory Circular RG 98-22 Reissued)

Regulatory Circulars<br />

continued<br />

Regulatory Circular RG99-65<br />

To: The Membership<br />

From: Department of Financial and Sales Practice Compliance<br />

Date: February 26, 1999<br />

Subject: Margin and Capital Requirements for Options on the Dow Jones<br />

E*Commerce Index (“ECM”)<br />

On February 26, 1999, the Chicago Board Options <strong>Exchange</strong> (“<strong>CBOE</strong>”) listed and began<br />

trading options on the Dow Jones E*Commerce Index (“ECM”). The ECM is a modified<br />

capitalization weighted index of 15 of the largest, most liquid U.S. Internet <strong>com</strong>merce<br />

stocks; that is, <strong>com</strong>panies involved in providing a good or service through an open network<br />

such as the Internet. The index will be rebalanced after the close of trading on expiration<br />

Friday on the March quarterly cycle. The base date for the ECM index is January 4, 1999,<br />

when the index level was calculated at 200.00 at the close of trading. ECM options are<br />

cash settled and European style exercise.<br />

The securities currently included in the index trade on the National Association of Securities<br />

Dealers Automated Quotation System (“NASDAQ”). This circular explains the margin<br />

and capital treatment applicable to transactions in ECM options.<br />

MARGIN<br />

In accordance with <strong>CBOE</strong> Rule 12.3(c)(4), a long option position must be paid for in full.<br />

The ECM index is considered narrow–based for margin purposes and option writers are<br />

subject to the margin requirements specified in <strong>CBOE</strong> Rule 24.11(b)(ii). The margin requirement<br />

for a short put or call on a narrow-based index is 100% of the current market<br />

value of the contract plus 20% of the underlying index value, less the out–of–the–money<br />

dollar amount, if any, subject to a minimum for calls of 100% of the option market value plus<br />

10% of the underlying index value, and a minimum for puts of 100% of the option market<br />

value plus 10% of the option’s aggregate exercise price.<br />

In a margin account, no margin need be required in respect of an ECM call option carried in<br />

a short position which is covered by a long position in equivalent units of a “qualified stock<br />

basket” as defined in <strong>CBOE</strong> Rule 24.11(a)(2). Correspondingly, no margin need be required<br />

in respect of a ECM put option carried in a short position which is offset by a short position<br />

in equivalent units of a qualified stock basket. In <strong>com</strong>puting margin on the underlying<br />

qualified stock basket, the current market value used shall not be greater than the exercise<br />

price in the case of a short ECM call. In the case of a short ECM put, in <strong>com</strong>puting margin<br />

on the underlying qualified stock basket, margin shall be the amount required by <strong>CBOE</strong><br />

Rule 12.3(b)(2), plus any amount by which the exercise price of the put exceeds the current<br />

market value of the qualified stock basket.<br />

Where a short option contract is covered by an “escrow agreement” meeting the requirements<br />

of <strong>CBOE</strong> Rule 24.11(d), no margin need be required on the short put or call.<br />

Spreads and straddles are permitted for options covering the same number of shares of the<br />

same underlying index. Members should be aware that due to their exercise feature, it is<br />

possible for European–style options to trade at a discount to their intrinsic values. It is<br />

possible that the spread margin held by the carrying broker could be<strong>com</strong>e insufficient to<br />

cover the assignment obligation on the short option if the customer is unable to exercise<br />

the long option and it is trading at a discount to its intrinsic value.<br />

RB2 RB2<br />

March March March 12, 12, 1999, 1999, 1999, Volume Volume Volume RB10, RB10, RB10, Number Number Number 11 11<br />

11

Regulatory Circulars<br />

continued<br />

Regulatory Circular RG99-65 continued<br />

OPTION MARKET–MAKER MARGIN REQUIREMENTS<br />

Pursuant to <strong>CBOE</strong> Rule 12.3(f), market–makers in ECM are allowed “permitted offset” treatment<br />

for qualified stock baskets. In the case of the ECM index, the basket must contain no<br />

less than 95% of the capitalization in the index, in order to qualify as a permitted offset.<br />

CAPITAL<br />

For capital purposes, ECM index options are treated as narrow–based. Under risk–based<br />

haircuts, the haircut is equal to the maximum potential loss for all ECM option positions<br />

calculated over a range of index movements of +(–)15% for all broker–dealers, subject to a<br />

minimum charge of $25 per contract. 1 A new product group will be established to include<br />

ECM options, TheStreet.<strong>com</strong> Internet Commerce Index (“ICX”) listed on the American Stock<br />

<strong>Exchange</strong> and the TheStreet.<strong>com</strong> Internet Sector Index (“DOT”) listed on the Philadelphia<br />

Stock <strong>Exchange</strong>. A 75% offset of gains versus losses at the same valuation point will be<br />

allowed between each index class within the product group. For those firms not utilizing<br />

risk–based haircuts, the haircut will be calculated pursuant to SEC Rule 15c3-1a(b).<br />

A basket offset is available to ECM options and offsetting qualified stock baskets under riskbased<br />

haircuts. The stock basket must represent not less than 95% of the capitalization of<br />

the index. A 95% offset between the qualified stock basket and the options will be applied<br />

with a minimum charge equal to 5% of the market value of the qualified basket.<br />

Questions regarding the margin and capital treatment of ECM options should be directed to<br />

Jim Adams at (312) 786-7718 or Rich Lewandowski at (312) 786-7183.<br />

1 Risk–based haircuts may be applied pursuant to SEC Rule 15c3-1a (Appendix A).<br />

Regulatory Circular RG99-66<br />

To: THE MEMBERSHIP<br />

From: LEGAL DIVISION<br />

Date: MARCH 2, 1999<br />

Subject: AGENCY SUBSIDY RULE FILING<br />

On February 26, 1999, the SEC approved the attached agency subsidy rule. [The agency<br />

subsidy rule is printed below. See SR-<strong>CBOE</strong>-98-35 under “Approved Rule Filings.”] The rule<br />

allows each market-maker crowd to volunteer to subsidize the activity of floor brokers who<br />

represent orders in that crowd and to lower each crowd’s order book brokerage rate. Following<br />

a market-maker crowds’ re<strong>com</strong>mendation, the Equity Floor Procedure Committee (EFPC)<br />

will determine what the market-maker surcharge, if any, will be. The surcharge will be collected<br />

by the <strong>Exchange</strong> and will be used for two purposes. First, the amount collected will be<br />

used to reimburse the <strong>Exchange</strong> to the extent EFPC reduces the rate charged by the<br />

<strong>Exchange</strong> to execute Order Book Official (OBO) orders. Second, the remaining subsidy will<br />

be paid to the floor broker(s) as an inducement for that floor broker to reduce his or her<br />

brokerage rate. The <strong>Exchange</strong> believes this rule will enable market-maker crowds to <strong>com</strong>pete<br />

more effectively for order flow by allowing the brokerage rates to be reduced.<br />

The rule, including defined terms, is attached for your review; the following highlights key<br />

points.<br />

• The subsidy applies to Stationary Floor Brokers (SFBs) in multiply traded classes in<br />

market-maker trading crowds.<br />

March March March 12, 12, 12, 1999, 1999, 1999, Volume Volume RB10, RB10, Number Number Number 11 11 11<br />

RB3<br />

RB3

Regulatory Circulars<br />

continued<br />

Rule Changes,<br />

Interpretations<br />

and Policies<br />

Regulatory Circular 99-66 continued<br />

• The subsidy is for Order Routing System (ORS) orders only.<br />

• Any Resident Market-Maker may re<strong>com</strong>mend a surcharge and/or an OBO rate reduc<br />

tion which may be voted on by that crowd’s Resident Market-Makers.<br />

• Each Resident Market-Maker’s vote will be weighted equally.<br />

• The surcharge that receives a majority of the votes cast will be re<strong>com</strong>mended to EFPC.<br />

• The Market-Maker Surcharge cannot exceed $.25 per contract, and generally will be in<br />

effect for a minimum of one month.<br />

• Although an SFB may be paid a surcharge, the SFB may charge any <strong>com</strong>mission rate<br />

that SFB desires.<br />

• Any SFB who receives any payments under this rule must disclose such payments to<br />

the SFB’s customers.<br />

• This rule will be in effect as a pilot program until March 31, 2000.<br />

Questions regarding this pilot program should be addressed to Tom Bond, Vice Chairman,<br />

(312)786-7088; Phil Slocum, Member Trading Services, (312)786-7212; or Pat Cerny, Regulatory<br />

Services Division (312)786-7722.<br />

Regulatory Circular RG 99-67<br />

Date: March 3, 1999<br />

To: Membership<br />

From: Market Performance Committees<br />

Re: Firm Quotes in Options Priced over $999<br />

The <strong>Exchange</strong>’s Market Performance Committees, pursuant to their authority under Rule<br />

8.51, have determined that the firm quote obligations of market makers shall not apply to<br />

those series of options classes where the price of the option contract exceeds $999. This<br />

exemption shall be effective until further notice.<br />

Questions regarding firm quote obligations may be directed to Daniel Hustad at (312) 786-<br />

7715.<br />

APPROVED RULE CHANGE(S)<br />

The Securities and <strong>Exchange</strong> Commission (“SEC”) has approved the following change(s)<br />

to <strong>Exchange</strong> Rules pursuant to Section 19(b) of the Securities <strong>Exchange</strong> Act of 1934, as<br />

amended (“the Act”). Copies are available from the Legal Division.<br />

The effective date of the rule change is the date of approval unless otherwise noted.<br />

SR-<strong>CBOE</strong>-98-35 – Floor Brokerage Subsidies<br />

On February 26, 1999, the SEC approved Rule Change File No. SR-<strong>CBOE</strong>-98-35, which<br />

adopts new Rule 2.40, Market-Maker Surcharge for Brokerage. (Securities <strong>Exchange</strong> Act<br />

Release No. 41121) Rule 2.40 authorizes a pilot program allowing market-makers in a<br />

trading crowd to subsidize the activity of floor brokers who represent orders in that crowd.<br />

For a summary of the key points of the rule, refer to Regulatory Circular RG99-66 (printed<br />

above).<br />

Questions regarding this pilot program should be addressed to Tom Bond, Vice Chairman,<br />

312-786-7088; Phil Slocum, Member Trading Services, 312-786-7212; or Pat Cerny, Regulatory<br />

Services Division 312-786-7722. The full text of new Rule 2.40 is set forth below.<br />

RB4 RB4<br />

March March March 12, 12, 1999, 1999, 1999, Volume Volume Volume RB10, RB10, RB10, Number Number Number 11 11<br />

11

Rule Changes,<br />

Interpretations and<br />

Policies continued<br />

SR-<strong>CBOE</strong>-98-35 continued<br />

Rule 2.40 Market-Maker Surcharge for Brokerage<br />

(a) Definitions.<br />

(b) Generally.<br />

(i) Stationary Floor Broker. A Stationary Floor Broker (“SFB”) in a particular<br />

option class is a floor broker (A) who has established a business in the<br />

trading crowd for that option class of accepting and executing orders for<br />

members or registered broker-dealers and (B) who transacted at least 80%<br />

of his orders for the previous month in the trading crowd at which that option<br />

class is traded.<br />

(ii) Resident Market-Maker. A Resident Market-Maker in a particular class of<br />

options is a market-maker who transacted at least 80% of his market-maker<br />

contracts in option classes traded in the trading crowd where the particular<br />

option class is traded in the prior calendar month.<br />

(iii) ORS Orders. For purposes of this Rule, an ORS order is an order that is<br />

(A) sent over the <strong>Exchange</strong>’s Order Routing System (“ORS”), (B) given an<br />

ORS identification number and (C) not an order of the firm for which the SFB<br />

acts as a nominee or for whom the SFB has registered his membership.<br />

(iv) Standard OBO Rate. The Standard OBO Rate is any rate for Order Book<br />

Official (“OBO”) floor brokerage established by the <strong>Exchange</strong> for the particular<br />

equity option class traded on the <strong>Exchange</strong> floor, other than pursuant to<br />

this Rule.<br />

(v) Standard Market-Maker Fees. Standard Market-Maker Fees are the total<br />

market-maker fees established by the <strong>Exchange</strong> for the particular option<br />

class other than any fees implemented pursuant to this Rule.<br />

(vi) Market-Maker Surcharge. The Market-Maker Surcharge is the amount of<br />

the fee, not to exceed 25¢ per contract, that the <strong>Exchange</strong> may impose on<br />

market-makers for a particular class of options pursuant to this Rule that is<br />

in addition to the Standard Market-Maker Fees for that class of option.<br />

(i) The appropriate Floor Procedure Committee may impose a Market-Maker<br />

Surcharge for transactions on a particular class of options, which Surcharge<br />

shall be imposed on a per contract basis for every contract traded by every<br />

market-maker, whether in-person or by order, in that option class during the<br />

period for which the Market-Maker Surcharge is in effect.<br />

(ii) In imposing the fee, the appropriate Floor Procedure Committee shall<br />

consider the vote of the Resident Market-Makers for a particular option class,<br />

as described in paragraph (d) of this Rule. In addition, the Committee shall<br />

consider the views of any market-maker in favor of or opposed to the re<strong>com</strong>mended<br />

Surcharge or in favor of some other Surcharge amount. The Committee<br />

shall provide notice of its meeting schedule for the consideration of the<br />

Market-Maker Surcharge and the deadline for the submission of other materials<br />

for its consideration. The Committee shall determine the manner in<br />

which it shall review the submitted materials and whether it shall allow personal<br />

appearances before the Committee. The Committee may delegate<br />

responsibility for reviewing submitted materials and to review other positions<br />

to a Sub-Committee provided the full Committee makes the final decision<br />

regarding whether the fee should be imposed and the amount, if any, of the<br />

Surcharge or any changes in the Surcharge. A decision of the appropriate<br />

March March March 12, 12, 12, 1999, 1999, 1999, Volume Volume RB10, RB10, Number Number Number 11 11 11<br />

RB5<br />

RB5

Rule Changes,<br />

Interpretations and<br />

Policies continued<br />

SR-<strong>CBOE</strong>-98-35 continued<br />

Floor Procedure Committee may be appealed to the <strong>Exchange</strong>’s Appeals<br />

Committee pursuant to Chapter XIX.; however, the Surcharge will be effective<br />

until the matter has <strong>com</strong>pleted the <strong>Exchange</strong>’s review process. The<br />

appropriate Floor Procedure Committee through authority delegated by the<br />

Board of Directors will submit a rule filing pursuant to Section 19(b)(3) of the<br />

<strong>Exchange</strong> Act before the implementation of any new Surcharge or any<br />

change in the Surcharge or change in the OBO rate made pursuant to this<br />

Rule.<br />

(iii) The Market-Maker Surcharge will be used to reimburse the <strong>Exchange</strong><br />

to the extent the appropriate Floor Procedure Committee reduces the OBO<br />

brokerage rate applicable to the particular class of options below the standard<br />

OBO Rate pursuant to paragraph (g) of this Rule. Any amount remaining<br />

after the <strong>Exchange</strong> has been reimbursed will be paid to every SFB<br />

in that option class who executed an ORS Order in that option class during<br />

the relevant period of time. To the extent more than one SFB executed<br />

ORS Orders during the relevant period, such remaining amount shall be<br />

paid to the SFBs on a pro rata basis based on the number of ORS contracts<br />

executed by the respective SFBs during the period. The Market-<br />

Maker Surcharge generally will be assessed after the end of the month in<br />

which transactions on which the Market-Maker Surcharge fee was based<br />

occurred.<br />

(c) Time Period. The Market-Maker Surcharge generally shall be instituted for a<br />

minimum period of one month.<br />

(d) Vote to Re<strong>com</strong>mend a Market-Maker Surcharge Amount.<br />

(i) Any Resident Market-Maker may re<strong>com</strong>mend a Market-Maker Surcharge<br />

amount by the Friday prior to the vote or by any other time and date required<br />

by the appropriate Floor Procedure Committee. The vote of the<br />

Resident Market-Makers to re<strong>com</strong>mend the Surcharge shall take place at<br />

the station where the applicable option class is traded on the Tuesday of<br />

expiration week for equity options, or on any other day selected by the<br />

Committee. The Committee shall provide 24 hour notice of the time and<br />

date of the vote to the trading crowd if the vote is to be held at a different time<br />

or on a different day. The Committee shall determine how the vote shall be<br />

conducted. Any Resident Market-Maker personally present at the trading<br />

station when the vote is conducted may vote on the amount of the Surcharge<br />

to be re<strong>com</strong>mended. The Order Book Official at the particular trading<br />

post shall conduct the vote.<br />

(ii) Each Resident Market-Maker’s vote shall be weighted equally.<br />

(iii) Any Surcharge amount that receives a majority of the votes cast shall<br />

be the Surcharge re<strong>com</strong>mended to the appropriate Floor Procedure Committee.<br />

If any Surcharge amount does not receive a majority on the first<br />

ballot, the OBO may conduct subsequent ballots with the proposed Surcharges<br />

receiving the most votes or may solicit Resident Market-Makers<br />

for other proposed Surcharge amounts.<br />

(e) Option Classes. The appropriate Floor Procedure Committee may specify those<br />

option classes on which a Surcharge may be assessed pursuant to paragraph (b) of<br />

this Rule. In no event may the appropriate Floor Procedure Committee permit a<br />

Surcharge to be assessed on a class that is not also listed for trading on at least one<br />

other options exchange. In addition, the Surcharge may not be assessed for an<br />

option class that has been allocated to a Designated Primary Market-Maker.<br />

RB6 RB6<br />

March March March 12, 12, 1999, 1999, 1999, Volume Volume Volume RB10, RB10, RB10, Number Number Number 11 11<br />

11

Rule Changes,<br />

Interpretations and<br />

Policies continued<br />

SR-<strong>CBOE</strong>-98-35 continued<br />

(f) Floor Brokerage Commission. Although any SFB who executes ORS Orders may<br />

be paid a part of the Surcharge as provided in subparagraph (b)(iii) of this Rule, each<br />

SFB may charge any <strong>com</strong>mission rate that SFB desires.<br />

(g) Book Brokerage Rates. The appropriate Floor Procedure Committee may reduce<br />

the <strong>Exchange</strong>’s OBO brokerage rate for a particular option class below the Standard<br />

OBO Rate upon a re<strong>com</strong>mendation of the Resident Market-Makers pursuant to the<br />

terms of the vote in paragraph (d). In determining to reduce the OBO brokerage rate,<br />

the Committee shall consider not only the vote of the Resident Market-Makers, but<br />

also the views of any other floor broker or market-maker who submits views to the<br />

Committee pursuant to the published schedule for such submissions. Notice of the<br />

hearing, governance of the hearing, and all appeal rights shall be the same as those<br />

set forth in paragraph (b)(ii) of this Rule. If the Committee determines to reduce the<br />

OBO brokerage rate below the Standard OBO Rate, the <strong>Exchange</strong> will make the<br />

appropriate filing as required by the <strong>Exchange</strong> Act. To the extent the Committee<br />

reduces the OBO brokerage rate below the Standard OBO Rate, any Market-Maker<br />

Surcharge shall be used to reimburse the <strong>Exchange</strong> for the difference pursuant to<br />

paragraph (b)(iii). If the <strong>Exchange</strong> determines on its own initiative, otherwise than<br />

pursuant to this Rule, to lower the Standard OBO Rate for a particular equity option<br />

class, the Market-Maker Surcharge will not be used to reimburse the <strong>Exchange</strong> for<br />

such reduction.<br />

(h) Disclosure of payments. Any SFB who receives any payment pursuant to paragraph<br />

(b)(iii) of this Rule must disclose the fact of such payment to its customers in a<br />

manner and frequency required by the <strong>Exchange</strong> or as otherwise may be required by<br />

Rule 10b-10 of the Securities <strong>Exchange</strong> Act of 1934.<br />

(i) Pilot program. This Rule will be in effect as a pilot program until March 31, 2000.<br />

Approved February 26, 1999(98-35)<br />

SR-<strong>CBOE</strong>-99-08 – <strong>Exchange</strong> Fees<br />

On February 24, 1999, the <strong>Exchange</strong> filed Rule Change File No. SR-<strong>CBOE</strong>-99-08, which<br />

notices the SEC of changes to transaction fees, the Prospective Fee Reduction Program<br />

and the Customer “Large” Trade Discount Program. Pursuant to Section 19(b)(3) of the<br />

Securities <strong>Exchange</strong> Act, the filing became effective on March 1, 1999. Any questions<br />

regarding the fee changes may be directed to Alan Dean at 312-786-7023. A copy of the<br />

filing is available from the Legal Division.<br />

PROPOSED RULE CHANGE(S)<br />

Pursuant to Section 19(b)(1) of the Securities <strong>Exchange</strong> Act of 1934, as amended (“the<br />

Act”), and Rule 19b-4 thereunder, the <strong>Exchange</strong> has filed the following proposed rule change(s)<br />

with the Securities and <strong>Exchange</strong> Commission (“SEC”). A copy of the rule change filing(s)<br />

is available from the Legal Division. Members may submit written <strong>com</strong>ments to the Legal<br />

Division.<br />

The effective date of a proposed rule change will be the date of approval by the SEC, unless<br />

otherwise noted.<br />

SR-<strong>CBOE</strong>-99-07 – “Cross-Only” Orders<br />

On February 16, 1999, the <strong>Exchange</strong> filed Rule Change File No. SR-<strong>CBOE</strong>-99-07, which<br />