Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

34<br />

FINANCIAL INFORMATION REGARDING THE KARDEX REMSTAR GROUP<br />

Notes to the consolidated financial statements<br />

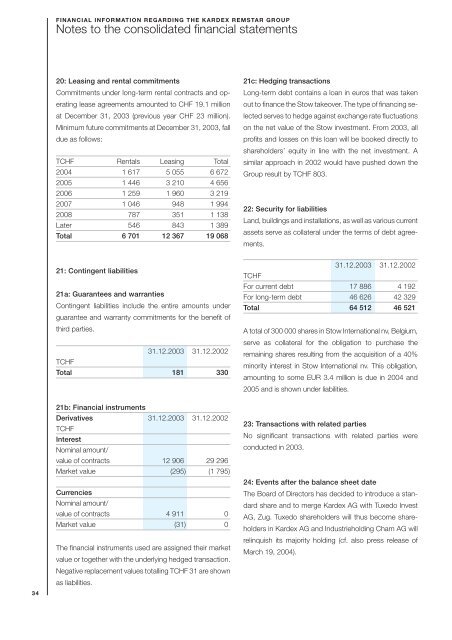

20: Leasing and rental commitments<br />

Commitments under long-term rental contracts and operating<br />

lease agreements amounted to CHF 19.1 million<br />

at December 31, <strong>2003</strong> (previous year CHF 23 million).<br />

Minimum future commitments at December 31, <strong>2003</strong>, fall<br />

due as follows:<br />

TCHF Rentals Leasing Total<br />

2004 1 617 5 055 6 672<br />

2005 1 446 3 210 4 656<br />

2006 1 259 1 960 3 219<br />

2007 1 046 948 1 994<br />

2008 787 351 1 138<br />

Later 546 843 1 389<br />

Total 6 701 12 367 19 068<br />

21: Contingent liabilities<br />

21a: Guarantees and warranties<br />

Contingent liabilities include the entire amounts under<br />

guarantee and warranty commitments for the benefit of<br />

third parties.<br />

31.12.<strong>2003</strong> 31.12.2002<br />

TCHF<br />

Total 181 330<br />

21b: Financial instruments<br />

Derivatives 31.12.<strong>2003</strong> 31.12.2002<br />

TCHF<br />

Interest<br />

Nominal amount/<br />

value of contracts 12 906 29 296<br />

Market value (295) (1 795)<br />

Currencies<br />

Nominal amount/<br />

value of contracts 4 911 0<br />

Market value (31) 0<br />

The financial instruments used are assigned their market<br />

value or together with the underlying hedged transaction.<br />

Negative replacement values totalling TCHF 31 are shown<br />

as liabilities.<br />

21c: Hedging transactions<br />

Long-term debt contains a loan in euros that was taken<br />

out to finance the Stow takeover. The type of financing selected<br />

serves to hedge against exchange rate fluctuations<br />

on the net value of the Stow investment. From <strong>2003</strong>, all<br />

profits and losses on this loan will be booked directly to<br />

shareholders’ equity in line with the net investment. A<br />

similar approach in 2002 would have pushed down the<br />

Group result by TCHF 803.<br />

22: Security for liabilities<br />

Land, buildings and installations, as well as various current<br />

assets serve as collateral under the terms of debt agreements.<br />

31.12.<strong>2003</strong> 31.12.2002<br />

TCHF<br />

For current debt 17 886 4 192<br />

For long-term debt 46 626 42 329<br />

Total 64 512 46 521<br />

A total of 300 000 shares in Stow International nv, Belgium,<br />

serve as collateral for the obligation to purchase the<br />

remaining shares resulting from the acquisition of a 40%<br />

minority interest in Stow International nv. This obligation,<br />

amounting to some EUR 3.4 million is due in 2004 and<br />

2005 and is shown under liabilities.<br />

23: Transactions with related parties<br />

No significant transactions with related parties were<br />

conducted in <strong>2003</strong>.<br />

24: Events after the balance sheet date<br />

The Board of Directors has decided to introduce a standard<br />

share and to merge <strong>Kardex</strong> AG with Tuxedo Invest<br />

AG, Zug. Tuxedo shareholders will thus become shareholders<br />

in <strong>Kardex</strong> AG and Industrieholding Cham AG will<br />

relinquish its majority holding (cf. also press release of<br />

March 19, 2004).