Classification and Measurement: Limited Amendments to IFRS 9

Classification and Measurement: Limited Amendments to IFRS 9

Classification and Measurement: Limited Amendments to IFRS 9

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

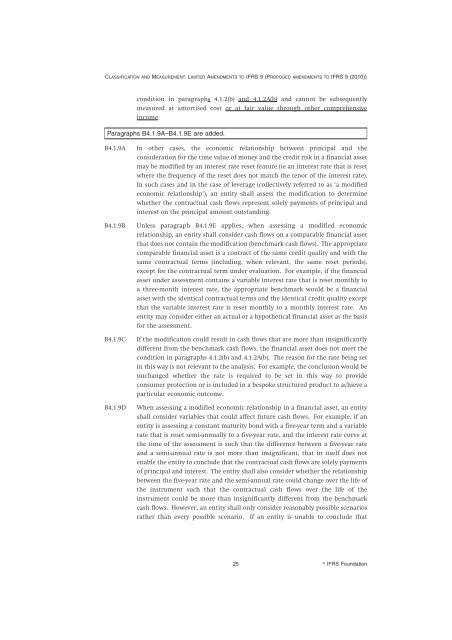

CLASSIFICATION AND MEASUREMENT: LIMITED AMENDMENTS TO <strong>IFRS</strong> 9 (PROPOSED AMENDMENTS TO <strong>IFRS</strong> 9 (2010))<br />

condition in paragraphs 4.1.2(b) <strong>and</strong> 4.1.2A(b) <strong>and</strong> cannot be subsequently<br />

measured at amortised cost or at fair value through other comprehensive<br />

income.<br />

Paragraphs B4.1.9A–B4.1.9E are added.<br />

B4.1.9A In other cases, the economic relationship between principal <strong>and</strong> the<br />

consideration for the time value of money <strong>and</strong> the credit risk in a financial asset<br />

may be modified by an interest rate reset feature (ie an interest rate that is reset<br />

where the frequency of the reset does not match the tenor of the interest rate).<br />

In such cases <strong>and</strong> in the case of leverage (collectively referred <strong>to</strong> as ‘a modified<br />

economic relationship’), an entity shall assess the modification <strong>to</strong> determine<br />

whether the contractual cash flows represent solely payments of principal <strong>and</strong><br />

interest on the principal amount outst<strong>and</strong>ing.<br />

B4.1.9B Unless paragraph B4.1.9E applies, when assessing a modified economic<br />

relationship, an entity shall consider cash flows on a comparable financial asset<br />

that does not contain the modification (benchmark cash flows). The appropriate<br />

comparable financial asset is a contract of the same credit quality <strong>and</strong> with the<br />

same contractual terms (including, when relevant, the same reset periods),<br />

except for the contractual term under evaluation. For example, if the financial<br />

asset under assessment contains a variable interest rate that is reset monthly <strong>to</strong><br />

a three-month interest rate, the appropriate benchmark would be a financial<br />

asset with the identical contractual terms <strong>and</strong> the identical credit quality except<br />

that the variable interest rate is reset monthly <strong>to</strong> a monthly interest rate. An<br />

entity may consider either an actual or a hypothetical financial asset as the basis<br />

for the assessment.<br />

B4.1.9C If the modification could result in cash flows that are more than insignificantly<br />

different from the benchmark cash flows, the financial asset does not meet the<br />

condition in paragraphs 4.1.2(b) <strong>and</strong> 4.1.2A(b). The reason for the rate being set<br />

in this way is not relevant <strong>to</strong> the analysis. For example, the conclusion would be<br />

unchanged whether the rate is required <strong>to</strong> be set in this way <strong>to</strong> provide<br />

consumer protection or is included in a bespoke structured product <strong>to</strong> achieve a<br />

particular economic outcome.<br />

B4.1.9D When assessing a modified economic relationship in a financial asset, an entity<br />

shall consider variables that could affect future cash flows. For example, if an<br />

entity is assessing a constant maturity bond with a five-year term <strong>and</strong> a variable<br />

rate that is reset semi-annually <strong>to</strong> a five-year rate, <strong>and</strong> the interest rate curve at<br />

the time of the assessment is such that the difference between a five-year rate<br />

<strong>and</strong> a semi-annual rate is not more than insignificant, that in itself does not<br />

enable the entity <strong>to</strong> conclude that the contractual cash flows are solely payments<br />

of principal <strong>and</strong> interest. The entity shall also consider whether the relationship<br />

between the five-year rate <strong>and</strong> the semi-annual rate could change over the life of<br />

the instrument such that the contractual cash flows over the life of the<br />

instrument could be more than insignificantly different from the benchmark<br />

cash flows. However, an entity shall only consider reasonably possible scenarios<br />

rather than every possible scenario. If an entity is unable <strong>to</strong> conclude that<br />

25<br />

� <strong>IFRS</strong> Foundation