Classification and Measurement: Limited Amendments to IFRS 9

Classification and Measurement: Limited Amendments to IFRS 9

Classification and Measurement: Limited Amendments to IFRS 9

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

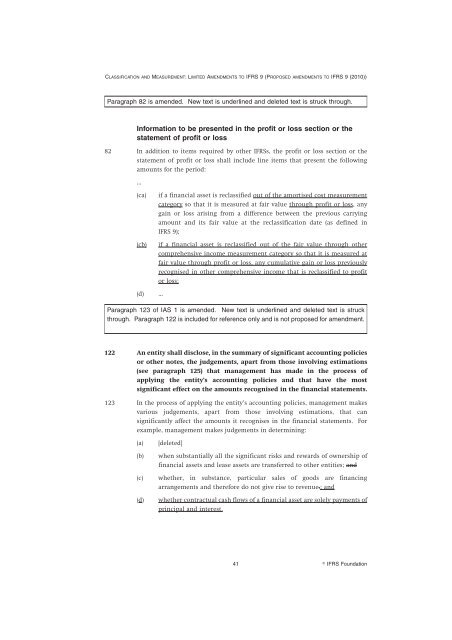

CLASSIFICATION AND MEASUREMENT: LIMITED AMENDMENTS TO <strong>IFRS</strong> 9 (PROPOSED AMENDMENTS TO <strong>IFRS</strong> 9 (2010))<br />

Paragraph 82 is amended. New text is underlined <strong>and</strong> deleted text is struck through.<br />

Information <strong>to</strong> be presented in the profit or loss section or the<br />

statement of profit or loss<br />

82 In addition <strong>to</strong> items required by other <strong>IFRS</strong>s, the profit or loss section or the<br />

statement of profit or loss shall include line items that present the following<br />

amounts for the period:<br />

...<br />

(ca) if a financial asset is reclassified out of the amortised cost measurement<br />

category so that it is measured at fair value through profit or loss, any<br />

gain or loss arising from a difference between the previous carrying<br />

amount <strong>and</strong> its fair value at the reclassification date (as defined in<br />

<strong>IFRS</strong> 9);<br />

(cb) if a financial asset is reclassified out of the fair value through other<br />

comprehensive income measurement category so that it is measured at<br />

fair value through profit or loss, any cumulative gain or loss previously<br />

recognised in other comprehensive income that is reclassified <strong>to</strong> profit<br />

or loss;<br />

(d) ...<br />

Paragraph 123 of IAS 1 is amended. New text is underlined <strong>and</strong> deleted text is struck<br />

through. Paragraph 122 is included for reference only <strong>and</strong> is not proposed for amendment.<br />

122 An entity shall disclose, in the summary of significant accounting policies<br />

or other notes, the judgements, apart from those involving estimations<br />

(see paragraph 125) that management has made in the process of<br />

applying the entity’s accounting policies <strong>and</strong> that have the most<br />

significant effect on the amounts recognised in the financial statements.<br />

123 In the process of applying the entity’s accounting policies, management makes<br />

various judgements, apart from those involving estimations, that can<br />

significantly affect the amounts it recognises in the financial statements. For<br />

example, management makes judgements in determining:<br />

(a) [deleted]<br />

(b) when substantially all the significant risks <strong>and</strong> rewards of ownership of<br />

financial assets <strong>and</strong> lease assets are transferred <strong>to</strong> other entities; <strong>and</strong><br />

(c) whether, in substance, particular sales of goods are financing<br />

arrangements <strong>and</strong> therefore do not give rise <strong>to</strong> revenue.; <strong>and</strong><br />

(d) whether contractual cash flows of a financial asset are solely payments of<br />

principal <strong>and</strong> interest.<br />

41<br />

� <strong>IFRS</strong> Foundation