Classification and Measurement: Limited Amendments to IFRS 9

Classification and Measurement: Limited Amendments to IFRS 9

Classification and Measurement: Limited Amendments to IFRS 9

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CLASSIFICATION AND MEASUREMENT: LIMITED AMENDMENTS TO <strong>IFRS</strong> 9 (PROPOSED AMENDMENTS TO <strong>IFRS</strong> 9 (2010))<br />

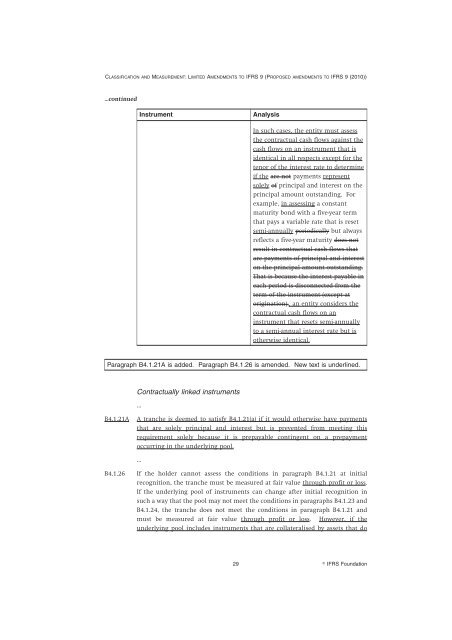

...continued<br />

Instrument Analysis<br />

In such cases, the entity must assess<br />

the contractual cash flows against the<br />

cash flows on an instrument that is<br />

identical in all respects except for the<br />

tenor of the interest rate <strong>to</strong> determine<br />

if the are not payments represent<br />

solely of principal <strong>and</strong> interest on the<br />

principal amount outst<strong>and</strong>ing. For<br />

example, in assessing a constant<br />

maturity bond with a five-year term<br />

that pays a variable rate that is reset<br />

semi-annually periodically but always<br />

reflects a five-year maturity does not<br />

result in contractual cash flows that<br />

are payments of principal <strong>and</strong> interest<br />

on the principal amount outst<strong>and</strong>ing.<br />

That is because the interest payable in<br />

each period is disconnected from the<br />

term of the instrument (except at<br />

origination)., an entity considers the<br />

contractual cash flows on an<br />

instrument that resets semi-annually<br />

<strong>to</strong> a semi-annual interest rate but is<br />

otherwise identical.<br />

Paragraph B4.1.21A is added. Paragraph B4.1.26 is amended. New text is underlined.<br />

Contractually linked instruments<br />

...<br />

B4.1.21A A tranche is deemed <strong>to</strong> satisfy B4.1.21(a) if it would otherwise have payments<br />

that are solely principal <strong>and</strong> interest but is prevented from meeting this<br />

requirement solely because it is prepayable contingent on a prepayment<br />

occurring in the underlying pool.<br />

...<br />

B4.1.26 If the holder cannot assess the conditions in paragraph B4.1.21 at initial<br />

recognition, the tranche must be measured at fair value through profit or loss.<br />

If the underlying pool of instruments can change after initial recognition in<br />

such a way that the pool may not meet the conditions in paragraphs B4.1.23 <strong>and</strong><br />

B4.1.24, the tranche does not meet the conditions in paragraph B4.1.21 <strong>and</strong><br />

must be measured at fair value through profit or loss. However, if the<br />

underlying pool includes instruments that are collateralised by assets that do<br />

29<br />

� <strong>IFRS</strong> Foundation