Whole Foods/Wild Oats Merger: - The Arthur Page Society

Whole Foods/Wild Oats Merger: - The Arthur Page Society

Whole Foods/Wild Oats Merger: - The Arthur Page Society

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

gave federal government the authority to dissolve mergers prior to an agreement. This<br />

allows time for the FTC to examine the proposal without having to later go through the<br />

trouble of dismantling an organization after it has already merged.<br />

4.6. Steps to File a <strong>Merger</strong> 36<br />

As a result of the HSR Act, corporations today must meet must meet a series of<br />

conditions in order to file a merger or acquisition. First, these companies must pass three<br />

qualification tests:<br />

1. <strong>The</strong> Commerce Test: Any party involved in the merger or acquisition must be involved<br />

in commerce. Due to the broad nature of this condition, nearly all proposals pass this test. 37<br />

2. <strong>The</strong> Size‐of‐the‐Person Test: This test concludes the size of the acquiring and the<br />

acquired parties based on financial information from the most recent annual statement of<br />

income, expenses and assets. <strong>The</strong> acquiring party must file if its total value of voting<br />

securities, NCI and assets exceeds $50 million.<br />

3. <strong>The</strong> Size‐of‐the‐Transaction Test: A ‘large’ merger or acquisition transaction is defined as<br />

one valued at more than $200 million. All mergers and acquisitions valued below this<br />

amount may not require approval from the FTC. 38<br />

If these conditions are applicable, acquiring corporations are ordered to submit a 16‐page<br />

analysis of the effects of the merger – including financial information of all parties involved<br />

– and pay a filing fee. Fees are based on the size of the transaction [See Table 1].<br />

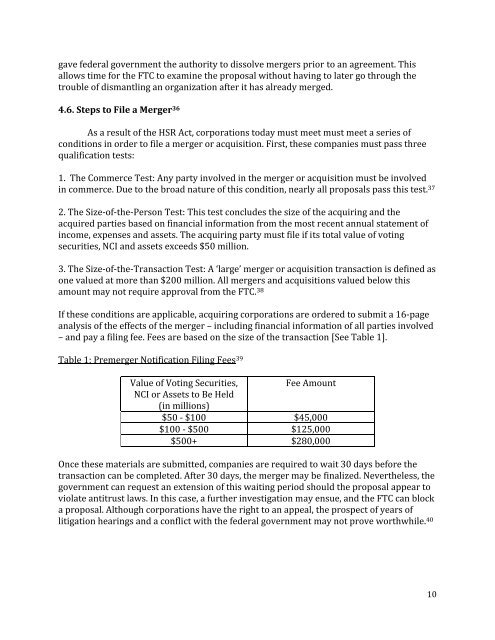

Table 1: Premerger Notification Filing Fees 39<br />

Value of Voting Securities,<br />

NCI or Assets to Be Held<br />

(in millions)<br />

Fee Amount<br />

$50 ‐ $100 $45,000<br />

$100 ‐ $500 $125,000<br />

$500+ $280,000<br />

Once these materials are submitted, companies are required to wait 30 days before the<br />

transaction can be completed. After 30 days, the merger may be finalized. Nevertheless, the<br />

government can request an extension of this waiting period should the proposal appear to<br />

violate antitrust laws. In this case, a further investigation may ensue, and the FTC can block<br />

a proposal. Although corporations have the right to an appeal, the prospect of years of<br />

litigation hearings and a conflict with the federal government may not prove worthwhile. 40<br />

10