p12 p24 p34 p44 - Sonae Sierra

p12 p24 p34 p44 - Sonae Sierra

p12 p24 p34 p44 - Sonae Sierra

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2007<br />

IN REVIEW<br />

INNOVATIVE SPIRITED MODERN

INNOVATIVE SPIRITED MODERN<br />

2 CEO’s Statement<br />

4 Our organisational structure<br />

6 Our partnerships past and present<br />

8 The year in numbers<br />

10 A year of achievements<br />

12 <strong>Sierra</strong> Investments<br />

24 <strong>Sierra</strong> Developments<br />

34 <strong>Sierra</strong> Management<br />

44 <strong>Sonae</strong> <strong>Sierra</strong> Brazil<br />

54 <strong>Sonae</strong> <strong>Sierra</strong> Consolidated Accounts<br />

58 Corporate Responsibility<br />

62 Board of Directors<br />

64 Other Executives<br />

66 Our Future<br />

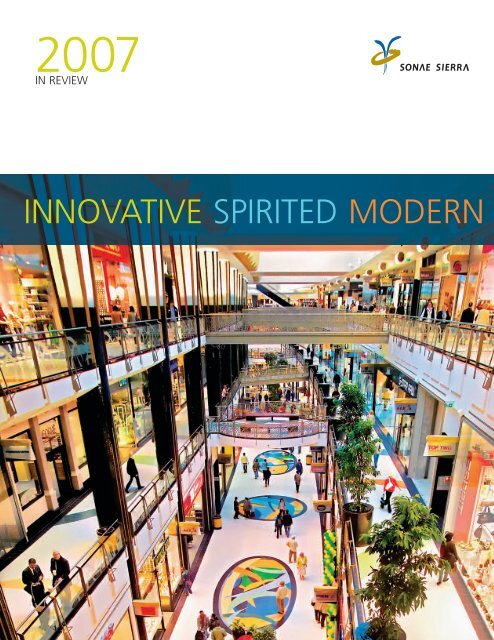

Front cover: Alexa, Berlin, Germany

FOR US, SHOPPING AND LEISURE ARE INDIVISIBLE.<br />

WE ARE AS PASSIONATE ABOUT INNOVATIVE IDEAS<br />

FOR THEIR DEVELOPMENT AND MANAGEMENT AS<br />

WE ARE COMMITTED TO THE SUSTAINABILITY OF<br />

EVERY CENTRE WE CREATE.<br />

THROUGH A UNIQUE COMBINATION OF CREATIVE<br />

ENERGY, IMAGINATION AND PRACTICALITY, WE<br />

NOT ONLY DEVELOP AND MANAGE EXCEPTIONAL<br />

RETAIL PROPERTY SOLUTIONS THAT PROVIDE<br />

STIMULATING SHOPPING AND LEISURE SPACES<br />

FOR OUR TENANTS, THEIR CUSTOMERS AND<br />

THE COMMUNITIES WE SERVE, WE ALSO<br />

DELIVER REWARDING RESULTS FOR OUR<br />

INVESTORS AND PARTNERS.<br />

1<br />

SONAE SIERRA In Review 2007

CEO’s Statement<br />

Álvaro Portela<br />

Chief Executive Officer<br />

2007 was a very good year for <strong>Sonae</strong> <strong>Sierra</strong>. We not only<br />

achieved record profits, we also broke new ground by expanding<br />

into new territory – Romania – where we have added three new<br />

assets to our portfolio.<br />

The increase in our profitability is due in no small measure to the<br />

inspirational hard work and dedication of our team. Working in<br />

sometimes difficult conditions and circumstances, they have<br />

sustained our steady progress towards our goal of becoming a<br />

€2 billion NAV company by 2009. At the end a year with two<br />

distinct halves – one of buoyant confidence in the two quarters<br />

prior to the US sub-prime crisis and one of some uncertainty over<br />

the following six months – our total net profits stood at €300<br />

million and our NAV had increased by 15% to €1,713 million.<br />

Now, as an alternative way of expressing our growth, we are<br />

seeking to improve the Open Market Value (OMV) of the<br />

properties we are responsible for, which stood at €6 billion in<br />

2007, to €12 billion by the end of 2012. Achieving this will<br />

enhance our standing as asset managers and make it possible for<br />

us to increase our share of the asset management market.<br />

New operational territory<br />

After six years without any geographical expansion, 2007 saw us<br />

enter the Romanian market.<br />

We have made a good beginning in this new territory by adding<br />

three new assets to our portfolio. We have acquired one<br />

operating shopping centre, River Plaza Mall in Ramnicu Valcea,<br />

170 km from Bucharest, and we are already building another<br />

new shopping centre in Craiova, 240 kms west of the capital.<br />

This centre will have a Gross Lettable Area (GLA) of over<br />

55,000m 2. We are making progress with the development of our<br />

third asset, an innovative centre in the city of Ploiesti, which will<br />

have a GLA of some 64,000m 2. In total, these two new<br />

developments represent an investment of €293 million.<br />

We see Romania as a very promising market. The country has many<br />

large cities, which already feature shopping centres, and there are<br />

good forecasts for the country’s continuing economic growth as the<br />

government encourages the development of a free market.<br />

We will continue to explore other territories but, as with<br />

Romania, we will only enter any new market when we have<br />

identified the right opportunities.<br />

New centre openings<br />

As well as breaking new ground in Romania, we have opened a<br />

number of new centres in our established markets.<br />

The most exciting of these is Alexa, in Berlin, a development we<br />

shared with Fonciére Euris, which opened in September with 178<br />

shops in a GLA of 56,200m 2. On the inauguration day, we had to<br />

have police on crowd control duty, and customers had to be<br />

asked to wait in line, because their numbers were so great. Since<br />

then Alexa has grown in popularity, with more than 5.2 million<br />

visits in just three-and-a-half months. I believe this bodes well for<br />

the opening of our other new centre in Germany, Loop5.<br />

Many of our competitors and current and potential investors<br />

were eager to see how our first German centre would perform.<br />

Alexa has proved that our style of product is popular outside our<br />

traditional southern Europe territory, which gives us<br />

encouragement for the future.<br />

Of the other new openings, 8ª Avenida in the Portuguese city of<br />

S. João da Madeira, is a €54.3 million investment with 130 shops<br />

in a GLA of 30,477m 2, while El Rosal in Ponferrada, Spain, is a<br />

€111 million investment between ourselves and the Mall Group,<br />

which has 147 shops in a GLA of 49,500m 2.<br />

Developments and renovations<br />

Our development pipeline remains robust, with new projects in<br />

Portugal, Spain, Italy, Germany, Greece, Romania and Brazil.<br />

In every case, our plan is to offer a <strong>Sierra</strong> concept of shopping and<br />

leisure which combines shopping with an element of fun. This is in<br />

line with our belief that shopping is not just an economic activity<br />

but also something which people can enjoy as a leisure pursuit.<br />

In addition to our new developments, we are continuing with our<br />

programme of renovation, including the refurbishment of Valecenter<br />

in Italy, which opened some 15 years ago and, over time, has been<br />

SONAE SIERRA In Review 2007 2

“WE ARE SEEKING TO IMPROVE THE OPEN<br />

MARKET VALUE OF THE PROPERTIES WE<br />

ARE RESPONSIBLE FOR TO €12 BILLION BY<br />

THE END OF 2012.”<br />

transformed. Originally one of the least appealing centres one might<br />

see anywhere, it is now an attractive destination that is popular with<br />

the people living in and around Marcon, near Venice.<br />

After several years, we have finally been able to start the<br />

construction of the first of the two office towers that formed part<br />

of the original designs for the Centro Colombo in Lisbon. Our<br />

activities have become more focused since this project was first<br />

designed, and we will be seeking to dispose of our share of the<br />

completed towers, now reduced to 25%, through a commercial<br />

property specialist with an interest in office space.<br />

Similarly, our sale of Lima Retail Park reflects our sharpened<br />

shopping centre focus and our view that – once completed –<br />

retail parks offer us little opportunity for adding to their value.<br />

Rewards for excellence<br />

Last year we were pleased to have won a number of awards.<br />

This year we have done even better.<br />

In October we were presented with an award as the best<br />

company operating in the European shopping centre sector. We<br />

first received this accolade, which is presented by the UK real<br />

estate magazine, “Property Week”, and its German counterpart,<br />

“Immobilien Zeitung”, in 2005. It is particularly pleasing to have<br />

succeeded twice.<br />

Equally satisfying was our winning of a Dupont Safety Award for<br />

our Personæ project. This ground-breaking safety & health<br />

programme focuses on the need to create a culture of accident<br />

anticipation and prevention at all our centres. Its aim is to build<br />

on the involvement of everyone working in our centres – tenants<br />

and our own staff alike – so that neither we nor our stakeholders<br />

have to rely solely on the work of a team of safety professionals.<br />

In July we won the Elite Lombard Award for the best retail<br />

strategy in Italy. This award is given to institutions, companies and<br />

top managers who, over the course of the year, have attained<br />

special achievements in various areas of real estate development.<br />

It was particularly pleasing to win this, because it shows the value<br />

of our consistent commitment to innovation and quality in all<br />

that we do.<br />

3<br />

Earlier in the year we had won the first-ever ReSource Award,<br />

created by the International Council of Shopping Centres (ICSC)<br />

Europe for the sole purpose of distinguishing a developer, project,<br />

manager or tenant who, in the ICSC’s opinion, consistently takes<br />

a long-term view of sustainability. It was gratifying to hear the<br />

President of the Jury, Stephen Pragnell, highlight two of our most<br />

recent developments as “excellent examples of the high level of<br />

innovation and quality the company has developed with the<br />

purpose of reaching profitability and sustainability for each of its<br />

shopping centres”.<br />

As a reflection of our commitment to sustainability and<br />

environmental efficiency, our objective is to obtain ISO 14001<br />

certification for all the shopping centres we own, as well as for<br />

the construction of all the centres we develop.<br />

The year ahead<br />

Last year I was able to announce our new partnership in Brazil with<br />

Developers Diversified Realty, which I am pleased to report is<br />

progressing well. This year we have consolidated our partnership<br />

with the German investment house, Deka, through the sale of 50%<br />

of LoureShopping, and we shall seek other similar liaisons over time.<br />

We also reinforced our partnership with Rockspring with the<br />

development of Pantheon Plaza, a new project in Larissa, Greece.<br />

At the beginning of 2008, events in the investment sector suggest<br />

that the climate for borrowing may become a little difficult over the<br />

course of the year. However, we expect consumer confidence to<br />

provide limited growth in Portugal, Italy and German, more robust<br />

growth in Greece and Spain, and stronger growth in Romania.<br />

As a result, we have every reason to look forward to another<br />

profitable period as we seek to attain our long-term goals.<br />

Álvaro Portela<br />

Chief Executive Officer<br />

SONAE SIERRA In Review 2007

OUR FOUR-PART ORGANISATIONAL STRUCTURE<br />

REFLECTS OUR THREE MAIN BUSINESS AREAS –<br />

EUROPEAN SHOPPING AND LEISURE CENTRE<br />

OWNERSHIP, DEVELOPMENT AND MANAGEMENT<br />

– AND OUR ACTIVITIES IN BRAZIL.<br />

Our organisational structure<br />

Portugal<br />

Spain<br />

Italy<br />

Germany<br />

Greece<br />

Romania<br />

SIERRA INVESTMENTS<br />

Owns <strong>Sonae</strong> <strong>Sierra</strong>’s assets,<br />

provides its asset management<br />

services and is responsible for<br />

our investments in Europe.<br />

Also holds our share of the<br />

<strong>Sierra</strong> Funds’ equity and acts as<br />

asset manager for the Funds.<br />

SEE PAGE 12<br />

*<br />

<strong>Sierra</strong><br />

Funds<br />

<strong>Sierra</strong><br />

Investments<br />

Portugal<br />

Spain<br />

Italy<br />

Germany<br />

Greece<br />

Romania<br />

<strong>Sierra</strong><br />

Corporate<br />

Services*<br />

<strong>Sierra</strong><br />

Developments<br />

SIERRA DEVELOPMENTS<br />

Responsible for the<br />

development of our shopping<br />

and leisure centres in Europe.<br />

Activities include all aspects of<br />

procurement, conceptual<br />

development, architectural<br />

design and construction<br />

management.<br />

SEE PAGE 24<br />

<strong>Sonae</strong><br />

<strong>Sierra</strong><br />

<strong>Sierra</strong><br />

Management<br />

Portugal<br />

Spain<br />

Italy<br />

Germany<br />

Greece<br />

Romania<br />

<strong>Sonae</strong> <strong>Sierra</strong><br />

Brazil<br />

SIERRA MANAGEMENT<br />

Investment<br />

Responsible for all aspects of<br />

the property management of<br />

our European shopping and<br />

leisure centres, including those<br />

owned by <strong>Sierra</strong> Investments<br />

and other third parties.<br />

SEE PAGE 34<br />

<strong>Sierra</strong> Corporate Services provides a comprehensive portfolio of financial, legal, human resources, environmental,<br />

communications, safety & health, and back-office services that support our operations.<br />

Development<br />

SONAE SIERRA In Review 2007 4<br />

Management<br />

SONAE SIERRA BRAZIL<br />

Operates autonomously,<br />

investing in, developing and<br />

managing a growing number<br />

of shopping and leisure centres<br />

in Brazil.<br />

SEE PAGE 44

COUNTRIES OF OPERATION<br />

5<br />

Portugal<br />

Italy<br />

Brazil<br />

Spain<br />

Germany<br />

Greece<br />

Romania<br />

SONAE SIERRA In Review 2007

OUR AIM IS TO DEVELOP LONG-TERM<br />

RELATIONSHIPS WITH LIKE-MINDED<br />

ORGANISATIONS WHO SEE US AS THEIR<br />

PARTNER OF CHOICE IN THE SHOPPING<br />

AND LEISURE SECTOR.<br />

Our partnerships past and present<br />

France<br />

CNP Assurances CDC<br />

Foncière Euris Ecureuil Vie<br />

Netherlands<br />

ING Real Estate ABP<br />

Germany<br />

Deka<br />

Greece<br />

Charagionis Group Lamda Development<br />

United Kingdom<br />

Grosvenor Fund Management<br />

Miller Developments<br />

Castle City<br />

SONAE SIERRA In Review 2007 6<br />

27 PARTNERS FROM<br />

Rockspring

Portugal<br />

Estevão Neves<br />

7<br />

NSL Group<br />

<strong>Sonae</strong> Distribuição Estação Shopping<br />

10 COUNTRIES<br />

Spain<br />

Mall Group<br />

Eroski Group<br />

LAR Group<br />

Italy<br />

Coimpredil<br />

Brazil<br />

USA<br />

AIG<br />

DDR<br />

TIAA- CREF<br />

Multiplan Tivoli EP<br />

Enplanta Engenharia<br />

SONAE SIERRA In Review 2007

IN A YEAR WHEN PROFITS ACHIEVED RECORD<br />

LEVELS, WE ALSO REINFORCED THE ASSET<br />

VALUE OF OUR PORTFOLIO WITH THE ENTRY<br />

OF SEVEN NEW OPERATING CENTRES.<br />

The year in numbers<br />

NOI of<br />

€156.2<br />

million (+4.8%)<br />

€6,154<br />

OMV of Assets under Management (€ million)<br />

2007<br />

2006<br />

2005<br />

2004<br />

2003<br />

2002<br />

2001<br />

8,162<br />

Number of tenant contracts under management<br />

2007<br />

2006<br />

2005<br />

2004<br />

2003<br />

2002<br />

2001<br />

NAV per share<br />

€52.69<br />

(+15%)<br />

OMV of<br />

€6,154<br />

million (+30.2%)<br />

SONAE SIERRA In Review 2007 8<br />

€m<br />

6,154<br />

4,721<br />

4,090<br />

3,335<br />

2,861<br />

2,569<br />

1,940<br />

No.<br />

8,162<br />

7,293<br />

7,166<br />

6,134<br />

5,399<br />

5,089<br />

3,949<br />

€300.1<br />

Consolidated Net Profit – IAS (€ million)<br />

2007<br />

2006<br />

2005<br />

2004<br />

2003<br />

2002<br />

2001<br />

€156.2<br />

Consolidated Net Operating Income – IAS (€ million)<br />

2007<br />

2006<br />

2005<br />

2004<br />

2003<br />

2002<br />

2001<br />

€m<br />

300.1<br />

270.6<br />

219.5<br />

126.8<br />

249.1<br />

144.5<br />

120.5<br />

€m<br />

156.2<br />

149.0<br />

125.7<br />

107.6<br />

98.1<br />

95.5<br />

73.8

€1,713m<br />

Real Estate Net Asset Value as of 31 December (€ million)<br />

2007<br />

2006<br />

2005<br />

2004<br />

2003<br />

2002<br />

2001<br />

1,855<br />

GLA owned in operating centres (000’s m 2)<br />

2007<br />

2006<br />

2005<br />

2004<br />

2003<br />

2002<br />

2001<br />

9<br />

€m<br />

1,713<br />

1,490<br />

1,265<br />

1,060<br />

948<br />

1,037<br />

934<br />

m 2<br />

1,855<br />

1,660<br />

1,586<br />

1,362<br />

1,203<br />

1,140<br />

790<br />

€52.69<br />

Real Estate Net Asset Value as of 31 December per share (€)<br />

2007<br />

2006<br />

2005<br />

2004<br />

2003<br />

2002<br />

2001<br />

2,183<br />

GLA under management (000’s m 2)<br />

2007<br />

2006<br />

2005<br />

2004<br />

2003<br />

2002<br />

2001<br />

SONAE SIERRA In Review 2007<br />

€<br />

52.69<br />

45.82<br />

38.90<br />

32.60<br />

29.16<br />

27.67<br />

24.9<br />

m 2<br />

2,183<br />

2,001<br />

2,025<br />

1,839<br />

1,564<br />

1,517<br />

1,128

2007 WAS AN EXCEPTIONAL YEAR FOR SONAE<br />

SIERRA. NOT ONLY DID WE START OPERATIONS<br />

IN ROMANIA AND OPEN FOUR NEW CENTRES<br />

ELSEWHERE IN EUROPE, WE ALSO ACHIEVED<br />

RECORD PROFITS OF €300 MILLION.<br />

A year of achievements<br />

2007 was a significant year for<br />

<strong>Sonae</strong> <strong>Sierra</strong>, with entry into<br />

the Romanian market and the<br />

inauguration of four new<br />

shopping centres.<br />

We strengthened our partnerships<br />

in Europe and have increased<br />

our holdings in three assets<br />

in Brazil.<br />

We are on course to achieve our<br />

goal of becoming a €2 billion<br />

NAV company by 2009.<br />

MARCH<br />

<strong>Sonae</strong> <strong>Sierra</strong>’s brand value increased<br />

by 44% to €566 million since the<br />

company’s new brand launch in 2004.<br />

MAY<br />

<strong>Sonae</strong> <strong>Sierra</strong> enters the Romanian<br />

market with the €42 million<br />

acquisition of the River Plaza Mall in<br />

Ramnicu Valcea, 170 km from the<br />

capital, Bucharest.<br />

SEPTEMBER<br />

The company’s first new centre in<br />

Germany – Alexa in Berlin – opens to<br />

massive acclaim from tenants and<br />

their customers.<br />

DECEMBER<br />

A new partnership with German<br />

fund manager Deka Immobilien<br />

Investment was done trough the<br />

sale to them of 50% of<br />

LoureShopping in Portugal.<br />

SONAE SIERRA In Review 2007 10

2007 WAS ALSO A YEAR IN WHICH WE HAVE<br />

INTERNATIONAL RECOGNITION FOR THE WAY<br />

WE MANAGE OUR BUSINESS.<br />

In October we were presented with an award from “Property Week” and<br />

“Immobilien Zeitung” as the best company in the European shopping centre sector.<br />

In the same month we won a Dupont Safety Award for Personæ, our groundbreaking<br />

safety & health programme.<br />

SIERRA<br />

INVESTMENTS<br />

2007 was another active<br />

year for <strong>Sierra</strong> Investments.<br />

We acquired a total of seven<br />

investments bringing the<br />

NAV of our portfolio to<br />

€1,713 million.<br />

• Acquired first operating<br />

shopping centre in Romania.<br />

• Acquired two new centres<br />

in Germany.<br />

• Strengthened our position<br />

in Spain.<br />

• Acquired new assets in<br />

Portugal.<br />

11<br />

SIERRA<br />

DEVELOPMENTS<br />

A competitive year in which we<br />

made good progress with<br />

developments in our traditional<br />

markets and began operations<br />

in a new one: Romania.<br />

• Started work on two new<br />

developments in Romania.<br />

• Opened four new shopping<br />

centres in Europe.<br />

• Four centres due to open<br />

in 2008.<br />

• 7 more under development<br />

and 13 new projects in<br />

different phases of<br />

completion.<br />

SIERRA<br />

MANAGEMENT<br />

A year of steady progress with<br />

a satisfactory performance from<br />

an enlarged portfolio in our<br />

core markets. New ventures<br />

started in Romania.<br />

• Began management of two<br />

centres in Germany.<br />

• Took over management of<br />

two centres in Romania.<br />

• Enlarged portfolio in Iberia.<br />

• Steady progress in Italy and<br />

Greece.<br />

SONAE SIERRA<br />

BRAZIL<br />

2007 was a year of<br />

consolidation in Brazil. We<br />

increased our holdings in three<br />

of our existing shopping<br />

centres and have started work<br />

on a new centre in Manaus.<br />

• Increased holdings in three<br />

São Paulo shopping centres.<br />

• Started construction of<br />

first-ever centre in Manaus.<br />

• Awarded first-ever<br />

ISO 14001 accreditation<br />

for a shopping centre<br />

in Brazil.<br />

<strong>p12</strong> <strong>p24</strong> <strong>p34</strong> <strong>p44</strong><br />

SONAE SIERRA In Review 2007

SIERRA INVESTMENTS OWNS THE COMPANY’S<br />

SHOPPING CENTRE ASSETS AND MANAGES ITS<br />

EUROPEAN INVESTMENT BUSINESS.<br />

SIERRA<br />

INVESTMENTS<br />

14<br />

21<br />

22<br />

Performance 2007<br />

The <strong>Sierra</strong> Fund in 2007<br />

Financial Report 2007<br />

SONAE SIERRA In Review 2007 12

Our core business activities<br />

<strong>Sierra</strong> Investments’ prime objective is to increase the asset value of all the<br />

company's shopping and leisure centres.<br />

The division is also becoming increasingly involved in managing thirdparty<br />

interests through the creation of real estate funds, and intends to<br />

devote more resources to the development of this new business.<br />

<strong>Sierra</strong> Investments’ principal contribution to <strong>Sonae</strong> <strong>Sierra</strong>'s results is<br />

derived from a combination of rental income and the rising market values<br />

of the shopping centres it owns. <strong>Sierra</strong> Asset Management, a company<br />

within <strong>Sierra</strong> Investments, also provides income-producing asset<br />

management services to the third party investors in these properties.<br />

Acting on behalf of the company, the division takes a long-term view,<br />

investing in assets developed by <strong>Sierra</strong> Developments as well as<br />

established centres acquired from third parties for their potential increase<br />

in value.<br />

<strong>Sierra</strong> Investments holds 50.1% of the <strong>Sierra</strong> Fund, thus maintaining its<br />

position as co-owner and manager of the Fund's underlying assets.<br />

<strong>Sierra</strong> Investments in 2007<br />

<strong>Sonae</strong> <strong>Sierra</strong>’s entry into the Romanian market was an important<br />

milestone for <strong>Sierra</strong> Investments. The successful acquisition of the River<br />

Plaza Mall in Ramnicu Valcea has allowed us to begin operating in<br />

Romania with a brand new asset that will give us a good understanding<br />

of the country’s retail market and a sound base for the future. We look<br />

forward to acquiring the centres under development in Craiova and<br />

Ploiesti in due course.<br />

Aside from our entry in this new territory, one of the major highlights of<br />

the year was our acquisition of two new centres in Germany: Münster<br />

Arkaden near Dortmund, for the <strong>Sierra</strong> Fund, and – from <strong>Sierra</strong><br />

Developments – the Alexa shopping and leisure centre in Berlin, which<br />

was inaugurated in September. The introduction of these two popular<br />

destinations into our portfolio will be followed by our future acquisition<br />

of Loop5 at Weiterstadt near Frankfurt. This is scheduled for 2009.<br />

During 2007 we strengthened our position in Spain through the<br />

acquisition of El Rosal, a shopping and leisure centre serving Ponferrada<br />

and the surrounding area.<br />

13<br />

Ana Guedes Oliveira<br />

<strong>Sonae</strong> <strong>Sierra</strong>, Executive Director,<br />

Investment and Asset Management, Europe<br />

Acquisition of River Plaza Mall in<br />

Ramnicu Valcea, Romania<br />

Acquisition of two new centres in<br />

Germany: Münster Arkaden and Alexa<br />

Acquisition of Modelo de Albufeira<br />

and Continente de Portimão, in<br />

Algarve, Portugal<br />

Acquisition of the 50% interest in<br />

GaiaShopping and the expanded<br />

ArrábidaShopping held by our original<br />

investment partners, and acquisition of<br />

8ª Avenida, all in Portugal<br />

Acquisition of El Rosal, in<br />

Ponferrada, Spain<br />

Sale of a 50% interest in<br />

LoureShopping in the Lisbon area to<br />

Deka Immobilien Investment<br />

SONAE SIERRA In Review 2007

Performance 2007<br />

In Portugal, we acquired 50% of two assets in Porto,<br />

GaiaShopping and the expanded ArrábidaShopping from our<br />

original investment partners, and acquired 8ª Avenida in S. João<br />

da Madeira from <strong>Sierra</strong> Developments. We have also started the<br />

construction of the first of the two office towers at the Colombo<br />

Centre in Lisbon, where we have a 25% share.<br />

In Italy, following the completion of its refurbishment, we<br />

celebrated the opening of the expansion of the Valecenter in<br />

Marcon near Venice.<br />

In a move designed to strengthen our links with German<br />

partners, we also sold 50% of LoureShopping to Deka<br />

Immobilien Investment at the end of 2007.<br />

Rents<br />

Fixed rents Variable rents Total rents % 07/06 rents<br />

2007 2006 2007 2006 2007 2006 total like-for-like<br />

Portugal 177,177 166,772 8,633 8,435 185,810 175,207 6.1% 3.9%<br />

Spain 65,790 64,642 3,543 3,384 69,333 68,026 1.9% 0.4%<br />

Italy 6,180 6,901 43 – 6,223 6,901 -9.8% -4.3%<br />

Greece 14,647 12,353 1,706 994 16,353 13,346 22.5% 22.5%<br />

Germany 9,270 – 199 – 9,469 – 100.0% –<br />

Romania 1,572 – – – 1,572 – 100.0% –<br />

Total 274,637 250,669 14,124 12,812 288,761 263,481 9.6% 5.3%<br />

Figures in Euro (thousands)<br />

Sales<br />

Sales % 07/06 sales<br />

2007 2006 total like-for-like<br />

Portugal 2,176,112 2,029,478 7.2% 5.9%<br />

Spain 904,740 828,284 9.2% 5.9%<br />

Italy 45,638 42,281 7.9% -16.3%<br />

Greece 164,061 118,779 38.1% 38.1%<br />

Germany 182,041 – 100.0% –<br />

Romania – – – –<br />

Total 3,472,592 3,018,821 15.0% 10.3%<br />

Figures in Euro (thousands)<br />

Rental income and property values<br />

In 2007, total rents from <strong>Sierra</strong> Investment’s owned portfolio<br />

increased by €25.3 million over the previous year – a 10%<br />

improvement or 5.3% on a like-for-like basis. This increase was<br />

achieved through organic (like-for-like) growth and acquisitions,<br />

both from <strong>Sierra</strong> Developments and from third parties. Turnover<br />

rents were 5.1% of total fixed rents.<br />

Following standard industry practice, we assess the performance<br />

of our properties through the growth of their market value.<br />

When compared with 2006, the increase in the valuation of our<br />

operating properties is €963 million. This increase is partly a result<br />

of the general decrease in exit yields of our existing shopping<br />

centres and their good operational performance, but also from<br />

the growth in our portfolio arising from the addition of seven<br />

new properties during 2007.<br />

Occupancy Rate<br />

SONAE SIERRA In Review 2007 14<br />

2007 2006<br />

Portugal 97% 98%<br />

Spain 94% 96%<br />

Italy 87% 79%<br />

Greece 100% 98%<br />

Germany 99% –<br />

Romania 100% –

Open Market Value Figures in Euro (thousands)<br />

Shopping Centres in Operation % <strong>Sierra</strong> * Open Market Value OMV Variation OMV Variation<br />

31 Dec. 2007 31 Dec. 2007 31 Dec. 2006 Total %<br />

AlgarveShopping 100% 157,989 140,176 17,813 13%<br />

ArrábidaShopping (3) 100% 179,032 73,926 105,107 142%<br />

CascaiShopping 50% 191,233 169,286 21,947 13%<br />

Centro Colombo 50% 408,756 361,250 47,506 13%<br />

Ocidente Tower (5) 25% 1,801 – 1,801 –<br />

Oriente Tower (5) 25% 1,577 – 1,577 –<br />

CoimbraShopping 100% 35,120 35,025 95 –<br />

GaiaShopping (3) 100% 185,431 81,632 103,800 127%<br />

GuimarãeShopping 100% 49,730 46,243 3,487 8%<br />

LoureShopping (4) 50% 65,362 119,205 -53,843 -45%<br />

MadeiraShopping 50% 40,263 38,549 1,714 4%<br />

MaiaShopping 100% 60,827 57,555 3,272 6%<br />

NorteShopping 50% 213,422 188,233 25,189 13%<br />

Parque Atlântico 50% 37,382 37,044 338 1%<br />

Estação Viana 100% 86,979 82,167 4,812 6%<br />

Centro Vasco da Gama 50% 156,940 137,952 18,988 14%<br />

ViaCatarina 50% 34,349 35,854 -1,506 -4%<br />

Serra Shopping 50% 23,589 22,426 1,163 5%<br />

RioSul Shopping 50% 58,279 55,516 2,763 5%<br />

CC Modelo de Albufeira (2) 50% 7,001 – 7,001 –<br />

CC Continente de Portimão (2) 50% 11,804 – 11,804 –<br />

8ª Avenida (1) 100% 71,485 – 71,485 –<br />

Total Portugal 2,078,347 1,682,036 396,310 24%<br />

Grancasa 50% 100,507 89,734 10,774 12%<br />

Max Center 50% 90,585 87,491 3,094 4%<br />

Valle Real 50% 49,574 48,128 1,446 3%<br />

La Farga 50% 31,674 29,949 1,725 6%<br />

Avenida M40 100% 65,106 82,506 -17,400 -21%<br />

Dos Mares 100% 59,391 55,308 4,083 7%<br />

Luz Del Tajo 100% 106,904 102,295 4,609 5%<br />

Zubiarte 50% 41,600 43,826 -2,226 -5%<br />

Plaza Mayor 100% 78,853 81,721 -2,868 -4%<br />

Plaza Éboli 100% 57,994 56,702 1,292 2%<br />

Parque Principado 50% 95,555 88,966 6,589 7%<br />

El Rosal (1) 100% 131,930 – 131,930 –<br />

Total Spain 909,671 766,624 143,047 19%<br />

Valecenter 100% 149,868 116,159 33,709 29%<br />

Airone 100% 18,642 18,506 136 1%<br />

Total Italy 168,510 134,665 33,845 25%<br />

Mediterranean Cosmos 19.95% 31,421 29,682 1,739 6%<br />

Total Greece 31,421 29,682 1,739 6%<br />

Münster Arkaden (2) 100% 168,634 – 168,634 –<br />

Alexa (1) 50% 176,950 – 176,950 –<br />

Total Germany 345,584 – 345,584 –<br />

River Plaza Mall (2) 100% 42,703 – 42,703 –<br />

Total Romania 42,703 – 42,703 –<br />

Total 3,576,236 2,613,007 963,229 37%<br />

* In Centres owned by SIERRA Fund, it means control<br />

(1) Opening during 2007<br />

(2) New Acquisition – Operating Centre<br />

(3) Acquisition of 50% in 2007<br />

(4) Sale of 50% in 2007<br />

(5) Sale of 25% in 2007; in 2006 the OMV was included in Centro Colombo<br />

15<br />

SONAE SIERRA In Review 2007

Performance 2007 continued<br />

Retail market outlook<br />

The retail market outlook suggests that, despite some unrest in<br />

the financial markets in the last half of 2007and early 2008, our<br />

core activities will keep on expanding across our target markets.<br />

In Portugal, following the progress made in 2006, economic<br />

activity in 2007 kept on improving. Although unemployment is<br />

falling slowly and no fiscal easing is anticipated, investors’ interest<br />

shows no sign of waning. 2007 recorded an increase in<br />

investment activity, mainly due to strong investment demand for<br />

prime retail property and to domestic funds’ activity, pushing for<br />

additional compression in yields.<br />

In Spain, economic activity remained strong, although by the final<br />

quarter of 2007 it began to slow as the credit lines that have<br />

fuelled much of the country’s growth over the past started to dry<br />

up. In the shopping centre sector, following the growth in supply,<br />

greater competition in some specific areas and an easing in<br />

economic growth, we have seen a growing degree of polarisation<br />

between the best and worst centres.<br />

In Italy, the latter half of 2007 saw relatively strong growth rates,<br />

with the property market having another strong year overall.<br />

Although the economy looks set to decelerate, Italy remains one<br />

of the best performing markets in Europe, in terms of rental<br />

growth. Shopping centres yields have stabilised as retailers<br />

continue to absorb the several large schemes of recent years.<br />

Economic activity in Greece remains strong at around 4.0% of<br />

GDP growth, although it was slowing slightly in the second half<br />

of 2007, with consumer spending still an important driver. Yield<br />

compression movements continued as part of an increasing<br />

investment activity. The country remains a relatively small market<br />

but it is still expected to outperform the EU with an improving<br />

investment market supported by the number of schemes<br />

scheduled to be completed during 2008.<br />

2007 was a strong year for the German economy, with<br />

unemployment falling to its lowest level in 15 years. However,<br />

despite an improvement in the labour market, the consumer<br />

sector remained weak and retail sales saw negative growth<br />

towards the end of the year. Shopping centre yields compression<br />

remains the main performance driver. Bearing in mind the<br />

country’s limited number of shopping centres, opportunities may<br />

arise from improvements and active management.<br />

In Romania, the economy continues to grow at a steady pace –<br />

well above most EU markets – supported by thriving consumer<br />

demand. The improved market transparency and a significant<br />

increase in the quality of shopping centres has increased<br />

investors’ interest and contributed to a significant reduction of<br />

the yield gap between Romania and its European neighbours.<br />

Future prospects<br />

Our constant objective is to look for opportunities that will allow<br />

us to add value to our existing portfolio, either through the<br />

expansion or improvement of our shopping and leisure centres,<br />

or through the ongoing process of tenant renewal.<br />

As mentioned in the description of our core business activities,<br />

we are also aiming to increase our asset management business<br />

during the coming year, through the management of third<br />

parties’ assets.<br />

Overall, we expect 2008 to offer more opportunities for shopping<br />

and leisure centre acquisition than were available to us in 2007,<br />

when the market was ‘hot’ and property prices were high. While<br />

the debt markets may take a little while to recover from the crisis<br />

of late 2007 and early 2008, we anticipate a calmer period as the<br />

year unfolds.<br />

SONAE SIERRA In Review 2007 16

7<br />

5<br />

4<br />

1 2 3<br />

4<br />

Owned shopping<br />

centres GLA (m 2)<br />

8ª Avenida<br />

S. João da Madeira, Portugal 20,155<br />

AlgarveShopping<br />

Guia, Albufeira, Portugal 42,540<br />

ArrábidaShopping<br />

Vila Nova de Gaia, Porto, Portugal 54,652<br />

CascaiShopping<br />

Cascais, Lisboa, Portugal 73,525<br />

CC Continente de Portimão<br />

Portimão, Portugal 13,485<br />

CC Modelo de Albufeira<br />

Albufeira, Portugal 10,461<br />

Centro Colombo<br />

Lisboa, Portugal 119,771<br />

Centro Vasco da Gama<br />

Lisboa, Portugal 47,691<br />

CoimbraShopping<br />

Coimbra, Portugal 26,494<br />

Estação Viana<br />

Viana do Castelo, Portugal 18,556<br />

GaiaShopping<br />

Vila Nova de Gaia, Porto, Portugal 59,683<br />

GuimarãeShopping<br />

Guimarães, Portugal 26,830<br />

LoureShopping<br />

Loures, Portugal 38,986<br />

MadeiraShopping<br />

Funchal, Madeira, Portugal 26,700<br />

MaiaShopping<br />

Maia, Porto, Portugal 28,906<br />

NorteShopping<br />

Matosinhos, Porto, Portugal 73,122<br />

Parque Atlântico<br />

Ponta Delgada, Azores, Portugal 22,340<br />

RioSul Shopping<br />

Seixal, Portugal 44,406<br />

Serra Shopping<br />

Covilhã, Portugal 17,680<br />

ViaCatarina<br />

Porto, Portugal 11,656

3<br />

6<br />

2<br />

1<br />

5<br />

6<br />

Owned shopping<br />

centres GLA (m 2)<br />

Avenida M40<br />

Madrid, Spain 48,223<br />

Dos Mares<br />

San Javier, Murcia, Spain 24,776<br />

El Rosal<br />

Ponferrada, Spain 49,476<br />

Grancasa<br />

Zaragoza, Spain 77,378<br />

La Farga<br />

Barcelona, Spain 17,412<br />

Luz del Tajo<br />

Toledo, Spain 42,020<br />

Max Center<br />

Bilbao, Spain 59,362<br />

Parque Principado<br />

Oviedo, Spain 74,398<br />

Plaza Éboli<br />

Pinto, Madrid, Spain 31,068<br />

Plaza Mayor<br />

Málaga, Spain 34,359<br />

Valle Real<br />

Santander, Spain 47,825<br />

Zubiarte<br />

Bilbao, Spain 20,562<br />

Airone<br />

Monselice, Padova, Italy 15,779<br />

Valecenter<br />

Marcon, Venice, Italy 58,152<br />

Alexa<br />

Berlin, Germany 56,445<br />

Münster Arkaden<br />

Münster, Germany 39,897<br />

Mediterranean Cosmos<br />

Thessalonica, Greece 45,956<br />

River Plaza Mall<br />

Ramnicu Valcea, Romania 11,953<br />

7

THE SIERRA FUND WAS ESTABLISHED IN 2003 WITH<br />

A TOTAL COMMITTED EQUITY OF €1.08 BILLION.<br />

SONAE SIERRA HOLDS 50.1% OF THE FUND AND<br />

SIERRA INVESTMENTS MANAGES ITS ASSETS.<br />

The <strong>Sierra</strong> Fund in 2007<br />

The objective of the <strong>Sierra</strong> Fund is to provide its investors with<br />

dividends and capital growth from investments in high quality,<br />

actively managed shopping centres in the Fund’s target markets<br />

of Portugal, Spain, Italy, Germany and Greece.<br />

Our five partner investors in the Fund are Stichting Pensioenfonds<br />

ABP of Holland, the French companies Caisse des Dépôts et<br />

Consignations EP, CNP Assurances and Ecureuil Vie, and TIAA-<br />

CREF which is based in the USA.<br />

The commitment of these international institutional investors not<br />

only validates the quality of <strong>Sonae</strong> <strong>Sierra</strong>'s existing assets and<br />

development programme, but also provides new knowledge sources<br />

which will help <strong>Sonae</strong> <strong>Sierra</strong> improve its performance going forward.<br />

The Fund reported another very good year at the end of 2007,<br />

with the investors’ return reaching 28%.<br />

During the year, the acquisition of Münster Arkaden was formally<br />

concluded.<br />

The Fund also contributed to the expansion and refurbishment of<br />

ArrábidaShopping, with the second phase due to open in March<br />

2008, and to the refurbishments of Valecenter and Grancasa<br />

which were initiated and are expected to come to full fruition<br />

during the first half of 2008. The Fund also benefited from the<br />

expansion of MaiaShopping, concluded in October with the<br />

openings of C&A, Springfield and Women Secret.<br />

21<br />

The <strong>Sierra</strong> Portugal Fund<br />

In addition, in March 2008 we launched a new fund – the<br />

<strong>Sierra</strong> Portugal Fund (SPF) – which focuses on a diversified<br />

portfolio of high quality shopping centre assets located in<br />

Portugal. The acquisition of the 50% interest in GaiaShopping<br />

and ArrábidaShopping, formerly owned by our investment<br />

partners, is part of this strategy. These two centres form an<br />

essential part of the new Fund, which is seeded with eight<br />

shopping centres and also benefits from a pipeline of three<br />

projects currently being developed in Portugal. The Fund’s<br />

total equity is € 300 million, of which <strong>Sonae</strong> <strong>Sierra</strong> intends<br />

to hold an interest of 20%.<br />

Three reference investors have joined <strong>Sonae</strong> <strong>Sierra</strong> in the<br />

initial closing of the SPF with combined commitments of<br />

€120m: LGPI – Local Government Pensions Institution, a<br />

Finnish pension fund for municipal workers; Ilmarinen, a<br />

Finnish mutual pension insurance company; Continental<br />

European Fund I and Continental European Fund II, two real<br />

estate funds of funds managed by Schroder Investment<br />

Management.<br />

SONAE SIERRA In Review 2007

SIERRA INVESTMENTS CONTRIBUTED €198.5 MILLION<br />

TO THE CONSOLIDATED PROFIT OF SONAE SIERRA.<br />

THE COMPANY CONSOLIDATES THE SIERRA FUND IN<br />

FULL, GIVEN THAT IT HOLDS EFFECTIVE CONTROL<br />

WITH 50.1% OF THE CAPITAL.<br />

Financial Report 2007<br />

Direct profits<br />

The direct profits of <strong>Sierra</strong> Investments are derived from the<br />

operation of shopping and leisure centres that are part of its<br />

portfolio, including those assets that are in the <strong>Sierra</strong> Fund. The<br />

direct profits also include the asset management services provided<br />

to the properties by <strong>Sierra</strong> Asset Management.<br />

The growth in turnover over 2006 is largely due to growth in the<br />

portfolio on two fronts.<br />

The first includes the opening of <strong>Sierra</strong> Developments’ centres in<br />

2007 – namely 8ª Avenida in Portugal, Alexa in Germany and El<br />

Rosal in Spain – and their acquisition by <strong>Sierra</strong> Investments.<br />

The second are the acquisitions of the River Plaza Mall in<br />

Romania, Münster Arkaden in Germany, and CC Continente de<br />

Portimão and CC Modelo de Albufeira in Portugal.<br />

The increase in asset management income over 2006 is also<br />

the result of the increase in the portfolio of the <strong>Sierra</strong> Fund and<br />

higher property valuations. Net Operating Income increased<br />

by 8%.<br />

Net financial costs rose 28% compared to 2006 due to an<br />

increase in bank debt from €1.175 million to a total of €1.680<br />

million. This increase is largely the result of the acquisition of<br />

assets during 2007 and of new financing/ refinancing of the<br />

existing portfolio.<br />

Indirect profits<br />

Indirect profits arise either from the change in value of the<br />

investment properties or the realisation of capital gains on the<br />

sale of assets and/or shareholding positions.<br />

The value created on investment properties reached €178 million<br />

in 2007, of which €167 million relate to value creation on assets<br />

in Portugal and €9 million in Spain.<br />

Minority interests of €82.5 million correspond mainly to 49.9%<br />

ownership of our five partners in the <strong>Sierra</strong> Fund results.<br />

Retail operating income<br />

of €192 million<br />

Net operating income (NOI)<br />

increased by 8% to €150 million<br />

Value created on properties<br />

of €178 million<br />

Net profit attributable to equity<br />

holders of €115.9 million<br />

SONAE SIERRA In Review 2007 22

<strong>Sierra</strong> Investments Profit & Loss Account (€ 000)<br />

23<br />

2007 2006 % 07/06<br />

Fixed Rental Income 169,326 152,080 11%<br />

Turnover Rental Income 8,601 7,600 13%<br />

Key-Money Income 6,167 6,264 -2%<br />

Other Income 7,536 7,103 6%<br />

Retail Operating Income 191,629 173,047 11%<br />

Property Management Services 9,644 8,719 11%<br />

Asset Management Services 22,075 18,093 22%<br />

Letting & Promotion 1,201 4,037 -70%<br />

Capital Expenditures 4,657 3,088 51%<br />

Other Costs 19,472 14,220 37%<br />

Retail Operating Costs 57,049 48,157 18%<br />

Retail Net Operating Margin 134,580 124,890 8%<br />

Parking Net Operating Margin 3,216 3,027 6%<br />

Co-generation Net Operating Margin 1,062 1,217 -13%<br />

Shopping Centre Net Operating Income 138,859 129,135 8%<br />

Offices Net Operating Income 342 372 -8%<br />

Income from Asset Management Services 23,072 18,661 24%<br />

Overheads 12,283 9,824 25%<br />

Asset Management Net Operating Income 10,789 8,836 22%<br />

Net Operating Income (NOI) 149,990 138,344 8%<br />

Depreciation 886 1,453 -39%<br />

Recurrent net financial costs/(income) 59,747 46,511 28%<br />

Non-Recurring costs/(income) (3,969) 200 –<br />

Results Before Corporate Taxes 93,327 90,179 3%<br />

Corporate Taxes 18,219 18,771 -3%<br />

Direct Profit 75,108 71,408 5%<br />

Realised Property Profit (1,549) (9) –<br />

Non-Realised Property Profit 179,918 221,060 -19%<br />

Total Indirect Income from Investments 178,370 221,051 -19%<br />

Deferred tax 55,023 51,560 7%<br />

Indirect Profit 123,347 169,492 -27%<br />

Net Profit for the Period<br />

Attributable to:<br />

198,455 240,900 -18%<br />

Equity holders 115,941 131,441 -12%<br />

Minority interests 82,514 109,458 -25%<br />

(un-audited accounts)<br />

<strong>Sierra</strong> Investments Consolidated Balance Sheet (€ 000)<br />

2007 2006 Var. (07 – 06)<br />

Investment properties & others 3,661,027 2,661,382 999,644<br />

Tenants 14,158 10,849 3,309<br />

Deferred taxes 18,655 15,677 2,978<br />

Other assets 100,956 80,586 20,370<br />

Deposits & short term investments 208,495 281,845 -73,349<br />

Total assets 4,003,291 3,050,339 952,952<br />

Net worth 930,795 832,265 98,530<br />

Minorities 440,212 398,014 42,198<br />

Bank loans 1,679,884 1,175,106 504,779<br />

Shareholder loans 97,318 73,041 24,276<br />

Deferred taxes 561,079 446,430 114,650<br />

Other liabilities 294,003 125,483 168,520<br />

Total liabilities 2,632,284 1,820,060 812,225<br />

Net Worth, minorities and liabilities 4,003,291 3,050,339 952,952<br />

(un-audited accounts)<br />

SONAE SIERRA In Review 2007

SIERRA DEVELOPMENTS HAS RESPONSIBILITY<br />

FOR ALL ASPECTS OF THE DEVELOPMENT OF<br />

THE COMPANY’S PORTFOLIO OF SHOPPING<br />

CENTRES IN EUROPE.<br />

SIERRA<br />

DEVELOPMENTS<br />

26<br />

32<br />

Performance 2007<br />

Financial Report 2007<br />

SONAE SIERRA In Review 2007 24

Our core business activities<br />

<strong>Sierra</strong> Developments’ activities cover land procurement, concept creation<br />

and development management services designed to ensure the successful<br />

completion and inauguration of <strong>Sonae</strong> <strong>Sierra</strong>’s new shopping and leisure<br />

centres in Europe.<br />

<strong>Sierra</strong> Developments contributes to our consolidated income in two<br />

principal ways: by supplying development services to our projects across<br />

Europe – which now include those in Romania – and by adding value to<br />

each one during its development phase. The full value of each project is<br />

realised when the completed property is acquired by <strong>Sierra</strong> Investments at<br />

market value.<br />

The most added value is created during each centre’s development<br />

phase. The constant recycling of capital, backed by a rigorous<br />

procurement policy and excellent management standards, creates<br />

innovative assets that are also attractive investments.<br />

Effective marketing and letting also impact on the success of our<br />

developments. These services are contracted out to <strong>Sierra</strong> Management.<br />

<strong>Sierra</strong> Developments in 2007<br />

25<br />

Fernando Guedes Oliveira<br />

<strong>Sonae</strong> <strong>Sierra</strong>, Executive Director,<br />

Developments Europe<br />

2007 was a positive year for <strong>Sierra</strong> Developments. Despite increased<br />

competition in all our markets, we not only made very good progress<br />

throughout Europe but also approved several new projects.<br />

In Portugal and Spain, the lowering of real estate yields had a very<br />

positive effect on the Open Market Value of the shopping centres we<br />

inaugurated or were developing during the year.<br />

In Italy, despite increasing financing costs and heavier fiscal charges on<br />

real estate deals, the additional pressure on yields made the market even<br />

more competitive than ever.<br />

In Germany, we had to take a number of measures to minimise the<br />

negative impact of the tax reform that was enacted on 1 January 2008.<br />

Inauguration of Alexa shopping centre<br />

in Berlin, Germany<br />

Inauguration of 8ª Avenida shopping<br />

centre in S. João da Madeira, Portugal<br />

Inauguration of El Rosal shopping<br />

centre in Ponferrada, Spain<br />

Inauguration and sale to PREF of Lima<br />

Retail Park in Viana do Castelo,<br />

Portugal<br />

Start of new developments in Ploiesti<br />

and Craiova in Romania<br />

SONAE SIERRA In Review 2007

Performance 2007<br />

Brand new market<br />

Nevertheless, we began work in Romania and have made good<br />

progress in what is, for us, a brand new market.<br />

The beginning of operations in any new market is always an<br />

important milestone in our progression. Our entry into the<br />

Romanian market shows that our company is becoming stronger<br />

in our newer territories, and that there is potential for even more<br />

growth in other Central European countries when the right<br />

opportunities present themselves.<br />

In addition to <strong>Sierra</strong> Investment’s acquisition of one operating<br />

shopping centre in Romania, we started work on two brand new<br />

developments in the cities of Craiova and Ploiesti, which will result in<br />

55,000m 2 and 64,000m 2 of Gross Lettable Area (GLA) respectively.<br />

New centre openings<br />

As well as starting our Romanian operations, we also inaugurated<br />

four new shopping and leisure centres in Europe.<br />

The most exciting of these was Berlin’s Alexa, which has not only<br />

set new standards of design and construction in the German<br />

shopping and leisure centre market, but also recorded a total of<br />

5.2 million visits in its first three-and-a-half months of trading.<br />

Other successful inaugurations included 8ª Avenida in S. João<br />

da Madeira in Portugal, which now offers 30,477m 2 of GLA, and<br />

El Rosal, a new centre in Ponferrada, Spain, which has 49,500m 2<br />

of GLA.<br />

We also opened Lima Retail Park in Viana do Castelo, Portugal,<br />

with 10,764m 2 of GLA. This Retail Park has since been sold to<br />

PREF, the European Retail Park Fund managed by British Land,<br />

as part of our planned disposal of completed retail park assets.<br />

New centre developments<br />

Looking ahead, we have four shopping centres due to open<br />

during 2008, seven more under development and 13 new<br />

projects in different phases of completion. We are also in the<br />

advanced stage of negotiations for several other very interesting<br />

opportunities.<br />

In Portugal, we are also developing a new retail park in Setúbal,<br />

in Greater Lisbon, as a 50/50 joint venture between ourselves and<br />

Miller Developments.<br />

At the beginning of 2008, we finally received a definitive building<br />

permit for Plaza Mayor Shopping in Málaga, Spain, which will<br />

allow us to restart the construction of 18,800m 2 of GLA, which is<br />

already fully let and due for completion in 2008. We have also<br />

continued the licensing process for Pulianas Shopping and Retail<br />

Park in Granada and hope to secure one other new project.<br />

Unfortunately, we were forced to postpone the opening of<br />

Freccia Rossa in Brescia, Italy. This centre is now due to open in<br />

April 2008 while Gli Orsi, in Biella, is expected to open in October<br />

2008. We are also making progress with the licensing of Le<br />

Terraze, in La Spezia, and we plan to secure two additional<br />

development projects in 2008.<br />

In Germany, the construction of Loop5 in Weiterstadt is<br />

progressing well and we expect the successful opening of Alexa<br />

to help us secure further development projects and investments.<br />

In Greece, our Pantheon Plaza project in Larissa, which we are<br />

developing as a 50/50 joint venture with Rockspring, is being<br />

expanded to create a larger centre designed to accommodate the<br />

market’s demands. It is scheduled to open by the end of 2008.<br />

We are progressing the development of Galatsi in Athens and, by<br />

the year’s end, we hope to have secured two new projects.<br />

In Romania, as reported elsewhere, we are poised to start work<br />

on new shopping centres in Craiova and Ploiesti during the first<br />

half of 2008, and we will be looking for more new opportunities<br />

in this market.<br />

SONAE SIERRA In Review 2007 26

4<br />

5<br />

2<br />

3<br />

1,6<br />

1 2<br />

3<br />

Projects under<br />

development GLA (m 2)<br />

Setúbal Retail Park<br />

Setúbal, Portugal 20,300<br />

Plaza Mayor Shopping<br />

Málaga, Spain 18,750<br />

Pulianas Shopping and Retail Park<br />

Granada, Spain 45,000<br />

Freccia Rossa<br />

Brescia, Italy 29,741<br />

Gli Orsi<br />

Biella, Italy 40,700<br />

Le Terrazze<br />

La Spezia, Italy 39,100<br />

Loop5<br />

Weiterstadt, Germany 56,000<br />

Galatsi Shopping<br />

Athens, Greece 38,695<br />

Pantheon Plaza<br />

Larissa, Greece 22,000<br />

Craiova Shopping<br />

Craiova, Romania 55,537<br />

Ploiesti Shopping<br />

Ploiesti, Romania 64,070<br />

Inaugurated in 2007<br />

8ª Avenida, S. João da Madeira, Portugal

4<br />

5<br />

6

WE ARE CONFIDENT WE CAN EXPAND OUR<br />

DEVELOPMENT PIPELINE AND MAINTAIN OUR<br />

PATTERN OF GROWTH IN OUR TRADITIONAL<br />

TERRITORIES AND THE NEW MARKETS OF<br />

CENTRAL EUROPE.<br />

Performance 2007 continued<br />

Prospects for 2008<br />

The economic outlook for 2008 seems to be improving at a<br />

slower-than-expected rate, and we face increased levels of<br />

competition, yet we are confident we can expand our<br />

development pipeline beyond its 2007 parameters.<br />

Our plan is to build on the sound base we have established in<br />

Portugal, Spain, Germany, Italy and Greece, and to become a<br />

major participant in Romania and other Central Europe markets.<br />

We are reorganising our structure and staffing, and being more<br />

selective in our choice of development opportunities, so that we<br />

can bring our plan to fruition. At the same time, we remain<br />

committed to innovation in terms of concepts and design as well<br />

as tenant mix and services.<br />

Our main ambition is to continue to be recognised as one of the<br />

best shopping centre developers in Europe and to maintain our<br />

pattern of growth through the development of new centres and<br />

working partnerships.<br />

31<br />

SONAE SIERRA In Review 2007

SIERRA DEVELOPMENTS CONTRIBUTED<br />

€61.6 MILLION TO THE CONSOLIDATED NET<br />

PROFIT OF SONAE SIERRA.<br />

Financial Report 2007<br />

Net Profit for the period<br />

The income from the development services, capitalised on the<br />

projects under development, remains at a high level.<br />

2007 was a year of successful inaugurations, with two openings<br />

in Portugal, one in Spain and one in Germany.<br />

The portfolio of projects under development remains highly<br />

dynamic, with new projects in Portugal, Spain, Italy, Germany,<br />

Greece and Romania.<br />

The realised value in projects benefited from the four<br />

inaugurations of the year, especially Alexa, which was valued on<br />

opening at a much higher than forecast.<br />

The value created in projects under development reached an<br />

impressive €93 million, which compares with €28 million<br />

recognised in the previous year. This performance is mainly due<br />

to the yields’ compression in the real estate market, and the<br />

excellent projects’ management combined with an efficient<br />

leasing of projects, both completed and under development.<br />

The operating costs increased by 27% when compared with<br />

2006, mainly due to the growth in our business activities and our<br />

entry into a new European market, which has resulted in higher<br />

personnel costs – up by 18% – arising from the reinforcement of<br />

our existing teams and the creation of new operational structures<br />

designed to support the new market.<br />

The net financial income is the result of the capital invested<br />

in our portfolio, which reduces as the financial leverage of<br />

projects increases.<br />

Development services delivered<br />

€13 million<br />

Value created on assets<br />

€93 million<br />

Net Profit attributable to equity<br />

holders €61.6 million<br />

SONAE SIERRA In Review 2007 32

<strong>Sierra</strong> Developments Profit & Loss Account (€ 000)<br />

33<br />

2007 2006(*) % 07/06<br />

Project Development Services Rendered 13,037 12,942 1%<br />

Value created in projects 92,635 28,401 226%<br />

Operating Income 105,672 41,343 156%<br />

Personnel costs 9,244 7,818 18%<br />

Other costs 19,344 14,685 32%<br />

Operating costs 28,587 22,503 27%<br />

Net Operating Income (NOI) 77,085 18,840 309%<br />

Depreciation and provisions 22 78 -71%<br />

Net financial costs/(income) (449) (2,912) 85%<br />

Profit Before Taxes 77,512 21,674 258%<br />

Corporate taxes (2,821) (2,265) -25%<br />

Deferred tax 18,718 12,101 55%<br />

Net Profit for the Period<br />

Attributable to:<br />

61,614 11,838 –<br />

Equity holders 61,614 11,838 –<br />

Minority interests – (0) –<br />

(un-audited accounts)<br />

(*) 2006 was restated in order to demonstrate the combined effect of the provision of services and the creation of value in<br />

projects<br />

<strong>Sierra</strong> Developments Consolidated Balance Sheet (€ 000)<br />

31/12/07 31/12/06 Var (07 – 06)<br />

Properties under development 470,341 348,482 121,859<br />

Customers 1,876 1,248 627<br />

Other assets 155,505 106,082 49,423<br />

Deposits 34,171 33,210 961<br />

Total assets 661,894 489,023 172,871<br />

Net worth 148,695 92,845 55,850<br />

Minorities 1,225 2,229 -1,004<br />

Bank loans 83,951 125,820 -41,869<br />

Shareholder loans 342,119 162,458 179,661<br />

Deferred taxes 28,050 8,784 19,265<br />

Other liabilities 57,854 96,886 -39,033<br />

Total liabilities 511,974 393,949 118,025<br />

Net worth, minorities and liabilities 661,894 489,023 172,871<br />

(un-audited accounts)<br />

SONAE SIERRA In Review 2007

SIERRA MANAGEMENT IS RESPONSIBLE FOR<br />

MANAGING, MARKETING AND LETTING A<br />

DIVERSE PORTFOLIO OF SHOPPING CENTRES<br />

OWNED BY SONAE SIERRA AND THIRD PARTIES<br />

IN EUROPE.<br />

SIERRA<br />

MANAGEMENT<br />

36<br />

43<br />

Performance 2007<br />

Financial Report 2007<br />

SONAE SIERRA In Review 2007 34

Our core business activities<br />

<strong>Sierra</strong> Management’s role is to create and maintain vital links between<br />

owners, tenants and shopping centre customers and thus contribute to<br />

<strong>Sonae</strong> <strong>Sierra</strong> profits through various management services we provide in<br />

the shopping centres we are responsible for.<br />

As a pioneer in our sector, we have long recognised that services like<br />

these must be maintained at the highest levels if the shopping centres in<br />

our care are to increase in value over time. This approach is particularly<br />

important in matters relating to tenant mix, marketing and operational<br />

efficiency, where we have achieved some notable successes.<br />

In the last year we have reorganised the new technologies side of our<br />

business with the objective of focussing solely on the activities which<br />

were adding value to our shopping centres. These activities now form<br />

part of our Marketing function. We have also created a new Innovation<br />

Office focused on enhancing the value proposition of the shopping<br />

centres we manage.<br />

<strong>Sierra</strong> Management in 2007<br />

35<br />

Pedro Caupers<br />

<strong>Sonae</strong> <strong>Sierra</strong> Executive Director,<br />

Property Management Europe<br />

<strong>Sierra</strong> Management made steady progress during 2007. Our business in<br />

our traditional territories produced a satisfactory performance in<br />

moderately good economic circumstances, while our entry into the<br />

Romanian market added two new shopping centres to our portfolio of<br />

managed properties. The first, River Plaza Mall in Ramnicu Valcea, is an<br />

already operating shopping centre acquired by <strong>Sierra</strong> Investments. The<br />

second, Arena Mall in Bacau, is owned by a third-party and was<br />

inaugurated last December. We look forward to the start of the leasing<br />

of <strong>Sierra</strong> Developments’ two new projects in this fast-moving market in<br />

the cities of Ploiesti and Craiova.<br />

We also started managing centres in Germany. The opening of Alexa in<br />

Berlin and our takeover of the management of the Münster Arkaden<br />

centre adds two major properties to our German portfolio. We believe<br />

Alexa is one of the most innovative shopping and leisure centres in<br />

Germany. It has an attractive style with several novel features, and an<br />

imaginative tenant mix offering consumers a wide choice of shopping<br />

and leisure activities. It was almost fully let when it opened in September.<br />

Since then its trading figures have been excellent, with traffic and sales<br />

well above budget.<br />

António Casanova<br />

<strong>Sonae</strong> <strong>Sierra</strong> Executive Director,<br />

Key Accounts, Marketing and<br />

Innovation<br />

Started management of Alexa and<br />

Münster Arkaden, in Germany<br />

Began management of River Plaza<br />

Mall and Arena Mall, in Romania<br />

Start of management of Lima Retail<br />

Park and 8ª Avenida, in Portugal<br />

Commenced management of El Rosal,<br />

in Spain<br />

SONAE SIERRA In Review 2007

Performance 2007<br />

The total visits in Portugal decreased in comparison to 2006,<br />

due to the cessation in the management of the Modelo galleries.<br />

On a comparable basis, this means that total visits increased<br />

by 0.2%. In Italy, the decrease in the number of visits on a<br />

comparable basis is linked to the refurbishment of the Valecenter,<br />

a fact that obviously limited the number of visits, and therefore<br />

sales figures, in 2007.<br />

Iberian additions<br />

We have enlarged our portfolio in Iberia with the addition of<br />

Lima Retail Park and 8ª Avenida in Portugal and El Rosal in Spain.<br />

Lima Retail Park, which – as reported elsewhere – was sold to<br />

PREF in December 2007, provides 13 retail outlets of between<br />

150m 2 and 4,000m 2 and features brands such as Maxmat,<br />

Moviflor, Mundo dos Fatos, Fábio Lucci and Casa. The car park<br />

has spaces for 400 vehicles. While it is not <strong>Sonae</strong> <strong>Sierra</strong>’s policy to<br />

own retail parks once they have been built, we are still able to<br />

provide income-earning management services at centres such as<br />

this one at Viana do Castelo.<br />

Sales and Visits<br />

Visits % 07/06 Sales % 07/06<br />

2007 2006 total like-for-like 2007 2006 total like-for-like<br />

Portugal 218,458 230,417 -5.2% 0.2% 2,389,145 2,229,748 7.1% 5.9%<br />

Spain 77,725 77,049 0.9% -0.8% 987,518 886,859 11.4% 6.1%<br />

Italy 14,563 12,545 16.1% -13.8% 45,638 42,281 7.9% -16.3%<br />

Greece 8,152 7,314 11.5% 11.5% 164,061 118,779 38.1% 38.1%<br />

Germany 5,234 – – – 182,041 – – –<br />

Romania 1,173 – – – – – – –<br />

Sales in Euro (thousands)<br />

Visits in thousands<br />

8ª Avenida is located in the city of S. João da Madeira, some 40<br />

kilometres south of Porto. It is a medium-size centre, built over<br />

two levels, and the result of an expansion into what was the<br />

Modelo supermarket gallery. It now offers more than 100 shops,<br />

thus making it possible for local people to satisfy most of their<br />

shopping needs without having to travel to Porto.<br />

El Rosal, located in Ponferrada in Spain’s Leon province, was<br />

opened in October 2007. Offering a total of more than<br />

49,500m 2, it occupies a dominant position in its catchment area.<br />

The centre still had some 30 shops unoccupied at the end of<br />

December, but it is trading rather well and we expect to reduce<br />

its vacancy levels very quickly.<br />

SONAE SIERRA In Review 2007 36

37<br />

SONAE SIERRA In Review 2007

SONAE SIERRA In Review 2007 40

2,6<br />

1<br />

4<br />

5<br />

1 2 3<br />

4<br />

Managed shopping<br />

centres GLA (m 2)<br />

8ª Avenida<br />

S. João da Madeira, Portugal 20,155<br />

AlgarveShopping<br />

Guia, Albufeira, Portugal 42,540<br />

ArrábidaShopping<br />

Vila Nova de Gaia, Porto, Portugal 54,652<br />

CascaiShopping<br />

Cascais, Lisboa, Portugal 73,525<br />

CC Continente da Amadora<br />

Amadora, Portugal 18,849<br />

CC Continente de Leiria<br />

Leiria, Portugal 23,785<br />

CC Continente de Portimão<br />

Portimão, Portugal 13,485<br />

CC Modelo de Albufeira<br />

Albufeira, Portugal 10,461<br />

Centro Colombo<br />

Lisboa, Portugal 119,771<br />

Centro Vasco da Gama<br />

Lisboa, Portugal 47,691<br />

CoimbraShopping<br />

Coimbra, Portugal 26,494<br />

Coimbra Retail Park<br />

Coimbra, Portugal 12,749<br />

Estação do Oriente S.C.<br />

Lisboa, Portugal 3,752<br />

Estação Viana<br />

Viana do Castelo, Portugal 18,556<br />

GaiaShopping<br />

Vila Nova de Gaia, Porto, Portugal 59,683<br />

Galeria Lambert<br />

Lisboa, Portugal 1,995<br />

Grandella Lisboa, Portugal 5,907<br />

GuimarãeShopping<br />

Guimarães, Portugal 26,830<br />

Lima Retail Park<br />

Viana do Castelo, Portugal 10,764<br />

LoureShopping<br />

Loures, Portugal 38,986<br />

MadeiraShopping<br />

Funchal, Madeira, Portugal 26,700<br />

MaiaShopping<br />

Maia, Porto, Portugal 28,906<br />

MarcoShopping<br />

Marco de Canavezes, Portugal 1,820<br />

NorteShopping<br />

Matosinhos, Porto, Portugal 73,122<br />

Parque Atlântico<br />

Ponta Delgada, Azores, Portugal 22,340<br />

RioSul Shopping<br />

Seixal, Portugal 44,406

3<br />

7<br />

5<br />

6<br />

Managed shopping<br />

centres GLA (m 2)<br />

Serra Shopping<br />

Covilhã, Portugal 17,680<br />

Sintra Retail Park<br />

Sintra, Portugal 17,489<br />

ViaCatarina<br />

Porto, Portugal 11,656<br />

Avenida M40<br />

Madrid, Spain 48,223<br />

Dos Mares<br />

San Javier, Murcia, Spain 24,776<br />

El Rosal<br />

Ponferrada, Spain 49,476<br />

Grancasa<br />

Zaragoza, Spain 77,378<br />

La Farga<br />

Barcelona, Spain 17,412<br />

La Morea<br />

Pamplona, Spain 18,878<br />

Luz del Tajo<br />

Toledo, Spain 42,020<br />

Max Center<br />

Bilbao, Spain 59,362<br />

Parque Guadaira<br />

Seville, Spain 32,668<br />

Parque Principado<br />

Oviedo, Spain 74,398<br />

Plaza Éboli<br />

Pinto, Madrid, Spain 31,068<br />

Plaza Mayor<br />

Málaga, Spain 34,359<br />

Valderaduey<br />

Zamora, Spain 20,400<br />

Valle Real<br />

Santander, Spain 47,825<br />

Zubiarte<br />

Bilbao, Spain 20,562<br />

Airone<br />

Monselice, Padova, Italy 15,779<br />

Valecenter<br />

Marcon, Venice, Italy 58,152<br />

Alexa<br />

Berlin, Germany 56,445<br />

Münster Arkaden<br />

Münster, Germany 39,897<br />

Mediterranean Cosmos<br />

Thessalonica, Greece 45,956<br />

River Plaza Mall<br />

Ramnicu Valcea, Romania 11,953<br />

Arena Mall<br />

Bacau, Romania 18,928<br />

7

OUR PRINCIPAL GROWTH IS EXPECTED TO COME<br />

FROM THE COUNTRIES OUTSIDE IBERIA – IN<br />

PARTICULAR IN GERMANY, ITALY AND ROMANIA<br />

– WHERE THERE IS SCOPE FOR THE APPLICATION<br />

OF OUR SKILLS.<br />

Performance 2007 continued<br />

Italian and Greek developments<br />

We have made no additions to our Italian portfolio during the<br />

year. Instead, we have concentrated on leasing space in Freccia<br />

Rossa in Brescia, which is due to open in April 2008, and in Gli<br />

Orsi in Biella, which is due to open in the Autumn. We have also<br />

started the leasing process for the larger stores that will feature in<br />

Le Terrazze in La Spezia, which is scheduled for completion and<br />

inauguration in 2010.<br />

We have one operating shopping centre in Greece,<br />

Mediterranean Cosmos, which opened in 2005. Lettings were<br />

comparatively slow during the first year of trading but have<br />

accelerated during the past year. Occupancy is now above 99%<br />

of Gross Lettable Area (GLA). Mediterranean Cosmos’s<br />

performance has convinced tenants of the value of being in a<br />

modern shopping and leisure centre and has eased our passage<br />

into the leasing processes for our new centres, Galatsi Shopping<br />

in Athens, which is due to open in 2009, and Pantheon Plaza in<br />

Larissa, due to open in the latter part of 2008.<br />

Looking ahead<br />

Looking ahead to the coming year, we anticipate some<br />

deceleration of growth in all the European economies we operate<br />

in the first half of the year, partly as a result of the difficulties<br />

facing the international debt market and partly because of some<br />

expected reduction in consumer confidence. We anticipate<br />

improved economic conditions during the second half-year.<br />

For <strong>Sierra</strong> Management, our principal growth is expected to come<br />

from the countries outside Iberia – in particular in Germany, Italy<br />

and Romania – where there is potential for acquiring shopping<br />

and leisure centres which, at present, do not enjoy the benefits of<br />

our management expertise. Within Iberia, our aim is to capitalise<br />

on the synergies between Portugal and Spain so that we can<br />

become more efficient as property managers while still<br />

maintaining a very high level of service.<br />

41<br />

As part of our commitment to high levels of service, we created<br />

a new cluster philosophy in the marketing area, scheduled for<br />

roll-out across Europe during 2008. This new approach brings<br />

together various centres according to their catchment areas and<br />

competitive situation, so that we can apply our management and<br />

marketing skills across the clusters in a more cost-effective way.<br />

Our over-arching objective is to be recognised as the best<br />

shopping centre management company in Europe – a status<br />

which has already been acknowledged, in broad terms, by <strong>Sonae</strong><br />

<strong>Sierra</strong>’s receipt of several property industry awards.<br />

As the company’s property Management division, we recognise<br />

that we must consolidate our presence in the countries outside<br />

Iberia before <strong>Sierra</strong> Management can expect to receive a similar<br />

accolade as the best pan-European specialists in our particular<br />

field.<br />

SONAE SIERRA In Review 2007

Performance 2007 continued<br />

2007<br />

2006<br />

2005<br />

2004<br />

2003<br />

2002<br />

2001<br />

2000<br />

1999<br />

1998<br />

1997<br />

1996<br />

Portugal<br />

Spain<br />

Italy<br />

Greece<br />

Germany<br />

Romania<br />

Portfolio under Management over time<br />

GLA (000 m 2)<br />

No. of Contracts<br />

Portfolio under Management in 2007<br />

GLA owned (000 m 2)<br />

GLA third-party (000 m 2)<br />

2007<br />

2006<br />

2007<br />

2006<br />

2007<br />

2006<br />

2007<br />

2006<br />

2007<br />

2006<br />

2007<br />

2006<br />

GLA<br />

(000 m 2)<br />

1,863<br />

1,682<br />