Resources Recruitment - Department of State Development - The ...

Resources Recruitment - Department of State Development - The ...

Resources Recruitment - Department of State Development - The ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

the big picture�<br />

<strong>The</strong> Global Scene<br />

Renewed optimism on global economic recovery<br />

<strong>The</strong> outlook on global economic recovery has noticeably improved in<br />

recent months. Economic growth in the US economy is expected to lead to<br />

renewed economic growth in Asia since the US is the largest market for<br />

Asian exports. In the US and Western Europe, interest rates are currently<br />

at record lows in an effort to strengthen economic growth.<br />

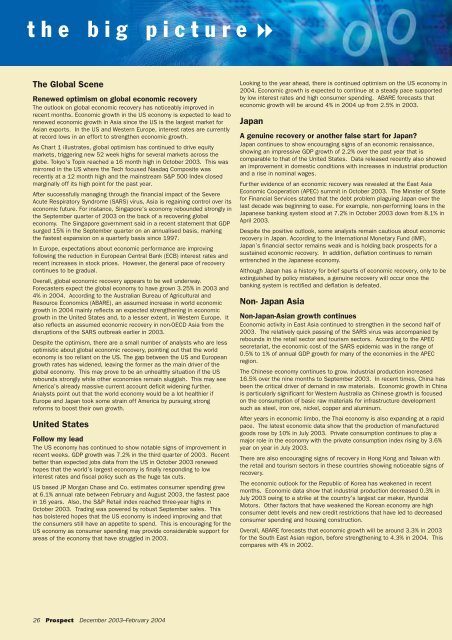

As Chart 1 illustrates, global optimism has continued to drive equity<br />

markets, triggering new 52 week highs for several markets across the<br />

globe. Tokyo’s Topix reached a 16 month high in October 2003. This was<br />

mirrored in the US where the Tech focused Nasdaq Composite was<br />

recently at a 12 month high and the mainstream S&P 500 Index closed<br />

marginally <strong>of</strong>f its high point for the past year.<br />

After successfully managing through the financial impact <strong>of</strong> the Severe<br />

Acute Respiratory Syndrome (SARS) virus, Asia is regaining control over its<br />

economic future. For instance, Singapore’s economy rebounded strongly in<br />

the September quarter <strong>of</strong> 2003 on the back <strong>of</strong> a recovering global<br />

economy. <strong>The</strong> Singapore government said in a recent statement that GDP<br />

surged 15% in the September quarter on an annualised basis, marking<br />

the fastest expansion on a quarterly basis since 1997.<br />

In Europe, expectations about economic performance are improving<br />

following the reduction in European Central Bank (ECB) interest rates and<br />

recent increases in stock prices. However, the general pace <strong>of</strong> recovery<br />

continues to be gradual.<br />

Overall, global economic recovery appears to be well underway.<br />

Forecasters expect the global economy to have grown 3.25% in 2003 and<br />

4% in 2004. According to the Australian Bureau <strong>of</strong> Agricultural and<br />

Resource Economics (ABARE), an assumed increase in world economic<br />

growth in 2004 mainly reflects an expected strengthening in economic<br />

growth in the United <strong>State</strong>s and, to a lesser extent, in Western Europe. It<br />

also reflects an assumed economic recovery in non-OECD Asia from the<br />

disruptions <strong>of</strong> the SARS outbreak earlier in 2003.<br />

Despite the optimism, there are a small number <strong>of</strong> analysts who are less<br />

optimistic about global economic recovery, pointing out that the world<br />

economy is too reliant on the US. <strong>The</strong> gap between the US and European<br />

growth rates has widened, leaving the former as the main driver <strong>of</strong> the<br />

global economy. This may prove to be an unhealthy situation if the US<br />

rebounds strongly while other economies remain sluggish. This may see<br />

America’s already massive current account deficit widening further.<br />

Analysts point out that the world economy would be a lot healthier if<br />

Europe and Japan took some strain <strong>of</strong>f America by pursuing strong<br />

reforms to boost their own growth.<br />

United <strong>State</strong>s<br />

Follow my lead<br />

<strong>The</strong> US economy has continued to show notable signs <strong>of</strong> improvement in<br />

recent weeks. GDP growth was 7.2% in the third quarter <strong>of</strong> 2003. Recent<br />

better than expected jobs data from the US in October 2003 renewed<br />

hopes that the world’s largest economy is finally responding to low<br />

interest rates and fiscal policy such as the huge tax cuts.<br />

US based JP Morgan Chase and Co. estimates consumer spending grew<br />

at 6.1% annual rate between February and August 2003, the fastest pace<br />

in 16 years. Also, the S&P Retail index reached three-year highs in<br />

October 2003. Trading was powered by robust September sales. This<br />

has bolstered hopes that the US economy is indeed improving and that<br />

the consumers still have an appetite to spend. This is encouraging for the<br />

US economy as consumer spending may provide considerable support for<br />

areas <strong>of</strong> the economy that have struggled in 2003.<br />

26 Prospect December 2003–February 2004<br />

Looking to the year ahead, there is continued optimism on the US economy in<br />

2004. Economic growth is expected to continue at a steady pace supported<br />

by low interest rates and high consumer spending. ABARE forecasts that<br />

economic growth will be around 4% in 2004 up from 2.5% in 2003.<br />

Japan<br />

A genuine recovery or another false start for Japan?<br />

Japan continues to show encouraging signs <strong>of</strong> an economic renaissance,<br />

showing an impressive GDP growth <strong>of</strong> 2.2% over the past year that is<br />

comparable to that <strong>of</strong> the United <strong>State</strong>s. Data released recently also showed<br />

an improvement in domestic conditions with increases in industrial production<br />

and a rise in nominal wages.<br />

Further evidence <strong>of</strong> an economic recovery was revealed at the East Asia<br />

Economic Cooperation (APEC) summit in October 2003. <strong>The</strong> Minster <strong>of</strong> <strong>State</strong><br />

for Financial Services stated that the debt problem plaguing Japan over the<br />

last decade was beginning to ease. For example, non-performing loans in the<br />

Japanese banking system stood at 7.2% in October 2003 down from 8.1% in<br />

April 2003.<br />

Despite the positive outlook, some analysts remain cautious about economic<br />

recovery in Japan. According to the International Monetary Fund (IMF),<br />

Japan’s financial sector remains weak and is holding back prospects for a<br />

sustained economic recovery. In addition, deflation continues to remain<br />

entrenched in the Japanese economy.<br />

Although Japan has a history for brief spurts <strong>of</strong> economic recovery, only to be<br />

extinguished by policy mistakes, a genuine recovery will occur once the<br />

banking system is rectified and deflation is defeated.<br />

Non- Japan Asia<br />

Non-Japan-Asian growth continues<br />

Economic activity in East Asia continued to strengthen in the second half <strong>of</strong><br />

2003. <strong>The</strong> relatively quick passing <strong>of</strong> the SARS virus was accompanied by<br />

rebounds in the retail sector and tourism sectors. According to the APEC<br />

secretariat, the economic cost <strong>of</strong> the SARS epidemic was in the range <strong>of</strong><br />

0.5% to 1% <strong>of</strong> annual GDP growth for many <strong>of</strong> the economies in the APEC<br />

region.<br />

<strong>The</strong> Chinese economy continues to grow. Industrial production increased<br />

16.5% over the nine months to September 2003. In recent times, China has<br />

been the critical driver <strong>of</strong> demand in raw materials. Economic growth in China<br />

is particularly significant for Western Australia as Chinese growth is focused<br />

on the consumption <strong>of</strong> basic raw materials for infrastructure development<br />

such as steel, iron ore, nickel, copper and aluminum.<br />

After years in economic limbo, the Thai economy is also expanding at a rapid<br />

pace. <strong>The</strong> latest economic data show that the production <strong>of</strong> manufactured<br />

goods rose by 10% in July 2003. Private consumption continues to play a<br />

major role in the economy with the private consumption index rising by 3.6%<br />

year on year in July 2003.<br />

<strong>The</strong>re are also encouraging signs <strong>of</strong> recovery in Hong Kong and Taiwan with<br />

the retail and tourism sectors in these countries showing noticeable signs <strong>of</strong><br />

recovery.<br />

<strong>The</strong> economic outlook for the Republic <strong>of</strong> Korea has weakened in recent<br />

months. Economic data show that industrial production decreased 0.3% in<br />

July 2003 owing to a strike at the country’s largest car maker, Hyundai<br />

Motors. Other factors that have weakened the Korean economy are high<br />

consumer debt levels and new credit restrictions that have led to decreased<br />

consumer spending and housing construction.<br />

Overall, ABARE forecasts that economic growth will be around 3.3% in 2003<br />

for the South East Asian region, before strengthening to 4.3% in 2004. This<br />

compares with 4% in 2002.