Travelex Holdings Limited Annual report & consolidated financial ...

Travelex Holdings Limited Annual report & consolidated financial ...

Travelex Holdings Limited Annual report & consolidated financial ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

50<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

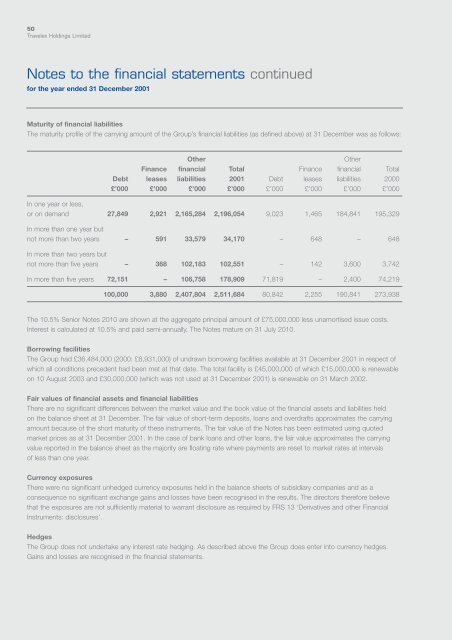

Maturity of <strong>financial</strong> liabilities<br />

The maturity profile of the carrying amount of the Group’s <strong>financial</strong> liabilities (as defined above) at 31 December was as follows:<br />

Other Other<br />

Finance <strong>financial</strong> Total Finance <strong>financial</strong> Total<br />

Debt leases liabilities 2001 Debt leases liabilities 2000<br />

£’000 £’000 £’000 £’000 £’000 £’000 £’000 £’000<br />

In one year or less,<br />

or on demand 27,849 2,921 2,165,284 2,196,054 9,023 1,465 184,841 195,329<br />

In more than one year but<br />

not more than two years – 591 33,579 34,170 – 648 – 648<br />

In more than two years but<br />

not more than five years – 368 102,183 102,551 – 142 3,600 3,742<br />

In more than five years 72,151 – 106,758 178,909 71,819 – 2,400 74,219<br />

100,000 3,880 2,407,804 2,511,684 80,842 2,255 190,841 273,938<br />

The 10.5% Senior Notes 2010 are shown at the aggregate principal amount of £75,000,000 less unamortised issue costs.<br />

Interest is calculated at 10.5% and paid semi-annually. The Notes mature on 31 July 2010.<br />

Borrowing facilities<br />

The Group had £36,484,000 (2000: £8,931,000) of undrawn borrowing facilities available at 31 December 2001 in respect of<br />

which all conditions precedent had been met at that date. The total facility is £45,000,000 of which £15,000,000 is renewable<br />

on 10 August 2003 and £30,000,000 (which was not used at 31 December 2001) is renewable on 31 March 2002.<br />

Fair values of <strong>financial</strong> assets and <strong>financial</strong> liabilities<br />

There are no significant differences between the market value and the book value of the <strong>financial</strong> assets and liabilities held<br />

on the balance sheet at 31 December. The fair value of short-term deposits, loans and overdrafts approximates the carrying<br />

amount because of the short maturity of these instruments. The fair value of the Notes has been estimated using quoted<br />

market prices as at 31 December 2001. In the case of bank loans and other loans, the fair value approximates the carrying<br />

value <strong>report</strong>ed in the balance sheet as the majority are floating rate where payments are reset to market rates at intervals<br />

of less than one year.<br />

Currency exposures<br />

There were no significant unhedged currency exposures held in the balance sheets of subsidiary companies and as a<br />

consequence no significant exchange gains and losses have been recognised in the results. The directors therefore believe<br />

that the exposures are not sufficiently material to warrant disclosure as required by FRS 13 ‘Derivatives and other Financial<br />

Instruments: disclosures’.<br />

Hedges<br />

The Group does not undertake any interest rate hedging. As described above the Group does enter into currency hedges.<br />

Gains and losses are recognised in the <strong>financial</strong> statements.