Travelex Holdings Limited Annual report & consolidated financial ...

Travelex Holdings Limited Annual report & consolidated financial ...

Travelex Holdings Limited Annual report & consolidated financial ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

54<br />

<strong>Travelex</strong> <strong>Holdings</strong> <strong>Limited</strong><br />

Notes to the <strong>financial</strong> statements continued<br />

for the year ended 31 December 2001<br />

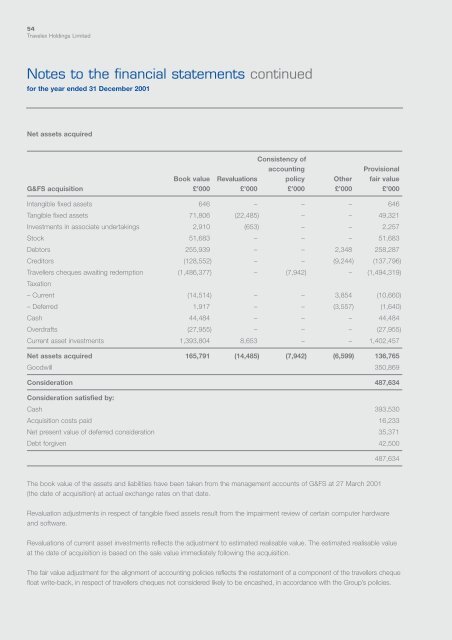

Net assets acquired<br />

Consistency of<br />

accounting Provisional<br />

Book value Revaluations policy Other fair value<br />

G&FS acquisition £’000 £’000 £’000 £’000 £’000<br />

Intangible fixed assets 646 – – – 646<br />

Tangible fixed assets 71,806 (22,485) – – 49,321<br />

Investments in associate undertakings 2,910 (653) – – 2,257<br />

Stock 51,683 – – – 51,683<br />

Debtors 255,939 – – 2,348 258,287<br />

Creditors (128,552) – – (9,244) (137,796)<br />

Travellers cheques awaiting redemption<br />

Taxation<br />

(1,486,377) – (7,942) – (1,494,319)<br />

– Current (14,514) – – 3,854 (10,660)<br />

– Deferred 1,917 – – (3,557) (1,640)<br />

Cash 44,484 – – – 44,484<br />

Overdrafts (27,955) – – – (27,955)<br />

Current asset investments 1,393,804 8,653 – – 1,402,457<br />

Net assets acquired 165,791 (14,485) (7,942) (6,599) 136,765<br />

Goodwill 350,869<br />

Consideration 487,634<br />

Consideration satisfied by:<br />

Cash 393,530<br />

Acquisition costs paid 16,233<br />

Net present value of deferred consideration 35,371<br />

Debt forgiven 42,500<br />

The book value of the assets and liabilities have been taken from the management accounts of G&FS at 27 March 2001<br />

(the date of acquisition) at actual exchange rates on that date.<br />

Revaluation adjustments in respect of tangible fixed assets result from the impairment review of certain computer hardware<br />

and software.<br />

487,634<br />

Revaluations of current asset investments reflects the adjustment to estimated realisable value. The estimated realisable value<br />

at the date of acquisition is based on the sale value immediately following the acquisition.<br />

The fair value adjustment for the alignment of accounting policies reflects the restatement of a component of the travellers cheque<br />

float write-back, in respect of travellers cheques not considered likely to be encashed, in accordance with the Group’s policies.