Who Predicted the Financial Crisis - Economic ... - CEO Magazine

Who Predicted the Financial Crisis - Economic ... - CEO Magazine

Who Predicted the Financial Crisis - Economic ... - CEO Magazine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

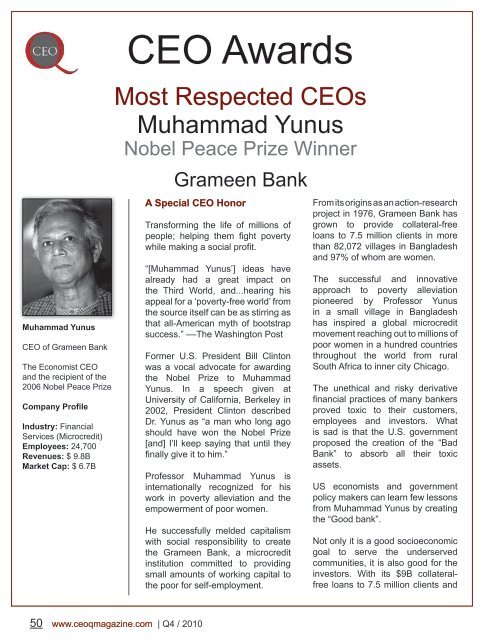

Muhammad Yunus<br />

<strong>CEO</strong> of Grameen Bank<br />

The Economist <strong>CEO</strong><br />

and <strong>the</strong> recipient of <strong>the</strong><br />

2006 Nobel Peace Prize<br />

Company Profile<br />

Industry: <strong>Financial</strong><br />

Services (Microcredit)<br />

Employees: 24,700<br />

Revenues: $ 9.8B<br />

Market Cap: $ 6.7B<br />

50 www.ceoqmagazine.com | Q4 / 2010<br />

<strong>CEO</strong> Awards<br />

Most Respected <strong>CEO</strong>s<br />

Muhammad Yunus<br />

Nobel Peace Prize Winner<br />

Grameen Bank<br />

A Special <strong>CEO</strong> Honor<br />

Transforming <strong>the</strong> life of millions of<br />

people; helping <strong>the</strong>m fight poverty<br />

while making a social profit.<br />

“[Muhammad Yunus’] ideas have<br />

already had a great impact on<br />

<strong>the</strong> Third World, and...hearing his<br />

appeal for a ‘poverty-free world’ from<br />

<strong>the</strong> source itself can be as stirring as<br />

that all-American myth of bootstrap<br />

success.” ––The Washington Post<br />

Former U.S. President Bill Clinton<br />

was a vocal advocate for awarding<br />

<strong>the</strong> Nobel Prize to Muhammad<br />

Yunus. In a speech given at<br />

University of California, Berkeley in<br />

2002, President Clinton described<br />

Dr. Yunus as “a man who long ago<br />

should have won <strong>the</strong> Nobel Prize<br />

[and] I’ll keep saying that until <strong>the</strong>y<br />

finally give it to him.”<br />

Professor Muhammad Yunus is<br />

internationally recognized for his<br />

work in poverty alleviation and <strong>the</strong><br />

empowerment of poor women.<br />

He successfully melded capitalism<br />

with social responsibility to create<br />

<strong>the</strong> Grameen Bank, a microcredit<br />

institution committed to providing<br />

small amounts of working capital to<br />

<strong>the</strong> poor for self-employment.<br />

From its origins as an action-research<br />

project in 1976, Grameen Bank has<br />

grown to provide collateral-free<br />

loans to 7.5 million clients in more<br />

than 82,072 villages in Bangladesh<br />

and 97% of whom are women.<br />

The successful and innovative<br />

approach to poverty alleviation<br />

pioneered by Professor Yunus<br />

in a small village in Bangladesh<br />

has inspired a global microcredit<br />

movement reaching out to millions of<br />

poor women in a hundred countries<br />

throughout <strong>the</strong> world from rural<br />

South Africa to inner city Chicago.<br />

The unethical and risky derivative<br />

financial practices of many bankers<br />

proved toxic to <strong>the</strong>ir customers,<br />

employees and investors. What<br />

is sad is that <strong>the</strong> U.S. government<br />

proposed <strong>the</strong> creation of <strong>the</strong> “Bad<br />

Bank” to absorb all <strong>the</strong>ir toxic<br />

assets.<br />

US economists and government<br />

policy makers can learn few lessons<br />

from Muhammad Yunus by creating<br />

<strong>the</strong> “Good bank”.<br />

Not only it is a good socioeconomic<br />

goal to serve <strong>the</strong> underserved<br />

communities, it is also good for <strong>the</strong><br />

investors. With its $9B collateralfree<br />

loans to 7.5 million clients and<br />

amazing rate of 98% loan repayment rates (no<br />

western bank can compete with that rate), <strong>the</strong><br />

Grameen bank could become <strong>the</strong> new model for<br />

banking and economic development. - Med Jones<br />

- President of International Institute of Management<br />

<strong>CEO</strong> Bio<br />

Born in 1940, Muhammad Yunus is a world famous<br />

Bangladeshi banker. Professor Muhammad Yunus<br />

received <strong>the</strong> Nobel Peace Prize in 2006 in Oslo,<br />

Norway, for his pioneering work in fighting global<br />

poverty through loans and o<strong>the</strong>r financial services<br />

for <strong>the</strong> poor.<br />

Microcredit involves <strong>the</strong> lending of small amounts<br />

of money to <strong>the</strong> world’s poorest people to start<br />

micro-businesses and move <strong>the</strong>mselves away from<br />

poverty.<br />

He previously was a professor of economics where<br />

he developed <strong>the</strong> concepts of microcredit and<br />

microfinance.<br />

He is one of <strong>the</strong> founding members of Global<br />

Elders.<br />

Yunus also serves on <strong>the</strong> board of directors of <strong>the</strong><br />

United Nations Foundation, a public charity created<br />

in 1998 with entrepreneur and philanthropist Ted<br />

Turner’s historic $1 billion gift to support United<br />

Nations causes.<br />

The UN Foundation builds and implements publicprivate<br />

partnerships to address <strong>the</strong> world’s most<br />

pressing problems, and broadens support for <strong>the</strong><br />

UN.<br />

Yunus is <strong>the</strong> author of Banker to <strong>the</strong> Poor and a<br />

founding board member of Grameen America and<br />

Grameen Foundation.<br />

<strong>CEO</strong> Insights<br />

We have created a society that does<br />

not allow opportunities for those people<br />

to take care of <strong>the</strong>mselves because we<br />

have denied <strong>the</strong>m those opportunities...I<br />

wanted to give money to people like this<br />

woman so that <strong>the</strong>y would be free from<br />

<strong>the</strong> moneylenders to sell <strong>the</strong>ir product at<br />

<strong>the</strong> price which <strong>the</strong> markets gave <strong>the</strong>m<br />

- which was much higher than what <strong>the</strong><br />

trader was giving <strong>the</strong>m<br />

Sometimes I felt that nobody was paying<br />

any attention, like I’ve been screaming<br />

and nobody’s hearing me. Now suddenly<br />

this prestigious [Noble Peace] prize<br />

comes, and you get a feeling that you<br />

can whisper, <strong>the</strong> whole world listens.<br />

This is your time to say what you wanted<br />

to say<br />

Poverty is a threat to peace. It is a<br />

breeding ground for political turmoil<br />

I was teaching in one of <strong>the</strong> universities<br />

while <strong>the</strong> country was suffering from a<br />

severe famine. People were dying of<br />

hunger, and I felt very helpless. As an<br />

economist, I had no tool in my tool box to<br />

fix that kind of situation<br />

I went to <strong>the</strong> bank and proposed that<br />

<strong>the</strong>y lend money to <strong>the</strong> poor people. The<br />

bankers almost fell over...<br />

My greatest challenge has been to<br />

change <strong>the</strong> mindset of people. Mindsets<br />

play strange tricks on us. We see things<br />

<strong>the</strong> way our minds have instructed our<br />

eyes to see<br />

Q4 / 2010 | www.ceoqmagazine.com 51