CBOE Exchange and Regulatory Bulletin - CBOE.com

CBOE Exchange and Regulatory Bulletin - CBOE.com

CBOE Exchange and Regulatory Bulletin - CBOE.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

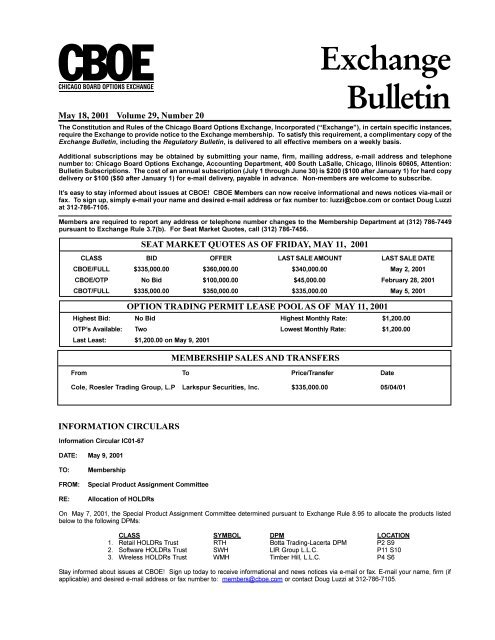

May 18, 2001 Volume 29, Number 20<br />

<strong>Exchange</strong><br />

<strong>Bulletin</strong><br />

The Constitution <strong>and</strong> Rules of the Chicago Board Options <strong>Exchange</strong>, Incorporated (“<strong>Exchange</strong>”), in certain specific instances,<br />

require the <strong>Exchange</strong> to provide notice to the <strong>Exchange</strong> membership. To satisfy this requirement, a <strong>com</strong>plimentary copy of the<br />

<strong>Exchange</strong> <strong>Bulletin</strong>, including the <strong>Regulatory</strong> <strong>Bulletin</strong>, is delivered to all effective members on a weekly basis.<br />

Additional subscriptions may be obtained by submitting your name, firm, mailing address, e-mail address <strong>and</strong> telephone<br />

number to: Chicago Board Options <strong>Exchange</strong>, Accounting Department, 400 South LaSalle, Chicago, Illinois 60605, Attention:<br />

<strong>Bulletin</strong> Subscriptions. The cost of an annual subscription (July 1 through June 30) is $200 ($100 after January 1) for hard copy<br />

delivery or $100 ($50 after January 1) for e-mail delivery, payable in advance. Non-members are wel<strong>com</strong>e to subscribe.<br />

It’s easy to stay informed about issues at <strong>CBOE</strong>! <strong>CBOE</strong> Members can now receive informational <strong>and</strong> news notices via-mail or<br />

fax. To sign up, simply e-mail your name <strong>and</strong> desired e-mail address or fax number to: luzzi@cboe.<strong>com</strong> or contact Doug Luzzi<br />

at 312-786-7105.<br />

Members are required to report any address or telephone number changes to the Membership Department at (312) 786-7449<br />

pursuant to <strong>Exchange</strong> Rule 3.7(b). For Seat Market Quotes, call (312) 786-7456.<br />

SEAT MARKET QUOTES AS OF FRIDAY, MAY 11, 2001<br />

CLASS BID OFFER LAST SALE AMOUNT LAST SALE DATE<br />

<strong>CBOE</strong>/FULL $335,000.00 $360,000.00 $340,000.00 May 2, 2001<br />

<strong>CBOE</strong>/OTP No Bid $100,000.00 $45,000.00 February 28, 2001<br />

CBOT/FULL $335,000.00 $350,000.00 $335,000.00 May 5, 2001<br />

OPTION TRADING PERMIT LEASE POOL AS OF MAY 11, 2001<br />

Highest Bid: No Bid Highest Monthly Rate: $1,200.00<br />

OTP’s Available: Two Lowest Monthly Rate: $1,200.00<br />

Last Least: $1,200.00 on May 9, 2001<br />

MEMBERSHIP SALES AND TRANSFERS<br />

From To Price/Transfer Date<br />

Cole, Roesler Trading Group, L.P Larkspur Securities, Inc. $335,000.00 05/04/01<br />

INFORMATION CIRCULARS<br />

Information Circular IC01-67<br />

DATE: May 9, 2001<br />

TO: Membership<br />

FROM: Special Product Assignment Committee<br />

RE: Allocation of HOLDRs<br />

On May 7, 2001, the Special Product Assignment Committee determined pursuant to <strong>Exchange</strong> Rule 8.95 to allocate the products listed<br />

below to the following DPMs:<br />

CLASS SYMBOL DPM LOCATION<br />

1. Retail HOLDRs Trust RTH Botta Trading-Lacerta DPM P2 S9<br />

2. Software HOLDRs Trust SWH LIR Group L.L.C. P11 S10<br />

3. Wireless HOLDRs Trust WMH Timber Hill, L.L.C. P4 S6<br />

Stay informed about issues at <strong>CBOE</strong>! Sign up today to receive informational <strong>and</strong> news notices via e-mail or fax. E-mail your name, firm (if<br />

applicable) <strong>and</strong> desired e-mail address or fax number to: members@cboe.<strong>com</strong> or contact Doug Luzzi at 312-786-7105.

Page 2 May 18, 2001 Volume 29, Number 20 Chicago Board Options <strong>Exchange</strong><br />

Information Circular IC01-68<br />

DATE: May 9, 2001<br />

TO: Membership<br />

FROM: Allocation Committee<br />

RE: Allocation of Option Classes<br />

On May 7, 2001, the Allocation Committee determined pursuant to <strong>Exchange</strong> Rule 8.95 to allocate the option class listed below to the<br />

following DPM:<br />

CLASS SYMBOL DPM LOCATION<br />

1. Patterson UTI Energy Inc. PTEN Johnson Trading J.V. P3 S7<br />

Stay informed about issues at <strong>CBOE</strong>! Sign up today to receive informational <strong>and</strong> news notices via e-mail or fax. E-mail your name, firm (if<br />

applicable) <strong>and</strong> desired e-mail address or fax number to: members@cboe.<strong>com</strong> or contact Doug Luzzi at 312-786-7105.<br />

DPM APPOINTMENT TRANSFER APPROVAL<br />

May 9, 2001<br />

The MTS Committee has conditionally approved pursuant to <strong>CBOE</strong> Rule 8.89 a proposal from Calusa, LLC, a member organization operating<br />

as a DPM, regarding changes to its ownership structure. The Calusa DPMs are located at Post 2 - Station 3 <strong>and</strong> Post 2 - Station 4.<br />

Botta Capital Management, LLC (“BCM”) is the sole member of Calusa, LLC. Currently, BCM consists of two classes of members, Class A<br />

members <strong>and</strong> Class B members. BCM’s Class A percentage interest ownership is as follows: Jeffrey Wolfson – 27%; Kevin Luthringshausen<br />

– 35%; Michael Frazin – 19%; Scott Bauer – 5%; Kelly Luthringshausen – 5%; Philip Teuscher – 3%; Brian Batt – 2%; Michael Edwards –<br />

2.5%; <strong>and</strong> Corey Zimmerman – 1.5%.<br />

Under the proposal: (i) Jeffrey Wolfson would transfer separate 8.55% Class A percentage interests in BCM to Michael Frazin <strong>and</strong> Kevin<br />

Luthringshausen in return for a promissory note payable in five years based on the book value of BCM. (ii) Immediately following the proposed<br />

sale, the Class A percentage interest ownership in BCM would change as follows: Jeffrey Wolfson – 9.9%; Kevin Luthringshausen – 43.55%;<br />

Michael Frazin – 27.55%; Scott Bauer – 5%; Kelly Luthringshausen – 5%; Philip Teuscher – 3%; Brian Batt – 2%; Michael Edwards – 2.5%;<br />

<strong>and</strong> Corey Zimmerman – 1.5%. (iii) The Class A members of BCM will amend the operating agreement to limit Mr. Wolfson’s authority as a<br />

manager to voting his 9.9% Class A percentage interest.<br />

With the exception of the foregoing, the management <strong>and</strong> trading staff of the Calusa DPM would remain unchanged.<br />

DPM APPOINTMENT TRANSFER APPROVAL<br />

May 9, 2001<br />

The MTS Committee has conditionally approved pursuant to <strong>CBOE</strong> Rule 8.89 a proposal from Botta Trading DPM, LLC (“BT”), a member<br />

organization operating as a DPM, regarding changes to its ownership structure. The BT DPM is located at Post 2, Station 2.<br />

Currently, BT consists of two classes of members, Class A members <strong>and</strong> Class B members. BT’s Class A percentage interest ownership is as<br />

follows: Jeffrey Wolfson – 27%; Kevin Luthringshausen – 35%; Michael Frazin – 19%; Scott Bauer – 5%; Kelly Luthringshausen – 5%; Philip<br />

Teuscher – 3%; Brian Batt – 2%; Michael Edwards – 2.5%; <strong>and</strong> Corey Zimmerman – 1.5%.<br />

Under the proposal: (i) Jeffrey Wolfson would transfer separate 8.55% Class A percentage interests to Michael Frazin <strong>and</strong> Kevin Luthringshausen<br />

in return for a promissory note payable in five years based on the book value of BT. (ii) Immediately following the proposed sale, the Class A<br />

percentage interest ownership in BT would change as follows: Jeffrey Wolfson – 9.9%; Kevin Luthringshausen – 43.55%; Michael Frazin –<br />

27.55%; Scott Bauer – 5%; Kelly Luthringshausen – 5%; Philip Teuscher – 3%; Brian Batt – 2%; Michael Edwards – 2.5%; <strong>and</strong> Corey<br />

Zimmerman – 1.5%. (iii) The Class A members of BT will amend the operating agreement to limit Mr. Wolfson’s authority as a manager to<br />

voting his 9.9% Class A percentage interest.<br />

With the exception of the foregoing, the management <strong>and</strong> trading staff of the BT DPM would remain unchanged.

Page 3 May 18, 2001 Volume 29, Number 20 Chicago Board Options <strong>Exchange</strong><br />

MEMBERSHIP INFORMATION FOR 05/03/01 THROUGH 05/09/01<br />

MEMBERSHIP APPLICATIONS RECEIVED<br />

FOR WHICH A POSTING PERIOD<br />

IS REQUIRED<br />

Individual Member Applicants Date Posted<br />

Joseph R.C. Pinto, Nominee 05/03/01<br />

TFM Investment Group<br />

2282 Rockefeller Dr.<br />

Geneva, IL 60134<br />

Robbie D. Wagner, Nominee 05/03/01<br />

AOTS Limited Partnership<br />

8222 23rd Avenue<br />

Kenosha, WI 53143<br />

Martin R. Ray, Nominee 05/03/01<br />

Robert C. Sheehan And Associates, Inc<br />

343 Dearborn St.<br />

Chicago, IL 60604<br />

Tomasz J. Nalezinski, Nominee 05/04/01<br />

Futrex Trading L.L.C.<br />

4224 N. Mason Ave.<br />

Chicago, IL 60634<br />

Laximinarain Athreya, Nominee 05/04/01<br />

Optiver Derivatives Trading USA-LLC<br />

440 S. LaSalle St. #1124<br />

Chicago, IL 60605<br />

Daniel J. Reinert, Nominee 05/04/01<br />

Robert C. Sheehan And Associates, Inc<br />

15948 Ellis Avenue<br />

South Holl<strong>and</strong>, IL 60473<br />

Jason Z. Kurnik, Nominee 05/04/01<br />

Goldsmith Trading, L.L.C.<br />

8 Emlin Place<br />

Kentfield, CA 94904<br />

Eric F. Jacobson, Nominee 05/04/01<br />

CTC LLC<br />

2658 N. Dayton<br />

Chicago, IL 60614<br />

Br<strong>and</strong>on Cone, Nominee 05/07/01<br />

Tansraafl Research & Trading LLC<br />

5510 S. Hyde Park Ave #1<br />

Chicago, IL 60637<br />

Robert E. Beltz, Nominee 05/07/01<br />

JSS Investments, L.L.C.<br />

825 W. Altgeld #1W<br />

Chicago, IL 60614<br />

Eric Michael Berindei, Nominee 05/07/01<br />

Wolverine Trading L.P.<br />

1083 Lombardy Ct.<br />

Chesterton, IN 46304<br />

Anthony P. Lignelli, Nominee 05/07/01<br />

Second City Trading, L.L.C.<br />

611 W. Briar #301<br />

Chicago, IL 60657<br />

Kevin P. Heaney, Nominee 05/07/01<br />

Knight Financial Products, L.L.C.<br />

1450 N. Clevel<strong>and</strong> Ave. #3F<br />

Chicago, IL 60610<br />

Date Posted<br />

Jonathan D. Wysaski, Nominee 05/07/01<br />

Mako Global Derivatives, L.L.C.<br />

527 N. Center<br />

Naperville, IL 60563<br />

Bradley R. Dumes, Nominee 05/07/01<br />

CTC L.L.C.<br />

1546 N. LaSalle, Apt# 203<br />

Chicago, IL 60610<br />

Daniel J. Petterec, Nominee 05/07/01<br />

Tradelink L.L.C.<br />

5 Beechwood Court East<br />

Buffalo Grove, IL 60089<br />

Ellis B. Chu, Nominee 05/07/01<br />

Orbit II Partners, L.P.<br />

1604 Fox Run Drive<br />

Arlington Heights, IL 60004<br />

Lloyd I. Miller III, Lessor 05/07/01<br />

4450 Gordon Drive<br />

Naples, FL 34102<br />

John G. Poast, Nominee 05/07/01<br />

Hull Trading Co. L.L.C.<br />

550 N. Kingsbury - #214<br />

Chicago, IL 60610<br />

Timothy S. Miller, Nominee 05/07/01<br />

Tansraafl Research & Trading L.L.C.<br />

937 S. Brainard<br />

LaGrange, IL 60525<br />

Jennifer Mistretta, Nominee 05/07/01<br />

Wolverine Trading L.P.<br />

3056 N. Racine - 2nd Floor<br />

Chicago, IL 60657<br />

Brian J. Barrett, Nominee 05/07/01<br />

Nomura Securities Inc.<br />

4240 N. Winchester<br />

Chicago, IL<br />

Christopher Louglin, Nominee 05/08/01<br />

Wolverine Trading L.P.<br />

330 N. Jefferson #1801<br />

Chicago, IL 60661<br />

Jude W. Khin, Nominee 05/08/01<br />

Big Blue Trading JV<br />

633 South Plymouth Ct. #703<br />

Chicago, IL 60605<br />

Ahmed Khaleel, Nominee 05/08/01<br />

JSS Investments, L.L.C.<br />

2244 N. Halsted Avenue #3F<br />

Chicago, IL 60614<br />

Edward R. Gierlach, CBT Registered For 05/08/01<br />

CMT Securities, L.L.C.<br />

28624 W. Heritage Oaks Road<br />

Barrington, IL 60010<br />

Matthew M. Ferullo, Nominee 05/08/01<br />

Blue Capital Group L.L.C.<br />

1928 N. Fremont St. #1R<br />

Chicago, IL 60614

Page 4 May 18, 2001 Volume 29, Number 20 Chicago Board Options <strong>Exchange</strong><br />

Christopher C. Sporer, Nominee 05/08/01<br />

BOTTA Capital Management L.L.C.<br />

440 S. LaSalle, #2400<br />

Chicago, IL 60605<br />

Member Organization Applicants<br />

Rubicon Investments L.L.C. 05/04/01<br />

Five Dollar Trading L.L.C. - Member<br />

Steven Malitz - Member<br />

Mark Eddy - Member<br />

Christopher B. Harris - CBT-RF<br />

440 S. LaSalle Street, #1751<br />

Chicago, IL 60605<br />

Grace Trading L.L.C. 05/07/01<br />

Daniel I. Nicolosi - Managing Member<br />

Ann L. Nicolosi - Member<br />

Phillip Bretts - CBT-RF<br />

Daniel Nicolosi - CBT-RF<br />

1118 W. Webster<br />

Chicago, IL 60614<br />

CMT Securities, LLC 05/07/01<br />

CMT U.S. Holdings L.L.C. - Member<br />

Jan-Dirk Lueders - Member<br />

Edward Gierlach - CBT-RF<br />

500 West Monroe St., Ste. 2630<br />

Chicago, IL 60661<br />

Saliba Partners, LLC 05/07/01<br />

John M. Saliba - Managing Member<br />

John M. Saliba - Nominee<br />

311 S. Wacker Drive, Suite 3800<br />

Chicago, IL 60606<br />

Eclipse, L.L.C. 05/07/01<br />

Craig Karsen - Member<br />

R<strong>and</strong>y Emer - Member<br />

Mark Elafros - Member<br />

230 S. LaSalle Street, #688<br />

Chicago, IL 60604<br />

DRC Corporation 05/08/01<br />

Cecila M. Kim - President<br />

Daniel K. Kim - Secretary<br />

William Sullivan - Member<br />

CWW L.L.C. - Member<br />

Scott Witten - Member<br />

William Sullivan - Nominee<br />

141 W. Jackson Blvd., 1310A<br />

Chicago, IL 60604<br />

Tighe Trading, L.L.C. 05/08/01<br />

David J. Hoelscher - Managing Member<br />

Paul R. Raemont - Nominee<br />

141 W. Jackson Blvd., Suite 1310-A<br />

Chicago, IL 60604<br />

Date Posted Date Posted<br />

Tahoe Trading, L.L.C. 05/09/01<br />

BCG, L.L.C. - Managing Member<br />

Steven B. Braveman - Managing Member<br />

Casteel Ridge Investors, L.L.C. - Managing Member<br />

Braverman Family Trust 1996 - Managing Member<br />

Steven B. Braveman- Trustee<br />

Hyedge, L.L.C. - Managing Member<br />

James R. Hyde - Managing Member<br />

Ross G. Kaminsky - Managing Member<br />

Lanny I. Brooks - CBT-RF<br />

Matthew K. Cashman - CBT-RF<br />

Mark A. Cameron - CBT-RF<br />

Edwardo A. Campins - CBT-RF<br />

Thomas B. Fredericks - CBT-RF<br />

Bradley D. Haag - CBT-RF<br />

Jamie Jacobs - CBT-RF<br />

Stephen F. Lake - CBT-RF<br />

William S. Menden - Nominee<br />

Joel A. Tenner - Nominee<br />

John M. Vignoe - CBT-RF<br />

440 S. LaSalle - Ste. 2500<br />

Chicago, IL 60605<br />

MEMBERSHIP LEASES<br />

New Leases Effective Date<br />

Lessor: George E. Morris 05/03/01<br />

Lessee: Wolverine Trading L.P.<br />

Timothy M. Benton, NOMINEE<br />

Rate: 1.435% Term: Monthly<br />

Lessor: Susquehanna Investment Group 05/04/01<br />

Lessee: Botta Trading-Lynx DPM LLC<br />

Rate: 1 1/2% Term: Monthly<br />

Lessor: Abn Amro Incorporated 05/07/01<br />

Lessee: Wes Options Company<br />

Wesley Demmon (WWD), NOMINEE<br />

Rate: 1 1/2% Term: Monthly<br />

Lessor: S & S Options 05/08/01<br />

Lessee: BOTTA Capital Management LLC<br />

Timothy J. Werner, NOMINEE<br />

Rate: 1 1/2% Term: Monthly<br />

Terminated Leases Termination Date<br />

Lessor: Gerald A. Wood J.R. 05/03/01<br />

Lessee: Wolverine Trading L.P.<br />

Timothy M. Benton (BTN), NOMINEE<br />

Lessor: Cole, Roesler Trading Group, L.P 05/04/01<br />

Lessee: Botta Trading-Lynx DPM L.L.C.<br />

Peter C. Guth (PG), NOMINEE<br />

Lessor: Susquehanna Investment Group 05/04/01<br />

Lessee: Tiger Options L.L.C.<br />

Martin E. Rauba (MRT), NOMINEE<br />

Lessor: Abn Amro Incorporated 05/08/01<br />

Lessee: Wes Options Company<br />

Wesley W. Demmon (WWD), NOMINEE

Page 5 May 18, 2001 Volume 29, Number 20 Chicago Board Options <strong>Exchange</strong><br />

MEMBERSHIP Terminations<br />

Individual Members Termination Date<br />

Peter Jon Skogh (PPJ) 05/03/01<br />

Nomura Securities International Inc<br />

311 S. Wacker Dr., Ste. 6100<br />

Chicago, IL 60606<br />

John M. Fusco (SCO) 05/04/01<br />

Prime International Equities, L.L.C.<br />

141 W. Jackson, Ste.1603<br />

Chicago, IL 60604<br />

Lessor(s):<br />

Gerald A. Wood Jr. 05/03/01<br />

139 S. Clay<br />

Hinsdale, IL 60521<br />

Nominee(s) / Inactive Nominee(s):<br />

Martin E. Rauba (MRT) 05/04/01<br />

Tiger Options LLC<br />

440 S. LaSalle, Ste. 3100<br />

Chicago, IL 60605<br />

Michael M. Klearman (MMK) 05/07/01<br />

PEAK6 Capital Management LLC<br />

209 S. LaSalle, Ste. 200<br />

Chicago, IL 60604<br />

Wesley W. Demmon (WWD) 05/07/01<br />

Wes Options Company<br />

440 S. LaSalle, Ste. 2500<br />

Chicago, IL 60605<br />

Michael Gooley (GOO) 05/08/01<br />

AOT USA LLC<br />

440 S. LaSalle, Ste. 2500<br />

Chicago, IL 60605<br />

George P. Konhilas (YME) 05/08/01<br />

Midl<strong>and</strong> Trading, L.L.C.<br />

230 S. LaSalle, Ste. 400<br />

Chicago, IL 60604<br />

Jeffrey F. Brice (JBB) 05/09/01<br />

Spear, Leeds & Kellogg<br />

440 S LaSalle, Ste. 2118<br />

Chicago, IL 60605<br />

Rex L. Hufnagel (REX) 05/09/01<br />

Spear, Leeds & Kellogg<br />

440 S. LaSalle - Suite 2118<br />

Chicago, IL 60605<br />

EFFECTIVE MEMBERSHIPS<br />

Individual Members Effective Date<br />

CBT Exercisers:<br />

J. Alex<strong>and</strong>er Stevens (JQQ) 05/03/01<br />

P.O. Box 2474<br />

Chicago, IL 60690<br />

Type of Business to be Conducted: Floor Broker Market Maker<br />

CBT Registered For:<br />

Effective Date<br />

Edward P. McFadden III (EDM) 05/07/01<br />

Knight Financial Products, L.L.C.<br />

330 Malden Avenue<br />

LaGrange Park, IL 60526<br />

Type of Business to be Conducted: Floor Broker Market Maker<br />

Philip M. Carava (FIL) 05/08/01<br />

Triangle Trading, L.L.C.<br />

440 S. LaSalle Ste.619<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

John L. Carter (KIT) 05/09/01<br />

Sparta Group Of Chicago, L.P.<br />

440 S. LaSalle Street, Ste. 2500<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

Lessor(s):<br />

George E. Morris Jr. 05/03/01<br />

5750 NE Isl<strong>and</strong> Cove Way<br />

Stuart, FL 34996<br />

Nominee(s) / Inactive Nominee(s):<br />

Joshua Abrams (GSE) 05/07/01<br />

PEAK6 Capital Management LLC<br />

2930 N. Sheridan Rd. #508<br />

Chicago, IL 60657<br />

Type of Business to be Conducted: Market Maker<br />

Wesley W. Demmon (WWD) 05/07/01<br />

Wes Options Company<br />

440 S. LaSalle, Ste. 2500<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

Michael W. Prete (PRE) 05/08/01<br />

440 S. LaSalle, Ste. 2500<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

Timothy J. Werner (TTW) 05/08/01<br />

BOTTA Capital Management LLC<br />

440 S. LaSalle -Ste 3400<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

Member Organizations<br />

Wes Options Company 05/07/01<br />

Sparta Group Of Chicago, L.P.<br />

440 S. LaSalle, Ste. 2500<br />

Chicago , IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

DRB, LLC 05/09/01<br />

Sparta Group Of Chicago, L.P.<br />

133 N. Elmore<br />

Park Ridge, IL 60068<br />

Type of Business to be Conducted: Market Maker

Page 6 May 18, 2001 Volume 29, Number 20 Chicago Board Options <strong>Exchange</strong><br />

JOINT ACCOUNTS<br />

New Participants Acronym Effective Date<br />

Adam D. Boyer QWD 05/03/01<br />

Edward P. McFadden III QPZ 05/07/01<br />

Edward P. McFadden III QUN 05/07/01<br />

Joshua Abrams QXP 05/07/01<br />

Joshua Abrams QZZ 05/07/01<br />

Scott I. Bauer QQW 05/09/01<br />

Joseph I. DiMaggio QOX 05/09/01<br />

New Accounts<br />

Timothy J. Werner QWE 05/08/01<br />

Luke G. O’Donnell Jr. QUK 05/08/01<br />

Michael G. Palermo QUK 05/08/01<br />

Terminated Participants Acronym Terminated Date<br />

Mark L. Dooley QEP 05/04/01<br />

Mark L. Dooley QTC 05/04/01<br />

Martin E. Rauba QTG 05/04/01<br />

Michael M. Klearman QXP 05/07/01<br />

George P. Konhilas QCB 05/08/01<br />

Kevin J. Galassini QRA 05/08/01<br />

Edward V. Dolinar QBZ 05/09/01<br />

Jeffrey F. Brice QLS 05/09/01<br />

Jeffrey F. Brice QSP 05/09/01<br />

Jeffrey F. Brice QMB 05/09/01<br />

Jeffrey F. Brice QQB 05/09/01<br />

Rex L. Hufnagel QLS 05/09/01<br />

Rex L. Hufnagel QMB 05/09/01<br />

Rex L. Hufnagel QQB 05/09/01<br />

CHANGES IN MEMBERSHIP STATUS<br />

Individual Member Applicants Effective Date<br />

Patrick T. Koehler 05/03/01<br />

From: CBT Registered For Kich Trading, Inc.;<br />

Floor Broker Market Maker<br />

To: CBT Registered For STC, L.L.C.; Floor Broker<br />

Effective Date<br />

M. Barbara O’Brien 05/03/01<br />

From: CBT Registered For Kich Trading, Inc.;<br />

Floor Broker Market Maker<br />

To: CBT Registered For STC, L.L.C.; Floor Broker<br />

Daniel K. Kim 05/03/01<br />

From: Lessor, CBT Individual; Market Maker<br />

To: Owner; Market Maker<br />

John F. Burke 05/07/01<br />

From: Nominee For MDNH Partners, L.P;<br />

Floor Broker<br />

To: Nominee For Israel A. Engl<strong>and</strong>er <strong>and</strong> Co;<br />

Floor Broker<br />

Daniel R. Bergtholdt Jr. 05/09/01<br />

From: CBT Registered For Pioneer Capital, L.L.C.;<br />

Market Maker<br />

To: CBT Registered For DRB, LLC; Market Maker<br />

MEMBER ADDRESS CHANGES<br />

Individual Members Effective Date<br />

Michael W. Prete 05/07/01<br />

440 S. LaSalle - Ste. 2500<br />

Chicago, IL 60605<br />

Ellis B. Chu 05/07/01<br />

440 S. LaSalle Ste. 2500<br />

Chicago, IL 60605<br />

Joseph R.C Pinto 05/07/01<br />

440 S. LaSalle - Ste. 1685<br />

Chicago, IL 60605<br />

James T. Moster 05/07/01<br />

111 W. Jackson - 10th Floor<br />

Chicago, IL 60604<br />

Lloyd I. Miller III 05/07/01<br />

4550 Gordon Dr.<br />

Naples, FL 34102<br />

Timothy S. Miller 05/07/01<br />

141 W. Jackson - Ste. 2221A<br />

Chicago, IL 60604<br />

Lawrence J. Blum 05/07/01<br />

207 Dickens Road<br />

Northfield, IL 60093<br />

Dustin P. Sugasa 05/07/01<br />

311 S Wacker Drive - Ste 900<br />

Chicago, IL 60606<br />

Christopher C. Sporer 05/08/01<br />

440 S. LaSalle - Ste 3400<br />

Chicago, IL 60605<br />

David J. Hoelscher 05/08/01<br />

432 S Fairview Avenue<br />

Park Ridge, IL 60068<br />

Lanny I. Brooks 05/09/01<br />

440 S. LaSalle - Ste. 2500<br />

Chicago, IL 60605

Page 7 May 18, 2001 Volume 29, Number 20 Chicago Board Options <strong>Exchange</strong><br />

Effective Date<br />

Mark A. Cameron 05/09/01<br />

440 S. LaSalle - Ste. 2500<br />

Chicago, IL 60605<br />

Eduardo A. Campins II 05/09/01<br />

440 S. LaSalle - Ste. 2500<br />

Chicago, IL 60605<br />

Thomas B. Fredericks 05/09/01<br />

440 S. LaSalle - Ste. 2500<br />

Chicago, IL 60605<br />

Stephen F. Lake 05/09/01<br />

440 S. LaSalle, Ste. 2500<br />

Chicago, IL 60605<br />

William S. Menden 05/09/01<br />

440 S. LaSalle Ste. 2500<br />

Chicago, IL 60605<br />

John M. Vignoe 05/09/01<br />

440 S. LaSalle Ste. 2500<br />

Chicago, IL 60605<br />

Joel A. Tenner 05/09/01<br />

440 S. LaSalle -Ste 2500<br />

Chicago, IL 60605<br />

Kurt R. Passehl 05/09/01<br />

440 S. LaSalle - Ste. 3100<br />

Chicago, IL 60605<br />

Member Organizations<br />

Prudential Securities Incorporated 05/04/01<br />

100 State Street, Ste. 100<br />

Erie, PA 16507<br />

S. R. Partners, Ltd. 05/07/01<br />

1158 Summitt Drive<br />

Beverly Hills, CA 90210<br />

Daiwa Securities America Inc. 05/07/01<br />

Financial Square 32 Old Slip, #14FL<br />

New York, NY 10005<br />

MEMBER NAME CHANGE<br />

Member Organizations Effective Date<br />

From: Dean Witter Reynolds 05/08/01<br />

To: Morgan Stanley DW Inc.<br />

POSITION LIMITS<br />

For all equity options classes except those listed below, the st<strong>and</strong>ard position <strong>and</strong> exercise limits pursuant to <strong>Exchange</strong> Rule<br />

4.11 <strong>and</strong> 4.12 will be applicable. For a <strong>com</strong>plete list of all applicable limits, check 2nd floor data information bins or contact the<br />

Department of Market Regulation. If you wish to receive regular updates of the position limit list, please contact C<strong>and</strong>ice<br />

Nickr<strong>and</strong> at (312) 786-7730 of the Department of Market Regulation.<br />

Class Limit Date<br />

BDH/BXH 22,500 contracts 5/19/01<br />

BNC 75,000 contracts 5/19/01<br />

FST/FTV 22,500 contracts 5/19/01<br />

IIH/IHX 22,500 contracts 5/19/01<br />

JQ/QYI/QYJ/QDM/YJN/OQK 150,000 contracts 5/19/01<br />

MNU 45,000 contracts 5/19/01<br />

MZU 150,000 contracts 5/19/01<br />

QFW/FIV 31,500 contracts 5/19/01<br />

QLL/AEX/AZV 150,000 contracts 5/19/01<br />

QMN/QMR/UMY 150,000 contracts 5/19/01<br />

SYY 150,000 contracts 5/19/01<br />

UML/UMQ/UEL 150,000 contracts 5/19/01<br />

XTO/XTG 4,725,000 shares 5/19/01<br />

CJT/SUQ/SUX/SWV/VSU/XWV/VZX 331,500 contracts 6/16/01<br />

CQR/RNC/YFA/OQC 150,000 contracts 6/16/01<br />

DME/EIM 60,000 contracts 6/16/01<br />

DNA/DWN 150,000 contracts 6/16/01<br />

FBB/GP/VGP 195,000 contracts 6/16/01<br />

GP/VGP/FBB 195,000 contracts 6/16/01<br />

SBL/SFB/THL 14,625,000 shares 6/16/01<br />

SUQ/SUX/SWV/VSU/XWV/VZX/CJT 331,500 contracts 6/16/01<br />

TEF/TEB/YEF 7,803,000 shares 6/16/01<br />

TGR/BCE/WFK/WFL/VFK 106,500 contracts 6/16/01<br />

THL/SBL/SFB 14,625,000 shares 6/16/01<br />

V/ONV 75,000 contracts 6/16/01<br />

WFC/VWF/FBW 150,000 contracts 6/16/01<br />

AFX/QQB 45,000 contracts 7/21/01<br />

AOT/SIW 31,500 contracts 7/21/01<br />

AIY/AXA 106,500 contracts 7/21/01<br />

AXA/AIY 106,500 contracts 7/21/01<br />

CJL/CVQ 53,000 contracts 7/21/01<br />

CMA/IMD 82,500 contracts 7/21/01<br />

CVQ/CJL 53,000 contracts 7/21/01<br />

DUK 150,000 contracts 7/21/01<br />

ETN/ETD 31,500 contracts 7/21/01<br />

EUA/EVA/EVB 45,000 contracts 7/21/01<br />

FKS/UVM 106,500 contracts 7/21/01<br />

HAU/LKQ 54,000 contracts 7/21/01<br />

HWP/WPW/WOW/YLP/VHP 181,500 contracts 7/21/01<br />

IDQ/IDK/IHO225,000 contracts 7/21/01

Page 8 May 18, 2001 Volume 29, Number 20 Chicago Board Options <strong>Exchange</strong><br />

Class Limit Date<br />

KGE/YKE/EXK/YKN 11,250,000 shares 7/21/01<br />

MEE/FRV 31,500 contracts 7/21/01<br />

QMT/TTD 135,000 contracts 7/21/01<br />

QQB/AFX 45,000 contracts 7/21/01<br />

QSD/DWP 11,250,000 shares 7/21/01<br />

QVM/QUM/UZQ 150,000 contracts 7/21/01<br />

SGR 45,000 contracts 7/21/01<br />

TTD/QMT 135,000 contracts 7/21/01<br />

UMN/OFO/UGE 12,571,000 shares 7/21/01<br />

UVM/FKS 106,500 contracts 7/21/01<br />

XAP/HWP/WPW/WOW/YLP/VHP 181,500 contracts 7/21/01<br />

ZUQ 150,000 contracts 7/21/01<br />

AQU/HUJ 11,250,000 shares 8/18/01<br />

BAW/PRM 105,210 contracts 8/18/01<br />

DWV/MXO189,000 contracts 8/18/01<br />

DZU/DZV 3,375,000 shares 8/18/01<br />

EKU 45,000 contracts 8/18/01<br />

FUO/FOC 3,375,000 shares 8/18/01<br />

GDQ 150,000 contracts 8/18/01<br />

MXO/DWV 189,000 contracts 8/18/01<br />

PRM/BAW 105,210 contracts 8/18/01<br />

OAQ/POL 11,250,000 shares 8/18/01<br />

YQK 225,000 contracts 8/18/01<br />

EPG/GOP 167,250 contracts 9/22/01<br />

FLW/RIG 150,000 contracts 9/22/01<br />

GOP/EPG 167,250 contracts 9/22/01<br />

LTR 63,000 contracts 9/22/01<br />

SLK/SAX/SLU/SSV/UQD/XXZ/UCQ/UNQ/<br />

YSU/YDI/YJU/YHH/OVU/VEQ/PVG 360,000 contracts 9/22/01<br />

RIG/FLW 150,000 contracts 9/22/01<br />

UQD/XXZ/UCQ/UNQ/YSU/YDI/YJU/YHH/<br />

OVU/VEQ/SLK/SAX/SLU/SSV 360,000 contracts 9/22/01<br />

AGC 150,000 contracts 10/20/01<br />

AMP/MRQ 150,000 contracts 10/20/01<br />

BBJ/BBO/BBQ 7,500,000 shares 10/20/01<br />

FBF/WGW/VFT/SBJ 22,470,000 shares 10/20/01<br />

IDJ/VMB/WVM/VVM 231,000 contracts 10/20/01<br />

MRQ/AMP 150,000 contracts 10/20/01<br />

MSQ/MQF/YMF/ODL/ORF/PJG/MQV 90,750 contracts 10/20/01<br />

NQK/BQG 3,375,000 shares 10/20/01<br />

NZQ/URJ 54,000 contracts 10/20/01<br />

QME/MEF 31,500 contracts 10/20/01<br />

SBJ/FBF/VFT/WGW 22,470,000 shares 10/20/01<br />

TR/TOK 1,390,000 shares 10/20/01<br />

VMB/WVM/VVM/IDJ 231,000 contracts 10/20/01<br />

AFL 150,000 contracts 11/17/01<br />

ARB/EYQ 60,000 contracts 11/17/01<br />

SO/SZC 75,000 contracts 11/17/01<br />

UTH/UHX 13,500 contracts 11/17/01<br />

ADI/AKI/WDI/WZQ/VIK/OKI 150,000 contracts 1/19/02<br />

AEQ/AXX/VAE/ODJ/AQH 300,000 contracts 1/19/02<br />

AHQ/WAH/VAY/AHU 150,000 contracts 1/19/02<br />

AIG/WAP/ZFA/WAJ/ZPW/VAF/ZKR/YWB 14,062,500 shares 1/19/02<br />

ALA/WNV 150,000 contracts 1/19/02<br />

AMQ/YAA//VAN 150,000 contracts 1/19/02<br />

AMR/WAR/UAR 75,000 contracts 1/19/02<br />

AN/YNP 75,000 contracts 1/19/02<br />

ANQ/ANC/AWL/VPJ 150,000 contracts 1/19/02<br />

AOL/AOE/AOO/AOW/OOL/VAN/XTE/YYW 26,250,000 shares 1/19/02<br />

AQH 150,000 contracts 1/19/02<br />

ASO/ZFH/WFH 7,500,000 shares 1/19/02<br />

AXP/AQP/VAX 225,000 contracts 1/19/02<br />

BCE/WFK/WFL/VFK/TGR 106,500 contracts 1/19/02<br />

BGQ/VNG 150,000 contracts 1/19/02<br />

BNQ/BYQ/BWR/WWO/YUX/YOW/YWR/<br />

YUJ/OKO/VRQ 300,000 contracts 1/19/02<br />

BP/VAO150,000 contracts 1/19/02<br />

CL/WTP/VGO150,000 contracts 1/19/02<br />

CYQ/CYJ/CWY/VYC 30,000,000 shares 1/19/02<br />

DOW/WDO/VDO/UKD 240,750 contracts 1/19/02<br />

ELN/VBZ/YPO150,000 contracts 1/19/02<br />

EMC/EMB/YME/WYK/VUE/EKO/EBC/VUP 270,000 contracts 1/19/02<br />

ENE/VEN 150,000 contracts 1/19/02<br />

ERQ/ERU/VRE/VVG/WYG 120,000 contracts 1/19/02<br />

F/WFO/YOD 75,000 contracts 1/19/02<br />

FQC/FZC/WFU/YFG/VFU 150,000 contracts 1/19/02<br />

GBD/YKB/GSK/WGX/VLX 15,975,000 shares 1/19/02<br />

GE/GEW/WGE/VGE 225,000 contracts 1/19/02<br />

GMH/YGH/VGL 225,000 contracts 1/19/02<br />

GSK/WGX/VLX/GBD/YKB 15,975,000 shares 1/19/02<br />

GTW/WGB/VGB 150,000 contracts 1/19/02<br />

HD/WHD/YSY/VHD 11,250,000 shares 1/19/02

Page 9 May 18, 2001 Volume 29, Number 20 Chicago Board Options <strong>Exchange</strong><br />

Class Limit Date<br />

IRU/IUR/RBU/IMU/YRU/YYR/OIR/OJN/GYV/OLR 150,000 contracts 1/19/02<br />

IUQ/IUU/QUV/WYJ/YJW/VYJ 450,000 contracts 1/19/02<br />

JNJ/WUY/VJN 150,000 contracts 1/19/02<br />

JPB/JSA/YBG/YMB/OYJ/JPM/CJM/WCV/XJM/<br />

VCR 39,000,000 shares 1/19/02<br />

JPM/CJM/WCV/XJM/VCR/JPB/JSA/YBG/YMB/<br />

OYJ 39,000,000 shares 1/19/02<br />

KR/VKK 150,000 contracts 1/19/02<br />

LDQ/WQM/WUO/WQZ/DOJ/VQM 22,500,000 shares 1/19/02<br />

LMQ/MLC//WMJ/YXW/VPC/LKR 225,000 contracts 1/19/02<br />

LOQ/LQL/UBX/YRB/UQB/WCX/VCE 150,000 contracts 1/19/02<br />

LSI/ISM/VBS 150,000 contracts 1/19/02<br />

LTD/WKX/ZOF/WDL/VLD 150,000 contracts 1/19/02<br />

MDT/WKV/VKD 150,000 contracts 1/19/02<br />

MGA/WMG/YGG/VAG 31,500 contracts 1/19/02<br />

MU/MUY/VGY/VLW/GYV 150,000 contracts 1/19/02<br />

MWD/MFZ/VWD 150,000 contracts 1/19/02<br />

NOK/NAY/NZY/VOK 300,000 contracts 1/19/02<br />

NT/NTV/WNT/YNZ/ZZN/UCY/YUC/ODT/ODV 38,190,000 shares 1/19/02<br />

ORQ/ORY/VOC/MOQ/WOK/VOK 300,000 contracts 1/19/02<br />

PCS/WVH/VVH 150,000 contracts 1/19/02<br />

PFE/WPE/XWZ/VPE 28,125,000 shares 1/19/02<br />

PHA/YNJ/VM 16,425,000 shares 1/19/02<br />

PNJ/YNJ/PHA/WGF/VM 16,425,000 shares 1/19/02<br />

Q/VWW/WUX 20,400,000 shares 1/19/02<br />

QAQ/AAW/AAO/AAF/AUA/VLM/OVG 300,000 contracts 1/19/02<br />

QFN/WOF/WCW/VRW/OFN/VKW 150,000 contracts 1/19/02<br />

QGC/QGW/GCB/GXW/WCK/YCK/YSW/VCK 150,000 contracts 1/19/02<br />

QYK/KYQ/YOR/VFR/KFN/KAY 150,000 contracts 1/19/02<br />

RAL/WLR/YKL/VLR 75,000 contracts 1/19/02<br />

RCQ/RDZ/RDW/RDU/VJG/WDK/YRL/YRM/<br />

WXD/WGJ//YRR/OYG/ORD 150,000 contracts 1/19/02<br />

RQC/VYD 300,000 contracts 1/19/02<br />

SAP/WTA/VSP 225,000 contracts 1/19/02<br />

SBC/VFE 17,325,000 shares 1/19/02<br />

SCH/WWS/YVV/VYS 11,250,000 shares 1/19/02<br />

SLB/WUB/WME/VWY 75,000 contracts 1/19/02<br />

SLR/VRL 150,000 contracts 1/19/02<br />

SQN/ONS/SMJ/OMT 300,000 contracts 1/19/02<br />

SWS/WRM/YWF/VWZ 3,465,000 shares 1/19/02<br />

TLQ/XOP 150,000 contracts 1/19/02<br />

TMX/XMR/WTE/TEW/VTE/TMU/TXZ/XRX/<br />

YRY/ORX 150,000 contracts 1/19/02<br />

TQA/TAZ/WRZ/VCY 225,000 contracts 1/19/02<br />

TXN/TNZ/TXR 300,000 contracts 1/19/02<br />

TYC/VYL 150,000 contracts 1/19/02<br />

UBX/YRB/UQB/WCX/VCE/LOQ/LQL 150,000 contracts 1/19/02<br />

UCY/YUC/NT/NTV/WNT/YNZ/ODT 38,190,000 shares 1/19/02<br />

UKD/DOW/WDO/VDO 240,750 contracts 1/19/02<br />

VZ/VBU/YLG 16,650,000 shares 1/19/02<br />

WNV/ALA 150,000 contracts 1/19/02<br />

WQS/XBR/VMQ 11,250,000 shares 1/19/02<br />

WUO/LDQ/WQM/ZPX/WQZ/DOJ/VQM 22,500,000 shares 1/19/02<br />

WUX/Q/UWW 20,400,000 shares 1/19/02<br />

WUY/JNJ/VJN 150,000 contracts 1/19/02<br />

XLQ/WXJ/VXJ/XLW 150,000 contracts 1/19/02<br />

XOP/TLQ 150,000 contracts 1/19/02<br />

XQL/YHS/OLH 120,000 contracts 1/19/02<br />

XTE/YYW/AOL/AOE/AOO/AOW/OOL/VAN 26,250,000 shares 1/19/02<br />

XWZ/PFE/WPE/VPE 28,125,000 shares 1/19/02<br />

YHQ/YHU/YHV/YMM/YUU/OYH/VYH/OYO/<br />

YCH/YHX/YHZ 150,000 contracts 1/19/02<br />

YPO/ELN/VBZ 150,000 contracts 1/19/02<br />

ZFH/WFH/ASO7,357,500 shares 1/19/02<br />

ZQN/QZN/YZZ/YQN/VON/VEE/ZQQ 150,000 contracts 1/19/02<br />

ZZN/UCY/XUC/YUC/NT/NTV/WNT/YNZ/ODT 38,190,000 shares 1/19/02<br />

AAQ/VAA/QAA 150,000 contracts 1/18/03<br />

AMD/AKD/WVV/YVD/VVV 150,000 contracts 1/18/03<br />

AP/VYA/OBP/YTV 75,000 contracts 1/18/03<br />

AQT/YAT/YHE/VLH 150,000 contracts 1/18/03<br />

AZA/VZA 150,000 contracts 1/18/03<br />

BUD/WBD/VBD 150,000 contracts 1/18/03<br />

C/ZUZ/ZZV/WRV/VRN/YSV/OCY 9,975,000 shares 1/18/03<br />

CAH/YCX/OCJ/CKJ/YKJ/OKJ 11,250,000 shares 1/18/03<br />

CVC/WJD/VJL/CVJ/YJD/VJL 31,500 contracts 1/18/03<br />

ENZ/OMJ/EKD/JME 3,307,500 shares 1/18/03<br />

EZQ/WZW/VZH 150,000 contracts 1/18/03<br />

FRX/FHA/WRT/VFB 150,000 contracts 1/18/03<br />

GLW/GRJ/GWD/WGU/YGW/YHL/VGC/<br />

VHO/WYY 225,000 contracts 1/18/03<br />

HHH/WHB/OHH/HXH/YYC/OYC/HHV<br />

/HWH/OHZ/THH/WBV/VWH 75,000 contracts 1/18/03

Page 10 May 18, 2001 Volume 29, Number 20 Chicago Board Options <strong>Exchange</strong><br />

Position Limit Circular PL01-58<br />

DATE: May 4, 2001<br />

Position Limit Circular PL01-59<br />

DATE: May 7, 2001<br />

Class Limit Date<br />

NQ/IQ/NQ/VNL 150,000 contracts 1/18/03<br />

IOU/FHY/GQG/YGA/OGC 21,150,000 shares 1/18/03<br />

LEH/LES/VHE/OHW 150,000 contracts 1/18/03<br />

LTQ/WZT/VZT/WKS 150,000 contracts 1/18/03<br />

LUV/WUV/VUV/LUP/YUH/OUN 11,250,000 shares 1/18/03<br />

MER/JMR/VME 150,000 contracts 1/18/03<br />

MOT/MQO/VMA/MOJ 225,000 contracts 1/18/03<br />

PVN/WVR/VQV 150,000 contracts 1/18/03<br />

QCI/IUL/YCF/OFZ 150,000 contracts 1/18/03<br />

QED/DUB/WZZ/VTQ/EXF 150,000 contracts 1/18/03<br />

RAQ/RAZ/VJR/OBM 150,000 contracts 1/18/03<br />

SEZ/YGM/OGM/VUQ 150,000 contracts 1/18/03<br />

SGQ/SGW/EZG/YDS/YYS/OIE/VEI 150,000 contracts 1/18/03<br />

SQX/VPR150,000 contracts 1/18/03<br />

TGT/VDH 150,000 contracts 1/18/03<br />

THQ/WTH/VTH/HB/YHJ/OBB 75,000 contracts 1/18/03<br />

TIF 120,000 contracts 1/18/03<br />

UBF/UBZ/GUF/ULF/OMW/OBO/BQB/OZD 150,000 contracts 1/18/03<br />

UBS/YWK/OWK 88,500 contracts 1/18/03<br />

UNH/WUH/VUH 150,000 contracts 1/18/03<br />

USB/YSR/OSR/USZ/WBP/VBV 169,500 contracts 1/18/03<br />

USZ/WBP/VBV/USB/YSR/OSR 169,500 contracts 1/18/03<br />

UVT/BWU/WWP/WJC/VLV/UVH/BWJ/WWB/VLE75,000 contracts 1/18/03<br />

WMB/WYM/VBB/AEB/AEK/HSD 75,000 contracts 1/18/03<br />

VUQ/SEZ/YGM/OGM 150,000 contracts 1/18/03<br />

YWK/OWK/UBS 88,500 contracts 1/18/03<br />

POSITION LIMIT CIRCULARS<br />

TO: Members <strong>and</strong> Member Organizations<br />

FROM: Department of Market Regulation<br />

RE: Equity Position <strong>and</strong> Exercise Limits<br />

Please be reminded that the position <strong>and</strong> exercise limits 1 for the following equity option classes will be decreased to a lower tier limit with the<br />

May 2001 expiration. Effective May 21, 2001, the position <strong>and</strong> exercise limits for the following equity option classes will be decreased to the<br />

applicable st<strong>and</strong>ard limit as noted below:<br />

Underlying Stock Option Symbol Stock Symbol St<strong>and</strong>ard Position <strong>and</strong> Exercise Limit<br />

Cyber-Care, Inc. RSU CYBR 31,500 Contracts<br />

Imrglobal Corporation QIQ IMRS 22,500 Contracts<br />

Net Perceptions, Inc. PEU NETP 31,500 Contracts<br />

Xybernaut Corporation XUY XYBR31,500 Contracts<br />

Copies of the <strong>com</strong>plete list of the applicable limits for all <strong>Exchange</strong> listed options are available in the 2nd floor data information bins or may be<br />

obtained from the Department of Market Regulation. If you wish to receive regular updates of the position limit list via telefax, please contact<br />

C<strong>and</strong>ice Nickr<strong>and</strong> at (312) 786-7730 in the Department of Market Regulation.<br />

1 Limits were previously reviewed in January 2001 <strong>and</strong>, at that time, these equity option classes were not eligible to remain at their current tier<br />

limit.<br />

TO: Members <strong>and</strong> Member Organizations<br />

FROM: Department of Market Regulation<br />

RE: Equity Option Position <strong>and</strong> Exercise Limits<br />

The position <strong>and</strong> exercise limit in the Brunswick Corp. (BC) was scheduled to be decreased after the September 2001 expiration. However, as<br />

a result of a review of trading statistics, it has been determined that BC’s position <strong>and</strong> exercise limit will remain unchanged at 31,500 contracts.<br />

For additional information, please contact Michael Felty at (312) 786-7504 in the Department of Market Regulation.

Page 11 May 18, 2001 Volume 29, Number 20 Chicago Board Options <strong>Exchange</strong><br />

Position Limit Circular PL01-60<br />

DATE: May 7, 2001<br />

TO: Members <strong>and</strong> Member Organizations<br />

FROM: Department of Market Regulation<br />

RE: Equity Option Position <strong>and</strong> Exercise Limits<br />

The position <strong>and</strong> exercise limit in the Citizens Communications Company (CZN) was scheduled to be decreased after the August 2001<br />

expiration. However, as a result of a review of trading statistics, it has been determined that CZN’s position <strong>and</strong> exercise limit will remain<br />

unchanged at 75,000 contracts.<br />

For additional information, please contact Michael Felty at (312) 786-7504 in the Department of Market Regulation.<br />

Position Limit Circular PL01-61<br />

DATE: May 7, 2001<br />

TO: Members <strong>and</strong> Member Organizations<br />

FROM: Department of Market Regulation<br />

RE: Equity Option Position <strong>and</strong> Exercise Limits<br />

The position <strong>and</strong> exercise limits in the Expedia, Inc. (EXPE/UED) <strong>and</strong> Readers Digest (RDA) were scheduled to be decreased after the July<br />

2001 expiration. However, as a result of a review of trading statistics, it has been determined that UED’s position <strong>and</strong> exercise limit will remain<br />

unchanged at 22,500 <strong>and</strong> RDA’s position <strong>and</strong> exercise limit will remain unchanged at 31,500.<br />

For additional information, please contact Michael Felty at (312) 786-7504 in the Department of Market Regulation.<br />

Position Limit Circular PL01-64<br />

DATE: May 9, 2001<br />

TO: Members <strong>and</strong> Member Organizations<br />

RE: UTI Energy, Inc. (“UTI”) merger <strong>com</strong>pleted with Patterson Energy, Inc. (“PTEN/NZQ”)<br />

Effective Date May 9, 2001<br />

Please be advised that the <strong>Exchange</strong> listed Patterson Energy, Inc. (“PTEN/NZQ”) on May 9, 2001. Following the above merger, UTI Energy,<br />

Inc.’s option symbol of UTI changed to URJ. Please be advised that UTI Energy, Inc. is listed on the American Stock <strong>Exchange</strong> <strong>and</strong> the<br />

Philadelphia Stock <strong>Exchange</strong>. As a result of the above merger, Patterson Energy, Inc.’s name has been changed to Patterson-UTI Energy, Inc.<br />

The stock symbol of PTEN <strong>and</strong> the option symbol of NZQ will remain the same.<br />

The <strong>Exchange</strong> has established that the position <strong>and</strong> exercise limits following this merger will be any <strong>com</strong>bination of URJ <strong>and</strong> NZQ option<br />

contracts on the same side of the market not to exceed 54,000 contracts through October 20, 2001. Following the October expiration, NZQ’s<br />

position <strong>and</strong> exercise limits will revert to the st<strong>and</strong>ard limit of 31,500 contracts.<br />

For additional information, please contact C<strong>and</strong>ice Nickr<strong>and</strong> at (312) 786-7730 in the Department of Market Regulation.<br />

Position LImit Circular PL01-65<br />

DATE: May 14, 2001<br />

TO: Members <strong>and</strong> Member Organizations<br />

RE: Equity Option Position <strong>and</strong> Exercise Limits<br />

As a result of a review of trading statistics, the following classes now qualify for a higher position <strong>and</strong> exercise limit:<br />

Option Class Stock Symbol New Tier<br />

ILA ILA 22,500<br />

RQK RTIX 22,500<br />

URL SRCL 22,500<br />

ASD ASD 31,500<br />

PHM PHM 31,500<br />

SPW SPW 31,500<br />

TQB TWAV 31,500<br />

TUF TUNE 31,500<br />

UAF ALGN 31,500<br />

Option Class Stock Symbol New Tier<br />

ACF ACF 60,000<br />

VQQ SVGI 60,000<br />

CCRCCR75,000<br />

KUK COSN 75,000<br />

TTU TWTC 75,000<br />

WB WB 75,000<br />

BBJ/BBO/BBQ BOBJ 7,500,000 Shares*<br />

*Position reflected in shares due to a 3-for-2 Stock Split. After October 20, 2001, the position <strong>and</strong> exercise limit will be 75,000 contracts<br />

of BBJ.<br />

For additional information, please contact Michael Felty at (312) 786-7504 in the Department of Market Regulation.

Page 12 May 18, 2001 Volume 29, Number 20 Chicago Board Options <strong>Exchange</strong><br />

Position Limit Circular PL01-66<br />

DATE: May 14, 2001<br />

FROM: Department of Market Regulation<br />

RE: Equity Option Position <strong>and</strong> Exercise Limits<br />

The position <strong>and</strong> exercise limit in the Homestore.<strong>com</strong>, Inc. (“HOMS/HMU”) was scheduled to be decreased after the July 2001 expiration.<br />

However, as a result of a review of trading statistics, it has been determined that HMU’s position <strong>and</strong> exercise limit will remain<br />

unchanged at 75,000 contracts. For additional information, please contact Michael Felty at (312) 786-7504 in the Department of Market<br />

Regulation.<br />

Position Limit Circular PL01-67<br />

DATE: May 14, 2001<br />

FROM: Department of Market Regulation<br />

RE: Equity Option Position <strong>and</strong> Exercise Limits<br />

The position <strong>and</strong> exercise limit in the Spectrian Corporation (“SPCT/QCS”) was scheduled to be decreased after the August 2001 expiration.<br />

However, as a result of a review of trading statistics, it has been determined that QCS’ position <strong>and</strong> exercise limit will remain unchanged<br />

at 22,500 contracts. For additional information, please contact Michael Felty at (312) 786-7504 in the Department of Market<br />

Regulation.<br />

Position Limit Circular PL01-68<br />

DATE: May 14, 2001<br />

FROM: Department of Market Regulation<br />

RE: Equity Option Position <strong>and</strong> Exercise Limits<br />

The position <strong>and</strong> exercise limit in the Machrochem Corporation (“MCHM/QQ”) was scheduled to be decreased after the September 2001<br />

expiration. However, as a result of a review of trading statistics, it has been determined that QQ’s position <strong>and</strong> exercise limit will remain<br />

unchanged at 22,500 contracts. For additional information, please contact Michael Felty at (312) 786-7504 in the Department of Market<br />

Regulation.<br />

RESEARCH CIRCULARS<br />

The following Research Circulars were distributed between May 4, <strong>and</strong> May 11, 2001. If you wish to read the entire document, please refer to<br />

the <strong>CBOE</strong> Web Site at www.cboe.<strong>com</strong>/tools/splt&mrg.htm For questions regarding information discussed in a Research Circular, please call<br />

the The Options Clearing Corporation at 1-800-OPTIONS. Visit www.cboe.<strong>com</strong>/tools/newlist.htm for information on new listings.<br />

Research Circular #RS01-277<br />

May 9, 2001<br />

AXA ADS (“AXA & adj. AIY”)<br />

2-for-1 ADS Split<br />

Ex-Distribution Date: May 17, 2001<br />

Research Circular #RS01-281<br />

May 4, 2001<br />

Raytheon Company Class A (“RTN.A/RYA”)<br />

Reclassification, Stock <strong>and</strong> option Symbol Change to (“RTN”)<br />

Effective Date: May 15, 2001<br />

Research Circular #RS01-282<br />

May 4, 2001<br />

Raytheon Company Class B (“RTN.B/RTN”)<br />

Reclassification & Stock Symbol Change to (“RTN”)<br />

Effective Date: May 15, 2001<br />

Research Circular #RS01-287<br />

May 8, 2001<br />

Barrett Resources Corporation (“BRR”)<br />

Tender Offer TERMINATED<br />

Research Circular #RS01-288<br />

May 10, 2001<br />

Willamette Industries, Inc. (“WLL”)<br />

Tender Offer **AMENDED** by Company Holdings, Inc.<br />

Research Circular #RS01-289<br />

May 9, 2001<br />

Methode Electronics Inc. Class A (“METHA/QME & adj. MEF”)<br />

Determination of Cash-In-Lieu Amounts<br />

Research Circular #RS01-290<br />

May 10, 2001<br />

*****UPDATE*****<br />

Biochem Pharma, Inc. (“BCHE/BQX/WOE/VCN”) Proposed<br />

Election Merger with Shire Pharmaceuticals Group plc<br />

(“SHPGY/UGH”)<br />

ELECTION DEADLINE: MAY 10, 2001<br />

Research Circular #RS01-291<br />

May 10, 2001<br />

IVAX Corporation (“IVX/YIV/OIV”) 5-for-4 Stock Split Ex-<br />

Distribution Date: May 21, 2001 05/10/01<br />

Research Circular #RS01-293<br />

May 11, 2001<br />

Baxter International, Inc. (“BAX”) 2-for-1 Stock Split<br />

Ex-Distribution Date: May 31, 2001<br />

Research Circular #RS01-294<br />

May 11, 2001<br />

SouthTrust Corporation (“SOTR/SHQ/YEB”)<br />

2-for-1 Stock Split<br />

Ex-Distribution Date: May 14, 2001

May 18, 2001 Volume RB12, Number 20<br />

<strong>Regulatory</strong><br />

Circulars<br />

<strong>Regulatory</strong><br />

<strong>Bulletin</strong><br />

The Constitution <strong>and</strong> Rules of the Chicago Board Options <strong>Exchange</strong>, Incorporated<br />

(“<strong>Exchange</strong>”), in certain specific instances, require the <strong>Exchange</strong> to provide notice to the<br />

membership. The weekly <strong>Regulatory</strong> <strong>Bulletin</strong> is delivered to all effective members to satisfy<br />

this requirement.<br />

<strong>Regulatory</strong> Circular RG01-59<br />

Date: May 7, 2001<br />

To: Members<br />

From: <strong>Regulatory</strong> Services Division<br />

Re: Joint Account Trading In OEX, SPX <strong>and</strong> DJX Indexes<br />

This memor<strong>and</strong>um addresses procedures established by the <strong>Exchange</strong> regarding the<br />

trading activities of joint account participants in the OEX, SPX <strong>and</strong> DJX (“Index”) option<br />

classes. These procedures supplement <strong>Exchange</strong> Rules regarding transactions on the<br />

floor by members. Additional procedures for joint accounts trading on RAES are contained<br />

in the rules <strong>and</strong> memor<strong>and</strong>a regarding the operations <strong>and</strong> eligibility requirements for those<br />

systems.<br />

The Committees have established that the following procedures apply to the trading of joint<br />

accounts in Index options:<br />

1. Joint accounts may be simultaneously represented in an Index crowd by participants<br />

trading in-person for the joint account.<br />

2. Joint account participants who are not trading in-person in an Index crowd, may<br />

enter orders for the joint account with floor brokers even if other participants are<br />

trading the same joint account in-person.<br />

3. When series are simultaneously opened during rotation, joint account participants<br />

trading the joint account in-person may enter orders for the joint account with floor<br />

brokers in series where they are unable to trade the joint account in-person.<br />

4. There is no restriction on the number of joint account participants that may participate<br />

on behalf of the joint account on the same trade in the Index.<br />

5. When joint account participants are trading in an Index crowd for their individual<br />

account or as a floor broker, another participant of the joint account may trade for<br />

the joint account in-person or enter orders for the joint account with floor brokers.<br />

6. Except for the exemption described in #7, members are reminded that they are<br />

prohibited from entering orders for their individual or joint accounts while they are<br />

trading in-person in an Index crowd even if the orders are for an account they are<br />

not then actively trading.

<strong>Regulatory</strong> Circulars<br />

continued<br />

<strong>Regulatory</strong> Circular RG01-59 continued<br />

7. Notwithst<strong>and</strong>ing the restriction described in #6, managers of <strong>Exchange</strong> approved<br />

RAES joint accounts may enter orders with floor brokers for the RAES joint account<br />

if the manager is trading in-person for his individual account in the Index<br />

crowd. If the manager is trading in-person for the joint account the manager may<br />

not enter an order for the joint account with a floor broker. CLERKS MAY NOT<br />

ENTER ORDERS VIA THE USE OF RAES TATS BY GIVING THEM TO FLOOR<br />

BROKERS TO CLOSE-OUT POSITIONS.<br />

8. Members must ensure that they do not trade in-person or by orders such that<br />

[any of the following results]:<br />

(a) a trade occurs between a joint account participant’s individual market-maker<br />

account <strong>and</strong> the joint account of which he or she is a participant, or<br />

(b) a trade occurs in which the buyer <strong>and</strong> seller are representing the same joint<br />

account <strong>and</strong> are on opposite sides of a transaction.<br />

9. Joint account participants may not act as a floor broker for the joint account of<br />

which they are a participant.<br />

10. Members may alternate trading in-person for their individual account <strong>and</strong> their<br />

joint account while in an Index crowd.<br />

Joint Account Identification<br />

The proper procedure for <strong>com</strong>pleting a trade ticket for joint account transactions is that<br />

both the member’s <strong>and</strong> joint account acronym must be included. This information is<br />

required to insure that the initiating joint account member receives credit for such transactions<br />

as they relate to reporting <strong>and</strong> market performance obligations set forth in <strong>Exchange</strong><br />

Rules 6.51 (d) <strong>and</strong> 8.7.03.<br />

Requests for exemptions from the above procedures should be directed to the appropriate<br />

Committee.<br />

Questions regarding this memor<strong>and</strong>um may be directed to Pat Cerny at (312) 786-7722<br />

or Steve Slawinski (312) 786-7744 in the Division’s Department of Market Regulation.<br />

(RG98-95, revised)<br />

<strong>Regulatory</strong> Circular RG01-60<br />

Date: May 7, 2001<br />

To: Members<br />

From: <strong>Regulatory</strong> Services Division<br />

Re: Joint Account Participant Trading In Equity Options<br />

This memor<strong>and</strong>um addresses procedures established by the Equity Floor Procedure<br />

Committee (“EFPC”) regarding the trading activities of joint account participants in equity<br />

option crowds. These procedures do not apply to the trading activities of DPMs in their<br />

appointed option classes. These procedures supplement <strong>Exchange</strong> Rules regarding<br />

transactions on the floor by members. The requirements governing joint account trading<br />

on RAES are contained in the rules <strong>and</strong> memor<strong>and</strong>a regarding the operations <strong>and</strong> eligibility<br />

requirements for that system (See Rules 6.8 <strong>and</strong> 8.16).<br />

RB2 May 18, 2001, Volume RB12, Number 20

<strong>Regulatory</strong> Circulars<br />

continued<br />

<strong>Regulatory</strong> Circular RG01-60 continued<br />

The EFPC has determined that the following procedures apply to the trading of joint accounts<br />

in equity options:<br />

1. A joint account may be simultaneously represented in a trading crowd only by<br />

participants trading in-person. Orders for a joint account may not be entered in a<br />

crowd where a participant of the joint account is trading in-person for the joint<br />

account. However, if no participant is trading in-person for the joint account, orders<br />

may be entered via floor broker so long as the same option series is not<br />

represented by more than one floor broker.<br />

2. Members may alternate trading in-person between their individual <strong>and</strong> joint accounts<br />

while in the crowd. Members who alternate trading between accounts<br />

must ensure that while trading the joint account another participant does not enter<br />

orders through a broker for the joint account in the same crowd or that an order is<br />

not being continuously represented for the joint account in the same crowd.<br />

3. The EFPC has determined that it is the responsibility of a joint account participant<br />

to ascertain whether joint account orders have been entered in a crowd prior to<br />

trading the joint account in-person.<br />

4. Joint account participants may not act as a floor broker for the joint account of<br />

which they are a participant.<br />

5. When a joint account participant is trading in a crowd for his individual account or<br />

actively as a floor broker for accounts unrelated to his joint account, another participant<br />

of the joint account may either trade in-person for the joint account or enter<br />

orders for the joint account with other floor brokers.<br />

6. Members are prohibited from entering orders in a particular crowd with floor brokers<br />

for their individual or joint account whenever they are trading in-person in that<br />

crowd; this applies even though the orders are for an account they are not then<br />

actively trading.<br />

7. It is a member’s responsibility to ensure that they do not trade in-person or enter orders<br />

with floor brokers such that:<br />

(a) a trade occurs between a joint account participant’s individual account <strong>and</strong> the<br />

joint account of which he or she is a participant, or<br />

(b) a trade occurs in which the buyer <strong>and</strong> seller are representing the same joint<br />

account <strong>and</strong> are on opposite sides of a transaction.<br />

Joint Account Identification<br />

The proper procedure for <strong>com</strong>pleting a trade ticket for joint account transactions is that<br />

both the initiating member’s acronym <strong>and</strong> the joint account acronym must be recorded.<br />

This information is required to insure that the initiating joint account member receives credit<br />

for such transactions as they relate to reporting <strong>and</strong> market performance obligations set<br />

forth in <strong>Exchange</strong> Rules 6.51(d) <strong>and</strong> 8.7.03.<br />

Requests for exemptions from the above procedures should be directed to the EFPC.<br />

Questions regarding this memor<strong>and</strong>um may be directed to Pat Cerny at (312) 786-7722 or<br />

Steve Slawinski at (312) 786-7744 in the Department of Market Regulation.<br />

(RG98-94, revised)<br />

May 18, 2001, Volume RB12, Number 20 RB3

<strong>Regulatory</strong> Circulars<br />

continued<br />

<strong>Regulatory</strong> Circular RG01-61<br />

Date: May 3, 2001<br />

To: The Membership<br />

From: Department of Market Regulation<br />

Re: Transactions Between Related Entities<br />

This Circular addresses the <strong>Exchange</strong>’s change in regulatory policy with respect to transactions<br />

between related accounts with <strong>com</strong>mon financial backing. Under the revised<br />

policy, trading between related entities as detailed below will be allowed, provided that<br />

such transactions are effected within existing exchange rules (i.e. in open out-cry <strong>and</strong> not<br />

of a manipulative nature), <strong>and</strong> where such entities have established a separation of business<br />

activities such that <strong>com</strong>mon control over daily trading activity does not exist. However,<br />

this change in policy does not effect the requirements of <strong>Exchange</strong> Rule 8.91 Limitations<br />

on Dealings of Designated Primary Market-Makers with respect to associated<br />

accounts of Designated Primary Market-Makers.<br />

Permitted Activity:<br />

• Trading will be allowed between different market maker or other broker/dealer accounts<br />

that are financed by the same member when there is no <strong>com</strong>mon control over<br />

the trading activity in those accounts.<br />

Example: Market-Makers ABC <strong>and</strong> XYZ are each financed independently by the<br />

same individual, AYZ. The financing is provided to each of them either<br />

through a joint account, partnership, or Limited Liability Corporation. AYZ<br />

has no control over the trading activity in the accounts. Under this scenario,<br />

ABC <strong>and</strong> XYZ would be able to effect transactions as contra-parties.<br />

• Trading will be allowed between subsidiaries (i.e., separate broker/dealers) independently<br />

operated under the same parent or holding <strong>com</strong>pany.<br />

Example: ABC Trading Co. <strong>and</strong> DEF Trading Co., which are separate broker/dealers,<br />

are both wholly owned by XYZ Holding Co. ABC <strong>and</strong> DEF operate<br />

independently from each other <strong>and</strong> each has no control over the trading<br />

activity in the other firm’s account. XYZ Holding also has no control over<br />

the trading activity in either ABC or DEF’s accounts. Under this scenario,<br />

ABC Trading <strong>and</strong> DEF Trading would be able to effect transactions<br />

as contra-parties.<br />

Prohibited Activity:<br />

The following activity will continue to be prohibited under the new policy:<br />

• A Market maker may not trade with his joint account, even though his percentage of<br />

ownership is less than 100% (i.e., market maker ABC finances market maker XYZ<br />

via a joint account <strong>and</strong> ABC is a participant in the joint account. XYZ makes his own<br />

trading decisions. ABC is still prohibited from trading directly with the joint account of<br />

which he is a member as all joint accounts are jointly <strong>and</strong> severally liable);<br />

RB4 May 18, 2001, Volume RB12, Number 20

<strong>Regulatory</strong> Circulars<br />

continued<br />

<strong>Regulatory</strong> Circular RG01-61 continued<br />

• Nominees of the same entity may not trade as contra-parties on behalf of the firm 1 ;<br />

• Firm traders employed by the same broker/dealer on different trading desks regardless<br />

of whether they are separate profit centers may not trade as contra-parties on<br />

behalf of the firm;<br />

• Spouses may not trade as contra-parties.<br />

Additional Considerations:<br />

Members should be aware that under the new policy, related entities will continue to be<br />

aggregated for position limit purposes unless they have been granted non-aggregation<br />

pursuant to <strong>Exchange</strong> Rule 4.11.03. 2<br />

Questions regarding this circular may be addressed to Pat Cerny at (312) 786-7722 or<br />

Steve Slawinski at (312) 786-7744.<br />

1 This prohibition also applies to members who are registered fors.<br />

2 Members requesting non-aggregation must demonstrate that they do not control the trading decisions of the<br />

market-maker or member firm entity being financed. The rule requires the submission of an affidavit <strong>and</strong>/or<br />

other supporting documentation to rebut the presumption of control. Trading activity is reviewed on a periodic<br />

basis to ascertain if similar patterns of trading decisions are apparent.<br />

<strong>Regulatory</strong> Circular RG01-62<br />

Date: May 7, 2001<br />

To: Members <strong>and</strong> Member Firms<br />

From: Market Operations Department<br />

Re: Restrictions on Transactions in Priceline.<strong>com</strong> Inc. (PUZ) Rite Aid Corp. (RAD)<br />

Trading in specific series in Priceline.<strong>com</strong> Inc. (PUZ) <strong>and</strong> Rite Aid Corp. (RAD) has been<br />

restricted. The PUZ options May, June <strong>and</strong> October 5, 7 ½ <strong>and</strong> 10 <strong>and</strong> the RAD May, June<br />

<strong>and</strong> October 5, 7 ½ <strong>and</strong> 10 have been restricted to closing customer orders only.<br />

Only closing transactions may be effected in the above mentioned series in PUZ <strong>and</strong> RAD<br />

options, except for (i) opening transactions by market-makers executed to ac<strong>com</strong>modate<br />

closing transactions of other market participants <strong>and</strong> (ii) opening transactions by <strong>CBOE</strong><br />

member organizations to facilitate the closing transactions of public customers executed<br />

as crosses pursuant to <strong>and</strong> in accordance with <strong>CBOE</strong> Rule 6.74(b or d). The specific series<br />

mentioned in PUZ <strong>and</strong> RAD options will not be traded on RAES.<br />

The execution of opening transactions in the series specified in PUZ <strong>and</strong> RAD options,<br />

except as permitted above, <strong>and</strong>/or the misrepresentation as to whether an order is opening<br />

or closing, will constitute a violation of <strong>CBOE</strong> rules, <strong>and</strong> may result in disciplinary action.<br />

There are no restrictions in place with respect to the exercise of PUZ <strong>and</strong> RAD options <strong>and</strong><br />

the Options Clearing Corporation (OCC) has advised <strong>CBOE</strong> that the expiration of PUZ <strong>and</strong><br />

RAD options will remain subject to OCC’s Exercise-by-Exception Procedures.<br />

Any questions regarding this circular may directed to Kerry Winters at (312) 786-7312.<br />

May 18, 2001, Volume RB12, Number 20 RB5

<strong>Regulatory</strong> Circulars<br />

continued<br />

Rule Changes,<br />

Interpretations<br />

<strong>and</strong> Policies<br />

<strong>Regulatory</strong> Circular RG01-64<br />

Date: May 9, 2001<br />

To: Members <strong>and</strong> Member Firms<br />

From: Market Operations Department<br />

Re: Rite Aid Corp. (RAD)<br />

Trading restrictions in specific series in Rite Aid Corp. (RAD) have been lifted in the following<br />

Rite Aide series May, June <strong>and</strong> October 5, 7 ½ <strong>and</strong> 10.<br />

Trading will resume in all RAD series on Wednesday, May 9, 2001.<br />

Any questions regarding this circular may directed to Kerry Winters at (312) 786-7312.<br />

APPROVED RULE CHANGE(S)<br />

The Securities <strong>and</strong> <strong>Exchange</strong> Commission (“SEC”) has approved the following change(s)<br />

to <strong>Exchange</strong> Rules pursuant to Section 19(b) of the Securities <strong>Exchange</strong> Act of 1934, as<br />

amended (“the Act”). Copies are available from the Legal Division.<br />

The effective date of the rule change is the date of approval unless otherwise noted.<br />

SR-<strong>CBOE</strong>-01-18 – <strong>Exchange</strong> Fees<br />

Pursuant to Section 19(b)(3) of the Securities <strong>Exchange</strong> Act, Rule Change File No. SR-<br />

<strong>CBOE</strong>-01-18 became effective May 1, 2001. The filing changes the <strong>Exchange</strong>’s Marketing<br />

Fee to exempt certain “deep-in-the-money” options transactions from the fee. Any<br />

questions regarding the rule change may be directed to Christopher Hill, Legal Division, at<br />

312-786-7031. A copy of the filing is available from the Legal Division.<br />

PROPOSED RULE CHANGE(S)<br />

Pursuant to Section 19(b)(1) of the Securities <strong>Exchange</strong> Act of 1934, as amended (“the<br />

Act”), <strong>and</strong> Rule 19b-4 thereunder, the <strong>Exchange</strong> has filed the following proposed rule<br />

change(s) with the Securities <strong>and</strong> <strong>Exchange</strong> Commission (“SEC”). A copy of the rule<br />

change filing(s) is available from the Legal Division. Members may submit written <strong>com</strong>ments<br />

to the Legal Division.<br />

The effective date of a proposed rule change will be the date of approval by the SEC,<br />

unless otherwise noted.<br />

SR-<strong>CBOE</strong>-01-16 – Order PACER<br />

On March 30, 2001, the <strong>Exchange</strong> filed Rule Change File No. SR-<strong>CBOE</strong>-01-16, which<br />

proposes to amend <strong>CBOE</strong> Rule 6.8 to enable the appropriate Floor Procedure Committee<br />

to regulate the number of orders a member firm may execute through RAES. Under<br />

the proposal, <strong>CBOE</strong> will add a new parameter, the order PACER, to ORS that will enable<br />

it to modulate the frequency of executions through RAES, as described below.<br />

When PACER is engaged, individual member firms will be entitled to execute, in a particular<br />

class, one RAES order (regardless of series) on the same side of the market every<br />

designated number of seconds. The appropriate FPC shall determine <strong>and</strong> establish the<br />

length of time for the PACER interval setting on a class by class basis.* Thus, if the<br />

1 While the appropriate FPC shall establish the length of the PACER interval, the DPM for a particular class,<br />

with input from the trading crowd, shall have the ability to disengage (<strong>and</strong> reengage) the order PACER for<br />

that class.<br />

RB6 May 18, 2001, Volume RB12, Number 20

Rule Changes,<br />

Interpretations <strong>and</strong><br />

Policies continued<br />

SR-<strong>CBOE</strong>-01-16 continued<br />

PACER interval is established at 5 seconds, each individual member firm would be entitled<br />

to receive one execution through RAES for all orders in all series within the same class on<br />

the same side of the market per 5 second interval. For purposes of this proposal, the<br />

following orders shall be deemed to be on the same side of the market:<br />

• Long calls <strong>and</strong> short puts (Bullish side of the class)<br />

• Short calls <strong>and</strong> long puts (Bearish side of the class)<br />

For example, if Firm XYZ executes an order through RAES to buy 50 AOL calls, it would be<br />

ineligible to receive additional RAES executions for either long calls or short puts in any<br />

AOL series until the PACER interval period expired. Firm XYZ orders on the opposite side<br />

of the market (i.e., short calls <strong>and</strong> long puts) would be eligible for execution, subject to the<br />

PACER parameters applicable to the opposite side of the market (i.e., one order execution<br />

every X seconds). Firm XYZ’s RAES-eligible orders sent through ORS that are received<br />

during the period the PACER interval precludes automatic execution (i.e., before X seconds<br />

expire), would not be routed to RAES <strong>and</strong> instead would be sent to PAR where they<br />

would be h<strong>and</strong>led in accordance with applicable procedures.<br />

The PACER interval shall apply only to RAES orders that would be assigned to market<br />

makers via st<strong>and</strong>ard RAES allocation methods (e.g., the wheel or variable RAES). As<br />

such, the PACER interval shall not apply to RAES orders executed against EBOOK via<br />

ABP or ABP Split-price. As an example, if the EBOOK represents the best price for a series<br />

along with autoquote <strong>and</strong> ORS receives three RAES-eligible orders to buy the same series<br />

(submitted by the same member firm), the first order would be executed against the EBOOK<br />

(extinguishing the order on the book). The second order would be executed in RAES,<br />

activating the PACER interval timer. The third order, because it was received during the<br />

period the PACER interval was activated, would not receive automatic execution <strong>and</strong> instead<br />

would be routed to the PAR station.<br />

Any questions regarding the proposed rule change may be directed to Steve Youhn, Legal<br />

Division, at 312-786-7416. The text of the proposed rule change is set forth below. Proposed<br />

new language is underlined.<br />

Rule 6.8 RAES Operations<br />

(d)(vi) The appropriate Floor Procedure Committee (“FPC”) may regulate the<br />

frequency of executions through RAES. To regulate the frequency, the FPC may<br />

institute a “PACER interval” applicable to a member firm’s RAES orders on the<br />

same side of the market within a given class of options. The PACER interval,<br />

which shall be activated by an initial RAES execution, shall prohibit subsequent<br />

RAES executions by the same member firm on the same side of the market within<br />

the same class until a set amount of time (the PACER interval) expires. Upon<br />

expiration of the PACER interval, that member firm would again be entitled to<br />

receive RAES executions in that class, subject to subsequent PACER restrictions.<br />

The appropriate FPC shall determine the length of the PACER interval. RAESeligible<br />

orders received during the PACER interval shall be routed to PAR. The<br />

PACER interval shall not be applicable to orders that execute against EBOOK.<br />

When there is a large influx of orders that route from RAES that are rerouted for<br />

manual h<strong>and</strong>ling such that there are more orders than can be h<strong>and</strong>led expeditiously,<br />

the DPM for the class, with input from the trading crowd, shall have the<br />

ability to disengage the order PACER for that class. When the influx of orders<br />

subsides such that orders may be h<strong>and</strong>led expeditiously, the DPM in the affected<br />

class, upon receipt of approval by two Floor Officials, may reactivate PACER in the<br />

affected class.<br />

For purposes of this rule, long (short) calls <strong>and</strong> short (long) puts shall be considered<br />

to be on the same side of the market.<br />

May 18, 2001, Volume RB12, Number 20 RB7

Rule Changes,<br />

Interpretations <strong>and</strong><br />

Policies continued<br />

SR-<strong>CBOE</strong>-01-17 – Membership Rules<br />

On April 4, 2001, the <strong>Exchange</strong> filed Rule Change File No. SR-<strong>CBOE</strong>-01-17, which proposes<br />

to:<br />

• change the voting requirement for approval of <strong>CBOE</strong> membership applications<br />

by the Membership Committee to the same voting requirement that<br />

applies to other <strong>CBOE</strong> <strong>com</strong>mittee decisions, <strong>and</strong><br />

• clarify that a membership owner that grants to another member an Authorization<br />

to Sell the membership may waive the requirement that the grantee of<br />

the Authorization to Sell provide at least 3 business days notice to the membership<br />

owner prior to exercising the grantee’s right to sell the membership.<br />

Any questions regarding the proposed rule change may be directed to Arthur Reinstein,<br />

Legal Division, at 312-786-7570. The full text of the proposed rule change is set forth<br />

below. Underlining indicates proposed new language; strikethrough indicates proposed<br />

deletions.<br />

Rule 3.9 Application Procedures <strong>and</strong> Approval or Disapproval<br />

(a) - (j) Unchanged.<br />

(k) [Approval of an application requires a vote of the majority of the members<br />

of the Membership Committee then in office.] Any applicant that is approved<br />

to be a member by the Membership Committee must be approved by the<br />

Membership Committee to perform in at least one of the recognized capacities of<br />

a member as stated in Rule 3.1(b). Written notice of the action of the Membership<br />

Committee, specifying in the case of disapproval of an application the grounds<br />

therefor, shall be provided to the applicant.<br />

(l) Unchanged.<br />

* * * * *<br />

Rule 3.14 Sale <strong>and</strong> Transfer of Membership<br />

(a) - (c) Unchanged.<br />