PRESIDENT'S MESSAGE sacha imbert, president - Society

PRESIDENT'S MESSAGE sacha imbert, president - Society

PRESIDENT'S MESSAGE sacha imbert, president - Society

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

JUNE 2012 ISSUE<br />

<strong>sacha</strong> <strong>imbert</strong>, <strong>president</strong><br />

PRESIDENT’S <strong>MESSAGE</strong> ..............1<br />

CFA FORECAST DINNER ............2<br />

FORECASTERS OF THE YEAR ......3<br />

CHARTERHOLDER PROFILE ......4-5<br />

EVENTS .......................................5<br />

NEWS FROM THE<br />

CFA INSTITUTE .............................6<br />

EDUCATION CHAIR<br />

REPORT ....................................7-8<br />

TREASURER’S REPORT .................8<br />

CFA OTTAWA ELECTIONS ...........9<br />

PRESIDENT’S <strong>MESSAGE</strong><br />

With the warming weather and Stanley Cup finals - unfortunately without our<br />

Senators - comes the end of CFA Ottawa’s fiscal year. This means that over the<br />

next few weeks, we will be voting for a new Board for 2012-2013. Building on the<br />

record breaking year we just had, I could not me more optimistic for the coming<br />

year and the success of our <strong>Society</strong>.<br />

In March, CFA Ottawa delivered a spectacular forecast dinner at the new Convention<br />

Centre, where 420 attendees had a chance to listen to our elite panel of speakers<br />

and network at the premier financial event of the year in Ottawa. We also hosted<br />

two very successful luncheons on Infrastructure and Active versus Passive Management,<br />

along with a networking event at the Mill Street Brew Pub.<br />

However, our biggest success is undoubtedly the international recognition the Ottawa<br />

<strong>Society</strong> received for its outstanding work. In May, CFA Ottawa <strong>Society</strong> won its<br />

first global award for the Best Outreach and Awareness Campaign, in front of our<br />

colleagues from around the world at the Annual Conference in Chicago. This is a<br />

major honour and hopefully only the beginning for the Ottawa <strong>Society</strong>.<br />

CFA Ottawa will be building on this success by drafting a strategic plan over the<br />

summer to ensure that we can meet our member’s goals and meet the increasing<br />

and growing list of strategic initiatives that the CFA Institute is implementing.<br />

The results from the survey we sent you will be very helpful for us in this exercise<br />

and we thank you for your participation.<br />

Over the coming months, you will notice new branding coming from the CFA<br />

Institute. This comes along with a focus on a bolder voice, broader mission and<br />

bigger community. As the financial markets continue to gyrate, the CFA Institute<br />

continues to evolve and grow.<br />

Have a great and safe summer!<br />

Sacha Imbert, CFA<br />

President, CFA Ottawa <strong>Society</strong>

RECORD BREAKING SUPPORT<br />

FOR 2012 ANNUAL FORECAST DINNER<br />

Each year the CFA Ottawa <strong>Society</strong> hosts the premier<br />

networking event for the local finance and investment<br />

community. This year was no exception. On March 29th,<br />

over 400 members and colleagues joined us for our largest<br />

event yet at the new Ottawa Convention Centre. This<br />

record attendance eclipsed our previous dinner by 56%<br />

and was a key driver in our recognition and success at the<br />

Global <strong>Society</strong> Excellence Awards in Chicago.<br />

We were honored to have three compelling guest speakers<br />

from three different areas of the profession. Focusing on<br />

macroeconomic trends, we had Doug Porter, CFA, Managing<br />

Director and Deputy Chief Economist of BMO Capital<br />

Markets. Speaking directly to investment trends and regulatory<br />

oversight, we had Eric Bushell, CFA, Chief Investment<br />

Officer from Signature Global Advisors.<br />

Finally, with fresh insights straight from the budget lockup<br />

sessions, we had Jamie Golombek, Managing Director<br />

of Tax and Estate Planning from CIBC Private Wealth<br />

Management. Mr. Golombek spoke about new themes<br />

from the budget and their implications for investors. The<br />

evening was moderated by Naomi Ridout, CFA, from<br />

Macquarie Private Wealth. Ms. Ridout is a past President<br />

of the CFA Ottawa <strong>Society</strong>.<br />

The CFA Ottawa <strong>Society</strong> would like to thank each of our<br />

presenters and the moderator for their contributions as well<br />

as each of our sponsors who helped make this event possible.<br />

We hope to build on the incredible success of this event<br />

next year and hope that our members will continue to push<br />

us to grow and improve our program offerings in the future.

Sponsors<br />

thank you<br />

to our<br />

reception sponsor<br />

gold sponsors<br />

silver sponsors<br />

CARLETON UNIVERSITY<br />

in kind sponsors<br />

FORECASTERS OF THE YEAR 2011<br />

Past President of the CFA Ottawa <strong>Society</strong>, Andrew Baechler, did an<br />

entertaining presentation of the annual Forecaster of the Year award. It<br />

is also important to note that Andrew was the winner of the 2010 award.<br />

Participants were asked to predict the year-end values for the TSX,<br />

S&P500, Oil, USD/CAD, and the price of Tim Horton’s stock.<br />

For the TSX, the group average over-predicted the change in value<br />

by 18% as bullish sentiments reigned among the participants. For<br />

the S&P500, the group average was a little more respectable with a<br />

variance of 13.1%. For oil, the predicted change varied by 7% when<br />

compared to the actual Year End closing price of $99.00. For the<br />

USD/CAD, the group over-predicted the increase in the CAD with<br />

an average estimate of $1.04 vs. the actual Year End value of $0.98.<br />

And for the price of Tim Horton’s, the group average estimated price<br />

was 5% off the mark.<br />

The average variance was slightly higher this year, when compared to last.<br />

Congratulations to our top forecaster Ian Sterling, who, on average, came<br />

within 6.5% of the targets. We commend Ian on his predictive prowess.<br />

Congratulations to runners up Ian Taylor and Graham Mayes for<br />

their accurate predictions. A special thanks to Andrew for the<br />

entertaining presentation.<br />

Category winners:<br />

FORECASTER<br />

Ian Sterling 6.5%<br />

Ian Taylor 7.1%<br />

Graham Mayes 8.0%<br />

CATEGORY<br />

TSX Paul Gasperetti<br />

S&P 500 Craig Lueck<br />

Oil<br />

USD/CAD exchange rate<br />

Tim Horton’s Stock Price (THI)<br />

Overall Winner<br />

VARIANCE<br />

FORECASTER<br />

Pascal Bruneau<br />

David Stewart<br />

James King<br />

Ian Sterling<br />

We would like to thank everyone for participating. Will performance<br />

persist? Attend next year’s Forecast Dinner to find out!

CHARTERHOLDER PROFILE<br />

brian cook, ca, cfa<br />

Brian has over 20 years of experience in the finance<br />

industry and is currently VP Finance at Brookfield<br />

Renewable Energy Group, and has been with<br />

Brookfield in this and other capacities for four years.<br />

Prior to this, he worked at MD Management in<br />

various finance and investment positions. Brian is<br />

also a former CFA Ottawa <strong>Society</strong> President.<br />

WE ASKED MR. COOK ABOUT HIS CAREER AS<br />

A CFA CHARTERHOLDER<br />

after completing the ca designation, what attracted you to<br />

a career in finance and why did you decide to pursue the cfa<br />

designation?<br />

Obtaining a CA designation and holding a CFA charter was not part of a<br />

grand plan. I initially completed a B.Comm in Hotel Management from<br />

the University of Guelph and worked for several years in the hotel business<br />

in Bermuda, where I was born and raised. I wanted to do something else<br />

after the Commerce degree, and met with people at Coopers and Lybrand<br />

(now PriceWaterhouseCoopers) and it was from these meetings that I<br />

began working on my CA designation. I did not have many of the required<br />

accounting and tax courses so I also spent several months in ‘the grind’ of<br />

summer school in Dalhousie University to obtain all the required courses.<br />

During my articling years at Coopers and Lybrand I worked on several<br />

company audits in the hotel, insurance, and investment industries.<br />

It was during this time that I worked on an audit of a Bermuda based investment<br />

management company that managed several retail mutual funds,<br />

and venture capital pools with investments in the United States and Asia,<br />

and clients who were based in Bermuda and Germany. This was my first<br />

real exposure to the investment industry and with an element of ‘global<br />

investing’. The principal owner was a great guy and a seasoned investor in<br />

stocks. He followed a value style of investing, held a contrarian view, with a<br />

long term horizon, all of which I found really interesting. During each year<br />

of that audit, I learned and appreciated more about the investment business.<br />

After I left Coopers and Lybrand I took a job as Controller of a hotel on<br />

the island. While I enjoyed the work, I got a call one day from the principal<br />

owner of that same investment company. He was looking for a Controller/<br />

Treasurer and that was it, I began to work in the investment industry.<br />

I completed the CFA Level 1 examination in Bermuda, and completed<br />

Levels 2 and 3 here, after my move to Ottawa. I like the portable nature<br />

of the CFA designation and the fact that it is globally recognized.<br />

what has holding a cfa charter meant for your career as an<br />

investment professional?<br />

From a management perspective, the CFA Charter has broadened my skill<br />

set and provided me with more tools in the tool kit. I like having both an<br />

investment lens and an accounting lens that I can use and apply to different<br />

opportunities and situations in the workplace.<br />

Working through the requirements for a CFA charter has given me a sound<br />

knowledge of the different types of investments, the importance of a well<br />

balanced portfolio construct, and how to more effectively understand and<br />

communicate the risks and returns. I think the CFA Institute does a fine<br />

job with respect to ongoing professional development and seminars – and<br />

this is great material to have access to as needed.<br />

This investment knowledge is beneficial both in the work place and for volunteer<br />

work. I find it rewarding to be able to provide investment input and<br />

direction as part of an Investment Committee of a national foundation.<br />

Continued on next page

CHARTERHOLDER PROFILE<br />

CONTINUED<br />

what gives you the most satisfaction<br />

in your role as vice-<strong>president</strong>, finance<br />

at brookfield renewable energy group?<br />

I have the opportunity to work with a great<br />

company, in a growing industry and with<br />

a fine group of business professionals. This<br />

is a rare combination of factors to find in<br />

the work place. We have been in business<br />

for over 100 years and operate one of the<br />

largest publicly-traded, renewable power<br />

platforms globally with annual revenues<br />

of $1.4 billion. The portfolio is primarily<br />

hydroelectric with over 170 power generating<br />

assets across 67 river systems in Canada,<br />

the United States and Brazil.<br />

The portfolio generates enough electricity<br />

from renewable resources to power over<br />

two million homes each and every day. We<br />

are listed on the TSX, and have filed in the<br />

United States in anticipation of a listing on<br />

the NYSE later this year.<br />

Given this background, what gives me the<br />

most satisfaction is providing people on the<br />

team with the opportunity to work to their<br />

full potential, and seeing them do well.<br />

specific to a new cfa charter-holder<br />

who wants to live and work in ottawa,<br />

what career advice would you offer?<br />

Some people tend to under-estimate Ottawa.<br />

The city has a lot to offer with a wide range<br />

of businesses that operate in the area, together<br />

with the benefits a good life style close by. I<br />

cycle along the Ottawa river every day to and<br />

from work, and the Gatineau hills are close by.<br />

From a career perspective, I would humbly<br />

offer the following advice i) accept that<br />

there will be moments of failure, we are<br />

only human, so learn from the mistakes and<br />

move on, ii) stay positive – celebrate when<br />

you win, iii) accept imperfection and don’t<br />

try to make perfect decisions. As Warren<br />

Buffet says “the best that you can do as a<br />

leader is to gather all the information that<br />

you can (in a timely manner), do a costbenefit<br />

analysis of the potential options, use<br />

your best judgment – and then go for it”.<br />

CFA OTTAWA LUNCHEON SERIES RECAP<br />

The Luncheon Series continued its stellar participation record from<br />

2010/2011, with two well received events in the early part of 2012.<br />

The topics featured and speakers included:<br />

• February 2012: Infrastructure - Eric Bonnor – Senior Vice-President,<br />

Brookfield Asset Management<br />

• May 2012: Searching for Alpha - Harry Marmer – Executive Vice-<br />

President, Institutional Investment Services, Hillsdale Investments<br />

• June 2012: Diversification & Beyond: The Risk Factor Approach to<br />

Asset Allocation – Sebastien Page – Executive Vice-President & Head<br />

of Client Analytics, PIMCO<br />

As a reminder, the Luncheon Series is focused on the professional development<br />

of members and candidates of the CFA Ottawa <strong>Society</strong>. Each<br />

luncheon is eligible for 1 credit hour of CFA Professional Development.<br />

We would like to extend our thanks to all who took some time out of<br />

their busy schedules to attend, and to the speakers that were gracious<br />

enough to share their knowledge.<br />

Should you have any future luncheon topic ideas or speaker suggestions,<br />

we would be glad to hear from you.<br />

CFA OTTAWA SOCIALS RECAP<br />

In 2011/2012, CFA Ottawa also brought to you three social events.<br />

These social events featured:<br />

• December 2012: Wine & Cheese at the Royal Ottawa Golf and<br />

Country Club<br />

• May 2012: “5 à 7” at the Mill Street Brewpub<br />

• June 2012: Post exam cocktails at Oliver’s<br />

These events are great to help facilitate dialogue with the local society’s<br />

volunteers and executives. It also offers a great networking opportunity<br />

to current and aspiring Charterholders.<br />

CFA OTTAWA WEBSITE<br />

Please regularly visit the newly improved CFA Ottawa <strong>Society</strong> website<br />

(www.cfaottawa.ca) for additional information on upcoming events<br />

and relevant developments in Ottawa’s financial analysis community.

CFA BRANDING<br />

The CFA Institute has created a new logo (below) in an effort<br />

to further promote the CFA Charter. The new logo was created<br />

within the context of a new branding strategy. The branding<br />

strategy is built bottom-up from the brand pillars, through the<br />

tone of voice, to finally the brand positioning. The brand pillars<br />

are identified as the following:<br />

• Professional excellence to raise standards in industry<br />

• Champion for ethical behavior in investment markets<br />

• A respected source of knowledge in investment markets<br />

• Strong global community of investment professionals<br />

• Serving interest of investors and of society<br />

The tone of voice represents the manner and style in which we<br />

speak about ourselves. It shapes how we look, feel and sound and<br />

should be reflected across all communications. Our tone of voice,<br />

within this strategy, has been defined as being; insightful, approachable,<br />

premium and vibrant. This finally leads to our brand<br />

positioning, which is defined as “Shaping and investment industry<br />

that serves the greater good.”<br />

Lastly, the new logo symbolizes the collective identity of our<br />

global community of investment professionals centered on a core<br />

of ethical best practice. The CFA Institute is updating the brand<br />

to better highlight our identity as a dynamic and growing global<br />

organization committed to actively building fair and effective<br />

financial markets.<br />

BRAND POSITIONING<br />

SHAPING AN INVESTMENT INDUSTRY THAT SERVES THE GREATER GOOD<br />

INSIGHTFUL<br />

Professional<br />

excellence<br />

to raise<br />

standards in<br />

the industry<br />

TONE OF VOICE<br />

APPROACHABLE PREMIUM VIBRANT<br />

Champion<br />

for ethical<br />

behaviour<br />

in investment<br />

markets<br />

BRAND PILLARS<br />

Respected<br />

source of<br />

knowledge<br />

in investment<br />

markets<br />

NEWS FROM THE CFA INSTITUTE<br />

Strong, global<br />

community<br />

of investment<br />

professionals<br />

Serving the<br />

interests of<br />

investors and<br />

of society<br />

JUNE EXAM<br />

On June 2nd 2012, the CFA Institute administered<br />

the CFA exams with a record number of<br />

registered candidates totaling nearly 150,000<br />

for all three levels of the exam. Good luck to<br />

those who wrote!<br />

CFA INSTITUTE MARKS<br />

50TH ANNIVERSARY OF<br />

THE CFA PROGRAM<br />

CFA Institute, celebrated 50 years of the Chartered<br />

Financial Analyst Program by opening<br />

Toronto Stock Exchange (TSX) and hosting<br />

ceremonies in 23 other financial centers around<br />

the world on Tuesday, May 29, 2012. The global<br />

market ceremonies represented the greatest<br />

number of stock exchanges worldwide opened<br />

or closed by one organization on a single day.<br />

CFA OTTAWA<br />

SURVEY RESULTS<br />

Thank you to members who responded to the<br />

2012 CFA Ottawa Member Survey. The response<br />

rate was excellent and the feedback was helpful.<br />

The <strong>Society</strong> was encouraged as the survey highlighted<br />

many things members believe we are<br />

doing well. The survey also pointed to potential<br />

areas of improvement; we will focus on these in<br />

the coming year.<br />

Following are some interesting points to note<br />

from the survey results:<br />

• 49% of members consider themselves to not<br />

be active members of the society;<br />

• The majority of members are satisfied (or above)<br />

with the quality of service CFA Ottawa is offering;<br />

• Members place significant value on Programming<br />

& Education, along with Career & Job related ads;<br />

• The <strong>Society</strong> should be concentrating efforts on<br />

promoting the CFA charter to local employers;<br />

• Most members attend 3 to 5 events per year<br />

and the main reason for attending is the topic<br />

of the event;<br />

• The forecast dinner was considered engaging<br />

and satisfying.<br />

Note that we welcome feedback at any time;<br />

please contact us directly at admin@cfaottawa.ca

CANDIDATE EXAM SUPPORT<br />

EDUCATION CHAIR REPORT<br />

As in years past, the CFA Ottawa <strong>Society</strong> undertook many activities leading up to the June exam to support local candidates in<br />

their efforts. These activities are outlined bellow;<br />

1. BSAS practice exam was distributed to 13 individuals this year. This was in addition to the approximately 20 students<br />

who signed up online for the practice exam and test bank.<br />

2. On May 12th, a study group session was held, with the help of Professor Yuriy Zabolotnyuk. This event was brought on by<br />

the suggestion of a candidate and will surely be implemented again next year. However, this will be done earlier in the study<br />

cycle to facilitate candidate success.<br />

3. On May 19th, a Schweser mock exam was held at Carleton University for all three levels of the CFA exam. This was an<br />

opportunity for candidates to experience a trial run of the exam day, a few weeks prior to the actual exam. 19 candidates<br />

signed up for the event, with some positive feedback from the participants after the fact. A special thank you to Anna<br />

Evstafyeva and Stevan Dostanic for making this event a success.<br />

4. The deadline for applications to the December 2012 exam scholarship is August 15th 2012. Scholarship application forms<br />

are available on the CFA Ottawa <strong>Society</strong> website.<br />

Please note, that candidates who sat for the June 2012 exam can provide feedback on exam questions and the administration<br />

of the exam via the CFA Institute website.<br />

CFA AND THE TELFER SCHOOL<br />

OF BUSINESS<br />

June marked the completion of the inaugural class of the<br />

Telfer Capital Market Mentorship Program. The program’s<br />

aim is to provide students with the knowledge,<br />

skills and experience to compete for and attain finance<br />

related positions of their choice.<br />

The program was led by Brian Carrière, Relationship<br />

Manager at the University of Ottawa, and included the<br />

participation of five local CFA Charterholders who volunteered with<br />

the program. Please contact Brian (bcarriere@telfer.uottawa.ca) if<br />

you are interested in becoming involved with this program in the<br />

upcoming year.<br />

The CFA Ottawa <strong>Society</strong> also contributed to the 2012 First Avenue<br />

Advisory of Raymond James Capital Markets Competition, held at<br />

the Telfer School of Business, by donating the second prize for the<br />

first runner-up in the competition.

oary macdonald<br />

TREASURER UPDATE<br />

UNIVERSITY OF OTTAWA FINANCE<br />

SOCIETY CFA AMBASSADOR<br />

Roary Macdonald is currently entering his 4th year in the Telfer<br />

School of Management at the University of Ottawa. Through a<br />

partnership with the Finance <strong>Society</strong>, he will represent the school<br />

and act as an ambassador for the CFA Institute for the upcoming<br />

year. The first role of its kind for the CFA Institute, its main<br />

responsibility will be to facilitate the student body in actively<br />

pursuing their CFA designation upon completing their bachelor’s<br />

degree. Through actively communicating with his peers, and establishing<br />

a network of current CFA Charterholders, his goal is to<br />

increase the level of commitment to this designation by bridging<br />

these two worlds.<br />

Name: Roary Macdonald<br />

Age: 21<br />

Hometown: Kingston, Ontario<br />

School: University of Ottawa, 4th year<br />

Program: Commerce, w/ Co-Op<br />

E-Mail: roary.macdonald@financesociety.ca<br />

CFA Ottawa <strong>Society</strong> 2011/2012 fiscal year-to-date results have tracked according to plan. At January 2012 our cash and equivalents<br />

balance stood at over $165,000. Having a strong surplus at this time is important given the cash outlays associated with hosting<br />

several spring lunches and the annual forecast dinner in March. The forecast dinner was a resounding success financially, bringing<br />

in a record number of table sponsorships. The <strong>Society</strong>’s revenues remain a function of regular CFA Institute funding, membership<br />

dues, employment postings, and cost-neutral programming. CFA Institute funding was down slightly year over year due<br />

to a new funding formula; this has not impacted our cash position materially.<br />

In 2011/2012 we continued to follow a treasury management policy for CFA Ottawa that was approved at the board level in<br />

2010. This provides clear guidelines and policies regarding deployment and management of surplus funds going forward as<br />

well as the cadence and mechanics of reporting to the board. We continue to seek ways to streamline the payment process for<br />

events, and we believe the Paypal and Eventbrite platforms help streamline the payment flows into the society and make cash<br />

management easier.<br />

Our goal is to continue to find ways to effectively deploy our capital and bring value added events and programming, and use<br />

society funding to help keep costs to members down.<br />

We welcome any questions or feedback on the current fiscal position. Have a great summer!<br />

Robert Pelletier, Treasurer<br />

CFA Ottawa <strong>Society</strong>

UPCOMING ELECTIONS FOR CFA OTTAWA BOARD<br />

In the coming weeks, you will receive an email to solicit your votes for the 2012/2013 CFA Ottawa <strong>Society</strong> Board of Directors. The<br />

email will include a link that will allow you to vote by proxy. You will also have the option to vote in person at the Annual Meeting, to<br />

be held in July of 2012 (exact date and location TBA). Full bios of the nominated individuals will be in the proxy form.<br />

CFA OTTAWA SOCIETY<br />

c/o Trevor Mulligan<br />

174 Bank Street • P.O. Box 71047<br />

Ottawa, Ontario K2P 1W0<br />

Email: admin@cfaottawa.ca<br />

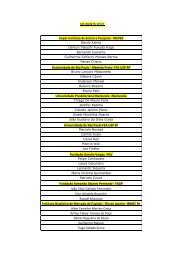

Ottawa CFA <strong>Society</strong> Volunteers & Leadership<br />

Sacha Imbert, CFA ..................................................................................................President<br />

Trevor Carson, CFA ................................................................................................Vice-President<br />

Pierre Barber, CFA ..................................................................................................Secretary<br />

Robert Ernest Pelletier, CFA ....................................................................................Treasurer<br />

Julian M. Deschatelets, CFA ...................................................................................Past President<br />

Andrew Baechler, CFA ............................................................................................Board Member at Large<br />

Paul Baron, CFA .....................................................................................................Education Chair<br />

Trevor J. Mulligan ...................................................................................................Administrative Support<br />

Roger Soler, CFA ....................................................................................................Membership Committee Chair<br />

Rebecca Tam, CFA ..................................................................................................Program Chair<br />

Adwaite Tiwary ......................................................................................................Technology Chair<br />

Stevan Dostanic ......................................................................................................Newsletter Editor<br />

Wesley Blight, CFA .................................................................................................Programming