Uncertainty Management and Risk Mitigation Over Asset Lifecycles

Uncertainty Management and Risk Mitigation Over Asset Lifecycles

Uncertainty Management and Risk Mitigation Over Asset Lifecycles

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Uncertainty</strong> <strong>Management</strong> <strong>and</strong> <strong>Risk</strong> <strong>Mitigation</strong><br />

<strong>Over</strong> <strong>Asset</strong> <strong>Lifecycles</strong><br />

Attendees Will<br />

• Discuss common interests informally with colleagues from around the world<br />

• Share knowledge <strong>and</strong> experience in off-the-record format<br />

• Gain new insight <strong>and</strong> perspective through conversations with others from international companies, service companies, contractors, research<br />

institutes <strong>and</strong> universities<br />

• Enjoy the relaxed atmosphere of learning through one-on-one interaction<br />

Come prepared to be a participant, not a spectator.<br />

The Forum Series Format<br />

28 November–1 December 2011<br />

Dubai, UAE<br />

The Forum Series provides morning, afternoon <strong>and</strong> evening sessions of short scheduled <strong>and</strong> unscheduled presentations with maximum time available<br />

for informal discussions <strong>and</strong> exchange of experience.<br />

To encourage maximum discussion, lengthy formal presentations are discouraged. Presentations are usually limited to three or four slides or<br />

transparencies. Breakout sessions for discussions in smaller groups are common. Participants are encouraged to come prepared to contribute their<br />

experience <strong>and</strong> knowledge, NOT to be spectators or students.<br />

The reporting of new, unpublished work <strong>and</strong> incomplete results is encouraged. Written papers are prohibited, <strong>and</strong> extensive note taking is not allowed.<br />

Information disclosed at a forum may not be used publicly without the originator’s permission. Participants are specifically requested to omit reference<br />

to forum proceedings in any subsequent published work or oral presentation.<br />

A short written summary of major issues <strong>and</strong> consensus arising from the forum may be prepared <strong>and</strong> distributed to attendees after the forum at the<br />

discretion of the steering committee <strong>and</strong> with appropriate SPE approval.<br />

11FSM2_BRO_8413_2011

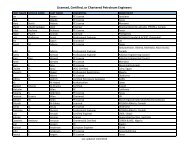

Committee Chairs<br />

Ian Bryant, Co-chairperson<br />

Schlumberger<br />

Marko Maucec, Co-chairperson<br />

Halliburton<br />

Committee<br />

Ahmed Al Neaimi<br />

ADMA-OPCO<br />

Ellen Cooper-Smith<br />

Decision Frameworks<br />

Ernesto Della Rossa<br />

Eni<br />

François-Michel Colomar<br />

IFP Middle East Consultancy-<br />

Beicip-Franlab<br />

Iain Percival<br />

Shell (Retired)<br />

Jonathan Carter<br />

Imperial College<br />

Mark Sykes<br />

ExxonMobil<br />

Michael Scanlon<br />

Schlumberger<br />

Moncef Attia<br />

ADMA-OPCO<br />

Paul van den Hoek<br />

Shell<br />

Ralf Schulze-Riegert<br />

SPT Group<br />

Reidar Bratvold<br />

University of Stavanger<br />

Rik Sneep<br />

South Rub Al-Khali Company<br />

Roger Ekseth<br />

Gyrodata<br />

Segun Jebutu<br />

Baker Hughes<br />

W. Scott Meddaugh<br />

Chevron<br />

Thirty Years of Innovative Thought <strong>and</strong> Accelerated Results<br />

28 November–1 December 2011<br />

Dubai, UAE<br />

<strong>Uncertainty</strong> <strong>Management</strong> <strong>and</strong> <strong>Risk</strong><br />

<strong>Mitigation</strong> <strong>Over</strong> <strong>Asset</strong> <strong>Lifecycles</strong><br />

Forum Description<br />

Effective management of lifecycle risk <strong>and</strong> uncertainty is critical to the success of oil <strong>and</strong> gas projects: many feel it is in<br />

fact the central challenge of the E&P business. In spite of the focus on uncertainty assessment <strong>and</strong> risk management in<br />

the last generation of reservoir development projects, surprises continue to occur.<br />

The field development <strong>and</strong> management process covers a broad range of decisions (technical as well as commercial),<br />

involving all E&P disciplines (sub-surface, wells, surface engineering <strong>and</strong> operations) <strong>and</strong> functional domains, over a time<br />

period that can span 25-35 years in which the asset will go through several development phases (primary, secondary <strong>and</strong><br />

tertiary recovery). The “objective or target function” for the asset in terms of production, recovery or business value may<br />

change over its lifecycle.<br />

There are accepted E&P practices for describing, evaluating <strong>and</strong> h<strong>and</strong>ling risks <strong>and</strong> uncertainties in the course of a<br />

development (probabilistic, deterministic, stochastic, scenario based or a combination of these). A distinction is made<br />

between the treatment of risks, as potential future events that can influence the achievement of project objectives, <strong>and</strong><br />

uncertainties which can have different sources, being model or data dependent.<br />

There is a growing sense in the industry that a more integrated, lifecycle approach to the above challenges is required,<br />

specifically to underst<strong>and</strong> how risks <strong>and</strong> uncertainties can be factored into technical or commercial decisions <strong>and</strong><br />

“evaluated” dynamically (using e.g. real options theory). Last but not least the propagation of risks <strong>and</strong> uncertainties<br />

through the project lifecycle is only understood for very obvious–low dimensional–decisions involving a limited number of<br />

parameters.<br />

New capabilities are beginning to emerge that should allow the industry to reduce development surprises <strong>and</strong> improve<br />

management of assets <strong>and</strong> reservoirs. These include advanced modelling of uncertainty, integrated workflows, robust<br />

uncertainty frameworks, improved surveillance <strong>and</strong> increased computing capacity.<br />

The forum aims to bring together a multi-disciplinary group of E&P specialists <strong>and</strong> generalists, as well as external experts<br />

to provide input <strong>and</strong> perspectives of non-E&P fields. It will address emerging developments <strong>and</strong> holistic approaches to the<br />

treatment <strong>and</strong> management of E&P risk <strong>and</strong> uncertainty. Challenges that the forum will address include:<br />

• Estimation <strong>and</strong> prioritisation of uncertainties<br />

• The limitations of the current risk/uncertainty models, decision models <strong>and</strong> management practices<br />

• Determination of the simplest models to appropriately model <strong>and</strong> predict the impact of uncertainties <strong>and</strong> development<br />

options<br />

• The impact of discipline specific models <strong>and</strong> work-processes on the overall quality of decisions across the asset lifecycle<br />

• The state-of-the-art in risk/uncertainty modelling <strong>and</strong> complex integrated technical <strong>and</strong> commercial decision making<br />

• Application of a Bayesian framework for uncertainty assessment<br />

• Whether an integrated risk/uncertainty management framework can be defined that allows consistent h<strong>and</strong>ling <strong>and</strong><br />

propagation across disciplines <strong>and</strong> field phases<br />

• Whether a hierarchy of risks/uncertainties can be identified, to allow for cost-effective evaluation <strong>and</strong> management<br />

• How non-technical risks/uncertainties <strong>and</strong> objectives can be incorporated into the management process <strong>and</strong> effectively<br />

communicated to decision makers at all levels<br />

• How increased computing power can be effectively deployed to h<strong>and</strong>le complex E&P risk <strong>and</strong> uncertainty problems<br />

Output of the forum will be a summary on the status of the field <strong>and</strong> recommended directions <strong>and</strong> priorities for improving<br />

the robustness of field development planning <strong>and</strong> lifecycle asset management.<br />

Who should attend?<br />

The target audience includes staff working in academia, service companies <strong>and</strong> oil companies. Exploration staff,<br />

geoscientists, petroleum engineers, drilling <strong>and</strong> facility engineers <strong>and</strong> project <strong>and</strong> asset management staff will benefit<br />

from attending this forum. Academics <strong>and</strong> specialists from non-E&P industries will be actively encouraged to attend <strong>and</strong><br />

contribute their insights.<br />

The forum is aimed at people whose principal job falls into any one of the following categories:<br />

Exploration <strong>and</strong> appraisal, geophysics <strong>and</strong> geology, petroleum engineering, drilling <strong>and</strong> completion, engineering,<br />

production, field development, reservoir management, economics <strong>and</strong> portfolio management, health, safety <strong>and</strong><br />

environment.<br />

www.spe.org/events/11fsm2<br />

Application<br />

Deadline:<br />

15 September<br />

2011<br />

Society of Petroleum Engineers

28 November–1 December 2011<br />

Dubai, UAE<br />

<strong>Uncertainty</strong> <strong>Management</strong> <strong>and</strong> <strong>Risk</strong> <strong>Mitigation</strong> <strong>Over</strong> <strong>Asset</strong> <strong>Lifecycles</strong><br />

These exciting topics will be discussed in an open setting designed for optimal input from all participants.<br />

Session 1: Characterisation of Static <strong>Uncertainty</strong><br />

Session Managers: Mark Sykes, ExxonMobil<br />

W. Scott Meddaugh, Chevron<br />

<strong>Uncertainty</strong> is ubiquitous in the oil <strong>and</strong> gas industry. A careful consideration of<br />

uncertainty must be embraced throughout the lifecycle of a petroleum asset<br />

in order to fully characterise the range of possible geologic, production <strong>and</strong><br />

economic-performance outcomes. Static uncertainty, the range in possible oil or<br />

gas volumes in-place in the reservoir <strong>and</strong> their connectivity prior to production<br />

start-up, is the first uncertainty that petroleum companies must address. Failure<br />

to recognise, underst<strong>and</strong> <strong>and</strong> quantify static uncertainties renders attempts to<br />

control or harness uncertainties in subsequent elements of an asset’s lifecycle<br />

futile. Recent scientific literature <strong>and</strong> industry practices have refined the<br />

geological, conceptual <strong>and</strong> computational methodologies available for use in<br />

uncertainty assessment <strong>and</strong> mitigation. This session of the forum looks to critically<br />

examine these established approaches, <strong>and</strong> to discuss alternatives, which may be<br />

more effective at identifying <strong>and</strong> mitigating static uncertainty.<br />

Session 2: Characterisation of Dynamic <strong>Uncertainty</strong><br />

Session Managers: Ian Bryant, Schlumberger<br />

Paul van den Hoek, Shell<br />

Following evaluation of static uncertainty, it is necessary to evaluate uncertainty in<br />

the anticipated dynamic performance of an oil or gas asset. Early characterisation<br />

of a range of potential production profiles, often based on well tests, will<br />

control investment decisions in infrastructure <strong>and</strong> evaluation of alternative field<br />

development plans. Subsequently, surface measurements, downhole pressure<br />

<strong>and</strong> temperature measurements <strong>and</strong> repeat seismic surveys may be used to<br />

revise production forecasts. This session of the forum looks to evaluate how these<br />

measurements can be incorporated into contingency planning <strong>and</strong> optimisation<br />

over the lifecycle of assets.<br />

Session 3: Forecasting <strong>Risk</strong>s<br />

Session Managers: Marko Maucec, Halliburton<br />

Francois-Michel Colomar, IFP Middle<br />

East-Beicip-Franlab<br />

The presence of a large number of geological uncertainties <strong>and</strong> limited well<br />

data typically increase the challenges associated with forecasting hydrocarbon<br />

recovery. Traditionally, reservoir development decisions are based on a production<br />

forecast from a single history-matched reservoir model. Challenges mainly emerge<br />

in the characterisation of the main features of the reservoir uncertainty space to<br />

underst<strong>and</strong> uncertainties impact on production forecast, identify <strong>and</strong> mitigate risk.<br />

This in practice requires considering only a few (but which?) of the many probable<br />

realisations <strong>and</strong> scenarios.<br />

How can we quantify the uncertainty parameters range including structural<br />

framework, stratigraphic, facies <strong>and</strong> petrophysical model, properly rank their<br />

impact in order to define the critical factors <strong>and</strong> reduce their range for more<br />

accurate production forecast? Can we clearly identify state-of-the-art technologies<br />

for pre-screening geological models <strong>and</strong> sensitivity analyses in terms of usability<br />

Application Information<br />

Participants at SPE forums are selected by the Forum Steering Committee on the basis of ability to contribute to the<br />

discussion of the topic. Attendance is limited to maximise each person’s opportunity to contribute.<br />

Online: www.spe.org/events/11fsm2<br />

Mail: SPE Middle East FZ, North Africa <strong>and</strong> India, DMCC, PO Box 215959, Dubai, UAE<br />

Fax: +971.4.457.3164<br />

<strong>and</strong> industrial economic impact? When does such methodology become too<br />

sophisticated <strong>and</strong> advanced for routine use <strong>and</strong> how to stimulate a faster<br />

knowledge transfer from academia to industrial implementations?<br />

Session 4: Simplicity Versus Complexity<br />

Session Managers: Rik Sneep, South Rub Al Khali Company<br />

Segun Jebutu, Baker Hughes<br />

‘Simplicity is the ultimate sophistication’ according to Leonardo da Vinci. In the<br />

petroleum industry, the truth is that the level of complexity required to establish<br />

an economically acceptable value proposition can be quite a challenge to define.<br />

It will require a delicate balance between dynamic universal factors such as time,<br />

technology <strong>and</strong> integration potential.<br />

To harness the full benefit of the system, we must challenge all the fundamental<br />

assumptions for our simplistic model, <strong>and</strong> have a pre-determined process to guide<br />

us from the simplistic model to that optimal level of technical detail required to<br />

establish a maximum value proposition at an acceptable risk level.<br />

We will explore the fine balance between simple <strong>and</strong> complex <strong>and</strong> the associated<br />

merits <strong>and</strong> pitfalls covering amongst other topics:<br />

• How to define the required level of complexity to fully underst<strong>and</strong> the petroleum<br />

system?<br />

• Change of complexity requirements through the project lifecycle<br />

• <strong>Uncertainty</strong> as a function of data availability—the risk of creating ‘false<br />

certainties’<br />

‘Everything should be made as simple as possible, but not simpler…’ Einstein<br />

knew it all along.<br />

Session 5: Heuristic Approaches in Complex E&P<br />

<strong>Uncertainty</strong> <strong>and</strong> <strong>Risk</strong> <strong>Management</strong>: Advancing the<br />

Industry by Synergising Intelligent Data Mining <strong>and</strong><br />

High-Performance Computing<br />

Session Managers: Ralf Schulze-Riegert, SPT Group<br />

Moncef Attia, ADMA-OPCO<br />

Advances in high-performance computing allow reservoir engineers to run highly<br />

complex simulation models. Multiple reservoir simulation or process models<br />

representing predefined uncertainty distributions are processed concurrently on<br />

multiple computing units. Workflows for estimation of prediction uncertainties are<br />

supported by generating large amount of information, which are mostly condensed<br />

to expected means, variances etc.<br />

Result presentation <strong>and</strong> the quality of data analysis are always critical. Data mining<br />

<strong>and</strong> smart data analysis techniques become even more important as the amount<br />

of information increases. At the same time heuristic approaches <strong>and</strong> expert<br />

knowledge remain a key success factor for any reservoir study supporting field<br />

development projects.<br />

Application Deadline: 15 September 2011<br />

An electronic version of the printed application form is available for downloading <strong>and</strong> printing at www.spe.org/events/11fsm2.<br />

You may also contact SPE at +971.4.457.5800 or sjubran@spe.org to receive a printed application form via mail, fax or email.

The question remains how to balance heuristics <strong>and</strong> high-performance computing<br />

workflows <strong>and</strong> how to combine key areas efficiently. Which degree of heuristics is<br />

essential <strong>and</strong> which contribution of workflow st<strong>and</strong>ards is acceptable? How can<br />

we combine expert knowledge <strong>and</strong> result analysis from intelligent data processing<br />

workflows? Which criteria exist for choosing the most suitable workflows <strong>and</strong><br />

which expert knowledge is required for choosing efficient <strong>and</strong> result oriented<br />

workflow components? When prior uncertainty definitions remain vague; how<br />

much do we gain from high-performance computing <strong>and</strong> what are the limitations?<br />

Which workflows based on high-performance computing become an industry<br />

st<strong>and</strong>ard <strong>and</strong> what type of synergies supported by heuristics is likely to become a<br />

competitive advantage in managing complex projects?<br />

Session 6: <strong>Risk</strong> Auditing <strong>and</strong> St<strong>and</strong>ards<br />

Session Managers: Roger Ekseth, Gyrodata<br />

Michael Scanlon, Schlumberger<br />

While oil <strong>and</strong> gas operations are by nature high risk ventures, no worldwide<br />

st<strong>and</strong>ards exist for lifecycle risk management or auditing. Much of the risk<br />

st<strong>and</strong>ards are set by individual corporations, local legislative authorities or by<br />

insurance requirements. By comparison, the aviation industry sets st<strong>and</strong>ards for<br />

operations <strong>and</strong> maintenance via IATA in order to consistently manage <strong>and</strong> audit<br />

risks on a global level. Given the potential hazards inherent in commercial aviation,<br />

the establishment of global st<strong>and</strong>ards of best practice, <strong>and</strong> risk auditing processes<br />

has ensured that aviation safety has consistently improved.<br />

The number <strong>and</strong> nature of relief wells drilled in the past year, the responsibility<br />

of environmental awareness <strong>and</strong> the inconsistency of project performance tend<br />

to indicate that the industry may benefit from a global st<strong>and</strong>ard that can be<br />

effectively administered while acknowledging the inherently competitive nature<br />

of the upstream industry. This should address not just the operational risk impact,<br />

which are visible <strong>and</strong> potentially catastrophic, but also the longer term lifecycle<br />

project risks in a consistent <strong>and</strong> auditable process.<br />

This session will seek to discuss the requirements for global st<strong>and</strong>ards <strong>and</strong> audit<br />

procedures for risk based evaluations <strong>and</strong> decisions, how comprehensive they<br />

need to be, <strong>and</strong> how they could be implemented <strong>and</strong> administered for the industry<br />

at large.<br />

Session 7: Optionality <strong>and</strong> Pricing for Contingency<br />

Session Managers: Micheal Scanlon, Schlumberger<br />

Reidar Bratvold, University of Stavanger<br />

In the past three years, the oil <strong>and</strong> gas sector has materially underperformed the<br />

Dow index, highlighting the relative inflexibility of projects to changes <strong>and</strong> the fact<br />

that our industry is not very well positioned to capitalise on market <strong>and</strong> technical<br />

uncertainties. While contracting strategies <strong>and</strong> investment sanction criteria can,<br />

to some extent, mitigate the impact of oil price fluctuations, the requirement to<br />

commit to detailed equipment design specifications <strong>and</strong> significant associated<br />

capital commitment very early in the project lifecycle when relatively little is<br />

known of the reservoir makes it difficult to turn the underlying uncertainties into<br />

competitive advantages <strong>and</strong> thus contributes to the underperformance.<br />

The process of formalising the assessment <strong>and</strong> categorisation of upstream project<br />

risks has continued to evolve. However, the communication of these risks in a<br />

st<strong>and</strong>ardised way between disciplines, <strong>and</strong> a structured <strong>and</strong> consistent process of<br />

establishing the value of contingency in the project plan <strong>and</strong> facility design, where<br />

the contingency may come at significant capital cost, is not well established or<br />

understood.<br />

This session will seek to explore the principles <strong>and</strong> processes that will allow a<br />

definition of the project risks <strong>and</strong> ways to value the mitigation of their downside<br />

impacts <strong>and</strong> capture their upside potentials based on facility design specifications,<br />

operating procedures <strong>and</strong> field management plans.<br />

Forum Registration Fee: Early Bird: USD 3,400 (Payment Deadline: 28 October 2011)<br />

Late Fee: USD 3,700<br />

Upon acceptance by the Forum Series Steering Committee, applicants will receive a registration <strong>and</strong> hotel accommodation form with<br />

detailed information on accommodation, transportation <strong>and</strong> fees. All participants must register <strong>and</strong> pay the full fixed fee in advance.<br />

Includes the following for the forum participant:<br />

• Registration to attend all nine forum sessions<br />

• Five nights of hotel accommodation including breakfast<br />

based on single occupancy<br />

• Welcoming reception <strong>and</strong> dinner<br />

• Scheduled meals<br />

• Return ground airport transfer by shuttle bus<br />

www.spe.org/events/11fsm2<br />

Session 8: Communication <strong>and</strong> Propagation through<br />

Lifecycle<br />

Session Managers: Ahmed Al Neaimi, ADMA-OPCO<br />

Iain Percival, Shell (Retired)<br />

Effective monitoring <strong>and</strong> managing of uncertainty <strong>and</strong> risk throughout the lifespan<br />

of the asset is critical to delivering the promises made at project sanction.<br />

The operating philosophy of the field has been premised on any number of<br />

assumptions regarding the behaviour of the reservoir(s), wells <strong>and</strong> the array<br />

of equipment required to lift, process <strong>and</strong> export the produced fluids. Any<br />

misunderst<strong>and</strong>ings or misinterpretations of the assumptions <strong>and</strong> associated<br />

uncertainties as the project is matured <strong>and</strong> passes from one owner to another will<br />

inevitably put the full lifecycle value at risk. The situation is exacerbated when an<br />

asset undergoes improved or enhanced recovery where the behaviour of injected<br />

fluids in addition to those produced brings additional uncertainties <strong>and</strong> their<br />

underst<strong>and</strong>ing/interpretation.<br />

The 21st century has led to a new era of transformation in the automation of fields,<br />

i.e. the advent of the “Smart Field”. However, one important question remains<br />

unanswered. Will smart fields help reduce the uncertainties effectively <strong>and</strong><br />

efficiently during the lifecycle <strong>and</strong> thereby mitigate the risk of operational mishaps<br />

<strong>and</strong> value erosion?<br />

The session will focus on examining <strong>and</strong> discussing ways to improve:<br />

• Communication between the functions involved with delivering value from a<br />

hydrocarbon asset<br />

• Ensuring knowledge is preserved with the passage of time with respect to the<br />

rationale supporting the taking of certain decisions<br />

• The underst<strong>and</strong>ing of the impact of living with uncertainty in one function on the<br />

work <strong>and</strong> decision making with the various stakeholders<br />

• The application of smart field technology <strong>and</strong> associated data delivery to address<br />

effectively the issues of managing post execution/commissioning residual<br />

uncertainty <strong>and</strong> risk<br />

Session 9: The Human Impact <strong>and</strong> <strong>Mitigation</strong> of Bias<br />

in Lifecycle <strong>Risk</strong> <strong>and</strong> <strong>Uncertainty</strong> <strong>Management</strong><br />

Session Managers: Ellen Cooper-Smith, Decision<br />

Frameworks<br />

Jonathan Carter, Imperial College<br />

Studies across industries confirm that it is more common for actual uncertainties<br />

used in project economics for asset management to fall outside of their predicted<br />

ranges, than inside, <strong>and</strong> risks are continually underestimated. Many suggest this to<br />

be due to both motivational <strong>and</strong> cognitive biases repeatedly resulting in commonly<br />

stated ranges, which are too narrow. Hence, the human element in risk <strong>and</strong><br />

uncertainty management remains a gap which needs to be addressed to achieve<br />

top tier performance.<br />

But how? How can the industry tap into the “wisdom of crowds”–those who<br />

know their assets <strong>and</strong> the technological risks associated with their projects <strong>and</strong><br />

help them counteract inherent biases to improve their uncertainty management?<br />

What means are available <strong>and</strong> or need to be developed to ensure not only better<br />

risk <strong>and</strong> uncertainty forecasting, but also better uncertainty reduction forecasting<br />

when optimising appraisal <strong>and</strong> development plans? This session will review known<br />

<strong>and</strong> cutting-edge techniques to do just that, enhance uncertainty management<br />

through the human element, rather than in spite of the human element.<br />

Please note: Attendees are expected to attend the full forum <strong>and</strong><br />

the fee is a fixed full registration fee. The base registration fee does<br />

not include accompanying persons. Details of accommodation <strong>and</strong> rates<br />

for spouses <strong>and</strong> family members will be sent with the registration packet<br />

that will be emailed to each delegate upon acceptance.<br />

IMPORTANT: All fees paid to SPE are net of taxes. The registration fees in this form do not include any local or withholding taxes.<br />

All such taxes will be added to the above-mentioned registration fees in the invoice.<br />

Forum sessions <strong>and</strong> housing will be at Al Bustan Rotana Hotel, Dubai, UAE.