Allianz Risk Transfer AG - Allianz Global Corporate & Specialty

Allianz Risk Transfer AG - Allianz Global Corporate & Specialty

Allianz Risk Transfer AG - Allianz Global Corporate & Specialty

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

unusually high reserve releases after the termination of a traditional reinsurance contract. However, even without the<br />

one-time effect, the overall results nearly doubled compared with 2010.<br />

Positive earnings throughout the financial crisis demonstrate the still sound underlying margins of ART's business and<br />

the increasing diversity of deals executed within its three areas of expertise. In our view, this allows for positive<br />

earnings even under very demanding market conditions.<br />

The traditional portfolios currently consist of relatively small industrial lines business underwritten in Switzerland and<br />

the Gulf region, which together earned net premiums of about €100 million in 2011. These portfolios contribute to<br />

potential earnings volatility and have been posting losses in the past, but made a positive contribution in 2011.<br />

Foreign exchange effects can influence ART <strong>AG</strong>'s profit and loss account because most of its transactions are in U.S.<br />

dollars or euros, whereas it reports publicly in Swiss franc. We base our analysis on euro values because ART is<br />

consolidated into <strong>AG</strong>CS and AZSE in this currency.<br />

Prospective<br />

In our view, the individual performance of various transactions demands management's close attention, given the<br />

currently challenging markets. However, the increasing number of transactions and broader risk diversity in ART's<br />

portfolio, as well as the termination of the alternative-assets business, should enhance earnings stability.<br />

For 2012 and beyond, we expect ART to achieve net income of at least €40 million on its nontraditional business. We<br />

expect the run-off process of its alternative-assets business to generate additional positive returns on average.<br />

Nevertheless, we acknowledge that individual years could be affected by adverse performance. For our ratings on<br />

ART, we assume that there will be no further material impairments on the company's alternative-asset transactions.<br />

For the traditional business, we assume a positive net income contribution.<br />

Investments: A Revised Asset Allocation Strategy After Run-Off Of<br />

Alternative-Assets Business<br />

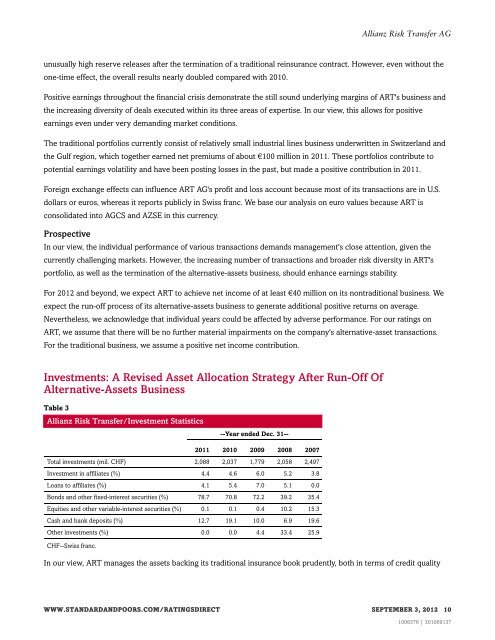

Table 3<br />

<strong>Allianz</strong> <strong>Risk</strong> <strong>Transfer</strong>/Investment Statistics<br />

--Year ended Dec. 31--<br />

2011 2010 2009 2008 2007<br />

Total investments (mil. CHF) 2,088 2,037 1,779 2,058 2,497<br />

Investment in affiliates (%) 4.4 4.6 6.0 5.2 3.8<br />

Loans to affiliates (%) 4.1 5.4 7.0 5.1 0.0<br />

Bonds and other fixed-interest securities (%) 78.7 70.8 72.2 39.2 35.4<br />

Equities and other variable-interest securities (%) 0.1 0.1 0.4 10.2 15.3<br />

Cash and bank deposits (%) 12.7 19.1 10.0 6.9 19.6<br />

Other investments (%) 0.0 0.0 4.4 33.4 25.9<br />

CHF--Swiss franc.<br />

<strong>Allianz</strong> <strong>Risk</strong> <strong>Transfer</strong> <strong>AG</strong><br />

In our view, ART manages the assets backing its traditional insurance book prudently, both in terms of credit quality<br />

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT SEPTEMBER 3, 2012 10<br />

1006376 | 301069137