RERC Real Estate Report - REDI-net.com

RERC Real Estate Report - REDI-net.com

RERC Real Estate Report - REDI-net.com

- TAGS

- rerc

- real

- estate

- redi-net.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>RERC</strong> © REAL ESTATE REPORT - THE NATIONAL REAL ESTATE AUTHORITY<br />

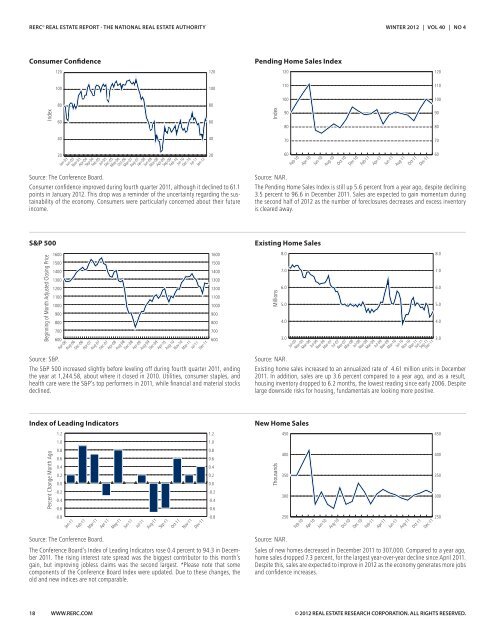

Consumer Confidence<br />

Index<br />

Consumer confidence improved during fourth quarter 2011, although it declined to 61.1<br />

points in January 2012. This drop was a reminder of the uncertainty regarding the sustainability<br />

of the economy. Consumers were particularly concerned about their future<br />

in<strong>com</strong>e.<br />

S&P 500<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

Jan-03<br />

Jun-03<br />

Nov-03<br />

Source: The Conference Board.<br />

Beginning of Month Adjusted Closing Price<br />

1600<br />

1500<br />

1400<br />

1300<br />

1200<br />

1100<br />

1000<br />

900<br />

800<br />

700<br />

600<br />

Source: S&P.<br />

Index of Leading Indicators<br />

18 WWW.<strong>RERC</strong>.COM<br />

Apr-04<br />

Sep-04<br />

Feb-05<br />

Jul-05<br />

Dec-05<br />

May-06<br />

Oct-06<br />

Mar-07<br />

Aug-07<br />

Jan-08<br />

Jun-08<br />

Nov-08<br />

Apr-09<br />

Sep-09<br />

Feb-10<br />

Jul-10<br />

Dec-10<br />

Jul-11<br />

Jan-12<br />

The S&P 500 increased slightly before leveling off during fourth quarter 2011, ending<br />

the year at 1,244.58, about where it closed in 2010. Utilities, consumer staples, and<br />

health care were the S&P’s top performers in 2011, while financial and material stocks<br />

declined.<br />

Percent Change Month Ago<br />

Apr-06<br />

1.2<br />

1.0<br />

0.8<br />

0.6<br />

0.4<br />

0.2<br />

0.0<br />

-0.2<br />

-0.4<br />

-0.6<br />

-0.8<br />

Aug-06<br />

Dec-06<br />

Source: The Conference Board.<br />

Apr-07<br />

Aug-07<br />

Dec-07<br />

Apr-08<br />

Aug-08<br />

Dec-08<br />

Apr-09<br />

Aug-09<br />

Dec-09<br />

Apr-10<br />

Aug-10<br />

Nov-10<br />

Mar-11<br />

Jul-11<br />

Dec-11<br />

Jan-11<br />

Feb-11<br />

Mar-11<br />

Apr-11<br />

May-11<br />

Jun-11<br />

Jul-11<br />

Aug-11<br />

Sep-11<br />

Oct-11<br />

Nov-11<br />

Dec-11<br />

The Conference Board’s Index of Leading Indicators rose 0.4 percent to 94.3 in December<br />

2011. The rising interest rate spread was the biggest contributor to this month’s<br />

gain, but improving jobless claims was the second largest. *Please note that some<br />

<strong>com</strong>ponents of the Conference Board Index were updated. Due to these changes, the<br />

old and new indices are not <strong>com</strong>parable.<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

1600<br />

1500<br />

1400<br />

1300<br />

1200<br />

1100<br />

1000<br />

900<br />

800<br />

700<br />

600<br />

1.2<br />

1.0<br />

0.8<br />

0.6<br />

0.4<br />

0.2<br />

0.0<br />

-0.2<br />

-0.4<br />

-0.6<br />

-0.8<br />

Pending Home Sales Index<br />

Index<br />

120<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

Existing Home Sales<br />

New Home Sales<br />

WINTER 2012 | VOL 40 | NO 4<br />

Feb-10<br />

Apr-10<br />

Jun-10<br />

Aug-10<br />

Oct-10<br />

Dec-10<br />

Feb-11<br />

Apr-11<br />

Jun-11<br />

Aug-11<br />

Oct-11<br />

Dec-11<br />

Source: NAR.<br />

The Pending Home Sales Index is still up 5.6 percent from a year ago, despite declining<br />

3.5 percent to 96.6 in December 2011. Sales are expected to gain momentum during<br />

the second half of 2012 as the number of foreclosures decreases and excess inventory<br />

is cleared away.<br />

Millions<br />

8.0<br />

7.0<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

Source: NAR.<br />

Jul-05<br />

Nov-05<br />

Mar-06<br />

Jul-06<br />

Nov-06<br />

Mar-07<br />

Jul-07<br />

Nov-07<br />

Mar-08<br />

Jul-08<br />

Nov-08<br />

Mar-09<br />

Jul-09<br />

Nov-09<br />

Mar-10<br />

Jul-10<br />

Nov-10<br />

Mar-11<br />

Jun-11<br />

Sep-11<br />

Dec-11<br />

Existing home sales increased to an annualized rate of 4.61 million units in December<br />

2011. In addition, sales are up 3.6 percent <strong>com</strong>pared to a year ago, and as a result,<br />

housing inventory dropped to 6.2 months, the lowest reading since early 2006. Despite<br />

large downside risks for housing, fundamentals are looking more positive.<br />

Thousands<br />

450<br />

400<br />

350<br />

300<br />

250<br />

Source: NAR.<br />

Feb-10<br />

Apr-10<br />

Jun-10<br />

Aug-10<br />

Oct-10<br />

Dec-10<br />

Feb-11<br />

Apr-11<br />

Jun-11<br />

Aug-11<br />

Oct-11<br />

Dec-11<br />

Sales of new homes decreased in December 2011 to 307,000. Compared to a year ago,<br />

home sales dropped 7.3 percent, for the largest year-over-year decline since April 2011.<br />

Despite this, sales are expected to improve in 2012 as the economy generates more jobs<br />

and confidence increases.<br />

© 2012 REAL ESTATE RESEARCH CORPORATION. ALL RIGHTS RESERVED.<br />

120<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

8.0<br />

7.0<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

450<br />

400<br />

350<br />

300<br />

250