Rick MacKay Elected President - The Institute of Chartered ...

Rick MacKay Elected President - The Institute of Chartered ...

Rick MacKay Elected President - The Institute of Chartered ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Rick</strong> <strong>MacKay</strong> was elected <strong>President</strong> and<br />

Chair <strong>of</strong> the Council <strong>of</strong> the <strong>Institute</strong> <strong>of</strong><br />

<strong>Chartered</strong> Accountants <strong>of</strong> Manitoba<br />

for 2012-13 at the Council meeting held<br />

immediately after the <strong>Institute</strong>’s Annual<br />

General Meeting on June 14th .<br />

“It is an honour to serve as president<br />

and I look forward to working with<br />

Council and the <strong>Institute</strong> staff over the<br />

coming year. I am looking forward to the<br />

opportunity to dialogue with members<br />

and in that regard, I hope you will contact<br />

me at any time if you have questions,<br />

comments or advice.<br />

“<strong>The</strong> next year promises to be very interesting<br />

as discussions continue across<br />

Canada with respect to the possible<br />

unification <strong>of</strong> various accounting bodies.<br />

It is<br />

Issue Number 177 June / July 2012<br />

<strong>Rick</strong> <strong>MacKay</strong> <strong>Elected</strong> <strong>President</strong><br />

important for our Manitoba members to<br />

stay aware <strong>of</strong> these discussions. Another<br />

priority for the Council over the<br />

upcoming year will be to continue to<br />

focus on attracting exceptional people<br />

to the pr<strong>of</strong>ession,” <strong>MacKay</strong> said.<br />

<strong>Rick</strong> is currently a partner in the Winnipeg<br />

<strong>of</strong>fice <strong>of</strong> Deloitte & Touche LLP and<br />

has extensive experience in the conduct<br />

<strong>of</strong> financial audits and providing business<br />

advisory services to several major<br />

Canadian corporations. He also has significant<br />

experience in providing a wide<br />

range <strong>of</strong> business advisory services<br />

and other assistance to many ownermanaged<br />

businesses and not-for-pr<strong>of</strong>it<br />

organizations.<br />

A career as a CA was not initially on<br />

<strong>Rick</strong>’s radar. He graduated<br />

with a BA degree from the<br />

University <strong>of</strong> Manitoba with<br />

a political studies major with<br />

the intention <strong>of</strong> pursuing a<br />

career in law.<br />

While dropping<br />

<strong>of</strong>f an assignment<br />

at the University<br />

during the last<br />

year <strong>of</strong> his BA<br />

degree, he saw<br />

a sign posted<br />

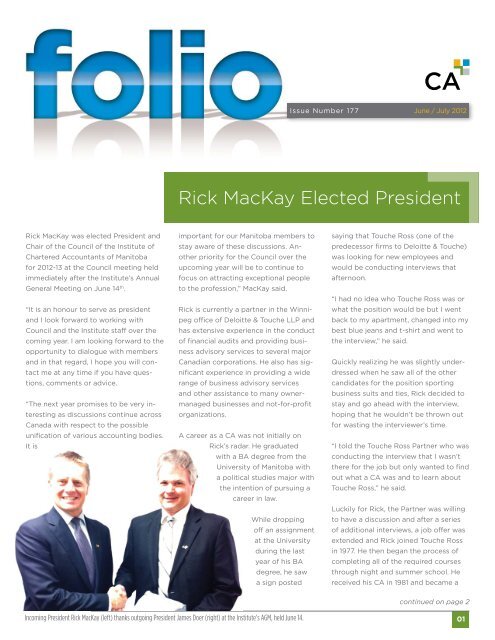

Incoming <strong>President</strong> <strong>Rick</strong> <strong>MacKay</strong> (left) thanks outgoing <strong>President</strong> James Doer (right) at the <strong>Institute</strong>’s AGM, held June 14.<br />

saying that Touche Ross (one <strong>of</strong> the<br />

predecessor firms to Deloitte & Touche)<br />

was looking for new employees and<br />

would be conducting interviews that<br />

afternoon.<br />

“I had no idea who Touche Ross was or<br />

what the position would be but I went<br />

back to my apartment, changed into my<br />

best blue jeans and t-shirt and went to<br />

the interview,” he said.<br />

Quickly realizing he was slightly underdressed<br />

when he saw all <strong>of</strong> the other<br />

candidates for the position sporting<br />

business suits and ties, <strong>Rick</strong> decided to<br />

stay and go ahead with the interview,<br />

hoping that he wouldn’t be thrown out<br />

for wasting the interviewer’s time.<br />

“I told the Touche Ross Partner who was<br />

conducting the interview that I wasn’t<br />

there for the job but only wanted to find<br />

out what a CA was and to learn about<br />

Touche Ross,” he said.<br />

Luckily for <strong>Rick</strong>, the Partner was willing<br />

to have a discussion and after a series<br />

<strong>of</strong> additional interviews, a job <strong>of</strong>fer was<br />

extended and <strong>Rick</strong> joined Touche Ross<br />

in 1977. He then began the process <strong>of</strong><br />

completing all <strong>of</strong> the required courses<br />

through night and summer school. He<br />

received his CA in 1981 and became a<br />

continued on page 2<br />

03 01

<strong>Rick</strong> <strong>MacKay</strong> <strong>President</strong> <strong>of</strong> ICAM for 2012-2013 cont’d<br />

continued from page 1<br />

Partner in Touche Ross in 1987. <strong>Rick</strong> was elected an FCA in<br />

2008.<br />

First elected to Council in 2007, <strong>Rick</strong> served as Secretary-Treasurer<br />

from 2009 to 2010. In 2010-11 he was appointed Second<br />

Vice-<strong>President</strong> and he served as First Vice-<strong>President</strong> this past<br />

year.<br />

National Update<br />

Progress continues on uniting the Canadian accounting pr<strong>of</strong>ession under the new Canadian <strong>Chartered</strong> Pr<strong>of</strong>essional Accountant<br />

(CPA) designation. Visit CPACanada.ca for more information.<br />

Alberta CMA and CGA boards release unification proposal<br />

In support <strong>of</strong> the Unification Framework and new CPA Certification<br />

Program, the Alberta CMA and CGA boards issued a<br />

provincial unification proposal, based on common principles.<br />

ICABC vote shows positive results<br />

<strong>The</strong> <strong>Institute</strong> <strong>of</strong> <strong>Chartered</strong> Accountants <strong>of</strong> BC (ICABC) released<br />

the preliminary results <strong>of</strong> its members’ vote held in May.<br />

Results indicate that <strong>of</strong> the 4,800 members who voted, 52%<br />

support the unification <strong>of</strong> the existing accounting Acts into<br />

one Act; 9% believe that elected Council should decide; and<br />

39% do not support unification.<br />

Leaders express solid support for unification<br />

A united pr<strong>of</strong>ession under the CPA designation is a strategically<br />

sound and practical long-term solution that is in the best<br />

interests <strong>of</strong> Canadians, according to 26 out <strong>of</strong> 28 influential<br />

Canadian and international stakeholders surveyed.<br />

Academic paper concludes unification can enhance selfregulation<br />

An academic analysis authored by William Lahey, Associate<br />

Pr<strong>of</strong>essor, Schulich School <strong>of</strong> Law, Dalhousie University, concludes<br />

that unification would strengthen and streamline the<br />

pr<strong>of</strong>ession’s self-regulatory function and enhance its capacity<br />

to fulfill its mandate to protect and advance public interest.<br />

Details <strong>of</strong> the new Canadian CPA Certification Program<br />

An immediate priority <strong>of</strong> the unified accounting organization<br />

would be developing the Canadian CPA certification program.<br />

02<br />

He has also served on the <strong>Institute</strong>’s Corporate Governance<br />

and Nominating Committee, as well as the <strong>Institute</strong>’s Advisory<br />

Committee on Public Accounting. <strong>Rick</strong> was Chair <strong>of</strong> the Audit<br />

Committee in 2008-09 and Chair <strong>of</strong> the Membership Linkages<br />

Committee in 2010-11.<br />

<strong>Rick</strong> has been an active member <strong>of</strong> the Winnipeg volunteer<br />

community, having served as a volunteer with such organizations<br />

as the United Way, the Associates <strong>of</strong> the I.H. Asper<br />

School <strong>of</strong> Business, the Heart and Stroke Foundation and<br />

several other community-based organizations.<br />

<strong>Rick</strong> and his wife Merril were married in 1979. <strong>The</strong>y have three<br />

children – Kyle, Lauren, and Kelli. <strong>Rick</strong> enjoys curling and golfing<br />

and has also been also an avid runner, having completed 10<br />

half marathons.<br />

Additional details <strong>of</strong> a potential new Canadian CPA certification<br />

program are now available online at CPACanada.ca.<br />

ICANL announces initial results <strong>of</strong> its member vote show<br />

support for unification<br />

<strong>The</strong> <strong>Institute</strong> <strong>of</strong> <strong>Chartered</strong> Accountants <strong>of</strong> Newfoundland and<br />

Labrador (ICANL) released the initial results <strong>of</strong> its member<br />

advisory vote held in June. Sixty-one percent (468) <strong>of</strong> ICANL<br />

members voted, with 62% <strong>of</strong> those voting in favour <strong>of</strong> the<br />

ICANL Boards’ merger proposal; 32% voting against and 6%<br />

voting to let the elected Board decide. Another 77% <strong>of</strong> participants<br />

voted in favour <strong>of</strong> becoming affiliated with a national<br />

body <strong>of</strong> CPAs should CPA emerge as the predominant accounting<br />

designation in Canada.<br />

ICAPEI vote show support for unification<br />

<strong>The</strong> <strong>Institute</strong> <strong>of</strong> <strong>Chartered</strong> Accountants <strong>of</strong> PEI (ICAPEI) released<br />

the preliminary results <strong>of</strong> its advisory vote held in June,<br />

with 72% <strong>of</strong> those who participated voting in support <strong>of</strong> the<br />

ICAPEI merger proposal. A more detailed break-down <strong>of</strong> results<br />

was not available at press-time - watch CPACanada.ca for<br />

a more thorough look at the results.<br />

Update on Ontario unification discussions<br />

In May, CMA Ontario and CGA Ontario announced that they<br />

are no longer participating in unification discussions. CA<br />

Ontario has pledged to continue its efforts to support the<br />

adoption <strong>of</strong> the CPA designation and the unification <strong>of</strong> the<br />

Canadian accounting pr<strong>of</strong>ession in accordance with the eight<br />

guiding principles as set out in the Unification Framework.

Council and Officers <strong>Elected</strong> for 2012-13<br />

At the 126 th Annual General Meeting <strong>of</strong> the <strong>Institute</strong> held on June 14, 2012, six members were elected by acclamation to fill seven<br />

<strong>of</strong> the vacancies on Council for a two year term.<br />

<strong>Rick</strong> M. <strong>MacKay</strong>, FCA<br />

<strong>President</strong> & Chair<br />

Teresa L. Okerlund, CA<br />

First Vice-<strong>President</strong><br />

<strong>The</strong> six members elected by acclamation were Dean Austin,<br />

Gordon Dowhan, Douglas Einarson, Derek Innis, Stuart<br />

McKelvie, and Teresa Okerlund.<br />

According to the <strong>Institute</strong>’s bylaws, Council has the authority<br />

to appoint an individual to fill the remaining vacancy. <strong>The</strong> term<br />

<strong>of</strong> <strong>of</strong>fice for the appointed individual is for one year instead<br />

<strong>of</strong> two and expires at the next Annual General Meeting. At the<br />

Statutory Meeting <strong>of</strong> Council held immediately after the AGM,<br />

Council appointed Sandra Cohen to fill the remaining vacancy.<br />

2012-13 Officers <strong>of</strong> Council<br />

<strong>Rick</strong> M. <strong>MacKay</strong>, FCA<br />

<strong>President</strong> & Chair<br />

Teresa L. Okerlund, CA<br />

First Vice-<strong>President</strong><br />

David Loewen, FCA<br />

Second Vice-<strong>President</strong><br />

Kevin E. Regan, FCA<br />

Secretary-Treasurer<br />

Members-at-Large<br />

Cheryl A. Atchison, CA<br />

K. Dean Austin, CA<br />

Sandra F. Cohen, CA•CIA<br />

Gordon A. Dowhan, CA<br />

Douglas J. Einarson, CA<br />

Derek B. Innis, CA<br />

C. Stuart McKelvie, FCA<br />

Brenna J. Minish-Kichuk, CA<br />

Janet B.A. Morrill, CA<br />

Heather D. Reichert, CA<br />

Scott D. Sissons, CA<br />

David Loewen, FCA<br />

Second Vice-<strong>President</strong><br />

Kevin E. Regan, FCA<br />

Secretary-Treasurer<br />

Also at the Statutory Meeting <strong>of</strong> Council following the AGM,<br />

Council elected the 2012-13 Officers and members <strong>of</strong> the<br />

Executive Committee. Council is composed <strong>of</strong> the <strong>of</strong>ficers,<br />

members-at-large and two public representatives.<br />

Under the <strong>Institute</strong> bylaws, one member must work and reside<br />

outside <strong>of</strong> Winnipeg. Brenna Minish-Kichuk meets this requirement.<br />

<strong>The</strong> two public representatives are appointed to Council<br />

by the <strong>President</strong> <strong>of</strong> the University <strong>of</strong> Manitoba. This is Anita<br />

Wortzman’s fourth year serving as a public representative and<br />

Elaine Goldie’s third.<br />

Thanks to the following retiring committee Chairs and<br />

Council members who were unavailable for a photo after<br />

the AGM:<br />

Paul Kochan<br />

Chair, Honours and Awards<br />

Travis de Koning<br />

Chair, Members Activities<br />

John Orisko<br />

Chair, Pr<strong>of</strong>essional Conduct<br />

Left: Foundation Chair Doug Einarson<br />

(right), thanks retiring Board member<br />

Ken Phernambucq at the Foundation’s<br />

AGM, held June 14, 2012.<br />

Tony Gauthier<br />

Chair, Bylaws Advisory<br />

Jeff Cristall<br />

Council<br />

Larry Frostiak<br />

Council<br />

Public Representatives<br />

Elaine Goldie<br />

Anita Wortzman, LLB<br />

Above: Lydia Bulat (right), retiring Chair <strong>of</strong> the<br />

Discipline Committe is thanked at the <strong>Institute</strong>’s<br />

AGM by the retiring <strong>President</strong> <strong>of</strong> Council, James<br />

Doer (left).<br />

03

High School Scholarships<br />

Awarded for 2012<br />

Students from high schools across the province applied and six individuals were selected to each receive a $1,000 scholarship.<br />

Each recipient displayed high scholastic achievement together with outstanding accomplishments in work, school and community<br />

activities. In addition, they are all continuing their post-secondary education in Manitoba and have expressed interest in the CA<br />

pr<strong>of</strong>ession.<br />

CA High School Scholarships<br />

<strong>The</strong> <strong>Institute</strong> <strong>of</strong> <strong>Chartered</strong> Accountants <strong>of</strong> Manitoba is pleased<br />

to announce that Brady Bouchard, Andrew Chudley, Mitchell<br />

Etkin, and Taylor Mitchell are the recipients <strong>of</strong> the 2012 High<br />

School Scholarships and wishes them every success in their<br />

future endeavours.<br />

04<br />

Brady Bouchard<br />

Glenboro School<br />

Mitchell Etkin<br />

St. John’s Ravenscourt<br />

School<br />

Andrew Chudley<br />

Collège Pierre Elliott<br />

Trudeau<br />

Taylor Mitchell<br />

J.H. Bruns Collegiate<br />

Allan M. Moore Scholarships<br />

<strong>The</strong> Manitoba <strong>Chartered</strong> Accountants Foundation Inc. congratulates<br />

Kimberly Cassels and Adam Owczar, recipients <strong>of</strong><br />

the 2012 Allan. M. Moore, FCA, Scholarships and wishes them<br />

every success in their future endeavours.<br />

Kimberly Cassels<br />

Glenboro School<br />

Adam Owczar<br />

Collège Sturgeon Heights<br />

Collegiate<br />

Al Moore was <strong>President</strong> <strong>of</strong> the <strong>Institute</strong> in 1974-75 and served<br />

on the Board <strong>of</strong> the Foundation in the early 1990s. He received<br />

the Lifetime Achievement Award from the <strong>Institute</strong> in 2004.<br />

Upon his passing, Al left a $50,000 bequest to the Foundation<br />

and a fund was established in his name with the income<br />

used to provide scholarships to high school students attending<br />

university and interested in a career as a CA.<br />

CAs represented in Manitoba Marathon<br />

Congratulations to all <strong>of</strong> the Manitoba CAs who participated in<br />

the Manitoba Marathon, held June 17, 2012.<br />

Special kudos to member Brian Walker, who came in second<br />

in the men’s full marathon with his time <strong>of</strong> 2:33.18. Brian, his<br />

wife Darolyn, and his twin brother Jeremy were all featured on<br />

the cover <strong>of</strong> the June 18th edition <strong>of</strong> the Winnipeg Free Press<br />

(“Walkers run well”).<br />

Darolyn placed second in the women’s half marathon and Jeremy<br />

took second in the men’s half marathon. All three Walkers<br />

are former U <strong>of</strong> M Bisons track team members (2000-2005).

Manitoba CAs receive Diamond<br />

Jubilee Medal<br />

<strong>The</strong> Queen’s Diamond Jubilee Medal was created by the<br />

Governor General <strong>of</strong> Canada to celebrate Queen Elizabeth<br />

II’s accession to the Throne 60 years ago.<br />

In seeking nominations for these medals, the Governor<br />

General’s <strong>of</strong>fice partnered with a variety <strong>of</strong> governmental<br />

and non-governmental organizations. <strong>The</strong> CICA was given<br />

the opportunity to nominate 38 persons for the medal. <strong>The</strong><br />

Board <strong>of</strong> Directors created a working group, and all <strong>of</strong> the<br />

PICAs/Ordre were invited to submit nominations.<br />

Two <strong>of</strong> the CAs nominated by the Manitoba <strong>Institute</strong> were<br />

selected to receive the Diamond Jubilee medal: Gabriel<br />

Forest and William Gray.<br />

Gabe was awarded this medal in recognition <strong>of</strong> his<br />

passionate support <strong>of</strong> the Manitoba Francophone<br />

community that has contributed so much to its vibrancy<br />

and success and in recognition <strong>of</strong> his extensive volunteerism<br />

to the accounting pr<strong>of</strong>ession and community at large.<br />

Bill was awarded this medal in recognition <strong>of</strong> his inspiration<br />

to the accountancy pr<strong>of</strong>ession throughout his extraordinarily<br />

long, full life – as a member <strong>of</strong> the Royal Canadian Navy, a<br />

trusted business advisor, an educator, a volunteer at home and<br />

abroad and an avid sportsman.<br />

Manitoba <strong>Chartered</strong> Accountants Accounting<br />

Student Scholarship<br />

Two Faculty <strong>of</strong> Business and Economics<br />

students at the University <strong>of</strong> Winnipeg<br />

were each awarded a $2,500 Manitoba<br />

<strong>Chartered</strong> Accountants Accounting<br />

Student Scholarship. This year’s<br />

recipients were Irfan Khambatta and<br />

Mohamed Mahamud.<br />

Funding for the scholarship is provided<br />

by the Foundation which made a<br />

commitment to give $300,000 over 10<br />

years to the Faculty <strong>of</strong> Business and<br />

Economics at the U <strong>of</strong> W to provide<br />

for student scholarships, bursaries and<br />

support to the accounting faculty.<br />

Bill Gray, FCA (left) and Gabe Forest, FCA (right) are presented with their Diamond Jubilee medals<br />

by James Doer, CA, at the <strong>Institute</strong>’s Annual General Meeting.<br />

Two other Manitoba CAs – William (Bill) Loewen and Donald<br />

Penny – were also recipients <strong>of</strong> the Diamond Jubilee medal, by<br />

virtue <strong>of</strong> their already being members <strong>of</strong> the Order <strong>of</strong> Canada.<br />

<strong>The</strong>y were presented their medals separately by the Governor<br />

General.<br />

All <strong>of</strong> these individuals will be recognized again, more<br />

formally, at the Member Recognition Dinner held in November.<br />

Congratulations!<br />

(l-r): Scholarship recipients Irfan Khambatta, Mohamed Mahamud, Foundation Board member Susan Hagemeister, and<br />

U <strong>of</strong> W <strong>President</strong> & Vice-Chancellor Lloyd Axworthy.<br />

05 03

Employers, Students Thrive as Top CA Students<br />

Drawn to Non-External Audit Training Environments<br />

As more organizations in industry, as well as in government <strong>of</strong>fices, qualify as accredited<br />

CA Training Offices with the ability to <strong>of</strong>fer significant training opportunities<br />

in diverse fields, they have benefitted immensely by attracting top quality students.<br />

This includes talented individuals whose academic achievements have placed them<br />

on the UFE Honour Roll.<br />

Each year, the UFE Honour Roll celebrates the top 50 students across Canada who<br />

have achieved the best standing out <strong>of</strong> nearly 4,000 writers. Some <strong>of</strong> these talented<br />

Honour Roll students are employed by training <strong>of</strong>fices outside <strong>of</strong> external audit. As<br />

indicated by the testimonies below, students believe they are on the right career path<br />

– and that they have been propelled in that direction, which speaks volumes for the<br />

success <strong>of</strong> the program.<br />

Kelly Schmitt, the Treasurer and Director<br />

<strong>of</strong> Investor Relations for SMART Technologies<br />

Inc., a Calgary-based maker <strong>of</strong><br />

interactive displays, provides an excellent<br />

illustration <strong>of</strong> how accomplished<br />

candidates are attracted outside <strong>of</strong><br />

external audit in the CA Training Office<br />

program.<br />

<strong>The</strong> 2011 UFE Honour Roll student is<br />

in the process <strong>of</strong> completing the final<br />

stages <strong>of</strong> her training in a finance rotation<br />

competency.<br />

“I’ve done all <strong>of</strong> my training here at<br />

SMART. I joined the company more<br />

than four years ago, even before I knew<br />

I would be working towards the CA<br />

designation. I’d already been out <strong>of</strong><br />

school for quite some time, and had also<br />

earned my CFA designation. Shortly<br />

after I joined SMART I heard that you<br />

could now do your CA training in industry.<br />

Once I learned that, I initiated the<br />

application process here to get SMART<br />

qualified to be a CA training <strong>of</strong>fice,<br />

which we succeeded in doing in 2009,”<br />

she explains.<br />

As Treasurer, Schmitt says she has<br />

been able to participate in a number<br />

<strong>of</strong> different projects to satisfy the CA<br />

Training Office program requirements,<br />

including being put in charge <strong>of</strong> researching<br />

whether strategic changes in<br />

the business warranted a change in the<br />

organization’s functional currency from<br />

06<br />

the Canadian to the U.S. dollar; and participating<br />

in a lengthy project aimed to<br />

take SMART Technologies public.<br />

“I was very fortunate. SMART being a<br />

CA training <strong>of</strong>fice allowed me to stay in<br />

my current career and get the designation.<br />

<strong>The</strong> reason I did the CA designation<br />

is because I truly believed it would<br />

open up more doors. While the CFA<br />

would have sufficed in my current role,<br />

if I want to move up and become a<br />

CFO, the CA designation is really valued<br />

throughout the business world,” says<br />

Schmitt.<br />

“I worked at a Big Four accounting firm<br />

in the summer after my third year <strong>of</strong><br />

university in the late ‘90s. Although I<br />

had always thought really highly <strong>of</strong> and<br />

wanted the CA designation, audit just<br />

wasn’t interesting to me. I couldn’t see<br />

myself taking that career path,” explains<br />

Schmitt.<br />

“But as soon as I heard they had opened<br />

up new training paths, I thought ‘that’s<br />

great,’ because the reality is that all<br />

CAs can’t stay at CA firms. <strong>The</strong>y end up<br />

coming out working in businesses, and<br />

it’s a different type <strong>of</strong> work.”<br />

Michael Murney, a consultant with<br />

Deloitte & Touche in Toronto, and 2011<br />

UFE Honour Roll student, is in the midst<br />

<strong>of</strong> obtaining the practical experience<br />

required to qualify as a CA. <strong>The</strong> uni-<br />

versity graduate, who has a business<br />

administration degree and also studied<br />

computer science, expects to earn his<br />

CA designation in 2013.<br />

Murney is completing his training without<br />

requiring a rotation through Deloitte’s<br />

external audit practice.<br />

“I’m with the Information and Technology<br />

Risk Services group, which is part<br />

<strong>of</strong> Deloitte’s Enterprise Risk Services<br />

practice. I chose this group because it<br />

allows me to combine my knowledge<br />

in information technology with my accounting<br />

and business acumen to work<br />

on challenging projects. At the same<br />

time this gives me the opportunity to<br />

earn my CA through an assurance competency,”<br />

he explains.<br />

“I’m doing some interesting things<br />

right now in s<strong>of</strong>tware asset management,<br />

helping clients manage licenses<br />

throughout their network based on<br />

what they’re entitled to under the terms<br />

<strong>of</strong> their purchase agreement from somebody<br />

like a Micros<strong>of</strong>t, or IBM,” notes<br />

Murney.<br />

Murney enjoys having the opportunity<br />

to work with client firms’ most senior<br />

financial people and assist with tasks<br />

such as providing assurance services to<br />

certify that proper controls over financial<br />

reporting, compliant with regulations,<br />

are in place.<br />

Another aspect <strong>of</strong> Murney’s training that<br />

he finds particularly fulfilling is being<br />

able to provide value added services<br />

such as recommendations to business<br />

clients that will assist them not only in<br />

terms <strong>of</strong> dealing with an accounting issue,<br />

but also to make business decisions<br />

that will help them prosper.<br />

Daphne Huang, who earned her CA designation<br />

in 2011 after placing on the<br />

continued on page 7

Training outside <strong>of</strong> external audit cont’d<br />

continued from page 6<br />

2010 UFE Honour Roll, also prospered<br />

through the CA Training Office program,<br />

which allowed her to pursue training in<br />

the field <strong>of</strong> taxation – a subject that had<br />

interested her from a very young age.<br />

Huang began a 30-month training program<br />

on the tax path with the Vancouver<br />

<strong>of</strong>fice <strong>of</strong> PricewaterhouseCoopers<br />

LLP (PwC) in May 2008, after receiving<br />

encouragement from her university tax<br />

pr<strong>of</strong>essor, who told her about the new<br />

training options available.<br />

<strong>The</strong> CA Training Office program provided<br />

both interesting memories in<br />

addition to the valuable experience<br />

necessary for Huang to pursue her goal<br />

<strong>of</strong> attaining a CA and ultimately specializing<br />

in the tax field. “One experience<br />

that stands out the most is my four<br />

month secondment to the tax group in<br />

the San José <strong>of</strong>fice. I learned a lot about<br />

U.S. tax and about what it’s like to work<br />

in the States,” she says.<br />

Huang enjoyed the personal contact<br />

her training provided with Chief Financial<br />

Officers and Controllers <strong>of</strong> client<br />

companies, including the opportunity<br />

to learn about different corporate tax<br />

strategies. That, too, was very beneficial<br />

in preparing Huang for her current role<br />

as a fully fledged CA in PwC’s international<br />

tax group.<br />

<strong>The</strong> work has led to a number <strong>of</strong> interesting<br />

assignments and international<br />

contacts, Huang stresses, citing a current<br />

project she is working on involving<br />

Hungarian tax.<br />

“<strong>The</strong> thing I really like about international<br />

tax is that every client is in a<br />

different country. One day I’ll think I’ve<br />

figured out Hungary’s tax regime. <strong>The</strong>n<br />

the next thing I’ll be doing is consulting<br />

for a Russian client, having to learn the<br />

tax laws between Canada and Russia,<br />

and reading the treaty between the two<br />

countries. And then the next client will<br />

be in, say, Indonesia.<br />

“So I feel like I’m always learning,” she<br />

stresses.<br />

Eric Chow, who is just completing his<br />

final rotation on an assurance path with<br />

TELUS Corporation’s Toronto <strong>of</strong>fice, also<br />

earned a spot on the UFE Honour Roll in<br />

2010, and is a newly minted CA.<br />

Chow praises the CA Training Office<br />

program with providing him the opportunity<br />

to experience complex financial<br />

issues and management decision making<br />

within multiple business units <strong>of</strong><br />

TELUS. “<strong>The</strong> ability to rotate to various<br />

areas <strong>of</strong> the business and learn and pick<br />

up experience in each <strong>of</strong> those areas,<br />

has given me the tools I need to become<br />

successful,” he says.<br />

Chow’s first rotation involved analyzing<br />

a number <strong>of</strong> business cases and reporting<br />

on corporate efficiency programs.<br />

His second examined the areas <strong>of</strong> revenue<br />

assurance and fraud management;<br />

and the third has dealt with corporate<br />

controllership issues.<br />

“In my current rotation, I’m doing a<br />

variety <strong>of</strong> management reporting at a<br />

consolidated level for my senior vicepresident<br />

and also the chief financial<br />

<strong>of</strong>ficer. <strong>The</strong>re’s a lot <strong>of</strong> variance analysis<br />

involved, so I’m constantly being challenged,”<br />

says Chow.<br />

Chow has also worked in TELUS’ rev-<br />

enue assurance and fraud management<br />

rotations. “Going through those rotations<br />

has given me the competencies I<br />

need for a successful long-term career<br />

with TELUS,” he stresses.<br />

DID YOU<br />

KNOW ?<br />

<strong>The</strong>re’s still time to register for<br />

the golf tournament! $106 (GST<br />

included) for green fees, power<br />

carts, driving range balls and a<br />

BBQ steak dinner! Tuesday, Aug.28<br />

at Bel Acres – see Coming Events<br />

for full details. Registration forms<br />

available online at icam.mb.ca.<br />

03 07

08<br />

introducing the<br />

CA Training Offi ce Program<br />

Our CA students are dedicated<br />

and eager to learn, performing<br />

above what we would normally<br />

hire at that level.<br />

Janice Madon, CA, SVP and<br />

Chief Auditor – Manulife Financial<br />

a new way to build tomorrow’s leaders<br />

With the new CA Training Offi ce Program, your business can train CA Students. That means you’re able<br />

to hire the best and brightest students and develop potential leaders from the ground up, ensuring<br />

the knowledge <strong>of</strong> your business and its industry are a natural part <strong>of</strong> the learning process.<br />

Respected for their knowledge, intelligence, skills and integrity, the perfect CA for your business<br />

is one that knows your business.<br />

Visit CATrainingOffi ce.ca<br />

see how the new application process makes it easy to start investing in your organization’s future

Annual S<strong>of</strong>tball Tournament<br />

Twelve teams took to the field on a picture-perfect day<br />

for ball in this year’s annual s<strong>of</strong>tball tournament.<br />

A&F Nemec Recruiting edged out the MNP Rams to win<br />

the A-side final. In the back-and-forth, closely contested<br />

game, A&F was down one run coming home and scored<br />

two in the bottom <strong>of</strong> the last inning to capture the<br />

championship and bring home the Ernst & Young Trophy.<br />

<strong>The</strong> Grant Thornton Alumni defeated the Exchange<br />

Income Corporation (EIC) in the B-side final. Thanks to all<br />

participants who came out to enjoy the day.<br />

B-side winners, the Grant Thornton Alumni.<br />

On June 12 & 13, 2012, we were proud to host 428 CAs, CMAs,<br />

CGAs, and other business pr<strong>of</strong>essionals at the 2012 CA & CMA<br />

Conference at the Winnipeg Convention Centre.<br />

A&F Nemec Recruiting, tournament champions and winners <strong>of</strong> the Ernst & Young trophy.<br />

CA & CMA Conference a great success<br />

Attendees greatly enjoyed the Winnipeg-focused theme <strong>of</strong><br />

keynote speakers Margaret Redmond, Barry Rempel, Jim Ludlow<br />

and Doug Brown.<br />

Margaret Redmond Doug Brown<br />

Jim Ludlow<br />

Barry Rempel<br />

09 03

CRA Proposing Mandatory<br />

E-filing Requirements after 2012<br />

A surprise measure was introduced in the 2012 federal budget legislation (Bill<br />

C-38), a mandatory e-file requirement, which will be effective for 2012 income<br />

returns filed after December 31, 2012. <strong>The</strong> proposal will impact tax preparers<br />

engaged to prepare more than 10 income tax returns annually.<br />

<strong>The</strong> proposal contains a new definition <strong>of</strong> “tax preparer” for this purpose, which<br />

includes a person or partnership that accepts consideration to prepare more than<br />

10 “returns <strong>of</strong> income” <strong>of</strong> corporations or more than 10 “returns <strong>of</strong> income” for<br />

individuals (other than trusts) in a calendar year. An employee who prepares these<br />

returns in performing their employment duties is not considered a tax preparer<br />

for these purposes. <strong>The</strong>se tax preparers must electronically file “any return <strong>of</strong><br />

income that they prepare for consideration” under proposed subsection 150.1(2.3),<br />

although up to 10 corporate returns and 10 individual returns may be filed by other<br />

means. Bill C-38 also introduces penalties for non-compliance <strong>of</strong> $25 for each<br />

individual return and $100 for each corporate return that is not e-filed.<br />

Specific e-file exceptions have been proposed. More information on Bill C-38<br />

is available on the Parliament <strong>of</strong> Canada’s website at parl.gc.ca. All <strong>of</strong> these<br />

amendments come into force on January 1, 2013.<br />

If you would like to share your thoughts on this proposal, please contact Gabe<br />

Hayos, FCA, CICA’s Vice-<strong>President</strong> <strong>of</strong> Taxation. He can be reached by e-mail at<br />

Gabe.Hayos@cica.ca or on his blog at CAConnect.<br />

CRA to Expand Carryover Information<br />

Displayed in “My Account”<br />

<strong>The</strong> Canada Revenue Agency (CRA) has carryforward information available<br />

for individual taxpayers who use the My Account service on their website.<br />

Accountants appointed as client representatives can access this information.<br />

Loss carryforward information is presently only available for the last 25 years, with<br />

the starting point for the 25-year slide rule currently starting at 1988. This period<br />

may not be sufficient, such as in respect <strong>of</strong> the capital gains deductions which<br />

started in 1985, or in respect <strong>of</strong> adjusted cost base values determined in 1972,<br />

when capital gains taxation became effective.<br />

<strong>The</strong> CICA has approached the CRA on this issue, and is pleased to report the<br />

following response from the CRA: “Information for Carryover amounts in My<br />

Account currently have a 25-year slide rule applied starting at 1988. Next year, at<br />

the current state, the display will be 1989 and subsequent years. However, due to<br />

the many requests being received from users, a work order has been prepared (in<br />

time for February 2013 systems update) to allow the display back to 1972 when<br />

required.”<br />

For additional information or questions, please contact Gabe.Hayos@cica.ca.<br />

10<br />

Auditor<br />

Selection<br />

To: <strong>The</strong> Members<br />

Each year the Audit Committee <strong>of</strong><br />

<strong>The</strong> <strong>Institute</strong> <strong>of</strong> <strong>Chartered</strong> Accountants<br />

<strong>of</strong> Manitoba reviews the selection<br />

process for the <strong>Institute</strong>’s auditors<br />

and makes a recommendation to<br />

Council for the coming year.<br />

This is in turn ratified by the membership<br />

at the AGM. In addition, the Audit<br />

Committee approves the fee for the<br />

coming year.<br />

Members <strong>of</strong> the Manitoba <strong>Chartered</strong><br />

Accountants Foundation Inc. also<br />

approve the use <strong>of</strong> the <strong>Institute</strong>’s<br />

auditors as the Foundation’s auditors<br />

at their AGM.<br />

Booke and Partners has now been approved<br />

as the <strong>Institute</strong>’s and Foundation’s<br />

auditors for 2012-13.<br />

In considering the appointment <strong>of</strong><br />

auditors, the committee evaluates the<br />

current auditors and has found that<br />

they continue to meet expectations.<br />

<strong>The</strong> committee has discussed the<br />

advantages and disadvantages <strong>of</strong><br />

changing auditors and feels that there<br />

has been no compelling reason to<br />

change.<br />

<strong>The</strong> committee has agreed however<br />

that if expressions <strong>of</strong> interest were to<br />

be received from other firms, it would<br />

consider a tendering process.<br />

Cheryl A. Atchison, CA<br />

Chair<br />

2011-12 Audit Committee

Launch <strong>of</strong> newly revised CICA<br />

In-Depth Tax Course - What’s Changed?<br />

Known as the best course for tax pr<strong>of</strong>essionals in Canada, CICA’s In-Depth Tax<br />

Program is about to get a makeover.<br />

<strong>The</strong> changes that begin rolling out in September 2012 are<br />

intended to update and improve the quality <strong>of</strong> the course for<br />

students and enhance accountability and performance assurance<br />

for employers. Rejuvenation <strong>of</strong> the course follows the<br />

recommendations <strong>of</strong> the October 2009 report <strong>of</strong> the Association’s<br />

Tax Education Task Force (TETF).<br />

“While preserving the curriculum’s successful mix <strong>of</strong> theory<br />

and on-the-job experience, we’re upgrading the course to respond<br />

to changing student needs and the rising complexity <strong>of</strong><br />

tax practice,” says Vivian Leung, CA, Program Director for Tax<br />

Education at CICA. “<strong>The</strong> new course will be more integrated<br />

and comprehensive, using a competency-based approach and<br />

by delivering content at an appropriate pace for optimum<br />

learning using today’s learning technologies.”<br />

What’s new in the course?<br />

<strong>The</strong> new In-Depth Tax Program will feature an orientation<br />

course dedicated to tax research and communications for all<br />

new students entering into the program. <strong>The</strong> addition <strong>of</strong> this<br />

course will ensure the participants’ first exposure into the<br />

Stakeholder consultation<br />

to enhance audit quality<br />

<strong>The</strong> Canadian Public Accountability Board (CPAB) and the<br />

Canadian <strong>Institute</strong> <strong>of</strong> <strong>Chartered</strong> Accountants (CICA) have<br />

initiated a research and consultation process to enable<br />

those with a stake in audit quality to discuss and determine<br />

Canada’s perspective on the audit issues currently being<br />

deliberated at the world table.<br />

<strong>The</strong> “Enhancing Audit Quality: Canadian Perspectives”<br />

consultation process will engage broad stakeholder input to<br />

develop Canadian views about solutions and seek to influence<br />

final outcomes with respect to strengthening audit<br />

quality globally.<br />

Check out the opportunities to participate and share your<br />

thoughts by visiting the CICA’s website for information on<br />

the process, including documents and resources online at<br />

cica.ca/enhancingauditquality.<br />

course is more focused and directional and it will also teach<br />

students the tax research framework they will be utilizing<br />

throughout the entire course.<br />

<strong>The</strong> new group study component will utilize learning technologies<br />

to deliver e-learning self-study modules and facilitate<br />

online discussions. This will be coupled with the traditional,<br />

in-person, facilitator-led discussions for an optimal learning<br />

experience. In-Residence will still feature lectures and tutorial<br />

sessions, however they will be re-developed implementing<br />

pedagogical best practices.<br />

<strong>The</strong> courses also include self-assessments, knowledge checks,<br />

and feedback reports. A certificate <strong>of</strong> achievement will also be<br />

granted to students upon successful completion <strong>of</strong> the course.<br />

To allow adequate time for the more comprehensive curriculum,<br />

the duration <strong>of</strong> the In-Depth Tax Course has been<br />

increased from the current two years to three. Research<br />

conducted with students <strong>of</strong> the existing In-Depth Tax Course<br />

indicated that the current course covered too much ground<br />

too fast.<br />

How does the new course affect current<br />

students?<br />

<strong>The</strong> existing course will be phased out over the next three<br />

years with current students completing the course in its present<br />

structure. For example, students who have completed our<br />

current In-Depth Tax 1 course will continue in September 2012<br />

with the existing In-Depth Tax 2 course.<br />

New course starts September 2012<br />

“Throughout this summer we will be adding new resources to<br />

the site and providing news about our progress as we ramp up<br />

to launch part one <strong>of</strong> the new In-Depth Tax Course this September,”<br />

says Leung. “With the remainder <strong>of</strong> the course being<br />

introduced gradually over the next three years, we are excited<br />

to continue our 40 year history as the country’s leading tax<br />

education course.”<br />

For more information about the new<br />

In-Depth Tax Course and to register, visit CICA’s<br />

Continuing Education Tax Courses Web<br />

Community at cpd.cica.ca/incometax.cfm.<br />

03 11

2012-2013<br />

12<br />

Fall / Winter PD Program<br />

Below is a listing <strong>of</strong> the course titles that will be <strong>of</strong>fered for the 2012-2013 Fall / Winter PD Program. Courses start in October and<br />

the PD Catalogues will be available online in September at icam.mb.ca.<br />

Accounting, Financial Reporting and Assurance<br />

Accounting, Auditing and Pr<strong>of</strong>essional Practice Update<br />

Accounting Update for CAs in Industry<br />

ASPE - Disclosure and Presentation<br />

Best Practice in Practice Management<br />

File Review Methodology<br />

Financial Instruments for Private Enterprises and NPOs<br />

Fraud Happens. What to do When You Suspect Fraud<br />

IFRS – An Update<br />

Internal Control for the Small Audit<br />

Internal Control for CEOs/CFOs<br />

Managing Pr<strong>of</strong>essional Risk In Your Practice<br />

Not-for-Pr<strong>of</strong>it Organizations - <strong>The</strong> New Accounting Standards<br />

Quality Control Systems for Small Firms<br />

Review & Compilation Engagements<br />

Revisiting Audit Risk<br />

<strong>The</strong> CAS Audit <strong>of</strong> Very Small Entities<br />

Corporate Finance<br />

Building a Financial Model<br />

Business Valuations – Advanced<br />

Business Valuations – Introduction<br />

Corporate Treasury Management<br />

Principles & Practices <strong>of</strong> Business Acquisitions<br />

Information Technology<br />

Advanced Word<br />

Advanced Excel<br />

Advanced PowerPoint<br />

Charting With Micros<strong>of</strong>t Office – Communicate More<br />

Effectively<br />

Cloud Computing and Google Productivity Tools<br />

Data Visualization and Mapping Tools for Accountants<br />

Excel Based Dashboards<br />

Excel Reporting – Best Practices, Tools and Techniques<br />

Mobile Tools and Apps for Accountants<br />

PDF Documents – What Accountants Need to Know<br />

PDF Forms – What Accountants Need to Know<br />

Technology for CAs: Don’t Get Left Behind<br />

Management, Leadership & Personal Development<br />

An Introduction to Strategy Driven Budgeting<br />

Budgeting and Financial Management<br />

Building a Financial Model<br />

Building Enterprise Performance Dashboards<br />

Conflict: Changing Viewpoints & Influencing Behaviour<br />

Controllership<br />

Diagnosing, Designing and Leading Change<br />

Effective Financial Analysis for Small Businesses<br />

Employee Motivation and Recognition<br />

Inspiring Leadership: Engage the Power & Passion <strong>of</strong> People<br />

It’s All About the People - Building Your Management Team for<br />

Maximum Performance<br />

Leadership – Generational Diversity<br />

Liability Concerns for Accountants Who Serve on Boards<br />

Manage your Time and Your Life<br />

Performance Management<br />

Planning to Achieve Competitive Advantage<br />

Power <strong>of</strong> Employee Coaching<br />

Practical Tips for Controllers and CFOs<br />

Risk Management from All Angles<br />

Ten Practical Topics for Accountants in Leadership<br />

Thinking Beyond the Box<br />

What Every CFO Needs To Know About Corporate<br />

Governance<br />

Writing for Impact and Results<br />

Writing Proposals That Win Business<br />

Not-for-Pr<strong>of</strong>it Sector<br />

Charity Fundraising and Receipting Rules<br />

Financial Instruments for Private Enterprises and NPOs<br />

GST/HST Issues for the Non-Pr<strong>of</strong>it Sector<br />

Not-for-Pr<strong>of</strong>it Organizations: <strong>The</strong> New Accounting Standards<br />

Recent Legal Developments Affecting Registered Charities<br />

Public Sector<br />

PSAB 101<br />

PSAB Government Not-For-Pr<strong>of</strong>it Organizations<br />

Taxation<br />

Advanced Tax Planning Strategies<br />

Agriculture Tax Update<br />

Annoying Basics <strong>of</strong> Tax<br />

Catching Up - 5 Years <strong>of</strong> Income Tax Developments<br />

Corporate Reorganizations<br />

Creative Compensation & Fringe Benefits for Small Business<br />

Estate Planning for HIgh Net Worth Individuals<br />

Everyday Income Tax Issues for the General Practitioner<br />

GST/HST Issues for the Non-Pr<strong>of</strong>it Sector<br />

GST/HST Update<br />

General Practitioners Need to Know<br />

Income Tax Update<br />

Income Tax Issues for the File Preparer<br />

Income Tax Planning Refresher for Corporate Tax<br />

Income Tax Planning Refresher for Personal Tax<br />

RIP - Tax Compliance Matters<br />

Taxation <strong>of</strong> Domestic Family Trusts - Basic<br />

Tax Decisions with Long-Term Implications<br />

Tax for Controllers<br />

Tax Issues for New Clients<br />

continued on page 13

PD Passports<br />

on SALE now!<br />

<strong>The</strong> Personal Passport<br />

Offers the convenience and flexibility <strong>of</strong> 5 seminar days<br />

(any combination <strong>of</strong> half-day, full day and two day sessions).<br />

Member Pricing:<br />

$850 until October 12<br />

$950 after October 12<br />

<strong>The</strong> Corporate Passport<br />

Non Member Pricing:<br />

$1,100 until October 12<br />

$1,200 after October 12<br />

Allows you or others in your organization 9 seminar days<br />

(any combination <strong>of</strong> half-day, full day and two day sessions).<br />

$2,000 until October 12<br />

$2,200 after October 12<br />

<strong>The</strong> Mini Passport - Only for members who are exempt<br />

from paying fees or are paying reduced fees.<br />

Offers the convenience and flexibility <strong>of</strong> 3 seminar days (any<br />

combination <strong>of</strong> half-day, full day and two day sessions).<br />

$300 until October 12<br />

$350 after October 12<br />

Buy early & save!<br />

Personal and Mini Passports can be purchased through the<br />

Member Login area at icam.mb.ca. Corporate passports must<br />

be purchased using the Passport Application Form available at<br />

icam.mb.ca or by calling the <strong>Institute</strong> at 204-942-8248.<br />

PD seminars cont’d<br />

Tax Issues in Real Estate - What You Need to Know<br />

Taxation <strong>of</strong> Employee Benefits<br />

US Real Estate – Personal Investments: US and Canadian<br />

Tax Implications<br />

Wealth Management<br />

All About Annuities<br />

Creating a Financial Plan<br />

Crushing Debt<br />

Smoke & Mirrors<br />

On-Line Learning<br />

Accounting Standards for Private Enterprises – A Survey <strong>of</strong><br />

the Standards<br />

Auditing in the New CAS Environment<br />

IFRS - A Survey <strong>of</strong> the Standards<br />

Income Tax Refresher – Corporate<br />

Income Tax Refresher – Personal<br />

FIRM CHANGES<br />

Craig & Ross, <strong>Chartered</strong> Accountants, registered a<br />

part-time practising <strong>of</strong>fice in Steinbach.<br />

R.G. Gamble (1970) registered the name Richard G. Gamble<br />

<strong>Chartered</strong> Accountant Inc. for the full-time practise <strong>of</strong> public<br />

accounting effective June 1, 2012. Consequently, the practice<br />

name Richard G. Gamble, <strong>Chartered</strong> Accountant, was<br />

deregistered.<br />

<strong>The</strong> practising <strong>of</strong>fice <strong>of</strong> Magnus <strong>Chartered</strong> Accountants LLP<br />

deregistered their part-time <strong>of</strong>fice in Steinbach.<br />

Applications for incorporation <strong>of</strong> pr<strong>of</strong>essional practice were<br />

accepted for the following:<br />

John D. Masson, <strong>Chartered</strong> Accountant Inc.<br />

Sandra Lepard <strong>Chartered</strong> Accountant Inc.<br />

Anthony J. Schmidt <strong>Chartered</strong> Accountant Inc.<br />

J.D. Masson (2009) registered the name John D. Masson,<br />

<strong>Chartered</strong> Accountant Inc. for the full-time practise <strong>of</strong> public<br />

accounting in Brandon.<br />

A.J. Schmidt (2007) registered the name Anthony J. Schmidt<br />

<strong>Chartered</strong> Accountant Inc. as a part-time practice <strong>of</strong> public<br />

accounting.<br />

WE COVER EVERY<br />

MOVE YOU MAKE.<br />

Life is all about changes. In your job, in your family and in the lifestyle<br />

you’re determined to protect. At CA Insurance Plans West, we provide<br />

one important thing that won’t change: solid insurance coverage from<br />

people who want the changes in your life to come easily. Whether you’re<br />

adding to your family or going out on your own in business, we promise<br />

to make tomorrow as secure and comfortable as today. It’s in our nature.<br />

And in our name.<br />

Visit caipw.ca or call 1.800.661.6430<br />

03 13

Here and <strong>The</strong>re<br />

WITH MEMBERS<br />

Unless otherwise noted, members are resident in Winnipeg.<br />

ARASON, Cade A. (2000), recently<br />

received the 2012 Annette Nagler Volunteer<br />

Award from Ronald McDonald<br />

House (Manitoba) for his volunteer work<br />

with the organization.<br />

ARKLIE, C. Hughes (1973) recently<br />

completed a degree in Environmental<br />

Studies and Anthropology from the<br />

University <strong>of</strong> Winnipeg.<br />

BARKMAN, Sidney M. (2012) formerly<br />

with Pope & Brooks is now with the<br />

Federal Public Service Health Care Plan<br />

Administration Authority in Ottawa, ON.<br />

BOLAND, Brendon D. (1999) previously<br />

with Princess Auto Ltd. is now Vice<br />

<strong>President</strong>, Finance and Chief Financial<br />

Officer <strong>of</strong> Grain Insurance and Guarantee.<br />

BROWN, Linnzi J. (2010) is now with<br />

KPMG in Calgary, AB.<br />

CATANESE, Tony N. (1986) has recently<br />

been appointed the Winnipeg Office<br />

Managing Partner <strong>of</strong> Pricewaterhouse-<br />

Coopers.<br />

CLARK, James A. (2006) formerly with<br />

PKBW Group is now with Lutheran<br />

Church–Canada.<br />

CORTENS, David A. (1981) previously<br />

with Novozymes Biologicals Ltd. in<br />

Saskatoon SK, is now Chief Financial<br />

Officer with EMW Industrial Ltd. in<br />

Yorkton, SK.<br />

COUTURE, C.O. (Chris) (1986; FCA<br />

2003) has transferred with PricewaterhouseCoopers<br />

to Toronto, ON.<br />

DUECK, Patrick K. (2011) formerly with<br />

Ernst & Young is now with BDO Canada<br />

in Winkler.<br />

14<br />

GOODMAN, Paul R. (1981) was elected<br />

to the Board <strong>of</strong> Directors <strong>of</strong> <strong>The</strong> Portage<br />

la Prairie Mutual Insurance Company at<br />

its 2011 annual meeting.<br />

HORBATY, Frederick J. (1998) formerly<br />

with GWL Realty Advisors Inc. is now<br />

Vice <strong>President</strong>, Finance & Administration<br />

with Habitat for Humanity Manitoba.<br />

LALUK, S.Y. Lena (1993) previously with<br />

Ernst & Young is now Senior Director,<br />

Portfolio Reporting & Governance with<br />

GWL Realty Advisors Inc.<br />

LONGMUIR, Jennifer L. (2009) previously<br />

with <strong>The</strong> Great-West Life Assurance<br />

Company is now Senior Tax<br />

Analyst with Schlumberger Canada<br />

Limited in Calgary, AB.<br />

MATCHETT, Kenneth L. (1968; FCA<br />

1979) was recently inducted into the<br />

Winnipeg Football Club Hall <strong>of</strong> Fame<br />

at the Club’s annual Legacy Dinner on<br />

June 18, 2012.<br />

MILES, Janice M. (1980; FCA 1991) is<br />

now Controller with Vector Construction<br />

Ltd.<br />

PENNER, Derek J. (2000) formerly<br />

with Monsanto Canada Inc. is now Chief<br />

Executive Officer with <strong>The</strong> Winning<br />

Combination Inc.<br />

POPE, Richard D. (1982; FCA 2007) was<br />

recently elected by the Board <strong>of</strong> Directors<br />

<strong>of</strong> the Winnipeg Humane Society<br />

to serve a two year term as the Board’s<br />

Vice Chair for 2012-14.<br />

STERDAN, Mark A. (2010) previously<br />

with PricewaterhouseCoopers has accepted<br />

the role <strong>of</strong> Internal Auditor with<br />

Standard Aero.<br />

THIESSEN, Timothy C. (2001) formerly<br />

<strong>of</strong> Aurcana Corporation is now Chief Financial<br />

Officer <strong>of</strong> Foran Mining Corporation<br />

in Vancouver, BC.<br />

TRETIAK, Gregory D. (1981; FCA 2011)<br />

previously with IGM Financial is now<br />

Executive Vice <strong>President</strong> and Chief Financial<br />

Officer <strong>of</strong> Power Corporation <strong>of</strong><br />

Canada in Montreal, QC.<br />

WANAMAKER, Lori M. (1989) formerly<br />

with the B.C. Government’s Ministry <strong>of</strong><br />

Public Safety and Solicitor General is<br />

now with the Ministry <strong>of</strong> Justice in Victoria,<br />

BC. She was also elected an FCA<br />

<strong>of</strong> the BC <strong>Institute</strong> in November 2011.<br />

WOWRYK, Richard A. (2012) previously<br />

with KPMG is now Associate Manager,<br />

Financial Reporting with Exchange<br />

Income Corporation.<br />

IN MEMORIAM<br />

We record with regret the passing <strong>of</strong>:<br />

John Vincent CORTENS<br />

(Member 1948)<br />

Passed Away May 16, 2012<br />

Kenneth Raymond MANSON<br />

(Member 1976)<br />

Passed Away May 16, 2012<br />

Donald Arthur Thomas MCFEE<br />

(Member 1959)<br />

Passed Away April 29, 2012<br />

Stanley Roy WYLYNKO<br />

(Member 1960)<br />

Passed Away April 26, 2012

News<br />

OF MEMBERS<br />

Welcome to New Members<br />

Admitted by Affiliation<br />

Myles Bevan BOYCE<br />

Christopher John CURTIS<br />

Sasha HEBERT<br />

Robert Radu PATRAULEA<br />

Admitted by Examination<br />

Brett Lindsey DAVENPORT<br />

Johan Yannis MACCÈS<br />

Jeffrey Thomas MATHEW<br />

Kayla Michelle MITCHELL<br />

Richard Andrew WOWRYK<br />

Admitted by CA Reciprocity<br />

Darren Keith ROTHERY<br />

Exemption from Membership Fees<br />

<strong>The</strong> following members (year <strong>of</strong> designation<br />

shown in brackets) have declared<br />

that they meet the criteria for exemption<br />

from membership fees:<br />

Dale Edward ANTONSEN (1989)<br />

Harold Wayne CHIARELLA (1978)<br />

Robert Edward COX (1972)<br />

John Douglas DONALD (1973)<br />

Barbara Lorraine DRAIN (1975)<br />

Marsden Don FENWICK (1962)<br />

Laurence GINSBERG (1970)<br />

Gordon William GOOSSEN (1971)<br />

Kenneth Edward GRAY (1948)<br />

Arthur Russell HOLMES (1977)<br />

James Gordon JAMES (1982)<br />

Graham Frederick James LANE (1981)<br />

Ronald Samuel MATLIN (1964)<br />

Robert Bergman MAY (1968)<br />

Kenneth James MONDOR (1973)<br />

Garry Melvin PAULSON (1973)<br />

Paul Anderson RITCHIE (1975)<br />

Norman SILVERBERG (1959)<br />

Robert Alexander SLATOR (1970)<br />

Kirk William WESTLUND (1976)<br />

Resigned in Good Standing<br />

Please note that members who move to<br />

another province or territory in Canada<br />

or Bermuda, obtain membership with<br />

that <strong>Institute</strong> <strong>of</strong> residence and do not<br />

wish to retain Manitoba membership<br />

are required to advise the Manitoba<br />

<strong>Institute</strong> in order to avoid suspension or<br />

termination <strong>of</strong> membership in Manitoba.<br />

In most cases, members who resign<br />

no longer reside in Manitoba and hold<br />

membership in another provincial institute.<br />

John Blair AMUNDSON<br />

Member 1991<br />

(Residing in Regina, SK)<br />

Stephen Andrew BANNATYNE<br />

Member 1978<br />

(Residing in Winnipeg)<br />

Gordon Douglas BENSON<br />

Member 1972<br />

(Residing in West St. Paul, MB)<br />

Colin Dexter BROWN<br />

Member 1997<br />

(Residing in Vancouver, BC)<br />

Hao (Vivian) CHEN<br />

Member 2011<br />

(Residing in Toronto, ON)<br />

Glen Ray DERBACK<br />

Member 1975<br />

(Residing in Castle Rock, CO)<br />

Ronald Peter FRIESEN<br />

Member 1993<br />

(Residing in Hague, SK)<br />

Kenneth Joseph GRONDIN<br />

Member 1995<br />

(Residing in Edmonton, AB)<br />

Hai-Ting (Julie) JEN<br />

Member 2011<br />

(Residing in Burnaby, BC)<br />

Bruce John JOHANNSON<br />

Member 1986<br />

(Residing in Toronto, ON)<br />

David James JOHNSTON<br />

Member 1988<br />

(Residing in Rocky Mountain House, AB)<br />

Kerrin Dale KERNEY<br />

Member 2009<br />

(Residing in Winnipeg)<br />

Scott Evan Grant LALUK<br />

Member 2003<br />

(Residing in Calgary, AB)<br />

Donald Edward MCCREA<br />

Member 1978<br />

(Residing in Calgary, AB)<br />

Joan Elizabeth NOLTING<br />

Member 1990<br />

(Residing in Nanaimo, BC)<br />

Bradford Nels Dorien REFVIK<br />

Member 1985<br />

(Residing in Winnipeg)<br />

Darcy Elizabeth SAMPSON<br />

Member 2011<br />

(Residing in Halifax, NS)<br />

Kamaljit SINGH<br />

Member 2011<br />

(Residing in Toronto, ON)<br />

Ronald Louie WELLS<br />

Member 1977<br />

(Residing in Devon, AB)<br />

Carolyn Eleanor Avery WRAY<br />

Member 1988<br />

(Residing in Victoria, BC)<br />

Specialty REGISTER<br />

<strong>The</strong> following members were entered in<br />

the <strong>Institute</strong>’s specialty register and are<br />

entitled to use their specialist designation:<br />

Donovan Paul Fontaine, CA•CIA<br />

Micheal Steven Giles, CA•CIA<br />

03 15

Congratulations to Cade Arason (above, right) who is pictured with Stacey Grocholski, Executive Director for Ronald McDonald<br />

House (Manitoba) on receiving the 2012 Annette Nagler Volunteer Award from Ronald McDonald House (RMH) for his volunteer<br />

work with the organization. Cade was also a recipient <strong>of</strong> the <strong>Institute</strong>’s Early Achievement Award in 2007.<br />

Congratulations to Ken Matchett (above, left, pictured with a member <strong>of</strong> the Blue Lightning Dance Team) on being inducted<br />

into the Winnipeg Football Club Hall <strong>of</strong> Fame at the Club’s annual Legacy Dinner on June 18, 2012 in recognition <strong>of</strong> his volunteer<br />

work with the organization. Ken was also a recipient <strong>of</strong> the <strong>Institute</strong>’s Lifetime Achievement Award in 2006.<br />

Photo courtesy <strong>of</strong> Dave Darichuk / Blue Bombers.<br />

Contact Us <strong>The</strong> <strong>Institute</strong> <strong>of</strong> <strong>Chartered</strong> Accountants <strong>of</strong> Manitoba<br />

Gary Hannaford FCA<br />

Chief Executive Officer<br />

ghannaford@icam.mb.ca Direct Line: 204.924.4410<br />

Kathy Zaplitny CA<br />

Sr. Director <strong>of</strong> Pr<strong>of</strong>essional Services & Operations<br />

kzaplitny@icam.mb.ca Direct Line: 204.924.4411<br />

Kim Metcalfe CA<br />

Director <strong>of</strong> Student Recruitment and Ethics<br />

kmetcalfe@icam.mb.ca Direct Line: 204.924.4419<br />

Dianne Laidler CMA<br />

Director <strong>of</strong> Administration<br />

dlaidler@icam.mb.ca Direct Line: 204.924.4412<br />

Shirley Sommer CA<br />

Registrar<br />

ssommer@icam.mb.ca Direct Line: 204.924.4414<br />

Tanya Beck<br />

Manager <strong>of</strong> Communications<br />

tbeck@icam.mb.ca Direct Line: 204.924.4416<br />

16<br />

Jody Bibeau<br />

Receptionist/Clerk<br />

jbibeau@icam.mb.ca Direct Line: 204.942.8248<br />

Michelle Chartrand<br />

Executive Assistant<br />

mchartrand@icam.mb.ca Direct Line: 204.924.4418<br />

Darlene Kochanski<br />

Communications Assistant<br />

dkochanski@icam.mb.ca Direct Line: 204.924.4415<br />

Marie Kostiuk<br />

PD Coordinator<br />

mkostiuk@icam.mb.ca Direct Line: 204.924.4413<br />

Kimberly Leung<br />

Assistant Registrar & Accounting Assistant<br />

kleung@icam.mb.ca Direct Line: 204.924.4417<br />

Practice Advisory Services Line<br />

204.942.8248 ext. 211<br />

COMING<br />

EVENTS<br />

CA & CMA Golf Tournament<br />

Bel Acres Golf & Country Club<br />

Tuesday, August 28<br />

Registration 11:30 am - 12:15 pm<br />

Tee Time 12:30 pm<br />

Dinner 5:30 pm<br />

Uniform Evaluation<br />

September 11-13<br />

Member Recognition Dinner<br />

Thursday, November 8, 2012<br />

<strong>The</strong> Fairmont Winnipeg<br />

Reception 6 pm<br />

Dinner 6:45 pm<br />

UFE Results Release<br />

November 30<br />

SUMMER HOURS<br />

<strong>The</strong> <strong>Institute</strong> is now operating on summer<br />

hours. Our doors are open from<br />

8:30 am to 4:30 pm.<br />

Regular <strong>of</strong>fice hours (8:30 am to 5 pm)<br />

will resume in the fall on Tuesday,<br />

September 4.<br />

<strong>The</strong> <strong>of</strong>fice will be closed on the<br />

following Statutory Holidays:<br />

August 6<br />

September 3<br />

October 8<br />

Folio published by:<br />

<strong>The</strong> <strong>Institute</strong> <strong>of</strong> <strong>Chartered</strong> Accountants <strong>of</strong> Manitoba<br />

700 - One Lombard Place, Winnipeg, MB R3B 0X3<br />

Tel: 204 942.8248 Fax: 204 943.7119<br />

Toll Free in MB: 1 888 942.8248<br />

icam@icam.mb.ca www.icam.mb.ca