Exchange Bulletin - CBOE

Exchange Bulletin - CBOE

Exchange Bulletin - CBOE

- TAGS

- bulletin

- cboe

- www.cboe.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

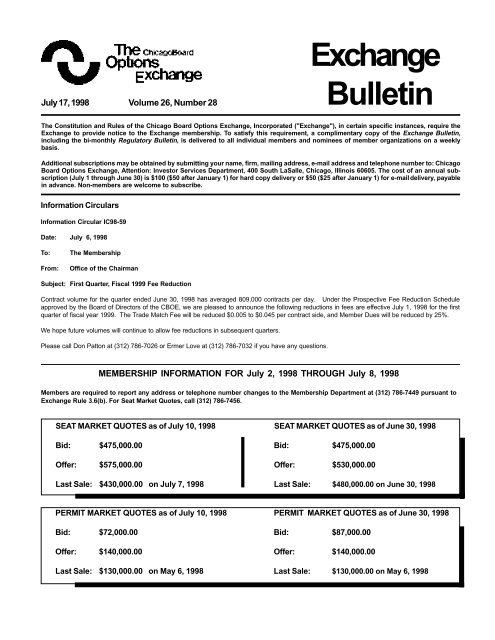

July 17, 1998 Volume 26, Number 28<br />

<strong>Exchange</strong><br />

<strong>Bulletin</strong><br />

The Constitution and Rules of the Chicago Board Options <strong>Exchange</strong>, Incorporated ("<strong>Exchange</strong>"), in certain specific instances, require the<br />

<strong>Exchange</strong> to provide notice to the <strong>Exchange</strong> membership. To satisfy this requirement, a complimentary copy of the <strong>Exchange</strong> <strong>Bulletin</strong>,<br />

including the bi-monthly Regulatory <strong>Bulletin</strong>, is delivered to all individual members and nominees of member organizations on a weekly<br />

basis.<br />

Additional subscriptions may be obtained by submitting your name, firm, mailing address, e-mail address and telephone number to: Chicago<br />

Board Options <strong>Exchange</strong>, Attention: Investor Services Department, 400 South LaSalle, Chicago, Illinois 60605. The cost of an annual subscription<br />

(July 1 through June 30) is $100 ($50 after January 1) for hard copy delivery or $50 ($25 after January 1) for e-mail delivery, payable<br />

in advance. Non-members are welcome to subscribe.<br />

Information Circulars<br />

Information Circular IC98-59<br />

Date: July 6, 1998<br />

To: The Membership<br />

From: Office of the Chairman<br />

Subject: First Quarter, Fiscal 1999 Fee Reduction<br />

Contract volume for the quarter ended June 30, 1998 has averaged 809,000 contracts per day. Under the Prospective Fee Reduction Schedule<br />

approved by the Board of Directors of the <strong>CBOE</strong>, we are pleased to announce the following reductions in fees are effective July 1, 1998 for the first<br />

quarter of fiscal year 1999. The Trade Match Fee will be reduced $0.005 to $0.045 per contract side, and Member Dues will be reduced by 25%.<br />

We hope future volumes will continue to allow fee reductions in subsequent quarters.<br />

Please call Don Patton at (312) 786-7026 or Ermer Love at (312) 786-7032 if you have any questions.<br />

MEMBERSHIP INFORMATION FOR July 2, 1998 THROUGH July 8, 1998<br />

Members are required to report any address or telephone number changes to the Membership Department at (312) 786-7449 pursuant to<br />

<strong>Exchange</strong> Rule 3.6(b). For Seat Market Quotes, call (312) 786-7456.<br />

SEAT MARKET QUOTES as of July 10, 1998 SEAT MARKET QUOTES as of June 30, 1998<br />

Bid: $475,000.00 Bid: $475,000.00<br />

Offer: $575,000.00 Offer: $530,000.00<br />

Last Sale: $430,000.00 on July 7, 1998 Last Sale: $480,000.00 on June 30, 1998<br />

PERMIT MARKET QUOTES as of July 10, 1998 PERMIT MARKET QUOTES as of June 30, 1998<br />

Bid: $72,000.00 Bid: $87,000.00<br />

Offer: $140,000.00 Offer: $140,000.00<br />

Last Sale: $130,000.00 on May 6, 1998 Last Sale: $130,000.00 on May 6, 1998

Page 2 July 17, 1998 Volume 26, Number 28 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong><br />

OPTION TRADING PERMIT- LEASE POOL as of July 3, 1998<br />

Highest Bid: No Bid Highest Monthly Rate: $3,700.00<br />

OTP's Available: None Lowest Monthly Rate: $50.00<br />

Last Lease: $250.00 on July 2, 1998<br />

Membership Sales and Transfers<br />

This notice is given pursuant to Rules 3.15 and 3.16 which permit certain types of claims to be filed with the Membership Department<br />

within 20 days from the date of this <strong>Exchange</strong> <strong>Bulletin</strong>.<br />

From To Price/Transfer Date<br />

Louis M. Skydell PBL Partners L.L.C. $480,000 07/02/98<br />

Boggs-Speth Partnership Paul J. Weiss $450,000 07/07/98<br />

Sondra C. Rabin Larkspur Securities, Inc. $475,000 07/08/98<br />

Jed H. Abraham Larkspur Securities, Inc. $430,000 07/08/98<br />

William S. Persky Larkspur Securities, Inc. $450,000 07/08/98<br />

Thomas J. Corbett Jr. Larkspur Securities, Inc. $450,000 07/08/98<br />

Howard S. Kotzen, Inc. Tague Securities Corp. $465,000 07/08/98<br />

Robin Spitalny The Arbitrage Group, L.P. $460,000 07/08/98<br />

Bernard & Yolanda Miller (Ptnrshp) PBL Partners L.L.C. $435,000 07/08/98<br />

MEMBERSHIP APPLICATIONS RECEIVED<br />

This notice is given persuant to <strong>Exchange</strong> Rule 3.9. Please send any<br />

comments to the Membership Committee in care of the Membership<br />

Department.<br />

Individual Member Applicants Date Posted<br />

Christ L. Sirigas, Nominee 07/02/98<br />

Timber Hill LLC<br />

10848 S. Lyman Ave.<br />

Chicago Ridge, IL 60415<br />

Kevin F. Mullen, CBT Individual 07/02/98<br />

P.O. Box 1615<br />

Chicago, IL 60690<br />

Garett J. Nesbitt, Nominee 07/02/98<br />

BOTTA Trading, Inc.<br />

2756 N. Pine Grove - Apt. 1110<br />

Chicago, IL 60614<br />

Richard L. Watkins, Nominee 07/02/98<br />

Tague Securities Corporation<br />

1711 N. Hoyne Ave. - #3<br />

Chicago, IL 60647<br />

Norman D. Friedman, Nominee 07/06/98<br />

JSS Investments, L.L.C.<br />

4142 Miller Drive<br />

Glenview, IL 60025<br />

Date Posted<br />

Eric W. Jones, Nominee 07/06/98<br />

Anteros Capital Markets L.L.C.<br />

516 W. Briar Pl. - #1D<br />

Chicago, IL 60657<br />

Keir S. Collins, Nominee 07/06/98<br />

Spear, Leeds & Kellogg<br />

3170 N. Sheridan Rd., Apt. 1229S<br />

Chicago, IL 60657<br />

Gregory J. Holstrom, Nominee 07/06/98<br />

Spear, Leeds & Kellogg<br />

600 W. Diversey - #905<br />

Chicago, IL 60614<br />

Dimitrios Cholevas, Lessee 07/06/98<br />

2233 W. Medill Ave. - #A<br />

Chicago, IL 60647<br />

Scott Trigg Thorstenson, Nominee 07/06/98<br />

Futrex Trading Llc<br />

2288 N. Kenmore<br />

Chicago, IL 60614<br />

Timothy D. Ritschel, Nominee 07/06/98<br />

Spear, Leeds & Kellogg<br />

1100 N. LaSalle - Apt. 513<br />

Chicago, IL 60610<br />

Brian J. Dowling, CBT Registered For 07/06/98<br />

Blackhawk Financial L.L.C.<br />

368 Fairbank Road<br />

Riverside, IL 60546

July 17, 1998 Volume 26, Number 28 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong> Page 3<br />

Date Posted<br />

Jeffrey D. Perkosky, Nominee 07/06/98<br />

Anteros Capital Markets L.L.C.<br />

111 W. Maple - #703<br />

Chicago, IL 60610<br />

Brian C. Morrison, Nominee 07/06/98<br />

Anteros Capital Markets L.L.C.<br />

2424 N. Clark St. - Apt. 612<br />

Chicago, IL 60614<br />

Jason A. Kaltz, Nominee 07/07/98<br />

Lakota Trading, Inc.<br />

1301 W. Fletcher - #129<br />

Chicago, IL 60657<br />

Paul J. Stravato, Nominee 07/07/98<br />

W.H. Trading, L.L.C.<br />

510 W. Wellington - #1T<br />

Chicago, IL 60657<br />

Thomas W. Simpson, Nominee 07/07/98<br />

Fulcrum Investment Group, L.L.C.<br />

574 Darlington - #15<br />

Crystal Lake, IL 60014<br />

Patrick J. Burke, Nominee 07/07/98<br />

James V. Proesel, Jr., Inc.<br />

13937 Charleston<br />

Orland Park, IL 60462<br />

Matthew N. Hulsizer, Nominee 07/07/98<br />

Peak6 Capital Management Llc<br />

743 N. Dearborn<br />

Chicago, IL 60610<br />

David S. Graff, CBT Registered For 07/07/98<br />

LFG, L.L.C.<br />

1722 Birch Street<br />

Des Plaines, IL 60018<br />

Joseph D. Mueller, Nominee 07/07/98<br />

RMB & Associates, L.P.<br />

10024 S. Longwood<br />

Chicago, IL 60643<br />

Richard J. Pyle, Nominee 07/07/98<br />

Peak6 Capital Management Llc<br />

3033 N. Sheridan Rd.<br />

Chicago, IL 60657<br />

Norman D. Gershon, Lessee 07/07/98<br />

2470 N. Clark - #607<br />

Chicago, IL 60614<br />

Richard L. Watkins, Nominee 07/08/98<br />

Eclipse J.V<br />

1711 N. Hoyne Ave. - #3<br />

Chicago, IL 60647<br />

Walter O. Teske, Lessee 07/08/98<br />

2229 N. Fremont<br />

Chicago, IL 60614<br />

Steven J. Pettinato, CBT Registered For 07/08/98<br />

Woody Creek Capital Management,Ltd.<br />

3713 N. Hermitage<br />

Chicago, IL 60613<br />

Date Posted<br />

Barry A. Levin, CBT Individual 07/08/98<br />

80 East St. Andrews Lane<br />

Deerfield, IL 60015<br />

Member Organization Applicants Date Posted<br />

BEEBE Trading, L.L.C. 07/06/98<br />

Larry S. Beebe, Nominee<br />

Erica L. Heine, Nominee<br />

230 S. LaSalle - Ste. 688<br />

Chicago, IL 60604<br />

Larry S. Beebe - Managing Member<br />

Taylor Trading, L.L.C. 07/06/98<br />

Jason B. Taylor, CBT Registered For<br />

440 S. LaSalle - Ste. 1646<br />

Chicago, IL 60605<br />

Jason B. Taylor - Managing Member<br />

Wigley Trading Co., Inc. - Member<br />

Jefferson Wigley - Member<br />

CBC Options Corp. - Member<br />

Charles B. Cox III - Member<br />

CSS, LLC 07/07/98<br />

Michael J. Carusillo, CBT Registered For<br />

401 S. LaSalle - Ste. 1703<br />

Chicago, IL 60605<br />

Michael J. Carusillo - Managing Member<br />

Clayton A. Strune - Managing Member<br />

Nicholas D. Schoewe - Manager<br />

Fireside Investments L.P. - Member<br />

Nicholas D. Schoewe - Shareholder<br />

John Robert Trading, L.P. 07/07/98<br />

Robert E. Elizondo, Nominee<br />

440 S. LaSalle - Ste. 2800<br />

Chicago, IL 60605<br />

Robert E. Elizondo - General Partner<br />

John J. Monik - Limited Partner<br />

Terrapin Trading Group, L.L.C. 07/07/98<br />

Brian J. Haag, Nominee<br />

111 Broadway - 2nd Floor<br />

New York, NY 10006<br />

Todd R. Hollander - Investing Member<br />

Ross J. Moore - Managing Member<br />

Robert P. Bucich - Managing Member<br />

Stuart P. Milsten - Investing Member<br />

Adar Strategic Investments, L.P. - Investing Member<br />

Michael H. Schwartz - Investing Member<br />

CON Trading LLC 07/07/98<br />

Patrick Connelly, Nominee<br />

James M. Halliday, Nominee<br />

440 S. LaSalle - Ste. 1600<br />

Chicago, IL 60605<br />

Patrick J. Connelly - Managing Member<br />

Izee Trading Company 07/07/98<br />

Marc R. Eisenberg, Nominee<br />

440 S. LaSalle - Ste. 2500<br />

Chicago, IL 60605<br />

Marc R. Eisenberg - President

Page 4 July 17, 1998 Volume 26, Number 28 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong><br />

Furman Trading Group, L.L.C. 07/07/98<br />

Boris Furman, CBT Registered for<br />

Neal A. Jaffe, Nominee<br />

440 S. LaSalle - Ste. 700<br />

Chicago, IL 60605<br />

Maple Trading Corp. - Member<br />

Boris Furman - President<br />

LaRocque Trading Group L.L.C. - Member<br />

LaRocque Trading, Inc. - Managing Member<br />

John P. LaRocque - President<br />

The Dooley Group Inc 07/08/98<br />

Robert B. Hutchison, CBT Registered For<br />

440 S. LaSalle - Ste. 1507<br />

Chicago, IL 60605<br />

William P. Dooley - President<br />

William P. Dooley Jr. - Vice President/Secretary<br />

MEMBERSHIP LEASES<br />

This notice is given pursuant to <strong>Exchange</strong> Rules 3.15 and 3.16 which<br />

permit certain types of claims to be filed with the Membership Department<br />

within 20 days from the date of this <strong>Exchange</strong> <strong>Bulletin</strong>.<br />

New Leases Effective Date<br />

Lessor: Alexander T. Mc Intosh 07/02/98<br />

Lessee: The Helios Group Illinois L.L.C.<br />

Matthew M. Heisler, NOMINEE<br />

Rate: 1 1/8% Term: Monthly<br />

Lessor: Alan Zahtz 07/02/98<br />

Lessee: QSA, L.L.C.<br />

Dirk R. La Borne, NOMINEE<br />

Rate: 1 1/8% Term: Monthly<br />

Lessor: David M. Ofman 07/06/98<br />

Lessee: Sallerson-Troob L.L.C.<br />

Michael H. Costley, NOMINEE<br />

Rate: 1 1/8% Term: Monthly<br />

Lessor: Richard F. Belden 07/06/98<br />

Lessee: Susquehanna Securities<br />

Robert Lawrence Wilson, NOMINEE<br />

Rate: 1 1/8% Term: Monthly<br />

Lessor: Anthony Dicrescenzo 07/06/98<br />

Lessee: ADC Options<br />

Joseph P. Knoch, NOMINEE<br />

Rate: $1.00 Term: Monthly<br />

Lessor: J.E.M. Worldwide Holding Ltd. 07/07/98<br />

Lessee: Alan M. Sartin<br />

Rate: 1 1/8% Term: Monthly<br />

Lessor: PBL Partners LLC 07/07/98<br />

Lessee: OTA Limited Partnership<br />

Brian P. Kelly, NOMINEE<br />

Rate: 1 1/8% Term: 15 Days<br />

Lessor: Paul J. Weiss 07/07/98<br />

Lessee: First Options Of Chicago, Inc.<br />

Nicholas L. Marovich, NOMINEE<br />

Rate: 1 % Term: One Day<br />

Lessor: Victor C. Faraci 07/07/98<br />

Lessee: Triangle Trading, L.L.C.<br />

Robert F. Piekarz, NOMINEE<br />

Rate: 1 1/8% Term: Monthly<br />

Date Posted Effective Date<br />

Lessor: Larkspur Securities, Inc. 07/08/98<br />

Lessee: KC-CO II L.L.C.<br />

Ryan T. Hauldren, NOMINEE<br />

Rate: 1 1/8% Term: Monthly<br />

Lessor: Larkspur Securities, Inc. 07/08/98<br />

Lessee: Susquehanna Securities<br />

James P. Fitzgibbons, NOMINEE<br />

Rate: 1 1/4% Term: Monthly<br />

Lessor: Larkspur Securities, Inc. 07/08/98<br />

Lessee: GPZ Trading, L.L.C.<br />

Timothy J. Smock, NOMINEE<br />

Rate: 1 1/8% Term: 24 Days<br />

Lessor: M.B. Partners II 07/08/98<br />

Lessee: Thomas J. Corbett Jr.<br />

Rate: 1 1/8% Term: Monthly<br />

Lessor: Larkspur Securities, Inc. 07/08/98<br />

Lessee: The Helios Group Illinois L.L.C.<br />

Robert A. Butler, NOMINEE<br />

Rate: 1 1/8% Term: 17 Days<br />

Lessor: Paul J. Weiss 07/08/98<br />

Lessee: TPHCO<br />

Thomas P. Haugh, NOMINEE<br />

Rate: 1 1/8% Term: 18 Days<br />

Lessor: PBL Partners L.L.C. 07/06/98<br />

Lessee: Mesirow Financial Inc..<br />

Daniel K. Busse, NOMINEE<br />

Rate: 1 1/4% Term: One Year<br />

Terminated Leases Termination Date<br />

Lessor: Louis M. Skydell 07/02/98<br />

Lessee: Susquehanna Securities<br />

Lessor: Alan Zahtz 07/02/98<br />

Lessee: Stuart B. Young (SPY)<br />

Lessor: Anthony Dicrescenzo 07/06/98<br />

Lessee: BEL Options Limited Partnership<br />

Jennifer M. Trumpis (JEN), NOMINEE<br />

Lessor: J.E.M. Worldwide Holding Ltd. 07/07/98<br />

Lessee: WST Trading Inc.<br />

Alan M. Sartin (MVS), NOMINEE<br />

Lessor: Boggs-Speth Partnership 07/07/98<br />

Lessee: Triangle Trading, L.L.C.<br />

Robert F. Piekarz (WDO), NOMINEE<br />

Lessor: Victor C. Faraci 07/07/98<br />

Lessee: Ing TT&S (U.S.) Securities Inc.<br />

Lessor: Paul J. Weiss 07/08/98<br />

Lessee: First Options Of Chicago, Inc.<br />

Nicholas L. Marovich (NIC), NOMINEE<br />

Lessor: M.B. Partners Ii 07/08/98<br />

Lessee: KC-Co II L.L.C.<br />

Ryan T. Hauldren (RTH), NOMINEE<br />

Lessor: Jed H. Abraham 07/08/98<br />

Lessee: Susquehanna Securities<br />

James P. Fitzgibbons (FTZ), NOMINEE

July 17, 1998 Volume 26, Number 28 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong> Page 5<br />

Effective Date<br />

Lessor: William S. Persky 07/08/98<br />

Lessee: GPZ Trading, L.L.C.<br />

Timothy J. Smock (OCK), NOMINEE<br />

Lessor: Howard S. Kotzen, Inc. 07/08/98<br />

Lessee: The Helios Group Illinois L.L.C.<br />

Robert A. Butler (BUL), NOMINEE<br />

Lessor: Robin Spitalny 07/08/98<br />

Lessee: TPHCO<br />

Thomas P. Haugh (TPH), NOMINEE<br />

Lessor: Bernard & Yolanda Miller (Ptrshp) 07/08/98<br />

Lessee: Mesirow Financial Inc.<br />

Daniel K. Busse (DKB), NOMINEE<br />

OPTION TRADING PERMIT LEASES<br />

New OTP Leases Effective Date<br />

This notice is given pursuant to <strong>Exchange</strong> Rules 3.15 and 3.27 which<br />

permit certain types of claims to be filed with the Membership Department<br />

within 20 days from the date of this <strong>Exchange</strong> <strong>Bulletin</strong>.<br />

Lessor: William E. Vezo 07/02/98<br />

Lessee: Lawrence Helfant Inc.<br />

Anna M. Degrassi-Kalkis, NOMINEE<br />

Rate: 1800.00 Term: Monthly<br />

Lessor: Spear, Leeds & Kellogg 07/07/98<br />

Lessee: CMB Trading Group L.L.C.<br />

Maria Rosario S. Pavkovic, NOMINEE<br />

Rate: $750.00 Term: Four Months<br />

Lessor: David M. Fleming 07/08/98<br />

Lessee: Sondra C. Rabin<br />

Rate: $500.00 Term: Weekly<br />

Terminated OTP Leases Termination Date<br />

This notice is given pursuant to <strong>Exchange</strong> Rules 3.15 and 3.27 which<br />

permit certain types of claims to be filed with the Membership Department<br />

within 20 days from the date of this <strong>Exchange</strong> <strong>Bulletin</strong>.<br />

LEASE POOL OPTION TRADING PERMIT LEASES<br />

New OTP Leases Effective Date<br />

Lessor: Chicago Board Options <strong>Exchange</strong> 07/02/98<br />

Lessee: ABN AMRO Incorporated<br />

H. Thomas Hampton, NOMINEE<br />

Rate: $550.00 Term: Monthly<br />

Lessor: Chicago Board Options <strong>Exchange</strong> 07/02/98<br />

Lessee: Spear, Leeds & Kellogg<br />

Peter T. Lawler, NOMINEE<br />

Rate: 500.00 Term: Monthly<br />

Lessor: Chicago Board Options <strong>Exchange</strong> 07/02/98<br />

Lessee: Spear, Leeds & Kellogg<br />

Gavin M. Lowrey, NOMINEE<br />

Rate: 250.00 Term: Monthly<br />

Lessor: Chicago Board Options <strong>Exchange</strong> 07/02/98<br />

Lessee: G-Bar Limited Partnership<br />

Brendan Byrd, NOMINEE<br />

Rate: $1050.00 Term: Monthly<br />

Effective Date<br />

Lessor: Chicago Board Options <strong>Exchange</strong> 07/02/98<br />

Lessee: William E. Vezo<br />

Rate: 750.00 Term: Monthly<br />

Terminated OTP Leases Termination Date<br />

This notice is given pursuant to <strong>Exchange</strong> Rules 3.15 and 3.27 which<br />

permit certain types of claims to be filed with the Membership Department<br />

within 20 days from the date of this <strong>Exchange</strong> <strong>Bulletin</strong>.<br />

Lessor: Chicago Board Options <strong>Exchange</strong> 07/02/98<br />

Lessee: Signal House Corp.<br />

Lessor: Chicago Board Options <strong>Exchange</strong> 07/02/98<br />

Lessee: ABN AMRO Incorporated<br />

H Thomas Hampton (TMY), NOMINEE<br />

Lessor: Chicago Board Options <strong>Exchange</strong> 07/02/98<br />

Lessee: Lawrence Helfant Inc.<br />

Anna M. Degrassi-Kalkis (ANZ), NOMINEE<br />

Lessor: Chicago Board Options <strong>Exchange</strong> 07/02/98<br />

Lessee: G-Bar Limited Partnership<br />

Michael W. Mayer (MKE), NOMINEE<br />

MEMBERSHIP TERMINATIONS<br />

Individual Members Termination Date<br />

CBT Registered For:<br />

Steven A. Smith (STX) 07/07/98<br />

LETCO Trading, L.P.<br />

440 S. LaSalle - Ste. 3012<br />

Chicago, IL 60605<br />

Lessee(s):<br />

Stuart B. Young (SPY) 07/02/98<br />

230 S. LaSalle - Ste. 688<br />

Chicago, IL 60604<br />

Lessor(s):<br />

Louis M. Skydell 07/02/98<br />

633 Sheridan Square<br />

Evanston, IL 60202<br />

Jed H. Abraham () 07/08/98<br />

3500 W. Church, #108<br />

Evanston, IL 60203<br />

Robin Spitalny 07/08/98<br />

84 Annin Rd.<br />

Far Hills, NJ 07931<br />

Nominee(s) / Inactive Nominee(s):<br />

Randall L. Swanson (SOS) 07/06/98<br />

RMB & Associates, L.P.<br />

RMB & Associates<br />

440 S. LaSalle-Ste 2525<br />

Chicago, IL 60605

Page 6 July 17, 1998 Volume 26, Number 28 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong><br />

Member Organizations<br />

Signal House Corp. 07/02/98<br />

14 Wall Street, 30th Floor<br />

New York, NY 10005<br />

Boggs-Speth Partnership 07/07/98<br />

ATTN: William Speth<br />

3240 Hartzell St.<br />

Evanston, IL 60201<br />

Bernard & Yolanda Miller (Ptnrshp) 07/08/98<br />

3500 N. Lake Shore Dr.<br />

Chicago, IL 60657<br />

EFFECTIVE MEMBERSHIPS<br />

This notice is given pursuant to <strong>Exchange</strong> Rule 3.11.<br />

Individual Members Effective Date<br />

CBT Exercisers:<br />

Robert L. Oakum (RLO) 07/07/98<br />

440 S. LaSalle - Ste 1646<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Market Maker<br />

Nominee(s) / Inactive Nominee(s):<br />

Termination Date<br />

Amy Ann Spejewski (AMI) 07/02/98<br />

BEL Options Limited Partnership<br />

7641 Hohman<br />

Munster, IN 46321<br />

Type of Business to be Conducted: Floor Broker Market Maker<br />

Matthew M. Heisler (MMH) 07/02/98<br />

The Helios Group Illinois L.L.C.<br />

311 South Wacker Drive, Ste. #5440<br />

Chicago, IL 60606<br />

Type of Business to be Conducted: Market Maker<br />

Michael H. Costley (MHC) 07/06/98<br />

Sallerson-Troob L.L.C.<br />

440 S. LaSalle - Ste. 2110<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Floor Broker Market Maker<br />

Robert Lawrence Wilson (BOB) 07/06/98<br />

Susquehanna Securities<br />

141 W. Jackson Blvd., Ste 2201-A<br />

Chicago, IL 60604<br />

Type of Business to be Conducted: Market Maker<br />

Joseph P. Knoch (ACD) 07/06/98<br />

ADC Options<br />

400 S. LaSalle-<strong>CBOE</strong> Box 139<br />

Chicago, IL 60605<br />

Type of Business to be Conducted: Floor Broker<br />

Maria Rosario S. Pavkovic (MRY) 07/07/98<br />

CMB Trading Group L.L.C.<br />

5449 W. Pensacola<br />

Chicago, IL 60641<br />

Type of Business to be Conducted: Market Maker<br />

JOINT ACCOUNTS<br />

This notice is given pursuant to <strong>Exchange</strong> Rule 8.9.<br />

New Participants Acronym Effective Date<br />

Matthew M. Heisler QND 07/02/98<br />

David M. Wheaton QAD 07/02/98<br />

Matthew M. Heisler QNR 07/02/98<br />

Robert Lawrence Wilson QGS 07/06/98<br />

Terrence S. Terrana QSQ 07/06/98<br />

Christopher J. Delaney QKN 07/07/98<br />

Daniel J. Hurley QNV 07/08/98<br />

Charles W. Palm QNV 07/08/98<br />

Charles W. Palm QLC 07/08/98<br />

New Accounts<br />

Dipen K. Mehta QDM 07/07/98<br />

John J. Cioffi III. QDM 07/07/98<br />

John S. Stafford Jr. QDM 07/07/98<br />

Terminated Participants Acronym Termination Date<br />

Stuart B. Young QFY 07/02/98<br />

David M. Wheaton QFL 07/02/98<br />

Louis R. Stern QSZ 07/06/98<br />

Randall L. Swanson QMB 07/06/98<br />

Steven A. Smith QPL 07/07/98<br />

Terminated Accounts<br />

John S. Stafford Jr. QTA 07/06/98<br />

Louis R. Stern QTA 07/06/98<br />

Robert A. Heitner QYT 07/06/98<br />

Terrence S. Terrana QYT 07/06/98<br />

CHANGES IN MEMBERSHIP STATUS<br />

Individual Member Applicants Effective Date<br />

David M. Wheaton 07/02/98<br />

From: Nominee For Flash Trading L.L.C.;<br />

Floor Broker, Market Maker<br />

To: Nominee For The Option Resource Group;<br />

Floor Broker, Market Maker<br />

William E. Vezo 07/02/98<br />

From: OTP Owner; Market Maker<br />

To: Lessee From Chicago Board Options <strong>Exchange</strong>;<br />

Market Maker/Lessor to Lawrence Helfant, Inc.

July 17, 1998 Volume 26, Number 28 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong> Page 7<br />

David M. Ofman 07/06/98<br />

From: Owner; Market Maker, Floor Broker<br />

To: Lessor to Sallerson-Troob L.L.C.<br />

Richard F. Belden Jr. 07/06/98<br />

From: Owner; Market Maker<br />

To: Lessor to Susquehanna Securities<br />

Terrence S. Terrana 07/06/98<br />

From: CBT Exerciser Registered For J.T.<br />

Limited Partnership; Market Maker<br />

To: CBT Exerciser Registered For Sparta<br />

Group Of Chicago, L.P.; Market Maker<br />

Alan M. Sartin 07/07/98<br />

From: Nominee For WST Trading Inc.; Market Maker<br />

To: Lessee From JEM Worldwide Holding Ltd.;<br />

Market Maker<br />

Paul J. Weiss 07/07/98<br />

From: Lessee From Evangeline Maloney;<br />

Market Maker<br />

To: Lessee From Evangeline Maloney;<br />

Market Maker/ Lessor To TPHCO;<br />

Thomas J. Corbett Jr. 07/08/98<br />

From: Owner; Market Maker<br />

To: Lessee From MB Partners II; Market Maker<br />

Sondra C. Rabin 07/08/98<br />

From: Owner; Market Maker, Floor Broker<br />

To: Lessee from David M. Fleming; Market Maker<br />

William S. Persky 07/08/98<br />

From: Lessor to GPZ Trading L.L.C./Lessor to<br />

QSA, L.L.C.<br />

To: Lessor to QSA, L.L.C.<br />

MEMBER ADDRESS CHANGES<br />

Individual Members Effective Date<br />

Joseph Ray 07/02/98<br />

7061 N. Kedzie Ave. - Apt. 208<br />

Chicago, IL 60645<br />

Michael De Filippis 07/06/98<br />

908 Valley View Trail<br />

Carol Stream, IL 60188<br />

Richard J. Bloss 07/06/98<br />

6747 N. Olmsted, #1-A<br />

Chicago, IL 60631<br />

Daniel T. Dismukes 07/06/98<br />

PO Box 643116<br />

Chicago, IL 60664<br />

Effective Date Effective Date<br />

Steven J. Pettinato 07/08/98<br />

1 Financial Plaza, Ste 1600<br />

Chicago, IL 60605<br />

Thomas J. Corbett Jr. 07/08/98<br />

601 Glenridge Dr.<br />

Glenview, IL 60025<br />

Scott Trigg Thorstenson 07/08/98<br />

30 S. Wacker, Ste 1611<br />

Chicago, IL 60606<br />

Brian J. Haag 07/08/98<br />

111 Broadway, 2nd Floor<br />

New York, IL 10006<br />

Robert E. Elizondo 07/08/98<br />

1344 N. Dearborn, Apt.#7-E<br />

Chicago, IL 60610<br />

Joseph D. Mueller 07/08/98<br />

C/O Sage Clearing<br />

440 S. LaSalle, Ste. 2500<br />

Chicago, IL 60605<br />

Marc R. Eisenberg 07/08/98<br />

c/o Sage Clearing<br />

440 S. LaSalle-Ste 2500<br />

Chicago, IL 60605<br />

Norman D. Gershon 07/08/98<br />

440 S. LaSalle, Ste. 2500<br />

Chicago, IL 60605<br />

Member Organizations Effective Date<br />

CSS,LLC 07/08/98<br />

401 South LaSalle Street, #1703<br />

Chicago, IL 60605<br />

John Robert Trading, L.P. 07/08/98<br />

440 S. LaSalle, Ste. 2800<br />

Chicago, IL 60605<br />

Terrapin Trading Group, L.L.C. 07/08/98<br />

111 Broadway, 2nd Flr.<br />

New York, NY 10006<br />

The Dooley Group Inc 07/08/98<br />

Attn: William P. Dooley<br />

440 S. LaSalle, Suite 1507<br />

Chicago, IL 60605<br />

Furman Trading Group, L.L.C. 07/08/98<br />

440 South LaSalle St., Ste. 700<br />

Chicago, IL 60605

Page 8 July 17, 1998 Volume 26, Number 28 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong><br />

POSITION LIMITS<br />

For all equity options classes except those listed below, the standard position and exercise limits pursuant to <strong>Exchange</strong> Rule 4.11 and<br />

4.12 will be applicable. For a complete list of all applicable limits, check 2nd floor data information bins or contact the Department of<br />

Market Regulation. If you wish to receive regular updates of the position limit list, please contact Candice Nickrand at (312) 786-7730 of<br />

the Department of Market Regulation.<br />

Class Limit Date<br />

BQR/FLT 2,927,500 shares 7/18/98<br />

ECL 15,000 contracts 7/18/98<br />

ENZ/ENX 472,500 shares 7/18/98<br />

EQD/EZD 937,500 shares 7/18/98<br />

MEA 15,000 contracts 7/18/98<br />

MOQ/MOZ 937,500 shares 7/18/98<br />

NWY/CQM 3,320,000 shares 7/18/98<br />

ORG/ORY 750,000 shares 7/18/98<br />

PQO 50,000 contracts 7/18/98<br />

QIG/TWZ 2,500,000 shares 7/18/98<br />

QRT 21,000 contracts 7/18/98<br />

QTP/ZTP 4,500 contracts 7/18/98<br />

TCB 9,000 contracts 7/18/98<br />

TWZ/QIG 2,500,000 shares 7/18/98<br />

VXQ 50,000 contracts 7/18/98<br />

YQC 9,000 contracts 7/18/98<br />

HLQ 21,000 contracts 8/22/98<br />

IOM 50,000 contracts 8/22/98<br />

KOZ/PPZ/PRH 15,000 contracts 8/22/98<br />

MHQ 21,000 contracts 8/22/98<br />

OAQ/OWQ 1,575,000 shares 8/22/98<br />

PGO 21,000 contracts 8/22/98<br />

PRH/PPZ/KOZ 15,000 contracts 8/22/98<br />

QAG 15,000 contracts 8/22/98<br />

QRI/RIU 1,125,000 shares 8/22/98<br />

SFE/SGZ 4,500 contracts 8/22/98<br />

CSC 21,000 contracts 9/19/98<br />

CVC 9,000 contracts 9/19/98<br />

FQB/FXB 1,575,000 shares 9/19/98<br />

ICN 1,575,000 shares 9/19/98<br />

QDA/QXA 675,000 shares 9/19/98<br />

RAL/BLW 7,500 contracts 9/19/98<br />

XSQ/XYQ 3,750,000 shares 9/19/98<br />

WH/WHZ 10,500 contracts 9/19/98<br />

WQQ 15,000 contracts 9/19/98<br />

XQH 15,000 contracts 9/19/98<br />

AC 9,000 contracts 10/17/98<br />

BAX/GNW 32,500 contracts 10/17/98<br />

BJS 21,000 contracts 10/17/98<br />

BQB/BZB 1,125,000 shares 10/17/98<br />

CCN/CXN 463,500 shares 10/17/98<br />

DAI/DAU 7,500 contracts 10/17/98<br />

DLJ 9,000 contracts 10/17/98<br />

FQW/FWW 750,000 shares 10/17/98<br />

GNW/BAX 32,500 contracts 10/17/98<br />

GPT 9,000 contracts 10/17/98<br />

GQZ 21,000 contracts 10/17/98<br />

KSS 15,000 contracts 10/17/98<br />

IQL 15,000 contracts 10/17/98<br />

MFQ 50,000 contracts 10/17/98<br />

OEI/UMZ 1,725,000 shares 10/17/98<br />

ORG/OZG 1,050,000 shares 10/17/98<br />

QEB/QXB 787,500 shares 10/17/98<br />

QTH 21,000 contracts 10/17/98<br />

RQW 15,000 contracts 10/17/98<br />

UMZ/OEI 1,725,000 shares 10/17/98<br />

AQU/ABU 1,125,000 shares 11/21/98<br />

BCQ 50,000 contracts 11/21/98<br />

BLC 9,000 contracts 11/21/98<br />

DFQ 13,500 contracts 11/21/98<br />

FRX 15,000 contracts 11/21/98<br />

GCN/GZZ 750,000 shares 11/21/98<br />

GD 15,000 contracts 11/21/98<br />

IMO 9,000 contracts 11/21/98<br />

JZQ/JZZ 1,125,000 shares 11/21/98<br />

LVQ/LWQ 2,000,000 shares 11/21/98<br />

OFQ/QFZ 25,000 contracts 11/21/98<br />

QIQ/QIZ 1,125,000 shares 11/21/98<br />

QZY/SGQ 41,000 contracts 11/21/98<br />

SGQ/QZY 41,000 contracts 11/21/98<br />

SNV/SVV 1,575,000 shares 11/21/98<br />

WSM 21,000 contracts 11/21/98<br />

CGP 15,000 contracts 12/19/98<br />

CQM/QUZ/NWY/NZS 3,750,000 shares 12/19/98<br />

EQN 21,000 contracts 12/19/98<br />

EVI/WIV 35,000 contracts 12/19/98<br />

GLK/GDZ 7,500 contracts 12/19/98<br />

HQR/HZR 7,500 contracts 12/19/98<br />

QVS/QSZ 1,125,000 shares 12/19/98<br />

RGQ/RGZ 675,000 shares 12/19/98<br />

Class Limit Date<br />

TRP/TZP 4,500 contracts 12/19/98<br />

WIV/EVI 35,000 contracts 12/19/98<br />

AAL/VHW 50,000 contracts 1/16/99<br />

BQX/BQZ 25,000 contracts 1/16/99<br />

CD/VUC/LUL/VFS/<br />

LFS<br />

9,750,000 shares 1/16/99<br />

CI 22,500 contracts 1/16/99<br />

CIQ/WCI/VHR 42,000 contracts 1/16/99<br />

CTC/VDT/VXD/LDT 4,462,500 ADSs 1/16/99<br />

GSB/GVB 10,500 contracts 1/16/99<br />

HAL/VHW 50,000 contracts 1/16/99<br />

HOT/IZT/VZU 4,900,000 shares 1/16/99<br />

HQB/HZB 1,155,000 shares 1/16/99<br />

IZT/VZU/HOT 4,900,000 shares 1/16/99<br />

KRB/LXK//VUK/<br />

VKX/VZK<br />

4,500,000 shares 1/16/99<br />

MER/VME/LME 50,000 contracts 1/16/99<br />

MMM/WMU/VMU/<br />

VMV<br />

25,000 contracts 1/16/99<br />

OMM/OMV 7,500 contracts 1/16/99<br />

QQR/QUR 675,000 shares 1/16/99<br />

QTQ 9,000 contracts 1/16/99<br />

STK/VSK/LSK 40,000 contracts 1/16/99<br />

TJX 50,000 contracts 1/16/99<br />

VFS/LFZ/CD/<br />

VUC/LUL<br />

9,750,000 shares 1/16/99<br />

VQT 40,000 contracts 1/16/99<br />

VUZ/THQ/VTH/<br />

LTH<br />

6,875,000 shares 1/16/99<br />

APC 15,000 contracts 2/20/99<br />

EQL 50,000 contracts 2/20/99<br />

JNY 21,000 contracts 2/20/99<br />

MZY/OFQ/OFZ 3,103,000 shares 6/20/99<br />

AIG/VAF/LAJ/<br />

VXE/LVJ<br />

3,750,000 shares 1/22/2000<br />

AN/VAQ/LAQ 50,000 contracts 1/22/2000<br />

AOL/VAN/LOL 50,000 contracts 1/22/2000<br />

ARC/VFR/LFR 40,000 contracts 1/22/2000<br />

BAC/VBA/LBA 50,000 contracts 1/22/2000<br />

CYQ/VYC/LCY/CYZ<br />

VYV/LYL<br />

3,750,000 shares 1/22/2000<br />

DD/VDD/LDD 50,000 contracts 1/22/2000<br />

EMC/VUE/LUE 50,000 contracts 1/22/2000<br />

CNC/UNG/VJS/LLG 4,775,000 shares 1/22/2000<br />

CPB/VLL/LLL/ZCP/<br />

VXL/ULL<br />

25,000 contracts 1/22/2000<br />

F/VFO/LFO/FZ/<br />

VFV/LFV<br />

25,000 contracts 1/22/2000<br />

GM/LGM/<br />

VGN/LGZ<br />

25,000 contracts 1/22/2000<br />

GPS/VGS/LGS<br />

VWS/LVP<br />

3,750,000 shares 1/22/2000<br />

HWP/VVX 32,500 contracts 1/22/2000<br />

IBM/VIB/LIB 50,000 contracts 1/22/2000<br />

LTD/VLD/LLD/TDU<br />

VUD/LDX<br />

25,000 contracts 1/22/2000<br />

LU/VEU/LUN 50,000 contracts 1/22/2000<br />

LUV/VUV/LOV/<br />

LYU/VUY/LVW<br />

3,000,000 shares 1/22/2000<br />

MTC/VM/LCT/<br />

VZV/LYC<br />

25,000 contracts 1/22/2000<br />

NKA/VOK/LOK 50,000 contracts 1/22/2000<br />

ORQ/VOR/LRO/OWQ 3,750,000 shares<br />

VZR/LRZ/WOU<br />

1/22/2000<br />

PEP/VP/LPP//<br />

VPR/LDV<br />

25,000 contracts 1/22/2000<br />

SCH/VYS/LWS<br />

SYH/VZY/LWZ<br />

2,000,000 shares 1/22/2000<br />

SLB/VWY/LYS 50,000 contracts 1/22/2000<br />

SLM/VRM/LOS/SLZ/<br />

VZL/LYM<br />

2,625,000 shares 1/22/2000<br />

SWY/VYW/LYW 40,000 contracts 1/22/2000<br />

TXN/VXT/LTN 50,000 contracts 1/22/2000<br />

UNG/CNC/VJS/LLG 4,775,000 shares 1/22/2000<br />

VSZ/WZY/VVX/HWP 32,500 contracts 1/22/2000<br />

WMB/VBB/LMB 21,000 contracts 1/22/2000<br />

MOB/VML/LML 50,000 contracts 2/19/2000<br />

ALL/LZL/ZZL 50,000 contracts 1/20/2001<br />

BEL/LEU/ZLE 50,000 contracts 1/20/2001<br />

DIS/LWD/ZDS 75,000 contracts 1/20/2001

July 17, 1998 Volume 26, Number 28 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong> Page 9<br />

Position Limit Circulars<br />

Position Limit Circular PL98-51<br />

Effective July 20, 1998<br />

Unhedged Position and Exercise Limits<br />

Pursuant to <strong>Exchange</strong> Rule 4.11, Interpretation .02 and <strong>Exchange</strong> Rule 4.12, all securities underlying the <strong>Exchange</strong>’s listed equity options have been<br />

reviewed to determine which options are eligible for either the 25,000, 20,000, 10,500, 7,500 or 4,500 contract position and exercise limits. Accounts<br />

which are directly or indirectly controlled by the same individual or entity must be aggregated to determine compliance with the position and exercise<br />

limit rules. Unless specifically mentioned, this notice refers to unhedged position and exercise limits.<br />

To be eligible for the 25,000 tier limit either:<br />

a. the number of outstanding shares must be at least 300 million and the past six-month trading volume in the underlying security must have<br />

totaled at least 75 million shares, or<br />

b. the past six-month trading volume in the underlying security must be at least 100,000 million shares.<br />

To be eligible for the 20,000 tier limit either:<br />

a. the number of outstanding shares must be at least 240 million and the past six-month trading volume in the underlying security must have<br />

totaled at least 60 million shares, or<br />

b. the past six-month trading volume in the underlying security must be at least 80,000 million shares.<br />

To be eligible for the 10,500 tier limit either:<br />

a. the number of outstanding shares must be at least 120 million and the past six-month trading volume in the underlying security must have<br />

totaled at least 30 million shares, or<br />

b. the past six-month trading volume in the underlying security must be at least 40 million shares.<br />

To be eligible for the 7,500 tier limit either:<br />

a. the number of outstanding shares must be at least 40 million and the past six-month trading volume in the underlying security must have<br />

totaled at least 15 million shares, or<br />

b. the past six-month trading volume in the underlying security must be at least 20 million shares.<br />

Position and exercise limits for equity options whose underlying security fails to meet any of the above criteria will be 4,500 option contracts.<br />

NOTE: <strong>Exchange</strong> Rules 4.11 and 4.12 also provide for equity option positions hedged with 100 shares of the underlying security or securities readily<br />

convertible into stock to be three times the standard limit for determining position and exercise limit compliance. The exemption applies to<br />

customer, firm and market-maker accounts. The exemption is automatic for accounts that have established one of the following four hedge<br />

strategies: long call/short stock, short call/long stock, long put/long stock, short put/short stock. As an example, a member or customer<br />

maintaining a short position of 5,000,000 shares of IBM common stock may establish a maximum long call, short put position of 75,000 IBM<br />

option contracts provided that two-thirds or 50,000 option contracts are hedged as described above. Members should also be reminded that<br />

the hedge must be established prior to exceeding the standard limit and generally must be held in the same account as the option positions.<br />

Equity Flex options positions shall not be aggregated with positions in non-Flex equity options for position and exercise limit compliance purposes.<br />

In addition, pursuant to <strong>Exchange</strong> Rule 24.4A, <strong>Exchange</strong> listed industry index options have also been reviewed to determine which options are eligible<br />

for either the 15,000, 12,000, or 9,000 contract position limit. These limits are also reflected on the attached listing.<br />

Following is a list of <strong>CBOE</strong> options with their applicable limits. Those option classes which now qualify for a higher tier limit will have the 25,000, 20,000,<br />

10,500 or 7,500 contract limit effective Monday, July 20, 1998. For those equity option classes whose limit has fallen to a lower tier (noted by a single,<br />

double, triple, or quadruple asterisk) the limit will be reduced effective the dates as noted. For those industry index options whose limit has fallen to a<br />

lower tier (noted by a single or double pound (#) sign) the limit will also be reduced effective the dates as noted.<br />

Also included is a list of option classes which have special position and exercise limits due to stock splits, dividends, or mergers.<br />

Please refer to the <strong>Exchange</strong> <strong>Bulletin</strong> for updates of non-standard position and exercise limits due to adjustments in the underlying securities, such as<br />

stock splits, stock dividends, etc.<br />

The general review for eligibility of equity and narrow based industry index options will be conducted again in January 1999. If prior to the six-month<br />

review, an underlying security for an equity option qualifies for a higher limit based on criteria met as defined in <strong>Exchange</strong> Rule 4.11, the position and<br />

exercise limit will be increased at that time. Industry index option position and exercise limits may also be increased prior to the January 1999 review<br />

if the criteria as defined in <strong>Exchange</strong> Rule 24.4A is met.<br />

Any questions concerning position and exercise limits should be directed to Patricia Cerny (312) 786-7722 or Karen Charleston (312) 786-7724.

Page 10 July 17, 1998 Volume 26, Number 28 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong><br />

EFFECTIVE DATE 7/20/98<br />

Note: <strong>Exchange</strong> Rules 4.11 and 4.12 allow equity option positions hedged with stock to be exempt in determining position and exercise limit compliance;<br />

however, the maximum position, after exempting positions where the option contract is hedged by 100 shares of the underlying security or securities readily<br />

convertible into stock to be three times the standard base limit.<br />

UNDERLYING STOCK SYMBOL POSITION<br />

A.G. EDWARDS, INC. AGE 7,500<br />

A.H. BELO CORP. BLC *****<br />

AAMES FINANCIAL CORP. AAM 20,000* * *<br />

AAVID THERMAL TECHNOLOGIES (AATT) QVI 4,500<br />

ABERCROMBIE & FITCH COMPANY ANF 10,500<br />

ABITIBI-CONSOLIDATED INC. ABY 7,500<br />

ABLE TELCOM, INC. (ABTE) QZB 7,500<br />

ABN AMRO HOLDING NV ADR AAN 4,500<br />

ACCESS HEALTH, INC. (ACCS) QQC 10,500<br />

ACCLAIM ENTERTAINMENT, INC. (AKLM) KKQ 25,000<br />

ACCUSTAFF, INC. ASI 20,000<br />

ACT NETWORKS, INC. (ANET) QTE 7,500<br />

ACTION PERFORMANCE COMPANIES, INC. (ACTN) QNC 10,500<br />

ACTIVISION, INC. (ATVI) AQV 7,500<br />

ADVANCED ENERGY INDUSTRIES, INC. (AEIS) OEQ 7,500*<br />

ADVANTA CORP. (ADVNA) AVQ 10,500*<br />

AERIAL COMMUNICATIONS, INC. (AERL) IQA 7,500<br />

AES CORP. AES 10,500<br />

AGNICO-EAGLE MINES LTD. AEM 4,500<br />

AGOURON PHARMACEUTICALS, INC. (AGPH) GQA 25,000* * *<br />

AGRIBIOTECH, INC. (ABTX) QXQ 20,000<br />

AGRIBRANDS INTERNATIONAL, INC. AGX 4,500<br />

AGRIUM, INC. AGU 10,500<br />

AIRTOUCH COMMUNICATION, INC. ATI 25,000<br />

AIRTRAN HOLDINGS, INC. (AAIR) VJQ 20,000<br />

AK STEEL HOLDING CORPORATION AKS 7,500<br />

ALBEMARLE CORP. ALB 4,500<br />

ALBERTO CULVER CO. ACV 4,500<br />

ALBERTO CULVER CO. CLASS A (ACV.A) ACJ 4,500<br />

ALCATEL ALSTHOM ALA 25,000<br />

ALLEGHENY TELEDYNE INCORPORATED ALT *****<br />

ALLEGIANCE CORP. AEH 7,500<br />

ALLIANCE CAPITAL MANAGEMENT AC *****<br />

ALLIANCE PHARMACEUTICAL CORP. (ALLP) AYQ 7,500<br />

ALLIANCE SEMICONDUCTOR CORP. (ALSC) QAS 10,500<br />

ALLIANT TECHSYSTEMS INC. ATK 4,500<br />

ALLIED CAPITAL CORPORATION (ALLC) CQL 7,500<br />

ALLIED WASTE INDUSTRIES, INC (AWIN) WQN 20,000<br />

ALLSTATE CORPORATION ALL *****<br />

ALTERA CORPORATION (ALTR) LTQ 25,000<br />

ALTERNATIVE RESOURCES CORP. (ALRC) EQM 7,500<br />

ALTRON, INC. (ALRN) NQR 7,500*<br />

ALUMINUM CO. OF AMERICA AA 25,000<br />

ALYDAAR SOFTWARE CORPORATION (ALYD) QLI 4,500<br />

AMAZON.COM, INC. (AMZN) ZQN 25,000<br />

AMBRESCO, INC. (AMMB) UKQ 10,500<br />

AMERICA WEST HOLDINGS CORPORATION AWA 10,500<br />

AMERICAN DISPOSAL SERVICES, INC. (ADSI) HIQ 7,500<br />

AMERICAN EAGLE OUTFITTERS, INC. (AEOS) AQU *****<br />

AMERICAN ECO CORPORATION (ECGOF) EOQ 10,500* *<br />

AMERICAN ELECTRIC POWER CO., INC. AEP 10,500<br />

AMERICAN EXPRESS CO. AXP 25,000<br />

AMERICAN GENERAL CORP. AGC 10,500<br />

AMERICAN INTERNATIONAL GROUP, INC. AIG *****<br />

AMERICAN MANAGEMENT<br />

SYSTEMS, INC. (AMSY) YAQ 10,500* *<br />

AMERICAN MOBILE SATELLITE CORP. (SKYC) KQF 4,500<br />

AMERICAN ONCOLOGY RESOURCES, INC. (AORI) QIA 10,500<br />

AMERICA ONLINE INC. AOL *****<br />

AMERICAN POWER CONVERSION CORP.(APCC) PWQ 25,000****<br />

AMERICAN STANDARD CORP. ASD 10,500* *<br />

AMERICAN STORES COMPANY ASC 25,000<br />

AMERICAN TOWER CORPORATION CLASS A AMT 10,500<br />

AMERICREDIT CORP. ACF 7,500<br />

AMERITECH AIT *****<br />

AMES DEPARTMENT STORES (AMES) QAF 7,500<br />

AMOCO CORPORATION AN *****<br />

AMP, INC. AMP 25,000<br />

AMWAY ASIA PACIFIC LTD. AAP 4,500<br />

ANADARKO PETROLEUM CORPORATION APC *****<br />

ANADIGICS, INC. (ANAD) DQA 10,500<br />

ANDREA ELECTRONICS CORPORATION AND 10,500*<br />

ANDREW CORP. (ANDW) AQN 25,000<br />

ANIXTER INTERNATIONAL INC. AXE 7,500<br />

ANN TAYLOR STORES CORP. ANN 7,500<br />

ANTEC CORPORATION (ANTC) AQC 10,500<br />

APACHE CORP. APA 10,500<br />

APEX PC SOLUTIONS INC. (APEX) PXQ 7,500<br />

APOLLO GROUP INC. (APOL) OAQ *****<br />

APPLEBEE’S INTERNATIONAL, INC. (APPB) AQB 10,500<br />

APPLE SOUTH, INC. (APSO) SQO 10,500<br />

UNDERLYING STOCK SYMBOL POSITION<br />

APPLIED MAGNETICS CORPORATION APM 25,000<br />

APPLIED MICRO CIRCUITS CORP. (AMCC) QLL 7,500<br />

APPLIX, INC. (APLX) LQX 7,500 *<br />

APRIA HEALTHCARE GROUP INC. AHG 10,500<br />

ARACRUZ CELLULOSE SA ARA 7,500<br />

ARBOR SOFTWARE CORPORATION (ARSW) WQE 7,500<br />

ARCADIA FINANCIAL LTD. AAC 7,500<br />

ARCTIC CAT INC. (ACAT) AQO 4,500<br />

ARKANSAS BEST CORPORATION (ABFS) QFA 7,500<br />

ARQUILE, INC. (ARQL) QET 7,500<br />

ARTERIAL VASCULAR<br />

ENGINEERING, INC. (AVEI) GQZ 25,000<br />

ARTESYN TECHNOLOGIES, INC. (ATSN) DQP 10,500<br />

ASA HOLDINGS, INC. (ASAI) AIQ 7,500<br />

ASCEND COMMUNICATIONS (ASND) QQA 25,000<br />

ASE TEST LIMITED (ASTSF) QDQ 7,500<br />

ASM INTERNATIONAL N.V. (ASMIF) IQB 7,500 *<br />

ASM LITHOGRAPHY HOLDING NV (ASMLF) MFQ *****<br />

ASPECT DEVELOPMENT, INC. (ASDV) QDV 7,500<br />

ASSOCIATED BANC-CORP (ASBC) QVS *****<br />

ASSOCIATED FIRST CAPITAL CORP. AFS 25,000<br />

ASTORIA FINANCIAL CORPORATION (ASFC) AQR 7,500<br />

AT HOME CORPORATION (ATHM) AHQ 25,000<br />

AT&T CORP. T 25,000<br />

ATLANTIC COAST AIRLINES (ACAI) QKA 7,500<br />

ATLANTIC RICHFIELD CO. ARC *****<br />

ATLAS AIR, INC. CGO 7,500 *<br />

ATMEL CORPORATION (ATML) AQT 25,000<br />

ATRIA COMMUNITIES, INC. (ATRC) QFW 7,500<br />

AU BON PAIN CO., INC. (ABPCA) BPQ 4,500<br />

AUSPEX SYSTEMS, INC. (ASPX) AQX 7,500<br />

AUTOLIV, INC. ALV 7,500 *<br />

AUTOMOBILE PROTECTION CORPORATION QFM 7,500<br />

(APCO)<br />

AUTOZONE INC. AZO 20,000<br />

AVID TECHNOLOGY INC. (AVID) AQI 10,500<br />

AVIRON (AVIR) QCV 7,500<br />

AVIS RENT A CAR, INC. AVI 10,500<br />

AVON PRODUCTS, INC. AVP 25,000 * * *<br />

AVX CORP. AVX 7,500 *<br />

AZTAR CORPORATION AZR 7,500<br />

B.F. GOODRICH COMPANY GR 10,500 * *<br />

BA MERCHANT SERVICES, INC. BPI 4,500<br />

BAAN COMPANY NV (BAANF) BQF 25,000<br />

BAKER (J.) INC. (JBAK) JBQ 4,500<br />

BALLARD POWER SYSTEMS, INC. (BLDPF) DFQ *****<br />

BANCO FRANCES DEL RIO DE LA<br />

PLATA S.A. ADR BFR 7,500 *<br />

BANCO RIO DE LA PLATE S.A. ADR BRS 10,500 * *<br />

BANCTEC, INC. BTC 4,500<br />

BANK OF COMMERCE (BCOM) QMB 4,500<br />

BANK OF NEW YORK CO. BK 25,000<br />

BANK OF TOKYO MITSUBISHI ADR MBK 10,500<br />

BANKAMERICA CORP. BAC *****<br />

BANTA CORP. (BNTA) BQQ 4,500<br />

BANYAN SYSTEMS INC. (BNYN) QYN 10,500<br />

BARNES AND NOBLE, INC. BKS 10,500 * *<br />

BATTLE MOUNTAIN GOLD CO. BMG 10,500<br />

BAXTER INTERNATIONAL, INC. BAX 25,000<br />

BAYARD DRILLING TECHNOLOGIES, INC. BDI 7,500 *<br />

BAY NETWORKS, INC. BAY 25,000<br />

BB&T CORPORATION BBK 10,500 * *<br />

BEA SYSTEMS, INC. (BEAS) BRQ 10,500<br />

BEAR STEARNS COMPANIES BSC 10,500<br />

BED BATH & BEYOND INC. (BBBY) BHQ 20,000<br />

BELL ATLANTIC CORP. BEL *****<br />

BELLWETHER EXPLORATION CO. (BELW) UQQ 7,500 *<br />

BERGEN BRUNSWIG CORPORATION BBC 10,500 * *<br />

BEST BUY CO., INC. BBY 25,000<br />

BETHLEHEM STEEL CORP. BS 25,000<br />

BIOCHEM PHARMA, INC. (BCHE) BQX *****<br />

BIOGEN INC. (BGEN) BGQ 25,000<br />

BIOMET, INC. (BMET) BIQ 10,500<br />

BIO-TECHNOLOGY GENERAL CORP. (BTGC) QTG 10,500<br />

BIOTIME, INC. (BTIM) QBO 7,500<br />

BIOVAIL CORPORATION INTERNATIONAL BVF 7,500<br />

BIRMINGHAM STEEL CORPORATION BIR 4,500<br />

BJ SERVICES COMPANY BJS 25,000<br />

BJ’S WHOLESALE CLUB, INC.<br />

BLACK & DECKER MANUFACTURING CO. BDK 10,500<br />

BMC SOFTWARE, INC. (BMCS) BCQ *****<br />

BOEING CO. BA *****

July 17, 1998 Volume 26, Number 28 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong> Page 11<br />

UNDERLYING STOCK SYMBOL POSITION<br />

BOISE CASCADE CORP. BCC 7,500<br />

BJ 7,500<br />

BOISE CASCADE OFFICE<br />

PRODUCTS CORPORATION BOP 4,500<br />

BORDEN CHEMICALS AND PLASTICS L.P. BCU 4,500<br />

BORDERS GROUP, INC. BGP 10,500 * *<br />

BOSTON CHICKEN, INC. (BOST) BQN 25,000<br />

BOSTON COMMUNICATIONS GROUP, INC. (BCGI)QGB 7,500<br />

BOSTON SCIENTIFIC CORPORATION BSX 25,000<br />

BRIGHTPOINT, INC. (CELL) QEF 25,000<br />

BRISTOL-MYERS SQUIBB CO. BMY 25,000<br />

BRITISH SKY BROADCASTING GROUP<br />

PLC ADS BSY 4,500<br />

BRITISH STEEL PLC ADS BST 10,500<br />

BRITISH TELECOMMUNICATIONS PLC BTY 10,500 *<br />

BROADBAND TECHNOLOGIES, INC. (BBTK) BQK 7,500 *<br />

BRODERBUND SOFTWARE, INC. (BROD) BDQ 10,500<br />

BROOKS AUTOMATION, INC. (BRKS) BQE 7,500 *<br />

BRUNSWICK CORP. BC 10,500<br />

BUFFETS, INC. (BOCB) BOQ 10,500<br />

BURLINGTON NORTHERN SANTA FE CORP. BNI 10,500<br />

BURR BROWN CORP. (BBRC) BQB *****<br />

BUSINESS OBJECTS S.A. ADR (BOBJY) BBQ 10,500<br />

C-CUBE MICROSYSTEMS, INC. (CUBE) UQB 25.000 ****<br />

CABLE & WIRELESS PLC ADS CWP 10,500 * *<br />

CABLEVISION SYSTEMS CORPORATION CLASS A CVC *****<br />

CABOT CORPORATION CBT 7,500<br />

CADENCE DESIGN SYSTEMS, INC. CDN 25,000<br />

CADIZ LAND COMPANY, INC. (CLCI) QAZ 7,500 *<br />

CALLAWAY GOLF CO. ELY 25,000<br />

CAMPBELL SOUP COMPANY CPB *****<br />

CANADIAN NATIONAL RAILWAY COMPANY CNI 10,500<br />

CAPITAL ONE FINANCIAL COF 10,500<br />

CARDIO THORACIC SYSTEMS INC. (CTSI) QAO 4,500<br />

CARIBINER INTERNATIONAL, INC. CWC 10,500<br />

CARNIVAL CORPORATION CCL 25,000<br />

CARRAMERICA REALTY CORP. CRE 7,500<br />

CARTER-WALLACE, INC. CAR 4,500<br />

CASEY’S GENERAL STORES, INC. (CASY) YQC 7,500<br />

CASH AMERICA INTERNATIONAL, INC. PWN 4,500<br />

CATALYTICA INC. (CTAL) QAN 7,500<br />

CATELLUS DEVELOPMENT CORP. CDX 7,500<br />

CATO CORPORATION (CACOA) CQO 7,500 *<br />

CBT GROUP PLC ADR (CBTSY) QAG *****<br />

CDW COMPUTER CENTERS, INC. (CDWC) DWQ 7,500<br />

CELGENE CORP. (CELG) LQH 4,500<br />

CELL GENESYS, INC. (CEGE) QII 7,500 *<br />

CELLSTAR CORP. (CLST) EQL *****<br />

CENDANT CORPORATION CD *****<br />

CENTEX CORPORATION CTX 10,500<br />

CENTOCOR INC. (CNTO) COQ 25,000<br />

CENTRAL GARDEN AND PET CO. (CENT) EQH 7,500<br />

CENTURY COMMUNICATIONS<br />

CORPORATION (CTYA) CQA 7,500<br />

CEPHALON INC. (CEPH) CQE 20,000 * * *<br />

CERIDIAN CORP. CEN 10,500 * *<br />

CERNER CORP. (CERN) CQN 10,500<br />

CHAMPION INTERNATIONAL CORP. CHA 10,500<br />

CHARLES SCHWAB CORPORATION (THE) SCH *****<br />

CHECKFREE HOLDINGS CORPORATION (CKFR) FCQ 10,500<br />

CHECK POINT SOFTWARE TECHNOLOGIES<br />

LTD. (CHKPF) KEQ 25,000<br />

CHINA TELECOM HK LTD., ADR CHL 10,500 *<br />

CHIRON CORP. (CHIR) CIQ *****<br />

CHOLESTECH CORPORATION (CTEC) QDT 4,500<br />

CHRIS-CRAFT INDUSTRIES, INC. CCN *****<br />

CHRONIMED, INC. (CHMD) HQC 4,500<br />

CHRYSLER CORP. C 25,000<br />

CHS ELECTRONICS, INC. (CHSE) KZQ 25,000<br />

CHUBB CORPORATION CB 10,500<br />

CIDCO, INC. (CDCO) OQI 7,500<br />

CIENA CORPORATION, INC. (CIEN) EUQ 25,000<br />

CIGNA CORP. CI *****<br />

CINCINNATI BELL INC. CSN 10,500<br />

CINERGY CORP. CIN 10,500<br />

CIRCUIT CITY STORES CARMAX GROUP KMX 4,500<br />

CIRRUS LOGIC, INC. (CRUS) CUQ 25,000<br />

CISCO SYSTEMS, INC. (CSCO) CYQ *****<br />

C.I.T. GROUP (THE) CIT 7,500<br />

CITICORP CCI 25,000<br />

CITRIX SYSTEMS, INC. (CTXS) XSQ *****<br />

CITY NATIONAL CORP. CYN 4,500<br />

CKE RESTAURANTS, INC. CKR 10,500<br />

CKS GROUP, INC. (CKSG) OIQ 7,500<br />

UNDERLYING STOCK SYMBOL POSITION<br />

CLAIRES STORES INC. CLE 10,500<br />

CLARIFY, INC. (CLFY) QCY 20,000 * * *<br />

CLAYTON HOMES CMH 10,500 * *<br />

CLEAR CHANNEL COMMUNICATIONS, INC. CCU 10,500<br />

CLIFFS DRILLING CO. CDG 10,500<br />

CMG INFORMATION SERVICES, INC. (CMGI) QGC 20,000<br />

CMS ENERGY CORPORATION CMS 7,500<br />

CNF TRANSPORATION INC. CNF 10,500<br />

CNS, INC. (CNXS) CQX 7,500 *<br />

COASTAL CORP. CGP *****<br />

COCA-COLA CO. KO 25,000<br />

COCA-COLA ENTERPRISES, INC. CCE 25,000 ****<br />

COCA-COLA FEMSA S.A. KOF 10,500<br />

COEUR D’ALENE MINES CORPORATION CDE 7,500<br />

COFLEXIP SA ADR (CXIPY) QCP 7,500<br />

COHO ENERGY, INC. (COHO) QHO 10,500 **<br />

COLGATE PALMOLIVE CO. CL 25,000 ****<br />

COLUMBIA HCA/HEALTHCARE CORPORATION COL 25,000<br />

COLUMBIA LABORATORIES, INC. COB 7,500<br />

COMAIR HOLDINGS INC. (COMR) KHQ 10,500<br />

COMMONWEALTH INDUSTRIES, INC, (CMIN) LQC 4,500<br />

COMPANHIA CERVEJARIA BRAHMA ADR BRH 10,500<br />

COMPANIA ANONIMA NACIONAL TELEFONOS<br />

DE VENEZUELA VNT 10,500<br />

COMPANIA DE TELECOMUICACIONES CTC *****<br />

DE CHILE S.A.<br />

COMPLETE BUSINESS SOLUTIONS, INC. (CBSL) CQQ 7,500<br />

COMPUCOM SYSTEMS, INC. (CMPC) ICQ 10,500<br />

COMPUSA INC. CPU 25,000<br />

COMPUSERVE CORP. (CSRV) SVW 10,500<br />

COMPUTER ASSOCIATES INTERNATIONAL INC. CA 25,000<br />

COMPUTER HORIZONS CORP. (CHRZ) ZQH 10,500<br />

COMPUTER LEARNING CENTERS, INC. (CLCX) QXT 25,000<br />

COMPUTER SCIENCES CORP. CSC 25,000<br />

COMPUWARE CORPORATION (CPWR) CWQ 25,000<br />

COMSHARE, INC. (CSRE) RQJ 4,500<br />

COMSTOCK RESOURCES INC. CRK 7,500 *<br />

COMVERSE TECHNOLOGY (CMVT) CQV 10,500<br />

CONCENTRA MANAGED CARE, INC. (CCMC) QYS 10,500<br />

CONSECO, INC. CNC *****<br />

CONSOLIDATED FREIGHTWAYS CORP. (CFWY) XQF 7,500<br />

CONSOLIDATED GRAPHICS, INC. CGX 4,500<br />

CONSOLIDATION CAPITAL CORP. (BUYR) QYB 7,500<br />

CONTINENTAL AIRLINES, INC. (CAI.B) CAI 10,500<br />

CORNING INCORPORATED GLW 25,000<br />

CORPORATE EXPRESS, INC. (CEXP) XQP 25,000<br />

CORRECTIONS CORP. OF AMERICA CCA 20,000<br />

COTT CORPORATION (COTTF) CQT 7,500<br />

COULTER PHARMACEUTICAL, INC. (CLTR) QCE 4,500<br />

COVANCE INC. CVD 10,500 * *<br />

COVENTRY HEALTHCARE, INC, (CVTY) OVQ 10,500 * *<br />

COX COMMUNICATIONS COX 10,500<br />

COX RADIO, INC. CXR 4,500<br />

CREATIVE TECHNOLOGY (CREAF) RFQ 25,000<br />

CREE RESEARCH, INC. (CREE) CQR 7,500<br />

CSG SYSTEMS INTERNATIONAL, INC. (CSGS) QGA 7,500<br />

CUMMINS ENGINE COMPANY INC. CUM 7,500<br />

CURATIVE HEALTH SERVICES, INC. (CURE) NQH 4,500<br />

CYBERCASH, INC, (CYCH) KBQ 10,500<br />

CYBERGUARD CORPORATION (CYBG) HFQ 7,500<br />

CYBERONICS, INC. (CYBX) QAJ 10,500<br />

CYLINK CORP. (CYLK) YQB 7,500<br />

CYMER INC. (CYMI) CQG 25,000 ****<br />

CYPRESS SEMICONDUCTOR CORP. CY 25,000<br />

CYPRUS AMAX MINERALS COMPANY CYM 10,500<br />

CYTYC CORP. (CYTC) YQK 10,500<br />

CYTOTHERAPEUTICS, INC. (CTII) QIT 4,500<br />

DAIMLER BENZ AG DAI *****<br />

DAMARK INTERNATIONAL, INC. (DMRK) DQN 4,500<br />

DANA CORPORATION DCN 10,500<br />

DAOU SYSTEMS, INC. (DAOU) QQX 10,500<br />

DARDEN RESTAURANTS, INC. DRI 10,500<br />

DATA BROADCASTING CORP. (DBCC) BQD 7,500<br />

DATA DIMENSIONS INC. (DDIM) QM 10,500<br />

DATAWORKS CORPORATION (DWRX) XBQ 7,500<br />

DAVE & BUSTER’S INC. (DANB) QUB 7,500 *<br />

DEKALB GENETICS CORP.-CLASS B DKB 7,500<br />

DELTA AIR LINES, INC. DAL 20,000 * * *<br />

DELTA & PINE LAND COMPANY DLP 7,500<br />

DELTA WOODSIDE INDUSTRIES, INC. DLW 4,500<br />

DENTSPLY INTERNATIONAL INC. (XRAY) XRQ 7,500

Page 12 July 17, 1998 Volume 26, Number 28 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong><br />

UNDERLYING STOCK SYMBOL POSITION<br />

DETROIT DIESEL CORP. DDC 4,500<br />

DEUTSCHE TELEKOM AG ADR DT 7,500<br />

DIAMOND MULTIMEDIA SYSTEMS, INC (DIMD) DAQ 25,000<br />

DIAMOND OFFSHORE DRILLING, INC. DO 25,000<br />

DIGITAL EQUIPMENT CORP. DEY *****<br />

DOLLAR THRIFTY AUTOMOTIVE GROUP, INC. DTG 7,500<br />

DONALDSON LUFKIN & JENRETTE INC. DLJ *****<br />

DONNA KARAN INTERNATIONAL, INC. DK 7,500 *<br />

DOUBLETREE CORPORATION (TREE) KOZ *****<br />

DOW CHEMICAL CO. DOW 25,000 ****<br />

DRESS BARN INC. (DBRN) DBQ 7,500<br />

DREXLER TECHNOLOGY CORPORATION (DRXR) RXQ 4,500<br />

DSP GROUP, INC. (DSPG) DPQ 10,500 **<br />

DSP COMMUNICATIONS, INC. (DSP) DQC 25,000 ****<br />

DURA PHARMACEUTICALS, INC. (DURA) DQR 25,000<br />

DURAMED PHARMACEUTICALS, INC. (DRMD) DUQ 7,500<br />

E.I. DUPONT DE NEMOURS & CO. DD *****<br />

EAGLE HARDWARE & GARDEN (EAGL) HGQ 10,500<br />

EARTHLINK NETWORK, INC. (ELNK) QKL 7,500<br />

EARTHSHELL CORPORATION (ERTH) QER 10,500<br />

EASTMAN CHEMICAL COMPANY EMN 7,500<br />

EASTMAN KODAK CO. EK 25,000<br />

EATON CORP. ETN 10,500<br />

ECHOSTAR COMMUNICATIONS CORP. (DISH) QHS 7,500<br />

ECI TELECOM LTD. (ECILF) ECQ 10,500<br />

ECOLAB INC. ECL 7,500<br />

8X8, INC. (EGHT) EDQ 7,500<br />

EINSTEIN/NOAH BAGEL CORP. (ENBX) BXQ 10,500 **<br />

ELAN CORPORATION, PLC ADRs ELN 10,500<br />

ELECTRIC LIGHTWAVE, INC. CI A (ELIX) XQQ 7,500<br />

ELECTROGLAS, INC. (EGLS) EIQ 10,500 **<br />

ELECTRONIC ARTS (ERTS) EZQ 25,000<br />

ELECTRO SCIENTIFIC INDUSTRIES, INC. (ESIO) EQO 4,500<br />

ELECTRONICS FOR IMAGING, INC. (EFII) EFQ 25,000<br />

ELF AQUITAINE ADS ELF 10,500<br />

EMC CORP. EMC *****<br />

EMISPHERE TECHNOLOGIES, INC. (EMIS) MTQ 4,500<br />

EMMIS COMMUNICATION CORPORATION (EMMS)QMJ 4,500<br />

EMPLOYEE SOLUTIONS, INC. (ESOL) OQC 25,000 * * *<br />

EMPRESAS ICA SOCIEDAD CONTROLADORA<br />

S.A. DE C.V. ICA 10,500 * *<br />

EMPRESAS LA MODERNA S.A. DE C.V. ELM 4,500<br />

ENCAD, INC. (ENCD) QEM 10,500 * *<br />

ENDOSONICS CORP. (ESON) QEN 7,500<br />

ENERGY GROUP PLC ADS TEG 7,500<br />

ENGLEHARD CORP. EC 10,500<br />

ENRON CORP. ENE 25,000<br />

ENRON OIL & GAS EOG 10,500<br />

ENSCO INTERNATIONAL, INC. ESV 25,000<br />

ENTERGY CORPORATION ETR 25,000<br />

ENTREMED, INC. (ENMD) QMA 10,500<br />

ENZO BIOCHEM, INC. ENZ 4,500<br />

EPITOPE, INC. (EPTO) QTP 4,500<br />

EQUITABLE COMPANIES INCORPORATED EQ 10,500<br />

EQUITY CORPORATION INTERNATIONAL EQU 4,500<br />

ERICSSON (L.M.) TELEPHONE CO. (ERICY) RQC *****<br />

ESC MEDICAL SYSTEMS LIMITED (ESCMF) QFC 10,500<br />

ESS TECHNOLOGY, INC. (ESST) SEQ 25,000 ****<br />

ESTEE LAUDER COMPANIES INC. EL 7,500<br />

E*TRADE GROUP, INC. (EGRP) QGR 25,000<br />

EVEREST REINSURANCE HOLDINGS INC. RE 7,500<br />

EVI WEATHERFORD, INC. EVI *****<br />

E.W. SCRIPPS COMPANY (THE) SSP 4,500<br />

EXABYTE CORPORATION (EXBT) EXQ 10,500 * *<br />

EXCALIBUR TECHNOLOGIES CORP. (EXCA) XQA 4,500<br />

EXCEL COMMUNICATIONS, INC. ECI 10,500<br />

EXCEL TECHNOLOGY, INC. (XLTC) XNQ 7,500 *<br />

EXCITE, INC. (XCIT) KQB 25,000<br />

EXTENDED STAY AMERICA, INC. ESA 10,500 * *<br />

EXXON CORP. XON 25,000<br />

FAMILY GOLF CENTERS (FGCI) JZQ *****<br />

FDX CORPORATION FDX 10,500<br />

FEDDERS CORPORATION FJC 4,500<br />

FEDERATED DEPARTMENT STORES, INC. FD 25,000<br />

FIDELITY NATIONAL FINANCIAL, INC. FNF 4,500<br />

FILA HOLDING SPA ADR FLH 7,500 *<br />

FILENET CORP. (FILE) ILQ 25,000<br />

FINGERHUT CO. INC. FHT 7,500<br />

FINISH LINE, INC. (FINL) FQN 10,500<br />

FIRST AMERICAN CORP. OF TENNESSEE FAM 10,500 * *<br />

FIRST CHICAGO NBD CORPORATION FCN 25,000<br />

FIRST COMMERCE CORPORATION (FCOM/OZQ) OZY 7,500<br />

FIRST DATA CORPORATION FDC 25,000<br />

FIRST HAWAIIAN, INC. (FHWN) WQW 4,500<br />

FIRST HEALTH GROUP CORPORATION (FHCC) HLQ *****<br />

FIRST SECURITY CORPORATION (FSCO) FQB *****<br />

FIRST UNION REAL ESTATE INVESTMENTS FUR 7,500<br />

UNDERLYING STOCK SYMBOL POSITION<br />

FIRSTAR CORP. FSR 10,500<br />

FLORIDA PANTHERS HOLDINGS INC. PAW 4,500<br />

FLOWSERVE CORPORATION FLS 7,500 *<br />

FLUOR CORP. FLR 20,000 * * *<br />

FMC CORPORATION FMC 4,500<br />

FOAMEX INTERNATIONAL, INC. (FMXI) FQX 4,500<br />

FOODMAKER, INC. FM 7,500<br />

FORD MOTOR CO. F *****<br />

FORE SYSTEMS, INC. (FORE) FQO 25,000<br />

FOREST LABORATORIES, INC. FRX *****<br />

FOREST OIL CORP. FST 4,500<br />

FORT JAMES CORPORATION FJ 25,000<br />

FORTE SOFTWARE, INC. (FRTE) RQF 7,500<br />

FOUNDATION HEALTH SYSTEMS, INC. FHS 10,500<br />

FPA MEDICAL MANAGEMENT, INC. (FPAM) FFQ 25,000<br />

FRANCE TELECOM SA, ADR FTE 4,500<br />

FREEPORT-MC MORAN COPPER & GOLD INC. FCX 20,000<br />

FRESENIUS MEDICAL CARE AG ADS FMS 7,500 *<br />

FRIEDE GOLDMAN INTERNATIONAL INC. (FGII) FQG 10,500<br />

FRITZ COMPANIES, INC. (FRTZ) TQZ 7,500 *<br />

FRONTIER CORPORATION FRO 10,500<br />

FRUIT OF THE LOOM INC. FTL 10,500<br />

FSI INTERNATIONAL (FSII) FQH 7,500 *<br />

FUISZ TECHNOLOGIES LTD. (FUSE) QML 7,500<br />

FURNITURE BRANDS INTERNATIONAL, INC. FBN 7,500<br />

GADZOOKS, INC. (GADZ) EQK 10,500 * *<br />

GAP INC. GPS *****<br />

GALILEO INTERNATIONAL, INC. GLC 10,500 * *<br />

GALILEO TECHNOLOGY LTD. (GALTF) QFG 10,500<br />

GALOOB TOYS, INC. GAL 7,500 *<br />

GARDEN RIDGE CORP. (GRDG) DQQ 4,500<br />

GARTNER GROUP (GART) GQT 20,000<br />

GATEWAY 2000 INC. GTW 25,000<br />

GAYLORD CONTAINER CORP. GCR 7,500<br />

GAYLORD ENTERTAINMENT COMPANY GET 7,500 *<br />

GEMSTAR INTERNATIONAL GROUP LTD. (GMSTF) QLF 10,500<br />

GENCORP GY 7,500 *<br />

GENERAL CABLE CORP. GCN *****<br />

GENERAL CIGAR HOLDINGS, INC. MPP 4,500<br />

GENERAL DATACOMM INDUSTRIES, INC. GDC 7,500 *<br />

GENERAL DYNAMICS CO. GD *****<br />

GENERAL ELECTRIC CO. GE 25,000<br />

GENERAL MAGIC, INC. (GMGC) GGQ 25,000<br />

GENERAL MOTORS CORP. GM *****<br />

GENERAL MOTORS CORP. CLASS H GMH 20,000<br />

GENERAL NUTRITION COMPANIES, INC. (GNCI) GQN 25,000<br />

GENESYS TELECOMMUNICATIONS<br />

LABORATORIES, INC. (GCTI) QHF 7,500<br />

GENZYME CORPORATION (GENZ) GZQ 20,000<br />

GENZYME GENERAL DIVISION CORP. (GENZL) YQZ 7,500 *<br />

4,500<br />

GENZYME TRANSGENICS CORPORATION (GZTC) GEQ 4,500<br />

GEOTEL COMMUNICATIONS CORPORATION (GEOC)QEG 7,500<br />

GERON CORPORATION (GERN) GQD 10,500 * *<br />

GILAT SATELLITE NETWORKS LTD. (GILTF) FQI 4,500<br />

GLENAYRE TECHNOLOGIES, INC. (GEMS) GQM 25,000 ****<br />

GLIATECH, INC. (GLIA) QGL 4,500<br />

GLOBAL MARINE, INC. GLM 25,000<br />

GLOBALSTAR TELECOMMUNICATIONS LTD. (GSTRF)YVQ 20,000<br />

GOLDEN STATE BANCORP, INC. GSB *****<br />

GOOD GUYS, INC. (GGUY) GQU 7,500<br />

GPU, INC. GPU 10,500<br />

GRAHAM FIELD HEALTH PRODUCTS GFI 10,500<br />

GRAND CASINOS, INC. GND 10,500 * *<br />

GREAT LAKES CHEMICAL CORPORATION GLK *****<br />

GREENPOINT FINANCIAL CORP. GPT *****<br />

GREEN TREE FINANCIAL CORP. (GNT) UNG *****<br />

GREY WOLF, INC. GW 25,000 ****<br />

GRIFFON CORPORATION GFF 4,500<br />

GRUPO TELEVISA, S.A. TV 25,000 * * *<br />

GRUPO TRIBASA S.A. GTR 10,500 * *<br />

GST TELECOMMUNICATIONS, INC. (GSTX) QGS 7,500<br />

GT INTERACTIVE SOFTWARE CORP. (GTIS) GQB 7,500<br />

GTECH HOLDINGS CORPORATION GTK 7,500<br />

GUCCI GROUP, INC. GUC 10,500<br />

GUESS?, INC. GES 4,500<br />

GUILFORD PHARMACEUTICALS, INC. (GLFD) GQF 7,500 *<br />

GULF CANADA RESOURCES LTD. GOU 25,000<br />

GULF ISLAND FABRICATION, INC. (GIFI) QIF 7,500 *<br />

GULF INDONESIA RESOURCES, LTD. GRL 7,500<br />

GULF SOUTH MEDICAL SUPPLY, INC. (GSMS) MUG 7,500<br />

GULFSTREAM AEROSPACE CORP. GAC 10,500<br />

GYMBOREE CORPORATION (THE) (GYMB) GMQ 10,500<br />

H.J. HEINZ COMPANY HNZ 25,000<br />

HADCO CORPORATION (HDCO) HQO 10,500 * *<br />

HAEMONETICS CORPORATION HAE 4,500<br />

HAIN FOOD, INC. (HAIN) QQH 7,500

July 17, 1998 Volume 26, Number 28 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong> Page 13<br />

UNDERLYING STOCK SYMBOL POSITION<br />

HALLIBURTON CO. HAL *****<br />

HAMBRECHT & QUIST GROUP HQ 7,500<br />

HANSON TRUST, P.L.C. HAN 7,500<br />

HARCOURT GENERAL, INC. H 7,500 *<br />

HARMAN INTERNATIONAL INDUSTRIES, INC. HAR 4,500<br />

HARMONIC LIGHTWAVES, INC. (HLIT) LOQ 7,500<br />

HARRAH’S ENTERTAINMENT, INC. HET 10,500<br />

HARRIS CORP. HRS 7,500<br />

HARTFORD FINANCIAL SERVICES GROUP, INC. (THE)HIG *****<br />

HARTFORD LIFE, INC. HLI 7,500<br />

HEALTH MANAGEMENT ASSOCIATES, INC. HMA 10,500<br />

HEALTH SOUTH CORPORATION HRC 25,000<br />

HEARTPORT INC. (HPRT) HQK 10,500<br />

HEFTEL BROADCASTING CORPORATION<br />

CLASS A (HBCCA) QBH 7,500<br />

HEILIG-MEYERS CO. HMY 10,500 * *<br />

HELENE CURTIS INDUSTRIES INC. RHC 4,500<br />

HELMERICH AND PAYNE INC. HP 10,500<br />

HENRY SCHEIN, INC. (HSIC) HQE 7,500<br />

HERBALIFE INTERNATIONAL INC. (HERBA) HQR 7,500 *<br />

HERMAN MILLER, INC. (MLHR) MHQ *****<br />

HERTZ CORPORATION HRZ 7,500<br />

HEWLETT-PACKARD CO. HWP *****<br />

HFS, INC. (HFS) VFZ *****<br />

HIBERNIA CORP. HIB 10,500<br />

HIGHWOODS PROPERTIES INC. HIW 7,500<br />

HITACHI, LTD. HIT 4,500<br />

HMT TECHNOLOGY CORP. (HMTT) HTQ 25,000 * * *<br />

HOECHST AG HOE 7,500<br />

HOLLINGER INTERNATIONAL, INC. HLR 10,500<br />

HOLLYWOOD ENTERTAINMENT CORP. (HLYW) HWQ 10,500<br />

HOLLYWOOD PARK INC. HPK 7,500 *<br />

HOMEBASE, INC. HBI 7,500<br />

HOMESTAKE MINING CO. HM 25,000<br />

HONEYWELL, INC. HON 10,500<br />

HONG KONG TELECOMMUNICATIONS HKT 10,500<br />

HOSPITALITY PROPERTIES TRUST HPT 4,500<br />

HOUSTON INDUSTRIES INC. HOU 25,000 ****<br />

HRPT PROPERTIES, INC. HRP 10,500<br />

HUBCO, INC. (HUBC) QOE 4,500<br />

HUMANA, INC. HUM 25,000<br />

HUMMINGBIRD COMMUNICATIONS<br />

LTD. (HUMCF) UQH 4,500<br />

HUNTINGTON BANCSHARES INC. (HBAN) HQB *****<br />

HUSSMAN INTERNATIONAL, INC. HSM 7,500<br />

HUTCHINSON TECHNOLOGY, INC. (HTCH) UTQ 25,000 * * *<br />

HYPERION SOFTWARE CORP. (HYSW) QHY 7,500<br />

I-STAT CORP. (STAT) TAQ 4,500<br />

ICG COMMUNICATIONS, INC. (ICGX) QIG 25,000<br />

ICN PHARMACEUTICALS ICN *****<br />

ICOS CORP. (ICOS) IIQ 10,500<br />

IDEXX LABORATORIES, INC. (IDXX) IQX 25,000 * * *<br />

IKON OFFICE SOLUTIONS, INC. IKN 25,000 ****<br />

IKOS SYSTEMS, INC. (IKOS) QIK 7,500 *<br />

IMATION CORP. IMN 7,500<br />

IMC GLOBAL, INC. IGL 10,500<br />

IMCLONE SYSTEMS, INC. (IMCL) QCI 10,500<br />

IMMUNE RESPONSE CORP. (IMNR) IMQ 10,500<br />

IMMUNOMEDICS, INC. (IMMU) QUI 7,500<br />

IMNET SYSTEMS, INC. (IMNT) IWQ 10,500 * *<br />

IMPERIAL CHEMICAL INDUSTRIES PLC ADR ICI 7,500<br />

IMPERIAL CREDIT INDUSTRIES, INC. (ICII) BQJ 10,500 * *<br />

IMPERIAL OIL LTD. IMO *****<br />

INDEPENDECE COMMUNITY BANK (ICBC) QYC 10,500<br />

INDIGO N.V. (INDGF) DQF 7,500<br />

INDUSTRY-MATEMATIK I INTERNATIONAL<br />

CORPORATION (IMIC) QVU 7,500<br />

IN FOCUS SYSTEMS, INC. (INFS) IQL *****<br />

INFORMATION MANAGEMENT RESOURCES,<br />

INC. (IMRS) QIQ *****<br />

INFORMATION RESOURCES, INC. (IRIC) IRQ 7,500<br />

INFORMIX CORP. (IFMX) IFQ 25,000<br />

ING GROEP NV ADR ING 7,500 *<br />

INGERSOLL RAND COMPANY IR 10,500<br />

INGRAM MICRO, INC. IM 10,500<br />

INNOVEX, INC. (INVX) IVQ 10,500<br />

INPRISE CORPORATION (INPR) BLQ 25,000 * * *<br />

INPUT/OUTPUT, INC. IO 10,500 * *<br />

INTEGRATED CIRCUIT SYSTEMS INC. (ICST) IBQ 10,500<br />

INTEGRATED DEVICE TECHNOLOGY, INC. (IDTI) ITQ 25,000<br />

INTEGRATED HEALTH SERVICES INC. IHS 7,500<br />

INTERMAGNETICS GENERAL CORPORATION IMG 4,500<br />

INTEGRATED PROCESS EQUIPMENT<br />

CORPORATION (IPEC) IQP 20,000 * * *<br />

UNDERLYING STOCK SYMBOL POSITION<br />

INTEGRATED SILICON SOLUTION, INC. (ISSI) IXQ 10,500 * *<br />

IINTL BUSINESS MACHINES CORP. IBM *****<br />

INTERIM SERVICE INC. IS 7,500<br />

INTERNT’L FLAVORS & FRAGRANCES INC. IFF 10,500<br />

INTERNATIONAL PAPER CO. IP 25,000<br />

INTERNATIONAL RECTIFIER CORP. IRF 10,500 * *<br />

INTERPUBLIC GROUP OF COMPANIES INC. IPG 10,500<br />

INTERSOLV, INC. (ISLI) IQV 10,500<br />

INTERSTATE BAKERIES CORP. IBC 7,500<br />

NTERVOICE, INC. (INTV) VQN 4,500<br />

INTIMATE BRANDS, INC. IBI 10,500<br />

INTUIT CORP. (INTU) IQU 25,000<br />

INVISION TECHNOLOGIES, INC. (INVN) VYQ 7,500<br />

IOMEGA CORP. IOM *****<br />

IONA TECHNOLOGIES PLC (IONAY) YWQ 7,500 *<br />

IRI INTERNATIONAL CORPORATION IIR 7,500<br />

IRIDIUM WORLD COMMUNICATION, INC. (IRIDF) QAK 10,500<br />

ISIS PHARMACEUTICALS, INC. (ISIP) QIS 7,500<br />

ITEQ, INC. (ITEQ) QIE 10,500<br />

ITT CORP. (ITT) IZT *****<br />

ITT INDUSTRIES, INC. IIN 7,500<br />

IVAX CORP. IVX 10,500<br />

JABIL CIRCUIT, INC. JBL 25,000<br />

JACKPOT ENTERPRISES, INC. J 4,500<br />

J.D. EDWARDS & COMPANY (JDEC) QJD 10,500<br />

JDA SOFTWARE GROUP, INC. (JDAS) QAH *****<br />

JEFFERSON SMURFIT CORP. (JJSC) JJQ 7,500<br />

JLG INDUSTRIES, INC. JLG 7,500<br />

JOHN H. HARLAND COMPANY JH 7,500<br />

JOHN MANVILLE CORPORATION JM 4,500<br />

JOHNSON & JOHNSON JNJ 25,000<br />

JONES APPAREL GROUP, INC. JNY *****<br />

JONES PHARMA INCORPORATED (JMED) JQM 20,000 * * *<br />

JOSTENS INC. JOS 4,500<br />

JUST FOR FEET, INC. (FEET) JQF 10,500<br />

K MART CORP. KM 25,000<br />

KEEBLER FOODS COMPANY KBL 7,500<br />

KELLSTROM INDUSTRIES, INC. (KELL) KQC 7,500<br />

KELLY SERVICES INC. CL.A (KELYA) YQE 4,500<br />

KEMET COPORATION (KMET) KQE 10,500 * *<br />

KENT ELECTRONICS CORP. KNT 7,500<br />

KERR-MCGEE CORP. KMG 7,500<br />

KEYSTONE FINANCIAL, INC. (KSTN) QPX 4,500<br />

KINDER MORGAN ENERGY PARTNERS LP ENP 4,500<br />

KLA -TENCOR CORPORATION (KLAC) KCQ 25,000<br />

KLM ROYAL DUTCH AIRLINES ADRS KLM 7,500<br />

KIRBY CORP. KEX 4,500<br />

KOHL’S CORPORATION KSS *****<br />

KOPIN CORP. (KOPN) KQO 4,500<br />

KULICKE AND SOFFA INDUSTRIES, INC. (KLIC) KQS 25,000 * * *<br />

LANCASTER COLONY CORP. (LANC) LCQ *****<br />

LAND’S END, INC. LE 4,500<br />

LANDRY’S SEAFOOD RESTAURANTS,<br />

INC. (LDRY) YQR 10,500<br />

LA QUINTA INNS INC. LQI 10,500<br />

LASER VISION CENTERS, INC. (LVCI) QVL 4,500<br />

LATTICE SEMICONDUCTOR CORP. (LSCC) LQT 25,000 * * *<br />

LCI INTERNATIONAL, INC. (LCI) LCZ *****<br />

LEARNING COMPANY (THE) TLC 10,500<br />

LEGG MASON, INC. LM 4,500<br />

LEGATO SYSTEMS, INC. (LGTO) EQN *****<br />

LEHMAN BROTHERS HOLDING CORP. LEH 20,000<br />

LEVEL ONE COMMUNICATIONS, INC. (LEVL) LVQ *****<br />

LEVEL THREE COMMUNICATIONS, INC. (LVLT) QHN 10,500<br />

LEXMARK INTERNATIONAL GROUP, INC. LXK 10,500<br />

LIMITED, INC. LTD *****<br />

LIPOSOME COMPANY INC. (LIPO) LPQ 25,000 * * *<br />

LITTON INDUSTRIES, INC. LIT 7,500<br />

LIZ CLAIBORNE, INC. LIZ 10,500<br />

LOEWEN GROUP, INC. LWN 7,500<br />

LOEWS CORPORATION LTR 7,500<br />

LOJACK CORPORATION (LOJN) LQJ 4,500<br />

LONE STAR STEAKHOUSE AND<br />

SALOON, INC. (STAR) LQS 25,000 ****<br />

LONG BEACH FINANCIAL CORP. (LBFC) QBB 10,500 * *<br />

LONG ISLAND BANCORP, INC. (LISB) LBQ 10,500<br />

LONG ISLAND LIGHTING COMPANY LIL 10,500<br />

LONGVIEW FIBRE COMPANY LFB 7,500 *<br />

LORAL SPACE & COMMUNICATIONS LTD. LOR 25,000<br />

LSI LOGIC CORP. LSI 25,000<br />

LTX CORP. (LTXX) XQT 10,500 * *<br />

LTV CORPORATION LTV 10,500<br />

LUCASVARITY PLC LVA 7,500 *<br />

LUCENT TECHNOLOGIES INC. LU *****<br />

LYCOS, INC. (LCOS) QWL 25,000

Page 14 July 17, 1998 Volume 26, Number 28 The Chicago Board Options <strong>Exchange</strong> <strong>Bulletin</strong><br />

UNDERLYING STOCK SYMBOL POSITION<br />

LYONDELL PETROCHEMICAL COMPANY LYO 10,500<br />

MACHROCHEM CORPORATION (MCHM) QQ 7,500<br />

MADERAS Y SINTETICOS S. A. ADS MYS 4,500<br />

MAGAININ PHARMACEUTICALS INC. (MAGN) NQG 7,500<br />

MADGE, N.V. (MADGF) MQE 20,000 * * *<br />

MAGNA INTERNATIONAL INC. MGA 10,500<br />

M.A. HANNA COMPANY MAH 7,500<br />

MALLINCKRODT GROUP INC. MKG 10,500 * *<br />

MANPOWER INC. MAN 10,500<br />

MANUGISTICS GROUP, INC. (MANU) ZUQ 25,000<br />

MARINE DRILLING COMPANIES INC. (MDCO) QDM 25,000<br />

MARINER HEALTH GROUP, INC. (MRNR) MQO 7,500<br />

MARK IV INDUSTRIES IV 7,500<br />

MARKET SPAN CORPORATION MN 10,500<br />

MASCOTECH, INC. MSX 7,500<br />

MAY DEPARTMENT STORES MAY 20,000 * * *<br />

MAYTAG CORPORATION MYG 10,500<br />

MBNA CORPORATION KRB *****<br />

MCDONALD’S CORP. MCD 25,000<br />

MCI COMMUNICATIONS CORP. (MCIC) MCQ 25,000<br />

MCLEOD USA (MCLD) QMD 7,500<br />

MEAD CORP. MEA 10,500<br />

MEDAPHIS CORP. (MEDA) MQA 25,000<br />

MEDAREX, INC. (MEDX) XDQ 7,500<br />

MEDICIS PHARMACEUTICAL CORP. (MDRX) MXQ 10,500<br />

MEDTRONIC INC. MDT 25,000<br />

MELLON BANK CORPORATION MEL 25,000<br />

MEMC ELECTRONIC MATERIALS, INC. WFR 7,500 *<br />

MERCANTILE BANCSHARES CORP. (MRBK) QKM 7,500<br />

MERCER INTERNATIONAL, INC. (MERCS) MQC 4,500<br />

MERCK & CO. MRK 25,000<br />

MERCURY INTERACTIVE CORP. (MERQ) RQB 10,500<br />

MERITOR AUTOMOTIVE, INC. MRA 7,500<br />

MERRILL LYNCH & CO., INC. MER *****<br />

MESA AIRLINES, INC. (MESA) EAQ 7,500<br />

METACREATIONS CORPORATION (MCRE) MQZ 10,500<br />

METAMOR WORLDWIDE, INC. (MMWW) EQB 10,500<br />

METHANEX CORP. (MEOHF) MQN 4,500<br />

METRICOM, INC. (MCOM) MQM 7,500 *<br />

METRO-GOLDWYN-MAYER, INC. MGM 4,500<br />

METROMEDIA FIBER NETWORK, INC. (MFNX) QFN 7,500<br />

METROMEDIA INTERNATIONAL GROUP, INC. MMG 7,500<br />

MEXICO FUND INC. MXF 7,500<br />

MGI PHARMA, INC. (MOGN) QOG 4,500<br />

MICREL, INC. (MCRL) MIQ 7,500<br />

MICROAGE INC. (MICA) MQI 10,500<br />

MICROCHIP TECHNOLOGY INC. (MCHP) QMT 25,000<br />

MICROGRAFX, INC. (MGXI) XQG 4,500<br />

MICRON ELECTRONICS, INC. (MUEI) MQU 25,000<br />

MICRON TECHNOLOGY INC. MU 25,000<br />

MICROTOUCH SYSTEMS, INC. (MTSI) TQM 4,500<br />

MIDAS, INC. MDS 4,500<br />

MIDWAY GAMES, INC. MWY 7,500<br />

MILLENNIUM CHEMICALS INC. MCH 10,500 * *<br />

MILLICOM INT’L. CELLULAR S.A. (MICCF) MQS 7,500<br />

MINNESOTA MINING &<br />

MANUFACTURING CO. MMM *****<br />

MITCHAM INDUSTRIES, INC. (MIND) QMU 7,500<br />

MMC NETWORKS, INC. (MMCN) CMQ 7,500<br />

MOBIL CORP. MOB *****<br />

MORGAN STANLEY DEAN WITTER & CO. MWD 25,000<br />

MOLEX INC. (MOLX) MOQ 10,500<br />

MOLEX, INC. CLASS A (MOLXA) EQD 10,500<br />