In English - Bharat Heavy Electricals Ltd.

In English - Bharat Heavy Electricals Ltd.

In English - Bharat Heavy Electricals Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(b) Liquidated damages are provided in line with<br />

the Accounting Policy of the company and the<br />

same is dealt suitably in the accounts on<br />

settlement or otherwise. Contingent liability<br />

relating to liquidated damages is shown in<br />

point no. 5 of Note no. 33.<br />

(c) The provision for contractual obligation is made<br />

at the rate of 2.5% of the contract revenue in<br />

line with significant Accounting Policy No.13<br />

to meet the warranty obligations as per the<br />

terms and conditions of the contract. The same<br />

is retained till the completion of the warranty<br />

obligations of the contract. The actual<br />

expenses on warranty obligation may vary<br />

from contract to contract and on year to year<br />

depending upon the terms and conditions of<br />

the respective contract.<br />

21. Previous year’s figures have been rearranged/<br />

regrouped wherever practicable to make them<br />

comparable to current year’s presentation and<br />

rounded off to the nearest thousand rupees. Further,<br />

previous year figures are given in the revised<br />

Schedule VI format as notified by the Ministry of<br />

Corporate Affairs from the current financial year<br />

2011-12.<br />

22. Liability due to micro and small enterprises has<br />

been determined on the basis of database of such<br />

undertakings created by units/divisions based on<br />

the responses received from suppliers/subcontractors<br />

as to their status and is given below:<br />

2011-12 2010-11<br />

` Lakh ` Lakh<br />

Total outstanding dues<br />

of Micro & Small<br />

Enterprises NIL NIL<br />

23. Revenue recognition as per Significant accounting<br />

policy No: 9A, has been carried out in respect all<br />

relevant orders.<br />

24. Balances shown under debtors, creditors,<br />

contractor’s advances, deposits and stock/ materials<br />

lying with sub-contractors/fabricators are subject to<br />

confirmation, reconciliation and consequential<br />

adjustment, if any. The reconciliation is carried out<br />

ongoing basis & provisions wherever considered<br />

necessary have been made in line with the<br />

guidelines.<br />

ANNUAL REPORT 2011-12<br />

192<br />

25. Disclosure requirements of Accounting Standards<br />

3, 7(R), 15(R), 17, 20, 21, 22 & 27 and Part IV of<br />

Schedule VI of Companies Act are made at<br />

company level.<br />

(a) Accounting Standard 17 - The Company<br />

operates in a single primary business namely<br />

Fabrication / Erection on turnkey basis or<br />

otherwise. The components manufactured by<br />

the Company are meant for utilization in such<br />

projects only. Therefore, the Company feels<br />

no separate disclosure is required.<br />

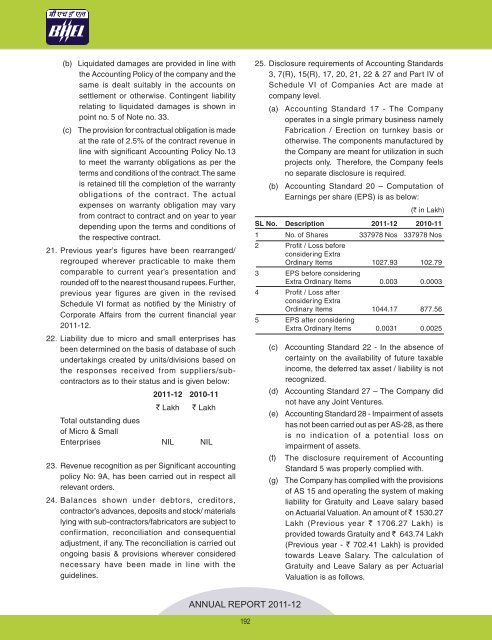

(b) Accounting Standard 20 – Computation of<br />

Earnings per share (EPS) is as below:<br />

(s in Lakh)<br />

SL No. Description 2011-12 2010-11<br />

1 No. of Shares 337978 Nos 337978 Nos<br />

2 Profit / Loss before<br />

considering Extra<br />

Ordinary Items 1027.93 102.79<br />

3 EPS before considering<br />

Extra Ordinary Items 0.003 0.0003<br />

4 Profit / Loss after<br />

considering Extra<br />

Ordinary Items 1044.17 877.56<br />

5 EPS after considering<br />

Extra Ordinary Items 0.0031 0.0025<br />

(c) Accounting Standard 22 - <strong>In</strong> the absence of<br />

certainty on the availability of future taxable<br />

income, the deferred tax asset / liability is not<br />

recognized.<br />

(d) Accounting Standard 27 – The Company did<br />

not have any Joint Ventures.<br />

(e) Accounting Standard 28 - Impairment of assets<br />

has not been carried out as per AS-28, as there<br />

is no indication of a potential loss on<br />

impairment of assets.<br />

(f) The disclosure requirement of Accounting<br />

Standard 5 was properly complied with.<br />

(g) The Company has complied with the provisions<br />

of AS 15 and operating the system of making<br />

liability for Gratuity and Leave salary based<br />

on Actuarial Valuation. An amount of ` 1530.27<br />

Lakh (Previous year ` 1706.27 Lakh) is<br />

provided towards Gratuity and ` 643.74 Lakh<br />

(Previous year - ` 702.41 Lakh) is provided<br />

towards Leave Salary. The calculation of<br />

Gratuity and Leave Salary as per Actuarial<br />

Valuation is as follows.