ANNUAL REPORT LAPORAN TAHUNAN - Berjaya Corp

ANNUAL REPORT LAPORAN TAHUNAN - Berjaya Corp

ANNUAL REPORT LAPORAN TAHUNAN - Berjaya Corp

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

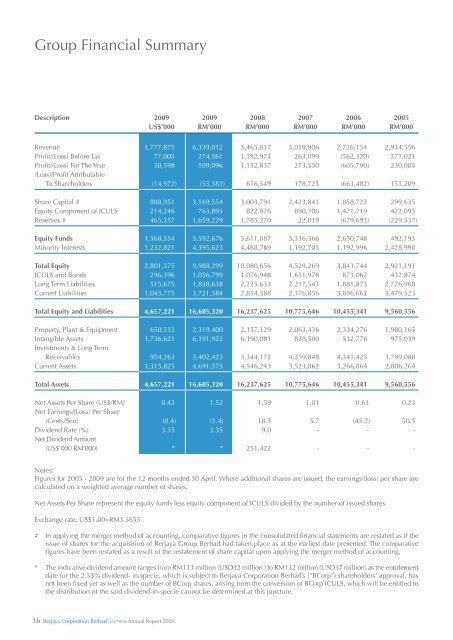

Group Financial Summary<br />

Description 2009 2009 2008 2007 2006 2005<br />

us$’000 Rm’000 Rm’000 Rm’000 Rm’000 Rm’000<br />

Revenue 1,777,875 6,339,012 3,465,837 3,019,906 2,726,154 2,934,556<br />

Profit/(Loss) Before Tax 77,005 274,561 1,192,973 263,099 (562,320) 371,021<br />

Profit/(Loss) For The Year 30,598 109,096 1,152,837 273,350 (605,790) 230,005<br />

(Loss)/Profit Attributable<br />

To Shareholders (14,972) (53,383) 616,549 178,723 (663,402) 151,209<br />

Share Capital # 888,951 3,169,554 3,003,791 2,423,841 1,858,722 299,635<br />

Equity Component of ICULS 214,246 763,893 822,826 890,706 1,471,719 422,095<br />

Reserves # 465,357 1,659,229 1,785,270 22,019 (679,693) (229,537)<br />

Equity Funds 1,568,554 5,592,676 5,611,887 3,336,566 2,650,748 492,193<br />

Minority Interests 1,232,821 4,395,623 4,468,769 1,192,703 1,192,996 2,428,998<br />

Total Equity 2,801,375 9,988,299 10,080,656 4,529,269 3,843,744 2,921,191<br />

ICULS and Bonds 296,396 1,056,799 1,076,948 1,651,978 873,062 432,874<br />

Long Term Liabilities 515,675 1,838,638 2,225,633 2,217,543 1,881,873 2,726,968<br />

Current Liabilities 1,043,775 3,721,584 2,854,388 2,376,856 3,856,662 3,479,523<br />

Total Equity and liabilities 4,657,221 16,605,320 16,237,625 10,775,646 10,455,341 9,560,556<br />

Property, Plant & Equipment 650,512 2,319,400 2,157,129 2,063,436 2,334,276 1,980,165<br />

Intangible Assets 1,736,621 6,191,922 6,190,081 828,500 512,776 975,039<br />

Investments & Long Term<br />

Receivables 954,263 3,402,423 3,344,172 4,359,848 4,341,425 3,799,088<br />

Current Assets 1,315,825 4,691,575 4,546,243 3,523,862 3,266,864 2,806,264<br />

Total Assets 4,657,221 16,605,320 16,237,625 10,775,646 10,455,341 9,560,556<br />

Net Assets Per Share (US$/RM) 0.43 1.52 1.59 1.01 0.63 0.23<br />

Net Earnings/(Loss) Per Share<br />

(Cents/Sen) (0.4) (1.4) 18.5 5.7 (45.2) 50.5<br />

Dividend Rate (%) 3.35 3.35 9.0 - - -<br />

Net Dividend Amount<br />

(US$’000 RM’000) * * 251,422 - - -<br />

Notes:<br />

Figures for 2005 - 2009 are for the 12 months ended 30 April. Where additional shares are issued, the earnings/(loss) per share are<br />

calculated on a weighted average number of shares.<br />

Net Assets Per Share represent the equity funds less equity component of ICULS divided by the number of issued shares.<br />

Exchange rate: US$1.00=RM3.5655<br />

# In applying the merger method of accounting, comparative figures in the consolidated financial statements are restated as if the<br />

issue of shares for the acquisition of <strong>Berjaya</strong> Group Berhad had taken place as at the earliest date presented. The comparative<br />

figures have been restated as a result of the restatement of share capital upon applying the merger method of accounting.<br />

* The indicative dividend amount ranges from RM113 million (USD32 million ) to RM132 million (USD37 million) as the entitlement<br />

date for the 2.35% dividend- in-specie, which is subject to <strong>Berjaya</strong> <strong>Corp</strong>oration Berhad’s (“B<strong>Corp</strong>”) shareholders’ approval, has<br />

not been fixed yet as well as the number of B<strong>Corp</strong> shares, arising from the conversion of B<strong>Corp</strong> ICULS, which will be entitled to<br />

the distribution of the said dividend-in-specie cannot be determined at this juncture.<br />

36 <strong>Berjaya</strong> <strong>Corp</strong>oration Berhad (554790-X) Annual Report 2009