Newsletter June 2012 - Association of Engineers Kerala

Newsletter June 2012 - Association of Engineers Kerala

Newsletter June 2012 - Association of Engineers Kerala

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Association</strong> <strong>Association</strong> <strong>of</strong> <strong>of</strong> <strong>Engineers</strong> <strong>Engineers</strong> <strong>Kerala</strong><br />

<strong>Kerala</strong><br />

within the prescribed period or if the appellant is not<br />

satisfied with the order <strong>of</strong> the Appellate Authority, he may<br />

prefer a second appeal with the Information Commission.<br />

Where the Information Commission at the time <strong>of</strong><br />

deciding the complaint or appeal is <strong>of</strong> the opinion that<br />

the Public Information Officer has without any reasonable<br />

cause, refused to receive an application for information<br />

or not furnished information within the time specified,<br />

or malafidely denied the request for information or<br />

Thought Thought <strong>of</strong> <strong>of</strong> the the day<br />

day<br />

The most discussed topic, now a days, among the<br />

Service personnel is the PFRDA bill (The Pension Fund<br />

Regulatory and Development Authority Bill, 2011). Let<br />

us have brief note on how the New Pension Scheme (NPS<br />

) as envisaged in PFRDA bill differ from present General<br />

pension Scheme. Our present pension scheme is a Defined<br />

Benefit Scheme( DB system). The pension amount is<br />

linked to the pay drawn, number <strong>of</strong> years <strong>of</strong> service etc.,<br />

and there is no direct contribution <strong>of</strong> the employee or<br />

employer towards a pension fund. Here the entire<br />

investment risk is borne by the pension fund manager<br />

which is the government.<br />

Traditionally, a large proportion <strong>of</strong> pension funds<br />

around the world have been <strong>of</strong> the DB type. However,<br />

many have been under funded, and some have collapsed<br />

6<br />

knowingly given incorrect, incomplete or misleading<br />

information or destroyed information, it shall impose<br />

penalty <strong>of</strong> Rs. 250/- each day till information is furnished<br />

subject to the condition that the total amount <strong>of</strong> penalty<br />

shall not exceed Rs. 25,000/-<br />

The ultimate aim <strong>of</strong> Right to Information Act is to<br />

have well informed citizenry, which is aware <strong>of</strong> its rights,<br />

and well trained <strong>of</strong>ficers <strong>of</strong> Public Authorities who are<br />

aware <strong>of</strong> therir duties and functions under the Act.<br />

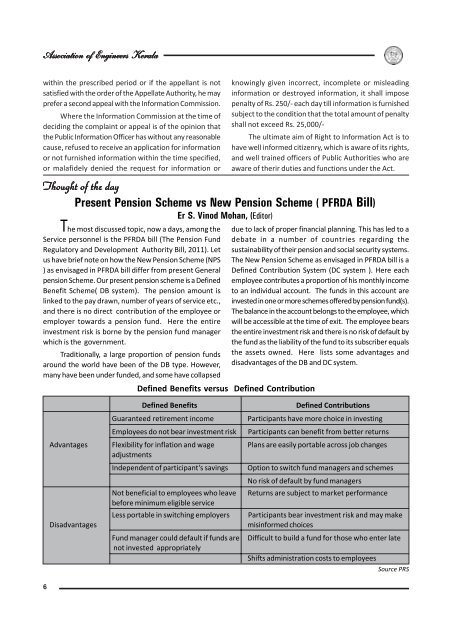

Present Pension Scheme vs New Pension Scheme ( PFRDA Bill)<br />

Er S. Vinod Mohan, (Editor)<br />

Defined Benefits versus Defined Contribution<br />

due to lack <strong>of</strong> proper financial planning. This has led to a<br />

debate in a number <strong>of</strong> countries regarding the<br />

sustainability <strong>of</strong> their pension and social security systems.<br />

The New Pension Scheme as envisaged in PFRDA bill is a<br />

Defined Contribution System (DC system ). Here each<br />

employee contributes a proportion <strong>of</strong> his monthly income<br />

to an individual account. The funds in this account are<br />

invested in one or more schemes <strong>of</strong>fered by pension fund(s).<br />

The balance in the account belongs to the employee, which<br />

will be accessible at the time <strong>of</strong> exit. The employee bears<br />

the entire investment risk and there is no risk <strong>of</strong> default by<br />

the fund as the liability <strong>of</strong> the fund to its subscriber equals<br />

the assets owned. Here lists some advantages and<br />

disadvantages <strong>of</strong> the DB and DC system.<br />

Defined Benefits Defined Contributions<br />

Guaranteed retirement income Participants have more choice in investing<br />

Employees do not bear investment risk Participants can benefit from better returns<br />

Advantages Flexibility for inflation and wage<br />

adjustments<br />

Plans are easily portable across job changes<br />

Independent <strong>of</strong> participant’s savings Option to switch fund managers and schemes<br />

No risk <strong>of</strong> default by fund managers<br />

Not beneficial to employees who leave<br />

before minimum eligible service<br />

Returns are subject to market performance<br />

Less portable in switching employers Participants bear investment risk and may make<br />

Disadvantages misinformed choices<br />

Fund manager could default if funds are<br />

not invested appropriately<br />

Difficult to build a fund for those who enter late<br />

Shifts administration costs to employees<br />

Source PRS