Retail Industry Global Report — 2010 - Ascendant Capital Advisors

Retail Industry Global Report — 2010 - Ascendant Capital Advisors

Retail Industry Global Report — 2010 - Ascendant Capital Advisors

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Future Outlook<br />

Even though retail sales exhibited signs of recovery towards<br />

the beginning of <strong>2010</strong>, there is skepticism regarding the retail<br />

outlook for the developed economies. Western Europe will<br />

remain depressed, restrained by markets such as Ireland,<br />

Spain and the UK, which continue to face problems such as high<br />

government borrowing, household debt and unemployment.<br />

North America is expected to witness a slight improvement but<br />

growth will be subdued because of more jobless claims. Multistore<br />

chains continue to respond to recessed retail consumption<br />

with store closings. The number of retail store closures<br />

in <strong>2010</strong> so far appears to be lower compared to that in 2009.<br />

However, it is still significant. Despite this, global retail sales<br />

growth is expected to be 7.3 percent in <strong>2010</strong>, before slowing to<br />

5.8 percent in 2011 and then rising again to 7.4 percent in 2012.<br />

In terms of volume growth, the global retail market is expected<br />

to return to comparable pre-2008 levels only by 2011 1 .<br />

To survive in these tough times, retailers must increasingly<br />

look to enhance their multi-channel retailing capabilities, as<br />

customers are tending to purchase more and more through<br />

multiple channels.<br />

The best performers in the retail industry will be those that<br />

optimally combine the brick-and-mortar experience with the<br />

electronic retailing experience, keeping in mind the interest<br />

of the customer. Given the pessimism prevailing in the retail<br />

segment, non-store and online sales will likely remain strong as<br />

1 EIU<br />

buyers will continue to buy online to obtain lower prices.<br />

Off-mall value specialty stores and small-ticket discretionary<br />

categories may see a return to profitability and growth.<br />

It is expected that in the next couple of years online sales will<br />

be shipped directly from the manufacturer to the consumer on<br />

a just-in-time basis. Internet retailing through mobile devices<br />

offers a huge opportunity for growth, as growth in traditional<br />

online retail matures. This can be primarily attributed to the<br />

expected global growth in mobile Internet usage.<br />

Whatever the future holds, the Internet will continue to break<br />

down barriers to create a level playing field for companies,<br />

countries and individuals around the world.<br />

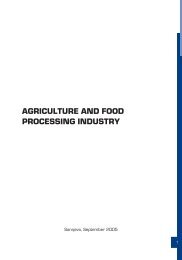

<strong>Global</strong> <strong>Retail</strong> Sales<br />

<strong>Retail</strong> Sales<br />

(USD billion)<br />

<strong>Retail</strong><br />

Growth Rate<br />

Online Sales<br />

(USD billion)<br />

Online<br />

Growth Rate<br />

IMAP’s <strong>Retail</strong> <strong>Industry</strong> <strong>Global</strong> <strong>Report</strong> <strong>—</strong> <strong>2010</strong>: Page 10<br />

2005 2006 2007 2008 2009<br />

11,100 11,900 13,200 14,500 13,900<br />

– 7.2% 10.9% 9.8% -4.1%<br />

181 222 271 304 349<br />

– 22.7% 22.1% 12.4% 14.5%<br />

Source: EIU, August <strong>2010</strong>