Retail Industry Global Report — 2010 - Ascendant Capital Advisors

Retail Industry Global Report — 2010 - Ascendant Capital Advisors

Retail Industry Global Report — 2010 - Ascendant Capital Advisors

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

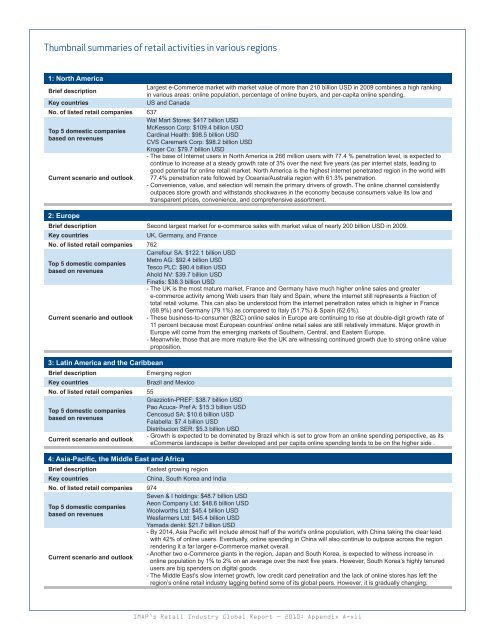

Thumbnail summaries of retail activities in various regions<br />

1: North America<br />

Brief description<br />

Largest e-Commerce market with market value of more than 210 billion USD in 2009 combines a high ranking<br />

in various areas: online population, percentage of online buyers, and per-capita online spending.<br />

Key countries US and Canada<br />

No. of listed retail companies 637<br />

Top 5 domestic companies<br />

based on revenues<br />

Current scenario and outlook<br />

2: Europe<br />

Wal Mart Stores: $417 billion USD<br />

McKesson Corp: $109.4 billion USD<br />

Cardinal Health: $98.5 billion USD<br />

CVS Caremark Corp: $98.2 billion USD<br />

Kroger Co: $79.7 billion USD<br />

- The base of Internet users in North America is 266 million users with 77.4 % penetration level, is expected to<br />

continue to increase at a steady growth rate of 3% over the next five years (as per internet stats, leading to<br />

good potential for online retail market. North America is the highest internet penetrated region in the world with<br />

77.4% penetration rate followed by Oceania/Australia region with 61.3% penetration.<br />

- Convenience, value, and selection will remain the primary drivers of growth. The online channel consistently<br />

outpaces store growth and withstands shockwaves in the economy because consumers value its low and<br />

transparent prices, convenience, and comprehensive assortment.<br />

Brief description Second largest market for e-commerce sales with market value of nearly 200 billion USD in 2009.<br />

Key countries UK, Germany, and France<br />

No. of listed retail companies 762<br />

Top 5 domestic companies<br />

based on revenues<br />

Current scenario and outlook<br />

3: Latin America and the Caribbean<br />

Carrefour SA: $122.1 billion USD<br />

Metro AG: $92.4 billion USD<br />

Tesco PLC: $90.4 billion USD<br />

Ahold NV: $39.7 billion USD<br />

Finatis: $38.3 billion USD<br />

Brief description Emerging region<br />

Key countries Brazil and Mexico<br />

No. of listed retail companies 55<br />

Top 5 domestic companies<br />

based on revenues<br />

Current scenario and outlook<br />

4: Asia-Pacific, the Middle East and Africa<br />

- The UK is the most mature market. France and Germany have much higher online sales and greater<br />

e-commerce activity among Web users than Italy and Spain, where the internet still represents a fraction of<br />

total retail volume. This can also be understood from the internet penetration rates which is higher in France<br />

(68.9%) and Germany (79.1%) as compared to Italy (51.7%) & Spain (62.6%).<br />

- These business-to-consumer (B2C) online sales in Europe are continuing to rise at double-digit growth rate of<br />

11 percent because most European countries’ online retail sales are still relatively immature. Major growth in<br />

Europe will come from the emerging markets of Southern, Central, and Eastern Europe.<br />

- Meanwhile, those that are more mature like the UK are witnessing continued growth due to strong online value<br />

proposition.<br />

Grazziotin-PREF: $38.7 billion USD<br />

Pao Acuca- Pref A: $15.3 billion USD<br />

Cencosud SA: $10.6 billion USD<br />

Falabella: $7.4 billion USD<br />

Distribucion SER: $5.3 billion USD<br />

Brief description Fastest growing region<br />

Key countries China, South Korea and India<br />

No. of listed retail companies 974<br />

Top 5 domestic companies<br />

based on revenues<br />

Current scenario and outlook<br />

- Growth is expected to be dominated by Brazil which is set to grow from an online spending perspective, as its<br />

eCommerce landscape is better developed and per capita online spending tends to be on the higher side .<br />

Seven & I holdings: $48.7 billion USD<br />

Aeon Company Ltd: $48.6 billion USD<br />

Woolworths Ltd: $45.4 billion USD<br />

Wesfarmers Ltd: $45.4 billion USD<br />

Yamada denki: $21.7 billion USD<br />

- By 2014, Asia Pacific will include almost half of the world’s online population, with China taking the clear lead<br />

with 42% of online users. Eventually, online spending in China will also continue to outpace across the region<br />

rendering it a far larger e-Commerce market overall.<br />

- Another two e-Commerce giants in the region, Japan and South Korea, is expected to witness increase in<br />

online population by 1% to 2% on an average over the next five years. However, South Korea’s highly tenured<br />

users are big spenders on digital goods.<br />

- The Middle East’s slow internet growth, low credit card penetration and the lack of online stores has left the<br />

region’s online retail industry lagging behind some of its global peers. However, it is gradually changing.<br />

IMAP’s <strong>Retail</strong> <strong>Industry</strong> <strong>Global</strong> <strong>Report</strong> <strong>—</strong> <strong>2010</strong>: Appendix A-xii