2008 - Twin Cities Habitat for Humanity

2008 - Twin Cities Habitat for Humanity

2008 - Twin Cities Habitat for Humanity

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Homeowner Story: Molly<br />

Months of searching <strong>for</strong> a home had worn Molly down. Each house she and her husband<br />

visited told its own story; too costly, unsafe neighborhood, run-down, no park nearby.<br />

“Then we found this absolute gem of a place in South Minneapolis,” exclaimed Molly.<br />

The couple closed on the property in December of 2005.<br />

Un<strong>for</strong>tunately within a few months of the purchase Molly and her husband divorced,<br />

leaving her with full responsibility <strong>for</strong> the mortgage. It didn’t take long <strong>for</strong> the luster of<br />

being a homeowner to wear off.<br />

Searching <strong>for</strong> answers she sought out a friend who worked in banking. With his assistance<br />

she was able to negotiate a new mortgage with fixed payments <strong>for</strong> the next three years.<br />

Our program provided<br />

the first steps toward<br />

her living a healthier life<br />

But nothing could have prepared Molly <strong>for</strong> what<br />

the next few weeks would bring. Within just four<br />

days she signed her final divorce papers and was<br />

diagnosed with breast cancer. For the first time<br />

in Molly’s life she was <strong>for</strong>ced to lean on others <strong>for</strong><br />

support. Recovering from a double-mastectomy, she<br />

moved back home with her parents and was out of<br />

work <strong>for</strong> months.<br />

Even as she coped with these un<strong>for</strong>tunate conditions, Molly reached out to her mortgage<br />

company to be sure they were aware of her situation. Despite these attempts her calls<br />

were seldom returned.<br />

“No one would talk to me. I couldn’t get a consistent person, let alone consistent<br />

answers,” said Molly. “I returned to work as soon as I could and made a double-payment<br />

in December so that I wouldn’t be more than three months behind on my mortgage<br />

and move into <strong>for</strong>eclosure. “<br />

With her options limited, a delinquency letter from the mortgage company proved to<br />

be pivotal. The letter described <strong>Twin</strong> <strong>Cities</strong> <strong>Habitat</strong>’s Mortgage Foreclosure Prevention<br />

Program which offers free counseling to those in need. Molly made the call immediately<br />

and a counselor was assigned to her. That’s when Molly started to notice a change.<br />

“The counselors were able to talk with people at [the mortgage company] that I couldn’t<br />

get through to, and they were able to get answers I never could,” said Molly. “Having<br />

someone to advocate on my behalf with the mortgage company and to navigate me<br />

through the process is what made all the difference. It’s what kept me in my home.”<br />

With her counselor’s help Molly was able to modify her loan this past Spring, bringing<br />

her primary mortgage to five percent. Program Manager Cheryl Petersen saw first<br />

hand the struggle Molly had to endure and was impressed with her commitment to<br />

being a part of the solution.<br />

“Our success is directly linked to how hard homeowners are willing to work to save<br />

their homes,” said Cheryl. “By helping Molly regain control of her mortgage, our<br />

program provided the first steps toward her living a healthier life.<br />

{ 14 } { 15 }<br />

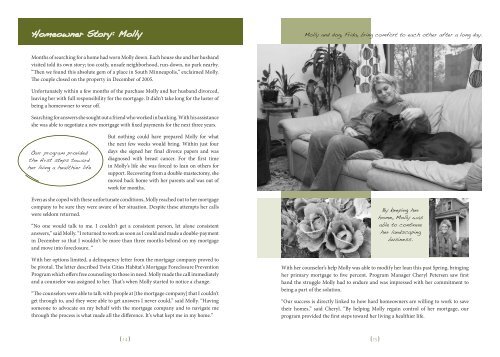

Molly and dog, Frida, bring com<strong>for</strong>t to each other after a long day.<br />

By keeping her<br />

home, Molly was<br />

able to continue<br />

her landscaping<br />

business.