acta capituli generalis diffinitorum ordinis praedicatorum fr. carolo a ...

acta capituli generalis diffinitorum ordinis praedicatorum fr. carolo a ...

acta capituli generalis diffinitorum ordinis praedicatorum fr. carolo a ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

De Rebus Ordinis 65<br />

We ordain that the above text becomes LCO 560 I and the present I & II<br />

become II & III respectively.<br />

4. We ordain that vicariates submit economic reports to their home provinces,<br />

as laid down in LCO 563 II, and that the provinces integrate this information<br />

in their own reports.<br />

5. We ordain that the entities, which received some funds <strong>fr</strong>om the Curia,<br />

report each year to the Syndic on how the money has been used. This<br />

evaluation report will help us to improve our monitoring procedures.<br />

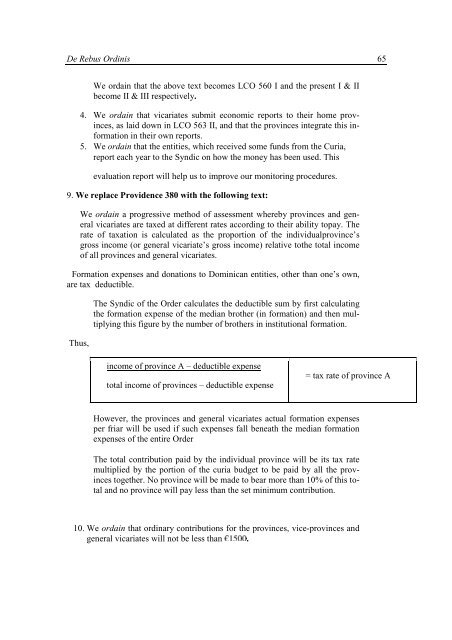

9. We replace Providence 380 with the following text:<br />

We ordain a progressive method of assessment whereby provinces and general<br />

vicariates are taxed at different rates according to their ability topay. The<br />

rate of taxation is calculated as the proportion of the individualprovince’s<br />

gross income (or general vicariate’s gross income) relative tothe total income<br />

of all provinces and general vicariates.<br />

Formation expenses and donations to Dominican entities, other than one’s own,<br />

are tax deductible.<br />

Thus,<br />

The Syndic of the Order calculates the deductible sum by first calculating<br />

the formation expense of the median brother (in formation) and then multiplying<br />

this figure by the number of brothers in institutional formation.<br />

income of province A – deductible expense<br />

total income of provinces – deductible expense<br />

= tax rate of province A<br />

However, the provinces and general vicariates actual formation expenses<br />

per <strong>fr</strong>iar will be used if such expenses fall beneath the median formation<br />

expenses of the entire Order<br />

The total contribution paid by the individual province will be its tax rate<br />

multiplied by the portion of the curia budget to be paid by all the provinces<br />

together. No province will be made to bear more than 10% of this total<br />

and no province will pay less than the set minimum contribution.<br />

10. We ordain that ordinary contributions for the provinces, vice-provinces and<br />

<br />

general vicariates will not be less than .