Laporan Tahunan - Matahari

Laporan Tahunan - Matahari

Laporan Tahunan - Matahari

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CATATAN ATAS LAPORAN KEUANGAN<br />

31 DESEMBER 2010, 2009 DAN 2008<br />

(Dinyatakan dalam jutaan Rupiah,<br />

kecuali dinyatakan lain)<br />

PT MATAHARI DEPARTMENT STORE Tbk<br />

(Dahulu/Formerly PT PACIFIC UTAMA Tbk)<br />

Halaman 5/24 Schedule<br />

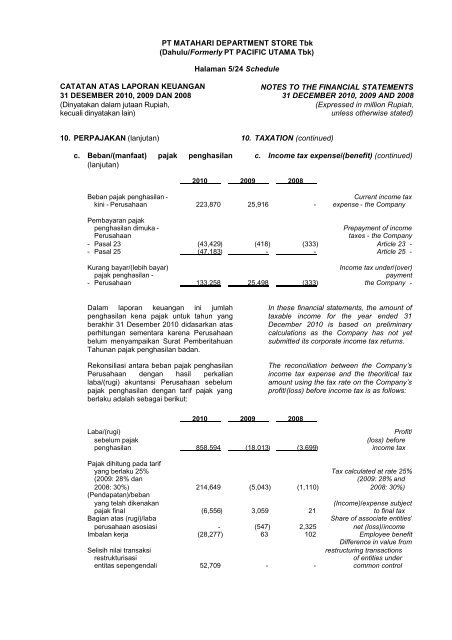

10. PERPAJAKAN (lanjutan) 10. TAXATION (continued)<br />

c. Beban/(manfaat) pajak penghasilan<br />

(lanjutan)<br />

2010 2009 2008<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2010, 2009 AND 2008<br />

(Expressed in million Rupiah,<br />

unless otherwise stated)<br />

c. Income tax expense/(benefit) (continued)<br />

Beban pajak penghasilan - Current income tax<br />

kini - Perusahaan 223,870 25,916 - expense - the Company<br />

Pembayaran pajak<br />

penghasilan dimuka - Prepayment of income<br />

Perusahaan taxes - the Company<br />

- Pasal 23 (43,429) (418) (333) Article 23 -<br />

- Pasal 25 (47,183) - - Article 25 -<br />

Kurang bayar/(lebih bayar) Income tax under/(over)<br />

pajak penghasilan - payment<br />

- Perusahaan 133,258 25,498 (333) the Company -<br />

Dalam laporan keuangan ini jumlah<br />

penghasilan kena pajak untuk tahun yang<br />

berakhir 31 Desember 2010 didasarkan atas<br />

perhitungan sementara karena Perusahaan<br />

belum menyampaikan Surat Pemberitahuan<br />

<strong>Tahunan</strong> pajak penghasilan badan.<br />

Rekonsiliasi antara beban pajak penghasilan<br />

Perusahaan dengan hasil perkalian<br />

laba/(rugi) akuntansi Perusahaan sebelum<br />

pajak penghasilan dengan tarif pajak yang<br />

berlaku adalah sebagai berikut:<br />

2010 2009 2008<br />

In these financial statements, the amount of<br />

taxable income for the year ended 31<br />

December 2010 is based on preliminary<br />

calculations as the Company has not yet<br />

submitted its corporate income tax returns.<br />

The reconciliation between the Company’s<br />

income tax expense and the theoritical tax<br />

amount using the tax rate on the Company’s<br />

profit/(loss) before income tax is as follows:<br />

Laba/(rugi) Profit/<br />

sebelum pajak (loss) before<br />

penghasilan 858,594 (18,013) (3,699) income tax<br />

Pajak dihitung pada tarif<br />

yang berlaku 25% Tax calculated at rate 25%<br />

(2009: 28% dan (2009: 28% and<br />

2008: 30%) 214,649 (5,043) (1,110) 2008: 30%)<br />

(Pendapatan)/beban<br />

yang telah dikenakan (Income)/expense subject<br />

pajak final (6,556) 3,059 21 to final tax<br />

Bagian atas (rugi)/laba Share of associate entities’<br />

perusahaan asosiasi - (547) 2,325 net (loss)/income<br />

Imbalan kerja (28,277) 63 102 Employee benefit<br />

Difference in value from<br />

Selisih nilai transaksi restructuring transactions<br />

restrukturisasi of entities under<br />

entitas sepengendali 52,709 - - common control