KETERANGAN AM 3 Tajuk Mesyuarat - Malaysian Institute of ...

KETERANGAN AM 3 Tajuk Mesyuarat - Malaysian Institute of ...

KETERANGAN AM 3 Tajuk Mesyuarat - Malaysian Institute of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

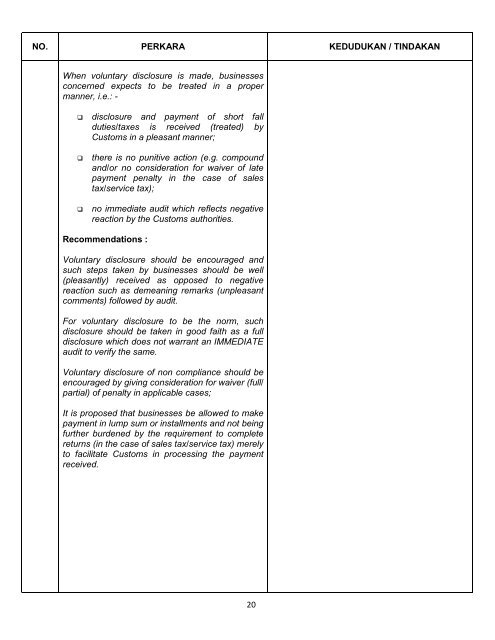

NO. PERKARA KEDUDUKAN / TINDAKAN<br />

When voluntary disclosure is made, businesses<br />

concerned expects to be treated in a proper<br />

manner, i.e.: -<br />

� disclosure and payment <strong>of</strong> short fall<br />

duties/taxes is received (treated) by<br />

Customs in a pleasant manner;<br />

� there is no punitive action (e.g. compound<br />

and/or no consideration for waiver <strong>of</strong> late<br />

payment penalty in the case <strong>of</strong> sales<br />

tax/service tax);<br />

� no immediate audit which reflects negative<br />

reaction by the Customs authorities.<br />

Recommendations :<br />

Voluntary disclosure should be encouraged and<br />

such steps taken by businesses should be well<br />

(pleasantly) received as opposed to negative<br />

reaction such as demeaning remarks (unpleasant<br />

comments) followed by audit.<br />

For voluntary disclosure to be the norm, such<br />

disclosure should be taken in good faith as a full<br />

disclosure which does not warrant an IMMEDIATE<br />

audit to verify the same.<br />

Voluntary disclosure <strong>of</strong> non compliance should be<br />

encouraged by giving consideration for waiver (full/<br />

partial) <strong>of</strong> penalty in applicable cases;<br />

It is proposed that businesses be allowed to make<br />

payment in lump sum or installments and not being<br />

further burdened by the requirement to complete<br />

returns (in the case <strong>of</strong> sales tax/service tax) merely<br />

to facilitate Customs in processing the payment<br />

received.<br />

20