KETERANGAN AM 3 Tajuk Mesyuarat - Malaysian Institute of ...

KETERANGAN AM 3 Tajuk Mesyuarat - Malaysian Institute of ...

KETERANGAN AM 3 Tajuk Mesyuarat - Malaysian Institute of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

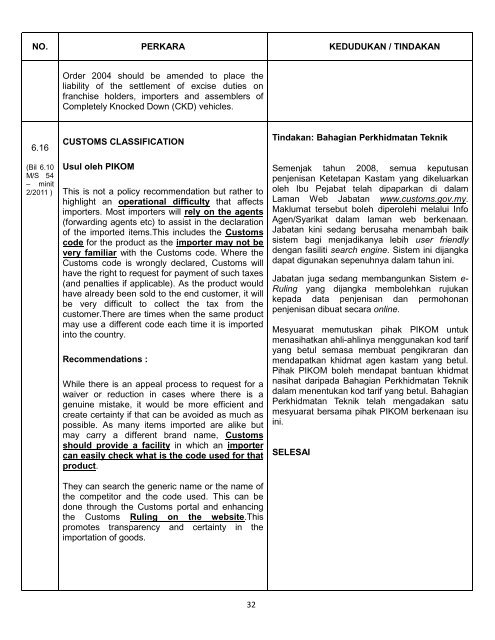

NO. PERKARA KEDUDUKAN / TINDAKAN<br />

6.16<br />

(Bil 6.10<br />

M/S 54<br />

– minit<br />

2/2011 )<br />

Order 2004 should be amended to place the<br />

liability <strong>of</strong> the settlement <strong>of</strong> excise duties on<br />

franchise holders, importers and assemblers <strong>of</strong><br />

Completely Knocked Down (CKD) vehicles.<br />

CUSTOMS CLASSIFICATION<br />

Usul oleh PIKOM<br />

This is not a policy recommendation but rather to<br />

highlight an operational difficulty that affects<br />

importers. Most importers will rely on the agents<br />

(forwarding agents etc) to assist in the declaration<br />

<strong>of</strong> the imported items.This includes the Customs<br />

code for the product as the importer may not be<br />

very familiar with the Customs code. Where the<br />

Customs code is wrongly declared, Customs will<br />

have the right to request for payment <strong>of</strong> such taxes<br />

(and penalties if applicable). As the product would<br />

have already been sold to the end customer, it will<br />

be very difficult to collect the tax from the<br />

customer.There are times when the same product<br />

may use a different code each time it is imported<br />

into the country.<br />

Recommendations :<br />

While there is an appeal process to request for a<br />

waiver or reduction in cases where there is a<br />

genuine mistake, it would be more efficient and<br />

create certainty if that can be avoided as much as<br />

possible. As many items imported are alike but<br />

may carry a different brand name, Customs<br />

should provide a facility in which an importer<br />

can easily check what is the code used for that<br />

product.<br />

They can search the generic name or the name <strong>of</strong><br />

the competitor and the code used. This can be<br />

done through the Customs portal and enhancing<br />

the Customs Ruling on the website.This<br />

promotes transparency and certainty in the<br />

importation <strong>of</strong> goods.<br />

32<br />

Tindakan: Bahagian Perkhidmatan Teknik<br />

Semenjak tahun 2008, semua keputusan<br />

penjenisan Ketetapan Kastam yang dikeluarkan<br />

oleh Ibu Pejabat telah dipaparkan di dalam<br />

Laman Web Jabatan www.customs.gov.my.<br />

Maklumat tersebut boleh diperolehi melalui Info<br />

Agen/Syarikat dalam laman web berkenaan.<br />

Jabatan kini sedang berusaha menambah baik<br />

sistem bagi menjadikanya lebih user friendly<br />

dengan fasiliti search engine. Sistem ini dijangka<br />

dapat digunakan sepenuhnya dalam tahun ini.<br />

Jabatan juga sedang membangunkan Sistem e-<br />

Ruling yang dijangka membolehkan rujukan<br />

kepada data penjenisan dan permohonan<br />

penjenisan dibuat secara online.<br />

<strong>Mesyuarat</strong> memutuskan pihak PIKOM untuk<br />

menasihatkan ahli-ahlinya menggunakan kod tarif<br />

yang betul semasa membuat pengikraran dan<br />

mendapatkan khidmat agen kastam yang betul.<br />

Pihak PIKOM boleh mendapat bantuan khidmat<br />

nasihat daripada Bahagian Perkhidmatan Teknik<br />

dalam menentukan kod tarif yang betul. Bahagian<br />

Perkhidmatan Teknik telah mengadakan satu<br />

mesyuarat bersama pihak PIKOM berkenaan isu<br />

ini.<br />

SELESAI