KETERANGAN AM 3 Tajuk Mesyuarat - Malaysian Institute of ...

KETERANGAN AM 3 Tajuk Mesyuarat - Malaysian Institute of ...

KETERANGAN AM 3 Tajuk Mesyuarat - Malaysian Institute of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

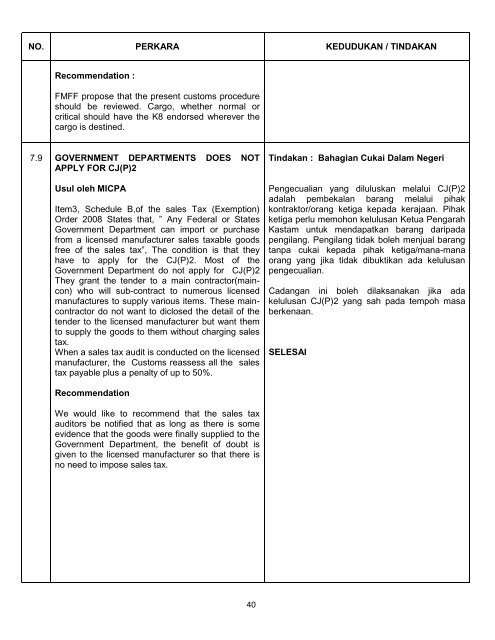

NO. PERKARA KEDUDUKAN / TINDAKAN<br />

7.9<br />

Recommendation :<br />

FMFF propose that the present customs procedure<br />

should be reviewed. Cargo, whether normal or<br />

critical should have the K8 endorsed wherever the<br />

cargo is destined.<br />

GOVERNMENT DEPARTMENTS DOES NOT<br />

APPLY FOR CJ(P)2<br />

Usul oleh MICPA<br />

Item3, Schedule B,<strong>of</strong> the sales Tax (Exemption)<br />

Order 2008 States that, ” Any Federal or States<br />

Government Department can import or purchase<br />

from a licensed manufacturer sales taxable goods<br />

free <strong>of</strong> the sales tax”, The condition is that they<br />

have to apply for the CJ(P)2. Most <strong>of</strong> the<br />

Government Department do not apply for CJ(P)2<br />

They grant the tender to a main contractor(maincon)<br />

who will sub-contract to numerous licensed<br />

manufactures to supply various items. These maincontractor<br />

do not want to diclosed the detail <strong>of</strong> the<br />

tender to the licensed manufacturer but want them<br />

to supply the goods to them without charging sales<br />

tax.<br />

When a sales tax audit is conducted on the licensed<br />

manufacturer, the Customs reassess all the sales<br />

tax payable plus a penalty <strong>of</strong> up to 50%.<br />

Recommendation<br />

We would like to recommend that the sales tax<br />

auditors be notified that as long as there is some<br />

evidence that the goods were finally supplied to the<br />

Government Department, the benefit <strong>of</strong> doubt is<br />

given to the licensed manufacturer so that there is<br />

no need to impose sales tax.<br />

40<br />

Tindakan : Bahagian Cukai Dalam Negeri<br />

Pengecualian yang diluluskan melalui CJ(P)2<br />

adalah pembekalan barang melalui pihak<br />

kontraktor/orang ketiga kepada kerajaan. Pihak<br />

ketiga perlu memohon kelulusan Ketua Pengarah<br />

Kastam untuk mendapatkan barang daripada<br />

pengilang. Pengilang tidak boleh menjual barang<br />

tanpa cukai kepada pihak ketiga/mana-mana<br />

orang yang jika tidak dibuktikan ada kelulusan<br />

pengecualian.<br />

Cadangan ini boleh dilaksanakan jika ada<br />

kelulusan CJ(P)2 yang sah pada tempoh masa<br />

berkenaan.<br />

SELESAI