lankhorst bhd ar2000 1-30 - Announcements

lankhorst bhd ar2000 1-30 - Announcements

lankhorst bhd ar2000 1-30 - Announcements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

properties held<br />

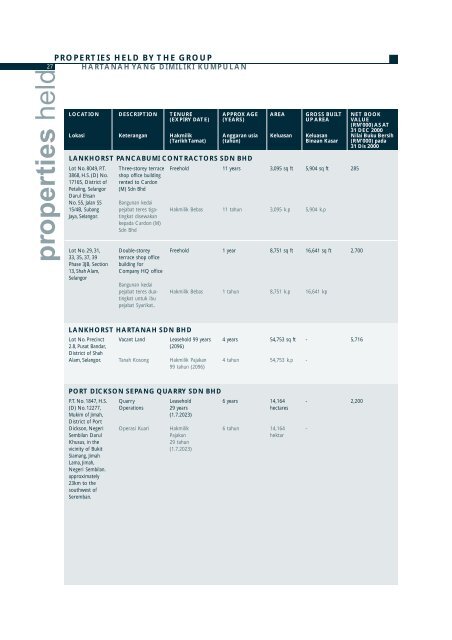

PROPERTIES HELD BY THE GROUP<br />

27 HARTANAH YANG DIMILIKI KUMPULAN<br />

LOCATION<br />

Lokasi<br />

Lot No. 8049, P.T.<br />

3868, H.S. (D) No.<br />

17165, District of<br />

Petaling, Selangor<br />

Darul Ehsan<br />

No. 55, Jalan SS<br />

15/4B, Subang<br />

Jaya, Selangor.<br />

Lot No. 29, 31,<br />

33, 35, 37, 39<br />

Phase 3JB, Section<br />

13, Shah Alam,<br />

Selangor<br />

Lot No. Precinct<br />

2.8, Pusat Bandar,<br />

District of Shah<br />

Alam, Selangor.<br />

P.T. No. 1847, H.S.<br />

(D) No. 12277,<br />

Mukim of Jimah,<br />

District of Port<br />

Dickson, Negeri<br />

Sembilan Darul<br />

Khusus, in the<br />

vicinity of Bukit<br />

Siamang, Jimah<br />

Lama, Jimah,<br />

Negeri Sembilan.<br />

approximately<br />

23km to the<br />

southwest of<br />

Seremban.<br />

DESCRIPTION<br />

Keterangan<br />

Three-storey terrace<br />

shop office building<br />

rented to Cardon<br />

(M) Sdn Bhd<br />

Bangunan kedai<br />

pejabat teres tigatingkat<br />

disewakan<br />

kepada Cardon (M)<br />

Sdn Bhd<br />

Double-storey<br />

terrace shop office<br />

building for<br />

Company HQ office<br />

Bangunan kedai<br />

pejabat teres duatingkat<br />

untuk ibu<br />

pejabat Syarikat..<br />

Vacant Land<br />

Tanah Kosong<br />

Quarry<br />

Operations<br />

Operasi Kuari<br />

TENURE<br />

(EXPIRY DATE)<br />

Hakmilik<br />

(Tarikh Tamat)<br />

Freehold<br />

Hakmilik Bebas<br />

Freehold<br />

Hakmilik Bebas<br />

Leasehold 99 years<br />

(2096)<br />

Hakmilik Pajakan<br />

99 tahun (2096)<br />

Leasehold<br />

29 years<br />

(1.7.2023)<br />

Hakmilik<br />

Pajakan<br />

29 tahun<br />

(1.7.2023)<br />

APPROX AGE<br />

(YEARS)<br />

Anggaran usia<br />

(tahun)<br />

LANKHORST PANCABUMI CONTRACTORS SDN BHD<br />

LANKHORST HARTANAH SDN BHD<br />

PORT DICKSON SEPANG QUARRY SDN BHD<br />

11 years<br />

11 tahun<br />

1 year<br />

1 tahun<br />

4 years<br />

4 tahun<br />

6 years<br />

6 tahun<br />

AREA<br />

Keluasan<br />

3,095 sq ft<br />

3,095 k.p<br />

8,751 sq ft<br />

8,751 k.p<br />

54,753 sq ft<br />

54,753 k.p<br />

14,164<br />

hectares<br />

14,164<br />

hektar<br />

GROSS BUILT<br />

UP AREA<br />

Keluasan<br />

Binaan Kasar<br />

5,904 sq ft<br />

5,904 k.p<br />

16,641 sq ft<br />

16,641 kp<br />

-<br />

-<br />

-<br />

-<br />

NET BOOK<br />

VALUE<br />

(RM’000) AS AT<br />

31 DEC 2000<br />

Nilai Buku Bersih<br />

(RM’000) pada<br />

31 Dis 2000<br />

285<br />

2,700<br />

5,716<br />

2,200

shareholders’ information<br />

SHAREHOLDERS’ INFORMATION<br />

28 MAKLUMAT PEMEGANG SAHAM<br />

ANALYSIS OF SHAREHOLDERS BY RANGE OF GROUP AS AT 16 MAY 2001<br />

Analisa Pemegang Saham dari berbagai Kumpulan pada 16 Mei 2001<br />

CATEGORY<br />

kategori<br />

1 - 999<br />

1,000 - 10,000<br />

10,001 - 100,000<br />

100,001 - 1,999,949<br />

1,999,950 & above/keatas<br />

NO. OR SHARES<br />

bilangan saham<br />

2,275<br />

2,688,080<br />

1,488,000<br />

8,286,645<br />

27,534,000<br />

39,999,000<br />

LANKHORST BERHAD<br />

SUBSTANTIAL SHAREHOLDERS AS AT 16 MAY 2001<br />

Pemegang Saham Terbesar pada 16 Mei 2001<br />

NO.<br />

bil<br />

1.<br />

2.<br />

3.<br />

4.<br />

5.<br />

% OVER TOTAL SHARES<br />

% dari jumlah saham<br />

0.01<br />

6.72<br />

3.72<br />

20.72<br />

68.83<br />

100.00<br />

STATEMENT OF DIRECTOR’S SHAREHOLDING AS AT 16 MAY 2001<br />

Penyata Pegangan Saham Para Pengarah pada 16 Mei 2001<br />

NO.<br />

bil.<br />

1.<br />

2.<br />

3.<br />

4.<br />

5.<br />

6.<br />

7.<br />

NAME OF SHAREHOLDERS<br />

Nama Pemegang Saham<br />

IR. TUAN HAJI AZLAN AWANG<br />

TUAN HAJI ABDUL AZIZ BAKRI<br />

PERBADANAN NASIONAL BERHAD<br />

KUALA LUMPUR GROWTH FUND<br />

KUALA LUMPUR AGGRESSIVE GROWTH FUND<br />

NAME OF DIRECTORS<br />

Nama Para Pengarah<br />

IR. TUAN HAJI AZLAN BIN AWANG<br />

TUAN HAJI ABDUL AZIZ BIN BAKRI<br />

YBHG. DATO’ IDRIS JUSOH<br />

YBHG. DATO’ SARI @ SHAARI MAJIHIN @ MAT JIHIN<br />

TUAN HAJI HASSAN TAN SRI IBRAHIM<br />

YBHG. DATO’ MOHD. NOR ABDUL WAHID<br />

PUAN NORLEZA ABU BAKAR<br />

SHAREHOLDING (DIRECT)<br />

Pegangan Saham (langsung)<br />

DIRECT INTERESTS<br />

Kepentingan secara langsung<br />

NO. OF SHAREHOLDERS<br />

bilangan pemegang saham<br />

611,145<br />

355<br />

10,112,000<br />

-<br />

-<br />

611,145<br />

355<br />

-<br />

-<br />

-<br />

-<br />

-<br />

%<br />

1.53<br />

-<br />

25.28<br />

-<br />

-<br />

%<br />

1.53<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

7<br />

1,274<br />

43<br />

23<br />

2<br />

1,349<br />

% OVER TOTAL SHAREHOLDERS<br />

% dari jumlah pemegang saham<br />

SHAREHOLDING (INDIRECT)<br />

Pegangan Saham (tidak langsung)<br />

18,188,<strong>30</strong>5<br />

18,479,195<br />

INDIRECT INTERESTS<br />

Kepentingan tidak secara langsung<br />

-<br />

1,000,000<br />

1,000,000<br />

18,188,<strong>30</strong>5<br />

18,479,195<br />

-<br />

-<br />

-<br />

-<br />

-<br />

0.52<br />

94.44<br />

3.19<br />

1.70<br />

0.15<br />

100.00<br />

%<br />

45.47<br />

46.20<br />

-<br />

2.50<br />

2.50<br />

%<br />

45.47<br />

46.20<br />

-<br />

-<br />

-<br />

-<br />

-

29<br />

MAKLUMAT PEMEGANG SAHAM<br />

THIRTY LARGEST SHAREHOLDERS AS AT 16 MAY 2001<br />

Tiga puluh Pemegang Saham terbesar pada 16 Mei 2001<br />

NO.<br />

bil.<br />

1.<br />

2.<br />

3.<br />

4.<br />

5.<br />

6.<br />

7.<br />

8.<br />

9.<br />

10.<br />

11.<br />

12.<br />

13.<br />

14.<br />

15.<br />

16.<br />

17.<br />

18.<br />

19.<br />

20.<br />

21.<br />

shareholders’ information SHAREHOLDERS’ INFORMATION<br />

22.<br />

23.<br />

24.<br />

25.<br />

26.<br />

27.<br />

28.<br />

29.<br />

<strong>30</strong>.<br />

NAME OF SHAREHOLDERS<br />

Nama Pemegang Saham<br />

CIMSEC NOMINEES (TEMPATAN) SDN BHD - PENGURUSAN DANAHARTA NASIONAL BERHAD FOR UFUK BESTARI SDN BHD<br />

PERBADANAN NASIONAL BERHAD<br />

AMSEC NOMINEES (TEMPATAN) SDN BHD - ARAB MALAYSIAN BANK BERHAD FOR ABDUL AZIZ BIN BAKRI<br />

AMANAH RAYA NOMINEES (TEMPATAN) SDN BHD - KUALA LUMPUR GROWTH FUND<br />

MAYBAN NOMINEES (TEMPATAN) SDN BHD - MAYBAN TRUSTEES BERHAD FOR KUALA LUMPUR AGGRESSIVE GROWTH FUND<br />

AZLAN BIN AWANG<br />

UFUK BESTARI SDN BHD<br />

CITICORP NOMINEES (ASING) SDN BHD - TNTC FOR GOVERNMENT OF SINGAPORE INVESTMENT CORPORATION PTE LTD<br />

SHAZILLA BINTI MOHD SAMSE<br />

PRB NOMINEES (TEMPATAN) SDN BHD - RUBBER INDUSTRY SMALLHOLDERS DEVELOPMENT AUTHORITY<br />

PRB NOMINEES (TEMPATAN) SDN BHD - RUBBER INDUSTRY SMALLHOLDERS DEVELOPMENT AUTHORITY<br />

MAYBAN NOMINEES (TEMPATAN) SDN BHD - MAYBAN TRUSTEES BERHAD FOR AMANAH SAHAM BANK ISLAM TABUNG PERTAMA<br />

UNIVERSAL TRUSTEE (MALAYSIA) BERHAD - MULTI-PURPOSE FIRST FUND<br />

PRB NOMINEES (TEMPATAN) SDN BHD - RUBBER INDUSTRY SMALLHOLDERS DEVELOPMENT AUTHORITY<br />

ALLIANCE GROUP NOMINEES (ASING) SDN BHD - HSBC TRUSTEE (S) LTD FOR THE VITTORIA FUND LTD<br />

VANGUARD NOMINEES (TEMPATAN) SDN BHD<br />

MALAYSIA NOMINEES (TEMPATAN) SENDIRIAN BERHAD - MALAYSIAN TRUSTEES BERHAD FOR MULTI-PURPOSE VISION FUND<br />

PRB NOMINEES (TEMPATAN) SDN BHD - RUBBER INDUSTRY SMALLHOLDERS DEVELOPMENT AUTHORITY<br />

BIMSEC NOMINEES (TEMPATAN) SDN BHD - PLEDGED SECURITIES ACCOUNT FOR TG. ABDULLAH IBNI SULTAN HJ AHMAD SHAH<br />

ALLIANCE GROUP NOMINEES (TEMPATAN) SDN BHD - PHEIM ASSET MANAGEMENT SDN BHD FOR MAGNUM CORPORATION BHD<br />

ALLIANCE GROUP NOMINEES (TEMPATAN) SDN BHD - PHEIM ASSET MANAGEMENT SDN BHD FOR EMPAT NOMBOR EKOR (SELANGOR) SDN BHD<br />

PRB NOMINEES (TEMPATAN) SDN BHD - RUBBER INDUSTRY SMALLHOLDERS DEVELOPMENT AUTHORITY<br />

KHAIROL ANUAR BIN MOHAMAD TAWI<br />

GHAZALI BIN SAIBOO<br />

HASNIZA BINTI MOHD ZAFERI<br />

ALLIANCE GROUP NOMINEES (TEMPATAN) SDN BHD - PHEIM ASSET MANAGEMENT SDN BHD FOR EMPAT NOMBOR EKOR (SELANGOR) SDN BHD<br />

AMANAH SAHAM MARA BERHAD<br />

ARAB-MALAYSIAN NOMINEES (ASING) SDN BHD - HSBC TRUSTEE (S) LTD FOR ASEAN EMERGING COMPANIES GROWTH FUND LTD<br />

MAYBAN FINANCE BERHAD - PLEDGED SECURITIES ACCOUNT FOR ESA BIN MOHAMED<br />

PRB NOMINEES (TEMPATAN) SDN BHD - RUBBER INDUSTRY SMALLHOLDERS DEVELOPMENT AUTHORITY<br />

TOTAL / JUMLAH<br />

SHAREHOLDING<br />

Pegangan Saham<br />

17,422,000<br />

10,112,000<br />

1,117,500<br />

1,000,000<br />

1,000,000<br />

611,145<br />

578,000<br />

550,000<br />

400,000<br />

376,000<br />

294,000<br />

244,000<br />

2<strong>30</strong>,000<br />

200,000<br />

184,000<br />

183,000<br />

178,000<br />

176,000<br />

155,000<br />

150,000<br />

150,000<br />

143,000<br />

133,000<br />

131,000<br />

103,000<br />

100,000<br />

100,000<br />

100,000<br />

100,000<br />

100,000<br />

36,320,645<br />

%<br />

43.56<br />

25.28<br />

2.79<br />

2.50<br />

2.50<br />

1.53<br />

1.45<br />

1.38<br />

1.00<br />

0.94<br />

0.74<br />

0.61<br />

0.58<br />

0.50<br />

0.46<br />

0.46<br />

0.45<br />

0.44<br />

0.39<br />

0.38<br />

0.38<br />

0.36<br />

0.33<br />

0.33<br />

0.26<br />

0.25<br />

0.25<br />

0.25<br />

0.25<br />

0.25<br />

90.80

<strong>30</strong><br />

MAKLUMAT PEMEGANG WARAN<br />

THIRTY LARGEST WARRANTHOLDERS AS AT 16 MAY 2001<br />

Tiga puluh Pemegang Waran terbesar pada 16 Mei 2001<br />

NO.<br />

bil.<br />

1.<br />

2.<br />

3.<br />

4.<br />

5.<br />

6.<br />

7.<br />

8.<br />

9.<br />

10.<br />

11.<br />

12.<br />

13.<br />

14.<br />

15.<br />

16.<br />

17.<br />

18.<br />

19.<br />

20.<br />

21.<br />

22.<br />

23.<br />

24.<br />

warrantholders’ information WARRANTHOLDERS’ INFORMATION<br />

25.<br />

26.<br />

27.<br />

28.<br />

29.<br />

<strong>30</strong>.<br />

NAME OF SHAREHOLDERS<br />

Nama Pemegang Saham<br />

PERBADANAN NASIONAL BERHAD<br />

AMANAH RAYA NOMINEES (TEMPATAN) SDN BHD - KUALA LUMPUR GROWTH FUND<br />

MAYBAN NOMINEES (TEMPATAN) SDN BHD - MAYBAN TRUSTEES BERHAD FOR KUALA LUMPUR AGGRESSIVE GROWTH FUND<br />

CITICORP NOMINEES (ASING) SDN BHD - TNTC FOR GOVERNMENT OF SINGAPORE INVESTMENT CORPORATION PTE LTD<br />

UNIVERSAL TRUSTEE (MALAYSIA) BERHAD - MULTI-PURPOSE FIRST FUND<br />

SHAZILLA BINTI MOHD SAMSE<br />

PRB NOMINEES (TEMPATAN) SDN BHD - RUBBER INDUSTRY SMALLHOLDERS DEVELOPMENT AUTHORITY<br />

PRB NOMINEES (TEMPATAN) SDN BHD - RUBBER INDUSTRY SMALLHOLDERS DEVELOPMENT AUTHORITY<br />

ALLIANCEGROUP NOMINEES (ASING) SDN BHD - HSBC TRUSTEE (S) LTD FOR THE VITTORIA FUND LTD<br />

PRB NOMINEES (TEMPATAN) SDN BHD - RUBBER INDUSTRY SMALLHOLDERS DEVELOPMENT AUTHORITY<br />

VANGUARD NOMINEES (TEMPATAN) SDN BHD<br />

MALAYSIA NOMINEES (TEMPATAN) SENDIRIAN BERHAD - MALAYSIAN TRUSTEES BERHAD FOR MULTI-PURPOSE VISION FUND<br />

PRB NOMINEES (TEMPATAN) SDN BHD - RUBBER INDUSTRY SMALLHOLDERS DEVELOPMENT AUTHORITY<br />

LIM BEE CHING<br />

BIMSEC NOMINEES (TEMPATAN) SDN BHD - PLEDGED SECURITIES ACCOUNT FOR TG. ABDULLAH IBNI SULTAN HJ AHMAD SHAH<br />

ALLIANCEGROUP NOMINEES (TEMPATAN) SDN BHD - PHEIM ASSET MANAGEMENT SDN BHD FOR MAGNUM CORPORATION BHD<br />

ALLIANCEGROUP NOMINEES (TEMPATAN) SDN BHD - PHEIM ASSET MANAGEMENT SDN BHD FOR EMPAT NOMBOR EKOR (SELANGOR) SDN BHD<br />

PRB NOMINEES (TEMPATAN) SDN BHD - RUBBER INDUSTRY SMALLHOLDERS DEVELOPMENT AUTHORITY<br />

SHAZILLA BINTI MOHD SAMSE<br />

HASNIZA BINTI MOHD ZAFERI<br />

ALLIANCEGROUP NOMINEES (TEMPATAN) SDN BHD - PHEIM ASSET MANAGEMENT SDN BHD FOR EMPAT NOMBOR EKOR (SELANGOR) SDN BHD<br />

AMANAH SAHAM MARA BERHAD<br />

ARAB-MALAYSIAN NOMINEES (ASING) SDN BHD - HSBC TRUSTEE (S) LTD FOR ASEAN EMERGING COMPANIES GROWTH FUND LTD<br />

MAYBAN FINANCE BERHAD - PLEDGED SECURITIES ACCOUNT FOR ESA BIN MOHAMED<br />

PERBADANAN NASIONAL BERHAD<br />

PRB NOMINEES (TEMPATAN) SDN BHD - RUBBER INDUSTRY SMALLHOLDERS DEVELOPMENT AUTHORITY<br />

AMSEC NOMINEES (TEMPATAN) SDN BHD - PLEDGED SECURITIES ACCOUNT FOR MAIDEN ABDUL KADIR BIN MOHD ALI<br />

PRB NOMINEES (TEMPATAN) SDN BHD - RUBBER INDUSTRY SMALLHOLDERS DEVELOPMENT AUTHORITY<br />

TAN LAI KIN<br />

MOHAMMAD RIAZZUDDIN BIN ALI AHMAD<br />

TOTAL / JUMLAH<br />

ANALYSIS OF WARRANTHOLDERS BY RANGE OF GROUP AS AT 16 MAY 2001<br />

Analisa Pemegang Waran dari berbagai Kumpulan pada 16 Mei 2001<br />

CATEGORY<br />

kategori<br />

1 - 999<br />

1,000 - 10,000<br />

10,001 - 100,000<br />

100,001 - 253,336<br />

253,337 & above/keatas<br />

NO. OR SHARES<br />

bilangan saham<br />

325,000<br />

489,500<br />

991,750<br />

762,500<br />

2,498,000<br />

5,066,750<br />

% OVER TOTAL SHARES<br />

% dari jumlah saham<br />

6.41<br />

9.66<br />

19.57<br />

15.05<br />

49.31<br />

100.00<br />

NO. OF SHAREHOLDERS<br />

bilangan pemegang saham<br />

929<br />

216<br />

28<br />

41<br />

1,178<br />

SHAREHOLDING<br />

Pegangan Saham<br />

2,498,000<br />

250,000<br />

250,000<br />

137,500<br />

125,000<br />

100,000<br />

94,000<br />

73,500<br />

50,000<br />

50,000<br />

45,000<br />

44,500<br />

44,000<br />

41,000<br />

38,750<br />

37,500<br />

37,500<br />

35,750<br />

33,250<br />

29,250<br />

25,000<br />

25,000<br />

25,000<br />

25,000<br />

25,000<br />

25,000<br />

20,000<br />

12,500<br />

12,500<br />

11,250<br />

4,220,750<br />

%<br />

49.<strong>30</strong><br />

4.93<br />

4.93<br />

2.71<br />

2.47<br />

1.97<br />

1.86<br />

1.45<br />

0.99<br />

0.99<br />

0.89<br />

0.88<br />

0.87<br />

0.81<br />

0.76<br />

0.74<br />

0.74<br />

0.71<br />

0.66<br />

0.58<br />

0.49<br />

0.49<br />

0.49<br />

0.49<br />

0.49<br />

0.49<br />

0.39<br />

0.25<br />

0.25<br />

0.22<br />

83.<strong>30</strong><br />

% OVER TOTAL SHAREHOLDERS<br />

% dari jumlah pemegang saham<br />

78.86<br />

18.34<br />

2.38<br />

0.34<br />

0.08<br />

100.00

FIN FINANCIAL FIN ANCIAL ST STATEMENTS<br />

ST TEMENTS

32<br />

DIRECTOR’S REPORT<br />

The directors have pleasure in presenting their report and the audited financial statements of the Group and of the Company<br />

for the year ended 31 December 2000.<br />

PRINCIPAL ACTIVITIES<br />

The principal activities of the Company consist of investment holding and provision of management services. The principal<br />

activities of the subsidiary companies are stated in Note 5 to the financial statements. There have been no significant changes<br />

in the nature of these activities during the financial year under review.<br />

RESULTS<br />

Profit after taxation<br />

Minority interests<br />

Profit attributable to shareholders<br />

Unappropriated profit brought forward (Restated)<br />

Profit available for appropriation<br />

In the opinion of the directors, except for the exceptional item as disclosed in Note 23 and the write off of material preliminary<br />

and pre-operating expenses to the income statement as the prior year adjustment as disclosed in Note 33 to the financial<br />

statements, the results of the operations of the Group and of the Company for the financial year ended 31 December 2000<br />

have not been substantially affected by any item, transaction or event of a material and unusual nature nor has any such item,<br />

transaction or event occurred in the interval between the end of the financial year and the date of this report.<br />

DIVIDEND<br />

There were no dividends proposed or declared by the Company in respect of the year ended 31 December 2000.<br />

RESERVES AND PROVISIONS<br />

There were no material transfers to or from reserves and provisions during the financial year under review other than those<br />

disclosed in the financial statements.<br />

DIRECTORS OF THE COMPANY<br />

Directors who served since the date of the last report are:<br />

Group<br />

RM<br />

12,856,284<br />

(451,926)<br />

12,404,358<br />

18,615,737<br />

31,020,095<br />

YBhg Dato’ Idris Jusoh (Appointed w.e.f. 8.6.2000)<br />

YBhg Dato’ Sari @ Shaari Majihin @ Mat Jihin<br />

YBhg Dato’ Haji Mohd Nor Abdul Wahid<br />

Ir. Tuan Haji Azlan Awang<br />

Tuan Haji Abdul Aziz Bakri<br />

Tuan Haji Hassan Tan Sri Ibrahim<br />

Tuan Haji Mat Hassan Esa (Resigned w.e.f. 24.11.2000)<br />

Mustaffa Abd Latiff (Appointed w.e.f. 8.6.2000 and<br />

resigned w.e.f. 24.11.2000)<br />

Azhar Mohd (Appointed w.e.f. 1.11.2000 and<br />

resigned w.e.f. 23.2.2001)<br />

Norleza Abu Bakar (Appointed w.e.f. 23.2.2001)<br />

Company<br />

RM<br />

10,659,649<br />

-<br />

10,659,649<br />

(108,360)<br />

10,551,289<br />

In accordance with Article 81 of the Company’s Articles of Association, Tuan Haji Abdul Aziz Bakri retires at the forthcoming<br />

Annual General Meeting, and being eligible, offers himself for re-election.

33<br />

DIRECTOR’S REPORT<br />

In accordance with Article 88 of the Company’s Articles of Association, YBhg Dato’ Idris Jusoh and Norleza Abu Bakar retire<br />

at the forthcoming Annual General Meeting, and being eligible, offer themselves for re-election.<br />

The directors who held office at the end of the financial year and their interests in the shares of the Company during the<br />

financial year are as follows:<br />

Direct<br />

Ir. Tuan Haji Azlan Awang<br />

Tuan Haji Abdul Aziz Bakri<br />

Indirect<br />

Ir. Tuan Haji Azlan Awang<br />

Tuan Haji Abdul Aziz Bakri<br />

By virtue of their interests in the Company, Ir. Tuan Haji Azlan Awang and Tuan Haji Abdul Aziz Bakri are deemed to be<br />

interested in the shares of subsidiary companies to the extent that the Company has interest.<br />

Save as disclosed above, none of the other directors who held office at the end of the financial year have any interest in the<br />

shares of the Company and its subsidiary companies during the year.<br />

DIRECTORS’ BENEFITS<br />

Since the end of the last financial year, no director of the Company has received or become entitled to receive any benefits<br />

(other than those disclosed in the financial statements) by reason of a contract made by the Company or a related company<br />

with a director or with a firm of which the director is a member or with a company in which the director has a substantial<br />

financial interest.<br />

During and at the end of the financial year, no arrangement subsisted to which the Company is a party, with the object or<br />

objects of enabling directors of the Company to acquire benefits by means of the acquisition of shares in or debentures of the<br />

Company or any other body corporate.<br />

ISSUE OF SHARES<br />

There were no movements in the share capital of the Company during the financial year.<br />

OPTIONS GRANTED OVER UNISSUED SHARES<br />

No options were granted to any person to take up unissued shares of the Company during the year.<br />

SIGNIFICANT EVENTS DURING THE YEAR<br />

Balance<br />

1.1.2000<br />

611,145<br />

355<br />

20,388,<strong>30</strong>5<br />

20,279,195<br />

Ordinary shares of RM1.00 each<br />

Bought<br />

Balance<br />

31.12.2000<br />

611,145<br />

355<br />

18,188,<strong>30</strong>5<br />

18,479,195<br />

(a) On 13 March 2000, the Securities Commission had approved the proposal submitted by the Company to vary<br />

certain terms and conditions of the Profit Guarantee and Stakeholder Agreement dated 18 June 1997, as set out<br />

below:<br />

(i) waiver of the shortfall in the Profit Guarantee amounting to RM15,855,668 for the financial year ended 31<br />

December 1999;<br />

(ii) a waiver of the Profit Guarantee amounting to RM19,969,200 for the financial year ended 31 December<br />

2000; and<br />

(iii) proposed restricted issue of up to a maximum of 8,133,500 warrants issued free of charge to entitled<br />

shareholders on the basis of one (1) warrant for every (2) ordinary shares of RM1.00 each held in the<br />

Company.<br />

-<br />

-<br />

-<br />

-<br />

Sold<br />

-<br />

-<br />

(2,200,000)<br />

(1,800,000)

DIRECTOR’S REPORT<br />

34<br />

The abovesaid proposal was approved by the Securities Commission subject to the terms and conditions set out<br />

below:<br />

(i) the respective Guarantors are to furnish a statutory declaration of their financial networth;<br />

(ii) the Guarantors are to dispose their shareholding of the 4.0 million shares of the Company, deposited with<br />

the Stakeholder under the terms of the Stakeholder Agreement (“Deposited Securities”), to meet the<br />

shortfall between the aggregate guaranteed profits and the actual profits achieved by the Group;<br />

(iii) the restricted warrants issue based on the balance of the Profit Guarantee not fulfilled. In this regard, the<br />

Company is to submit a scheme for the proposed restricted warrants issue for the Securities Commission<br />

consideration and approval; and<br />

(iv) the warrants issue is not to be offered to the Guarantors and person(s) connected to them.<br />

On 21 March 2000, the Company announced that it has been informed by the Guarantors that they will be making<br />

an appeal to the Securities Commission’s conditional approval of the proposal.<br />

Subsequently, on 13 April 2000, the Company announced that it has been informed by the Guarantors that they will<br />

not be making any appeal to the Securities Commission on its conditional approval of the proposals and would<br />

proceed with the proposal as approved by the Securities Commission.<br />

Subsequent to the Securities Commission approval via its letter dated 13 March 2000 whereby one of the conditions<br />

imposed is that the Guarantors are to dispose their shareholding of the Deposited Securities to recover the shortfall<br />

between the aggregate guaranteed profits and the actual profits achieved by the Group.<br />

Following the instruction by the special committee set up by the Board of Directors of the Company, the Stakeholder<br />

disposed the Deposited Securities through a stockbroker to recover the profit shortfall.<br />

Our advisor, Messrs. Utama Merchant Bank Berhad, on 26 July 2000 submitted a scheme for the proposed restricted<br />

warrants issue (“Restricted Issue”) for the Securities Commission consideration and approval. The proposal was<br />

approved by the Securities Commission on <strong>30</strong> August 2000 subject to the exercise price of the warrants be fixed at<br />

a discount of not more than 10% to the five (5) day weighted average price of the Company’s shares preceding the<br />

price fixing date (i.e. the date between the Securities Commission’s approval and the Book Closure date).<br />

The Board of Directors on 22 September 2000 then fixed the exercise price of the warrants at RM2.00 being an<br />

approximately 10% discount or RM0.22 to the five (5) day weighted average market price of the Company’s shares.<br />

The exercise price of the warrants was announced through our advisor, Messrs. Utama Merchant Bank Berhad on 25<br />

September 2000.<br />

Messrs. Utama Merchant Bank Berhad then on 3 October 2000 proceeded with the application to the Kuala Lumpur<br />

Stock Exchange for the listing and quotation of the restricted issue of 5,066,750 warrants to be issued free of charge<br />

to the entitled shareholders on the basis of one (1) warrant for every four (4) existing ordinary shares held in the<br />

Company and the listing of 5,066,750 new ordinary shares of RM1.00 each arising from the exercise of 5,066,750<br />

warrants. On 16 October 2000, the Kuala Lumpur Stock Exchange approved-in-principle the admission to the<br />

Official List of the Kuala Lumpur Stock Exchange and the listing and quotation of the warrants and the new ordinary<br />

shares arising from the exercise of the warrants. Hence all approvals for the proposed Restricted Issue had been<br />

obtained.<br />

The Company then announced the Book Closure Date for the warrants entitlement on 31 October 2000 and the<br />

Register of Members was closed on 28 November 2000 to 29 November 2000 (both dates inclusive) to determine<br />

shareholders’ entitlement to the Restricted Issue. Save for the Guarantors and persons connected to them, the<br />

restricted issue of warrants was allotted to shareholders whose name appeared in the Register of Members and<br />

record of Depositors on 27 November 2000. The warrants were successfully listed on the Kuala Lumpur Stock<br />

Exchange on 26 December 2000.<br />

(b) On 22 February 2000, the Company through its wholly owned subsidiary, Lankhorst Pancabumi Contractors Sdn.<br />

Bhd. subscribed an additional 240,000 ordinary shares of RM1.00 each at par in Rampai Budi Jaya Sdn. Bhd. by way of<br />

capitalisation of cash advances made to Rampai Budi Jaya Sdn. Bhd.<br />

(c) On 11 July 2000, the Company through its wholly owned subsidiary, Lankhorst Pancabumi Contractors Sdn. Bhd.<br />

acquired the whole issued and paid up capital of Lankhorst Pavement Technologies Sdn. Bhd. (formerly known as<br />

Lankhorst Asset Sdn. Bhd.) of RM2.00 for a cash consideration of RM2.00.

35<br />

DIRECTOR’S REPORT<br />

Aside from Ir. Tuan Haji Azlan Awang and Tuan Haji Abdul Aziz Bakri who held one (1) share each in Lankhorst Asset<br />

Sdn. Bhd. since 25 September 1996 and deemed interested in the said transaction, none of the other directors of the<br />

Company has any interest either directly or indirectly in the said transaction.<br />

(d) On 4 October 2000, the Company subscribed an additional 19,000,000 ordinary shares of RM1.00 each at par in<br />

Lankhorst Pancabumi Contractors Sdn. Bhd. by way of capitalisation of cash advances made to Lankhorst Pancabumi<br />

Contractors Sdn. Bhd.<br />

(e) On 19 October 2000, the Company through its wholly owned subsidiary, Lankhorst Pancabumi Contractors Sdn.<br />

Bhd. acquired Consortium Ibjay-Aritech System Sdn. Bhd. at a nominal cash consideration of RM2.00 for the issued<br />

and paid up capital of RM2.00.<br />

None of the directors has any interests in this transaction either directly or indirectly.<br />

SUBSEQUENT EVENTS<br />

(a) The Company through its advisor Messrs. Commerce International Merchant Bank Berhad announced on 12 January<br />

2001 the following:<br />

(i) proposed renounceable Rights Issue of up to 90,131,500 ordinary shares of RM1.00 each at the issue price<br />

of RM1.00 each per Rights Share on the basis of two (2) Rights Shares for every one (1) existing ordinary<br />

share of RM1.00 each held; and<br />

(ii) proposed Employees’ Share Option Scheme (ESOS) for eligible directors and employees of the Company<br />

and its subsidiaries.<br />

The Company is in the process of finalising the submission to the Securities Commission and other relevant authorities.<br />

The submission to the Securities Commission and other relevant authorities will be made within six (6) months<br />

from the date of announcement.<br />

(b) On 23 February 2001, the Company through its wholly owned subsidiary, Lankhorst Pancabumi Contractors Sdn.<br />

Bhd. acquired the whole issued and paid up capital of Konsep Kukuh Sdn. Bhd for a cash consideration of RM2,400.<br />

None of the directors of the Company has any interest, either directly or indirectly in the said transaction.<br />

OTHER STATUTORY INFORMATION<br />

Before the income statement and balance sheet of the Group and of the Company were made out, the directors took<br />

reasonable steps to ascertain that:<br />

i) all known bad debts have been written off and adequate provision made for doubtful debts; and<br />

ii) all current assets have been stated at the lower of cost and net realisable value.<br />

At the date of this report, the directors of the Company are not aware of any circumstances:<br />

i) which would render the amount written off for bad debts, or the amount of the provision for doubtful debts, in the<br />

financial statements of the Group and of the Company inadequate to any substantial extent; or<br />

ii) which would render the value attributed to the current assets in the financial statements of the Group and of the<br />

Company misleading; or<br />

iii) which have arisen which render adherence to the existing method of valuation of assets or liabilities of the Group<br />

and of the Company misleading or inappropriate; or<br />

iv) which would render any amount stated in the financial statements of the Group and of the Company misleading,<br />

other than those already dealt with in this report and in the relevant financial statements.<br />

At the date of this report, there does not exist:<br />

i) any charge on the assets of the Group or of the Company that has arisen since the end of the financial year which<br />

secures the liabilities of any other person; or

36<br />

DIRECTOR’S REPORT<br />

ii) any contingent liability in respect of the Group and of the Company that has arisen since the end of the financial year.<br />

No contingent liability or other liability of the Group and of the Company has become enforceable, or is likely to become<br />

enforceable within the period of twelve months after the end of the financial year which, in the opinion of the directors, will or<br />

may substantially affect the ability of the Group and of the Company to meet their obligations as and when they fall due.<br />

AUDITORS<br />

The auditors, Messrs. Hasyudeen & Co., retire and have expressed their willingness to accept re-appointment under the style<br />

of Messrs. Khairuddin Hasyudeen & Razi.<br />

Signed on behalf of the Board in accordance with a resolution of the directors,<br />

IR. TUAN HAJI AZLAN AWANG TUAN HAJI ABDUL AZIZ BAKRI<br />

Director Director<br />

Dated: 24 April 2001<br />

Shah Alam

37<br />

STATEMENT BY DIRECTORS<br />

We, the undersigned, being two of the directors of LANKHORST BERHAD, do hereby state that in the opinion of the<br />

directors, the financial statements set out on pages 39 to 58 are drawn up in accordance with the provisions of the Companies<br />

Act, 1965 and applicable approved accounting standards in Malaysia so as to give a true and fair view of the state of affairs of<br />

the Group and of the Company as at 31 December 2000 and of their results and changes in equity and cash flows of the Group<br />

and of the Company for the year ended on that date.<br />

Signed on behalf of the Board in accordance with a resolution of the directors,<br />

IR. TUAN HAJI AZLAN AWANG<br />

Director<br />

TUAN HAJI ABDUL AZIZ BAKRI<br />

Director<br />

Dated: 24 April 2001<br />

Shah Alam<br />

STATUTORY DECLARATION<br />

I, TUAN HAJI ABDUL AZIZ BAKRI, being the executive director primarily responsible for the financial management of<br />

LANKHORST BERHAD, do solemnly and sincerely declare that the financial statements set out on pages 39 to 58 are to the<br />

best of my knowledge and belief, correct and I make this solemn declaration conscientiously believing the same to be true, and<br />

by virtue of the provisions of the Statutory Declarations Act, 1960.<br />

Subscribed and solemnly declared by the )<br />

abovenamed at Shah Alam in the state of )<br />

Selangor Darul Ehsan on this 24 day of April 2001) TUAN HAJI ABDUL AZIZ BAKRI<br />

Before me,

38<br />

AUDITORS’ REPORT<br />

TO THE MEMBERS OF LANKHORST BERHAD<br />

We have audited the financial statements set out on pages 39 to 58 of LANKHORST BERHAD comprising of the balance sheet<br />

and the notes to the financial statements at 31 December 2000 and of the income statement, the statement of changes in<br />

equity and the cash flow statement of the Group and of the Company for the year ended on that date.<br />

The preparation of the financial statements are the responsibility of the Company’s directors. Our responsibility is to express<br />

an opinion on the financial statements based on our audit.<br />

We conducted our audit in accordance with the approved standards on auditing issued in Malaysia. These standards require<br />

that we plan and perform the audit to obtain all the information and the explanations which we considered necessary to<br />

provide us with sufficient evidence to give reasonable assurance that the financial statements are free of material misstatement.<br />

Our audit includes examining, on a test basis, evidence relevant to the amounts and disclosures in the financial statements. Our<br />

audit also includes assessment of the accounting principles used and significant estimates made by the directors as well as<br />

evaluating the overall adequacy of the presentation of information in the financial statements. We believe our audit provides a<br />

reasonable basis for our opinion.<br />

In our opinion:<br />

a) the financial statements are properly drawn up in accordance with the provisions of the Companies Act, 1965 and<br />

applicable approved accounting standards in Malaysia so as to give a true and fair view of:<br />

and<br />

(i) the state of affairs of the Group and of the Company as at 31 December 2000 and of the results of their<br />

operations and changes in equity and cash flows of the Group and of the Company for the year ended on<br />

that date; and<br />

(ii) the matters required by Section 169 of the Act to be dealt with in the financial statements of the Group<br />

and of the Company;<br />

b) the accounting and other records and the registers required by the Act to be kept by the Company and by its<br />

subsidiary companies have been properly kept in accordance with the provisions of the Act.<br />

We are satisfied that the financial statements of the subsidiary companies which have been consolidated with the Company’s<br />

financial statements are in the form and content appropriate and proper for the purposes of the preparation of the consolidated<br />

financial statements and we have received satisfactory information and explanations required by us for these purposes.<br />

Our auditors’ reports on the financial statements of the subsidiary companies were not subject to any qualification and did not<br />

include any comment required to be made under Section 174 (3) of the Act.<br />

HASYUDEEN & CO. Nik Mohd Hasyudeen Yusoff<br />

AF 0875 1576/12/02(J)<br />

Public Accountants<br />

Dated: 24 April 2001<br />

Kuala Lumpur

BALANCE SHEET AS AT 31 DECEMBER 2000<br />

39<br />

FIXED ASSETS<br />

INVESTMENT IN SUBSIDIARY COMPANIES<br />

INVESTMENT IN ASSOCIATED COMPANIES<br />

OTHER INVESTMENTS<br />

DEVELOPMENT EXPENDITURE<br />

DEFERRED EXPENDITURE<br />

CURRENT ASSETS<br />

Amount due from customers for contract work<br />

Stocks<br />

Trade debtors<br />

Sundry debtors, deposits and prepayments<br />

Amount due from subsidiary companies<br />

Amount due from an associated company<br />

Fixed deposits<br />

Cash and bank balances<br />

CURRENT LIABILITIES<br />

Amount due to customers for contract work<br />

Trade creditors<br />

Sundry creditors and accruals<br />

Amount due to directors<br />

Hire purchase creditors<br />

Borrowings<br />

Provision for taxation<br />

NET CURRENT ASSETS<br />

FINANCED BY:<br />

SHARE CAPITAL<br />

SHARE PREMIUM<br />

RESERVE ON CONSOLIDATION<br />

UNAPPROPRIATED PROFITS/<br />

(ACCUMULATED LOSSES)<br />

Shareholders’ equity<br />

MINORITY INTERESTS<br />

LONG TERM LIABILITIES<br />

Hire purchase creditors<br />

Borrowings<br />

Deferred taxation<br />

NOTE<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

10<br />

16<br />

17<br />

18<br />

19<br />

20<br />

17<br />

18<br />

21<br />

2000<br />

RM<br />

27,992,595<br />

-<br />

5,977,775<br />

2,693,458<br />

7,860,409<br />

-<br />

101,885,502<br />

957,248<br />

104,327,969<br />

13,913,424<br />

-<br />

43,636<br />

2,533,035<br />

3,113,931<br />

226,774,745<br />

22,811,964<br />

56,241,254<br />

12,443,499<br />

181,780<br />

5,168,988<br />

61,778,905<br />

6,377,753<br />

165,004,143<br />

61,770,602<br />

106,294,839<br />

39,999,000<br />

12,892,071<br />

6,234,993<br />

31,020,095<br />

90,146,159<br />

(910,396)<br />

8,125,014<br />

8,712,062<br />

222,000<br />

106,294,839<br />

GROUP<br />

1999<br />

RM<br />

(Restated)<br />

<strong>30</strong>,623,905<br />

-<br />

5,727,241<br />

2,693,458<br />

16,554,099<br />

15,795<br />

93,747,246<br />

253,538<br />

55,593,446<br />

11,097,135<br />

-<br />

264,574<br />

1,961,796<br />

5,386,656<br />

168,<strong>30</strong>4,391<br />

11,737,464<br />

48,338,016<br />

7,917,198<br />

109,4<strong>30</strong><br />

5,051,364<br />

57,620,373<br />

3,371,6<strong>30</strong><br />

134,145,475<br />

34,158,916<br />

89,773,414<br />

39,999,000<br />

12,892,071<br />

6,234,993<br />

18,615,737<br />

77,741,801<br />

(1,365,8<strong>30</strong>)<br />

10,202,424<br />

3,178,019<br />

17,000<br />

89,773,414<br />

The accompanying notes form an integral part of the financial statements<br />

2000<br />

RM<br />

122,940<br />

28,415,<strong>30</strong>3<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

139,716<br />

34,946,062<br />

-<br />

-<br />

1,<strong>30</strong>6<br />

35,087,084<br />

-<br />

-<br />

101,003<br />

-<br />

12,145<br />

-<br />

-<br />

113,148<br />

34,973,936<br />

63,512,179<br />

39,999,000<br />

12,892,071<br />

-<br />

10,551,289<br />

63,442,360<br />

-<br />

69,819<br />

-<br />

-<br />

63,512,179<br />

COMPANY<br />

1999<br />

RM<br />

28,211<br />

9,415,262<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

24,148<br />

43,424,770<br />

-<br />

-<br />

5,153<br />

43,454,071<br />

-<br />

-<br />

114,833<br />

-<br />

-<br />

-<br />

-<br />

114,833<br />

43,339,238<br />

52,782,711<br />

39,999,000<br />

12,892,071<br />

-<br />

(108,360)<br />

52,782,711<br />

-<br />

-<br />

-<br />

-<br />

52,782,711

40<br />

INCOME STATEMENT<br />

FOR THE YEAR ENDED 31 DECEMBER 2000<br />

Revenue<br />

Cost of sales<br />

Gross profit<br />

Other operating income<br />

Administrative expenses<br />

Other operating expenses<br />

Profit/(Loss) from operation<br />

Finance cost<br />

Exceptional item<br />

Share of profit of associated companies<br />

Profit/(Loss) before taxation<br />

Taxation<br />

Profit after taxation<br />

Minority interest<br />

Net profit after taxation for the year<br />

Basic earnings per share (sen)<br />

NOTE<br />

22<br />

23<br />

24<br />

25<br />

26<br />

2000<br />

RM<br />

GROUP<br />

131,150,771<br />

(108,<strong>30</strong>7,527)<br />

22,843,244<br />

172,254<br />

(14,072,596)<br />

(1,525,977)<br />

7,416,925<br />

(1,763,449)<br />

10,800,000<br />

556,457<br />

17,009,933<br />

(4,153,649)<br />

12,856,284<br />

(451,926)<br />

12,404,358<br />

31<br />

1999<br />

RM<br />

(Restated)<br />

146,384,642<br />

(129,824,772)<br />

16,559,870<br />

911,292<br />

(13,802,203)<br />

(160,757)<br />

3,508,202<br />

(2,200,855)<br />

-<br />

2,220,744<br />

3,528,091<br />

(792,769)<br />

2,735,322<br />

(320,117)<br />

2,415,205<br />

The accompanying notes form an integral part of the financial statements<br />

6<br />

2000<br />

RM<br />

259,900<br />

-<br />

259,900<br />

-<br />

(390,688)<br />

-<br />

(1<strong>30</strong>,788)<br />

(2,091)<br />

10,800,000<br />

-<br />

10,667,121<br />

(7,472)<br />

10,659,649<br />

-<br />

10,659,649<br />

COMPANY<br />

1999<br />

RM<br />

258,765<br />

-<br />

258,765<br />

1,399<br />

(372,339)<br />

-<br />

(112,175)<br />

-<br />

-<br />

-<br />

(112,175)<br />

-<br />

(112,175)<br />

-<br />

(112,175)

41<br />

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY<br />

FOR THE YEAR ENDED 31 DECEMBER 2000<br />

Balance as at<br />

31 December 1998<br />

Prior year adjustment<br />

(Note 33)<br />

As restated<br />

Net profit after taxation<br />

for the year (restated)<br />

Balance as at<br />

31 December 1999<br />

Net profit after taxation<br />

for the year<br />

Balance as at<br />

31 December 2000<br />

Share<br />

Capital<br />

RM<br />

39,999,000<br />

-<br />

39,999,000<br />

-<br />

39,999,000<br />

-<br />

39,999,000<br />

NON-DISTRIBUTABLE DISTRIBUTABLE<br />

Share<br />

Premium<br />

RM<br />

12,892,071<br />

-<br />

12,892,071<br />

-<br />

12,892,071<br />

-<br />

12,892,071<br />

STATEMENT OF CHANGES IN EQUITY<br />

FOR THE YEAR ENDED 31 DECEMBER 2000<br />

Balance as at<br />

31 December 1998<br />

Net loss for the year<br />

Balance as at<br />

31 December 1999<br />

Net profit for the year<br />

Balance as at<br />

31 December 2000<br />

Share<br />

Capital<br />

RM<br />

39,999,000<br />

-<br />

39,999,000<br />

-<br />

39,999,000<br />

Note 19<br />

NON-DISTRIBUTABLE<br />

Share<br />

Premium<br />

RM<br />

12,892,071<br />

Reserve on<br />

consolidation<br />

RM<br />

6,234,993<br />

-<br />

6,234,993<br />

-<br />

6,234,993<br />

-<br />

6,234,993<br />

The accompanying notes form an integral part of the financial statements<br />

-<br />

12,892,071<br />

-<br />

12,892,071<br />

Unappropriated<br />

profits<br />

RM<br />

21,725,436<br />

(5,524,904)<br />

16,200,532<br />

2,415,205<br />

18,615,737<br />

12,404,358<br />

31,020,095<br />

DISTRIBUTABLE<br />

Unappropriated<br />

profits<br />

RM<br />

3,815<br />

(112,175)<br />

(108,360)<br />

10,659,649<br />

10,551,289<br />

Total<br />

RM<br />

80,851,500<br />

(5,524,904)<br />

75,326,596<br />

2,415,205<br />

77,741,801<br />

12,404,358<br />

90,146,159<br />

Total<br />

RM<br />

52,894,886<br />

(112,175)<br />

52,782,711<br />

10,659,649<br />

63,442,360

42<br />

CASH FLOW STATEMENT<br />

FOR THE YEAR ENDED 31 DECEMBER 2000<br />

CASH FLOWS FROM OPERATING ACTIVITIES<br />

Cash receipt from customers<br />

Cash payment to suppliers and subcontractors<br />

Cash paid to employees and for expenses<br />

Cash (used in)/generated from operations<br />

Interest received<br />

Interest paid<br />

Tax paid<br />

Net cash (used in)/generated from operating activities<br />

CASH FLOWS FROM INVESTING ACTIVITIES<br />

Proceeds from disposal of fixed assets<br />

Advances (to)/from subsidiary companies<br />

Purchase of fixed assets - (*)<br />

Purchase of investment<br />

Net cash (used in)/generated from investing activities<br />

CASH FLOWS FROM FINANCING ACTIVITIES<br />

Repayment to hire purchase creditors<br />

Dividend paid<br />

Net decrease in short term borrowing<br />

Amount advanced by directors<br />

Proceeds from exceptional item<br />

Conversion of overdraft to term loan<br />

Proceeds from issuance of share capital<br />

from minority shareholders<br />

Advances from/(to) associated company<br />

Net cash generated from/(used in) financing activities<br />

Net increase/(decrease) in cash and cash equivalents<br />

Cash and cash equivalents brought forward<br />

Cash and cash equivalents carried forward (Note 29)<br />

2000<br />

RM<br />

90,040,565<br />

(88,516,428)<br />

(10,461,951)<br />

(8,937,814)<br />

177,166<br />

(6,454,414)<br />

(1,014,689)<br />

(16,229,751)<br />

981,104<br />

-<br />

(2,168,949)<br />

-<br />

(1,187,845)<br />

(2,347,356)<br />

(45,461)<br />

(1,120,<strong>30</strong>6)<br />

72,350<br />

10,678,000<br />

11,184,329<br />

160,000<br />

-<br />

18,581,556<br />

1,163,960<br />

(10,923,838)<br />

(9,759,878)<br />

1999<br />

RM<br />

170,961,057<br />

(108,836,522)<br />

(33,921,876)<br />

28,202,659<br />

47,727<br />

(5,191,789)<br />

(5,543,913)<br />

17,514,684<br />

2,<strong>30</strong>4,290<br />

-<br />

(393,469)<br />

(201,150)<br />

1,709,671<br />

(2,571,681)<br />

(116,325)<br />

(18,805,417)<br />

67,390<br />

-<br />

-<br />

-<br />

(455,560)<br />

(21,881,593)<br />

(2,657,238)<br />

(8,266,600)<br />

(10,923,838)<br />

NOTES TO CASH FLOW STATEMENT FOR THE YEAR ENDED 31 DECEMBER 2000<br />

(*) PURCHASE OF FIXED ASSETS<br />

During the year, the Group acquired fixed assets with an aggregate cost of RM5,647,949 (1999:RM393,469) of which<br />

RM3,479,000 (1999:nil) were acquired by means of hire purchase arrangement and long term borrowing.<br />

During the year, the Company acquired fixed assets with an aggregate cost of RM110,680 (1999:Nil) of which RM85,000<br />

(1999:Nil) were acquired by means of hire purchase arrangement.<br />

SUMMARY OF THE EFFECTS OF ACQUISITION OF SUBSIDIARY COMPANIES<br />

Cash and bank balances<br />

Other assets<br />

Sundry creditors and accruals<br />

Total purchase consideration<br />

Less: Cash and cash equivalent of subsidiary companies acquired<br />

Cash flow on acquisition, net of cash acquired<br />

The accompanying notes form an integral part of the financial statements<br />

GROUP COMPANY<br />

2000<br />

RM<br />

-<br />

-<br />

(387,135)<br />

(387,135)<br />

-<br />

(1,254)<br />

(3,324)<br />

(391,713)<br />

-<br />

(10,261,418)<br />

(25,680)<br />

-<br />

(10,287,098)<br />

2000<br />

RM<br />

4<br />

7,408<br />

(7,408)<br />

(3,036)<br />

-<br />

-<br />

-<br />

10,678,000<br />

-<br />

-<br />

-<br />

10,674,964<br />

4<br />

(4)<br />

-<br />

(3,847)<br />

5,153<br />

1,<strong>30</strong>6<br />

1999<br />

RM<br />

295,200<br />

-<br />

(<strong>30</strong>9,939)<br />

(14,739)<br />

1,399<br />

-<br />

(1,240)<br />

(14,580)<br />

-<br />

237,632<br />

-<br />

-<br />

237,632<br />

-<br />

(287,993)<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

(287,993)<br />

(64,941)<br />

70,094<br />

5,153<br />

1999<br />

RM<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-

43<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2000<br />

1. PRINCIPAL ACTIVITIES<br />

The principal activities of the Company consist of investment holding and provision of management services. The<br />

principal activities of the subsidiary companies are stated in Note 5 to the financial statements. There have been no<br />

significant changes in the nature of these activities during the financial year under review.<br />

2. BASIS FOR PREPARATION OF THE FINANCIAL STATEMENTS<br />

The financial statements of the Company have been prepared in accordance with the provisions of the Companies<br />

Act, 1965 and in compliance with applicable approved accounting standards in Malaysia.<br />

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES<br />

All significant accounting policies set out below are consistent with those applied in previous financial year except for<br />

the policies on preliminary and pre-operating expenses and the classification of cash and cash equivalents as explained<br />

below.<br />

3.1 Accounting convention<br />

The financial statements have been prepared under the historical cost convention modified by the revaluation<br />

of leasehold quarry land.<br />

3.2 Basis of consolidation<br />

The consolidated financial statements include the audited financial statements of the Company and all its<br />

subsidiary companies made up to the end of the financial year. The results of subsidiary companies acquired<br />

or disposed off during the year are included in the consolidated income statement from the date of<br />

their acquisition or up to the date of their disposal. Inter company transactions are eliminated on consolidation<br />

and the consolidated financial statements reflect external transactions only. The proportion of the<br />

profit and loss applicable to minority shareholders are deducted in arriving at the profit attributable to the<br />

shareholders of the Company.<br />

3.3 Goodwill/Reserve on consolidation<br />

The difference between the purchase price and the value of net assets of subsidiary companies at the date<br />

of acquisition is included in the consolidated balance sheet as goodwill or reserve arising on consolidation.<br />

Goodwill arising on consolidation is contra off against reserve arising on consolidation and the balance<br />

retained in the consolidated balance sheet at cost and is written down only when the directors are of the<br />

opinion that there is a permanent diminution in its value.<br />

3.4 Fixed assets and depreciation<br />

Fixed assets are stated at cost or revalued amount less accumulated depreciation or amortisation.<br />

The carrying value of the short term leasehold quarry land will be amortised over a period of 25 years<br />

after commencement of the quarry operations.<br />

Depreciation is provided on a straight line basis to write off the cost of the other fixed assets over their<br />

estimated useful lives at the following principal annual rates:<br />

Freehold land and building 2%<br />

Furniture and fittings 10% - 20%<br />

Office equipment 10% - 20%<br />

Plant and machinery 10% - 20%<br />

Motor vehicles 20%<br />

Computers 10% - 33 1/3%<br />

Renovation 10% - 33 1/3%<br />

Revaluation of freehold land and buildings is undertaken in every 5 years. Surplus arising from revaluation<br />

is credited directly to revaluation reserve. Deficit in excess of the revaluation reserve arising from previous<br />

revaluation is charged to the income statement.

44<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2000<br />

3.5 Investment in subsidiary companies<br />

Investment in subsidiary companies is stated at cost less write down for permanent diminution in value of<br />

investment. Provision for permanent diminution is only made where in the opinion of the directors, there<br />

is a permanent diminution in value. Permanent diminution in the value of an investment is recognised as an<br />

expenses in the period in which the diminution is identified.<br />

3.6 Investment in associated companies<br />

An associated company is a company, other than a subsidiary company, in which the Group has a long term<br />

equity interest of between 20% to 50% and where the Group has representative on the board and is in a<br />

position to exercise significant influence over its financial and policy decisions.<br />

The consolidated income statement includes the Group’s share of profits less losses of the associated<br />

companies based on the latest available audited or management financial statements of the associated<br />

companies concerned. In the consolidated balance sheet, the Group’s interest in the associated companies<br />

are stated at cost, plus the Group’s share of post acquisition retained profits/losses and reserves.<br />

3.7 Other investments<br />

Other investments are stated at cost less write down for permanent diminution in value of investment.<br />

3.8 Development expenditure<br />

Development expenditure comprises construction and other related development cost including interest<br />

cost and administrative overheads relating to the project. However, in compliance with MASB Standard No.<br />

1, pre-operating expenses included in the development expenditure are not to be carried on the face of<br />

balance sheet.<br />

In order to conform with the benchmark treatment, this change in accounting policy has been accounted<br />

for retrospectively. The comparative figures have been restated which assumes that the new policy had<br />

always been in use.<br />

3.9 Deferred expenditure<br />

Deferred expenditure comprises preliminary and pre-operating expenses of certain subsidiary companies.<br />

All expenses incurred by the Company prior to commencement of operation are treated as pre-operating<br />

expenses. Preliminary and pre-operating expenses will be written off or amortised upon commencement<br />

of commercial operation. However, in compliance with MASB Standard No. 1, the preliminary and preoperating<br />

expenditure are not to be carried on the face of balance sheet.<br />

In order to conform with the benchmark treatment, this change in accounting policy has been accounted<br />

for retrospectively. The comparative figures have been restated which assumes that the new policy had<br />

always been in use.<br />

3.10 Amount due from/(to) customers for contract work<br />

3.11 Stocks<br />

Amount due from/(to) customers for contract work is stated at cost plus attributable profits less provision<br />

for foreseeable losses and progress billings. Cost includes the cost of direct labour, materials, borrowings<br />

cost and overhead expenses which were incurred in connection with the contracts.<br />

Stocks consist of geosynthetic materials and spare parts of machinery stated at the lower of cost and net<br />

realisable value after making allowance for obsolete and slow-moving stocks determined on first-in firstout<br />

basis. Cost is defined as all expenditure incurred in bringing the stocks to their present condition and<br />

location and is determined on weighted average basis.<br />

3.12 Debtors<br />

Known bad debts are written off and specific provision is made for any debts considered to be doubtful<br />

of collection. In addition, a general provision based on a percentage of debtors is made to cover possible<br />

losses which are not specifically identified.

45<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2000<br />

3.13 Accounting for hire purchase<br />

The cost of assets acquired under hire purchase agreement is capitalised. The depreciation policy on these<br />

assets is similar to that of the Group’s other fixed assets as set out in Note 3.4. Outstanding obligations<br />

due under the hire purchase agreements after deducting finance expenses are included as liabilities in the<br />

financial statements. Finance expenses pertaining to the hire purchase are capitalised as part of construction<br />

work in progress. Other finance expenses are charged to the income statement over the duration of<br />

the hire purchase agreement.<br />

3.14 Taxation<br />

Taxation is provided for based on the amount of tax estimated to be payable at current prevailing rates on<br />

the operating profit for the year, adjusted for any permanent differences.<br />

3.15 Deferred taxation<br />

Deferred taxation is calculated on the liability method in respect of all material timing differences except<br />

where the liability is not expected to arise in the foreseeable future. Deferred tax benefits are only recognised<br />

where there is reasonable expectation of realisation in the near future.<br />

3.16 Revenue recognition<br />

Revenue from contract work is recognised on the percentage of completion method based on progress<br />

billings in cases where the outcome of the contract can be reliably estimated. In cases where the outcome<br />

cannot be reliably estimated, the revenue is recognised only to the extent of contract costs incurred that<br />

is probable will be recoverable. In all cases, anticipated losses are provided for in full.<br />

Revenue from property development projects are recognised on the percentage of completion method<br />

based on the progress billings in cases where the outcome of the contract can be reliably estimated in<br />

respect of all development units that have been sold. In cases where the outcome cannot be reliably<br />

estimated, no profit should be recognised on the development units sold. Any estimated losses on these<br />

property are provided for in full.<br />

Revenue from sale of goods is measured at the fair value of the consideration receivable and is recognised<br />

in the income statement when the significant risks and rewards of ownership have been transferred to the<br />

buyer.<br />

Income from investments is included in the income statement when the right to receive has been established.<br />

Sales between Group companies are excluded from revenue of the Group.<br />

3.17 Currency translation<br />

Transactions in foreign currencies are recorded in Malaysian Ringgit at rates of exchange ruling at the time<br />

of the transaction. Monetary assets and liabilities outstanding at balance sheet date denominated in foreign<br />

currencies are translated at the rate of exchange ruling at that date. Gains and losses from foreign exchange<br />

are taken to the income statement in the year which they arise.<br />

3.18 Borrowing costs<br />

Borrowing costs incurred directly attributable to the financing of the construction works are capitalised as<br />

part of construction work in progress. Other borrowing costs are charged to the income statement as and<br />

when incurred.<br />

3.19 Cash and cash equivalents<br />

Cash and cash equivalents comprise cash in hand, cash at bank, fixed deposits with licensed banks or<br />

financial institutions and bank overdraft. With effect from the financial year revolving credits and trade<br />

facilities are no longer regarded as cash and cash equivalents.

46<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2000<br />

4. FIXED ASSETS<br />

Group<br />

At valuation:<br />

Short term leasehold quarry land<br />

At cost:<br />

Freehold land and building<br />

Furniture and fittings<br />

Office equipment<br />

Plant and machinery<br />

Motor vehicles<br />

Computers<br />

Renovation<br />

At valuation:<br />

Short term leasehold quarry land<br />

At cost:<br />

Freehold land and building<br />

Furniture and fittings<br />

Office equipment<br />

Plant and machinery<br />

Motor vehicles<br />

Computers<br />

Renovation<br />

At valuation:<br />

Short term leasehold quarry land<br />

At cost:<br />

Freehold land and building<br />

Furniture and fittings<br />

Office equipment<br />

Plant and machinery<br />

Motor vehicles<br />

Computers<br />

Renovation<br />

Balance as at<br />

1.1.2000<br />

RM<br />

2,500,000<br />

350,000<br />

1,508,946<br />

2,875,941<br />

<strong>30</strong>,242,142<br />

15,018,537<br />

2,162,729<br />

2,200,459<br />

56,858,754<br />

Balance as at<br />

1.1.2000<br />

RM<br />

200,000<br />

57,400<br />

556,079<br />

1,483,672<br />

13,488,556<br />

8,867,518<br />

717,803<br />

863,821<br />

26,234,849<br />

2000<br />

RM<br />

2,200,000<br />

2,821,342<br />

808,290<br />

1,184,983<br />

14,581,600<br />

4,019,998<br />

1,277,292<br />

1,099,090<br />

27,992,595<br />

Additions<br />

RM<br />

ACCUMULATED DEPRECIATION<br />

Additions<br />

RM<br />

-<br />

2,552,760<br />

5,560<br />

74,161<br />

1,467,046<br />

1,462,342<br />

82,182<br />

3,898<br />

5,647,949<br />

100,000<br />

24,018<br />

150,137<br />

281,447<br />

3,639,032<br />

2,799,338<br />

249,816<br />

241,446<br />

7,485,234<br />

1999<br />

RM<br />

2,<strong>30</strong>0,000<br />

292,600<br />

952,867<br />

1,386,577<br />

16,759,278<br />

6,151,019<br />

1,444,926<br />

1,336,638<br />

<strong>30</strong>,623,905<br />

COST<br />

Disposals<br />

RM<br />

Disposals<br />

RM<br />

-<br />

-<br />

-<br />

-<br />

-<br />

(2,477,485)<br />

-<br />

-<br />

(2,477,485)<br />

-<br />

-<br />

-<br />

-<br />

-<br />

(1,683,460)<br />

-<br />

-<br />

(1,683,460)<br />

Balance as at<br />

31.12.2000<br />

RM<br />

2,500,000<br />

2,902,760<br />

1,514,506<br />

2,950,102<br />

31,709,188<br />

14,003,394<br />

2,244,911<br />

2,204,357<br />

60,029,218<br />

Balance as at<br />

31.12.2000<br />

RM<br />

<strong>30</strong>0,000<br />

81,418<br />

706,216<br />

1,765,119<br />

17,127,588<br />

9,983,396<br />

967,619<br />

1,105,267<br />

32,036,623<br />

NE T BOOK VALUE Depreciation<br />

1999<br />

RM<br />

100,000<br />

7,000<br />

164,441<br />

285,<strong>30</strong>9<br />

3,769,<strong>30</strong>9<br />

3,454,441<br />

242,950<br />

242,632<br />

8,266,082

NOTES TO THE FINANCIAL STATEMENTS<br />

47 31 DECEMBER 2000<br />

Company<br />

Computers<br />

Renovation<br />

Office equipment<br />

Furniture and fittings<br />

Motor vehicles<br />

Computers<br />

Renovation<br />

Office equipment<br />

Furniture and fittings<br />

Motor vehicles<br />

Computers<br />

Renovation<br />

Office equipment<br />

Furniture and fittings<br />

Motor vehicles<br />

Balance as at<br />

1.1.2000<br />

RM<br />

10,014<br />

16,118<br />

9,984<br />

6,090<br />

-<br />

42,206<br />

Additions<br />

RM<br />

9,937<br />

-<br />

-<br />

-<br />

100,743<br />

110,680<br />

COST<br />

Disposals<br />

RM<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

Balance as at<br />

31.12.2000<br />

RM<br />

19,951<br />

16,118<br />

9,984<br />

6,090<br />

100,743<br />

152,886<br />

The net book value of fixed assets of the Group and of the Company which were acquired under hire purchase<br />

arrangement are as follows:<br />

GROUP<br />

COMPANY<br />

Plant and machinery<br />

Motor vehicles<br />

Balance as at<br />

1.1.2000<br />

RM<br />

5,589<br />

3,224<br />

3,964<br />

1,218<br />

-<br />

13,995<br />

2000<br />

RM<br />

11,039<br />

11,283<br />

4,023<br />

4,263<br />

92,332<br />

122,940<br />

ACCUMULATED DEPRECIATION<br />

2000<br />

RM<br />

8,356,032<br />

3,669,927<br />

12,025,959<br />

Additions<br />

RM<br />

3,323<br />

1,611<br />

1,997<br />

609<br />

8,411<br />

15,951<br />

Details of borrowings where charges exist over certain fixed assets are disclosed in Note 18.<br />

The short term leasehold quarry land of a subsidiary company has been stated at valuation which was carried out by<br />

an independent professional valuer in 1996. No provision for deferred tax was made in view of the insignificant<br />

amount involved.<br />

Had the short term leasehold quarry land been carried at historical cost, the carrying amount of the revalued asset<br />

that would have been included in the financial statements of the Group at the end of the financial year is RM880,000<br />

(1999: RM920,000).<br />

1999<br />

RM<br />

10,436,532<br />

5,584,<strong>30</strong>4<br />

16,020,836<br />

Disposals<br />

RM<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

2000<br />

RM<br />

-<br />

92,332<br />

92,332<br />

Balance as at<br />

31.12.2000<br />

RM<br />

1999<br />

RM<br />

1999<br />

RM<br />

-<br />

-<br />

-<br />

8,912<br />

4,835<br />

5,961<br />

1,827<br />

8,411<br />

29,946<br />

NE T BOOK VALUE Depreciation<br />

1999<br />

RM<br />

4,425<br />

12,894<br />

6,020<br />

4,872<br />

-<br />

28,211<br />

2,016<br />

1,612<br />

1,997<br />

609<br />

-<br />

6,234

48<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2000<br />

Depreciation charge for the year<br />

Less: Depreciation capitalised in cost<br />

incurred on uncompleted contracts (Note 10)<br />

Depreciation charged to income statement<br />

5. INVESTMENT IN SUBSIDIARY COMPANIES<br />

Unquoted shares, at cost<br />

Name of company<br />

Lankhorst Pancabumi Contractors Sdn Bhd<br />

Cardon (M) Sdn Bhd<br />

Lankhorst Hartanah Sdn Bhd<br />

Lankhorst International (Cayman) Pte Ltd<br />

Subsidiary companies of Lankhorst Pancabumi Contractors Sdn Bhd.<br />

Lankhorst Wastewater Technology Sdn Bhd<br />

Lankhorst Oil and Gas Services Sdn Bhd<br />

Lankhorst Quarry Management Sdn Bhd<br />

Port Dickson Sepang Quarry Sdn Bhd<br />

Rampai Budi-Jaya Sdn Bhd<br />

Lankhorst Track Construction Sdn Bhd<br />

Lankhorst M & E Sdn Bhd<br />

Consortium Ibjay-Aritech System Sdn Bhd<br />

Lankhorst Pavement Technologies Sdn Bhd<br />

(formerly known as Lankhorst Asset. Sdn Bhd)<br />

Subsidiary company of Cardon (M) Sdn Bhd<br />

Tradepro Sdn Bhd<br />

GROUP INTEREST (%)<br />

2000<br />

100<br />

100<br />

100<br />

100<br />

100<br />

95<br />

90<br />

75.5<br />

60<br />

60<br />

55<br />

100<br />

100<br />

100<br />

2000<br />

RM<br />

28,415,<strong>30</strong>3<br />

COMPANY<br />

1999<br />

RM<br />

9,415,262<br />

All the above subsidiary companies were incorporated in Malaysia except for Lankhorst International (Cayman) Pte<br />

Ltd which was incorporated in the Cayman Islands, British West Indies.<br />

*Temporarily ceased operations, however the management is pursuing several alternatives to revive the operations<br />

of the subsidiary companies.<br />

1999<br />

100<br />

100<br />

100<br />

100<br />

100<br />

95<br />

90<br />

75.5<br />

60<br />

60<br />

55<br />

-<br />

-<br />

100<br />

Principal activities<br />

Civil and geotechnical engineering and<br />

building construction works.<br />

Geotechnical engineering and trading<br />

and application of geosynthetic materials.<br />

Property development and investment.<br />

Dormant.<br />

Water and wastewater treatment works.<br />

Oil and gas contracting and supply.<br />

Quarry operations*.<br />

Quarry operations*.<br />

Turnkey contractor.<br />

Railway track construction works.<br />

Mechanical and electrical contractor.<br />

Building and construction works.<br />

Dormant.<br />

General trading.<br />

2000<br />

RM<br />

7,485,234<br />

(3,939,242)<br />

3,545,992<br />

GROUP<br />

1999<br />

RM<br />

8,266,082<br />

(4,967,022)<br />

3,299,060

NOTES TO THE FINANCIAL STATEMENTS<br />

49 31 DECEMBER 2000<br />

6. INVESTMENT IN ASSOCIATED COMPANIES<br />

Unquoted shares, at cost<br />

Post acquisition profit<br />

Shares of net assets of associated company<br />

Goodwill on consolidation<br />

The associated companies, all of which are incorporated in Malaysia are as follows:<br />

Name of company<br />

Konsortium Panzana-Lankhorst Sdn Bhd *<br />

Tractors Petroleum Services Sdn Bhd *<br />

* Audited by another firm of public accountants.<br />

7. OTHER INVESTMENTS<br />

Investment, at cost<br />

- Unquoted shares<br />

- Others<br />

8. DEVELOPMENT EXPENDITURE<br />

Leasehold land, at cost<br />

Development expenditure<br />

GROUP INTEREST (%)<br />

2000<br />

40<br />

35<br />

Leasehold land of a subsidiary amounting to RM118,921 was pledged to the licensed financial institution as a collateral<br />

for the revolving credit facility granted to the subsidiary company as stated in Note 18.<br />

An adjustment of RM1,015,363 has been made retrospectively which represents the effect of changes in accounting<br />

policy as mentioned in Note 3.8 and Note 33.<br />

1999<br />

40<br />

35<br />

2000<br />

RM<br />

875,040<br />

5,102,735<br />

5,977,775<br />

2000<br />

RM<br />

5,827,775<br />

150,000<br />

5,977,775<br />

Principal activities<br />

GROUP<br />

GROUP<br />

Civil construction works.<br />

1999<br />

RM<br />

875,040<br />

4,852,201<br />

5,727,241<br />

1999<br />

RM<br />

5,577,241<br />

150,000<br />

5,727,241<br />

Supply and services of Caterpillar engines<br />

and equipment.<br />

2000<br />

RM<br />

2,400,000<br />

293,458<br />

2,693,458<br />

2000<br />

RM<br />

7,335,483<br />

524,926<br />

7,860,409<br />

GROUP<br />

GROUP<br />

1999<br />

RM<br />

2,400,000<br />

293,458<br />

2,693,458<br />

1999<br />

RM<br />

(Restated)<br />

7,335,483<br />

9,218,616<br />

16,554,099

50<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2000<br />

9. DEFERRED EXPENDITURE<br />

Deferred expenditure<br />

An adjustment of RM7,734,270 has been made retrospectively which represents the effect of changes in accounting<br />

policy policy as mentioned in Note 3.9 and Note 33.<br />

10. AMOUNT DUE FROM/(TO) CUSTOMERS FOR CONTRACT WORK<br />

Cost incurred on uncompleted construction contracts<br />

Attributable profits<br />