Participatieve analyse van de governance in de tak arbeidsongevallen

Participatieve analyse van de governance in de tak arbeidsongevallen

Participatieve analyse van de governance in de tak arbeidsongevallen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Participatieve</strong> <strong>analyse</strong> <strong>van</strong> <strong>de</strong> <strong>governance</strong> <strong>van</strong> <strong>de</strong> <strong>tak</strong> <strong>arbeidsongevallen</strong><br />

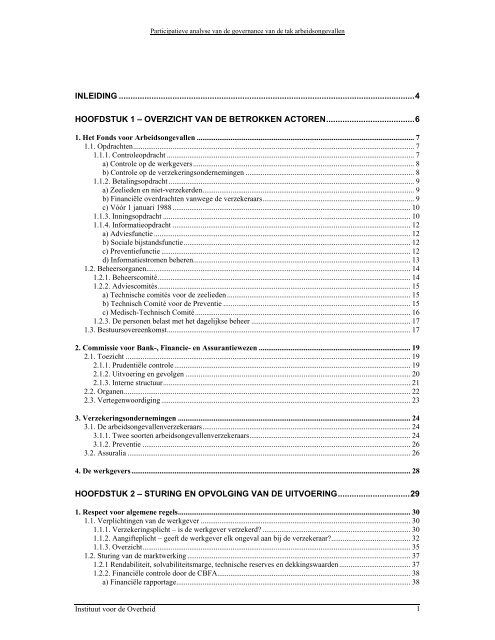

INLEIDING ...............................................................................................................................4<br />

HOOFDSTUK 1 – OVERZICHT VAN DE BETROKKEN ACTOREN......................................6<br />

1. Het Fonds voor Arbeidsongevallen .................................................................................................................... 7<br />

1.1. Opdrachten...................................................................................................................................................... 7<br />

1.1.1. Controleopdracht .................................................................................................................................... 7<br />

a) Controle op <strong>de</strong> werkgevers...................................................................................................................... 8<br />

b) Controle op <strong>de</strong> verzeker<strong>in</strong>gson<strong>de</strong>rnem<strong>in</strong>gen .......................................................................................... 8<br />

1.1.2. Betal<strong>in</strong>gsopdracht ................................................................................................................................... 9<br />

a) Zeelie<strong>de</strong>n en niet-verzeker<strong>de</strong>n................................................................................................................. 9<br />

b) F<strong>in</strong>anciële overdrachten <strong>van</strong>wege <strong>de</strong> verzekeraars................................................................................. 9<br />

c) Vóór 1 januari 1988............................................................................................................................... 10<br />

1.1.3. Inn<strong>in</strong>gsopdracht .................................................................................................................................... 10<br />

1.1.4. Informatieopdracht ............................................................................................................................... 12<br />

a) Adviesfunctie ......................................................................................................................................... 12<br />

b) Sociale bijstandsfunctie......................................................................................................................... 12<br />

c) Preventiefunctie ..................................................................................................................................... 12<br />

d) Informatiestromen beheren.................................................................................................................... 13<br />

1.2. Beheersorganen............................................................................................................................................. 14<br />

1.2.1. Beheerscomité....................................................................................................................................... 14<br />

1.2.2. Adviescomités....................................................................................................................................... 15<br />

a) Technische comités voor <strong>de</strong> zeelie<strong>de</strong>n.................................................................................................. 15<br />

b) Technisch Comité voor <strong>de</strong> Preventie .................................................................................................... 15<br />

c) Medisch-Technisch Comité................................................................................................................... 16<br />

1.2.3. De personen belast met het dagelijkse beheer ..................................................................................... 17<br />

1.3. Bestuursovereenkomst.................................................................................................................................. 17<br />

2. Commissie voor Bank-, F<strong>in</strong>ancie- en Assurantiewezen ................................................................................. 19<br />

2.1. Toezicht ........................................................................................................................................................ 19<br />

2.1.1. Pru<strong>de</strong>ntiële controle.............................................................................................................................. 19<br />

2.1.2. Uitvoer<strong>in</strong>g en gevolgen ........................................................................................................................ 20<br />

2.1.3. Interne structuur.................................................................................................................................... 21<br />

2.2. Organen......................................................................................................................................................... 22<br />

2.3. Vertegenwoordig<strong>in</strong>g ..................................................................................................................................... 23<br />

3. Verzeker<strong>in</strong>gson<strong>de</strong>rnem<strong>in</strong>gen ............................................................................................................................ 24<br />

3.1. De <strong>arbeidsongevallen</strong>verzekeraars............................................................................................................... 24<br />

3.1.1. Twee soorten <strong>arbeidsongevallen</strong>verzekeraars...................................................................................... 24<br />

3.1.2. Preventie ............................................................................................................................................... 26<br />

3.2. Assuralia ....................................................................................................................................................... 26<br />

4. De werkgevers..................................................................................................................................................... 28<br />

HOOFDSTUK 2 – STURING EN OPVOLGING VAN DE UITVOERING...............................29<br />

1. Respect voor algemene regels............................................................................................................................ 30<br />

1.1. Verplicht<strong>in</strong>gen <strong>van</strong> <strong>de</strong> werkgever ................................................................................................................ 30<br />

1.1.1. Verzeker<strong>in</strong>gsplicht – is <strong>de</strong> werkgever verzekerd? ............................................................................... 30<br />

1.1.2. Aangifteplicht – geeft <strong>de</strong> werkgever elk ongeval aan bij <strong>de</strong> verzekeraar?.......................................... 32<br />

1.1.3. Overzicht............................................................................................................................................... 35<br />

1.2. Stur<strong>in</strong>g <strong>van</strong> <strong>de</strong> marktwerk<strong>in</strong>g ....................................................................................................................... 37<br />

1.2.1 Rendabiliteit, solvabiliteitsmarge, technische reserves en <strong>de</strong>kk<strong>in</strong>gswaar<strong>de</strong>n...................................... 37<br />

1.2.2. F<strong>in</strong>anciële controle door <strong>de</strong> CBFA....................................................................................................... 38<br />

a) F<strong>in</strong>anciële rapportage............................................................................................................................. 38<br />

Instituut voor <strong>de</strong> Overheid 1